The Clarion Investment Committee met on 20 March 2025. The following notes summarise the main points of consideration in the Investment Committee discussions and provide information about our current investment strategy and fund performance.

Please click here to access our March Stock Market & Economic Commentary written by Clarion Group Chairman, Keith Thompson.

Economic & Market Snapshot

Economics

- In a sign that a weakening stock market and uncertainty about government spending and trade policy is taking a toll, US consumer confidence fell to its lowest level since November 2022, with long-term inflation expectations hitting a 32-year high. Consumer confidence among Democrat voters fell to the lowest level ever recorded, including during the financial crisis in 2008/09.

- The S&P 500 US equity index entered a technical correction, falling more than 10% from its February peak, amid fears that the ongoing US trade uncertainties will impact economic growth.

- A poll of 220 US CEOs by Chief Executive magazine, carried out in early March, found that business optimism had fallen to the lowest level since November 2012.

- A measure of US economic policy uncertainty compiled by three US academic economists reached its second-highest level of data going back to 1985.

- The EU and Canada announced retaliatory tariffs on US goods, worth $28 billion and $21 billion respectively, in response to the US imposing 25% steel and aluminium tariffs. The UK government said it would not immediately impose retaliatory tariffs.

- The US reversed an additional 25% tariff proposal on Canadian steel and aluminium imports, while the Canadian province of Ontario reversed plans to impose a 25% surcharge on power exports to the US.

- US consumer price inflation fell to 2.8% in the year to February, with core inflation falling to a four-year low of 3.1%. Markets firmed up their expectations of three US interest rate cuts this year.

- The Bank of Canada cut interest rates for the seventh consecutive time, to 2.75%, amid ongoing trade tensions with the US that are impacting Canadian business and consumer confidence.

- UK GDP unexpectedly contracted by 0.1% in January, following growth of 0.4% in December, according to official figures. The decline was mainly due to falling industrial production while the service sector expanded marginally.

- The UK government introduced its Planning and Infrastructure bill, aimed to reduce regulatory and planning burden for housebuilding and infrastructure projects.

- The UK ranks among the lowest of OECD countries for welfare generosity, with the poorest UK households worse off than those in Slovenia and Malta, according to a report by the National Institute of Economic and Social Research.

- A poll of economists found that Germany could increase public debt from 63% to 86% of GDP, equivalent to nearly €2 trillion, without damaging future growth amid recent announcements to boost defence and infrastructure spending.

- Euro area investor sentiment improved in March to its highest level since June last year, according to the Sentix index, amid recent announcements of debt-financed defence and infrastructure spending programmes.

- Investors reduced their allocations of US equities by a record amount in March, according to a survey of fund managers by the Bank of America.

- The Bank of England maintained interest rates at 4.5%, as expected, as it continues its “gradual and careful approach” to reducing rates. Markets expect the Bank to reduce interest rates to 4% by the end of 2025.

- Annual UK wage growth remained steady at 5.9% in the three months to January.

- The UK government announced plans to reduce welfare spending by approximately £5 billion a year and civil service spending by £2 billion a year by 2030.

- UK chancellor Rachel Reeves suggested taxes on big tech firms may be changed as part of a deal to avoid US president Donald Trump’s next raft of tariffs.

- UK consumer confidence unexpectedly improved in March, but remains in a “fragile” state, according to GfK who compile the index

Business

- The FT reports that more than 200 major US corporates have reduced references to DEI and related terms such as “diversity” in their annual reports.

- Swedish start-up Northvolt, one of Europe’s most prominent battery manufacturers, filed for bankruptcy after failing to obtain further financing.

- German defence company Rheinmetall says it is considering repurposing one of Volkswagen’s car manufacturing plants, which is due to cease production by 2027, to produce tanks.

- Italian defence company Leonardo announced plans to launch 38 satellites by 2028 for military and civilian purposes, saying that it will provide European governments with an alternative to US-owned Starlink.

- US electric car manufacturer Tesla said it would be “exposed to disproportionate impacts” from retaliatory import tariffs by other countries, in an unsigned letter to the US trade representative Jamieson Greer, the FT reports.

- Car manufacturer BMW reported a 36% fall in profits in 2024, following weak Chinese demand, and warned that earnings are expected to remain at similar levels this year due to European and US tariffs.

- OpenAI, the maker of ChatGPT, signed an $11.9 billion contract with cloud computing company CoreWeave to receive AI infrastructure as part of efforts to boost its computing power.

- Mobile network operator Virgin Media O2 said it will spend £700 million on improving the speed and reliability of its network, amid the competitive threat from merger of rivals Vodafone and Three.

- UK prime minister Sir Keir Starmer announced plans to scrap the arms-length body that runs the NHS in England and bring the health service back under direct political control.

- More than half of the global greenhouse gas emissions in 2023 were linked to 36 energy companies and cement producers, according to the Carbon Majors database, with state-owned companies comprising 16 of the top 20 emitters.

- Shares in Chinese EV manufacturer BYD soared to a record high following its announcement of new charging technology that can add over 400 kilometre of range in five minutes.

- US tech company Oracle announced plans to invest $5 billion in the UK over the next five years, focused on cloud services infrastructure.

- Gong Cha, the brand behind the popular drink Bubble tea, announced a major UK expansion of 225 shops and nearly 2,000 jobs.

- The Association of the British Pharmaceutical Industry labelled the UK as “uninvestable” following the recent rise of the medicine sales tax.

- European technology companies, including aerospace manufacturer Airbus, have called on the EU to create a sovereign infrastructure fund and “buy European” to boost investment in new technologies and improve strategic autonomy.

Global & Political Developments

- Ukraine said it was willing to accept a US-proposed 30-day ceasefire with Russia. The US subsequently agreed to resume military assistance.

- Russia said there are “grounds for optimism” for a ceasefire deal but there is “a lot ahead to be done”, as US envoy Steve Witkoff met Russian president Vladimir Putin to discuss further details about a potential ceasefire.

- Switzerland’s new defence minister has said that cooperation and joint training exercises with NATO are “absolutely necessary” in a sign that the long-neutral country is reconsidering its defence needs.

- Mark Carney, former governor of the Bank of England, replaced Justin Trudeau as the leader of the Liberal Party and Canada’s prime minister. He has called a snap General Election for 28 April.

- Canada’s Liberal Party has seen a surge in poll ratings since the start of the year, attributed in part to increased Canada-US tensions.

- Germany’s incoming chancellor Friedrich Merz has agreed a deal with the Green party for increased public borrowing to boost infrastructure and defence spending.

- Romania’s constitutional court upheld a ban imposed by the electoral bureau on Călin Georgescu, the far-right frontrunner, from its presidential elections following allegations of violating electoral rules.

- The UK government announced proposals to reform the civil service, including tighter performance monitoring of the highest-paid civil servants and the creation of “mutually agreed exits” of underperforming staff, in a bid to boost performance.

- UK ministers are reported to have dropped plans to freeze a major disability benefit in response to opposition from Labour MPs.

- Israel renewed ground operations in Gaza and launched a series of air strikes as the ceasefire with Hamas collapsed.

- Large European NATO members, including the UK and Germany, are discussing plans to reduce Europe’s dependence on the US over the next 5 to 10 years, the FT reports.

- Volodymyr Zelenskyy rebuffed a proposal by Donald Trump for the US to take over Ukraine’s nuclear power plants to ensure greater protection against Russia. The US also hoped to reopen discussions on accessing Ukraine’s raw minerals, the FT reports.

- Protests ensued following the arrest of Istanbul’s mayor Ekrem İmamoğlu, the main political rival to Turkey’s president Recep Tayyip Erdoğan, over terrorism and corruption charges.

- Atmospheric carbon dioxide levels reached an 800,000-year high in 2024, according to the UN’s World Meteorological Organisation, with last year likely to have been the hottest on record.

- London’s Heathrow Airport was shut down amid a power outage that caused significant travel disruption

Strategy

The current strategy sees a further reduction in US exposure in favour of an increase in Europe, the UK and Asia and a tilt towards value stocks and away from growth.

- The Investment Committee are maintaining their tactical position of being underweight US stocks, particularly mega cap tech stocks, and overweight UK, Asia & Emerging Markets and Europe and broadly neutral on Japan.

- Short duration bonds are preferred to longer duration bonds.

- Inflation is expected to persist, and the long-term average is expected to be around the 3% level which will curtail future interest rate cuts.

- A new interest rate cutting cycle has begun and is expected to create optimism throughout 2025, but a higher interest rate and higher inflation environment will become the new norm.

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future. Liquidity has been the most significant driver of returns to date but there remains a downside risk to high valuation stocks.

- The Chinese economy is stagnant but further fiscal and monetary stimulus may provide relief.

- Geopolitical risks remain elevated.

- The IC exercised its right to make a tactical asset allocation call when compared to the benchmark allocations:

- Prudence : The US exposure was reduced by 3%, UK increased by 1% and Europe by 2%

- Navigator : The US exposure was reduced by 3%, UK increased by 1% and Europe by 2%

- Meridian : The US exposure was reduced by 5%, UK increased by 2% and Europe by 3%

- Explorer : The US exposure was reduced by 5%, UK increased by 2%

- and Europe by 3%

- Within Europe, there was a tilt towards a more value-based approach

- Dimensional Sterling Short Duration UK Real Return was added in the UK Inflation Linked Gilts sector in Prudence & Navigator

- Invesco Global Emerging Markets replaces JPM Emerging Markets Income in the Emerging Markets Sector in Meridian and Explorer

- We are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Asia and Emerging Markets where valuations are generally more attractive which will help to offset some of the economic headwinds and geopolitical uncertainty.

Clarion Portfolio Funds and Managed Portfolios.

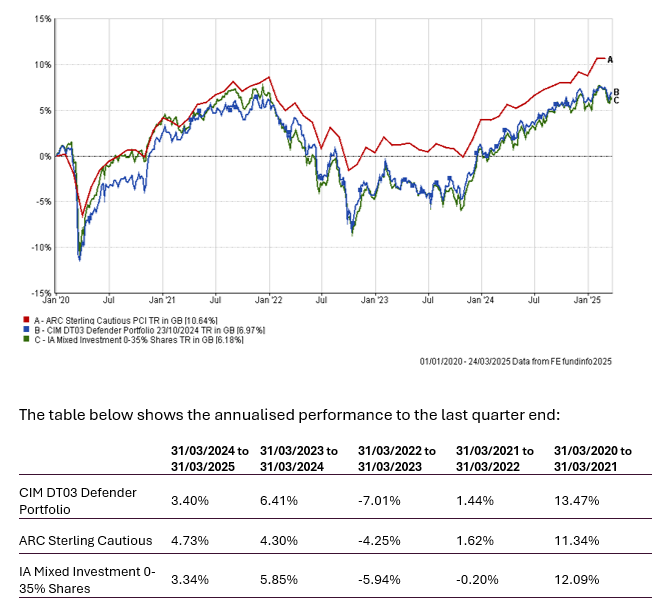

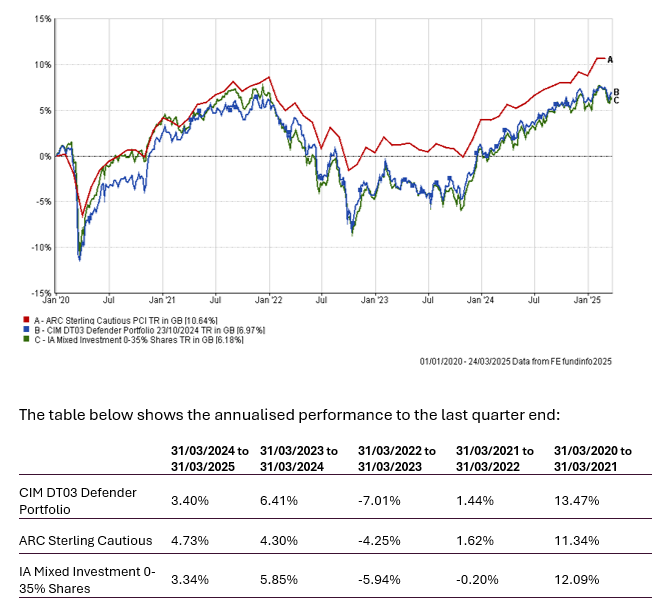

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

Changes to the Defender Portfolio

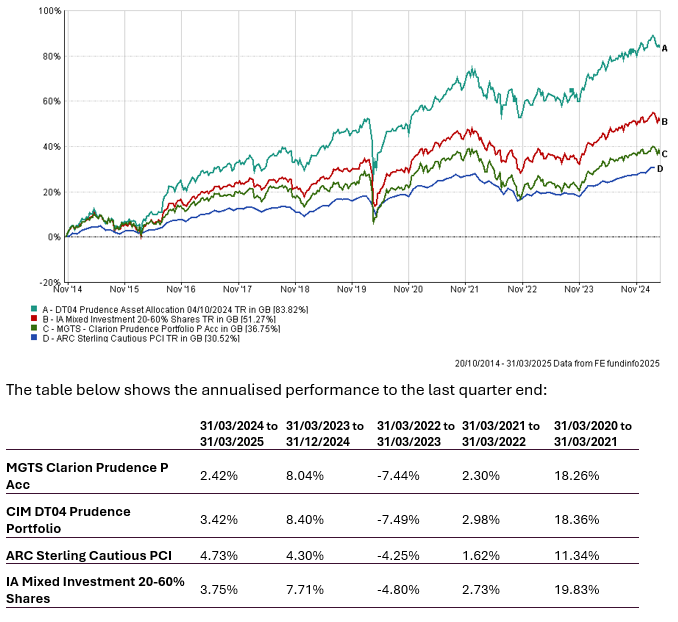

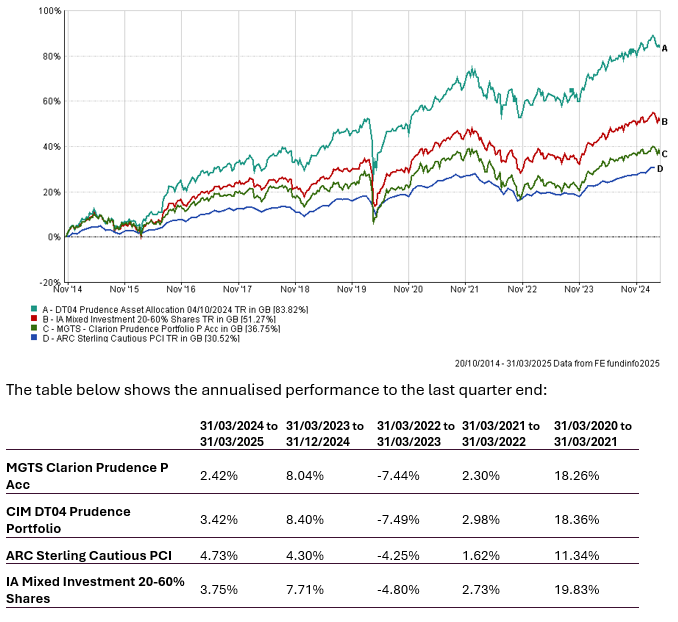

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund & Portfolio

- HSBC European Index was reduced from 3.60% to 3.20%

- iShares $ TIPS was reduced from 7.00% to 3.50%

- Dimensional US Core Equity was reduced from 6.50% to 5.00%

- Dimensional US Small Companies was reduced from 3.25% to 2.50%

- Fidelity Index was reduced from 3.25% to 2.50%

- Dimensional European Value was increased from 2.40% to 4.80%

- Dimensional UK Core Equity was increased from 3.50% to 4.00%

- Dimensional UK Small Companies was increased from 1.75% to 2.00%

- Dimensional UK Value was increased from 1.75% to 2.00%

- Dimensional Sterling Short Dated Duration Real return was added to the portfolio (3.50%)

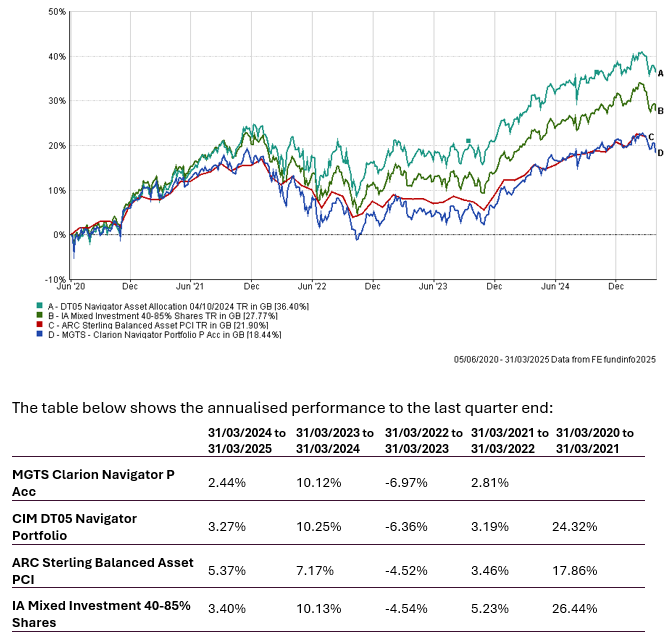

Navigator Fund & Managed Portfolio

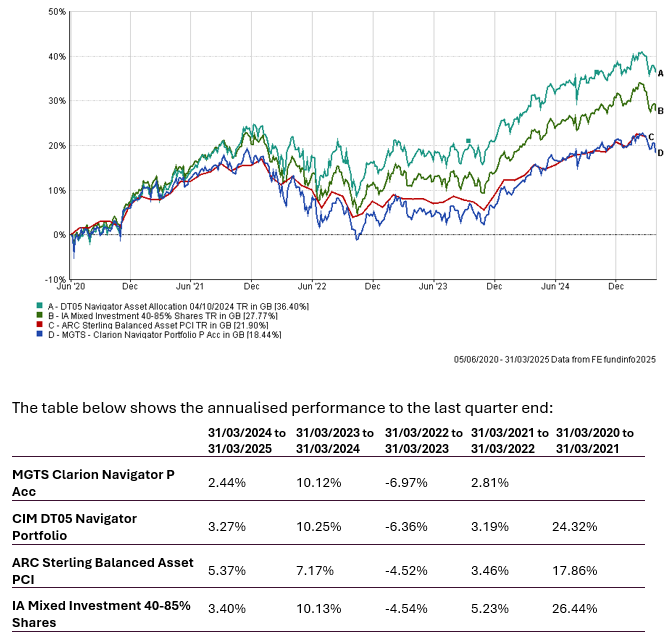

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

- Fidelity Index was reduced from 3.25% to 2.50%

- Dimensional US Small Companies was reduced from 3.25% to 2.50%

- Dimensional US Core Equity was reduced from 6.50% to 5.00%

- iShares $ TIPS was reduced from 4.00% to 2.00%

- HSBC European Index was reduced from 3.60% to 3.20%

- Dimensional European Value was increased from 2.40% to 4.80%

- Dimensional UK Core Equity was increased from 3.50% to 4.00%

- Dimensional UK Small Companies was increased from 1.75% to 2.00%

- Dimensional UK Value was increased from 1.75% to 2.00%

- JPM Emerging Markets Income was removed from the portfolio (2.00% to 0.00%)

- Invesco Global Emerging Markets was added to the portfolio (2.00%)

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

- Fidelity Index was reduced from 5.00% to 3.75%

- Dimensional US Small Companies was reduced from 5.00% to 3.75%

- Dimensional US Core Equity was reduced from 10.00% to 7.50%

- HSBC European Index was reduced from 4.20% to 4.00%

- Dimensional European Value was increased from 2.80% to 6.00%

- Dimensional UK Core Equity was increased from 4.00% to 5.00%

- Dimensional UK Small Companies was increased from 2.00% to 2.50%

- Dimensional UK Value was increased from 2.00% to 2.50%

- JPM Emerging Markets Income was removed from the portfolio (2.60% to 0.00%)

- Invesco Global Emerging Markets was added to the portfolio (2.60%)

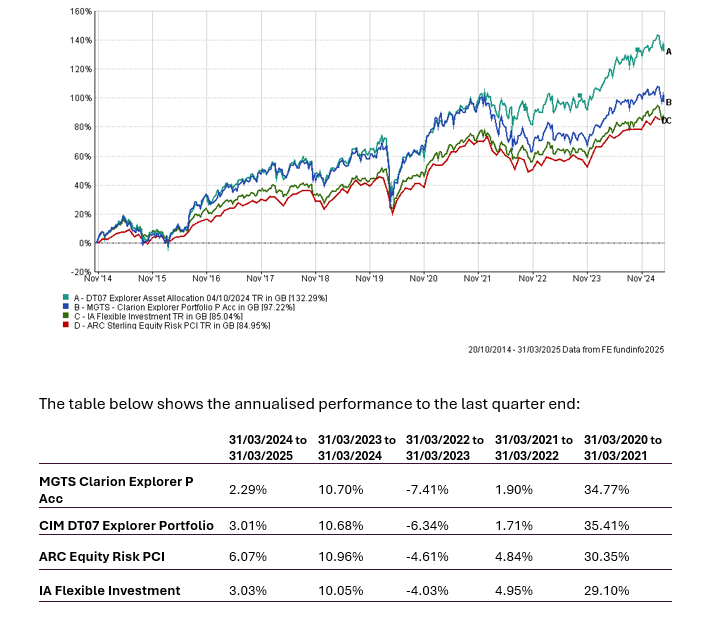

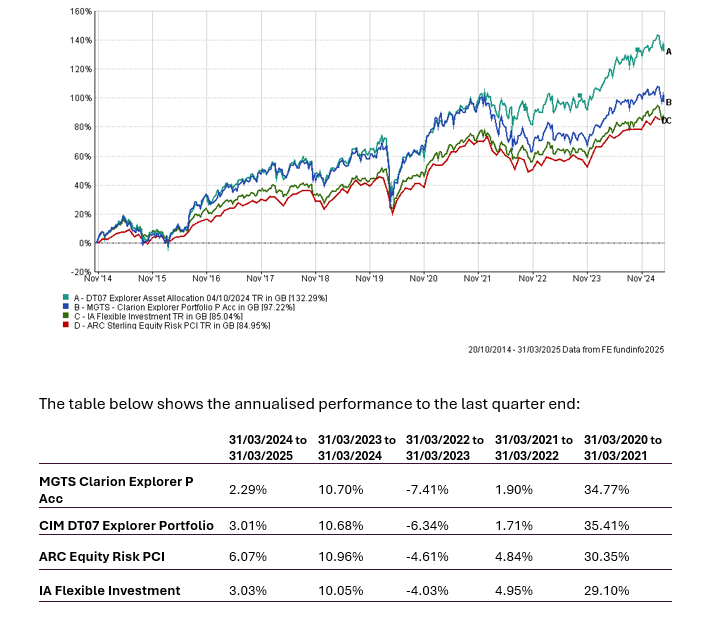

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

- Fidelity Index was reduced from 5.00% to 3.75%

- Dimensional US Small Companies was reduced from 5.00% to 3.75%

- Dimensional US Core Equity was reduced from 10.00% to 7.50%

- HSBC European Index was reduced from 4.20% to 4.00%

- Dimensional European Value was increased from 2.80% to 6.00%

- Dimensional UK Core Equity was increased from 4.00% to 5.00%

- Dimensional UK Small Companies was increased from 2.00% to 2.50%

- Dimensional UK Value was increased from 2.00% to 2.50%

- JPM Emerging Markets Income was removed from the portfolio (4.00% to 0.00%)

- Invesco Global Emerging Markets was added to the portfolio (4.00%)

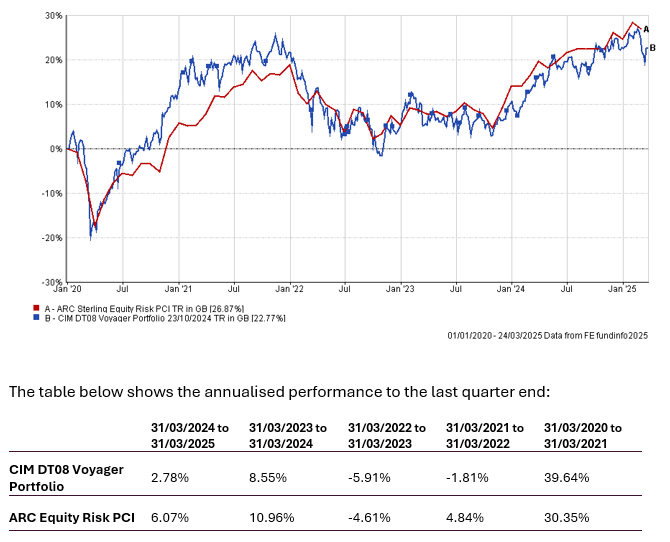

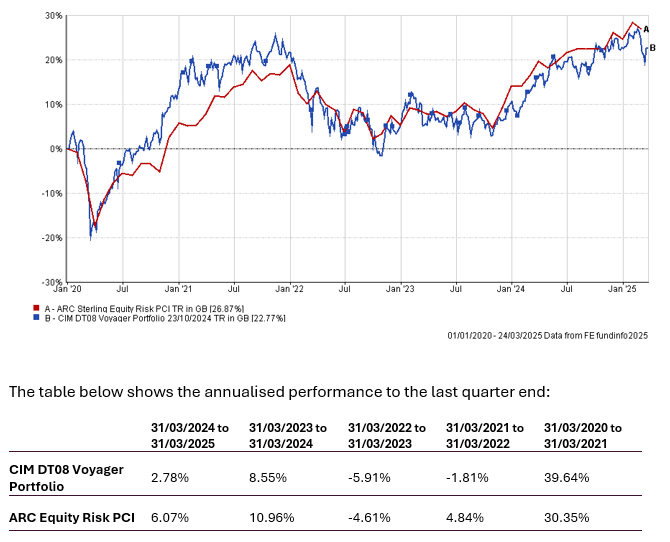

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

Changes to the Voyager Portfolio

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Adventurer Portfolio

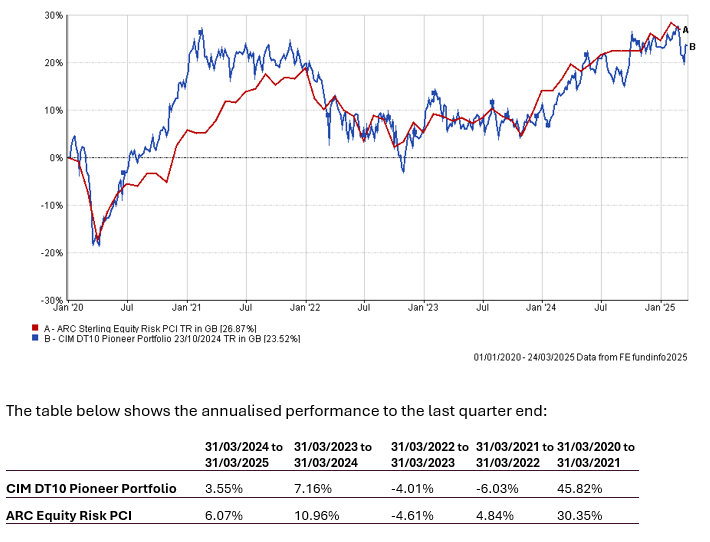

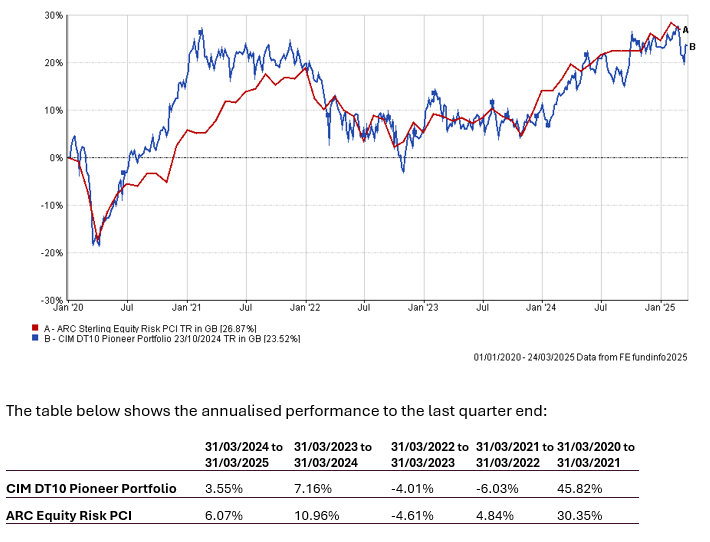

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Pioneer Portfolio

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

March 2024

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.