Category: Financial Planning, Investment management

Minutes of the Clarion Investment Committee held at Overbank, 52 London Road, Alderley Edge, Cheshire, SK9 7DZ at 13:00 on 18th July 2019.

| Keith Thompson (KT) | Chair/Director |

| Ron Walker (RW) | Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

| John Winstanley (JW) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 20th June 2019 were agreed by the Committee as a true and accurate record.

To read the latest market and economic commentary please click here.

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

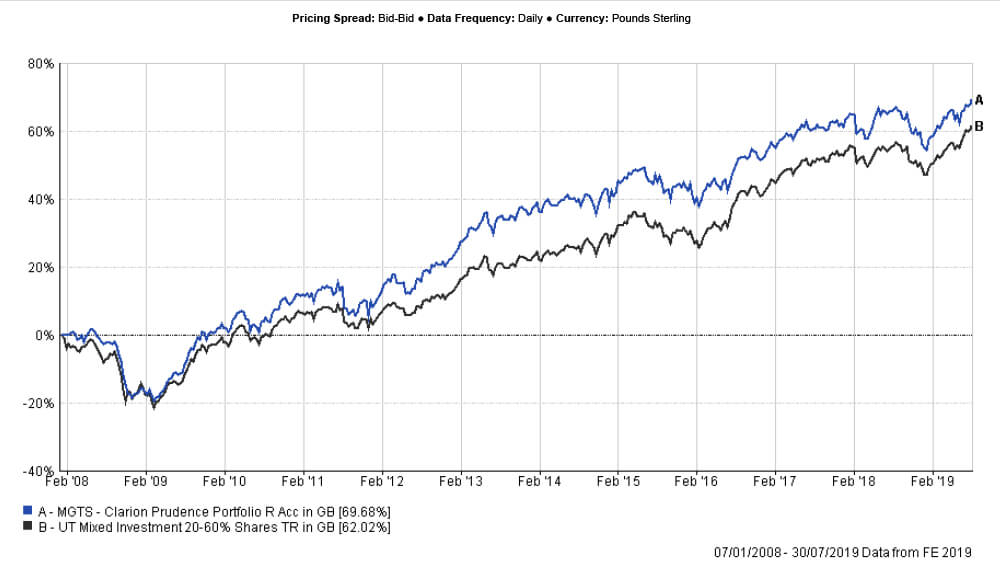

While the fund was c.1.3 percentage points behind the IA Mixed Investment 20-60% Shares sector over 3 months, performance improved in the second half of June and July. The fund benefited from an improvement in the asset allocation effect as equities outperformed bonds and cash over 4 weeks. The underlying fund selection has been weaker primarily due to the underperformance of the short-dated bond funds which lagged longer-dated bonds as bond yields fell further pushing up capital values.

The underlying fund selection among equity funds was strong over 12 weeks as all but three funds outperformed their respective benchmarks. The Committee were pleased with the way the Fundsmith Equity and M&G Global Dividend funds pair together, given that the two have a negative correlation of their excess returns. The M&G Global Dividend Fund also has quite a high yield which is appropriate for the Clarion Prudence Fund.

In the UK, the Committee were also pleased with the recent performance of the Threadneedle UK Equity Income fund: the best performing UK Equity Income holding over 12 weeks.

The performance profile of the Man GLG UK Equity Income fund has weakened over the short-term. This fund has a mid-cap bias and tends to outperform when the pound appreciates and generally does better on positive news about the UK’s economy. The Committee feel that the recent performance profile was in line with expectations and raised no concerns at this stage.

Overall, the Committee are happy with the performance of the Prudence fund and no changes have been proposed.

Medium to long term performance of the Prudence Fund is good and ahead of both benchmark the respective sector. The Committee approved the strategy and confirmed it is in line with the mandate.

Similar to the Prudence portfolio, Meridian lagged the sector over 3 months by circa 1.3% points with the performance profile showing signs of improvement in June and July. The underweight allocation to the US was the main detractor on the asset allocation side, while fund selection was mixed across the board. In bonds, a bias to short-dated bond funds was the main detractor, while in equities, small and mid-cap funds have generally underperformed.

The committee were pleased with strong performance profiles demonstrated by both Asian funds and the underlying European fund over 12 weeks. The global funds also made a positive contribution on a cumulative basis.

Selection in the UK has been weaker over the shorter term, although most funds continue to be ahead of their respective sectors over 12 weeks. Over 4 weeks, the strategies with a mid-cap bias, such as SVM UK Growth and SDL UK Buffettology funds, have underperformed the IA UK All Companies sector due to weaker Sterling and an unstable political situation in the UK.

The Committee discussed replacing the M&G Global Dividend fund in this portfolio. The Committee came to the decision that it would be appropriate to sell the M&G strategy as the underlying oil and gas theme has now been partly realised. The fund will be replaced with the Artemis Global Select fund, which has a more balanced portfolio and does not run either a specific growth or value bias.

Following a weaker performance profile of the SLI UK Equity Income Unconstrained fund, the Committee decided to reduce the allocation to this fund by 50% and re-allocate the proceeds into the Artemis Income fund. The Artemis strategy has a tilt towards large-cap stocks and consists of a more balanced portfolio.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no other changes at this stage.

Performance of the Meridian Fund over both the long and medium term is excellent being ahead of both the benchmark and the sector. The Committee approved the strategy and confirmed it is in line with the mandate.

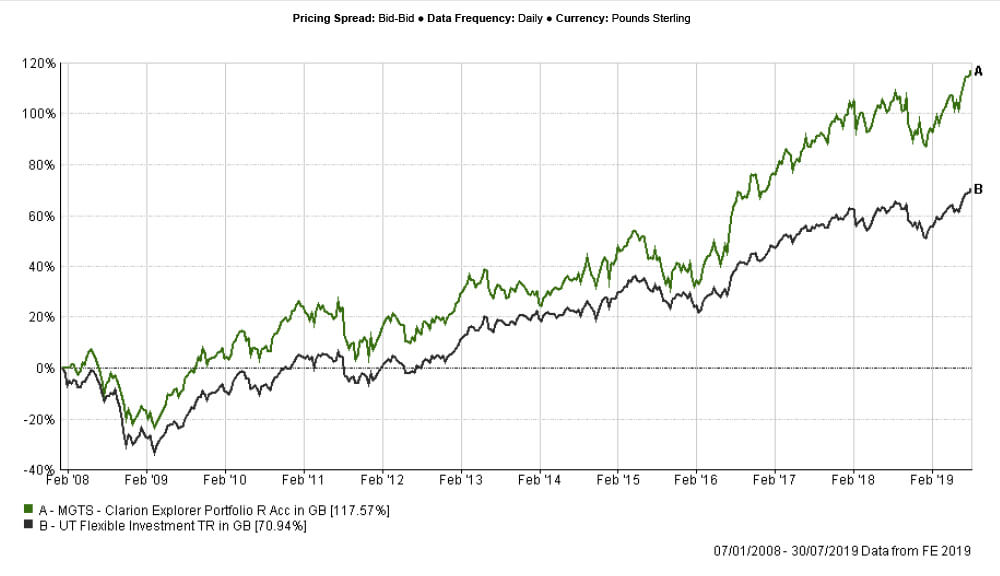

Over three months Explorer has outperformed the IA Flexible Investment sector by c.0.8 percentage points. The fund underperformed the sector slightly during the period of market falls in May but recovered strongly in June and July.

Strong fund selection remains the main driver of the fund’s positive relative returns, while asset allocation continued to slightly detract from performance. The underweight allocation to the US was the main detractor over the period.

The underlying selection was very strong in Asia, where all but one underlying fund outperformed the IA Asia Pacific ex Japan sector over 12 weeks. The Schroder Institutional Pacific fund continued to be the best performing Asian holding over the period, with a c.7.7% return in absolute terms.

In Europe, both underlying funds outperformed the sector over both 4 weeks and 12 weeks. In Emerging Markets, more than half of underlying funds outperformed over 12 weeks and all funds outperformed over 4 weeks.

Selection was slightly weaker in Japan, where both underlying funds have lagged the IA Japan sector over 12 weeks. However, the Committee raised no concerns about the allocation to Japan at this stage.

The Committee decided to sell the M&G Global Dividend strategy and replace it with the Artemis Global Select fund.

Given that the fund continues to be underweight to the US when compared to its strategic allocations, KT proposed reducing the allocation to Emerging Markets and increasing the fund’s exposure to the US. RW feels that the fund’s current performance profile is strong and there is no immediate need to change asset allocations. The Committee agreed to leave the portfolio’s allocations unchanged at this stage.

The Committee are pleased with the overall performance of this strategy and proposed no other changes at this meeting.

Performance of Explorer remains strong over both medium-and long-term time frames and returns are within the risk reward profile of the Fund. The Committee approved the strategy and confirmed it is in line with the mandate.

The following changes were made to reflect the changes to the Clarion Portfolio Funds.

Model D

Model E

Model F

Model G

Clarion wish to bring the model portfolios in line with the Clarion funds and to cease blending the portfolios. The intention is to create four strategies which would match the risk profiles of most investors and therefore to simplify the risk management and improve the interaction of the Clarion Portfolio Funds and the model portfolios. A fourth fund is likely to be introduced in the future, which is expected to be suitable for inclusion in the IA Mixed Investment 40-85% Shares sector.

| Action to be taken by | Action Point | Review Point |

| DK | To change the order of the investment committee information pack and put the attribution analysis next to other information on individual funds. | Next IC |

| DK | To proceed with changes agreed at IC | ASAP |

| DK | To create an annual review document | Ongoing |

| All | To review UK mid-cap position in Explorer | Next IC |

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.