The Clarion Investment Committee met on 19 June. The following notes summarise the main points of consideration in the Investment Committee Discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Please click here to access our June Stock Market & Economic Commentary written by Clarion Group Chairman, Keith Thompson.

Economic Commentary & Market Outlook

The following is a summary of the major events since the last Clarion Investment Diary.

Economics

- The US Federal Reserve (Fed) maintained interest rates at 4.25% – 4.5% for the fourth consecutive time, saying they are “well positioned to wait for more clarity on the outlook for inflation and economic activity”. The Fed cut its forecast for US economic growth this year to 1.4% from 1.7% in March

- Following the interest rate decision, Fed governor Christopher Waller said US interest rates could be lowered “as early as July”

- US retail sales fell by a greater-than-expected 0.9% in May, the largest monthly fall since March 2023, as sales continued to decline following the frontloading of purchases prior to the imposition of US import tariffs

- Central banks are expected to increase their holding of gold over the coming year, according to a survey of monetary authorities by the World Gold Council, while holdings of US dollars are expected to fall over the next five years amid recent geopolitical uncertainty

- The global supply of oil is expected to outstrip demand in 2025, despite conflict in the Middle East, due to rising OPEC+ production and weak oil consumption in China and the US, according to the International Energy Agency

- Donald Trump signed an executive order to implement the previously agreed trading arrangement with the UK, which includes a reduction of US import tariffs on the majority of the UK’s car exports

- UK inflation eased slightly to 3.4% in the year to May from 3.5% in April

- The Bank of England (BoE) maintained interest rates at 4.25%, saying it will remain “sensitive to heightened unpredictability in the economic and geopolitical environment”

- The UK government released its ten-year infrastructure strategy that details plans for £725 billion of economic and social infrastructure. A National Infrastructure Pipeline detailing the projects to be undertaken will be published in July

- UK consumer confidence improved for the second consecutive month in June due to an improvement in consumers’ views on the economic outlook

- Economic sentiment in the German finance sector improved in June at its fastest pace since April 2023, according to the ZEW survey

- The price of insuring ships sailing through the Strait of Hormuz has risen by more than 60% since the conflict between Israel and Iran began, the FT reports

- The Central Bank of Japan maintained interest rates at 0.5% and agreed to slow down the rate at which it reduces its bond purchase programme over fears of economic stability

- Large investors are reportedly reducing their exposure to US equity markets over fears of US public debt levels and trade uncertainty, the FT reports

- UK house prices increased by a more-than-expected 0.5% in May, compared with the previous month, according to Nationwide

- The European Commission announced that Bulgaria is ready to join the euro area in 2026, following previous delays due to inflation being above required levels and political uncertainty

- Japan recorded 686,000 births in 2024, the lowest since records began in 1899, as concerns continue to grow over the country’s ageing population

- Global trade uncertainty will be a greater challenge for central banks of emerging market economies than the COVID pandemic, according to IMF’s first deputy managing director Gita Gopinath, due to the unpredictable nature of tariffs and differing effects across countries

Business

- Facebook’s parent company Meta announced a $15 billion investment in start-up company Scale AI as it faces strong competition among tech firms in developing Gen AI models, the FT reports

- US quantum computing company IonQ announced it will buy UK start-up Oxford Ionics for £1.1 billion, while US semiconductor company Qualcomm agreed to buy UK chip designer Alphawave for $2.4 billion, continuing the recent trend of US firms acquiring UK technology companies

- A consortium led by UK engineering company Rolls-Royce won a UK government contract to build three small modular nuclear reactors, producing enough energy for 1.5 million homes, with the government pledging £2.5 billion over the next three years to support the project

- UK chancellor Rachel Reeves announced plans to partially restore the winter fuel payment, with nine million pensioners qualifying at an expected cost of £1.6 billion

- Elon Musk, former head of the US Department of Government Efficiency, called Donald Trump’s proposed tax and spending package a “disgusting abomination” and called for Trump to be impeached. Trump responded by threatening to cut government subsidies and contracts going to Musk’s companies. Tesla’s share price fell sharply on the news

- The chief executive of Gen AI company OpenAI, Sam Altman, accused Facebook-owner Meta of luring its developers with significant sign-on bonuses and salaries as industry competition intensifies

- Two major US companies in the clean-energy industry filed for bankruptcy this month, highlighting concerns for the sector amid Mr Trump’s proposals to cut clean energy tax credits

- UK steel manufacturer British Steel secured a £500 million contract to supply train tracks for Network Rail over the next five years, following the government’s recent intervention at its Scunthorpe steel production plant

- Spanish lender Sabadell is considering selling British bank TSB amid a potential takeover by Spanish rival BBVA, the FT reports

- The owner of the UK’s largest bioethanol plant, ABF Sugar, said the government has two weeks to provide a rescue package for the industry, following the recent US-UK trade agreement that includes a 1.4 billion litre tariff-free import quota to the UK

- The UK’s House of Commons Environment, Food and Rural Affairs Committee called for a “root and branch” reform of the water industry and said the government should consider various other models of water company ownership, amid ongoing financial issues of utilities company Thames Water

- The UK government said that the High Speed 2 rail line will face higher costs and further delays, following the publication of an assessment into the current progress of the project

- The European Commission approved a joint venture between companies across the UK, Italy and Japan to produce the next generation of fighter jets

- Meta said it plans to let brands use artificial intelligence to fully create online advertisements and target customers from next year, The Wall Street Journal reports, the latest demonstration of growing AI adoption

Global and political developments

- The US military carried out strikes on three Iranian nuclear sites, saying they had caused “extremely severe damage and destruction”

- Iranian president Masoud Pezeshkian said the US “must receive a response for their aggression” following the strikes. UK prime minister Keir Starmer, French president Emmanuel Macron and German chancellor Friedrich Merz jointly called for Iran to negotiate an agreement

- Spanish prime minister Pedro Sánchez reportedly opposed a NATO proposal to increase defence spending targets to 5% of GDP, according to Spanish newspaper El País, calling the measure “unreasonable” and “counterproductive”

- The EU refused to hold an annual high-level economic dialogue with China due to ongoing trade disagreements between the two sides

- North Korea will send 5,000 military construction workers to the Kursk Oblast region to support Russia in repair work caused by Russia’s conflict with Ukraine

- Mr Starmer said the small boat crisis in the English Channel is “deteriorating”, as he agreed with Mr Macron to boost UK-French cooperation

- The world’s ‘carbon budget’, the amount of greenhouse gases that can be emitted while still having a 50% chance of keeping global warming to less than 1.5 degrees above pre-industrial levels, is set to expire within the next three years, according to a group of international scientists

- Mr Trump ordered the National Guard and Marines to Los Angeles to tackle protests over immigration raids. The governor of California, Gavin Newsom, said that Mr Trump’s actions were inflaming the situation

- US technology entrepreneur Elon Musk said he “regrets” some of his previous comments against Mr Trump

- The EU announced further sanctions against Russia, including restricting imports of refined products that use Russian oil and banning the use of the Nord Stream gas pipeline to Germany

- The US government said it was concerned over the Chinese government wanting to build its new UK embassy at Royal Mint Court in London, where it could potentially access sensitive communication infrastructure

- The UK, EU and Spain reached an agreement on Gibraltar’s borders that allows open land travel between Gibraltar and Spain in return for Spanish border checks for those flying or sailing into the British territory

- Russia struck targets in Ukraine with missiles and drones in a significant attack following Ukraine’s recent drone attacks on airfields far from the front lines

- Mr Trump said his recent conversation with Russian president Vladimir Putin was not one “that will lead to immediate peace”

- Israel said it will respond to recent missile attacks launched from Syria towards Israel

- Mr Trump announced plans to ban citizens of 12 countries, including Afghanistan, Iran, Libya and Yemen, from entering the US, citing national security concerns

- Karol Nawrocki, a member of the Eurosceptic opposition party Law and Justice, won the Polish presidential election. His appointment is likely to frustrate the government of centrist prime minister Donald Tusk in its attempts to strengthen the rule of law

- South Korea’s newly elected president, Lee Jae-myung, said his country faces “a tangled web of overlapping crises” following recent political turmoil and higher global economic uncertainty

Strategy

- The bond allocations within the portfolios target the short and mid sections of the yield curve where capital appreciation is expected.

- High yield bond strategies are avoided as credit spreads do not currently offer a worthwhile risk premium.

- The US equity market is underweighted on a valuation basis and strategies within the portfolio are particularly underweight mega-cap stocks.

- The UK equity market is conversely overweighted on a valuation basis.

- Asia, Emerging Markets and China are also overweighted as they trade below their long-term historical averages after experiencing a period of poor performance. The IC believe these regions have potential to grow their valuations in the long-term from a low base.

- UK and US small and mid-cap equity allocations are also included based on an attractive entry point which current valuations provide.

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future.

- After completing appropriate research and due diligence, the BNY Mellon Global Infrastructure fund and FTF ClearBridge Global Infrastructure fund are to be introduced into the Clarion Portfolio Funds with an appropriate reduction to the Legal & General Infrastructure Index fund. The Legal & General fund is heavily weighted to America, whereas the BNY Mellon and the FTF ClearBridge funds have higher allocations to European and global infrastructure projects.

- The recent underperformance of the Baillie Gifford Pacific fund was also noted but in-depth analysis revealed that the reason was because of the fund’s overweight exposure to Chinese equities. The IC feel that China may become a beneficiary of the end of American Exceptionalism and so decided to retain this fund for the time being and review on an ongoing basis. The Baillie Gifford Pacific fund also complements and blends well with the other fund holdings in the Asia Pacific Sector.

- Despite rising geopolitical tensions, we are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Europe, Asia and Emerging Markets where valuations are generally more attractive which will help to offset some of the economic headwinds and geopolitical uncertainty.

Clarion Funds

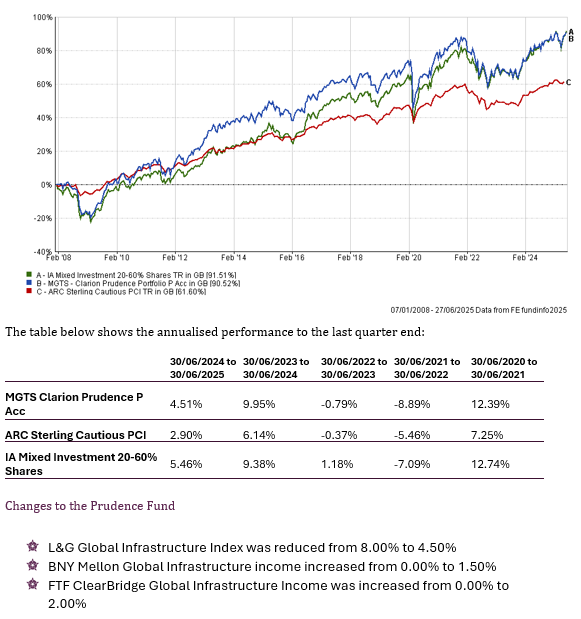

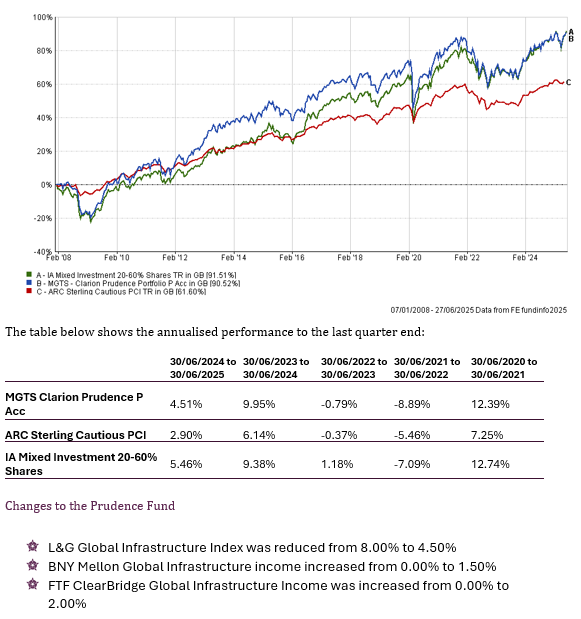

Prudence Fund

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

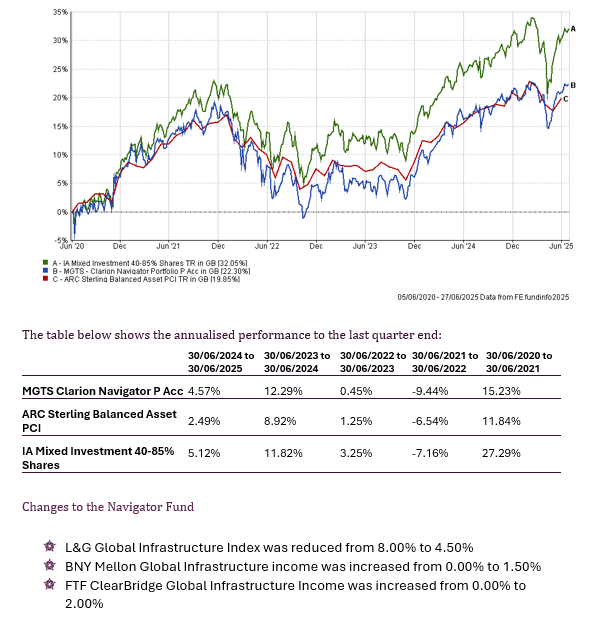

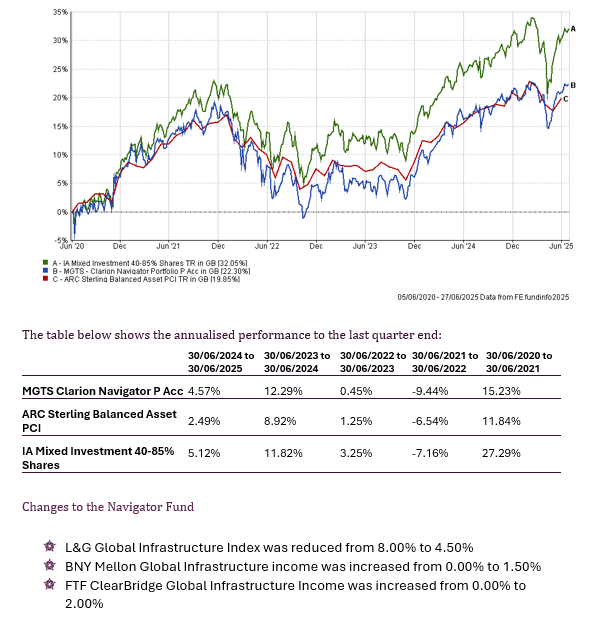

Navigator Fund

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

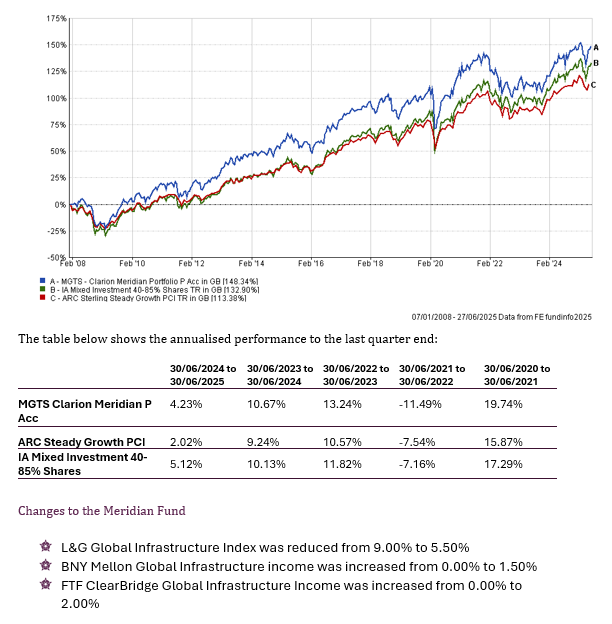

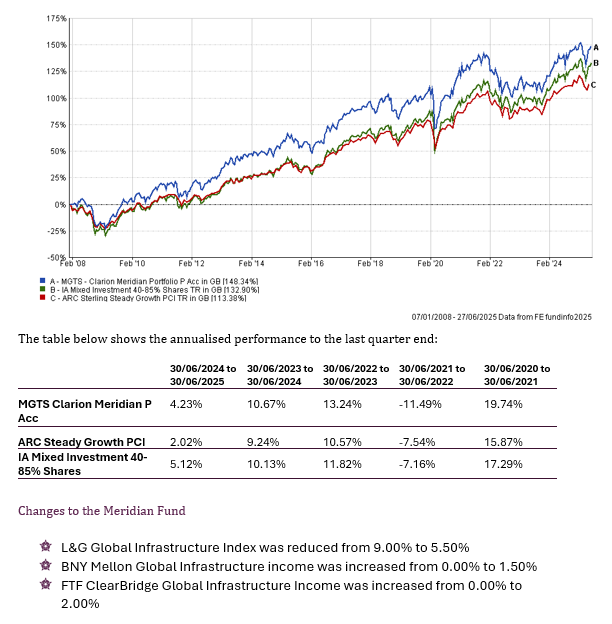

Meridian Fund

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

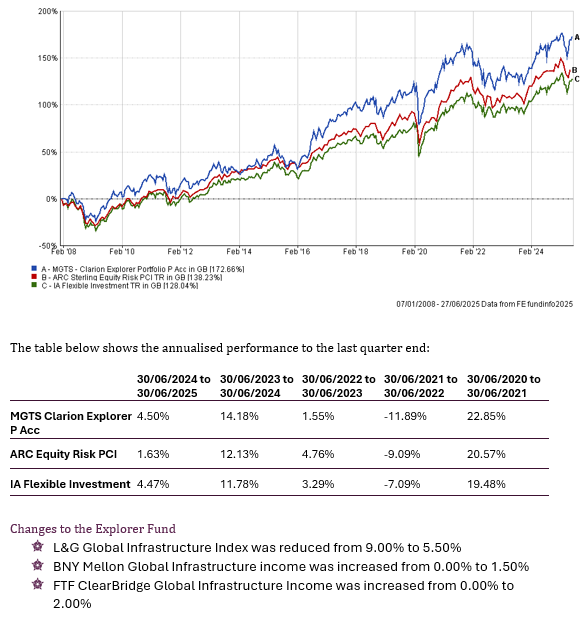

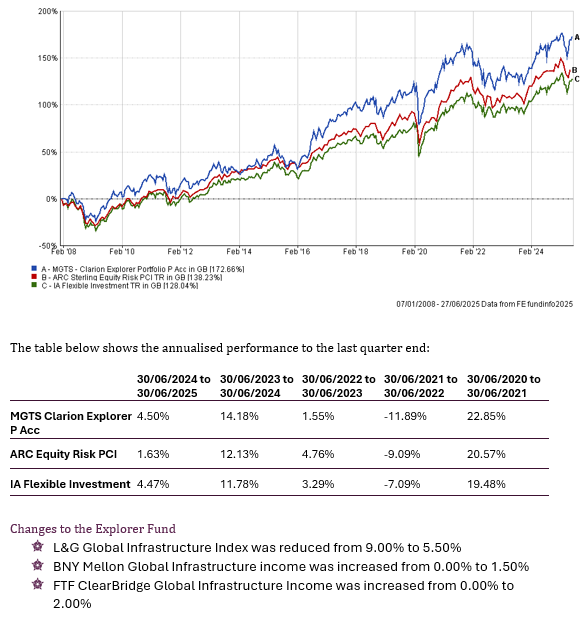

Explorer Fund

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

June 2025

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.