Tags: cash savings, inflation, interest rates

Category:

Financial Planning,

Investment management

“Interest rates are to asset prices what gravity is to an apple. When there are low interest rates, there is a low gravitational pull on asset prices.” Warren Buffett

In February 2009 when base interest rates had just been cut to 1% per annum, I had a friendly wager with an accountant friend about the future path of interest rates. His view was that rates would recover to the 2007 level of more than 5% per annum within a couple of years. My prediction was that it would take at least 10 years. We agreed a friendly wager of £25 per year for each year beyond 2014. I am still collecting the money which is donated to a charity of my choice!

Due to the impact of the global financial crisis, base interest rates fell to their lowest level for 300 years. Starting at 5.75% in July 2007, then a 6-year high, rates had fallen to only 1% by February 2009. They continued on a downward path with a further fall to 0.5% in March 09 and eventually to 0.25% in August 2016. There was a very small rise back to 0.5% in November 2017.

To put this in context, in October 1981, the base interest rate was 15%.

And now amidst the Covid-19 pandemic crisis, base rates have been cut to just 0.1% per annum. My prediction of 10 years from February 2009 for a return to a semblance of interest rate normality now looks hopelessly too short. Interest rates are unlikely to be significantly higher for years to come. My accountant friend has declined my invitation to have another small wager!

Indeed, there is now a growing risk of negative interest rates, something which is quite difficult to comprehend. Think about this. Not only could you be lending money to the government, a bank or other savings institution but you could be paying them for the privilege of doing so.

Low interest rates are vital to allow governments to pay for the enormous cost of the coronavirus pandemic which in the case of the UK has pushed up government debt to more than £2trillion and counting. Inflation would be a ‘blessing’ in disguise for the authorities as this would reduce the real value of the debt but central banks led by the US Fed have openly stated that they will tolerate inflation consistently above 2% per annum before even considering a rise in interest rates.

Savers and people who rely on a decent income from their cash savings have faced an interest rate drought for more than 11 years and are likely to continue to do so for the foreseeable future. Even with moderately low levels of inflation, cash and bank deposits are losing purchasing power at an alarming rate.

In the 10 years from December 2009, the UK retail price rose +34% compared to a return on cash of +5.1%, a negative real return of almost 29%. I suspect these numbers will be even wider apart in the 2020s.

The interest rate on the NSI direct saver account, a popular home for cash savings, is being reduced to a paltry 0.15% at the end of November, an erosion of purchasing power due to inflation of almost 2% per annum.

What then can savers do about this dilemma?

Investors always chose between different homes for their savings. This cycle, the fact that bonds offer zero returns trumps most other considerations and demand for stocks and shares has risen in response. Cash holdings pay you zero. And bonds offer similarly negligible returns, with far higher risks. This situation, of financial assets being compared to cash itself, has driven massive inflation in these asset prices. This has been renewed as walls of cash have flooded into the system in response to the coronavirus pandemic.

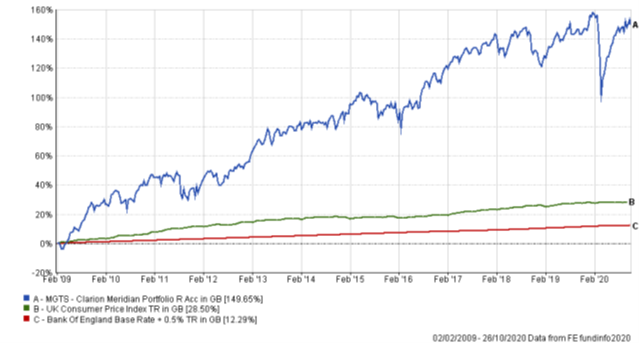

In the graph below which solution would you prefer? The red line C shows a gradual erosion in the purchasing power of a deposit account compared to the green line B (inflation). By way of comparison, the blue line A is the Clarion Meridian Portfolio Fund which, although not without volatility, shows a return 10 times more than a deposit account over the timeframe since I first entered my friendly wager 11 years ago.

This situation looks set to continue so we would urge you to please re-evaluate your attitude to risk and fully explore your options. In the current low interest rate environment, we would only recommend holding cash on deposit as an emergency fund and/or to cover living expenses for a six- or twelve-month period.

There are several alternatives, ranging from low to medium risk, to holding money on deposit and this is where diligent financial planning can play an important role. Having a robust lifelong financial plan and lifetime cash flow strategy can provide you with the comfort to help you make better use of your cash savings.

Clarion are uniquely placed to examine, evaluate, and discuss the alternatives with you and formulate an appropriate financial strategy.

Please contact one of our advisers for an informal, friendly, and free, consultation without obligation.

KEITH W THOMPSON

CLARION GROUP CHAIRMAN

NOVEMBER 2020

Creating better lives now and in the future for our clients, their families and those who are important to them.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.