The Clarion Investment Committee met on 21 August 2025. The following notes summarise the main points of consideration in the Investment Committee Discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Please click here to access our August Stock Market & Economic Commentary written by Clarion Group Chairman, Keith Thompson.

Economic Commentary & Market Outlook

The following is a summary of the major news and events since the last Clarion Investment Diary.

Economics

- US president Donald Trump threatened to impose a 100% import tariff on semiconductors, but said companies could avoid the levy by investing in the US

- Trump announced an additional 25% tariff on imported goods from India over its purchases of Russian oil, taking the total tariff rate on Indian goods to 50%. The tariffs are an attempt to reduce Russian oil revenues and pressure Moscow into a ceasefire with Ukraine

- Switzerland’s president and economy minister travelled to the US to “present a more attractive offer” as it seeks to lower the country’s 39% import tariff rate imposed by Washington

- The EU halted its proposed retaliatory tariffs against the US following the initial agreement of a trade deal that will see a base rate import tariff of 15% on EU goods exports

- The Bank of England (BoE) cut interest rates by 0.25% to 4%. BoE governor Andrew Bailey said the decision was “finely balanced,” with only five of the nine members in favour of the rate cut. Investors subsequently pared back expectations for future rate cuts

- The BoE forecasts UK inflation to peak at 4% in September and remain above the 2% target rate for most of the next two years. BoE deputy governor Dave Ramsden said he was “surprised” by the persistence of inflation

- The UK government will face a £41 billion gap in the public finances by the Autumn Budget later this year, according to the National Institute for Economic and Social Research think tank, increasing the likelihood of future tax rises

- FT analysis shows that about 3,800 company directors have left the UK since the Autumn Budget last year, which abolished the non-domiciled tax regime and raised other taxes on wealthy individuals

- UK economic activity reached a 12-month high in August, the fourth consecutive month of expansion, according to surveys of purchasing managers

- Purchasing managers’ surveys for the US and euro area for August also showed activity at a 12-month high

- Germany’s key ifo survey of business confidence rose in August, continuing an improving trend that started in January

- US Federal Reserve chair Jay Powell hinted that the Fed may cut interest rates in September

- Credit rating agency S&P Global maintained its credit rating for US government debt, saying that it expects tax revenues from import tariffs to help offset the cost of the government’s recent tax and spending bill

- US data centres used 4.4% of total US electricity in 2023, according to the Department of Energy. Their share of consumption is expected to increase to up to 12% by 2028

- The RMT union announced strikes across the London Underground from 5 September over pay and working conditions

- The number of UK bank branches has fallen by a third over the last five years to 6,870, according to official data, as banks move towards online services

- The EU and US announced the details of their recently agreed trade deal, which includes a baseline US import tariff rate of 15% on EU goods. The US administration said tariff rates on European cars will remain at 27.5% until the EU “eliminate tariffs on all US industrial goods”

- The FT reported that the EU is speeding up plans to establish a European digital currency over fears that recent US legislation in support of the stablecoin market will reduce EU competitiveness

- Japanese exports fell for the third consecutive month in July, driven by falling exports to the US in the wake of tariff increases

- Approximately half of UK businesses expect staff to be ‘on site’ all the time, up from 27% two years ago, signalling a shift away from home working, according to the British Chambers of Commerce

- UK house prices increased by 0.4% in July compared with the previous month, after near flat growth in June following the end of the stamp duty holiday, according to Halifax

- The OECD warned that business investment is lower than pre-pandemic levels and well below rates seen before 2008. OECD chief economist Álvaro Pereira said countries would “not be able to sustain growth” if investment does not pick up

- The US administration extended its tariff truce with China for another 90 days to continue trade negotiations

- US consumer price inflation remained steady at 2.7% in the year to July, increasing expectations that the Federal Reserve will cut interest rates in September. However, producer prices rose by 3.3% in the year to July, up from 2.4% in June, as the effects of import tariffs begin to feed through US supply chains

- US consumer sentiment unexpectedly fell in August, according to the University of Michigan, reversing some of the gains made in the previous two months

- UK GDP grew by 0.3% in the second quarter this year, down from 0.7% in the previous quarter but above market expectations of 0.1%

- UK payroll employment fell for the sixth consecutive month in July

- Scotland’s net fiscal deficit increased to 11.7% of GDP in 2024-25, according to estimates published by the Scottish government, nearly double that of the UK as a whole, driven by falling oil revenues and rising public expenditure

- UK chancellor Rachel Reeves is drawing up plans for a second planning and infrastructure bill that will further overhaul planning rules to allow for quicker delivery of national projects such as the third Heathrow Airport runway, the FT reports

- Indian prime minister Narendra Modi announced tax and regulatory reforms as part of plans to build a “self-reliant India” following the imposition of 50% US import tariffs against the country

- Chinese industrial output growth slowed to 5.7% in July compared with the same month last year, the lowest rate since November 2020, amid trade tensions and concerns over the strength of China’s domestic economy

Business

- Apple said it will increase its investment in the US by $100 billion to a total of $600 billion over the next four years. Trump said Apple would avoid the incoming semiconductor tariffs because of the investment

- Technology company Palantir recorded revenues of $1 billion in the second quarter this year, nearly 50% more than in 2024, which it attributed to the booming AI industry

- US construction equipment maker Caterpillar warned of a potential $1.5 billion hit to profits from US import tariffs this year, as it posted a fall in earnings in the second quarter

- Shares in investment giant Berkshire Hathaway have fallen 14% since May, compared to an 11% gain in the overall S&P 500 index, following chief executive Warren Buffett’s retirement announcement

- BP made its largest discovery of oil and gas reserves in 25 years. The field, located off the coast of Brazil, could be a multi-billion-barrel site, but could take up to 10 years for production to begin

- The UK Supreme Court ruled that car dealers do not owe a “fiduciary duty” to customers, reversing part of a previous judgement by the UK Court of Appeal that threatened the UK banking sector with up to £44 billion of compensation payments. The ruling means compensation payments are likely to be less than £20 billion

- The US government is finalising a deal to acquire a 10% stake in US chipmaker Intel

- Japanese technology company Softbank also said it will invest $2 billion as part of plans to expand its US tech investments

- Social media company TikTok is expected to lay off hundreds of UK security and content moderators as it looks to use artificial intelligence to automate some of the work

- Australian airline Qantas was fined $59 million, the largest in Australian corporate history, for illegally sacking nearly 2,000 workers during the COVID pandemic

- Member’s club Soho House announced a $2.7 billion takeover deal by a group of investors led by US hotel company MCR Hotels

- Danish pharmaceuticals company Novo Nordisk halved the price of its Ozempic diabetes and weight-loss drug in the US for people purchasing it without using health insurance, in response to Trump’s demands for drugmakers to lower prices in the US

- Online bank Monzo is in discussions with telecom companies to offer its own mobile phone service as it looks to expand beyond its current financial services offerings. Other digital finance firms, such as Revolut and Klarna, are also looking to offer mobile phone services

- US self-driving technology company Nuro raised $230 million in its latest funding round, valuing the start-up at $6 billion, amid increased investor appetite for autonomous driving vehicles

- The UK government dropped demands for Apple to provide a “back door” to its customers’ data, ending its disagreement with the US government over the issue

- UK retailer Marks and Spencer announced plans to build a £340 million automated warehouse in the Midlands as part of plans to double the size of its food business and increase automation across its supply chain

- UK sales of Tesla vehicles fell 60% in July compared with the same month last year amid low electric vehicle demand and increasing competition from Chinese rivals such as BYD

- Visa is closing in on a deal to move office locations to Canary Wharf, the FT reports, while HSBC announced it will continue leasing office space in the business district for another 15 years. Both decisions defy the recent trend of high-profile organisations leaving the area

- US car manufacturer Ford plans to invest $2 billion in redeveloping a manufacturing site in Kentucky as part of efforts to produce more affordable electric vehicles.

- Elon Musk said he will take “immediate legal action” against Apple for allegedly refusing to rank his social media site X or AI app Grok in the ‘must have’ section of the app store

- AI company Perplexity offered to buy Google Chrome for $34.5 billion, ahead of Google’s upcoming federal court decision on remedies for its dominance of online search

- Technology companies Nvidia and AMD agreed to pay the US government 15% of their revenues from selling chips in China as part of a deal to secure export licenses. The US has previously banned the sale of some semiconductors to China over national security concerns

- The EU approved a €4.1 billion takeover of Just Eat Takeaway by Dutch investment company Prosus

- Defence manufacturer Rheinmetall said economies of scale and automation techniques will lower the cost of tanks and armoured vehicles in the coming years amid significantly increased European defence spending

- UK accessory retailer Claire’s appointed administrators last week after its parent business filed for bankruptcy protection in the US

Global & Political Developments

- Israel’s security cabinet approved a new military offensive in Gaza to take control of Gaza City and lead to the creation of “a civil administration for the entire enclave”

- Russian president Vladimir Putin and Mr Trump failed to reach a ceasefire agreement during their meeting in Alaska. Mr Putin demanded Ukraine cede the regions of Donetsk and Luhansk in exchange for freezing the front line, the FT reports

- Ukrainian president Volodymyr Zelensky travelled to Washington along with European leaders for talks with the US administration. Mr Trump said the US would help arrange European security guarantees for Ukraine if a peace deal was agreed

- Russian foreign minister Sergei Lavrov said that Russia’s agreement to any security guarantees is contingent on its inclusion in the process, alongside China

- Russia increased its missile and drone attacks on Ukrainian cities. Moscow suspended petrol exports last week following Ukrainian missile attacks on Russian oil refineries that led to record petrol prices

- Hamas said that it would accept a ceasefire proposal to end the conflict in Gaza, the FT reports

- The Israel Defence Forces said it will call up 60,000 reservists over the coming weeks as it prepares to take control of Gaza City

- UK asylum applications surpassed 111,000 in the Labour government’s first year in office, up from 97,000 in the previous year. UK home secretary Yvette Cooper announced reforms to the current asylum appeals process

- UK health minister Wes Streeting walked away from talks with drug companies after they refused to accept the government’s latest offer on drug pricing

- Mr Trump deployed the US National Guard in Washington after declaring a public safety emergency, saying the capital was “becoming a situation of complete and total lawlessness” as a result of crime

- Mexican president Claudia Sheinbaum said that Mexico’s independence was “not at risk” following reports that Mr Trump had ordered the US military to target Latin American drug cartels crossing the Mexico-US border

- The UK, France, and Germany said they are prepared to reimpose sanctions on Iran if it fails to resume negotiations with the US on its nuclear programme

- UK defence secretary John Healey said the UK is ready to deploy troops to Ukraine to help secure peace if a ceasefire deal is reached

- The Spanish government said it will replace its current fighter jets with European-made aircraft, rather than the US-made F-35 fighter jets, amid increasing tensions between the US and Spain over the latter’s defence policy

- UK deputy prime minister Angela Rayner demanded further information from Chinese authorities over plans for its new embassy in London after Beijing initially submitted plans containing redacted drawings, the FT reports

- The General Medical Council, the UK’s medical regulator, called for reforms to training and career progression as it warned that nearly 20% of doctors are considering leaving the profession, while a further 12% are considering moving abroad

Strategy

- The bond allocations within the portfolios target short and mid sections of the yield curve where capital appreciation is expected.

- High-yield bond strategies are avoided as credit spreads do not currently offer a worthwhile risk premium.

- The US equity market is underweighted on a valuation basis, and strategies within the portfolio are particularly underweight mega-cap stocks.

- The UK equity market is conversely overweighted on a valuation basis.

- Asia, Emerging Markets, and China are also overweighted as they trade below their long-term historical averages after experiencing a period of poor performance. The IC believe these regions have the potential to grow their valuations in the long-term from a low base.

- UK and US small and mid-cap equity allocations are also included based on an attractive entry point, which current valuations provide.

- US big tech and large-cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future.

- No changes to the underlying funds were considered necessary as all funds were performing in line with expectations and within their risk-reward parameters.

- Despite ongoing geopolitical tensions, we are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Europe, Asia, and Emerging Markets where valuations are generally more attractive, which will help to offset some of the economic headwinds and geopolitical uncertainty.

Clarion Funds

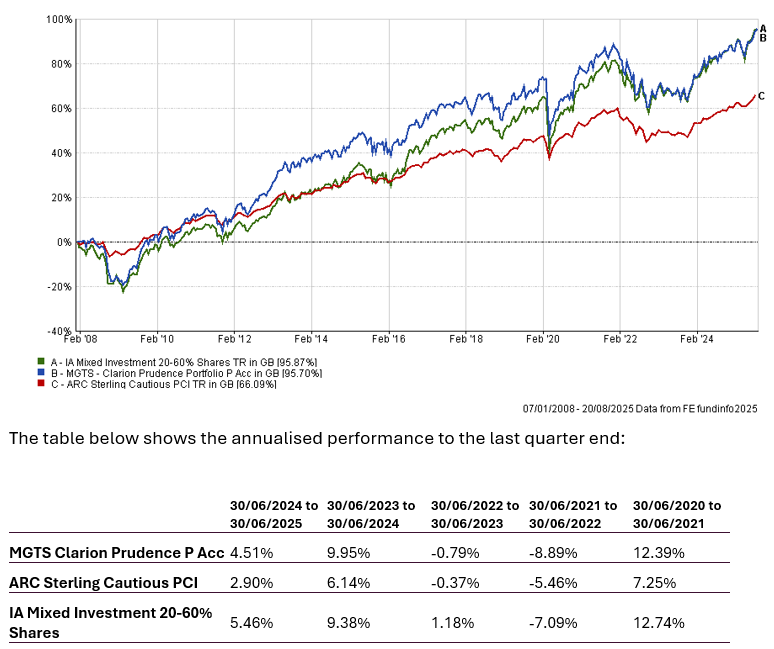

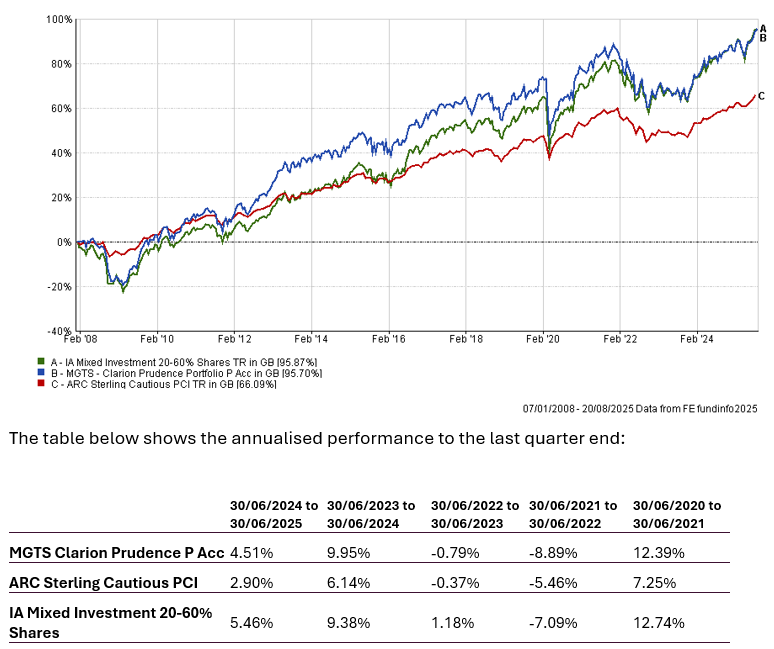

Prudence Fund

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund & Portfolio

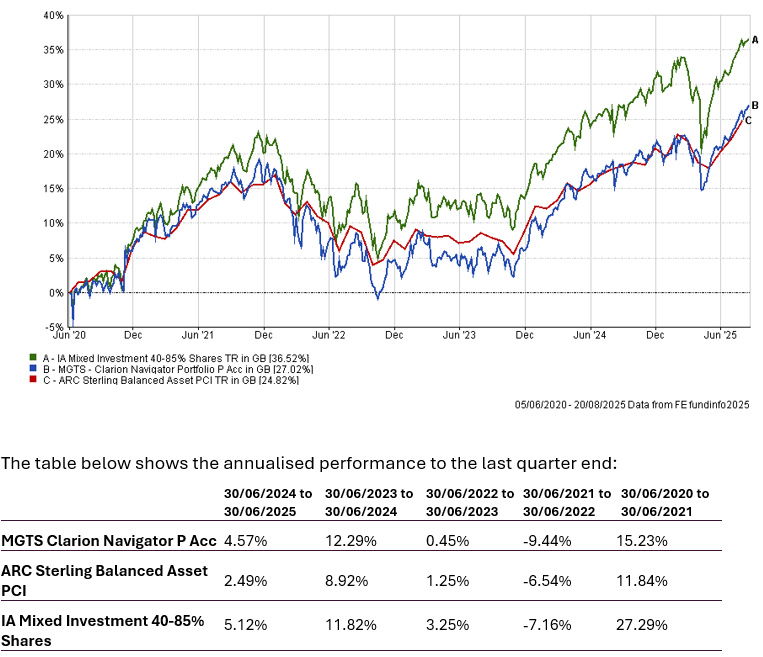

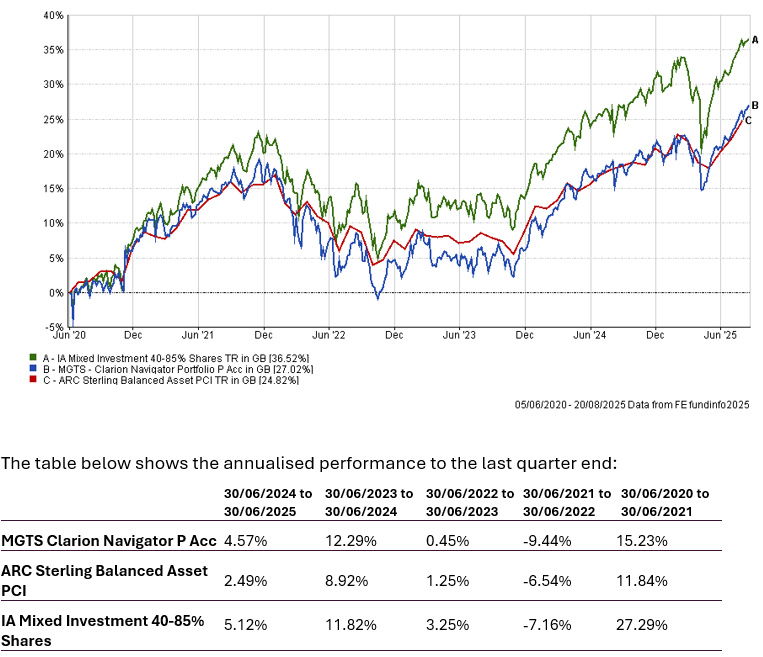

Navigator Fund

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

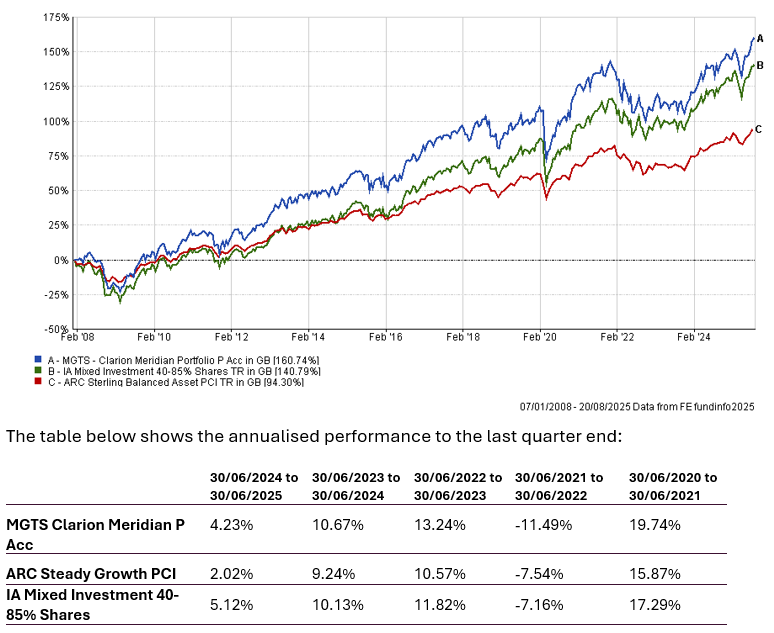

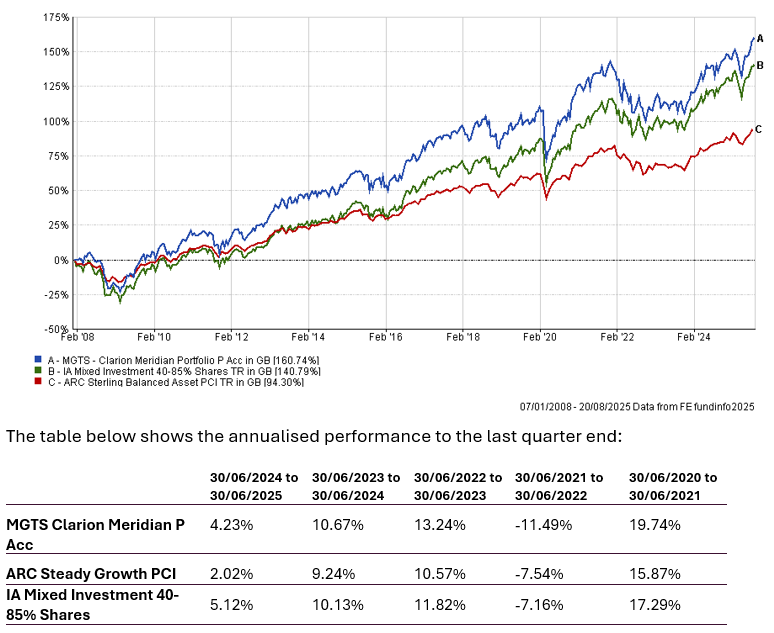

Meridian Fund

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

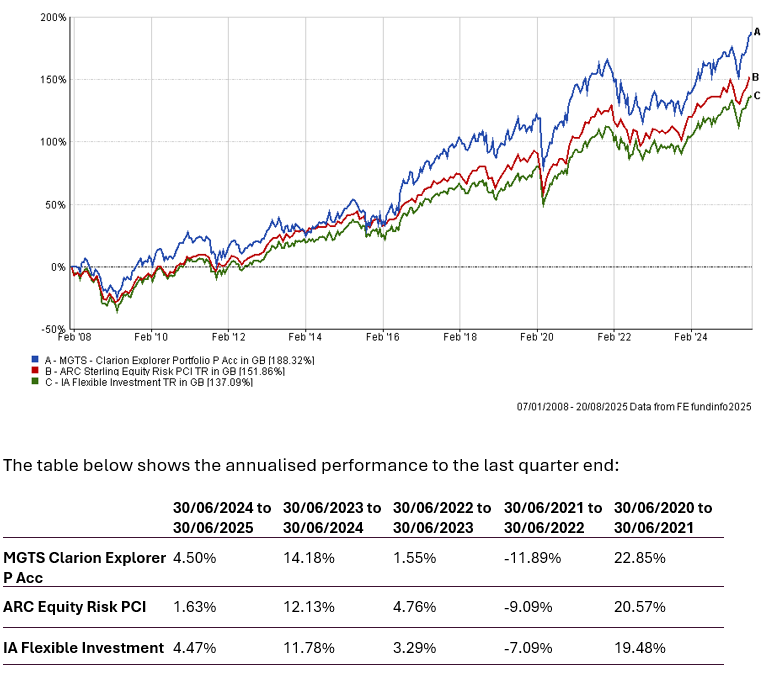

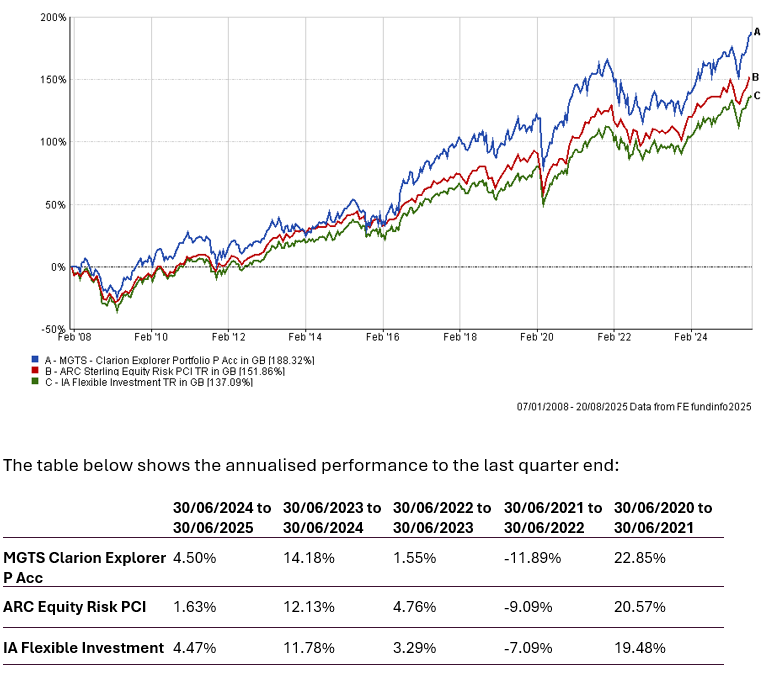

Explorer Fund

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

August 2025

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.