Category: Investment management

The Clarion Investment Committee (IC) met on 8 November 2017 to review the performance and composition of the Clarion Portfolio Funds. A summary of the Committee’s deliberations is detailed below.

The IC discussed an overview of the global economy and agreed that the key points set out in the minutes of the last IC meeting on 4 October remain unchanged.

The past few months have seen a continuation of positive returns for most investors and after an extended period of positive returns the question of profit taking versus continuing to expect further growth is in the minds of many investors.

Investment cycles vary considerably in length from a matter of weeks to multi-decade cycles. The longest cycles can extend for 30 years or more and when these long term cycles change they can provide the highest level of risk but also the greatest opportunities for investors.

The current Bull (rising) market in stock markets has lasted more than 8.5 years to date; the previous bull markets since 1926, starting with the most recent, lasted 5.1 years,12.8 years,12.9 years, 2.5 years, 6.4 years, 13.9 years, 15.1 years and 3.7 years. Bear (falling) markets tend to be shorter and have lasted from 3 months to 2.8 years with the most recent two Bear markets lasting 1.3 years and 2.1 years. This data tends to suggest that the length of Bull markets vary significantly and the current Bull market is well within the range. Some investors are nervous that the current bull market in equities has lasted longer than previous cycles but history suggests that this is not a relevant factor in determining when and if to take profits.

The basic principle of investment is to place money which is not required immediately, through capital markets in order to have greater spending power in the future. In order to be successful the returns created must exceed inflation otherwise spending power will be lower in the future. The current position is that fixed interest markets, particularly Government Bonds and Cash deposits, are not likely to meet this basic fundamental requirement because of the current low yields in both nominal and real terms. Fixed interest markets have experience a prolonged Bull market with yields falling from circa 14% per annum to circa 1.2% per annum over 30 years. Given the current economic environment and the inflationary pressures now building it is reasonable to assume that this positive cycle in fixed interest markets is coming to an end.

History also shows that equities often outperform during periods of moderate inflation as companies are often able to raise prices providing some inflation protection for shareholders. The amount of quantitative easing injected into the global economy currently exceeds $15 trillion dollars and continues to rise. This cash is gradually filtering into the real economy and is driving global economic growth, reducing unemployment, increasing future confidence and beginning to show signs of increasing inflation. Given the gigantic size, the effects of the quantitative easing programme are likely to continue for years to come, perhaps even decades.

In this scenario, the IC favour equities over bonds and bond exposure is generally focused within shorter dated bonds which are less vulnerable to capital losses if interest rates continue to increase. Equity funds are generally value rather than growth in style. There have been strong returns from some growth strategies, however the underlying business models often require ongoing cash investment and growth valuations are vulnerable to the tighter monetary conditions the IC expect within the fixed interest markets going forward.

The IC continue to favour Asia and Emerging Markets over the US due to higher economic growth rates and more attractive valuations.

If the IC believe the risks to equities increase in the future we would consider taking profits but at this time believe that the upside is attractive, especially given the low returns from cash.

The IC reviewed risk management, eligibility and investment and borrowing reports and confirmed that these were in order and no action was required.

The IC noted that the Value at Risk (VAR) ratios for the Clarion Meridian and Clarion Prudence funds are below the benchmark. The earlier spike in the VAR ratios of the Prudence and Meridian funds was due to the timing difference between valuation points of these two funds and their respective benchmarks. The IC agreed that a chart showing historic changes in the relative VAR ratio will be useful for risk assessment and monitoring. This data will be available in the new proprietary Margetts database in the near future.

The IC also discussed the recommended holding periods for the three Clarion funds and agreed that it would be useful to quantify these figures. The recommended holding periods were originally derived from the empirical study of maximum recovery times from the biggest losses of various asset classes. This study indicates that the Clarion Prudence portfolio is likely to recover from a negative period in c. 3 years, the Clarion Meridian portfolio is likely to recover from a negative period in c. 5 years and the Clarion Explorer portfolio is likely to recover from a negative period in c. 7 years. The Committee agreed that these periods look appropriate and decided to include them in the Investment Process document and other appropriate fund literature going forward.

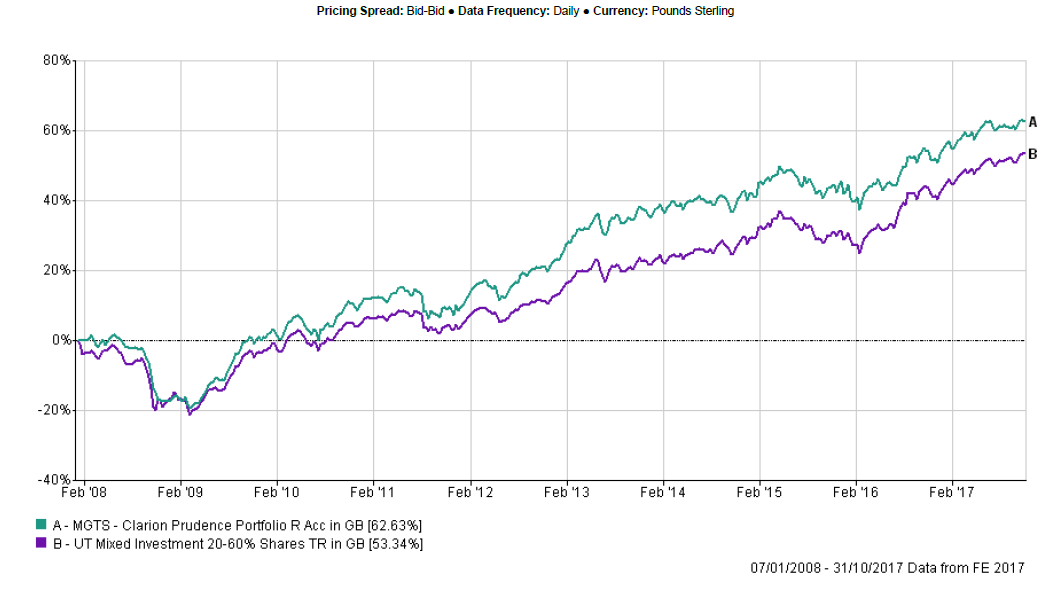

Over 12 weeks the fund has slightly underperformed the sector by c. 0.5% but has outperformed its technical benchmark by c. 0.4%. The fund performed more strongly during the first half of October, however the current overweight to cash has detracted from returns during the second half of the month due to the stronger short term performance of bonds which has been driven by UK Gilt yields retracting to lower levels. Performance since inception remains strong and is ahead of both the sector average and the technical benchmark.

It was noted that while the fund has exposure to bond funds that invest primarily in bonds with an investment grade rating and high allocations to AA and AAA rated bonds, many other funds in the sector bear higher risks by allocating more assets to High Yield non-investment grade bonds (bonds with a rating below BBB). High Yield bonds typically have lower exposure to interest rate risk and higher exposure to credit risk, therefore these assets are likely to outperform higher rated bonds during periods of tighter credit spreads and relatively flat or rising bond yields as being experienced at present.

The IC discussed the attribution analysis which shows the main drivers of the fund’s relative performance compared to its technical benchmark. According to the report, the underweight position in longer duration UK Gilts was the biggest contributor to returns over 12 months, followed by the active allocation to Global Equity funds. An overweight allocation to cash was the biggest detractor from the fund’s returns.

Following the above discussion, the IC debated the reduction of the fund’s cash position by c. 6%. It was agreed that the higher cash position was introduced as a temporary measure and given the IC’s overall positive view on the global economy, it is now appropriate to reduce the exposure to cash. The IC again discussed the prospects of buying a property/ground rent fund but were concerned that both traditional property, as well as ground rent funds, are relatively illiquid and investors have to have a relatively long holding period to benefit from these assets. In the current stage of the business cycle it is likely to be less appropriate for investments in fixed income and/or property assets, given that both are likely to be negatively affected if bond yields were to continue rising. It was agreed that investments with higher liquidity are likely to be more appropriate for the Prudence fund.

The IC debated the possibility of reinvesting some of the available cash into equity funds, specifically increasing the equity position by 4% to 5% allocation. However, some members held a more cautious view on the equity market and felt that an immediate 4% increase might be too aggressive. The IC agreed the reinvestment of cash was appropriate but did not wish to reinvest all 6% in one move and would prefer this to be done more gradually.

It was suggested that reinvesting 2% into equities and 2% into short dated bonds might be appropriate and the IC agreed with the wider allocation changes and debated increasing the allocation to Global Equity funds by 2% due to the uncertainty of Brexit negotiations. Introducing an Asian income fund to increase the portfolio’s diversification was discussed but a counter argument was that introducing exposure to Asia in the Prudence portfolio is likely to cause an overlap with the relatively high allocations to this area in the Meridian and Explorer portfolios and would increase the risk taken by Clarion clients who invest in the blends of the Clarion funds. It was noted that most of the UK funds included in the Prudence portfolio have a bias to large cap companies with high foreign exposure and therefore these funds are also likely to benefit if Sterling was to depreciate. Following a lengthy debate the IC agreed to split the 2% increase in the equity allocation equally between Global Equity and UK Equity Income funds.

The IC debated that the proposed 2% increase in the allocation to bonds should be split equally between the M&G UK Inflation Linked Corporate Bond fund and Royal London Short Duration Credit fund. It was noted that the M&G UK Inflation Linked Corporate Bond fund could enter a period of weaker performance if credit spreads widen. The IC agreed with the changes proposed in relation to the higher allocation to equity funds and decided to discuss reinvestment of more cash at a later stage.

The IC discussed concerns regarding the lack of political stability in the European Union and the potential effect the future Italian elections could have on European equity markets. It was noted that European stock markets had enjoyed a strong run in 2017 and now might be a good point to take profits and reduce the European allocation in the Prudence portfolio to a neutral position, which implies selling out of the SLI European Equity Income fund and spreading the proceeds among other regions. However the IC decided against any changes at this stage and the allocation to Europe will be debated again at a future date.

It was noted that the Threadneedle UK Equity Income fund has underperformed the relevant IA sector over 3 and 6 months although the IC have no immediate concern about this holding, given that the fund’s 12 months performance remains strong. It was decide to investigate the recent weaker performance of this holding and to review again at the next IC meeting.

The IC mentioned the positive contribution brought by the switch from Troy Trojan Income into the Franklin UK Equity Income fund. While the Troy strategy continued to lag the market, the Franklin fund performed strongly over the short term.

The IC questioned the performance of the M&G Global Dividend fund, which has lagged relative to the Global sector over 3 months. It was however noted that this fund has a ‘Value’ bias and while this can lead to periods of weaker relative performance, over the longer term this fund is likely to perform strongly.

The IC noted the strong performance of the Henderson Global Equity Income and IP Global Equity Income funds. These two holdings tend to work very well when combined with the M&G Global Dividend strategy, as all three funds pursue different themes which benefits diversification.

The IC have no other concerns about the performance of the Prudence strategy and no other changes have been proposed at this time.

The IC approved the strategy and confirmed it is in line with the mandate.

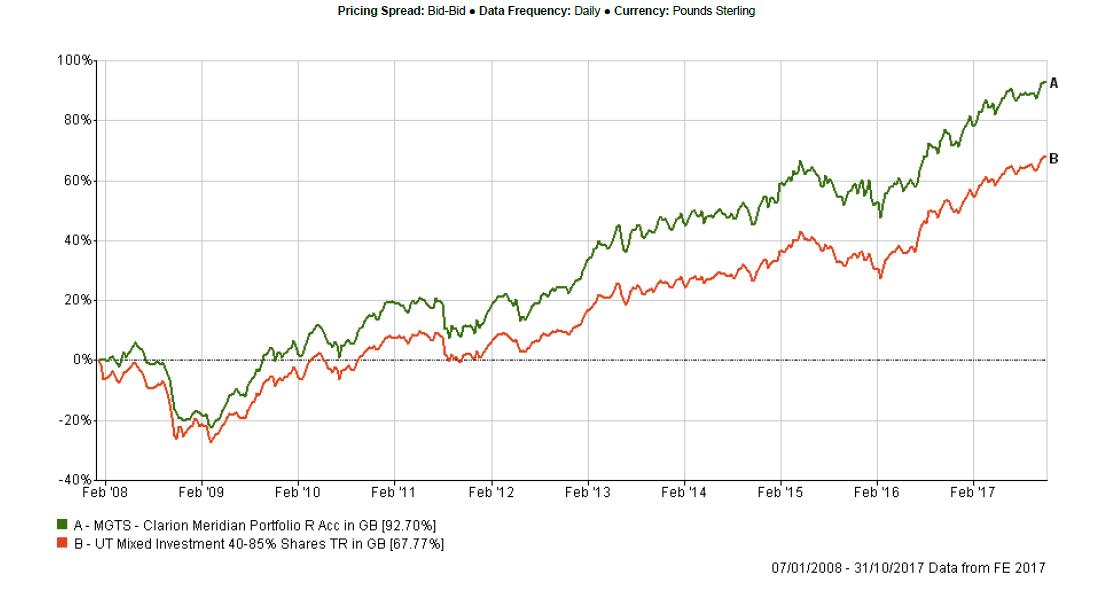

The fund has marginally underperformed the sector by c. 0.2% and outperformed the technical benchmark. Similar to the Prudence strategy, the Meridian fund performed more strongly during the first two weeks of October, while its performance has weakened slightly in the second half of the month due to lower Gilt yields and the overweight position to cash. Performance since inception of the fund remains strong and is ahead of both the sector average and the technical benchmark.

The fund’s attribution analysis shows that relative to the technical benchmark, the strategy has benefited from both the underweight position to Gilts and also the fund selection in the UK All Companies allocation. The overweight to cash and the fund selection in Asia have detracted from returns over 12 months. In Asia, the Stewart Investors Asia Pacific Leaders fund was the main cause of weaker relative returns. This fund has now been replaced by the First State Asia Focus fund. The IC are pleased with the short term performance of the First State fund and commented positively on the outcome of that switch.

To be consistent with the decisions taken in the Prudence portfolio, the IC decided to decrease the fund’s allocation to cash in favour of equities. The IC debated an Emerging Markets fund and funding the purchase partly by decreasing cash and partly by reducing the allocations to Europe and the UK. The IC discussed a number of Emerging Markets funds and the potential effect the EM allocation can have on the portfolio. It was noted that most EM funds have a relatively large allocation to Asia which is already represented in the fund. Therefore it was agreed that the cash position will be reduced by 2% with 1% being invested in Asia, 0.5% will be invested in a UK All Companies fund and 0.5% will be invested in the M&G Global Dividend fund.

For the same reasons debated above under the Prudence Fund, consideration was given to reducing the fund’s exposure to Europe in favour of other geographical areas. As agreed under Prudence the IC decided not to take any actions at this stage but agreed to have a more in depth discussion at a later stage.

The IC noted the strong performance of the SVM UK Equity Growth strategy. The IC acknowledged that keeping this strategy in the portfolio has benefited performance, despite the period of weaker returns the SVM fund experienced shortly after the Brexit vote.

The IC discussed the weaker recent relative performance of the Majedie UK Equity fund. Majedie have stated that the fund is currently positioned defensively, and includes an overweight position to precious metal miners, which has detracted from the fund’s relative returns over 3 months.

Overall, the IC are happy with the performance of the Meridian fund and no other changes have been proposed at this stage.

The IC approved the strategy and confirmed it is in line with the mandate.

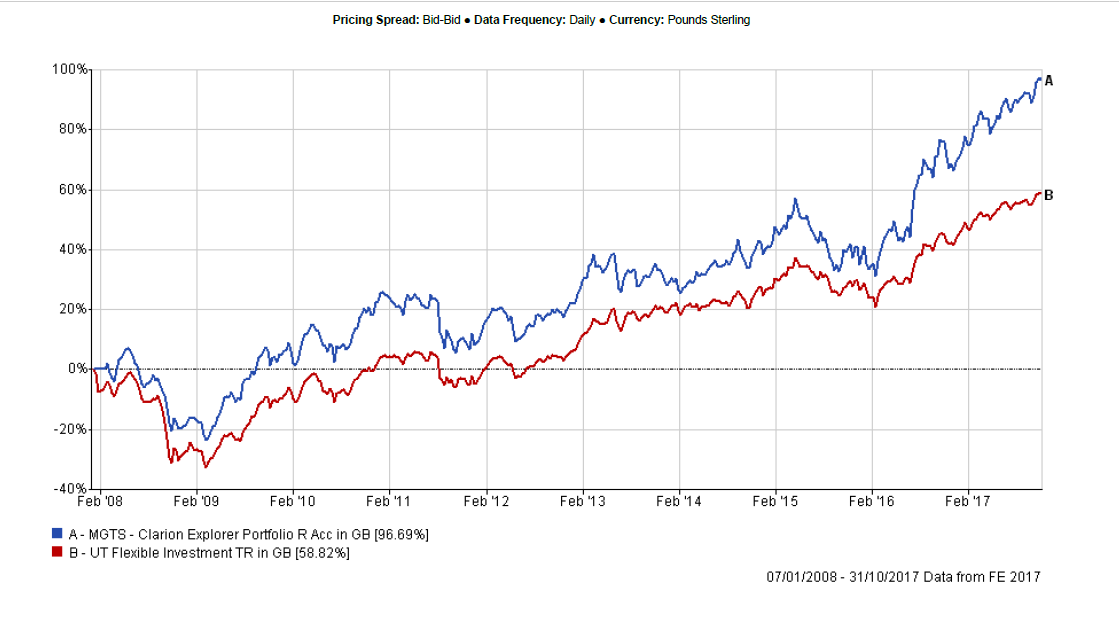

The Explorer fund has outperformed the sector by c. 1.9% over 12 weeks and was in line with the technical benchmark. Performance since inception of the fund remains strong and is ahead of both the both the sector average and the technical benchmark.

The attribution analysis indicates that relative to the benchmark the fund is underweight to North America and overweight to Asia and Emerging Markets. While this positioning had a positive asset allocation effect, fund selection in Asia and Emerging Markets was weaker relative to the indices which represent these markets in the benchmark. The IC raised no concerns about this outcome and acknowledged that the fund selection in the Explorer portfolio tends to be more defensive, while the Asia and Emerging Markets indices included in the technical benchmark feature some more risky stocks traded in these markets.

The IC debated decreasing the portfolio’s cash position and noted that the potential for fiscal stimulus in the US is likely to be positive for the US stock markets, therefore the IC debated increasing the fund’s exposure to the US. Whilst the IC agree that this is a strong argument, a proposal was also put forward in favour of increasing the exposure to Japan. It was noted that while the US, UK and Europe are planning to tighten their monetary policy, Japan is expected to continue to pursue monetary easing, which is likely to lead to the further depreciation of the Japanese Yen relative to other major currencies. Currency depreciation is likely to benefit Japanese producers, and Japanese equity valuations. The IC agreed therefore that a higher allocation to Japan is likely to benefit the portfolio when the monetary policy of the major countries became more diverse.

The IC therefore agreed to increase the allocation to Japan by 2%, which will be funded from the cash balance. The allocation to Japan will be split between two holdings. The weighting of the Lindsell Train Japanese fund will be reduced by 2% (to 4.5%) and the Schroder Tokyo (unhedged) fund will be introduced at a 4% weighting.

As above, the IC debated reducing the fund’s exposure to Europe but agreed not to take any definitive action at this stage.

The IC briefly discussed the portfolio’s allocation to Asia. It was again noted that the Stewart Investor Asia Pacific Leaders fund’s performance has improved over 4 weeks. The IC decided not to make any changes to the fund selection in Asia but will review the position at the next IC meeting.

Overall the IC are pleased with the portfolio’s performance, and no other changes were proposed.

The IC approved the strategy and confirmed it is in line with the mandate.

The IC reviewed performance charts for the Clarion models which now include strategic benchmarks instead of the IA based blends. While the performance profiles of the model portfolios were more in line with their respective strategic benchmarks, the IC decided that it would be useful to add the IA based benchmarks which show the average performance of the peer group as well as the performance of the relevant blends of Clarion funds.

The following deals have been agreed to bring the models in line with the new underlying fund selection in the Clarion range of funds.

The IC reviewed the Veritas Asian fund. The key points are noted below.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.