Tags: Explorer, funds, investment, Meridian, Prudence, stock market

Category:

Financial Planning,

Investment management

Minutes of the Clarion Investment Committee held at 2pm on 21st May 2020 by video link.

Committee members in attendance: –

| Sam Petts (SP) | IC Chairman and Financial Planner (Clarion Wealth Planning) |

| Keith Thompson (KT) | Chair/Director |

| Dmitry Konev (DK) | Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | Fund Manager (Margetts Fund Management) |

| Apologies received from both Ron Walker and Jacob Hartley |

Minutes from the previous meeting held on 23rd April 2020 were agreed by the Committee as a true and accurate record.

Please click here to access the May Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

We continue to watch unfolding events in relation to the coronavirus pandemic closely as well as the economic news flow which on the whole has been pretty bleak. As always our thoughts are with those affected by the spread of the virus but looking at the situation dispassionately, clients should be reassured that we continue to function successfully with staff working from home and that day to day management of the Clarion Portfolio Funds and Model portfolios remains unaffected. The Investment Committee continue to focus on our responsibilities to our investors.

The following notes summarise the main points discussed by the Investment Committee at the May meeting.

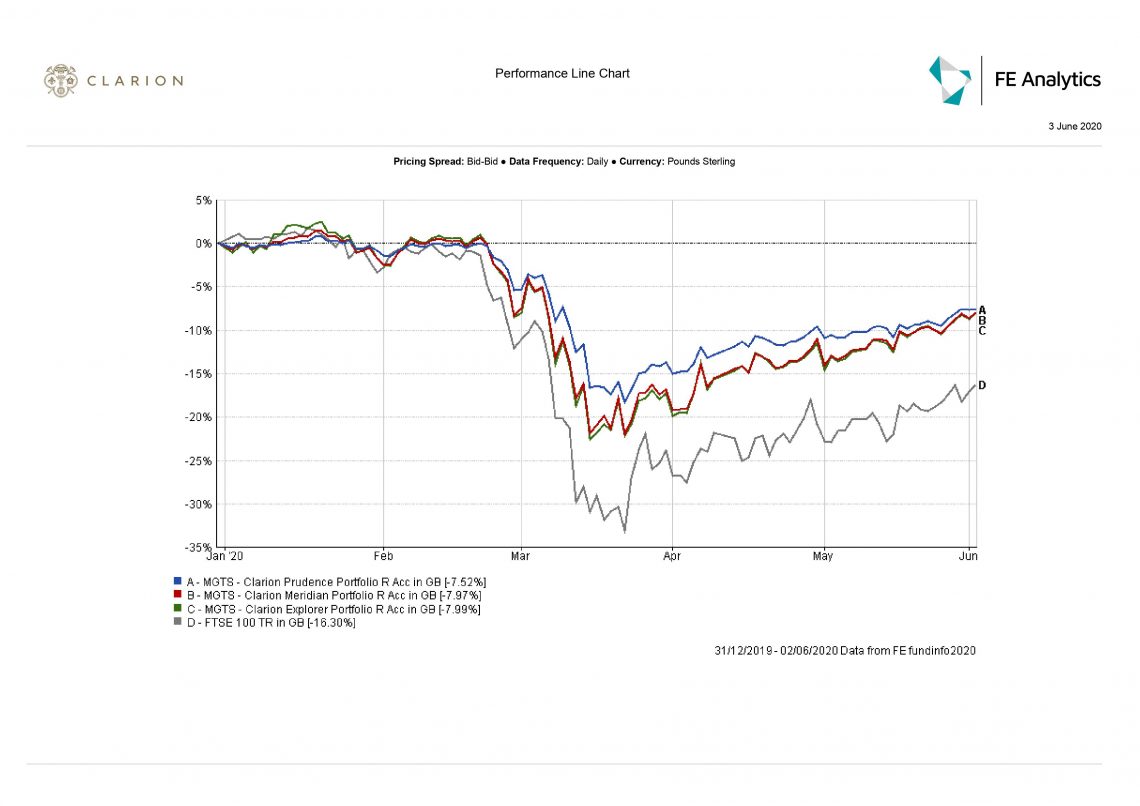

Stock markets continue to be driven by investor sentiment over Covid‐19, and the volatility of oil prices. Markets remain volatile and in these uncertain times investors naturally feel a high level of anxiety and remain susceptible to short term sentiment and news flow. Having lived and managed money successfully through previous crises we have learned how important it is to follow our tried and tested investment approach and to focus on our long term investment strategies.

Improving statistics were noted across a number of Covid‐19 hotspots, notably in Italy, where new daily cases decreased from a 3‐day moving average of 4,500 in April to less than 200 towards the end of May. The USA, one of the countries ostensibly struggling the most with the disease with circa 2 million cases and 100,000 deaths has managed to flatten its daily new cases. In Japan where no restrictions were placed on residents’ movements and businesses from restaurants to hairdressers have remained open throughout the pandemic, new recorded cases of the coronavirus have dwindled to mere dozens.

With the peak of the initial wave of the virus apparently overcome, investor’s attention has turned the tentative moves to ease lockdown measures and reinvigorate economic activity. Markets have been buoyed by these developments and also by the possibility of vaccines and antibody tests, as well as the improving disease statistics, and have continued their recovery from March’s historic lows. Although markets are still well off the peaks of January/February, most equity indices have recovered a significant amount of the March losses, rewarding investors who remained invested and who took the opportunity to buy attractive companies at discount valuations.

Eyebrows were raised at a recent unprecedented market event as the West Texas Intermediate crude oil future contract for May delivery turned negative, hitting minus $38 per barrel, meaning producers were actually paying buyers to take oil off their hands. This was due to a lack of available local storage. An entrepreneurial investor with transport and storage availability for a month would have been hypothetically able to exploit this state of affairs by being paid $38 a barrel for receiving delivery in May, and then being paid over $20 a barrel for delivery in June. This was an unusual localised issue, but it still served to spook global oil markets, with the Brent index falling 28% to $20 the next day, exacerbating the already depressed market which had plunged from $50 to $32 in March. This coincided with results from the two big FTSE100 oil players, BP and Shell, both staples of UK income portfolios. BP opted to continue paying their quarterly dividend, but Shell slashed their quarterly dividend by 2/3rds, the first dividend cut by the company since World War II. Oil prices have recovered somewhat but concerns remain over the scale of market oversupply, with storage sites fast filling up and prices for shipping also escalating as long‐term freighters were pushed into service as additional floating oil storage units.

The UK has seen a combination of political and moral pressure, along with prudence in the face of Covid‐19, which weighed on dividend payments with c.40% of companies in both the FTSE 100 and 250 indices choosing to cancel, cut or suspend their upcoming dividend payments. In spite of this, the yield on the FTSE100 remains attractive at circa 4%, offering investors income far in excess of gilts and bank interest. While the short‐term outlook is disconcerting for income investors, over the medium term many of these companies will reinstate investor pay‐outs when it is possible to do so. Banks, however, are unlikely to do so, having been told to maintain high levels of capital reserves to see them through any potential credit crunch.

The US Presidential elections narrowed down to the likely candidates as Bernie Sanders suspended his campaign, leaving Joe Biden as the only plausible Democratic nominee to face Donald Trump in November. Biden has surged in the polls despite a hiatus in campaigning, and the emergence of accusations in the media of a past potential sexual assault. Donald Trump’s re‐election hopes had largely been pinned on a strong economy and buoyant stock market, for which he often claimed sole responsibility. US voters have, however, rationally seen soaring unemployment claims and Covid‐19 cases as evidence that his leadership qualities in the midst of a crisis are questionable. Trump’s fervent desire to see the US economy unlock, apparently regardless of the potential increases in death rates, is indicative that he sees his re‐election chances floundering. Only time will tell whether this strategy will see a rise in GDP and the stock market, or tragically, a rise in deaths.

The ever‐widening gap between yield on equities and bonds, a substantial number of which are once again in negative yielding territory, keeps us firmly placed in the former camp across the Clarion Portfolio Fund range and Model portfolios. Equities in the FTSE 100 index, despite dividends being cut, are still on average yielding more than 4%, and the price of UK equities based on historic valuation metrics remains attractive.

With the peak of the initial wave of the virus reached, and economies planning further relaxation in the lockdown measures, the committee’s attention has turned to which countries are best placed to take advantage of the world which will emerge. We remain impressed by Asia’s response to the virus and are encouraged by the scale of testing that Europe and the UK are managing, which along with tracking data is key to any successful return of a functioning economy. The US remains behind the curve, and by reopening its economy too soon it may risk a devastating second wave of the virus. We remain underweight the US across our portfolios due to this risk, and the nature of US equity market being driven by mega‐caps, which have outperformed in the crisis but could lag cyclical stocks in a recovery environment in relative terms.

Our attitude to bonds remains that they offer poor returns for the risk involved, as demonstrated by their notable lack of differential performance in March’s equity falls. The aggressive QE programmes reinstated in the wake of the virus continue to distort bond markets, and lack of yield is pushing investors into riskier territory in the search for income. Out short‐dated bias aims to offset these risks while offering income without paying a hefty premium.

Whether we have seen the bottom of this cycle remains to be seen and much will depend on how quickly the current severe lockdown is lifted and normal economic activity resumes. It seems the best we can hope for is a gradual return to normality. Any easing will be welcome and will contribute to a gradual recovery in economic activity and further recovery in stock markets.

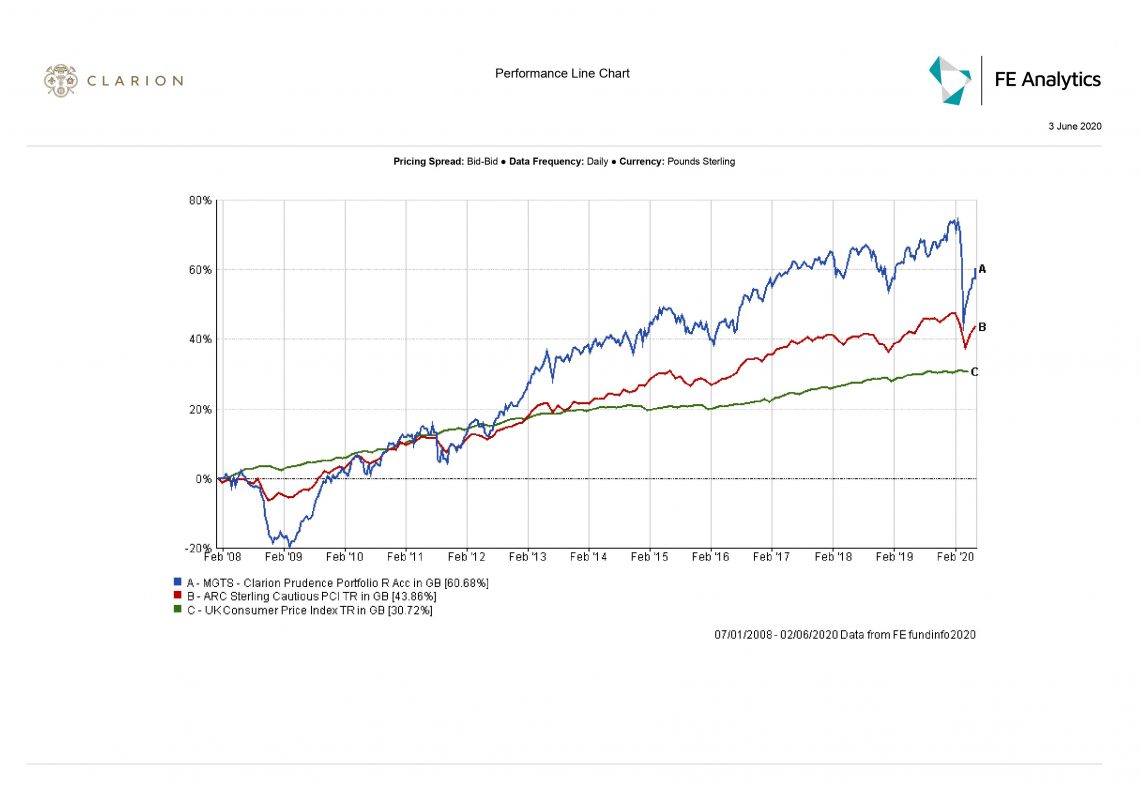

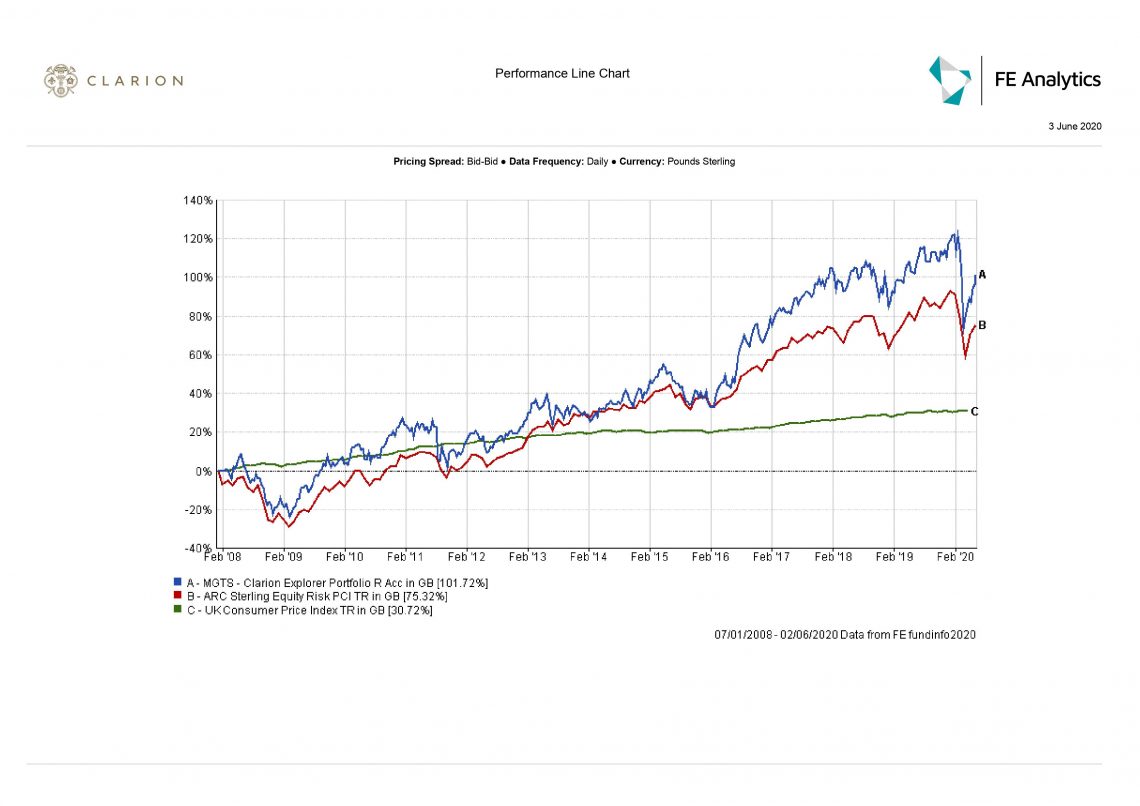

We believe the Clarion Portfolio funds and model portfolios are well positioned to benefit fully from a further rebound in markets when that occurs.

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

We remain confident in our overall fund selection process. The Clarion Portfolio funds are performing well relative to peers. Our weighting towards Asia has worked in our favour as Asian Markets have fallen less than Western Markets. We are pleased with the way in which the funds held up in the dramatic falls of a few weeks ago and also with the way they have recovered on the market bounce back. We are firmly focused on maximising the opportunity ahead.

The majority of the underlying funds in Prudence, Meridian, and Explorer have outperformed their respective benchmarks over most time frames. All underlying holdings are highly liquid with no exposure to open ended property funds where redemptions have been blocked for some weeks causing problems for other fund of fund strategies.

The underlying fund selection has been very strong as most funds in the portfolio outperformed over 1 to 12 weeks and the allocation effect has been positive.

M&G Global Dividend has recovered and has outperformed over shorter term periods. This fund has a value strategy which has captured a lot of opportunities in the oil and gas sector. The Fund provides an ideal diversifier to the growth style of FundSmith Equity.

Bond holdings performed in line with expectations and the high yield bond fund outperformed slightly on credit spreads tightening.

The only underlying EM holding and the only European holding both outperformed their respective sectors over 12 weeks.

Four out of five UK holdings outperformed over 12 weeks. Man GLG UK equity income was slightly disappointing. On further examination the underperformance was attributed to a higher allocation to the construction and building sector which suffered more than most sectors in the downturn but which the committee feel currently offers good prospects for a sharp bounce when economic activity resumes.

Following on from recent interim meetings the committee once again debated the attractions of adding a small exposure to Japan in favour of a slight reduction to the UK Equity income sector. Domestic companies in Japan are the most cash rich companies in the world with more than two thirds having net cash on their balance sheets compared to the US where less than 20% of companies have net cash. Japan is also one of the most attractive markets on valuation terms and the Yen often provides a safe haven in times of market falls.

With these points in mind it was decide to reduce the UK exposure by 3% and to allocate this to JPMorgan Japan which has a mid-cap, domestic value bias and has been a first quartile performer over the last 5 years, 3 years and 12 months.

The Committee were happy with the performance of all the funds in the portfolio and proposed no other changes.

The Committee approved the strategy and confirmed it is in line with the mandate.

Meridian outperformed the sector and benchmark over 1 and 2 weeks and was in line over 12 weeks. The Committee were pleased with the selection of funds as most holdings outperformed their respective sectors over 12 weeks.

The allocation effect was slightly negative whereas the selection effect was neutral and the cumulative effect was positive.

It was particularly pleasing to note that the BlackRock UK Equity fund which was introduced recently to replace the Investec UK Special Situations fund had outperformed whereas the Investec fund had continued to underperform.

The Committee approved the strategy and confirmed it is in line with the mandate.

Explorer outperformed the IA Flexible Investment sector over 1 and 2 weeks and was in line over 12 weeks. Fund selection was strong and all but 4 underlying holdings have outperformed their respective sectors.

All Emerging Markets, European and Global funds were ahead over 12 weeks. In the UK the mid-cap strategy has underperformed, while the large-cap fund outperformed.

Consideration was given to looking for a replacement for the GLG Man UK Equity Income Fund which has underperformed slightly for the reasons outlined above under Prudence. This fund will be reviewed again at the next meeting when Evenlode Global Income will be considered as an alternative to provide further diversification on a global basis and to take advantage of any further weakening of sterling.

The Committee debated increasing the exposure to Japan for the reasons outlined under Prudence and it was decided to reduce the allocation to cash by 1% and use this to increase the allocation to Japan to 6% with an equal weighting between the existing Lindsell Train Japanese Fund and the JPMorgan Japan Fund.

It was interesting to note that over 1 year the best performing funds were Artemis Global Select and FundSmith both with positive returns of circa 11% was the strongest equity fund over 12 weeks with c.-6.7% return.

The Committee are pleased with the overall performance of this strategy and no changes have been proposed.

The Committee approved the strategy and confirmed it is in line with the mandate.

The Clarion Portfolio funds and model portfolios are well positioned to benefit from a return to growth in the economy and remain slightly overweight equities. We remain in regular contact with our fund managers who are taking full advantage of the current situation to invest in solid growth companies with strong balance sheets at bargain basement prices.

Appropriate adjustments were made to the model portfolios to reflect the changes to the Prudence & Explorer Funds mentioned above.

None of note.

Next Investment Committee Meeting is 18th June although in the interim period the Committee intend to conduct slightly shorter conference calls on a twice-weekly basis.

————————————————————————————————————–

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.