Category: Financial Planning

The Cable News Network (CNN) began broadcasting at 5 pm on 1 June 1980. While it was the first 24-hour news channel, it wasn’t long before competitors followed in CNN’s footsteps, ushering in the age of the 24-hour news cycle.

The advent of the internet and social media has only served to exacerbate the endless stream of news – and this can be particularly true when it comes to financial updates.

With a seemingly endless stream of stock market, inflation, and other economic headlines, it’s perhaps no surprise that Arbuthnot Latham reports that 87% of affluent people in the UK are worried about the economy.

However, when you cut through the noise, things are looking much brighter than you may think – recent data paints an optimistic picture of our economic future. Here are five reasons to feel positive about the UK economy.

Over recent months, high inflation in the UK has never been far from the headlines. The Consumer Prices Index (CPI) hit 11.1% in October 2022, the highest rate for 40 years, and has exceeded the Bank of England (BoE)’s 2% target since mid-2021.

You’ll likely have felt the effect of high inflation through rising grocery and energy bills.

Inflation can also erode the spending power of your money and could reduce the real-term growth of your savings and investments. When working hard to reach your long-term goals, this can be particularly frustrating.

The positive news is that April’s data revealed inflation is close to target levels at 2.3%. As expected, Rishi Sunak has touted this as a win for the Conservative party – whether voters agree will become clear in July’s election.

Either way, lower inflation means that cost-of-living pressures should start to recede. Additionally, if interest rates remain higher than the inflation rate, the real growth of your pension and other investments should improve, putting you in a more positive financial situation in the long run. That brings us to…

The BoE uses the base rate as one of the tools at its disposal to try and control inflation. The theory is that a higher base rate increases the cost of borrowing for commercial banks, which is passed on to individuals and businesses through higher interest rates on loans and mortgages.

Higher interest rates can bring inflation under control by reducing spending in the economy. Spending falls through two primary mechanisms:

Reduced spending can result in slower price increases, which puts downward pressure on the CPI.

With inflation at 2.3%, many economists expect the Bank of England (BoE) to lower the base rate later this year.

A lower base rate should mean lenders cut mortgage rates and this should reduce the cost of borrowing (although, if you’re on a fixed-rate deal, you won’t feel this benefit until you renew). This will be positive news for millions of mortgage holders.

However, a downside is that you’ll also likely earn less on cash savings as many banks and building societies will likely cut rates in line with a lower base rate.

When the BoE will act is up for debate. The BBC reports the IMF has recommended cutting the base rate to 4.75% or 4.5% by the end of 2024, and to 3.5% by the end of 2025.

Rate cuts will also make access to credit cheaper for business owners. If that’s you, this may provide a good opportunity for investment and growth.

On 10 May 2024, you’ll have woken up to the good news that the UK economy grew by 0.6% in the first three months of the year. This is the fastest quarterly growth in two years and confirms that the minor recession the UK experienced in the second half of 2023 is over.

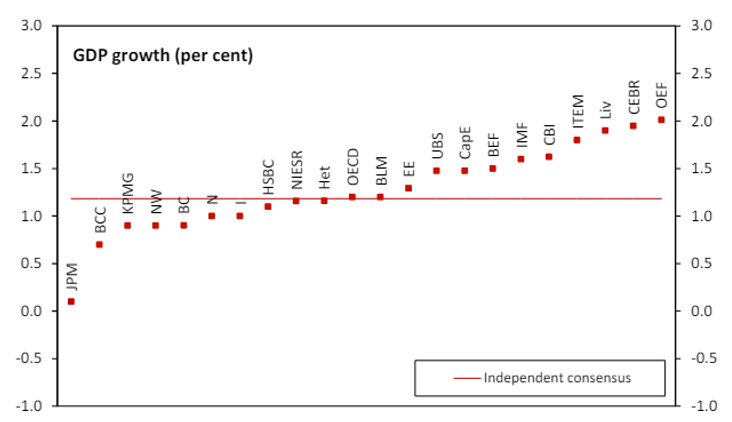

This latest figure indicates the UK economy is heading in the right direction. Indeed, in the Treasury’s round-up of forecasts for the UK economy, it reports that all participating independent analysts predict positive GDP growth for 2025.

Source: HM Treasury

A growing UK economy is good for everyone.

Growing GDP means more money is being spent, boosting tax receipts. The government then has more money to fund public services like the NHS and schools, or the ability to reduce taxes.

A growing economy is also usually good news for business. Rising GDP typically means consumers are spending more, extra jobs are created, and workers benefit from better pay rises.

As a result of all this, you should feel your standards of living rise, a reason for everyone in the UK to feel better about the economy.

In further good news for the economy, the FTSE 100 hit several all-time highs in the first half of 2024; most recently, the index peaked on 15 May.

Household names like Rolls-Royce and NatWest have led the way, with their share price jumping 82% and 55% respectively in the last 12 months.

This strong performance is a big positive if you hold UK investments and could potentially boost the size of your pension and ISA pots.

As the UK market rallies, the future looks bright. In recent years, AI-driven growth has made the US market the global star – but things may be about to level out.

Your home is probably one of your most valuable assets and may be an important part of your financial plan. Consequently, recent declines in UK property values may be concerning.

Though the price fall has been significant – the Guardian reports that the average UK home is worth £11,700 less than in August 2022 – there are signs that this lull is coming to an end.

In the short term, the Standard reports that sales agreed between January and April 2024 are 17% higher than in the same period in 2023, and 1.1 million sales are forecast to take place in 2024. Additionally, Rightmove’s data shows average asking prices have reached a record high of £375,000.

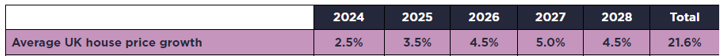

The long-term outlook is also positive. Savills forecast house prices to increase by 21.6% by the end of 2028, driven by strong UK economic performance and falling interest rates.

Source: Savills

A financial planner can help you navigate the 24-hour news cycle, encouraging you to focus on your long-term goals rather than short-term headlines.

With Clarion Wealth on your side, you can feel positive about the economy, safe in the knowledge you have a financial plan to help you reach your goals no matter the economic climate.

Email [email protected] or call us on 01625 466360 to find out more.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.