Category: Financial Planning, Investment management

As this was the first Investment Committee Meeting of 2018, the Committee felt it would be useful to review the major global developments of 2017.

Three key points stand out:

Brexit negotiations dominated politics in the United Kingdom and in December the European Council agreed to sign off “sufficient progress” opening the door for a transition period which would see the U.K. staying in the customs union and single market until 2021. This removes a degree of uncertainty but post transition arrangements look set to be more fractious with Parliament due to vote on the terms of withdrawal and the Cabinet divided over what the final Brexit “end game” should be.

Outside the UK, there were general elections in France, Germany, the Netherlands and an unofficial independence referendum in Catalonia. However, the greatest contribution to global uncertainty followed the inauguration of Donald Trump as President of the United States. The new President promised to shake up the Establishment and introduce a wave of economic and foreign policy reforms. Geopolitical risks were not helped by an escalation of tensions between the US and North Korea with President Trump threatening a retaliation of “fire and fury” if North Korea persisted in advancement of its nuclear programme.

Despite the high levels of political uncertainty global trade is set to grow by 3.4% in 2017 compared with an annual average of 2.5 % over the previous 5 years. Impressively this growth has been broad based with growth in most advanced economies accelerating. Despite the negative predictions of some economists, the UK economy also continues to hold up as final Brexit approaches.

One of the major policy milestones of 2017 was the Federal Reserve’s decision in September to begin scaling back its balance sheet, eight years after the introduction of quantitative easing. It came after the four major central banks of the developed world had collectively purchased around $10.6 trillion of assets since 2008 – equivalent to around 9% of global gross domestic product. The massive volume of central bank purchases since the financial crisis has helped to supress bond yields, boost equity prices and, in some cases, cause sharp exchange rate movements.

Tighter monetary policy and rising interest rate expectations have helped to push ten-year bond yields in the US up from around 2.0% in September to 2.4% today. But despite rising interest rates and elevated political uncertainty in 2017, equity markets made decent gains across the world. Overall, although politics threatened to destabilise financial markets in 2017, a healthy global economy enabled equity markets to have their strongest year since 2013 with cyclical sectors, especially information technology, being the standout performers while defensive sectors have fared the worst.

So, with 2017 ending with the global economy being in overall good health, the Clarion Investment Committee have a positive outlook for 2018 and feel that markets are generally likely to achieve positive returns. Nominal growth has been increasing and the Committee expect this to continue during 2018. Increasing nominal growth is positive for corporate earnings, company valuations and subsequently stock market growth.

At the same time the Committee feel the challenge for 2018 will be to avoid “bubbles” that have the potential to reverse during the year. As it is difficult to predict the timing of reversals the Committee favour value oriented strategies over growth. Growth strategies tend to be driven by more cyclical themes which can change quickly and significantly, whereas value strategies are more reliable and tend not to be driven by short term trends.

In conclusion the committee are very pleased with the performance of the Clarion portfolio funds and model portfolios throughout 2017 and are reasonably confident of a continuation of a favourable economic environment and positive financial markets at least for the first half of 2018.The investment strategy is likely to remain broadly similar to 2017 for the foreseeable future, namely a preference for quality equities over cash and bonds with a preference for value style investments. Bond exposure will be through short dated bonds which are less sensitive to interest rate rises.

The Committee reviewed risk management, eligibility and investment & borrowing reports and confirmed that these were in order and no action was required.

The relative Value at Risk ratio (VAR) for the Prudence portfolio has increased over one month and is now above the upper threshold of 120. It was noted that the ratio is likely to have increased due to the portfolio’s active allocation to Global funds, which are not represented in the benchmark used to calculate the relative VAR ratio. The performance of Global funds has been affected by the recent increase in currency volatility, which is likely to have had a temporary effect on the portfolio’s VAR ratio. The Committee agreed that the Prudence portfolio is managed in line with its mandate and no actions will be taken at this stage. The relative VAR ratio will be monitored closely going forward, and if it continues to be above the 120 level, the Committee will look to determine whether the fund is indeed taking too much risk.

The relative VAR ratio for Meridian came down and is now in line with the benchmark. The ratio for Explorer was slightly below the benchmark.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns at this stage.

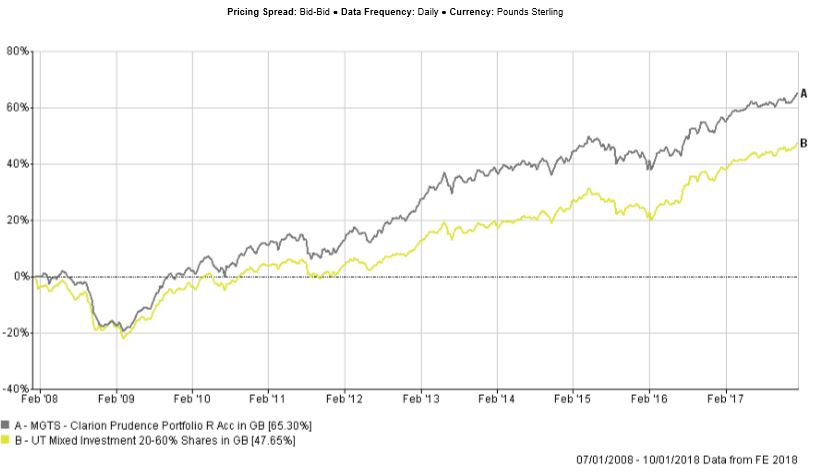

Over 12 weeks the fund performed in line with the sector and lagged the strategic benchmark by c.1%. The active allocation to Global funds detracted from the fund’s relative returns. The benchmark allocates c.50% to the FTSE 350 index, while the fund allocated c.35% to the UK and c.21% to Global equities. Global equity funds performed more weakly compared to UK equity funds over 3 months, which is likely to be due to the recent appreciation of Sterling.

Long term performance of the portfolio continues to be ahead of both the sector average and the benchmark.

The fund’s active allocation to short duration corporate bond strategies also detracted from the relative performance, given that longer duration government and corporate bonds outperformed over the quarter. The Committee believe that the stronger recent performance of longer term sovereign bonds is likely to be short lived and that the UK and US government bond markets have entered a downward cycle. Short dated bonds are likely to be less affected by this trend.

The Committee also looked at the longer-term performance of the Prudence fund, which lagged the sector over 12 months but it was noted that this was due to the fund taking less risk compared to the sector.

In equities, the fund holds a c.35% exposure to the UK and a c.21% exposure to global funds which naturally have a tilt towards the US. Over 12 months, both Global and UK funds produced similar returns of c.12%. The IA Mixed Investment 20-60% Shares sector has exposure to a wider number of regions, and includes a c.10% combined allocation to Asia, Emerging Markets and Japan, which returned c.25% – 30%. This helped to detract from the fund’s relative returns.

In bonds, the Prudence portfolio favours funds with a tilt towards investment grade bonds (rated BBB and above). Compared to the sector, the fund is under-weight to high yield bonds (rated below BBB) and unrated issues. The fund currently only has a c.3% exposure to these types of bonds, while an average fund in the sector has a c.14% exposure. Over 12 months, high yield bonds on average outperformed investment-grade corporate bonds by c.1%, which further detracted from the fund’s relative performance.

It is the Committee’s opinion that the Prudence fund represents investors with a cautious attitude to risk, while the average fund in the IA Mixed Investment 20-60% Shares sector has been taking more risk. The Committee believes that the returns and risk profiles of some other funds in the sector do not match the requirements of a cautious investment, given that cautious investors are typically more sensitive to losses rather than excess gains.

It was also noted that the fund’s standard deviation was higher compared to the sector but equally it was also noted that other funds in the sector would often include relatively less liquid high yield bond funds and property funds in their portfolios. These can reduce standard deviation during normal market conditions, while the underlying credit and liquidity risks may not be visible until these assets face some significant outflows.

The Committee discussed the potential for taking on slightly more risk in Prudence and it was proposed reinvesting 3% from cash to equities and bonds which would bring the fund’s cash position in line with the long term strategic allocation (c.10%). It was agreed that it would be best to split 3% equally between bonds and equities.

The Committee debated adding the Vanguard FTSE U.K. Equity Income Index fund to the portfolio. Adding this fund would slightly reduce the expense charge of the overall portfolio and increase its exposure to commodities and financials. It was however noted that it is likely to take up to 3 weeks to open an account for the Prudence fund with Vanguard, therefore it is unlikely that this fund can be purchased before the next Clarion IC meeting. The Committee decided to reinvest 1.5% from cash to short duration bonds at this stage and instruct BNY to open the Vanguard account and the reinvestment of a further 1.5% will be discussed at the next meeting.

Whilst the short term underperformance of the fund was duly noted the Committee have no other concerns about the performance of this strategy particularly as the fund is taking less risk than the sector average and benchmark. No other changes have been proposed at this time.

The committee approved the strategy and confirmed it is in line with the mandate.

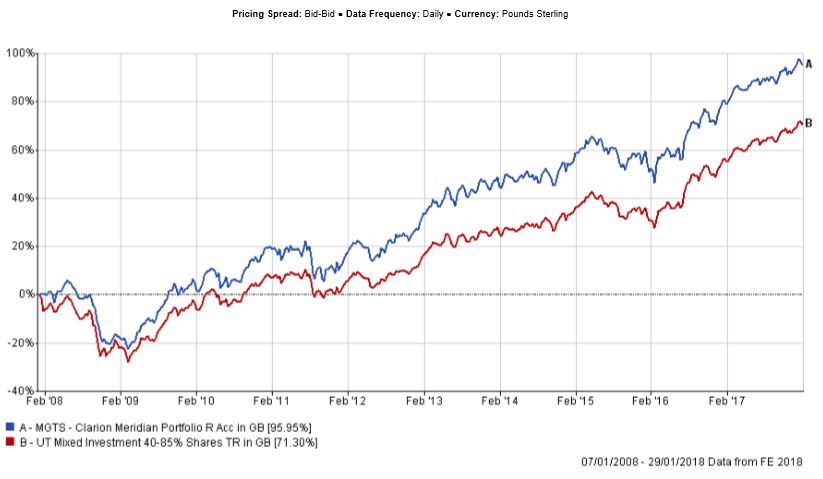

The fund performed more strongly compared to the sector and marginally lagged the benchmark over 3 months. Long term performance continues to be ahead of both the sector and the benchmark. It was noted that the fund price has almost doubled since launch 10 years ago. This represents an average annual return net of charges of more than 7% per annum at a time when interest rates have averaged less than 1% per annum.

In bonds, the fund has benefited from holding the Kames Investment Grade Bond fund, which is a more traditional, longer duration corporate bond strategy. Over the period the Kames fund has benefited from tighter credit spreads and lower yields. The Kames fund has outperformed shorter duration strategies by c.1%.

In equities, the Committee are pleased with the performance of the two Asia Pacific funds and the way these holdings complement each other in investment styles and strategies. The strong performance of the First State Asia Focus strategy during the recent falls in Chinese equities was also noted and applauded.

The Committee discussed the improving performance of the Majedie UK Equity fund, which performed better over the shorter term. The Committee decided to keep the fund in the portfolio and review its performance at the next IC meeting.

SVM UK Growth continued to perform strongly. The Committee are satisfied with the earlier decision to keep this fund, which has contributed strongly to the fund’s performance over 12 months and is now the third best performing holding in the portfolio.

The performance of the Rathbone Income fund has been slightly disappointing. It is now one of the weakest underlying funds in the Meridian portfolio. A meeting has been arranged with the fund manager (Carl Stick) at the end of January and this will be discussed at the next Investment Committee meeting.

Overall the Committee are happy with the performance of the fund and no changes have been proposed at this stage.

The committee approved the strategy and confirmed it is in line with the mandate.

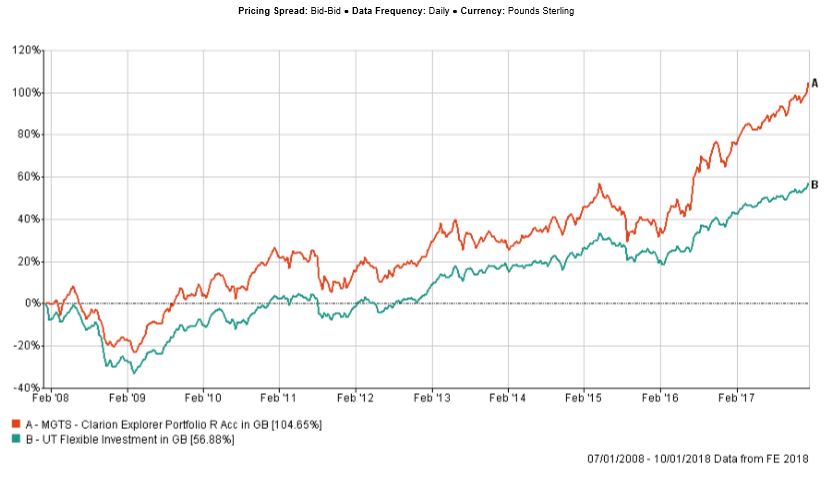

The fund outperformed the sector over 12 weeks and its performance in line with the benchmark. Long term performance is very strong and continues to be ahead of both the sector average and the benchmark. It was noted that the fund price has more than doubled since launch 10 years ago. This represents an average annual return net of charges of more than 7% per annum at a time when interest rates have averaged less than 1% per annum.

The fund continues to be overweight to Asia and Emerging Markets relative to the sector. Both areas performed strongly over 3 months, and were the main driver behind the fund’s positive relative returns.

The Committee commented on the strong performance of both European funds, and were especially pleased with the strong returns provided by the Jupiter European strategy. The Committee reviewed the performance and risk profile of the Jupiter fund on a number of occasions and decided to keep this fund in this portfolio. While the Jupiter strategy faced a period of weaker returns during the 4th quarter of 2016, it has recovered strongly and was one of the best performing European funds in 2017.

The Committee looked at the underlying Asia and Emerging Markets funds and concluded that there was a good split of styles present in these regions. It was pleasing to note that the decision to retain the Stewart Investors Asia Pacific Leaders and the Henderson Emerging Markets Opportunities strategies in the portfolio, which performed defensively during the recent dip in the Chinese equity market, had contributed to the good performance of Explorer.

In Japan, the equal split between hedged and unhedged strategies continues to work well. While the Lindsell Train Japanese Hedged strategy was one of the strongest underlying holdings over 12 months, the Schroder Tokyo Unhedged fund had performed better over more recent periods.

Overall the Committee are pleased with the portfolio’s performance, particularly the achiement of a 100% increase in the unit price since inception and no changes were proposed.

The committee approved the strategy and confirmed it is in line with the mandate.

The Committee reviewed the performance of the Clarion models and agreed that they perform in line with the Committees’ expectations.

The following deals have been agreed to bring the models in line with the new underlying fund selection in the Clarion range of funds.

No other business.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.