Category: Financial Planning

Inflation has never been too far from the headlines in recent years.

After hitting a 40-year high in 2022, it briefly returned to the Bank of England’s (BoE) target rate of 2% in 2024, though it remained above that level for nine months of the year.

According to the latest figures from the Office for National Statistics (ONS), inflation rose by 3% in the 12 months to January, marking its highest level in 10 months.

Persistently above-optimal inflation can pose challenges for both your personal finances and the wider economy, and it can be especially harmful to cash savings.

Read on to discover the risks of holding too much cash, especially during periods of high inflation.

If the interest rate on your cash savings doesn’t outpace or keep up with inflation, the real-terms value – or “purchasing power” – of your money will decline over time.

For example, if you saved £10,000 in an account earning 1% interest over a year while inflation averaged 2%, your savings would have grown, but their real-terms value would have fallen.

By the end of the year, you’d have earned £100 in interest, bringing your balance to £10,100. However, to maintain the same purchasing power as the year before, your savings would need to be worth £10,200 – meaning you would have made a real-terms loss due to inflation.

Over time, this erosion could significantly reduce the purchasing power of your cash, even though it may appear to be growing.

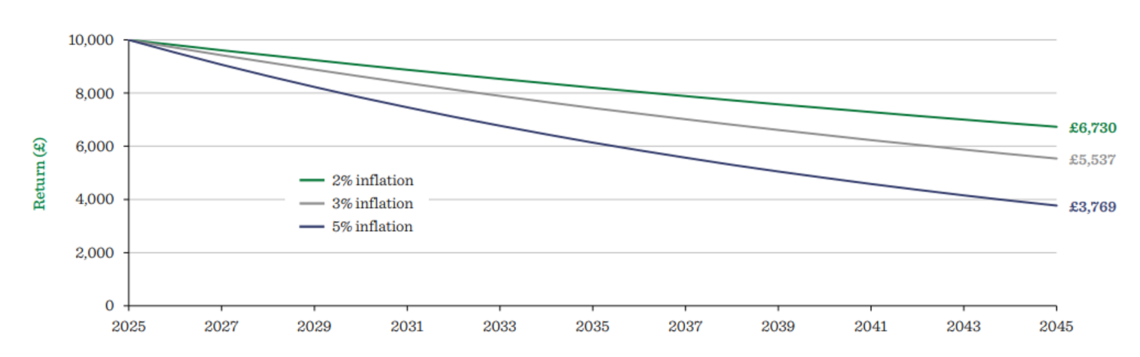

The graph below shows how inflation levels of 2%, 3%, and 5% can reduce the purchasing power of cash savings worth £10,000 over a 20-year period.

Source: Quilters

As you can see, the real-terms value of your wealth could fall by almost half (£4,463) over 20 years if inflation averaged just 3%. It could also drop by around a third (£3,270) even if inflation averaged the 2% target rate.

So, with inflation currently at 3%, it’s likely that your cash savings will lose their purchasing power over time.

Cash savings are useful for short-term goals, such as saving for a holiday, as they offer easy access to liquid funds. However, over longer periods, investing in the market has historically offered greater potential for outpacing inflation.

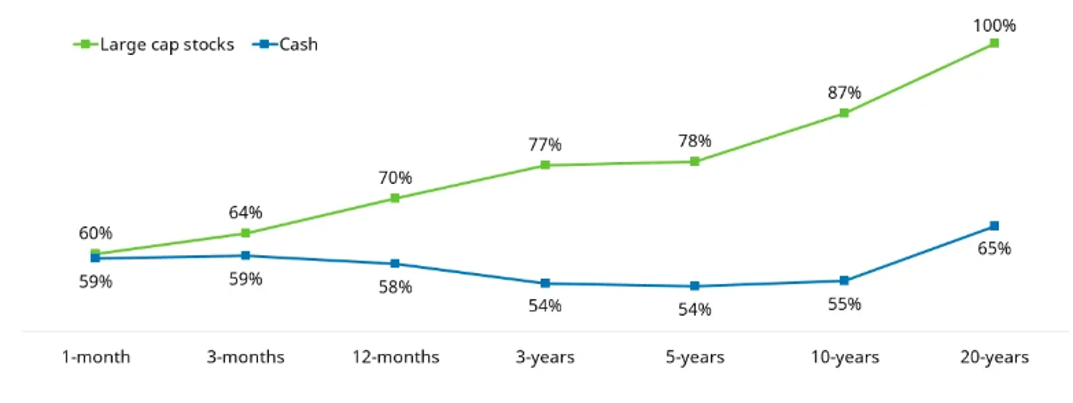

The graph below shows the percentage of time that large-cap stocks and cash have beaten inflation in the US over different time horizons between 1923 and 2023.

Source: Schroders

As you can see, over a single month, cash and stocks had a similar likelihood of beating inflation. However, over longer periods, the odds shifted significantly.

The chances of stocks outpacing inflation steadily increased over time, reaching 100% over a 20-year horizon. In contrast, cash became steadily less likely to beat inflation over a decade but slightly improved its chances to 65% over 20 years.

So, while maintaining some cash savings is a good idea, investing in stocks provides greater potential for long-term wealth growth and inflation-beating returns.

In addition to guaranteed returns, one of the main benefits of keeping cash savings is that most accounts offer protection up to the Financial Services Compensation Scheme (FSCS) limit – currently £85,000.

While the market can’t guarantee returns or protection, history shows that it has delivered strong long-term growth, and there are strategies you can adopt to help bolster your stability and increase your chances of success.

Portfolio diversification involves spreading your investments across various asset classes, sectors, and regions.

A well-diversified portfolio can help minimise the impact of downturns in any single area while also opening you up to wider growth opportunities.

Additionally, diversifying across asset classes can help your wealth to keep pace with inflation, as gains from appreciating investments could offset the loss of purchasing power in cash holdings.

Maintaining a long-term investment focus allows you to capture the market’s growth potential, which, as you read earlier, has historically had a higher chance of outpacing inflation compared to cash.

Research from Schroders highlights the risks of cashing out during downturns. For example, those who exited the market during the 2008 financial crisis would still be waiting to recover, whereas investors who remained saw their portfolios rebound by around 2013.

Even after significant dips, the market has historically been quicker to rebound than if you were to wait for the same returns on your cash.

A financial planner can work with you to develop the best strategies to help ensure your wealth keeps pace with inflation.

They can help you build a well-diversified portfolio, encourage you to maintain a long-term focus amid challenging times, and adjust your strategy as needed along the way.

To speak to a financial planner, get in touch.

Email [email protected] or call us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.