Category: Financial Planning, Investment management

Minutes of the Clarion Investment Committee held at Overbank, 52 London Road, Alderley Edge, Cheshire, SK9 7DZ at 13:00 on 22nd August 2019.

| Keith Thompson (KT) | Chair/Director |

| Ron Walker (RW) | Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

| Adam Wareing (AW) | Paraplanner (Clarion Wealth Planning) |

| Jacob Hartley (Guest) | Clarion Wealth Planning |

Minutes from the previous meeting held on 18th July 2019 were agreed by the Committee as a true and accurate record.

For the full economic commentary “Slowdown or Mid Cycle” please click here.

The following is a brief summary of the key topics discussed by the Investment Committee:

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

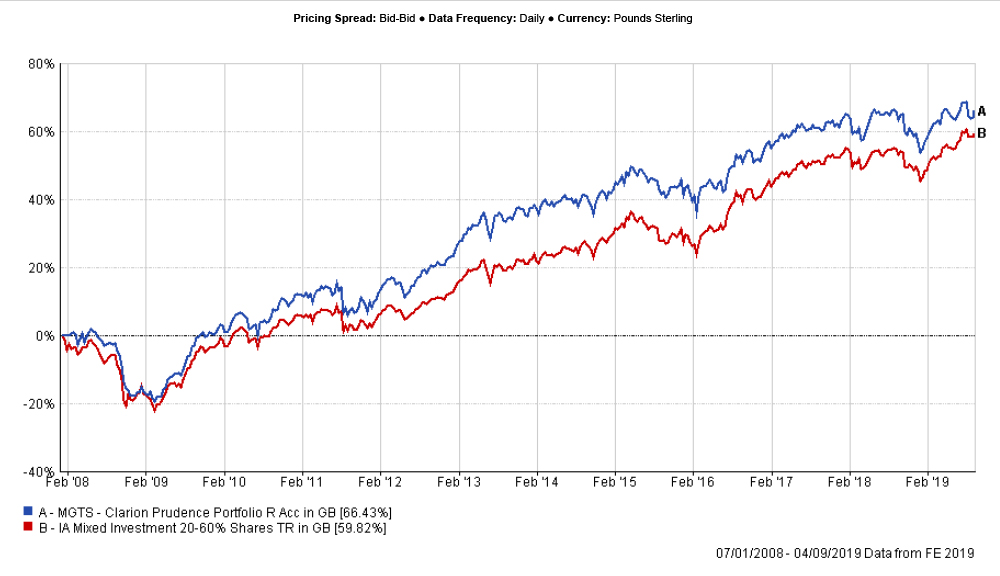

Fund performance has slightly lagged the sector over 3 months. The underweight allocation to bonds and overweight to equities detracted from returns as the latter have underperformed over the period. However, an underweight allocation to the UK in favour of global funds contributed to returns.

In bonds, fund selection detracted from relative returns as all underlying short-duration strategies, which the fund has a bias to, have underperformed their respective sectors over the period. With bond yields falling further, long-duration outperformed short-duration strategies.

In equities, fund selection was strong as most underlying equity funds have outperformed their respective sectors. Within the portfolio’s allocation to the IA Global sector, the positive relative performance of the Fundsmith equity strategy has outweighed the weaker relative performance of the M&G Global Dividend fund.

The Committee discussed the recent spell of weaker performance of the M&G Global Dividend fund. The fund currently holds a significant allocation to the Basic Materials and Energy sectors, which have underperformed due to weaker commodity prices. It was agreed to request a commentary from M&G and the fund will be discussed in more detail at the next IC meeting. DK will also research and present potential alternatives which can be used to replace this fund.

In the UK, fund selection was strong as all underlying funds, with the exception of Man GLG UK Income strategy, have outperformed the IA UK Equity Income sector. The Man GLG fund has a tilt towards mid-cap stocks and its recent performance was in line with the Committee’s expectations.

Overall, the Committee are happy with the performance of the Prudence fund and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

Similar to the Prudence portfolio, the Clarion Meridian fund has underperformed its sector due to the overweight allocation to equities and an underweight allocation to cash and bonds. Compared to the sector this fund also has an overweight allocation to the UK and an underweight allocation to the US, which further detracted from the relative performance.

In bonds, all underlying short-dated strategies have underperformed their respective sectors over 12 weeks following a period of falling yields, which led to the outperformance of longer-dated bonds.

In the UK, strategies with a mid-cap bias, such as SVM UK Growth and SLI UK Equity Income unconstrained have underperformed their respective sectors over 12 weeks. The Committee have no concerns about the SVM fund given that its recent performance profile was in line with expectations. There are, however, some concerns about the underperformance of the SLI fund and the Committee have now reduced the allocation to this fund. Margetts have been given the mandate to sell out of this holding as soon as its performance recovers.

The Committee were pleased with the strong relative performance of the Artemis Income fund which has been recently added to the portfolio as a replacement for the SLI UK Equity Income fund. The Artemis fund has outperformed the IA UK Equity Income sector over 2,4 and 12 weeks.

Overall, selection of equity funds in other geographic areas was strong, as all but one underlying equity fund outside of the UK have outperformed their respective sectors.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no changes at this stage.

The Committee approved the strategy and confirmed it is in line with the mandate.

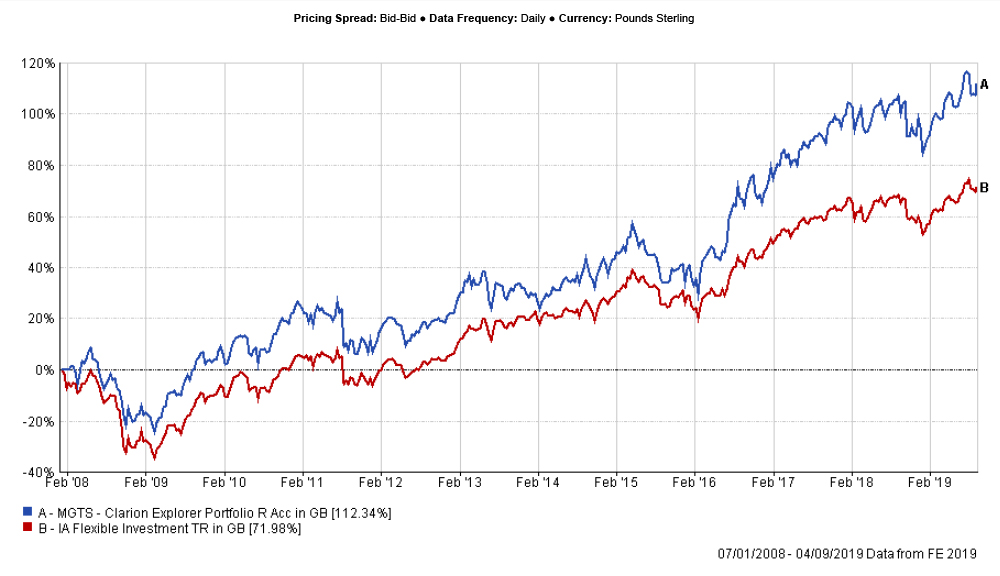

Explorer performed in line with the IA Flexible sector over 3 months. While the underweight allocation to the US created the biggest drag on the relative performance, the underlying fund selection was strong across all geographic areas.

The Committee discussed fund selection in Asia and Emerging Markets and concluded that there were no issues associated with any of the underlying funds in these areas. Performance of the underlying funds has been strong.

In Europe, the Hermes European ex UK fund has marginally underperformed the IA Europe ex UK sector over 12 weeks. The Committee raised no concerns about the Hermes fund at this stage.

The Committee have noted the strong performance profile of the Artemis Global Select strategy which has been recently added to the portfolio.

The Committee discussed the weaker relative performance of the Lindsell Train Japanese Equity Hedged strategy. This fund has underperformed the IA Japan sector due to the recent strengthening of the Japanese Yen. KT asked whether holding a hedged and an unhedged share class together adds any benefit to the portfolio’s overall performance. DK demonstrated that while both share classes provide exposure to the Japanese equity market, they cancel out currency movements of the Yen against Sterling. The Committee discussed whether it would be worth hedging all of the exposure to Japan but decided to take no action as currency movements are difficult to predict and this would add an additional layer of risk to the strategy.

The Committee are pleased with the overall performance of this strategy and proposed no changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

No changes.

The Committee discussed the difference in performance profiles of the Clarion models compared to the blends of the Clarion portfolio funds. This could suggest that Clarion blended strategies have been overdiversified, while Clarion models now represent more focused portfolios which have been constructed using a narrower selection of funds.

AW asked whether FCA should be notified about changes in Clarion models. TR believes that there is no need to notify FCA and a notification to clients will be appropriate.

AW will work on new strategic allocations for Clarion funds and will send a proposal for the launch of the fourth Clarion Portfolio fund strategy. TR will look at the proposal and decide whether FCA need to be notified about the changes to existing Clarion portfolios.

| Action to be taken by | Action Point | Review Point |

| AW | To send out proposed strategic allocations for Clarion funds. | ASAP |

| DK | To request a commentary for the M&G Global Dividend fund. | Next IC |

| DK | To create an annual review document. | Ongoing |

| DK | To prepare a number of potential substitutes for the M&G Global Dividend fund. | Next IC |

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.