Category: Financial Planning, Investment management

Minutes for the Clarion Investment Committee Meeting held at Overbank, 52 London Road, Alderley Edge, Cheshire, SK9 7DZ on the 24th May 2019.

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 29th April 2019 were agreed by the Committee as a true and accurate record.

In the recent European Elections, the electorate punished both mainstream parties in the UK for their continuing opposing positions on Brexit and procrastination at being able to agree a solution. Expectation of a compromise deal did not materialise.

Theresa May has now been forced to announce her resignation and a hard Brexit supporter is likely to take her place with Boris Johnson the forerunner at this stage.

The possibility of a No Deal exit has now resurfaced and this may encourage the Europeans to adopt a more accommodative stance in the final negotiations. UK Industry Leaders strongly oppose a No Deal exit which is also unlikely to be endorsed by Parliament. The Government must attempt, therefore, to negotiate a sensible middle of the road deal which still seems to be the most likely outcome. Hopefully this will placate both Brexit and Remain Camps alike.

A similar level of political uncertainty also persists in the US/China trade discussions (See separate Article).

Despite significant political uncertainty in the UK, Europe, America, China and indeed in other parts of the World, economic growth remains positive. A low interest rate environment with subdued inflation provides a favourable “Goldilocks” economic backdrop of not being too hot to create inflation forcing a rise in interest rates, nor too cold to cause an economic slowdown and recession.

The world economy is in a reasonably healthy state. Real GDP has been expanding for the best part of a decade. A record number of people in the UK and US are in work and unemployment is at the lowest rate in 45 years. Real wages are rising and private net wealth is at near record highs. Public finances are steadily improving.

Of course there are issues, there are large regional inbalances, but the feel good factor, so important for consumer confidence, looks set to continue.

As the final outcome of the various political differences throughout the world is impossible to predict, geographical and sector diversification is, as always, the key to navigating uncertainty. An investment strategy focusing on strong companies with visible and predictable earnings and strong balance sheets is likely to be the most rewarding at this stage of the economic cycle.

Our strategy of focusing on the UK, Asia and Emerging Markets on valuation grounds remains unchanged with a sensible allocation to America & Japan. We are underweight Europe, where political and fiscal uncertainty is heightened, and we avoid Companies with a significant exposure to China. In fixed interest we prefer short duration bonds.

All risk and stress tests confirm that the Clarion Funds and Model portfolios are managed in accordance with their appropriate risk rating and there are no concerns regarding liquidity and/or capital risks other than normal market volatility.

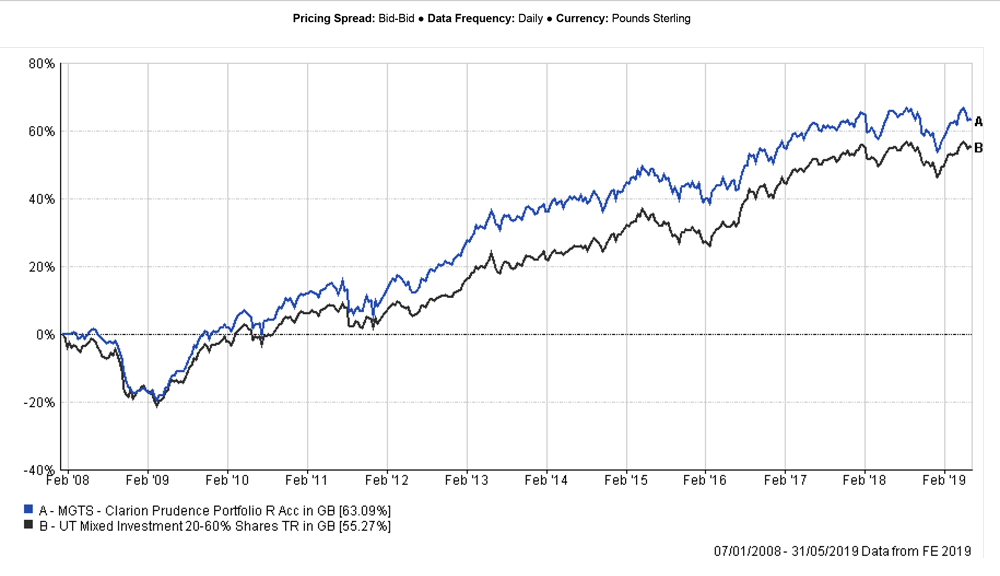

The Prudence fund performed in line with the IA Mixed Investment 20-60% Shares sector over 12 weeks.

The allocation effect was positive, with the fund’s active allocation to global funds being the strongest contributor. Fund selection was relatively strong in equities and weaker in bonds.

Short duration bond funds marginally underperformed their respective sectors as bond yields fell.

Among UK equity funds, the Threadneedle UK Equity Income fund underperformed the sector over 12 weeks. However, this fund was one of the best underlying UK holdings over 12 months and given its strong long-term performance, the Committee has no immediate concern.

The Henderson Global Equity Income fund continued to lag the sector. DK mentioned that this strategy has a relatively large allocation to Europe and on that basis, it has unperformed some more US based strategies included in the IA Global sector.

KT proposed selling down the Henderson holding and replacing it with the Fundsmith Equity strategy. TR is slightly cautious because of the outstanding performance of Fundsmith Equity, but acknowledges the quality of the underlying stock picking. After a long discussion the Committee agreed that the Fundsmith strategy looks relatively defensive, but has performed very well compared to its peers and decided that the Henderson holding will be replaced with Fundsmith.

Overall, the Committee are pleased with the performance of the Prudence fund and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

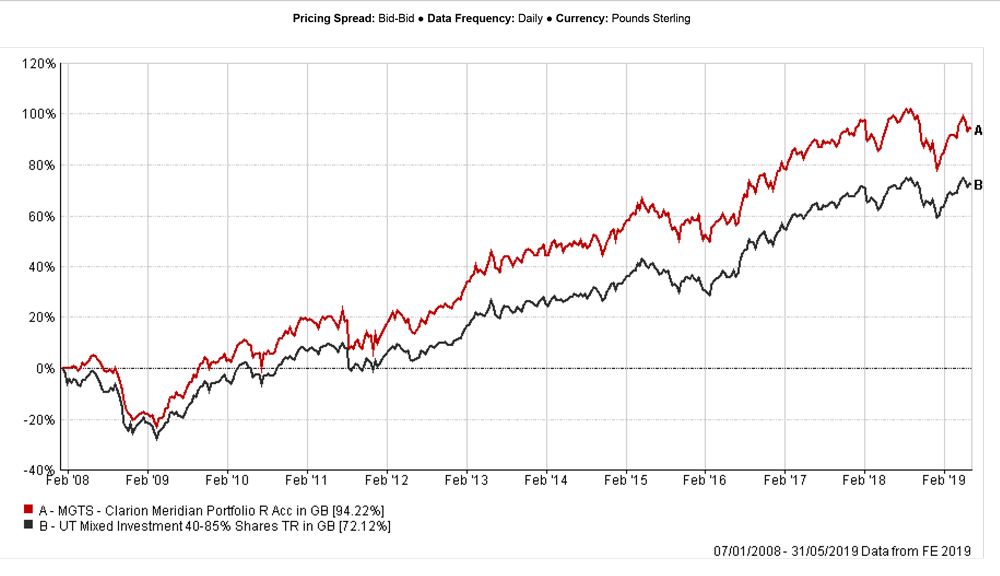

The Meridian Fund performed in line with the IA Mixed Investment 40-85% Shares sector over 3 months. Over 4 weeks the fund’s overweight allocation to equities detracted from returns slightly, as equities fell over the period. Fund selection in equities was generally strong, while underlying short-dated bond funds lagged their respective sectors.

The Committee commented on a strong selection of the Asian, European and Global funds, as all underlying strategies in these geographic areas have outperformed their sectors.

However, the Committee raised some concerns regarding the SLI UK Equity Income Unconstrained fund. DK commented that this Fund has a bias to UK mid-cap value stocks which have underperformed global large cap stocks over 12 months. TR pointed out that sooner or later the underlying value will be realised. The Committee agreed and decided hold the Fund but agreed to give Margetts a mandate to sell when a repricing uplift occurs.

The Committee discussed the rationale for adding an infrastructure fund to the portfolio as a defensive compromise between equities and bonds. It was agreed that this will be discussed in more detail at the next IC meeting.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no other changes at this stage.

The Committee approved the strategy and confirmed it is in line with the mandate.

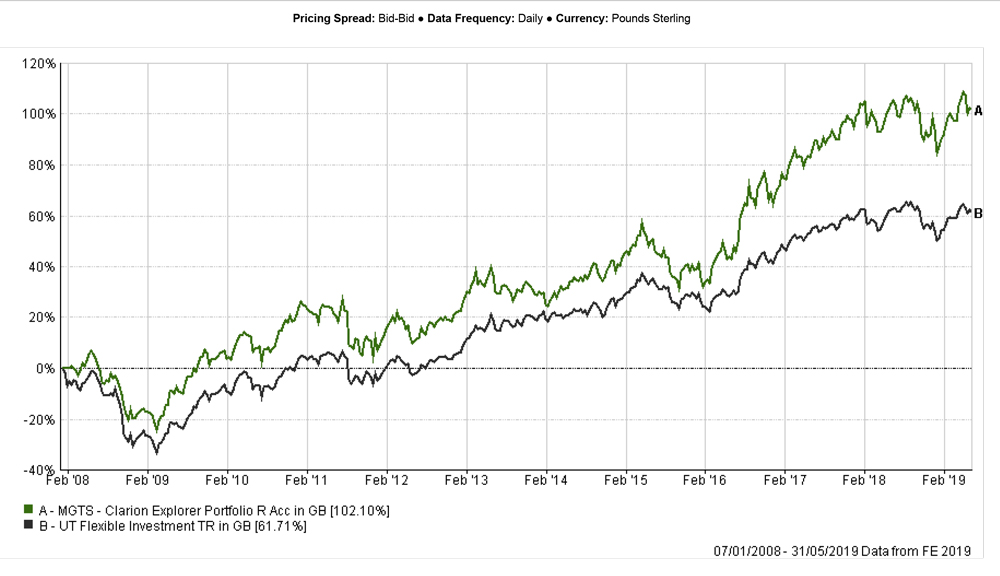

Explorer was in line with the IA Flexible Investment sector over 3 months. Asset allocation detracted slightly from the relative performance, while the underlying fund selection was strong.

All but one of the underlying Asia and Emerging Markets funds outperformed their sectors over 12 weeks, which was in line with expectations. Most of these funds have a focus on high quality assets and tend to outperform during periods of market falls. Selection in other areas was also strong.

The Schroder Tokyo fund was the only area of concern for the Committee at this stage. The fund is in the process of being handed over to a new portfolio manager. Due to this change and its recent underperformance relative to the IA Japan sector, the Committee feel that other options should be explored. It has been agreed that a replacement for the Schroder Tokyo fund will be discussed in more detail at the next IC meeting when DK will present alternatives.

The Committee are pleased with the overall performance of this strategy and proposed no other changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model A

Model B

Model C

Model D

Model E

No other business.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.