Category: Financial Planning, Investment management

Minutes of the Clarion Investment Committee held at Overbank, 52 London Road, Alderley Edge, Cheshire, SK9 7DZ at 13:00 on 18th July 2019.

| Ron Walker (RW) | Director |

| Jonnie Whittle (JW) | Director |

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Sam Petts (SP) | Financial Planner (Clarion Wealth Planning) |

Minutes from the previous meeting held on 24th May 2019 were agreed by the Committee as a true and accurate record.

(Also see separate Market and Economic Commentary)

The Committee had a full and comprehensive discussion regarding the global economic environment. In summary the key elements of which were as follows:

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

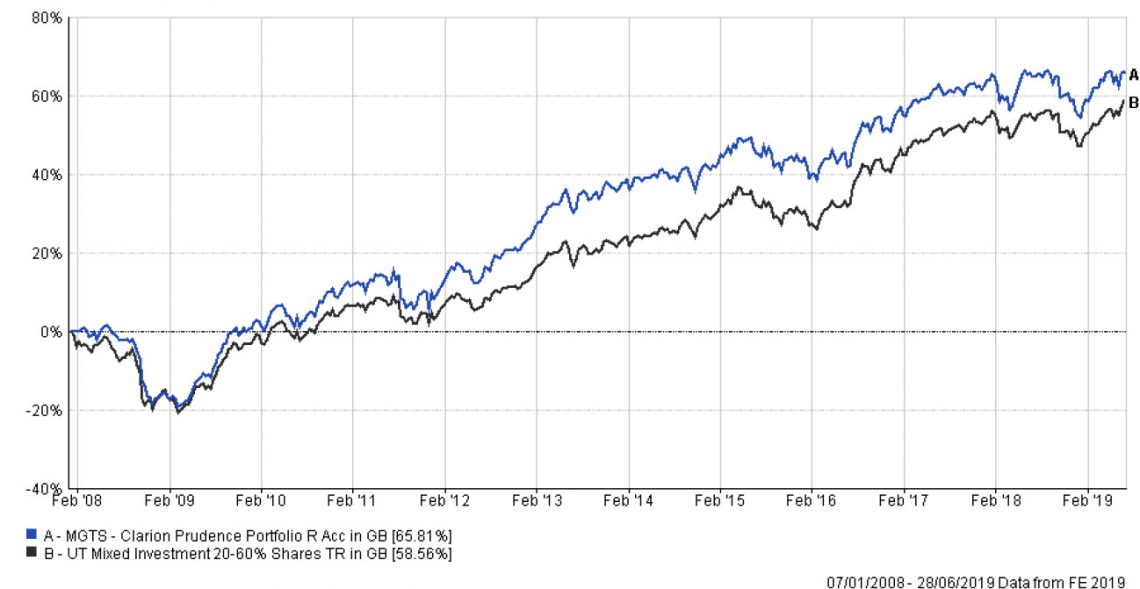

Over 3 months Prudence was c.1 percentage point ahead of the IA Mixed Investment 20-60% Shares sector. The fund has benefited from an active allocation to Global equity funds, while a selection of underlying bond funds detracted from returns.

The M&G Global Dividend strategy underperformed the IA Global sector over 12 weeks, following weaker oil prices in April and May. However, the Committee were pleased to note the outperformance of the recently added Fundsmith Equity fund.

Most underlying UK funds outperformed their respective sectors over 12 weeks. The Committee are pleased with improvements in the performance of the Threadneedle UK Equity Income fund. This strategy lagged the IA UK Equity Income sector at the beginning of the year but has delivered strong returns in recent months.

The Man GLG UK Income fund has underperformed the sector. This fund has a tilt to mid-cap stocks, which have struggled compared to large-cap following a recent increase in the risk of a no-deal Brexit and a subsequent depreciation of Sterling.

The Committee discussed the viability of adding an Infrastructure fund to the portfolio. DK presented a number of possible alternatives, including the Foresight fund. The Committee agreed that most infrastructure fund are not a suitable alternative to replace a bond fund in the portfolio due to their higher risk nature but might provide diversification to the equity funds. While the Foresight fund looks like a low risk alternative, DK believes that the fund’s low standard deviation is a function of the illiquidity of its underlying assets. The Committee agreed with DK and voted against inclusion of an Infrastructure fund in Prudence because of possible liquidity problems.

Considering the current widespread political and economic uncertainty, the Committee debated the possible attractions of having an exposure to Gold in the Clarion Funds and Model Portfolios. Gold is often considered a safe haven in times of uncertainty and financial stress. It can also act as inflation hedge and tends to performer well when the dollar is weak. Similarly, the Japanese Yen can also act as a safe haven in times of heightened economic and financial stress.

After much debate about the relative merits and disadvantages of a small exposure to gold either physical or via a suitable gold mining fund, or gold ETF, it was decided not to include any exposure at the present time largely because it was felt that current asset prices are already discounting the political and economic risks. Furthermore, gold prices have had a good run recently making the metal vulnerable to a set-back.

Overall, the Committee are happy with the performance of the Prudence fund and no changes have been proposed at the present time.

The Committee approved the strategy and confirmed it is in line with the mandate.

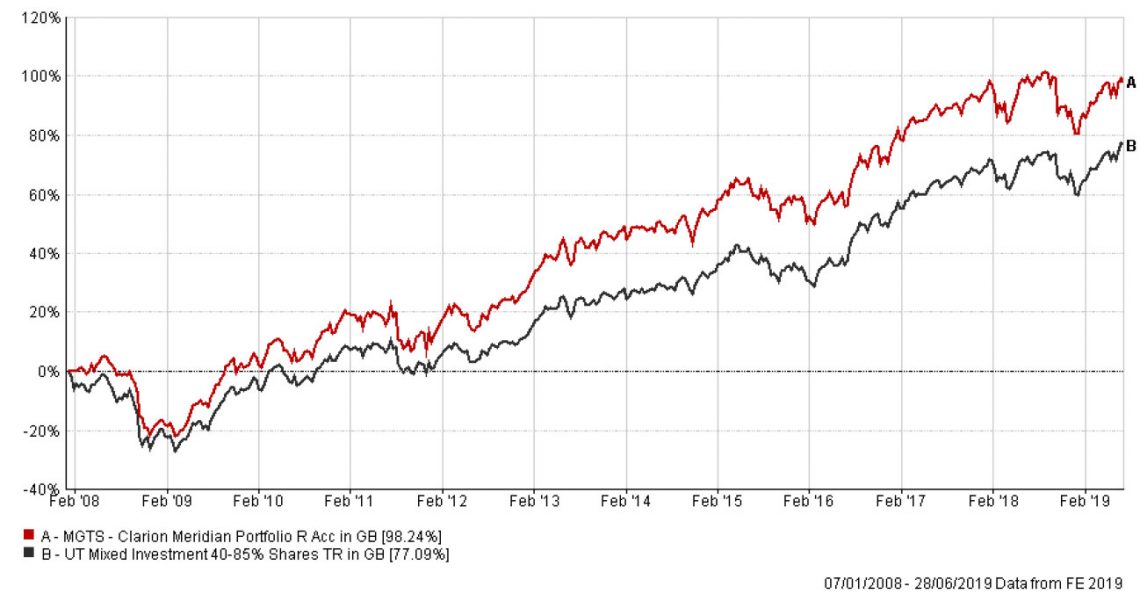

Meridian has marginally lagged the IA Mixed Investment 40-85% Shares sector by c.0.8 percentage points over 3 months. Most of this weaker performance occurred during the market falls in May and are mostly attributable to the portfolio’s underweight allocation to North America and Bonds. Active allocations and selections of Asian and Global equity funds had a positive effect on relative returns.

Similar to Providence, the choice of short-dated bond funds further detracted from returns as longer-duration bonds outperformed following a fall in bond yields.

Fund selection was strong in Asia, Europe and UK All Companies, where all active underlying funds have outperformed their relevant sectors over 12 weeks.

Selection in the UK Equity Income sector had mixed results, with the Rathbone Income fund outperforming while the SLI UK Equity Income Unconstrained fund underperformed the sector. The Committee have again reviewed the performance profile of the SLI fund and agreed to continue to hold this fund until the next wave of outperformance.

In the wake of the recent dealing suspension of the Woodford Income strategy, TR voiced concerns of a potential future illiquidity of the recently added Buffettology fund, which has attracted a significant amount of assets over the last 12 months. The fund currently has assets under management in excess of £1bn. DK agrees with TR and believes that the Committee should monitor flows in and out of this fund and also monitor the underlying holdings for signs of stress and illiquidity and potentially aim to sell out of it if the underlying AUM reaches £2bn-£4bn. The Committee agreed with TR and DK and will proceed accordingly although it was acknowledged that there were no immediate areas of concern and performance of the fund was excellent.

TR suggested considering potential alternatives as a replacement for the M&G Global Dividend fund. The Meridian portfolio does not have an income requirement and a different strategy could be more advantageous. The Committee will look at potential replacements and ideas will be discussed at the next IC meeting.

Overall the Committee are happy with the performance of the Clarion Meridian fund and no changes were made at this stage.

The Committee approved the strategy and confirmed it is in line with the mandate.

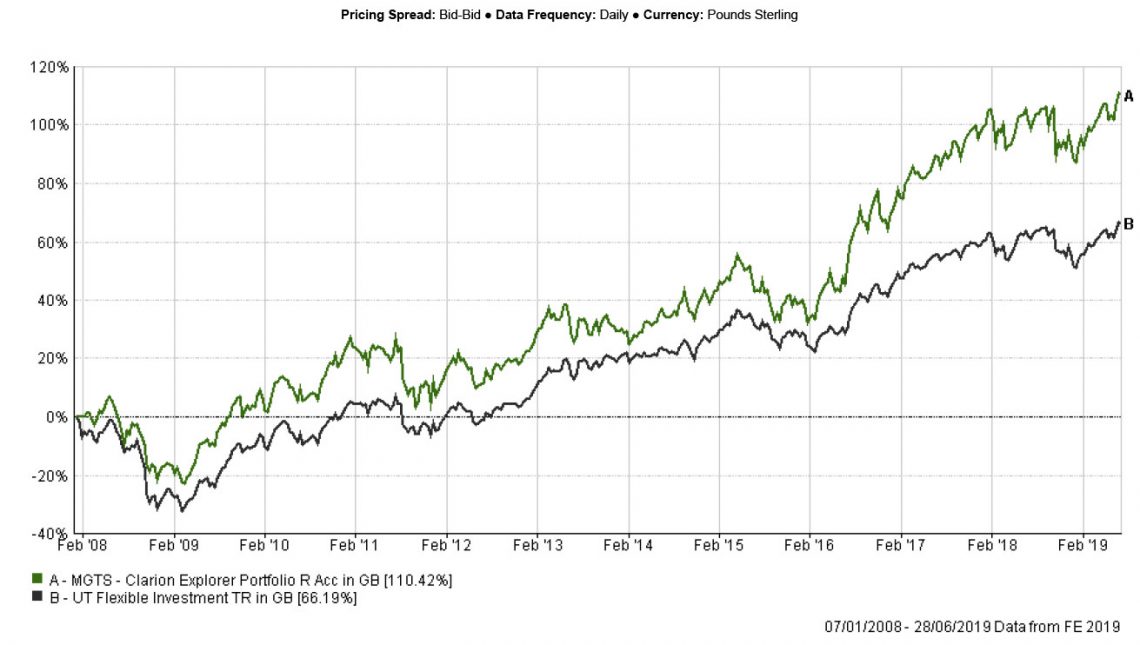

The performance of the Explorer fund remained strong and the fund was c.0.6 percentage points ahead of the IA Flexible Investment sector. While asset allocation detracted from returns, given the fund’s underweight to the US and bonds compared to the sector, the underlying fund selection was strong and compensated for the weaker allocation effect.

In Asia and Emerging Markets, only two underlying funds lagged their respective sectors over 12 weeks, with the remaining 7 funds outperforming. Both European holdings outperformed the IA Europe ex UK sector, with the BlackRock European Dynamic fund closing the period with a c.7% return in absolute terms.

The Lindsell Train Global Equity fund was the strongest performing underlying holding over 12 weeks with a c.10.4% return. Although positive in absolute terms, the M&G Global Dividend fund has underperformed the IA Global sector by c.3 percentage points over the period.

The Committee have commented on the weaker relative performance of both underlying Japanese funds. DK presented some replacements for the Schroder Tokyo strategy and suggested that the Baillie Gifford Japanese fund was the most appropriate. The Committee agreed with DK and decided to replace the Schroder Tokyo fund with the Baillie Gifford strategy.

KT asked whether the allocation to Japan should remain with an equal split between the currency hedged and unhedged share classes. TR believes that Japanese currency can move significantly either up or down relative to Sterling and that holding both a hedged and an unhedged strategy reduces the overall currency exposure. The Committee agreed with TR’s argument.

The Committee are pleased with the overall performance of this strategy and proposed no other changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model E

Model E

Model E

AOB

No other business.

Action Points

| Action to be taken by | Action Point | Review Point | |

| DK | To organise a project group with Clarion to work on risk profiler | Next IC | |

| DK | To proceed with changes agreed at IC | ASAP | |

| DK | To look at potential replacements for the M&G Global Dividend fund | Next IC | |

| DK | To create an annual review document | Next IC | |

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.