Tags: Explorer, investment, Investment committee, investors, Meridian, Prudence

Category:

Investment management

Minutes of the Clarion Investment Committee held on June 18, 2020, at 2pm by video link.

Committee Members in attendance: –

| Sam Petts (SP) | IC Chairman and Financial Planner |

| Keith Thompson (KWT) | Clarion Chairman |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) | Technical Assistant Clarion |

Apologies from Ron Walker, Founding Director, Clarion.

Minutes from the previous meeting held on 21st May 2020 were agreed by the Committee as a true and accurate record.

Please click here to access the June Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee:

‐ Global debt issuance is moving forward in leaps and bounds as demand for debt remains high.

‐ New Zealand was recently declared free of Covid‐19 but has reported two new infections, imported from the UK, which are believed to be isolated.

‐ Global cases continue to rise, although deaths appear to have peaked, causing some confusion over whether the global pandemic has peaked or not.

‐ Markets welcome the re‐opening of Western economies but remain nervous of further outbreaks or a second wave. Some US States have reported a resurgence of infections, leading to renewed anxiety.

‐ Several vaccines have reportedly moved to human trials with growing optimism that a successful vaccine may be available before the end of 2020.

‐ The UK economy contracted by a record breaking 20.4% during April, reflecting a full month of economic lock‐down. This marks the highest fall since records began in 1997, but it is likely to have recovered partly during May as economic restrictions were eased.

‐ Stock markets have remained volatile but generally buoyant during June, pushed on by stimulus and hopes of a ‘V’ or ‘U’ shaped recovery, despite concerns expressed by the Federal Reserve and the OECD (Organisation for Economic Co‐operation and Development).

‐ Brexit has begun to re‐emerge as the December 31st deadline looms. The British Government are adamant that no extension will be requested and the UK will exit the transition period without a deal if necessary. Both UK and EU leaders have recently talked positively about the prospects of reaching an agreement.

Historically, banks have been unkindly, but sometimes accurately, characterised as willing to lend you money you do not need. The same cannot be said for bond markets, which are presently willing to lend money which is desperately needed by governments and corporates to finance Covid‐19 costs at record low rates.

The Financial Times recently reported that US companies have issued nearly as much debt this year than during the whole of 2019 in order to build the cash required to navigate Covid‐19 risks. Companies have even moved beyond raising cash that is required imminently to opportunistically locking in long‐term cheap finance by taking advantage of current high liquidity. The Federal Reserve has also been boosting demand in the corporate bond market by making direct purchases. Amazon, for example, issued three‐year bonds with a coupon of 0.4%, whilst Boeing, plagued with Covid‐19 and previous 737 Max grounding issues raised $25 billion, including a 10‐year bond with a 5.15% yield, reportedly three times over‐subscribed.

As more debt has been issued, market commentators have been looking for signs that demand will be overwhelmed, but this has not occurred to date. Global stock markets have an approximate valuation of $89.5 trillion compared to $253 trillion for global debt markets, meaning debt markets are approximately three times the size of equity markets. The size of the market and minimal yields illustrate the staggering amount of money seeking low risk assets at present and how a change in sentiment could push demand into the much smaller global equity market.

The availability of low‐cost debt is a major advantage for businesses tackling Covid‐19 risks, but lenders seem to be taking most of the risk for little return. The availability of low‐cost debt is an important backstop for the global economy during these times of uncertainty, but we continue to be concerned for the long‐term prospects of assets yielding less than central bank inflation targets.

Whilst Covid‐19 infections are believed to have peaked in Europe and the US, global infections continue to rise. Daily infections seem to have peaked for the United States but continue to steadily rise in Brazil, India, Pakistan and other economies.

Whether the global economy is past the worst of the Covid‐19 peak is a point of debate. Global deaths appear to have peaked despite infections continuing to rise. Optimists suggest this is due to higher testing levels picking up more infections, where previously many were unrecorded. Other explanations suggest that the virus is becoming less virulent and treatments are more effective, whilst the worst case is that deaths will begin to rise as they lag the infection rate.

Reports from the UK suggest a break‐through in Covid‐19 treatment as a widely available steroid, dexamethasone, assists in the recovery of around 75% of infected patients. It has also been reported that a number of vaccines have moved to human trials with a range of positive commentary resulting. It is accepted that finding a successful vaccine is hit and miss. However, a high number of simultaneous trials significantly increases the chances of success.

The OECD has released figures showing the predicted impact of Covid‐19 on global GDP based on a single hit and a double‐hit scenario. This does not provide any real surprises as a single hit results in a ‘V’ or ‘U’ recovery whilst a double hit leads to a ‘W’ recovery. The best case is for a recovery to pre-pandemic global GDP by Q4 2021.

This underlines current market sensitivity to further outbreaks as the difference between the two scenarios is stark. Simply, the recovery will be much quicker and stronger if a second wave is avoided and, understandably, stock markets are currently very sensitive to data suggesting a break in either direction.

We believe the evidence points to a single hit scenario, although we accept that we are dealing with variables which are not completely understood. The experience of China, North Korea and others to successfully manage Covid‐19, falling death rates, improving treatments and the prospect for vaccines all suggest that further infections should not lead to secondary economic shutdowns.

The BBC recently reported that senior EU figures had suggested the prospect of the UK and EU agreeing a trade deal was “very good” and could be achieved in July. Boris Johnson also felt that a deal in July was possible and both sides should “get on and do it”. These reports suggest the mood is turning more positive and markets would welcome the end of Brexit uncertainty that has been hanging over UK equities and Sterling since the referendum on 23rd June 2016.

We believe that the relative risk of Brexit has reduced as other global risks have risen steeply in relation to Covid‐19. It is in the interests of both sides to reach a compromise arrangement, although European negotiations have a habit of being tense and concluding at the eleventh hour.

As noted in previous updates, the US equity market has outperformed other developed markets significantly over the past decade, partly due to higher earnings growth but also due to increasing valuation multiples. The US has been in a hurry to re‐open and may have moved too quickly as some states, such as Florida, have reported increasing Covid‐19 infections once more. This may force a more gradual approach and could lead the US economy to ultimately lag in the global recovery, with Asia already pulling ahead and Europe also emerging from lockdown.

In conclusion, we remain optimistic for equity valuations to continue to recover and we are nervous about the low yields offered by longer dated debt. Asia and European markets are attractively valued and may recover more quickly from Covid‐19 due to the success of their lockdowns. In this case, US equities could disappoint as they are already priced to perfection. A surprise breakthrough in Brexit negotiations is possible and would boost UK asset prices, particularly UK mid‐caps.

We believe the Clarion Portfolio funds and model portfolios are well positioned to benefit fully from a further rebound in markets when that occurs.

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

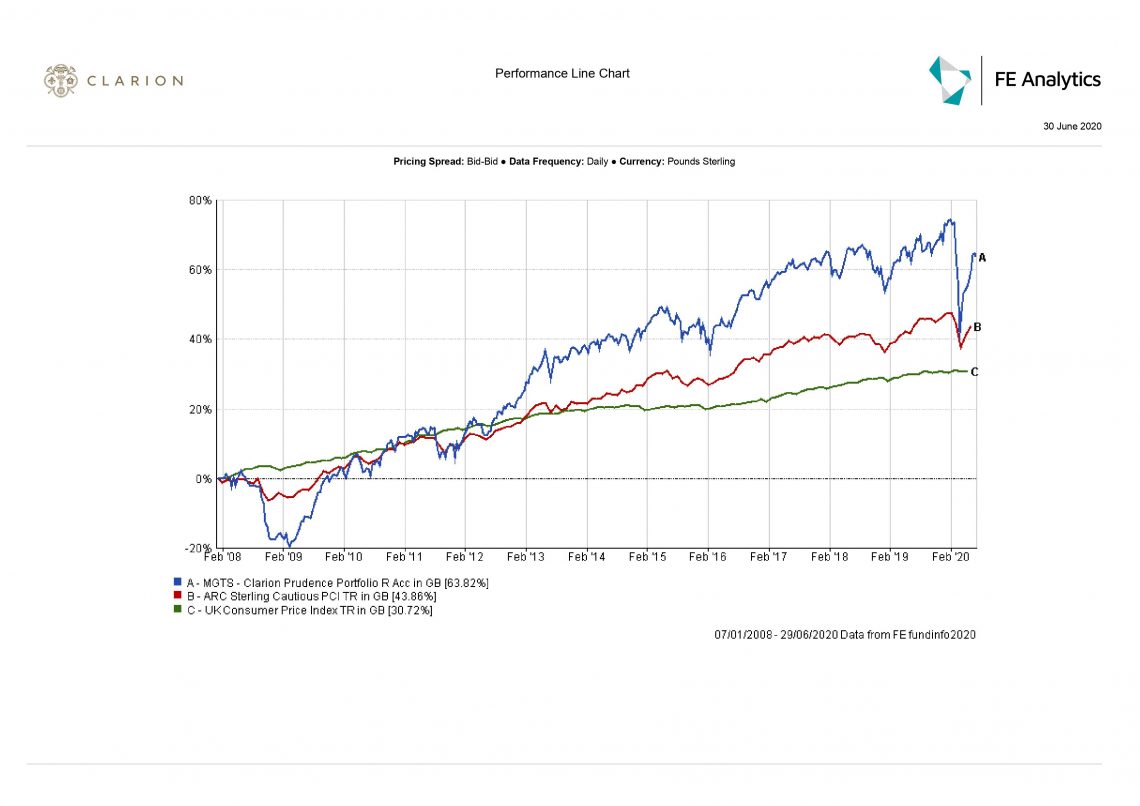

We remain confident in our overall fund selection process. The Clarion Portfolio funds are performing well relative to peers. Our weighting towards Asia has worked in our favour as Asian Markets have fallen less than Western Markets, with the exception of the US. We are pleased with the way in which the funds held up in the dramatic falls in March and also with the way they have recovered on the market bounce back. We are firmly focused on maximising the opportunities ahead.

The recent increase in exposure to Japanese mid cap companies has also benefited performance.

The majority of the underlying funds in Prudence, Meridian, and Explorer have outperformed their respective benchmarks over most time frames. All underlying holdings are highly liquid with no exposure to open ended property funds where redemptions have been blocked for some weeks causing problems for other fund of fund strategies

The fund performed in line with expectations over the quarter and also with the IA Mixed Investment 20-60% Shares sector and outperformed the strategic benchmark.

Bond holdings performed in line with expectations and the high yield bond fund outperformed slightly on credit spreads tightening.

The allocation effect from other areas of the portfolio was positive whilst the selection effect was neutral. The underlying fund selection has been very strong as most funds in the portfolio outperformed over most time periods with a positive contribution from the exposure to global funds and UK equity income funds. It was pleasing to note a recovery the Man GLG UK equity income fund and also the M&G Global Dividend Fund.

First State Asia underperformed slightly on the market bounce back but this was to be expected because of the defensive nature of the fund and it fell less than other funds in the sector in the market falls.

The only underlying EM holding and the only European holding both outperformed their respective sectors over 12 weeks.

Following on from the May meeting and recent interim meetings the committee debated the attractions of increasing the exposure to Japan with a slight reduction to the UK Equity income sector and cash. As previously highlighted, domestic companies in Japan are the most cash rich companies in the world with more than two thirds having net cash on their balance sheets compared to the US where less than 20% of companies have net cash. Japan is also one of the most attractive markets on valuation terms and the Yen often provides a safe haven in times of market falls.

With these points in mind it was decided to reduce the UK exposure by 1% and also cash by 1% to increase JPMorgan Japan by 2% to 5%. As previously discussed this fund has a mid-cap, domestic value bias and has been a first quartile performer over the last 5 years, 3 years and 12 months.

Overall this will bring the total equity exposure to 51% and the bond/cash holdings to 49%.

The Committee were happy with the performance of all the funds in the portfolio and proposed no other changes.

The Committee approved the strategy and confirmed it is in line with the mandate.

Meridian outperformed the sector and benchmark over 1, 2& 4 weeks and was in line over 12 weeks. The Committee were pleased with the selection of funds as most holdings outperformed their respective sectors over 12 weeks. The Meridian fund has benefited from a positive asset allocation effect although a slightly negative selection effect impinged overall performance by a small amount. Overall the cumulative effect was very positive.

Fund selection in Emerging Markets was mixed, with one holding outperforming and one underperforming over 12 weeks. Both Asian funds have demonstrated a strong performance profile year to date with lower than average falls in the market downturn in March although they have lagged slightly in the recovery due to their defensive qualities. Both global equity funds have been strong and outperformed the IA Global sector.

In the UK, the Buffettology fund has bounced back after the falls and is now the best performing UK holding over 12 weeks. It was also again particularly pleasing to note that the BlackRock UK Equity fund which was introduced to replace the Investec UK Special Situations fund had outperformed whereas the Investec fund had continued to underperform.

Following on from previous meetings the committee debated the attractions of increasing the exposure to Japan with a slight reduction to the UK Equity income sector and cash. As previously highlighted domestic companies in Japan are the most cash rich companies in the world with more than two thirds having net cash on their balance sheets compared to the US where less than 20% of companies have net cash. Japan is also one of the most attractive markets on valuation terms and the Yen often provides a safe haven in times of market falls.

With these points in mind it was decided to reduce the UK exposure by 1% and also cash by 1% and increase Baillie Gifford Japanese by 2% to 7%.

The Committee are pleased with the performance of the Meridian Fund and proposed no other changes to fund selection at this time and made no further comments.

The Committee approved the strategy and confirmed it is in line with the mandate.

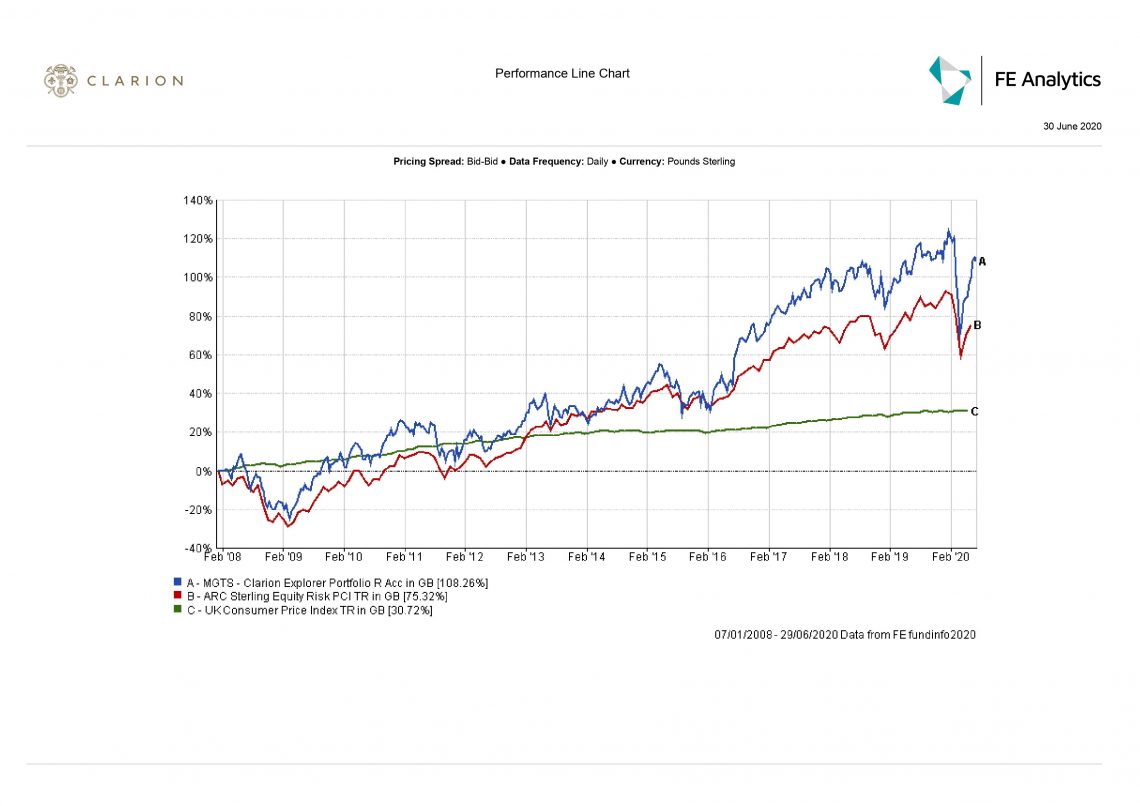

The fund was ahead of both the sector and strategic benchmark over 12 weeks and also outperformed over shorter time periods. Both the allocation and selection effects were very positive over three months. Fund selection was strong and all but 4 underlying holdings have outperformed their respective sectors.

The underweight allocation to the US and overweight allocation to the UK slightly detracted from returns.

All Emerging Markets, European and Global funds were ahead over 12 weeks. In the UK the mid-cap strategy has underperformed, while the large-cap fund outperformed.

KT again proposed looking into replacing exposure to the UK Equity Income sector with a Global Equity Income fund. TR feels this might be a good idea, but does not want to increase the allocation to the US. DK presented the Evenlode Global Income Fund as a possibility. This fund has demonstrated good performance but has a concentrated portfolio of 30-50 stocks which for a global fund is quite small and can lead to a higher degree of volatility. It was decided to give this possible switch further consideration and to discuss again at the next committee meeting.

The Committee debated increasing the exposure to Japan for the reasons outlined under Prudence & Meridian and it was decided to increase the two existing Japan funds by 1.5% each bringing the allocation to Japan to 8%. This will be funded by reducing cash by 1% and the Emerging Markets and the UK exposure by 1% each.

The Committee are pleased with the overall performance of the Explorer Fund and the underlying fund selection and the asset allocation and no further changes were proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

Appropriate adjustments were made to the model portfolios to reflect the changes to the Prudence, Meridian & Explorer Funds mentioned above.

The Clarion Portfolio funds and model portfolios are well positioned to benefit from a return to growth in the economy and remain slightly overweight equities. We remain in regular contact with our fund managers who are taking full advantage of the current situation to invest in solid growth companies with strong balance sheets at attractive valuations.

None of note.

Next Investment Committee Meeting is July 16 although in the interim period the Committee intend to conduct slightly shorter conference calls on a weekly basis.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.