Category: Financial Planning, Investment management

The key points discussed by the Committee were as follows:

The Committee reviewed risk management, eligibility and investment & borrowing powers reports and confirmed that these were in order and no action was required.

Upon reviewing the risk data for the Clarion funds, the Committee have noted that the relative VaR ratios for all three Clarion funds are now in line with expectations and below the lower internal threshold of 100. The Committee are pleased to note that the relative VaR ratio for the Clarion Prudence portfolio has now normalised and reduced from a c.130 level to below 100. The Committee have discussed the underlying risks of the Clarion Prudence strategy on numerous occasions, concluding each time that the fund’s underlying level of risk was below the benchmark and no action was required. The Committee expected the relative VaR ratio for Prudence to come down, once the Brexit event fell out of the relative VaR calculation period, and this has now materialised.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns.

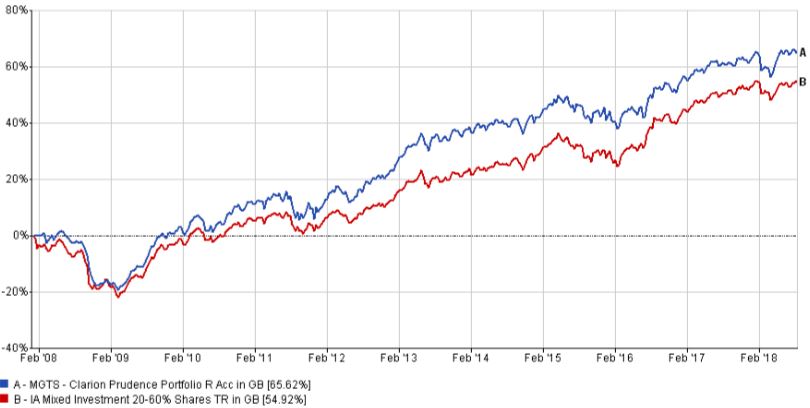

The fund outperformed the sector by c.0.9 percentage points over 3 months and marginally lagged the strategic benchmark. The fund’s short duration bond exposure underperformed the corporate bond sector over the period, as Gilt yields decreased. Long term performance of the fund since inception is comfortably ahead of both sector and benchmark as demonstrated by the supporting graph.

The active allocation to global equity funds was a major contributor to the fund’s strong performance. On average the underlying global funds returned c.6% over 12 weeks, with the M&G Global Dividend strategy being the strongest, with c.7.7% returns. The Invesco Perpetual Global Equity Income fund was the weakest global equity strategy over the period, which was mainly due to its overweight allocation to Europe and a general tilt to ‘Value’. The Committee believe that the Invesco fund adds diversification to the portfolio and raised no concerns at this stage.

The Majedie UK Income fund remains on the watchlist. This fund is going through a manager change process. The former manager stepped down at the end of June and the new manager is expected to assume responsibility in November. Meanwhile the fund is managed by the Majedie UK team. The new manager, Mark Wharrier, has previously managed the BlackRock UK Income fund which historically had a relatively average performance profile. It is the opinion of the Committee that the strategy of the Majedie fund is likely to change according to the new manager’s previous experience. The Committee review this holding on a regular basis and with some alternatives lined up and it is likely that this fund will be sold in the near term.

The Committee are pleased with the performance of the Threadneedle UK Equity Income fund, which is now in the 2nd quartile over 12 months, up from being in the fourth quartile at the beginning of the year. The Threadneedle fund is now the best performer over 3 months as well as over 6 months. In relative terms the Threadneedle strategy’s return was c.4.9 percentage points above the sector over 12 weeks, while the second best performing UK holding, the Royal London UK Equity Income fund, returned c.1.3 percentage points above the sector over the same period.

The Premier Income fund continues to lag the sector. The Committee looked at the main drivers of the fund’s weaker performance and identified that stock selection was the main detractor from returns. Over 6 months, the fund held one stock that saw its shares permanently suspended (Conviviality) and another three stocks which have suffered losses of c.25% – 36% over the period. All of these stocks have been held at significant weightings, and detracted c.3-4% from the fund’s total return over 6 months.

Based on this information, the Committee discussed whether the Premier Income strategy should be held in the portfolio going forward. Following a discussion, the Committee agreed to sell out of the Premier fund and reduce the risk and cost of the underlying portfolio by reinvesting the proceeds in a low-cost FTSE index tracker. The Committee holds the view that the FTSE index has a natural bias to ‘Value’ and provides a good mix of exposure to both the domestic as well as international economies.

There were no other changes proposed to the fund and the Committee are pleased with the overall performance of this strategy.

The committee approved the strategy and confirmed it is in line with the mandate.

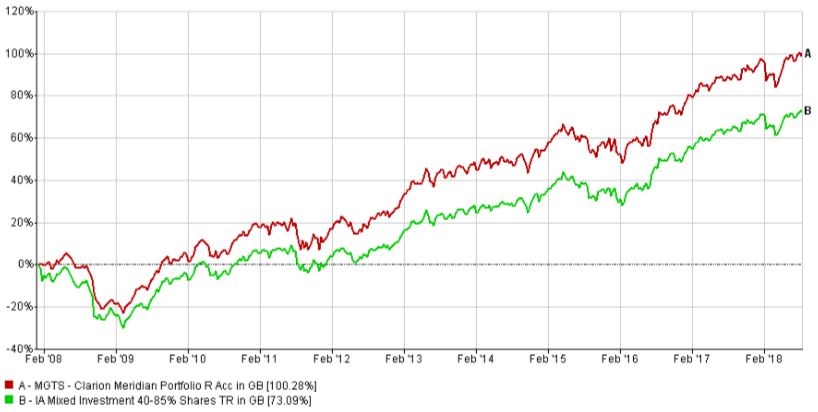

Over 12 weeks the strategy’s performance was c.1.3 percentage points ahead of the sector. Compared to the sector, the fund’s overweight allocation to equities was the main contributor to stronger relative returns. Performance since inception of the fund remains comfortably ahead of both the sector average and the benchmark as demonstrated by the supporting graph.

The US was the strongest equity market over the period, with both US index tracking funds delivering c.13% returns in absolute terms. The allocation to a global equity fund was the second strongest contributor, as the M&G Global Dividend fund returned c.7.7% over the period. The Committee were pleased to note that both underlying Asian holdings and the only European holding have outperformed their respective benchmarks.

In general, international equities performed more strongly than the UK over the period. This performance differential between international and domestic equities can be linked to the recent c.4% depreciation of sterling. The overall fund selection has been good and only 1 underlying fund was below the 2nd quartile over 12 months.

The Committee discussed the M&G Optimal Income fund and the risks related to its relatively large size of c.£24bn, which is significantly larger than most of its competitors. It was proposed to either replace the M&G fund with the Schroder Strategic Credit strategy or to redistribute the proceeds from the sale of M&G Optimal Income among the other underlying bond funds. The Schroder strategy has a tilt towards short duration bonds and historically has a relatively defensive performance profile and therefore provides a good alternative to the M&G strategy.

A proposal was also made to sell the M&G Optimal Income fund and reinvest the proceeds in a short duration corporate bond index tracking fund. If implemented, this switch will reduce the fund’s exposure to credit risk and lower the underlying costs. The Committee agreed with this proposal and decided to sell the M&G Optimal Income fund in favour of the Legal and General Short Dated Sterling Corporate Bond Index strategy.

The Committee also expressed concerns regarding the elevated valuation of US stocks which are mainly ‘Growth’ biased and the effect trade wars could have on US companies with global supply chains. It was universally agreed that the UK currently provides better value due to the negative effect of the localised political risk on companies included in the FTSE 100 index, which generate a substantial proportion of earnings from overseas. It was agreed that in the event of a global economic downturn there could be a flight to safety which would benefit the Dollar, the Yen and possibly Gold. However, it was accepted that the potential overvaluation of ‘Growth’ equities and the negative effect trade wars could have on large cap US stocks and a proposal was put forward to diversify the fund’s allocation to the US with a fund targeting small- and mid-cap US stocks which are more likely to benefit from a strong domestic US economy. However, it was also felt that smaller companies’ stocks in the US are more vulnerable to interest rate rises their valuation could suffer if borrowing costs rise significantly and inflation expectations increase.

A proposal was then put forward to reduce the US allocation and allocate the proceeds among short duration bonds and UK equities, to reduce the risk further. The Committee agreed to reduce the US weighting by 3%, and allocate 2% to short duration bonds and a further 1% to UK equities.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no further changes.

The committee approved the strategy and confirmed it is in line with the mandate.

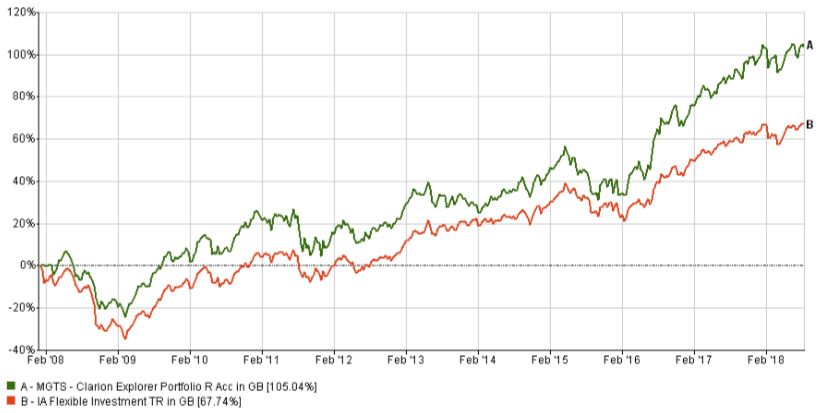

The fund performed strongly and was ahead of the sector and in line with the benchmark over 3 months. The allocation to the US and the fund selection in Europe were the two major drivers of the fund’s performance over the period. The fund selection was generally strong across the portfolio, with only two underlying holdings falling below the 2nd quartile over 12 months.

Long term performance since inception of the fund remains very strong as demonstrated by the supporting graph.

The Committee are pleased with the continuation of the strong performance shown by the Stewart Investors Asia Pacific Leaders fund, the valuation of which is now at an all-time high. The Committee have also noted the improving performance of the Henderson Emerging Markets Opportunities strategy, which is now in the 2nd quartile over 12 months, up from the 4th quartile 3 months ago. Also, there was a significant improvement in the performance of the ‘Value’ biased emerging markets strategy, JPM Emerging Markets Income, which had lagged the market previously due to its more defensive style. However, it has outperformed during the current market conditions, where more risky emerging markets stocks are out of favour.

In Europe, the Jupiter European fund continues to perform very well. This fund has outperformed the sector by c.9.7 percentage points over the quarter. The Jupiter strategy has a high concentration and is of a significant size. The fund’s recent success can be attributed to the manager’s stock picking skills, given the high tracking error relative to the sector. The Committee are generally happy with the Jupiter fund’s performance. However, a note of caution is warranted due to the size of this strategy and its concentration.

The committee feel that Europe currently has the highest risk of interest rates surprising on the upside and believe that this could lead to a short-term underperformance of European equities, however this could provide a buying opportunity over the longer term. To materialise these expectations in the future, it was proposed to further reduce the portfolio’s allocation to Europe and to reinvest the proceeds in Japan to increase diversification. The Committee agreed to this change and decided to reduce Europe by 2% which will be reallocated to Japan.

There were no other changes applied to the portfolio at this time.

The committee approved the strategy and confirmed it is in line with the mandate.

In order to bring the Clarion model portfolios into line with thee portfolio funds the following changes were implemented.

Model B

Model C

Model D

Model E

Model F

Model G

Disclaimer:

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email enquiries@clarionwealth.co.uk.

Click here to sign-up to The Clarion for regular updates.