Category: Investment management

There is a sense of a continuation of the goldilocks scenario as investors look forward to 2018. Growth momentum that has built over the course of 2017 is expected to continue across most economies, providing a supportive backdrop for risk assets. Indeed, while growth remains below that seen before the financial crisis of 2007/8, the persistence and breadth suggests that the upward momentum may at last be self-sustaining. Despite this upbeat backdrop, the Committee do not expect any materiel acceleration in inflation in 2018, even in those economies most advanced in their cycles. This combination of solid growth and relatively subdued inflation provides scope for most central banks to stage a slow exit from accommodative policy settings. Although political risks remain, the committee feel these are weighing more heavily on longer-term growth prospects rather than presenting near term risks to a continuing benign environment for risk assets.

The Committee feel that this favourable economic and market outlook rests on a number of key assumptions. Most importantly that worldwide growth continues on a steady path and that the world is starting to enter a more virtuous stage of the economic cycle, with businesses more prepared take the plunge on investment and households easing back on their precautionary savings. The current slowdown in China poses a threat to the favourable scenario but the Committee do not expect this to lead to a hard landing for the Chinese economy. The Committee also note that the monetary tightening in the US could also pose a risk to growth but feel that economies and markets are now strong enough to absorb this policy tightening without incident.

The Committee remain nervous that asset prices are elevated and valuations, particularly growth stocks, are full, but if the world continues to grow at a steady pace there is no reason why corporate profitability should not grind upwards with a corresponding increase in equity prices.

In conclusion the Committee feel that 2018 could be a replay of 2017 in terms of modest growth, continued maintenance of valuation multiples and high single digit returns from equities. The Committee do not feel that any changes to the current strategy, which currently favours equities over bonds and cash, are necessary. Within the equity allocation, value stocks are favoured over growth stocks whilst for the fixed income allocation, short duration bonds are favoured to reduce the overall sensitivity to interest rate rises.

The Committee reviewed risk management, eligibility and investment & borrowing reports and confirmed that these were in order and no action was required.

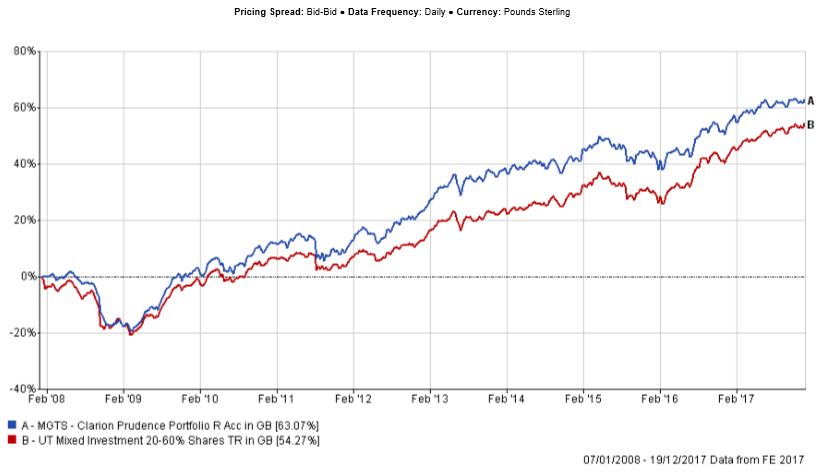

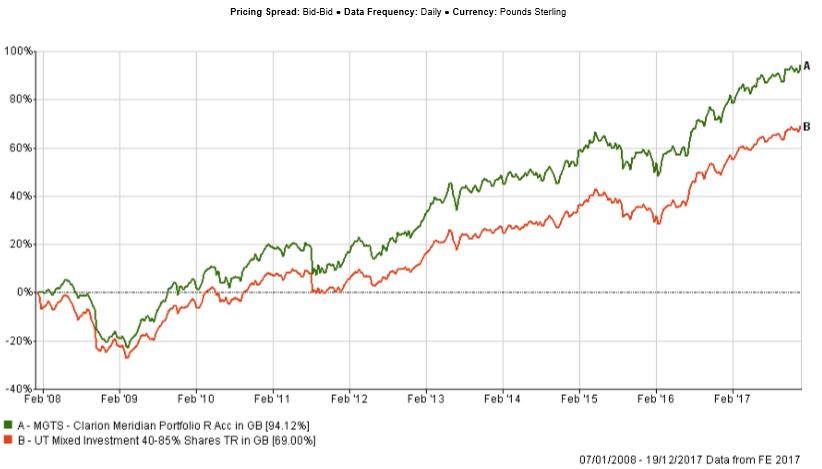

Relative Value at Risk ratios for the Clarion Prudence and Clarion Meridian portfolios have increased over 4 weeks and exceeded the 100 level, however they remained below the upper threshold of 120. This could mean that the Clarion Prudence and Clarion Meridian portfolios currently take slightly more risk compared to their strategic benchmarks. The Committee agreed this is likely to be due to the recent increase in the equity allocation in both portfolios. The Committee agreed that the risk levels of all portfolios were in line with expectations and had no concerns.

The fund has outperformed the sector and the benchmark over 3 months and benefited from the active allocation to Global funds which produced positive 12 week returns, while UK equities have declined by an average of c. 1%. The active allocation to short–dated bond funds further strengthened the portfolio’s returns, as most underlying bond funds outperformed their respective sectors and generally performed better than their longer dated peers.

Performance since inception of the fund remains strong and is ahead of both the sector average and the technical benchmark.

The Committee noted that due to the current flatness of the yield curve, yields on short dated bond funds are currently similar to yields on longer dated bond funds. It is the Committee’s opinion that short duration bond funds are likely to provide stronger risk adjusted returns during the period of rising interest rates. The Committee remain positive on holding short duration bond strategies.

The M&G Global Dividend fund recovered some of its previous underperformance following a strong 4 weeks’ performance. This fund was purchased to replace the Fundsmith Equity strategy as a more Value tilted alternative. The M&G fund has outperformed Fundsmith over 6 and 3 months as well as over 4 weeks. The Committee are comfortable with this holding and expect it to continue to perform strongly.

The Committee noted the recent underperformance of the Threadneedle UK Equity Income fund. This fund has has been a good long-term performer and the recent weaker performance was relatively marginal. The fund’s current positioning is more defensive compared to the sector with a higher allocation to Utilities, Healthcare and Industrials, which were generally out of favour, but which operate with strong margins and low leverage. The fund has little exposure to Commodities and Financials, which has detracted from relative returns over 12 months. The Committee feel that the fund’s performance profile could deteriorate further and believe that the investment process needs a more detailed review. The Fund Analyst will review the fund’s investment process and present the findings at the next IC meeting.

The Committee discussed the possible sale of the SLI European Equity Income fund. The Committee feel that political risks are rising in Europe and given the strong recent performance of the European equity market, it could be a logical point to capitalise profits and reinvest the proceeds more globally. The Committee therefore decided to reinvest all the proceeds into Global equity funds, increasing the overall allocation to these funds from 17% to 21%. Weightings in all three global funds will be increased to c. 7%.

The Committee debated replacing the Smith and Williamson Short-Dated Corporate Bond fund with the L&G Short-Dated Sterling Corporate Bond Index strategy. The Smith and Williamson strategy has an uncompetitive charging structure, while the L&G Index fund is cheaper and has a similar performance profile and risk characteristics. The Committee have voted unanimously in support of the switch.

The Committee are pleased with the performance of the Clarion Prudence Fund and no other changes have been proposed at this time.

The committee approved the strategy and confirmed it is in line with the mandate.

The fund has outperformed the sector and benchmark over 12 weeks, with the two US funds and a global strategy being the main contributors to returns, followed by the First State Asia Focus fund. The portfolio has also benefited from the strong performance of the underlying bond funds and the performance of the M&G Optimal Income fund in particular.

Performance since inception of the fund remains strong and is ahead of both the sector average and the technical benchmark.

The Committee are generally happy with the performance of the majority of the underlying holdings given that the majority of them have outperformed their respective sectors over 3 months.

The Committee discussed the weaker two-week performance of the SVM UK Growth fund, however raised no concerns given that this strategy was the strongest underlying UK holding over 12 months. In 2016 this fund went through a period of underperformance and recovered strongly in 2017. The Committee hold a long term view that this strategy is likely to continue delivering strong returns and that the mid-cap nature of the fund blends in well with the other two underlying UK holdings.

The slightly weaker performance of the Majedie UK Equity fund was noted but over the long term the Majedie team are good stock pickers and can sometimes enter some specific themes ahead of the sector rotation. It was noted that according to the fund’s attribution analysis, the allocations to UK retailers, which have previously underperformed, had been increased. The Majedie team hold a view that the margins of the UK retailers have improved and are likely to benefit from gently rising inflation and wages. The Committee agreed to continue holding this fund; however, it will be reviewed at the next IC meeting.

The Committee expressed concern that the recent merger of Henderson and Janus could create tensions within the company and have a negative effect on the day to day management of Henderson funds. It was noted that three investment professionals from the Henderson European Equities team, had recently departed and this could be indicative of potential instability within the team. The Committee agreed to sell the fund and after looking at a number of options, decided to replace it with the F&C UK Growth and Income strategy. The F&C fund has been a steady long term performer and is likely to blend in well with the IP European Equity Income fund already included in the portfolio.

The committee debated the US tracker funds and it was noted that the Royal London US Tracker fund had a slightly higher charging structure than other funds in the sector. The Committee looked at a number of options and decided to buy the Fidelity US Index fund. The Fidelity fund has performed stronger than the Royal London strategy and has a more attractive cost structure.

Overall the Committee are happy with the performance of the Clarion Meridian fund and no other changes have been proposed at this stage.

The committee approved the strategy and confirmed it is in line with the mandate.

The fund has performed in line with the sector average but has marginally lagged the strategic benchmark over 6 months. The fund’s performance was strong in October and the first half of November, however its returns became weaker from the 3rd week of November to date.

The long term performance of the fund since inception remains strong and is ahead of both the sector average and the strategic benchmark.

The overweight allocation to Asia and Emerging Markets relative to the sector and benchmark was the main driver of relative returns. While Asia and Emerging Markets performed strongly over 12 months, the recent correction in these markets had a negative effect on the fund’s relative performance.

The Committee are pleased about the stronger relative performance of the Stewart Investors Asia Pacific Leaders and Henderson Emerging Markets Opportunities strategies. Both funds have underperformed their respective sectors during the recent period of strong trending markets in the Asia and Emerging Markets regions, however their more defensive positioning has benefited them during the recent market falls, when both funds fell less compared to the market.

Overall the Explorer portfolio has a tilt towards more ‘Value’ biased strategies, which often lag ‘Growth’ during strong market trends, and tend to outperform during negative and/or more volatile markets.

It was noted that the Aberdeen Asia Pacific Equity strategy is one of the portfolio’s weaker underlying holdings. The Committee discussed replacing it with a more aggressive strategy, such as the Veritas Asian Fund but decided not to proceed with the change at this stage. It was noted the Veritas fund has a significant exposure to the Chinese tech sector, which has benefited the funds long term performance but which has detracted from its relative returns over 4 weeks. The Committee agreed to come back to this discussion at the next IC meeting.

The Committee are happy with the performance of both Japanese strategies. Both funds have outperformed the IA Japan sector over 1 month and it is the opinion of the Committee that splitting the overall allocation between a hedged and unhedged strategy provides a balanced approach to the Japanese exposure.

Overall the Committee are pleased with performance of the Clarion Explorer fund and no changes were proposed.

The committee approved the strategy and confirmed it is in line with the mandate.

The Committee reviewed performance of Clarion models and agreed that they perform in line with the Committees’ expectations.

The following changes have been agreed to bring the models in line with the new underlying fund selection in the Clarion range of funds.

The Analyst provided a review of the GAM Star Credit Opportunities fund. The key points are noted below.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.