Category: Financial Planning, Investment management

It was with sadness that many in the academic and economic worlds learned of the passing of influential psychologist and economist Daniel Kahneman in March 2024.

Kahneman, who was perhaps most widely known for his best-selling book Thinking, Fast and Slow, had enjoyed nearly 70 years in academia. In that time he made several significant contributions to the field of behavioural economics despite never studying a course on the subject.

His work with fellow psychologist Amos Tversky developing the behavioural model of “Prospect Theory” has been particularly influential. Among other things, Prospect Theory highlights the inherent propensity for humans to be “loss-averse”, a behaviour that can affect the way you invest.

Read on to learn more about the theory of loss aversion, what it can teach you about how you might invest, and how you can avoid letting it hamper your progress towards your goals.

Kahneman and Tversky first developed their Prospect Theory in the 1979 paper “Prospect Theory: An Analysis of Decision under Risk”.

In it, they found that people feel the pain of a loss more than the pleasure from a gain of the same size. In Kahneman and Tversky’s own words, “losses loom larger than gains”.

In fact, they found that losses are psychologically twice as painful as gains are pleasurable.

For example, imagine a friend proposes flipping a coin and, if it lands on tails, you pay them £10. How much would you need to win if the coin lands on heads to take this bet?

Kahneman’s research found, on average, people would need to win at least £20 to accept.

This bias towards avoiding loss can influence many areas of your life. However, perhaps most importantly, it can affect your long-term investment decisions.

If you decide to prioritise not making a loss over making a gain, this can inform your approach to investing.

By prioritising avoiding losses, you may seek less risky investment options which, in turn, may yield lower returns than higher-risk choices. Over time, this strategy could mean your portfolio grows more slowly than it would with a less “loss-averse” strategy. This could mean you don’t achieve the level of growth you need, leaving you with a shortfall in later life.

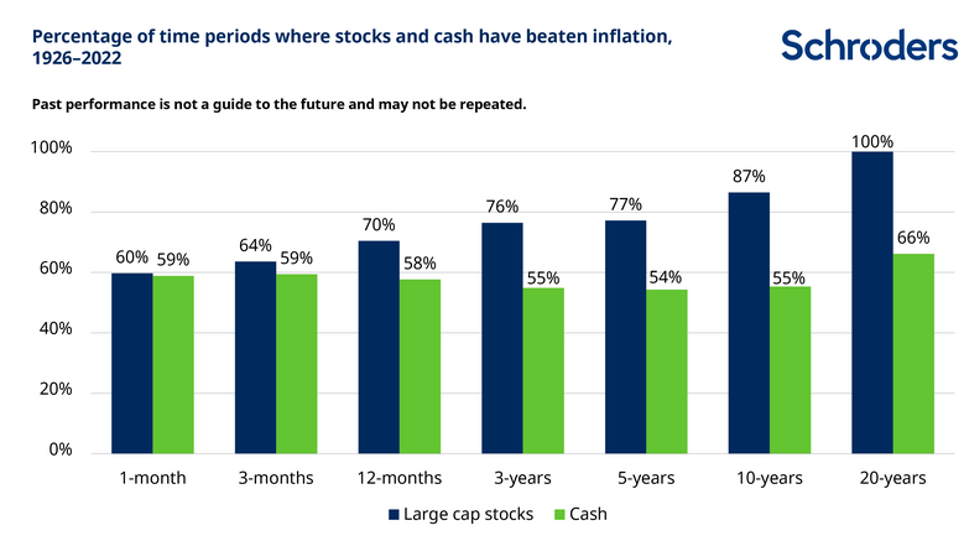

The below graph from Schroders illustrates this effect. It compares the “riskier” strategy of investing in stocks with the “loss-averse” method of cash savings, showing how likely each holding is to beat inflation over various time periods.

Source: Schroders

Cash savings provide guaranteed returns so your capital is never at risk. However, if the interest on your savings is below the rate of inflation, the spending power of your money will fall in real terms. Schroders’ analysis found that cash only beats the rate of inflation about 60% of the time, no matter how long you hold it.

In comparison, while investments held in equities can fluctuate in value, the analysis found they always had a higher probability of beating inflation than cash, and if held for any period over 20 years, the probability of beating inflation hit 100%.

Acting in a loss-averse manner and holding more of your wealth in low-risk assets could increase the chances of your spending power falling over time.

A loss-averse investment strategy can also push you to sell assets during a downturn to avoid making further losses. While this does limit the size of any losses to those you’ve already made, it essentially turns a paper loss into an actual loss. It means you eliminate the potential for future gains if and when markets recover, something history tells us is commonplace.

We only need to look back a few years for a real-world example of the downsides of this behaviour. As Chase reports, in 2018 the US market experienced two large corrections, spurring many investors to sell out of fear of further losses.

The market later bounced back meaning, as a result, the typical US investor lost roughly twice as much as the S&P 500. This was largely because investors sold their holding out of fear of further losses, missing out on the market recovery when it eventually came.

Even with an understanding of loss aversion, it’s still very difficult to remove your instinctive, emotional decision-making urges from your investment process.

Working with a professional can create a “buffer” between you and your investments. An expert can help you be more objective, and avoid making potentially detrimental decisions driven by loss aversion.

Our team at Clarion regularly meet to discuss the latest economic and political trends so we can help you make informed investment decisions that prioritise your long-term goals, rather than acting on any loss-averse instincts.

To learn more about how we can help you, email [email protected] or call us on 01625 466360.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.