The Clarion Investment Committee met on 15 August 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Economics

- US inflation dropped to 2.9% in the 12 months to July, the lowest level since March 2021, reaffirming expectations that the Fed will begin to cut interest rates next month

- US retail sales grew by 1.0% in July compared with the previous month, in part due to rising spending on cars and electronics

- A survey of US small business managers found optimism at its highest level since February 2022

- Together, this positive data has helped calm fears over an imminent US recession and has boosted investor sentiment

- The UK economy grew by 0.6% from the first to the second quarter, in line with expectations, as strong growth in the services sector offset falls in construction manufacturing output. Monthly growth was flat in June

- UK wage growth slowed to 5.4% in the three months to June compared with the same period last year, the smallest rise seen in two years and likely to be seen as evidence that inflationary pressures continue to recede

- UK inflation rose to 2.2% in the 12 months to July, up from 2.0% the previous month as energy prices did not fall as steeply as they had a year ago. Despite this being the first increase in the headline annual inflation measure this year, on a monthly basis, consumer prices fell by 0.2% from June to July and the closely watched core and services inflation measures declined

- British retail sales rose by 0.5% from June to July following a 0.9% contraction in the preceding month

- UK renters are spending a record 28.8% of their gross income on rent, according to figures published by the ONS last week, as year-on-year growth in rental prices remained unchanged at 8.6% in the 12 months to July

- The euro area posted growth of 0.3% in the second quarter, in line with expectations as employment grew 0.2% from the first quarter

- Investor sentiment in Germany plunged in August, according to an influential survey by the ZEW institute

- Chinese industrial production rose 5.1% in July compared with the same month in the previous year as investment in manufacturing was up 9.3% in the first seven months of the year. The news will do little to assuage fears of industrial overcapacity in China

- Meanwhile, house prices continued to decline in China for the 14th consecutive month while the inventory of unsold homes reached its highest level since 2016

- Japan posted growth of 0.8% in the second quarter, the fastest quarterly growth seen in a year as rising wages fuelled an increase in consumer spending

Business

- UK fintech Revolut sold shares held by employees that implied a valuation of $45bn, making it Europe’s most valuable start-up

- Businesses have complained to the UK government that they are paying for physical customs checks that are not taking place following the introduction of a new post-Brexit charge on food and plants in April

- The UK government offered train drivers in England a settlement comprising a 5% pay rise for 2022-23, 4.75% for 2023-24, and 4.5% for 2024-25, in a deal that unions will recommend to members

- Iron ore prices hit their lowest levels in two years, in part due to weak demand from China, hitting the stocks of relevant large mining companies

- Sales of individual annuity products in the UK rose 50% in the first half compared with the same period last year, as higher interest rates make the products more attractive

Global and political developments

- Israel and Lebanon engaged in crossfire as tensions remain high in the Middle East

- The US, Qatar, and Egypt proposed a ceasefire deal between Israel and Hamas. A further meeting is expected to take place soon to discuss the proposals

- US president Joe Biden said that such a ceasefire would likely reduce the risk of Iran retaliating against Israel for the assassination of a Hamas leader in Tehran last month as Iran rejected calls for restraint

- Ukrainian troops are pushing to take more territory in the Kursk region of Russia, meanwhile Ukrainian authorities ordered the evacuation of civilians near the front lines in Ukraine’s Donetsk region as Russian forces continue to advance in the east

- Germany issued an arrest warrant for a Ukrainian diver in relation to the bombing of the Nord Stream pipeline in 2022

- Japanese prime minister Fumio Kishida announced that he would step down in September

- The US announced that it would ease restrictions on sharing some military technology with the UK and Australia, boosting the 2021 AUKUS agreement

Please click here to access the August Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary & Strategy

- After a good first half of the year equity markets hit the buffers on the first Monday in August. Global markets fell, volatility surged, and investors stampeded into safe assets, including US treasuries. At one-point, global equities were down 8% from their July peak. The sell off was most acute in Japan, where the main index suffered the sharpest one-day decline for 37 years. Investors also focused on the US, with the S&P 500 having its worst day since 2022.

- Since then, markets have regained most of those losses and volatility has fallen back. Most major stock markets are still up comfortably year-to-date. As the dust settles the big question is whether the market ructions were a harbinger of weaker growth.

- Equity market moves are rarely an accurate predictor of changes in the economic outlook, but the increase in volatility, which has been strangely absent so far in this tightening cycle, is a reminder of the risks to economic growth. A slowdown would have a negative impact on highly valued growth stocks, particularly the so-called Mag 7 US Tech stocks and would support our strategy of being overweight value stocks particularly in the UK. Value stocks and undervalued markets, particularly the UK, Europe and Asia are likely to be the key beneficiaries of a rotation out expensive US stocks.

- Notwithstanding the recent volatility the Investment Committee is maintaining its position of being underweight US stocks and overweight UK, Europe & Emerging Markets

- The Investment Committee has become increasingly cautious about the outlook for the US economy, concerned by unsustainably low consumer savings rates as well as by high levels of personal debt. The US government has its own debt issues too. It will need to tackle its fiscal deficit at some stage, providing a further drag on economic growth

- The Investment Committee believes that inflation will persist and while it is likely to dip below 2% in the next few months, the long-term average is expected to be around the 3% level due to wage inflation.

- A higher interest rate and higher inflation environment will become the new norm

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations.

- Liquidity has been the most significant driver of returns to date but there remains a downside risk to high PE stocks.

- It will take a full economic cycle for the inflationary effects of printing money after the global financial crisis and Covid to dissipate.

- There were no changes to the underlying funds at this meeting.

Since December 2023, there has been a tilt towards evidence-based factor investing, which involves a disciplined approach backed up by significant amounts of Nobel Prize-winning economic research. Factor investing involves trusting the market but tilting the investment choice towards smaller companies, value companies (those trading at a discount) and profitable companies. The evidence shows that over the long-term, these types of investments outperform the typical index tracking and actively managed funds.

Clarion is accessing these factor-based investments through Dimensional Fund Advisors. At the present time Dimensional are the only investment manager in the UK which offer this type of investment. Since inclusion, investment performance has been impressive, costs have decreased, and it is likely that we will look to introduce more factor-based funds into the portfolios as and when appropriate.

The Clarion funds are well positioned to take advantage of the latest economic conditions and over the last 12 months (to 27/08/2024) investment returns have been as follows:

- Explorer has returned 15.43% against the RTMA Risk 5 Growth sector average of 04% and the IA Flexible sector average of 13.04%

- Meridian has returned 14.12% against the RTMA Risk 5 Growth sector average of 04% and the IA Mixed Investment 40-85% Shares sector average of 13.77%

- Navigator has returned 13.25% against the RTMA Risk 4 Balanced sector average of 13.47% and the IA Mixed Investment 40-85% Shares sector average of 13.77%

- Prudence has returned 11.07% against the RTMA Risk 3 Moderate sector average of 11.84% and the IA Mixed Investment 20-60% Shares sector average of 11.54%

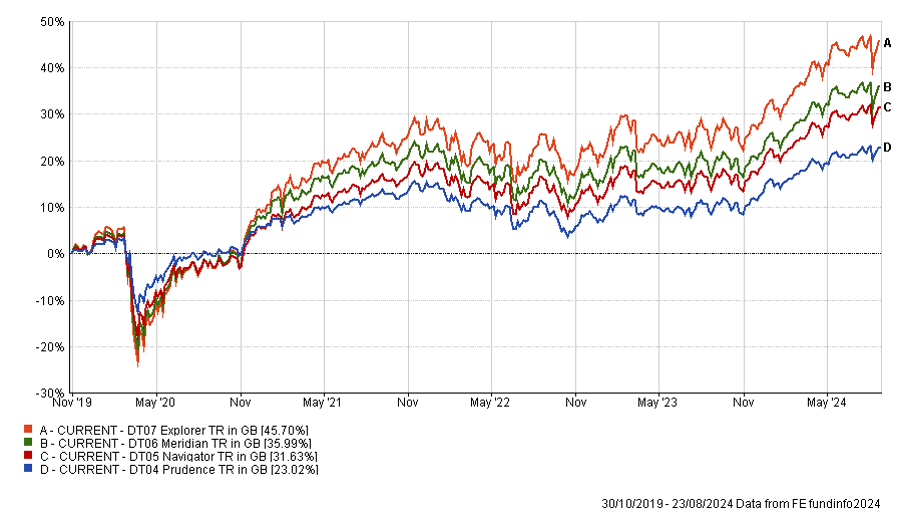

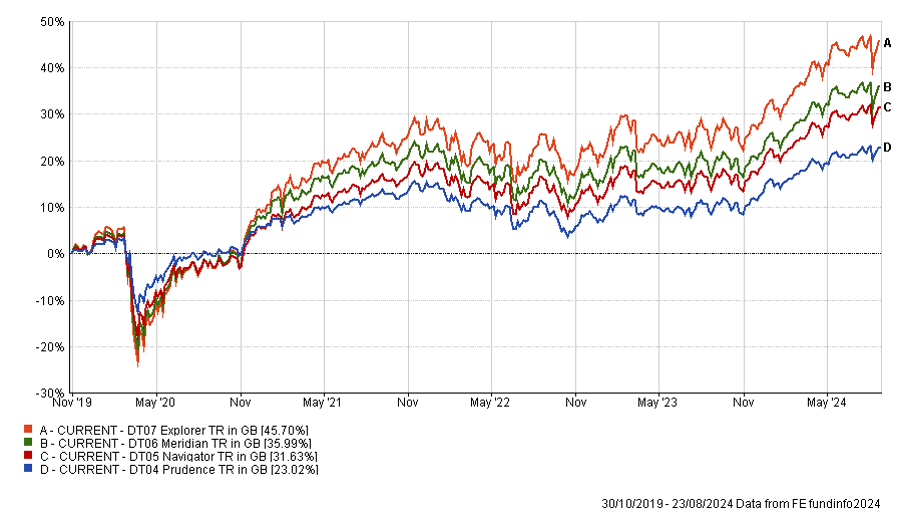

The performance of the CURRENT portfolios back tested over five years is shown in the chart below. This is assuming that we made the recent changes five years ago and then adopted the buy and hold approach favoured when using evidence-based factor investing.

Clarion Funds & Discretionary Portfolios:

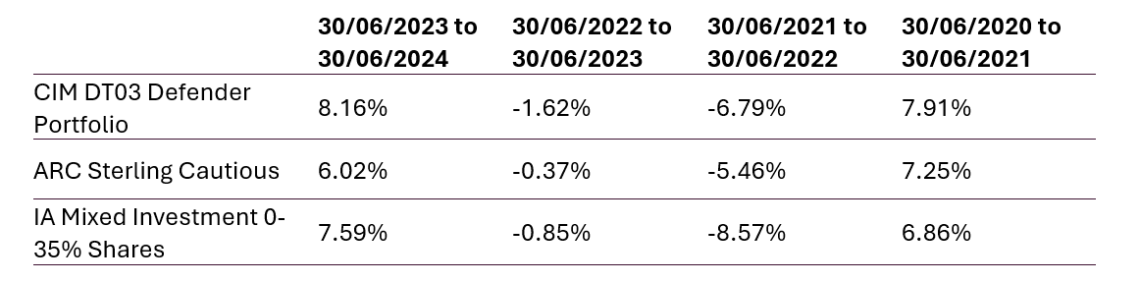

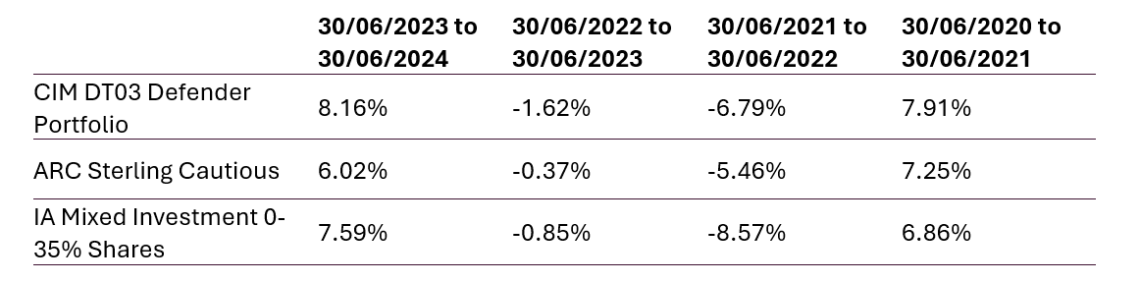

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Defender Portfolio

- There were no changes to the Defender Portfolio in August 2024.

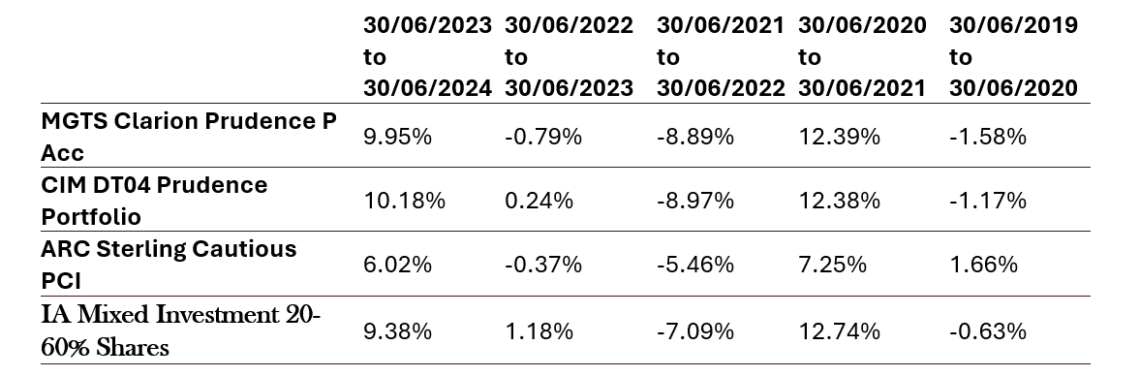

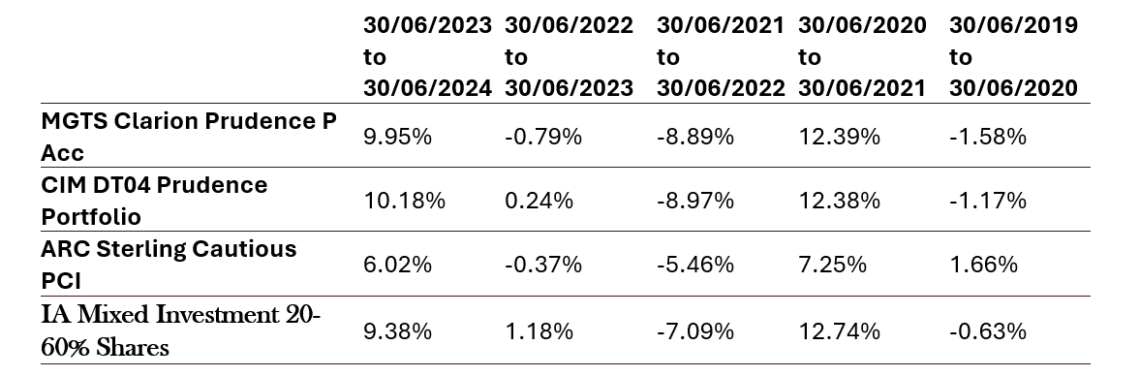

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Prudence Fund & Portfolio

- There were no changes to the Prudence Portfolio in August 2024.

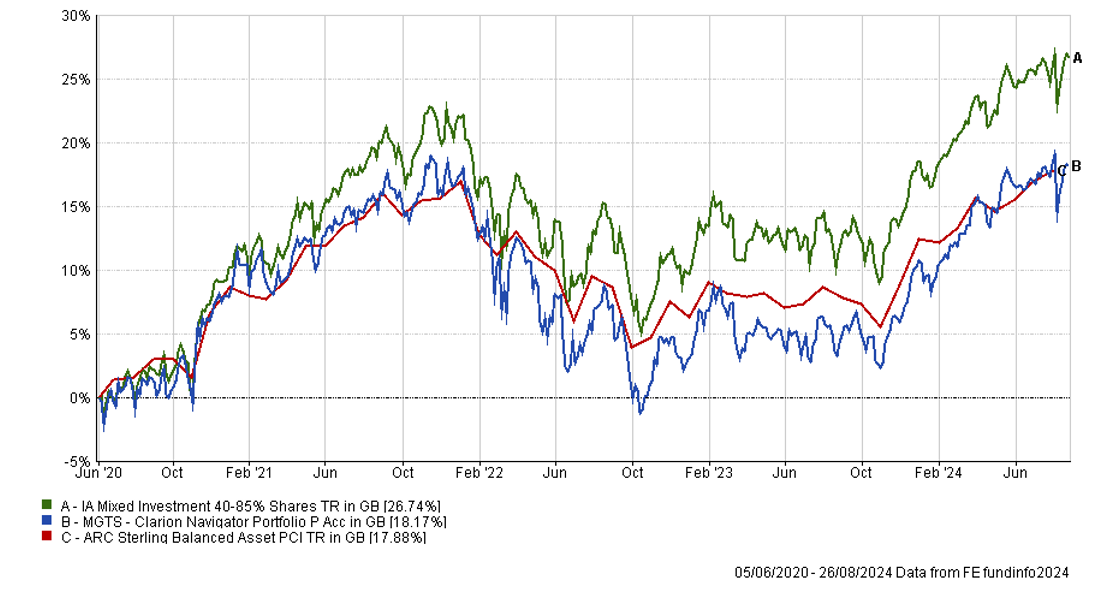

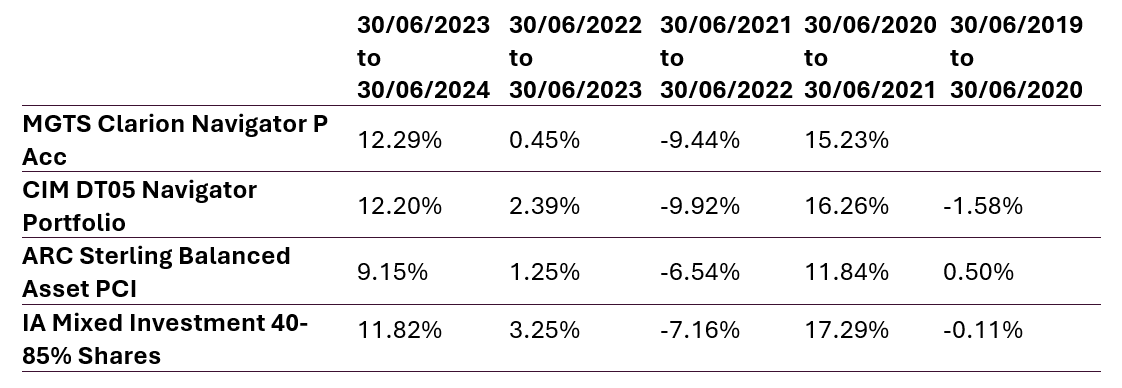

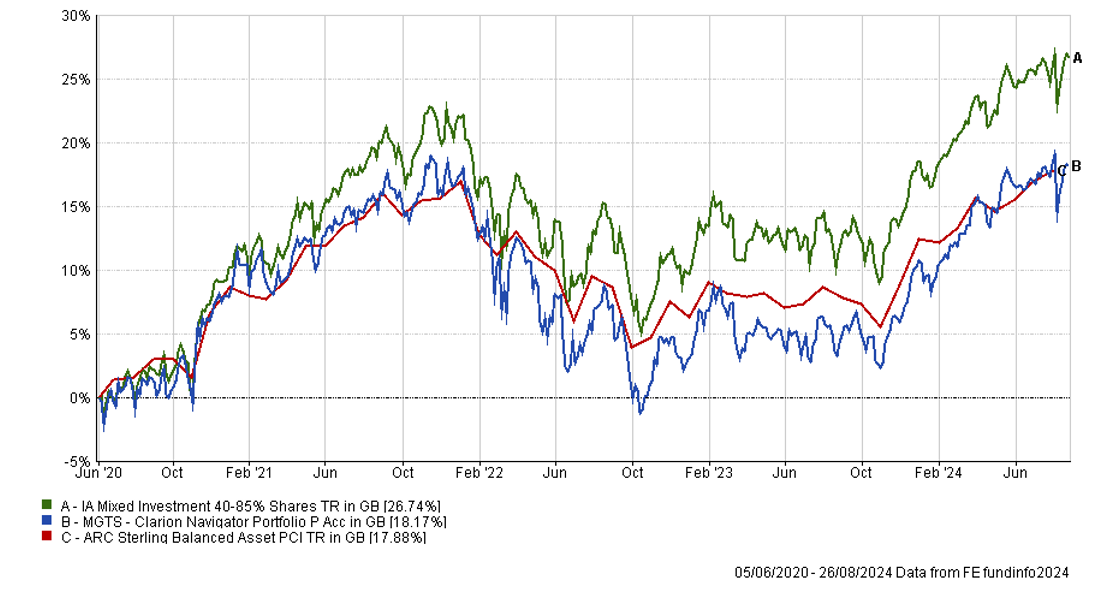

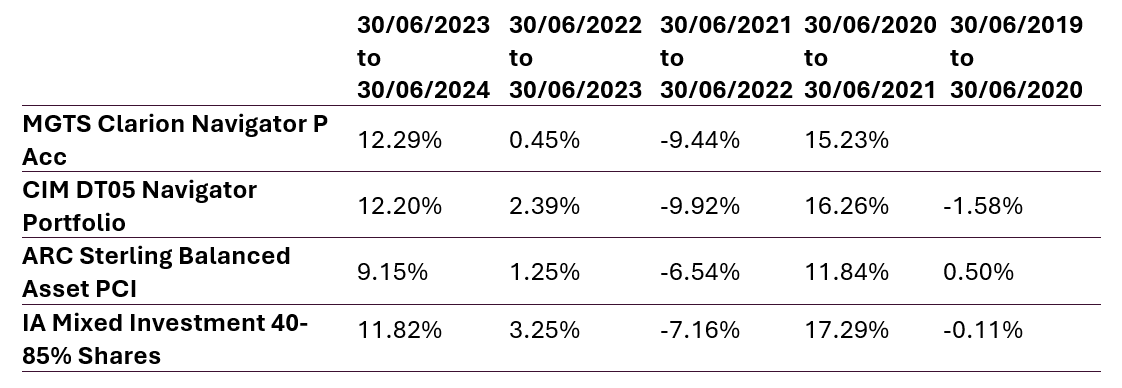

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Navigator Fund & Portfolio

- There were no changes to the Navigator Portfolio in August 2024.

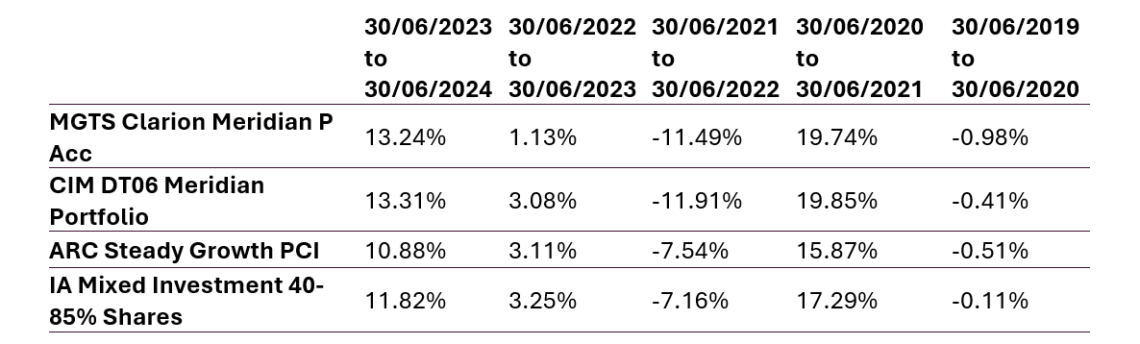

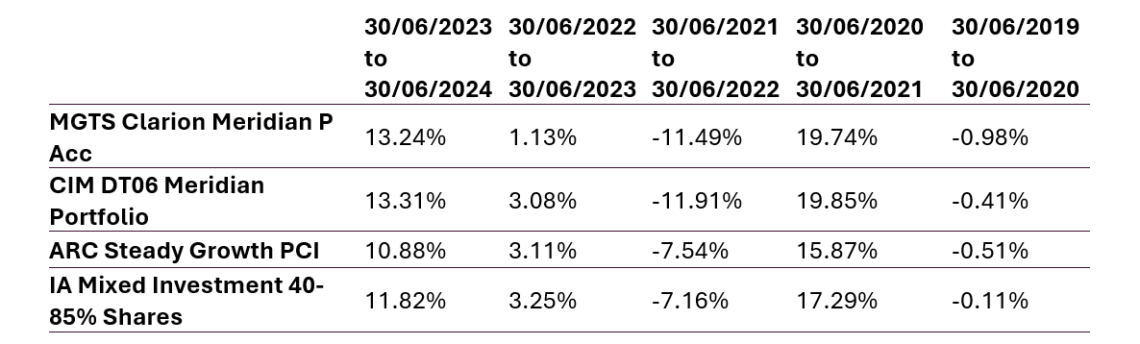

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Meridian Fund & Portfolio

- There were no changes to the Meridian fund or portfolio in August 2024

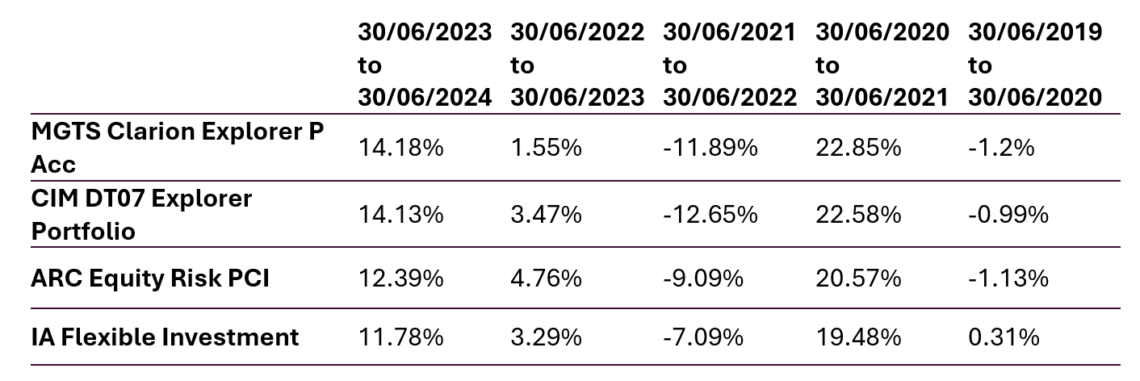

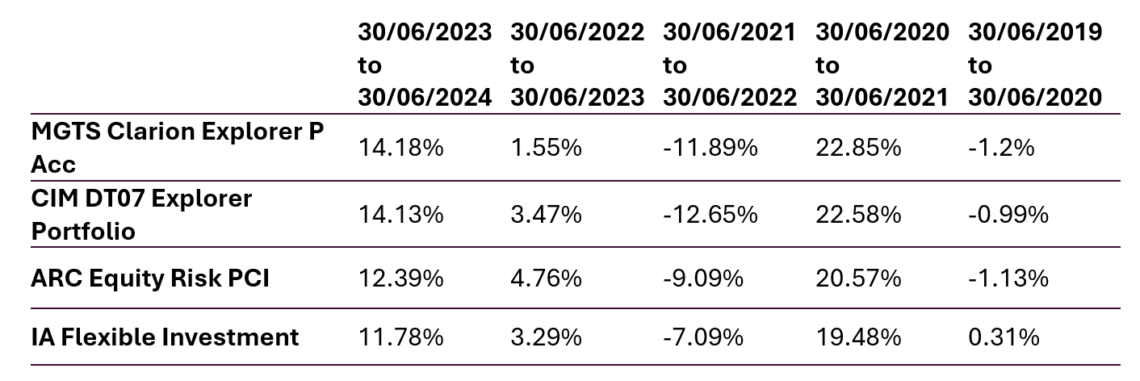

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Explorer Fund & Portfolio

- There were no changes to the Explorer fund or portfolio in August 2024

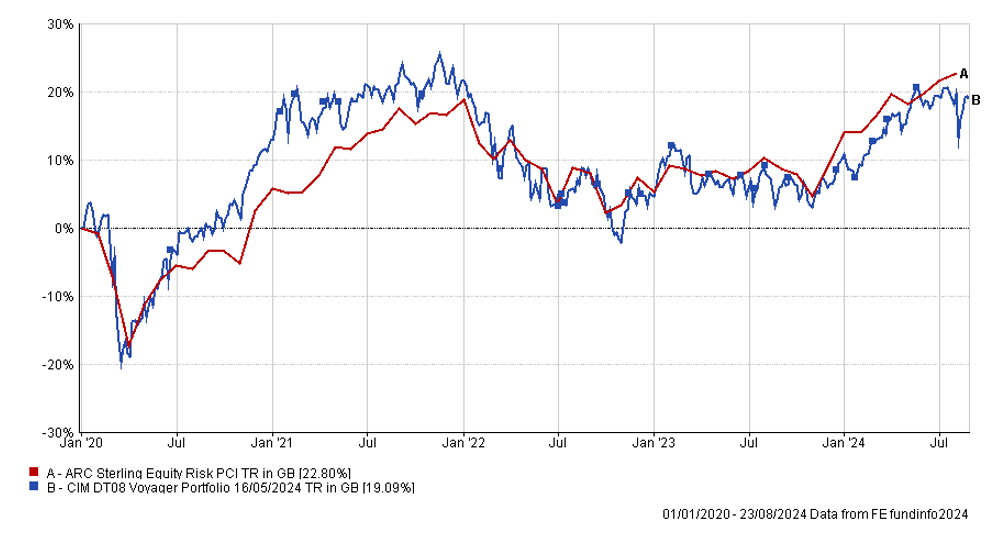

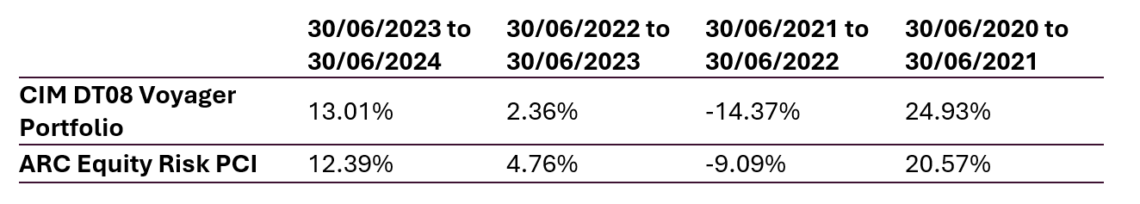

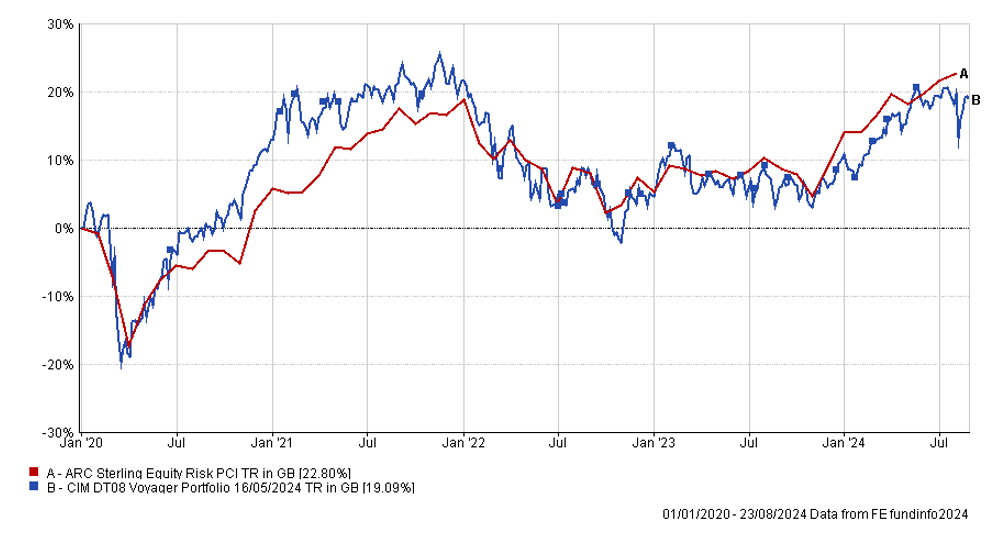

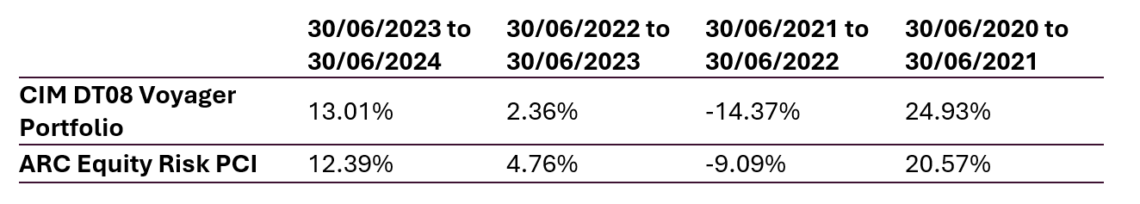

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Voyager Portfolio

- There were no changes to the Voyager portfolio in August 2024

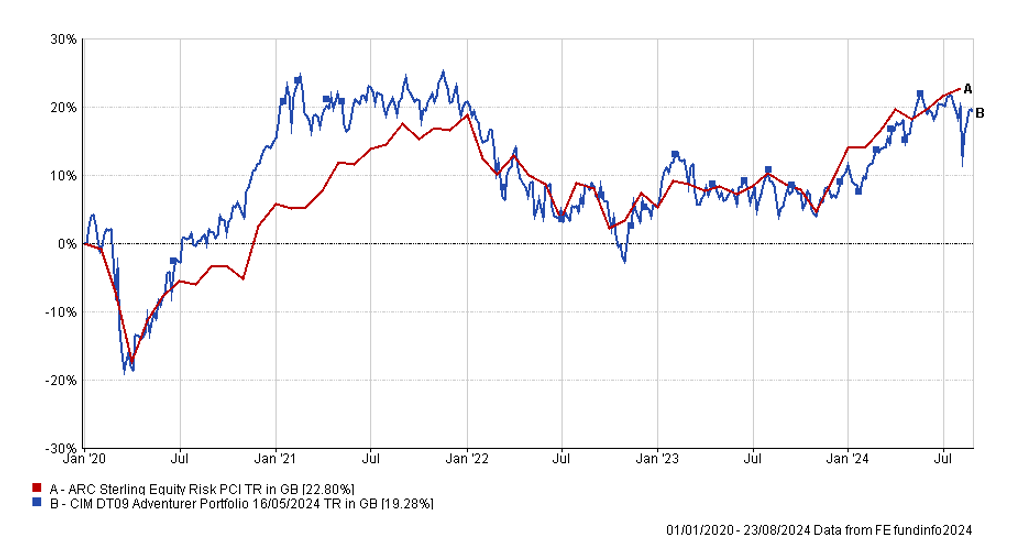

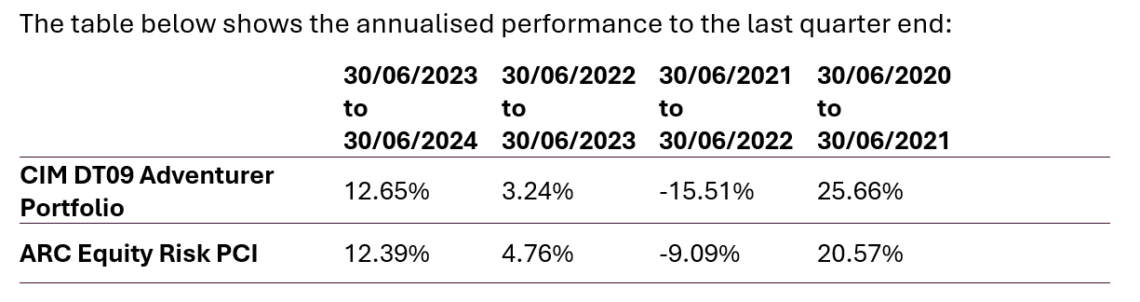

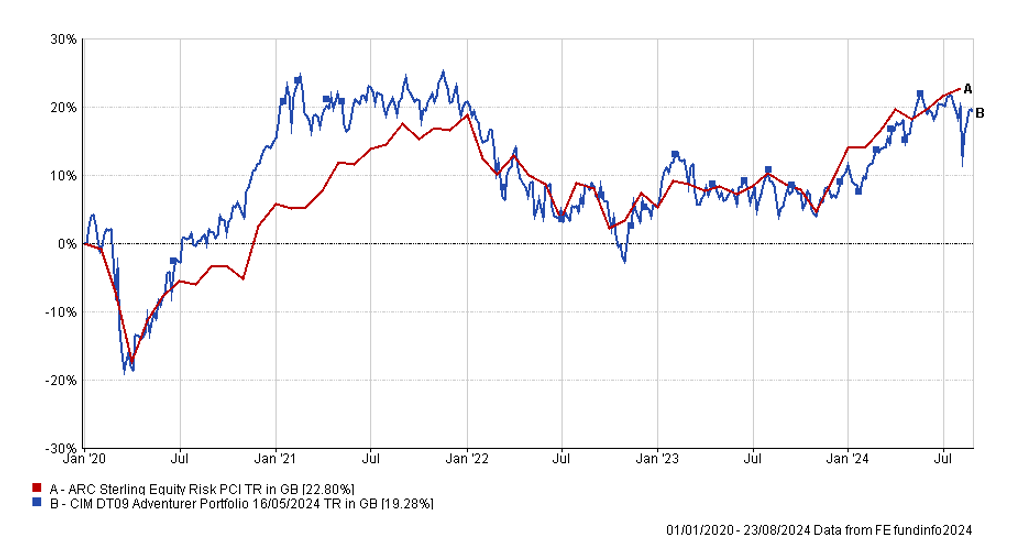

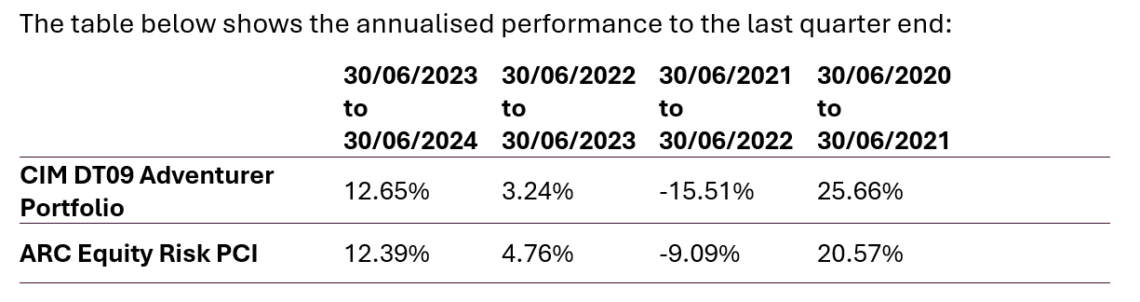

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Adventurer Portfolio

- There were no changes to the Adventurer portfolio in July 2024

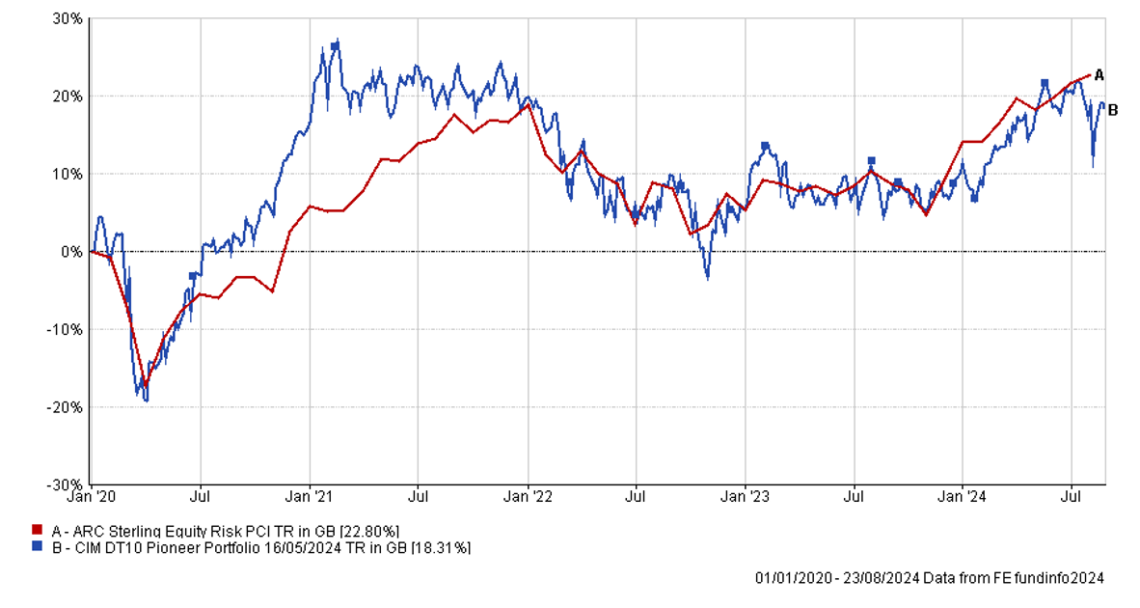

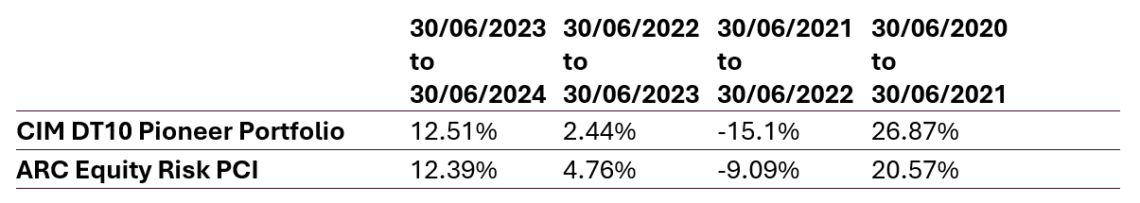

Pioneer Managed Portfolio

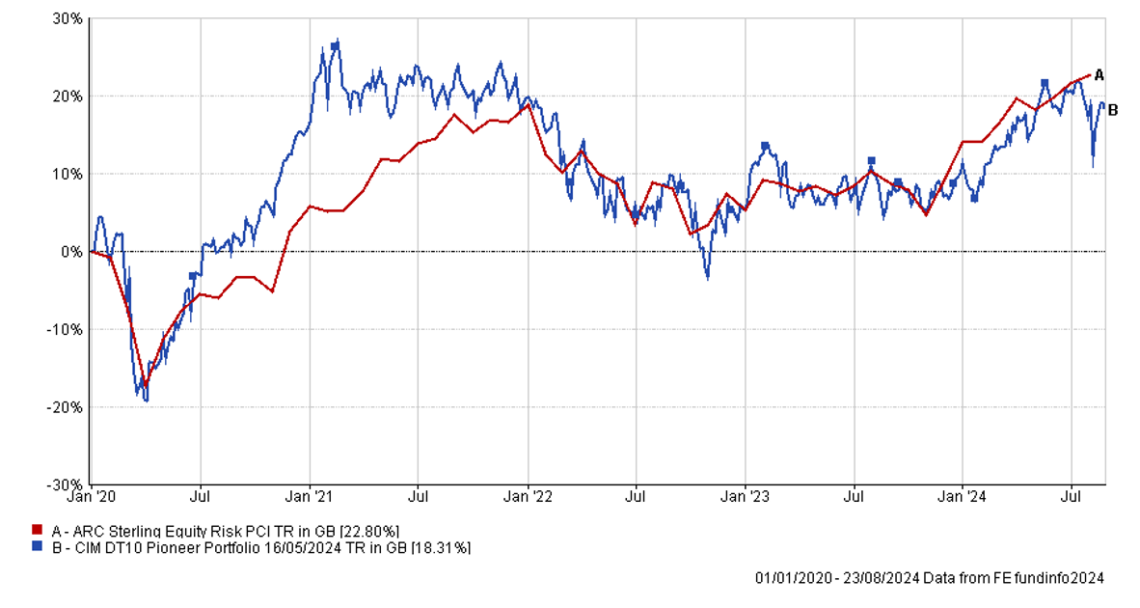

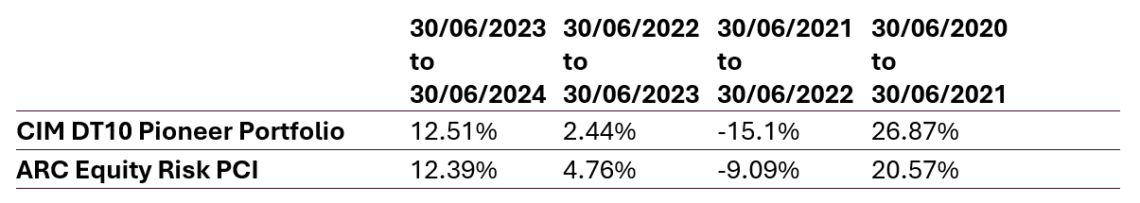

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Pioneer Portfolio

There were no changes to the Pioneer portfolio in August 2024

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

K W Thompson

Clarion Group Chairman

August 2024

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.