Category: Financial Planning, Investment management

Minutes of the meeting held at Overbank, 52 London Road, Alderley Edge, Cheshire, SK9 7DZ on 29th April 2019

| Ron Walker (RW) | Director |

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 28th March 2019 were agreed by the Committee as a true and accurate record.

All risk and stress tests confirm that the Clarion Funds and Model portfolios are managed in accordance with their appropriate risk rating and there are no concerns regarding liquidity and/or capital risks other than the normal market volatility.

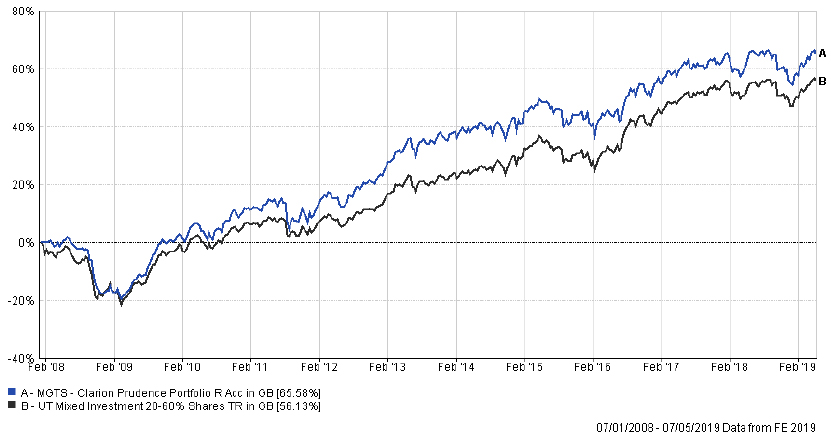

Over 3 months, Prudence outperformed the IA Mixed Investment 20-60% Shares sector by c.1.2 percentage points. April was another positive month and the fund has benefited from both a positive fund selection and asset allocation. The fund is up circa 7% year to date.

The fund’s underlying bond holdings performed well in April as bond yields have levelled off. Over 4 weeks, the Royal London Global Index Linked Bond fund was the only underlying bond holding which has underperformed its sector but the Committee are comfortable holding this fund as a hedge against the possibility of inflationary pressures emerging.

In the UK, the Threadneedle UK Equity Income fund lagged the IA UK Equity Income sector over 12 weeks, but outperformed over shorter time periods. All other underlying UK funds outperformed the sector over 12 weeks and the Committee have no concerns regarding the underlying fund selection.

The Committee looked at the strong performance profile of the Man GLG UK Equity Income fund, which was purchased to replace the Majedie UK Income strategy. The Committee compared performance profiles of the Majedie and Man GLG funds and concluded that this was a good move given that Man GLG outperformed by c.5 percentage points since the date of the switch.

With regard to the two underlying global equity holdings, the Committee are pleased with the improving performance profile of the Henderson Global Equity Income strategy, which complements the M&G Global Dividend fund.

Overall, the Committee are happy with the performance of the Prudence fund and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

Meridian was c.1 percentage point ahead of the IA Mixed Investment 40-85% Shares sector over 3 months. The fund is up circa 9% year to date.

The fund has benefited from a positive asset allocation effect, driven primarily by its overweight to equities. Fund selection showed mixed results and had a neutral effect in March and April.

Over 12 weeks the fund selection in Asia was relatively strong as the Fidelity Institutional South East Asia and First State Asia Focus funds complemented each other well. In bonds, there was an improvement in short-term performance of the underlying short-duration strategies, which have benefited from flattening of bond yields. In Europe, Fidelity European performed well over 12 weeks and also over shorter-term periods.

Since the start of 2019 the fund has struggled with selection of UK strategies, as half of these were behind their respective sectors over 12 weeks. At the previous IC meeting the Committee agreed to replace the SLI UK Equity Income Unconstrained strategy with Evenlode Income. However the Evenlode fund is now soft-closed and new investors are required to pay a 5% initial fee. It was therefore agreed to retain the SLI fund at this stage and to explore other options in the near future, once the fund’s current themes have been realised.

TR also expressed concerns about the performance profile of the Rathbone Income strategy, which struggled against the sector during market rises in 2019 and did not provide a significant level of protection during market falls in 2018. The Rathbone fund does however have an excellent medium to long term performance and a well respected fund manager and the Committee decide to retain the fund for the time being but will look at potential replacements at the next Committee meeting.

DK presented his review of the JPM UK Dynamic fund’s performance during the second half of 2018 and the year to date. DK explained that this is a relatively cyclical strategy which is expected to underperform during periods of negative markets and outperform on market rises. While the fund’s underperformance during market falls in 2018 was largely in line with expectations, the subsequent underperformance during market rises in 2019 was out of character. Changes in the fund’s positioning indicate that at the end of 2018, the fund manager reduced the portfolio’s exposure to cyclical equities and increased some more defensive positions, which led to the fund’s underperformance both on market falls and on market rises.

DK felt that the JPM strategy did not perform in line with expectations and proposed replacing it with another UK All Companies fund. TR and other members of the Committee agreed with DK’s view.

DK proposed looking at the Royal London Sustainable Leaders fund, which has a strong 10-year track record, however Margetts do not have a formal research note on this strategy. The Committee looked at the fund’s characteristics and identified a relatively high concentration of holdings.

As an alternative KT proposed the Castlefield Buffettology fund but TR commented on the fund’s relatively high concentration and high exposure to small-cap stocks. DK acknowledged TR’s points, but thought that this fund could be purchased at a smaller weighting due to higher risk involved because of concentration concerns. KT accepted TR’s comments and agreed with DK and overall the Committee agreed that the strong out performance of the Buffettology Fund was very impressive and the Fund should therefore be included in the Meridian strategy.

The Committee looked at a number of other UK funds and in particular the Liontrust Special Situations. DK provided the Committee with a quick overview of the strategy and explained that it holds a third of the portfolio in small-cap, mid-cap and large-cap stocks. Despite the fund’s current size of c.£4.5bn, the Committee feel that this is a well-run strategy with adequate liquidity.

DK proposed selling the JPM UK Dynamic fund and buying both the Liontrust Special Situations and Castlefield Buffettology funds at equal 4% weightings. The Committee supported this decision and DK will execute the switch as soon as a relevant account for the Castlefield Buffettology fund has been opened.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no other changes at this stage.

The Committee approved the strategy and confirmed it is in line with the mandate.

Explorer was c.1.7 percentage points ahead of the sector over 3 months and is up circa 10% year to date.

The underlying fund selection was strong, while asset allocation had a marginally negative effect due to the portfolio’s underweight to North America. Over one year, only one underlying holding was behind its respective sector, which confirms the strength of the underlying fund selection. Over 12 weeks, only 4 funds were behind their respective sectors.

In Asia, the Schroder Asian Income and Stewart Investors Asia Pacific Leaders lagged the IA Asia Pacific ex Japan sector. Both holdings have a defensive tilt and tend to lag on rising markets, hence the Committee raised no concerns at this stage.

TR commented on the weaker relative performance of the Jupiter European fund as it was c.5 percentage points behind the sector over 12 weeks. DK added that the fund manager is stepping down and the strategy will be transferred to a new manager later on in 2019. TR and KT raised concerns about the health of Jupiter as a business, while DK believes that the European strategy is likely to change significantly under new management.

The Committee agreed to replace the Jupiter European fund with another European holding. DK proposed buying the Baillie Gifford European or Hermes Europe ex UK fund. The Committee compared the performance and risk profile of the two strategies and concluded that the Hermes fund looked more attractive. TR proposed reducing the fund’s allocation to Europe by 2% and reinvesting the proceeds into the UK. The Committee agreed with TR’s proposal. Following these changes, the Jupiter European fund will be sold, Hermes Europe ex UK will be introduced at a 4% weighting, BlackRock European Dynamic reduced to 4% and 2% will be reinvested in Vanguard FTSE UK All Share Index.

The Committee are pleased with the overall performance of this strategy and proposed no other changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

The model portfolios were adjusted to reflect the changes to the Meridian and Explorer Funds.

Model D

Model E

Model F

Model G

No other business.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.