Category: Financial Planning

The Clarion Investment Committee met on 30 September 2025, at the offices of Margetts Fund Management in Birmingham.

The main theme of the meeting was to discuss and review the recent Dynamic Planner annual presentation, which provided a summary of the main investment themes of the past 12 months and a review of the performance of the Dynamic Planner model portfolio benchmarks.

Please click here to access our September Stock Market & Economic Commentary written by Clarion Group Chairman, Keith Thompson.

Our investment philosophy is guided by proven financial research and applied with care by our in-house Investment Committee. We do not chase trends or make predictions. Instead, we rely on evidence, structure, and oversight to manage wealth responsibly over the long term.

We focus on what can be controlled: diversification, discipline, and costs. This allows us to create efficient portfolios designed to weather uncertainty and deliver the returns that markets provide.

Our approach is built on five enduring principles, which together form the foundation of our Investment Philosophy.

Each of the five principles reflects our commitment to managing your wealth with clarity, discipline, and care.

1) Evidence-based investing. Disciplined diversified portfolios deliver better long-term outcomes than chasing the latest market trend.

2) A systematic process. A structured repeatable process designed to remove guesswork and emotion.

3) Cost efficiency. We carefully select cost-effective investment solutions without compromising quality.

4) Independent oversight. Every decision is reviewed and challenged by our in-house Investment Committee, supported by Margetts Fund Management and Dynamic Planner.

5) A responsible perspective. Identifying risks and opportunities that could affect your wealth in the years to come and building resilience into client portfolios.

Review of the past turbulent year’s market performance, noting that the allocation models performed well and slightly exceeded expectations despite high volatility.

The performance of fixed-income markets was unusual. Corporate bonds showed strength due to high earnings, while government bonds, particularly sovereign bonds, underperformed.

Analysed the high concentration risk in US equity markets driven by ‘US exceptionalism’, contrasting this with better valuation opportunities in European, UK, and Japanese markets.

Outlined the global economic outlook, highlighting slightly improved growth prospects but noting that inflation remains more resilient than expected, creating a difficult policy dilemma for central banks.

Reviewed the performance and outlook for China and Emerging Markets, noting China’s strategic export diversification towards Asia and the region’s continuing role as a key driver of global growth.

Explained recent minor strategic allocation changes, including reducing US equity exposure to diversify into European and Japanese markets and adjusting fixed income and cash levels in different risk-based portfolios.

Highlighted that volatility is expected to remain high, particularly in government bond markets, and that there is an opportunity to diversify equity allocations to improve portfolio resilience.

The past year was characterised by the expected market indecisiveness and volatility, leading to a turbulent period for investments.

Benchmark performances have shown serious fluctuations, with significant upward and downward movements observed on a monthly basis.

Despite the volatility, models and benchmark allocations have performed in line with, and in some cases, have overshot expected performance.

This outperformance is viewed as a positive result, demonstrating that the underlying models have held up well amidst challenging market conditions.

A divergence has been observed between model volatility, which remains at expected levels, and realised volatility, which has dropped.

This drop in realised volatility is particularly noticeable in higher-risk allocations, though it is anticipated that this will mean-revert over time.

Value at Risk (VaR) breaches have occurred but have remained within the expected range of three to five breaches for 95% VaR on monthly returns, indicating risk is being managed as anticipated.

The equity market recovery between months has prevented more significant breaches than might have been expected.

Inflation has proven to be more resilient and ‘sticky’ than expected across the US, UK, and Europe, consistently tracking above central bank targets.

This persistence creates an unenviable dilemma for central banks, forcing them to balance their inflation-fighting mandate with the prospect of lower economic growth.

The Bank of England (BoE) faces a particularly difficult twin dilemma of high inflation and stagnant growth.

Central bank policies are beginning to diverge, with the US Federal Reserve (Fed) recently cutting rates based on a slowing labour market, while other regions follow their own paths.

Equity markets experienced some down months, particularly in the US as anticipated, but the magnitude of the monthly drops was not as severe as feared.

In stark contrast, the performance of fixed income markets was more concerning, with monthly drops of 2-3% being ‘odd’ and ‘scary’.

The most significant drops were seen in government bond markets, traditionally considered safe assets, which experienced a major shake-out in the investment-grade sovereign space.

Conversely, the corporate bond market has performed extremely well, holding up and tracking expected returns and volatility effectively.

Analysis shows that ‘US exceptionalism’, where US markets consistently outperformed the rest of the world, has been challenged since January, with US and non-US markets now tracking each other closely.

This is partly driven by massive passive flows into US equities, creating a self-perpetuating cycle and increasing concentration risk, with just seven stocks now constituting 33% of the US market.

US valuations, particularly in the technology sector driven by AI investment, appear stretched compared to historical averages. In contrast, valuations in the rest of the world are more in line with historical norms.

Significant investment plans in Europe and the UK, alongside the pivot of Chinese trade towards Asia, present compelling diversification opportunities away from a complete reliance on US equities.

A major ‘regime shift’ has occurred in fixed income, with yields on bonds jumping by 2-3 percentage points, creating new opportunities for portfolio diversification.

This shift is driven by sticky inflation and a massive requirement for public spending on defence and infrastructure in developed countries, leading to higher government borrowing.

Corporate bond markets have been a bright spot, supported by exceptional corporate earnings, with 89% of S&P 500 companies beating expectations

The outlook for global growth has seen a slight improvement, with the IMF raising projections by 0.1-0.2%.

Emerging markets, especially in Asia, continue to be the primary engines of global growth. The strengthening partnership between India and China creates a more powerful economic bloc.

Chinese growth, previously a debatable issue, has now stabilised due to government efforts to support the internal consumer market and diversify exports.

The primary area of concern within developed world markets remains the UK, where growth has been tracking at or near 0%.

Following major changes made previously, the most recent meeting resulted in smaller, more refined tweaks to the asset allocation.

Key headwinds identified include persistently higher inflation, fractured supply chains and ongoing geopolitical tensions, and the risk of a slowdown in the US labour market.

There is also uncertainty around the real-time impact of large, long-term investment commitments made in the US and the diversification of international trade.

Asset allocation changes.

The improving outlook for non-US equity markets has allowed for greater regional diversification in the portfolios.

Small reductions have been made to US equity allocations, with corresponding increases in European and Japanese equities.

For lower-risk portfolios, allocations to government fixed income have been reduced in favour of holding more cash to improve diversification and manage correlation risk.

For higher-risk portfolios, there is a slight increase in inflation-linked assets and a reduction in fixed income to fund a more regionally diversified equity allocation.

It was clarified that inflation-linked debt remains a core part of the allocation and a small amount was added to provide defence against inflation, which is expected to remain high.

Regarding future government debt volatility, it was noted that while prediction is difficult, volatility is expected to remain elevated due to high government issuance requirements, though it could reduce if markets absorb the new debt well.

On using small caps for diversification, it was explained that while there is an observed de-correlation, it is largely due to illiquidity and poor price discovery.

In a downturn, small caps can fall harder, so this is not used as a strategic allocation.

It was noted that all the underlying funds were performing in line with expectations and within their risk-reward parameters, but the Committee agreed that some minor tweaks might be necessary to meet the new benchmark allocations. These will be discussed and implemented at the next meeting.

Despite ongoing geopolitical tensions, we are cautiously optimistic about stock markets for the remainder of 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Europe, Asia, and Emerging Markets, where valuations are generally more attractive, which will help to offset some of the economic headwinds and geopolitical uncertainty.

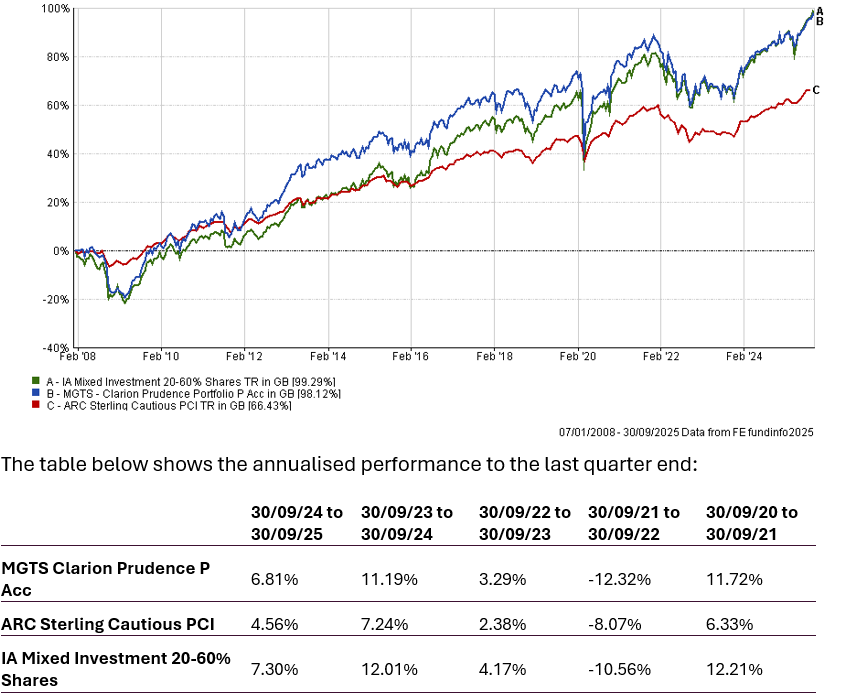

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Due to changes in the underlying strategic asset allocation, the following changes were made to the Prudence portfolio:

Equities

Bonds

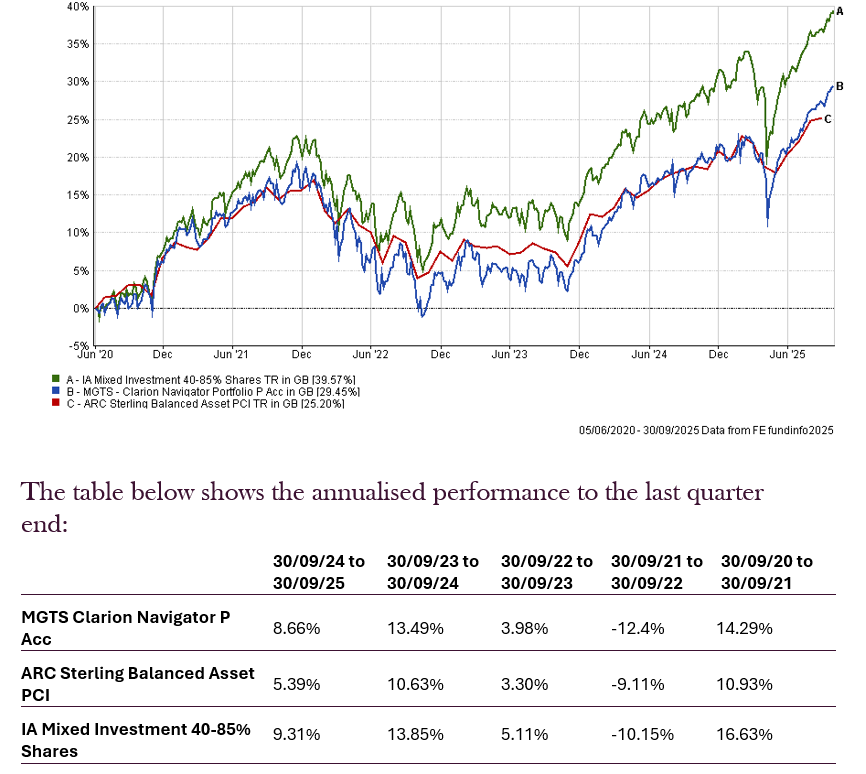

The chart below shows the historical performance of the Navigator fund against a relevant benchmark since the start of the available data.

Due to changes in the underlying strategic asset allocation, the following changes were made to the Navigator portfolio:

Equities

Bonds

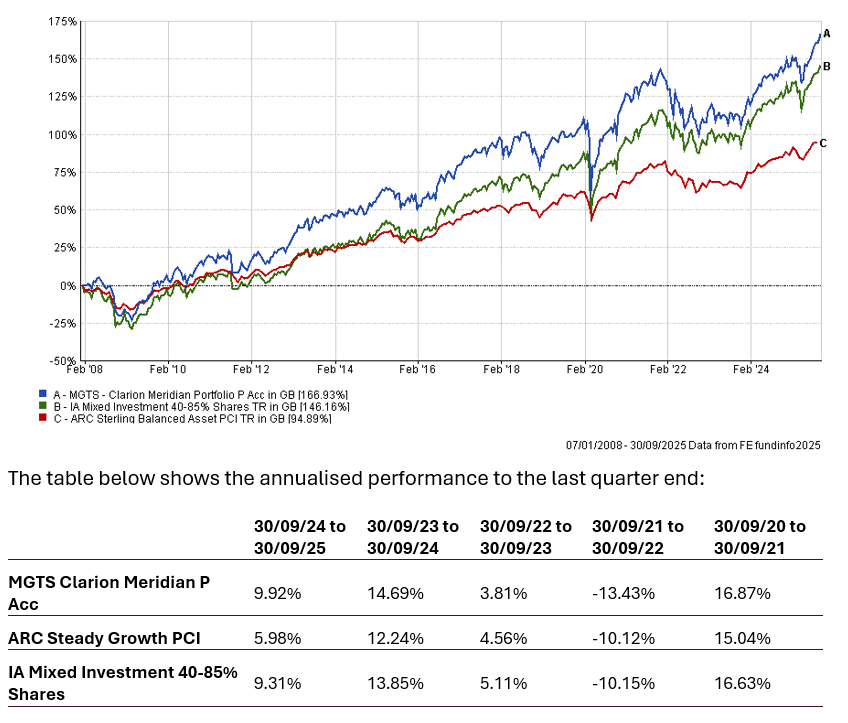

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Due to changes in the underlying strategic asset allocation, the following changes were made to the Meridian portfolio:

Equities

Bonds

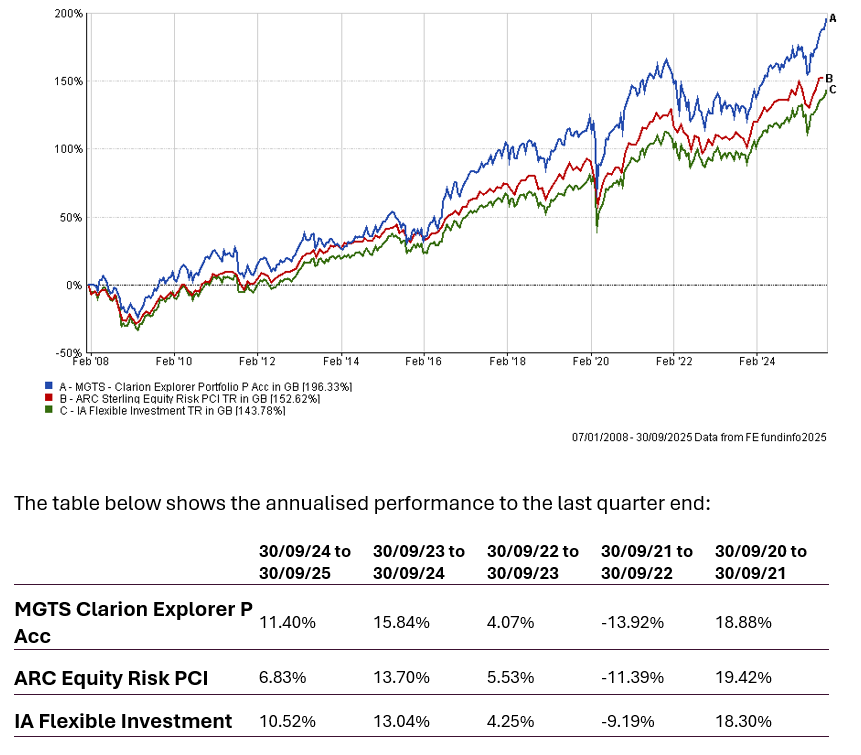

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Due to changes in the underlying strategic asset allocation, the following changes were made to the Explorer portfolio:

Equities

Bonds

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson CIP; Dip FA

Creating better lives now and in the future for our clients, their families and those who are important to them

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.