Category: Financial Planning, Investment management

The Clarion Investment Committee met on 12 September 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Please click here to access the September Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The main theme of the Investment Committee meeting on 12 September was to review the benchmark allocations recommended by Dynamic Planner for the forthcoming year. This was undertaken to incorporate the ever-changing investment landscape and resulted in some significant changes to the trusted asset model in terms of both asset classes and benchmark allocations.

The process adopted to review the benchmark allocations is objective and is based on forward-looking data, taking inputs from organisations like the World Bank, IMF, and OECD. There was a great deal of discussion around a number of key areas by Committee members. This led to a unanimous decision to adopt the changes recommended by Dynamic Planner as set out below.

A productive discussion also took place regarding a reduction in ‘home bias,’ as the higher allocation to UK assets are generally referred to.

To reflect the changing landscape of global investments, the committee is making the following changes to the asset classes used in the benchmark asset allocations.

First, the global investment grade bonds asset class will be removed from the benchmark asset allocation and replaced with two new asset classes: global investment grade sovereign bonds and global investment grade corporate bonds. The primary reason for this change is to harmonise the way we look at the UK and global fixed income markets. Splitting the asset class into its component parts also allows for enhanced diversification and increased opportunity to take advantage of the relative risk-return characteristics of the two asset classes.

Second, property has been removed from the benchmark allocation. Property as an asset class has faced difficulties since the Brexit vote in 2016, compounded by the pandemic. Most of the property funds with daily liquidity were severely affected by redemptions, resulting in the “gating” of these vehicles. As many clients were unable to redeem their investments, property was retained as an asset class within the benchmark allocations. With these issues recently resolved, the investment solutions in the property space have been closed. As a result, illiquid property is not really an investable asset class anymore and has therefore been removed from the asset allocation. This change also improves the liquidity of the overall benchmark allocations.

Finally, listed infrastructure has been added as an asset class. Globally, governments, supranational organisations and companies have identified a growing infrastructure investment gap. In the UK, the government has also identified infrastructure as a path to sustainable growth for the economy. As an asset class, infrastructure has numerous desirable characteristics, including stable cashflows linked to inflation and low correlation to broader markets. The asset class also provides exposure to attractive long-term themes, offering exposure not only to traditional infrastructure, such as transportation but also to evolving areas, such as clean energy and digital infrastructure. While most infrastructure investment is through private markets, more liquid exposure can be gained through listed infrastructure companies that invest in, build, and operate infrastructure assets.

Historically, our investment benchmark has been heavily skewed towards domestic equities and fixed income compared to global standards. Currently, UK equities constitute around 30% of our equity portfolio, while globally they account for only 4-5%. This mismatch is due to the decreasing presence of UK equities in the MSCI All Country World Index (ACWI) and the primarily global nature of listed UK companies.

The Committee believes that while we shouldn’t match the MSCI ACWI’s proportion of UK equities, we need to align more with global trends. UK mid and small-cap companies, which benefit most from local economic policies, form a minor part of the UK benchmark, not justifying a higher allocation to UK equities. Additionally, the UK’s economic challenges make global fixed income investments more attractive.

We are also incorporating listed infrastructure into our benchmarks due to its stable cash flows and potential for higher earnings with similar volatility to global equities. Consequently, we are shifting some investments from property to listed infrastructure.

In the medium-risk funds, elevated yields in fixed income assets present an opportunity to reduce cash holdings in favour of global fixed income.

Lastly, concerns about China’s structural issues and geopolitical tensions prompted a debate about reallocating Asia Pacific ex-Japan and emerging market equities. However, complexities in changing asset class profiles led us to maintain the current mix, with future reviews planned.

Changes to asset allocation will be implemented following the next IC meeting.

Other topics of discussion were as follows:

Since December 2023, there has been a tilt towards evidence-based factor investing, which involves a disciplined approach backed up by significant amounts of Nobel Prize-winning economic research. Factor investing involves trusting the market but tilting the investment choice towards smaller companies, value companies (those trading at a discount) and profitable companies. The evidence shows that over the long term, these types of investments outperform the typical index tracking and actively managed funds.

Clarion is accessing these factor-based investments through Dimensional Fund Advisors. At present, Dimensional are the only investment manager in the UK that offers this type of investment. Since inclusion, investment performance has been impressive, costs have decreased, and it is likely that we will look to introduce more factor-based funds into the portfolios as and when appropriate.

The Clarion funds are well positioned to take advantage of the latest economic conditions and performance year to date has been as follows:

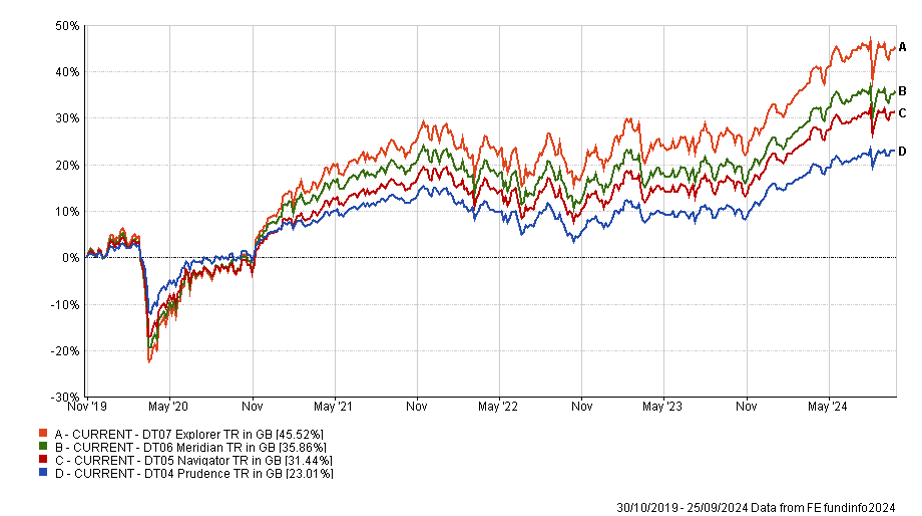

The performance of the CURRENT portfolios back tested over five years is shown in the chart below. This is assuming that we made the recent changes five years ago and then adopted the buy and hold approach favoured when using evidence-based factor investing.

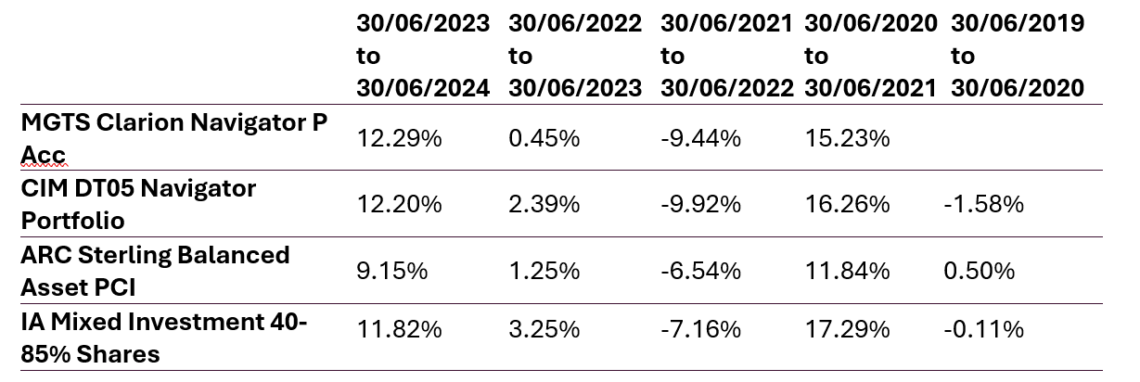

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

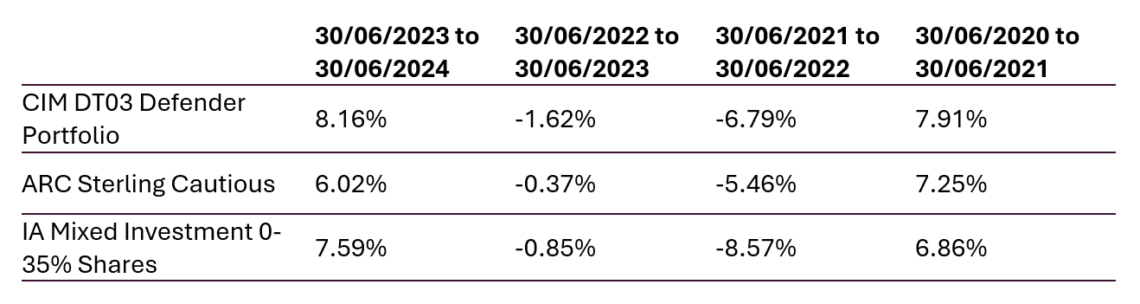

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

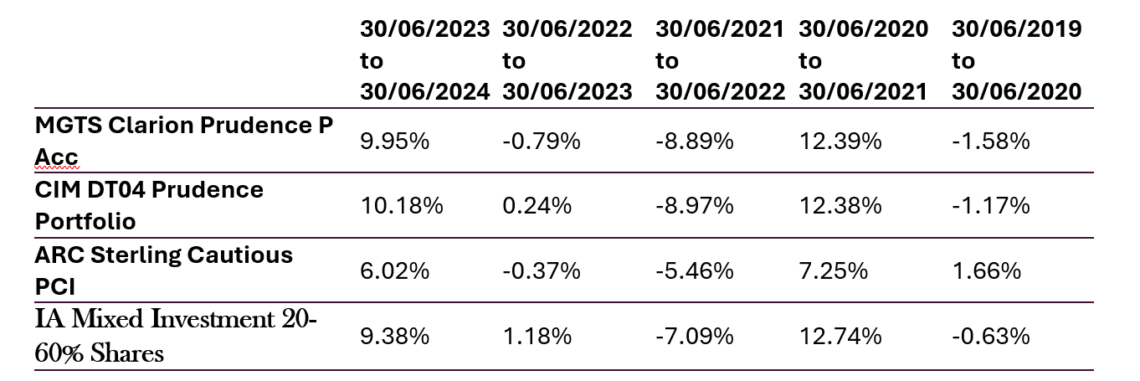

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

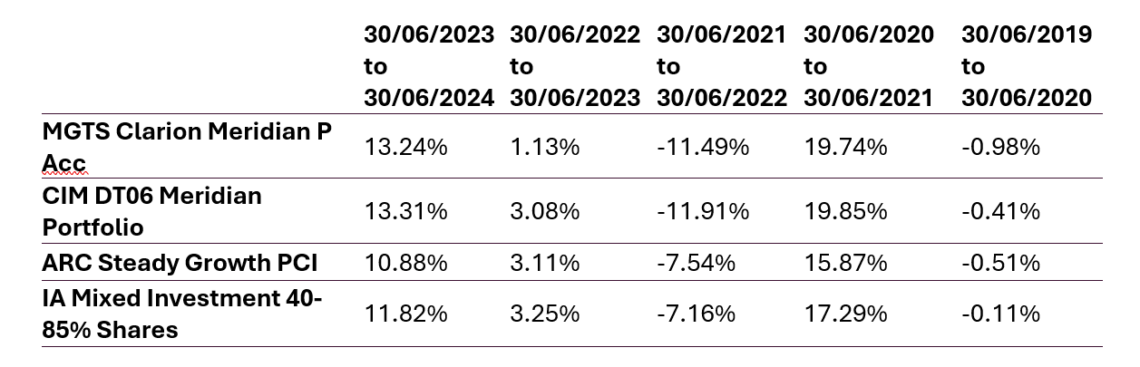

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

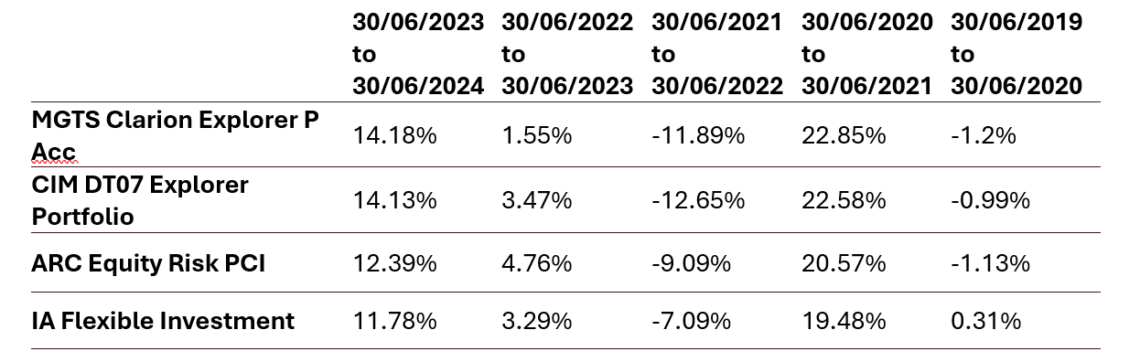

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

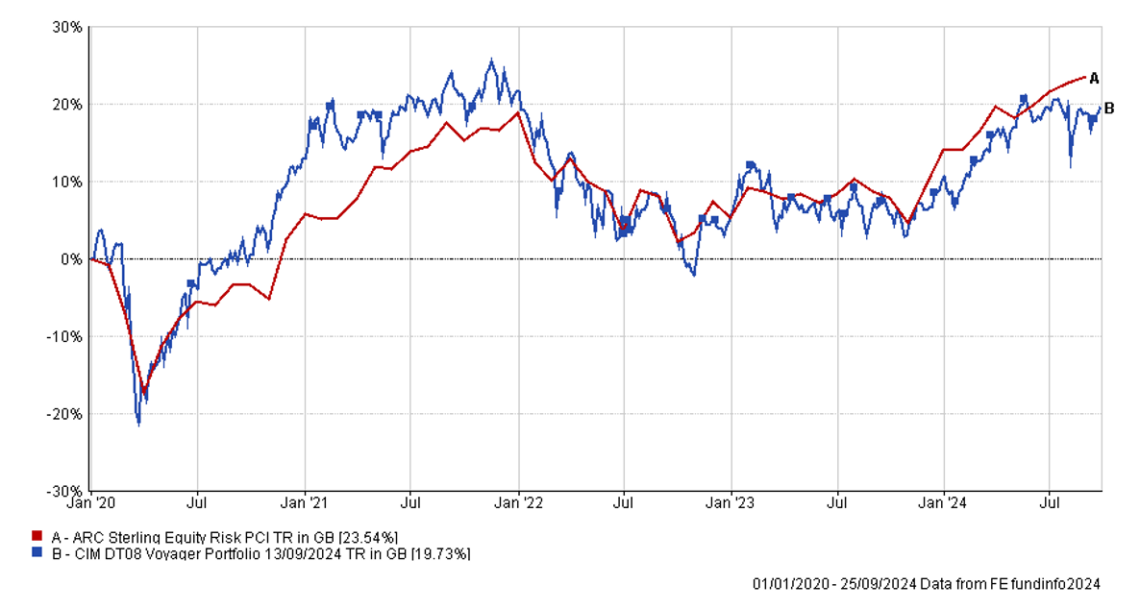

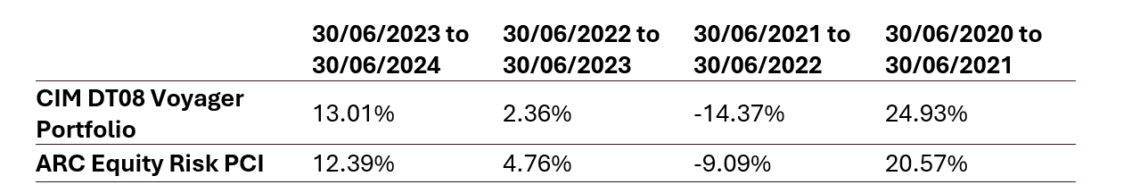

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

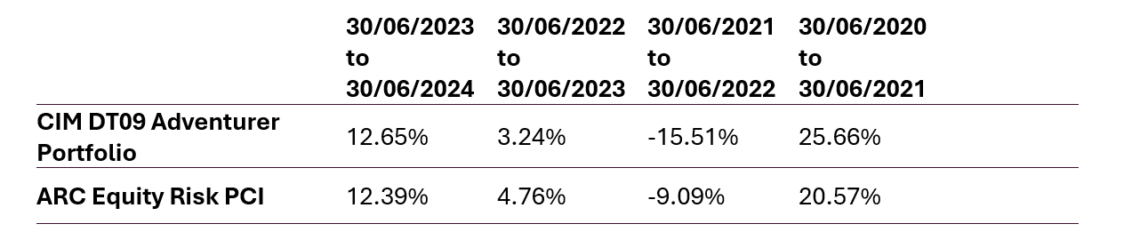

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

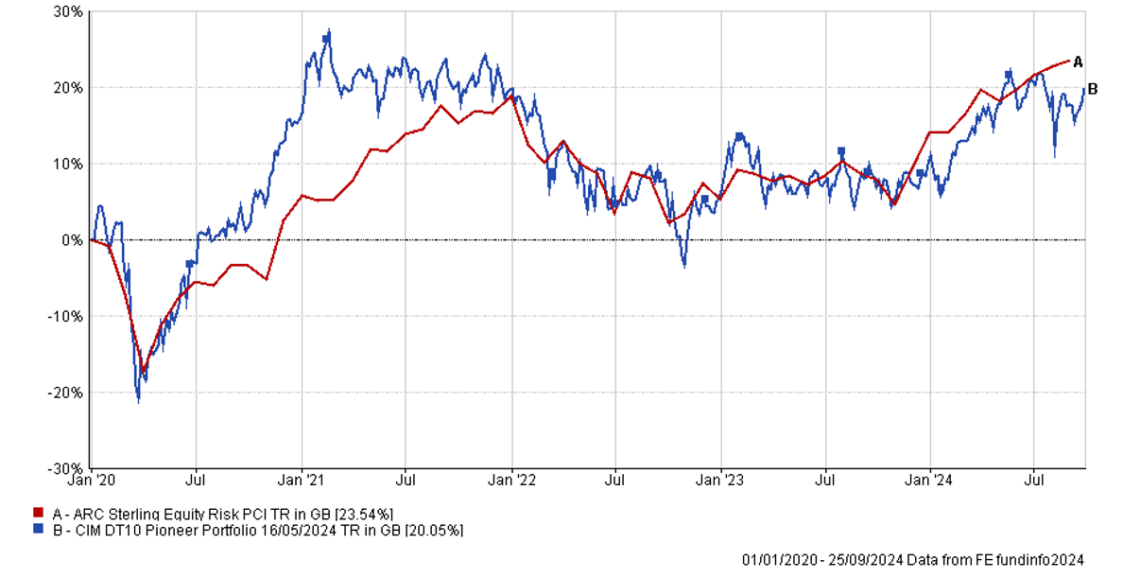

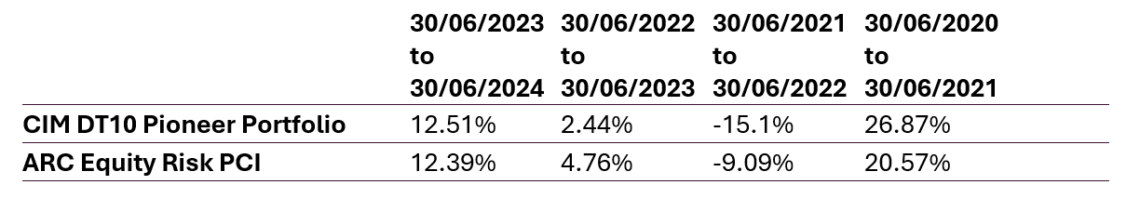

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

September 2024

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.