Category: Financial Planning, Lifestyle

Recently, our non-executive director Keith Thompson met up with one of our valued clients for a drink and a chat. Sadly, this client’s wife is seriously ill but, despite his challenging circumstances, he had a positive outlook.

He said: “I’m lucky Keith. I have good support from family and friends, and I don’t have to worry about money. Your lot do that.”

He went on to praise not just the technical ability of the Clarion Wealth team, but also our “care ability” and talents for “looking after people” and “making life simple”.

Both the financial and personal support of our team have allowed him to “get on with the important side of life” at a difficult time when it would have been easy for him to become overwhelmed.

This story underlines many of the beliefs we hold about the importance of financial planning as a powerful tool to boost your mental health and emotional wellbeing.

With this story in mind, and Mental Health Awareness Week just around the corner, what better time to explore the many connections between financial planning and mental health?

As planners, we’ve long believed there’s a strong connection between working with a financial planner and improved mental wellbeing.

When we ask our clients about the benefits of working with Clarion, they rarely point to investment performance first. Instead, they mention:

Moreover, in the case of Keith’s client, he benefited from the reassurance that he could take care of his loved one without worrying about “the financial side of life”.

While we see the benefits of financial planning on mental wellbeing every day, research has also empirically linked the two.

Royal London found that financial planning delivers more than just financial benefits. Their research reinforces our belief that planning boosts emotional wellbeing by making you feel better about money and yourself.

The client story you read earlier perfectly illustrates how having a financial planner on your side can give you peace of mind during difficult times.

Whether your partner falls seriously ill, you spend a period out of work, you go through divorce or separation, or a family member passes away, it’s important to be able to focus on yourself and those close to you when life presents challenges.

Unfortunately, these incidents often create financial trials too, and money worries can worsen your mental health at a time when you may already be feeling low.

Indeed, the Money and Mental Health Policy Institute found that 86% of people with experience of a mental health condition reported that their financial situation had made their condition worse.

Having planners on your side – like our team at Clarion – can allow you to “get on with the important side of life” without worrying about financial practicalities, safe in the knowledge that you have an expert in your corner. To paraphrase Keith’s client: “That’s what our lot do!”

Feeling in control of your finances can contribute to enhanced wellbeing. Not only can feeling out of control increase your anxiety and stress levels, but it can also be detrimental to your physical health.

As Time reports, being under financial strain leads to a 60% greater risk of developing serious health problems.

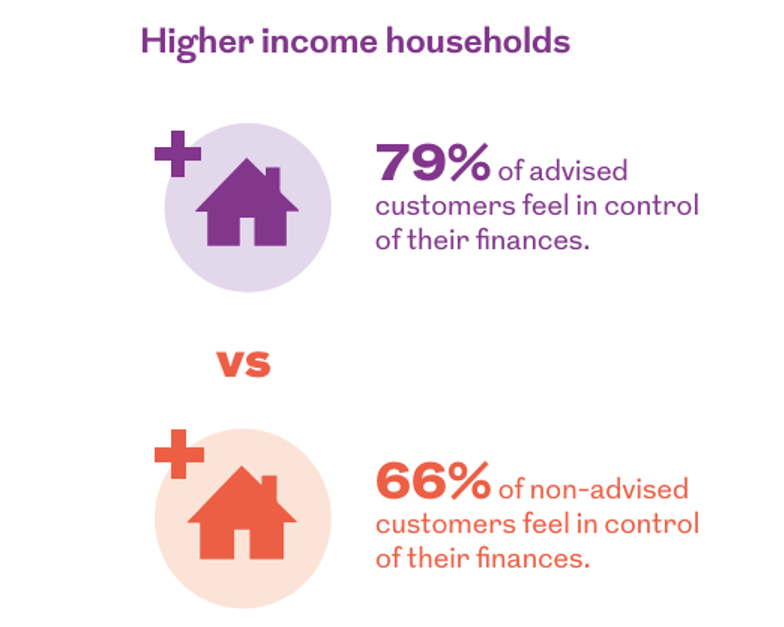

Working with a financial planner can reduce this stress. Royal London’s research found that individuals who take advice felt more in control of their finances, and this holds true among higher-income households.

Source: Royal London

At Clarion Wealth we work with many successful people from all walks of life. We’ve learnt that no one is immune to money worries, but we’ve also seen the powerful ways our work can help alleviate financial anxiety and stress both in the short and long term.

A cornerstone of our practice at Clarion Wealth is building deep and long-lasting relationships with our clients. We’re dedicated to finding out what makes you tick, and we’ll dig deep into your financial situation and life goals so that we can be the best financial partner and confidante possible.

We’ve found that a strong relationship with our clients leaves us better placed to help you build the financial future of your dreams.

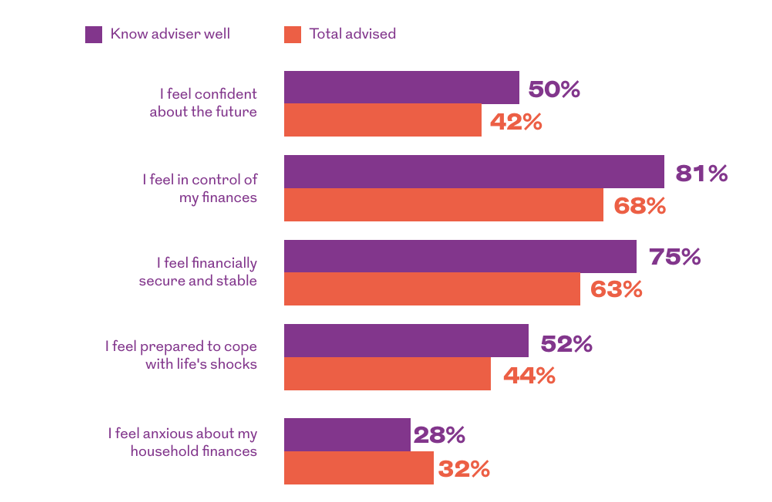

Royal London’s research reinforces this belief. They found that those who receive a “holistic” style of advice and who regularly meet with their planner feel more prepared to cope with shocks, more in control, and less anxious about their finances.

Source: Royal London

As Keith’s chat with his client shows, building a lasting and meaningful relationship with a planner can be worth its weight in gold when the unexpected happens.

If you think your mental or emotional wellbeing could benefit from working with a financial planner, get in touch.

Email [email protected] or call 01625 466360 to take the first steps towards a financially and emotionally rewarding relationship.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.