Category: Financial Planning, Investment management

The Committee had a full discussion regarding the current economic situation and positioning of financial markets. The following is a summary of the main points discussed.

The Committee reviewed risk management, eligibility and investment & borrowing powers reports and confirmed that these were in order and no action was required.

The Committee reviewed StatPro reports and confirmed that the relative Valuation at Risk (VaR) ratios for all three funds were below 100% and stress tests were in line with expectations.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns.

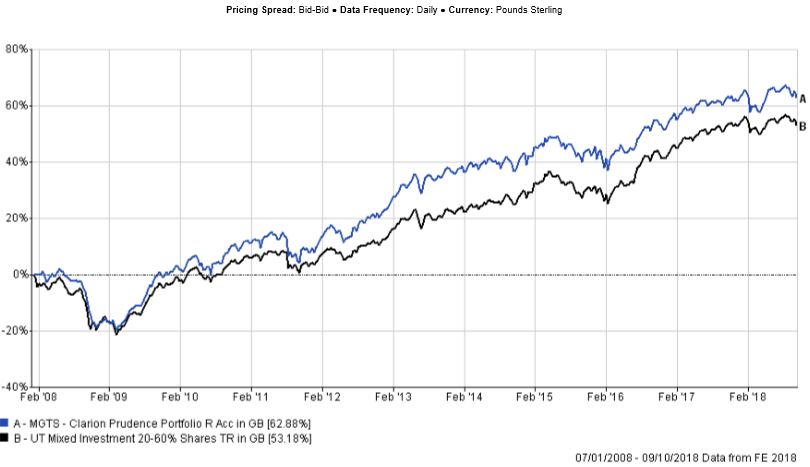

The fund’s performance was slightly weaker compared to the sector over 3 months. Compared to the sector, the fund is overweight to the UK and underweight to the US, which was the main driver of this performance differential, given that the US outperformed the UK over the period.

Long term performance remains strong and is ahead of both the strategic benchmark and the sector average since inception of the Fund.

All underlying bond funds outperformed their respective sectors over 12 weeks. The majority are now in the first and second quartile among their sector peers, when ranked by total return over 12 months. The Committee were pleased to acknowledge that the short duration bias in bonds is now working and is benefiting the portfolio returns.

Among the global equity funds, M&G Global Dividend continues to look strong, while the performance of the Henderson Global Equity Income and Invesco Perpetual Global Equity Income funds are improving. Both the Henderson and Invesco funds have higher allocations to Europe compared to the M&G strategy, hence they often perform differently under different market conditions.

The Committee considered whether it was appropriate to reduce the portfolio’s allocation to global funds given the recent strength of the US market and the potential for future positive repricing in other markets. It was noted that the Henderson and Invesco funds have relatively high allocations to Europe, while the M&G strategy has more direct and indirect exposure to Asia and Emerging Markets. It was agreed that compared to the IA Global sector, the three global funds are less exposed to the US and provide a good level of diversification to the portfolio, which is helpful during a period of relatively high levels of political uncertainty. The Committee agreed to leave the current positioning unchanged.

The Committee feel that the current fund selection in the UK is good, given that all underlying UK funds are within the second and first quartile ranked by total returns among their sector peers. Also 3 of the underlying UK funds have outperformed the IA UK Equity Income sector over 12 weeks.

The Committee have previously raised concerns about the manager change of the Majedie UK Income fund. While Majedie have stated that the fund’s investment process and style are not expected to change, the Committee have grounds to believe that the new manager’s style is likely to be significantly different from the way the fund has been managed previously. Three potential alternatives were considered; Evenlode Income, Miton UK Multi Cap Income and Man GLG Income. It was noted that the Evenlode fund is relatively more concentrated but has a large cap bias, which correlates with other underlying UK equity holdings included in the portfolio which may reduce diversification. The Miton fund holds a bigger number of holdings, its returns have lower correlation with other existing underlying UK funds, however it has a small-cap bias and c.60% of the portfolio is concentrated in the small-cap space. The Man GLG fund has a more balanced portfolio with a relatively low correlation with other existing holdings and a mixture of small, mid and large cap stocks, and also a well spread portfolio of c.60 underlying holdings.

The Committee discussed each option in more detail and compared their risk and performance profiles. It was noted that the Evenlode fund had demonstrated a strong and stable historic performance whilst both Man GLG and Miton had demonstrated lower correlation with other underlying UK funds. Concerns were raised about the possible lower liquidity of the Miton fund due to its small cap bias. The Committee concluded that given all the arguments discussed, the Man GLG fund is likely to be the best option for the Clarion Prudence portfolio, given its relatively low correlation and a reasonable spread across a number of holdings as well as the market cap spectrum. The Committee therefore decided to replace the Majedie UK Income strategy with the Man GLG UK Income fund.

There were no other changes proposed to the fund and the Committee are pleased with the overall performance of this strategy.

The Committee approved the strategy and confirmed it is in line with the mandate.

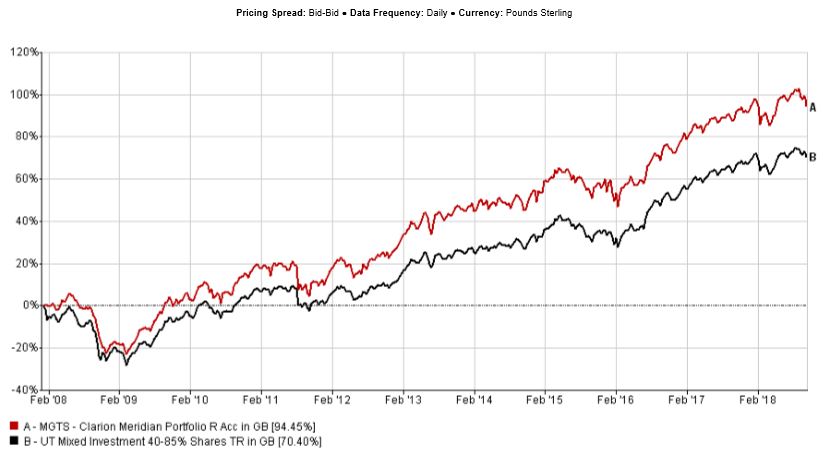

The Clarion Meridian fund performed in line with the sector over 12 weeks. While the fund’s active allocations to Asia and Emerging Markets have detracted slightly from relative returns over the period, the underlying fund selection was generally strong. Long term performance remains strong and is ahead of both the strategic benchmark and the sector average since inception.

Among the underlying equity holdings, only 2 out of 10 active funds have underperformed their sectors. The Committee have noted how well the First State Asia Focus and Fidelity Institutional South East Asia funds work together. The First State fund has a bias to India, while the Fidelity fund has a higher exposure to China. The two strategies tend to outperform and underperform the IA Asia Pacific ex Japan sector during different periods of time, which increases the overall diversification of the portfolio.

In bonds, the L&G Short Dated Sterling Corporate Bond and Royal London Short Duration Credit funds outperformed the IA £ Corporate Bond sector, however the Royal London Short Duration Global Bond and Kames Investment Grade Bond funds have marginally lagged their sectors. A proposed was made to replace the Kames fund with the BlackRock Corporate Bond 1-10 Year fund, which has a lower management charge and has a shorter duration. Before proceeding, however, the Committee will need to confirm the availability of the BlackRock fund on the platforms used to manage the Clarion model portfolios and it was decided that a final decision will be taken at next month’s meeting.

The Committee have noticed the weaker relative performance of the F&C European Growth & Income strategy. While the fund’s performance is strong over 12 months, it performed more weakly compared to the IA Europe ex UK sector over shorter term time frames. The Committee raised no significant concerns at this stage, however it was agreed to investigate the main themes which influence the fund’s performance.

The Committee are pleased to note that the performance of the Rathbone Income strategy looks stronger over 3 months. This fund continues to be under scrutiny due to the relatively weak performance in 2017.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no changes at this stage.

The Committee approved the strategy and confirmed it is in line with the mandate.

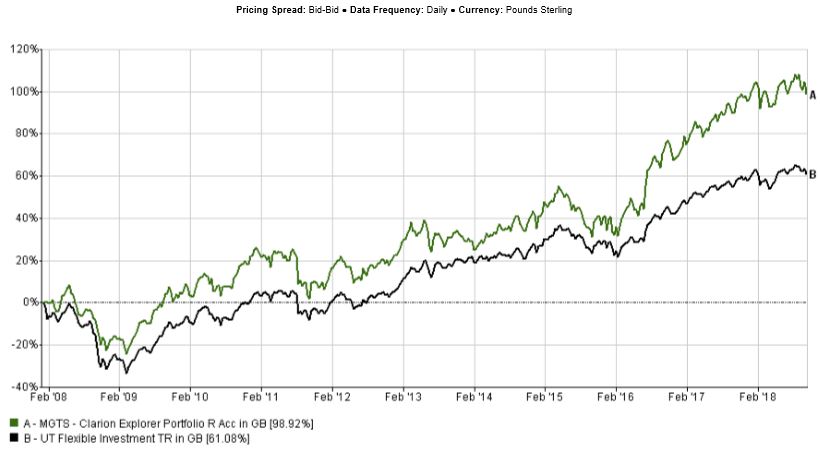

The Explorer strategy was marginally ahead of the sector over 3 months. As with the Meridian fund, the overweight to Asia and Emerging Markets and the underweight to the US detracted from relative returns, however the negative allocation was balanced out by the positive fund selection.

Long term performance of the fund is very strong and ahead of both the benchmark and the sector average since inception of the fund.

In Asia, the Fidelity Asia fund was the only holding which underperformed the IA Asia Pacific ex Japan sector over 12 weeks, which is in line with expectations, given that this fund has a China bias and works well in the context of other underlying Asia holdings.

In Emerging Markets, the underlying selection produced more mixed results, with two funds outperforming and two funds underperforming the IA Global Emerging Markets sector. This split was in line with the Committee’s expectations as both the outperforming funds are generally more defensive compared to the two underperforming funds.

The Committee again looked at the strong performance of the Jupiter European fund although voices of caution were expressed due to the fund’s size and concentration of holdings. The Committee compared the performance of the Jupiter fund to the more mid- and small-cap oriented fund, Miton European Opportunities. Despite their differences, the two strategies performed very similarly and delivered strong returns. The Committee decided to review in detail the underlying holdings in the Jupiter portfolio and assess their concentration and liquidity and discuss this Fund again at the next meeting.

The two Japanese holdings continued to perform well as a pair. The Schroder Tokyo fund has recovered some of the earlier weaker performance and now outperforms the sector over 3 months. The Lindsell Train Japanese strategy remains the best performing holding in the portfolio and has delivered c.24% returns over 12 months in absolute terms.

The Committee are pleased with the overall performance of this strategy and proposed no changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

The Clarion fund asset allocations used for the model blends were updated.

Model C

| Action Point | Review Point |

| To add a benchmark to the L&G UK Index fund | Next IC |

| To replace Majedie UK Income with Man GLG UK Income | ASAP |

| To check the availability of BlackRock Corporate Bond 1-10 Year | Next IC |

| To review the performance of F&C European Growth & Income | Next IC |

| To review the concentration of Jupiter European | Next IC |

| To review the performance of Rathbone Income | Next IC |

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.