Category: Business, Financial Planning

The Committee reviewed risk management, eligibility and investment & borrowing reports and confirmed that these were in order and no action was required.

The relative VAR ratio for Prudence remained above the higher threshold of 120. This was due to StatPro’s choice of proxies used for some of the fund’s underlying holdings, which do not match the risk and return characteristics correctly. While Margetts are working with StatPro to resolve this issue, a solution has not yet been found.

The Committee compared the performance and risk statistics of the fund to its technical benchmark, which is used by StatPro. This data suggests that the fund is currently taking less risk compared to the benchmark; therefore, the Committee have concluded that the fund’s risk profile is in line with expectations, and that the recent spike in the relative VaR ratio was due to technical factors.

Relative VaR ratios for Meridian and Explorer were in line with expectations and the Committee made no further comments.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns at this stage.

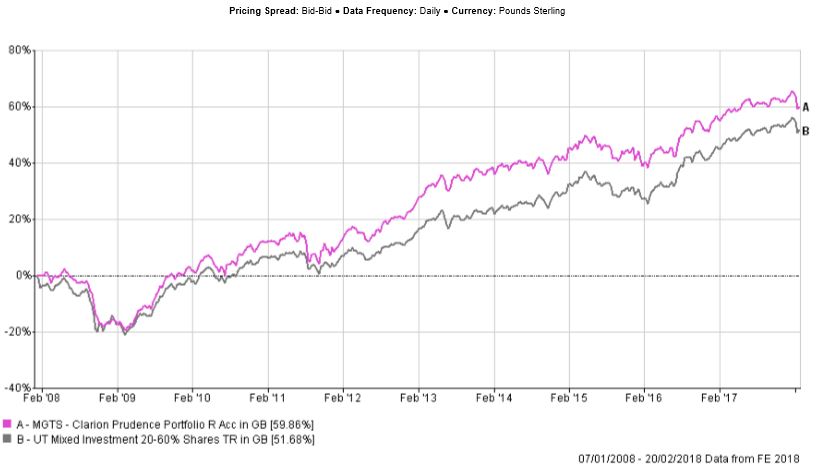

The Committee are pleased with the improvements in the fund’s performance as it has outperformed the sector and benchmark over 3 months. Performance since inception is ahead of both the sector and benchmark.

The fund’s allocation to short duration bonds was the major contributor to returns over the period. Yields on 10 year UK Gilts increased from c.1.3% to c.1.5% in January, which caused longer dated bonds to depreciate more significantly than bonds with a shorter duration.

An active allocation to global equity funds was another contributor to returns relative to the technical benchmark. All of the underlying global Equity funds have a tilt towards the US, which has outperformed the UK over the quarter.

Within its allocation to the UK Equity Income sector, the fund has a high exposure to funds with value and quality biases, which tend to perform more strongly during negative markets. 4 out of 6 underlying UK funds outperformed the IA UK Equity Income sector during the recent market falls, which was in line with the expectations of the Committee.

The Committee discussed the relatively weaker 3 and 12 months’ performance of the Threadneedle UK Equity Income fund. This period of underperformance can be attributed to the manager’s allocation decisions and the fact that this fund holds little exposure to the Technology, Energy and Basic Materials sectors, which returned c.20% over 6 months. Compared to the sector, the fund holds an overweight allocation to Industrials, which have been relatively flat over the period. The fund’s more recent performance has improved slightly and the Committee decided to retain the fund at this stage and review further at the next IC meeting.

The Committee debated the possibility of selling the M&G UK Inflation Linked Corporate Bond fund and redistributing the proceeds among the existing short duration bond holdings or buying an additional short duration fund. It was noted that the performance of the M&G fund has a negative correlation with credit spreads and tends to outperform when spreads are tightening and underperform when spreads are becoming wider. While the fund performed strongly in 2017, it is the Committee’s opinion that most of this stronger performance was due to the tightening in credit spreads. Given that credit spreads are currently close to their historic lows; it was felt that the potential downside of this strategy outweighs the potential upside.

It was proposed selling out of this holding completely and adding an additional short duration bond fund. A counter proposal was to redistribute the proceeds among the underlying short duration bond funds, with a bias towards the two cheapest index tracking bond strategies; Vanguard Short Duration Investment Grade Bond Index and L&G Short Dated Corporate Bond Index. The Committee agreed to redistribute the proceeds among the existing holdings, due to the cost reduction benefits.

The Committee were of the opinion that the recent market falls provide a good opportunity to increase the portfolio’s exposure to equities. The Committee agreed to increase the UK Equity Income sector by 1% and decided to buy an additional UK holding and chose the Vanguard FTSE UK Equity Income Index fund due to its natural ‘value’ bias. Subsequently, the fund’s allocation to cash will be reduced by 1%.

Overall the Committee are pleased with the performance of this strategy and no other changes have been proposed at this time.

The committee approved the strategy and confirmed it is in line with the mandate.

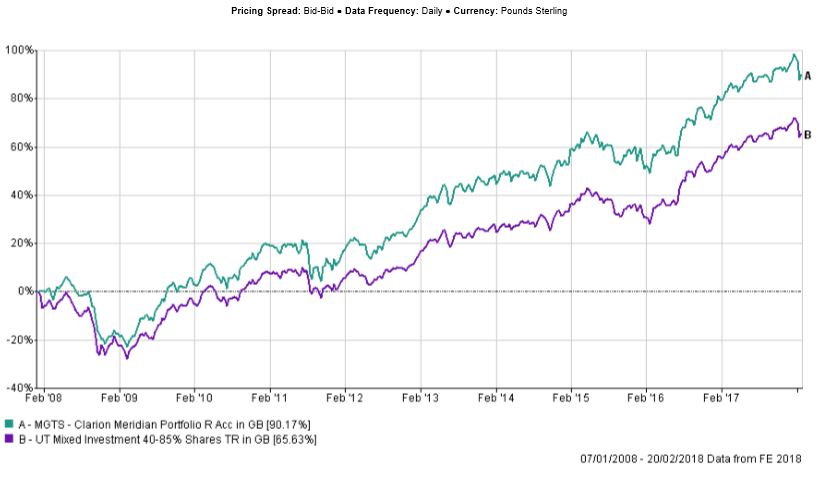

The fund’s performance continued to improve and has now outperformed the sector and benchmark over 3 months. Similar to Prudence, the fund’s more defensive bond allocation contributed to returns, following a sharp rise in bond yields.

The Fund has outperformed both the sector average and the benchmark since inception.

In equities, while the underlying holdings produced mixed absolute returns, most funds have outperformed their respective sectors. The M&G Global Dividend strategy was the strongest performer in absolute terms.

The Committee were pleased to see the First State Asia Focus strategy outperform the IA Asia Pacific ex Japan sector over 3 months as well as over shorter time frames. The fund’s outperformance of the sector during falling markets highlights its defensive qualities, which is in line with the Committee’s expectations.

The Committee debated replacing the Fidelity Institutional Asia fund with the BlackRock Asia strategy. It was noted that while both funds have relatively similar longer-term performance profiles, the BlackRock strategy is significantly cheaper compared to Fidelity.

The strong performance of the newly acquired F&C European Growth and Income fund has been noted. The Committee were pleased with the decision to replace the Henderson European fund with F&C.

In the UK, the Rathbone Income fund’s performance has improved, confirming the fund manager’s earlier comments about the more defensive positioning of this strategy. While the Committee acknowledge the recent improvement, performance of this fund will continue to be monitored.

The Majedie UK Equity fund was the Committee’s only concern at this stage. This strategy has been underperforming the IA sector for some time and produced near zero returns over 12 months. It was argued that there may be some merit in keeping the Majedie fund in the portfolio alongside the SVM UK Growth strategy, as the two have opposite ‘value’ vs ‘growth’ biases. The Committee looked at the fund in more detail and decided to replace it but due to the higher than usual volatility in equities, the fund will not be replaced until the next IC meeting.

The Committee are happy with performance profiles of all other underlying holdings as well as the performance of the Meridian fund and no other changes have been proposed at this stage.

The committee approved the strategy and confirmed it is in line with the mandate.

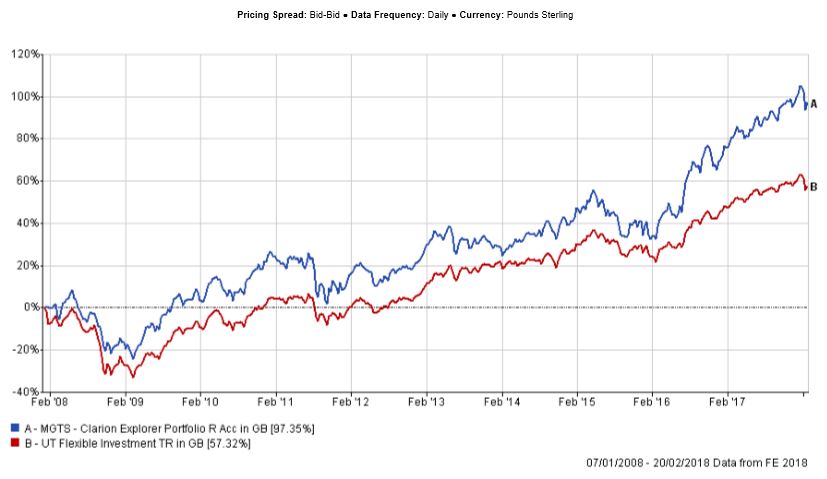

Over 12 weeks the fund outperformed the sector and benchmark by c.1.5% and c.2% respectively. While some of the more volatile funds in Asia, Emerging Markets and Europe partly gave away some of their earlier stronger performance, the ‘value’ biased holdings performed better during the recent markets falls.

Performance of the fund since inception continues to be strong and is ahead of both the sector average and the benchmark.

The Committee were pleased to see improvements in the performance of the Henderson Emerging Markets Opportunities and Stewart Investors Asia Pacific Leaders funds. Due to their more defensive investment strategies, both funds lagged the sector over 12 months, as performance of the latter was driven primarily by strong rises in valuations of more cyclical stocks but relative performance has been strong in recent market falls.

The sterling hedged Lindsell Train Japanese Equity fund continued to perform more strongly compared to the sector and has benefited from the recent appreciation of the pound. The unhedged Schroder Tokyo fund also outperformed the IA Japan sector over the period. The Schroder Tokyo strategy has a ‘value’ bias as well as a typical overweight to small and mid-cap equities compared to the sector. This strategy often lags the sector on strong upside moves, but tends to outperform during negative periods.

The Committee have noted the recent weaker performance of the Jupiter European strategy and had a look at its underlying portfolio and performance profile in more detail. This is a concentrated and ‘growth’ orientated fund. The Jupiter fund is a cyclical strategy and while it often outperforms the market during market rises, it is expected to fall harder when markets turn. While the Committee review this holding on a regular basis, this fund continues to be favoured due to its aggressive and active positioning.

The Committee are currently happy with the performance of all underlying holdings as well as the performance of the overall portfolio, and no changes were proposed at this stage.

The committee approved the strategy and confirmed it is in line with the mandate.

While the Committee decided to increase the allocation to equities in the Clarion Prudence strategy and add the Vanguard FTSE UK Equity Index fund to the portfolio, this decision has not yet been reflected in the Clarion models. In Prudence the Vanguard fund has been initially introduced at a 1% weighting, which will be increased to a full position once the volatility in equity markets has normalised. To avoid excessive dealing, the fund will be introduced in the models at a later stage with the full weighting.

In the meantime, the following changes were approved to reflect the changes to the Portfolio Funds.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.