Category: Financial Planning, Investment management

Minutes from the previous meeting held on 27th September 2018 were agreed by the Committee as a true and accurate record.

The committee discussed the current macro global economic environment and the upsurge in financial market volatility in recent weeks. The accompanying article entitled “Equity Investing and Market Commentary” from our Chairman provides some perspective on the stock market falls in October.

The key elements were as follows:

The Committee reviewed risk management, eligibility and investment & borrowing powers reports and confirmed that these were in order and no action was required.

The Committee reviewed StatPro reports and confirmed that the relative Value at Risk (VaR) ratios for all three Clarion funds were below 100% and stress tests were in line with expectations.

The Committee agreed that all portfolios are managed in line with expectations and raised no concerns.

The fund’s 12 weeks performance was marginally under the sector, which can be attributed to its overweight equity allocation. However, the fund has outperformed its technical benchmark, which could indicate that UK gilts, which are included in the benchmark, provided little protection during the recent market falls.

Short duration bonds performed well during the most recent round of interest rate rises. Over 12 weeks, all short duration bond funds in the portfolio had positive absolute returns and outperformed the IA £ Corporate Bond sector by c.1 percentage point. The Royal London Global Index Linked Bond fund was the only bond holding in the portfolio which showed negative returns in absolute and relative terms. This is a more traditional bond fund with a relatively high duration, and its recent weaker performance was in line with the Committee’s expectations.

Among the global equity funds, the M&G Global Dividend continued to dominate over its peer group and outperformed the IA Global sector by c.3.2 percentage points over 3 months. The performance of the Henderson Global Equity Income and Invesco Perpetual Global Equity Income funds has been somewhat weaker. Both these Funds have a higher allocation to the UK and Europe, which created a headwind to their relative performance as both regions underperformed the US, which constitutes a large part of the IA Global sector.

Despite the weaker performance of the UK relative to other developed markets, most of the fund’s underlying UK holdings have an income and value bias and held up well during the recent market falls. The Committee have noted the weaker recent performance of the Threadneedle UK Equity Income and Aviva UK Equity Income funds and discussed these funds in more detail. The performance of the Threadneedle fund is likely to have been driven by its relatively high allocation to the industrial sector, while the performance of the Aviva fund has been more affected by its exposure to energy and basic materials. The Committee raised no concerns about either of these holdings at this stage, given that both funds have strong longer-term performance profiles.

The Committee are happy overall with the performance of this strategy and made no changes to the portfolio at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

Over 12 weeks the fund has marginally lagged the sector and benchmark, which can be attributed to its overweight equity position, as underlying equity funds on average fell by c.6%.

The fund’s bond selection continued to perform strongly as all but one fund outperformed their IA sector. The Kames Investment Grade Bond fund was the only underlying bond holding which underperformed its IA sector over the period. While the Committee raised no concerns about the performance of this strategy, the decision has been made following the discussion the last meeting, to replace this holding with the BlackRock 1-10 Year Corporate Bond fund, which has a similar duration, and a more attractive costing structure. The Committee agreed to proceed with this change and will execute the switch before the next IC meeting.

Both underlying Asia holdings performed strongly over 3 months and outperformed the IA Asia Pacific ex Japan sector. The First State Asia Focus fund has historically had a quality bias and the team behind this strategy look to add value by choosing companies with strong governance characteristics. The Fidelity Institutional South East Asia fund’s exposure to China is more in line with the sector average, however the team tends to choose higher quality companies, which often translates into lower drawdowns compared to the IA sector.

The Committee discussed the F&C European Growth and Income fund, which struggled during the recent period of market falls. It was noted that this fund has a concentrated portfolio of c.30 stocks with a growth bias, which have not been favoured by the market over the last few months. The Committee acknowledged that this strategy’s longer-term performance looks relatively strong and raised no particular concerns at this stage.

In the UK, all underlying UK Equity Income holdings have outperformed the IA UK Equity Income sector. The Committee were pleased to see improvements in the performance of the Rathbone Income fund, which has now outperformed the sector over 6 months. The SVM UK Growth fund was the weakest UK holding over the period and delivered a c.-12% return in absolute terms. It is the opinion of the Committee that the SVM fund performed in line with expectations given its strong growth bias and higher exposure to small- and mid-cap equities.

Overall the Committee are happy with the performance of the Clarion Meridian fund and made no other changes.

The Committee approved the strategy and confirmed it is in line with the mandate.

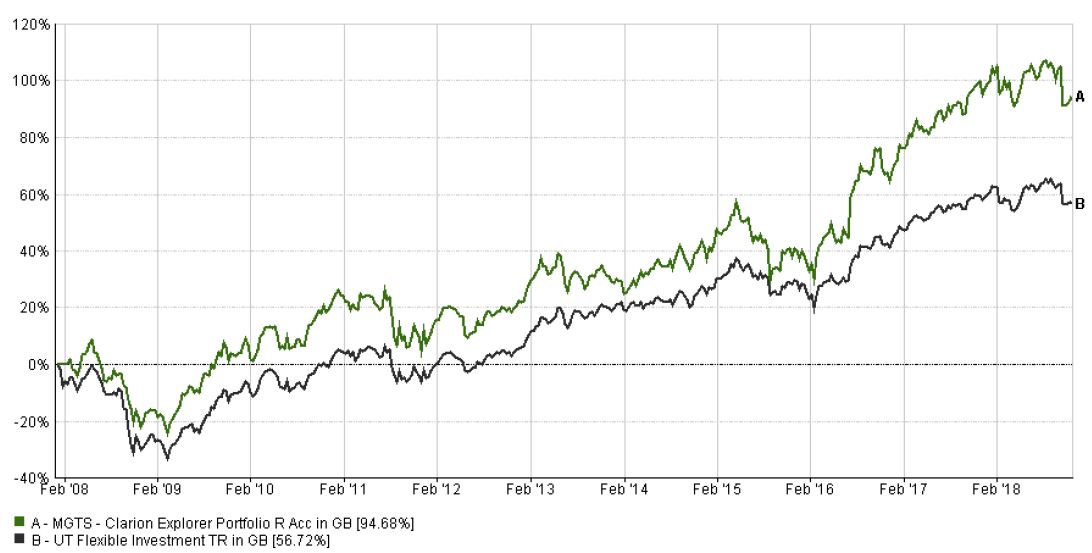

The Explorer strategy was a touch below the sector and higher than the benchmark over 12 weeks. Compared to the sector, the fund is overweight to Asia and Emerging Markets and underweight to bonds and the US. This positioning detracted from relative returns over the period, given that Asia and Emerging Markets fell by more in the beginning of October, however the fund has recovered half of its relative underperformance over the last 2 weeks.

Despite its higher exposure to more volatile assets, the underlying fund selection was very strong, with all but 3 funds outperforming their respective sectors over 12 and 4 weeks. The fund has historically had a tilt towards quality and value assets, which have underperformed growth stocks in 2017, however they have had lower drawdowns during the most recent market falls.

In Asia, the Fidelity Asia fund was the only holding that underperformed the IA Asia Pacific ex Japan sector. This performance profile was in line with the Committee’s expectations, given the fund’s relatively higher exposure to the Chinese tech sector.

The Committee were pleased to see all underlying Emerging Markets funds outperforming the IA Global Emerging Markets sector over 12 weeks. The JPM Emerging Markets Income fund continued to outperform other underlying Emerging Markets funds and is now one of the top performing funds in the sector over 1 year.

The Committee discussed the Jupiter European strategy and its performance. This fund remains the top performing fund in the IA Europe ex UK sector, and despite its concentration and size, its portfolio is relatively liquid. The Jupiter fund’s portfolio has a strong growth bias and while in general growth stocks have underperformed over 4 and 12 weeks, the Jupiter fund’s performance remained strong, which is likely to have been driven by the underlying stock selection.

In Japan, the Lindsell Train Japanese fund has lagged the sector over 12 weeks, however its weaker relative performance has been partially offset by the more defensive Schroder Tokyo strategy, which has outperformed the sector over the same period.

The Committee have noted that the recent performance of the Clarion Explorer strategy was relatively similar to the performance of the Clarion Meridian fund, which is expected to be lower risk. The Committee agreed that this anomaly needs a further investigation and it was agreed to further investigate the main drivers of this convergence and present the findings at the next Investment Committee meeting.

The Committee are pleased with the overall performance of this strategy and proposed no changes at this meeting.

The Committee approved the strategy and confirmed it is in line with the mandate.

The Clarion fund asset allocations used for the model blends were updated.

Model D

Model E

Model F

No other business.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.