Minutes of the Clarion Investment Committee held at 1pm on 8th April 2021 by Video Link.

Committee Members in attendance: –

| Sam Petts (SP) | IC Chairman/Investment Manager |

| Keith Thompson (KWT) | Chairman (Clarion Investment Management) |

| Ron Walker (RW) | Managing Director (Clarion Investment Management) |

| Adam Wareing (AW) | Operations Director & Compliance Director (Clarion Investment Management) |

| Jacob Hartley (JH) | Associate Financial Planner (Clarion Wealth Planning) |

| Dmitry Konev (DK) | Senior Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | CEO (Margetts Fund Management) / Investment Manager |

| Elizabeth Chapman (EC) | Analyst (Margetts Fund Management) |

Minutes from the previous meeting held on 11th March 2021 were agreed by the Committee as a true and accurate record.

Please click here to access the April Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

The UK continues to forge ahead in its successful vaccine rollout with over 35 million Brits (half of all UK adults) having received their first dose of the vaccine, and over 5 million having received their second dose. The initial priority group, including all over 45s and those with underlying health conditions have now all been offered their first dose while the date for the rest of the adult population in the UK is July 31st. Fears of a resurgence as children returned to school proved to be unfounded, as new infections, hospitalisation and death figures all fell, and the crucial “R” number remained below 1.

Israel is leading the world in its vaccination rollout three months after it first began, with over half the population already fully vaccinated. Israeli citizens who have either recovered from Covid-19 or received both doses of the vaccine have been allocated a “green pass” allowing them to access venues not already open to other members of the public. The US has also ramped up its vaccination program, which has seen more than 30% of the population receive their first dose and approximately 15% of the population receive both doses.

By comparison, the outlook for the EU is far bleaker as their vaccination program has lagged the rest of the western world. Having been late to order and approve vaccines, and begin their vaccination program, the EU rollout was further marred by unsubstantiated scares surrounding the safety of the Oxford/Astra Zeneca vaccine (the provision of which was temporarily paused), production and supply issues, and a lack of uptake by the public. With countries such as Germany and France showing signs of a possible third wave, economic recovery in these areas is likely to be months behind the UK. For Brexiteers, this could be seen as a clear vindication of Brexit.

One of the world’s greatest, and little known, fortunes was wiped out in days at the end of March. From his perch high above Midtown Manhattan, just across the street from Carnegie Hall, Bill Hwang, was quietly building one of the world’s greatest fortunes. Even on Wall Street, few ever noticed him – until suddenly, everyone did.

In the early days of April reports began to emerge of a huge block sell trades in select US and Chinese stocks, worth c.$100 billion. These trades were later revealed to be the result of an overleveraged low profile hedge fund, Archegos Capital, defaulting on margin calls. Some stocks plummeted more than 50% and others saw double digit falls. Prime brokers affected in the liquidation were Goldman Sachs, Morgan Stanley, Credit Suisse, Nomura, and Deutsche Bank. Goldman Sachs, Morgan Stanley and Deutsche Bank moved rapidly in liquidating assets and suffered only relatively small losses as a result, but Credit Suisse and Nomura appear to have been left as the bag holders, nursing prospective losses in the billions. Archegos managed to rack up almost eight times leverage using total return swaps, and the scale of the leveraged position was spread out across multiple banks, meaning the total exposure was not readily apparent.

Bill Hwang’s reported $30 billion fortune was wiped out in days.

The failure of Archegos Capital demonstrates the value of risk diversification amongst a variety of assets. Despite large falls in the individual stocks, most of the market remained unaffected and well diversified investors will not have seen a material impact to their portfolios as a result. The Clarion Portfolio Funds and model portfolios, by virtue of careful attention to asset allocation, and the additional diversification offered by a fund of funds structure (where each of the c.15-20 portfolio holdings will themselves be invested in dozens, and possibly hundreds of companies each) demonstrates their value in capital preservation in such times.

With stimulus injected during Covid more than $20 trillion, inflation risk remains a firm focus. Even a slight increase in inflation could have a significant impact on the expected return of long-dated bonds and, as such, the Committee continue to favour shorter-dated bonds within the portfolio funds and model portfolios.

UK equity yields continue to rise as dividends are reinstated and offer attractive valuations relative to bonds. Sentiment is beginning to look more favourable towards the UK, compounded by the UK’s successful vaccine strategy and the value focus of its indices, which have benefitted from the growth to value rotation seen since Q4 last year, and accordingly our portfolio funds and model portfolios retain an overweight positioning.

Asia Pacific equities have performed well through the pandemic and remain at reasonable prices in terms of historical valuations. As such we retain an overweight position in this sector at present.

In contrast, large tech stocks dominate the US stock market, with FAANG stocks comprising over 20% of the S&P 500, and it is our view that valuations have become extended, which justifies our underweight allocation to the US.

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

To summarise, the committee agreed the following changes to the Prudence fund:

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end.

| 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | 31/03/17 to 31/03/18 | 31/03/16 to 31/03/17 | |

| MGTS Clarion Prudence R Acc | 17.96% | -7.89% | 3.87% | -1.24% | 9.59% |

| IA Mixed Investment 20-60% Shares | 19.83% | -7.19% | 2.86% | 0.83% | 12.90% |

To summarise, the committee agreed the following changes to the Navigator fund:

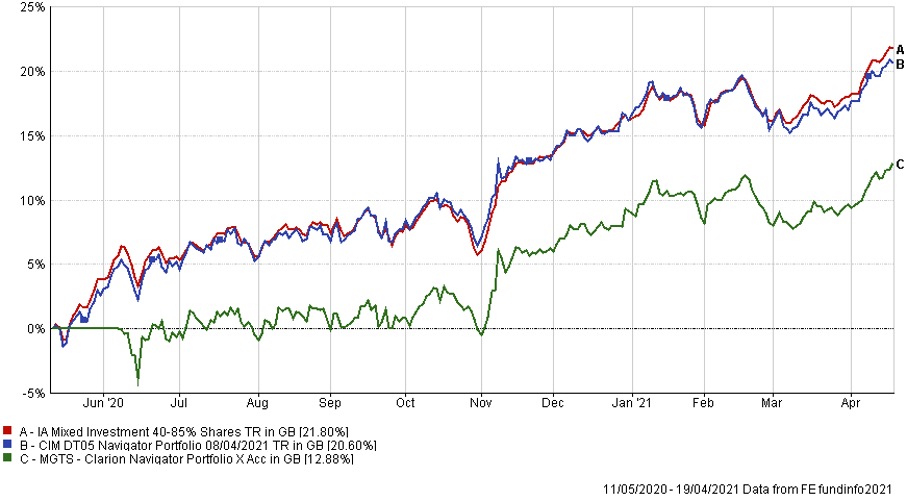

Whilst the Navigator fund launched on 12th May 2020, the fund didn’t receive any cash inflows until 5th June 2020 meaning that no investments were made before this date. You can identify this period as the Navigator fund growth appears flat whilst the sector grew over this period. This gives the impression that the fund lagged the sector when, in fact, the Navigator fund was unable to participate in any market growth during this period.

However, we also manage a Navigator discretionary portfolio containing almost identical investments to the Navigator fund and this was invested during this period. The chart below compares the performance of this portfolio against both the Navigator fund and the sector since 12th May 2020. The table shows the performance between 11th May 2020 and the end of the previous quarter.

| 11/05/20 to 31/03/21 | |

| MGTS Clarion Navigator X Acc | 9.67% |

| CIM DT05 Navigator Portfolio | 17.02% |

| IA Mixed Investment 40-85% Shares | 17.98% |

To summarise, the committee agreed the following changes to the Meridian fund:

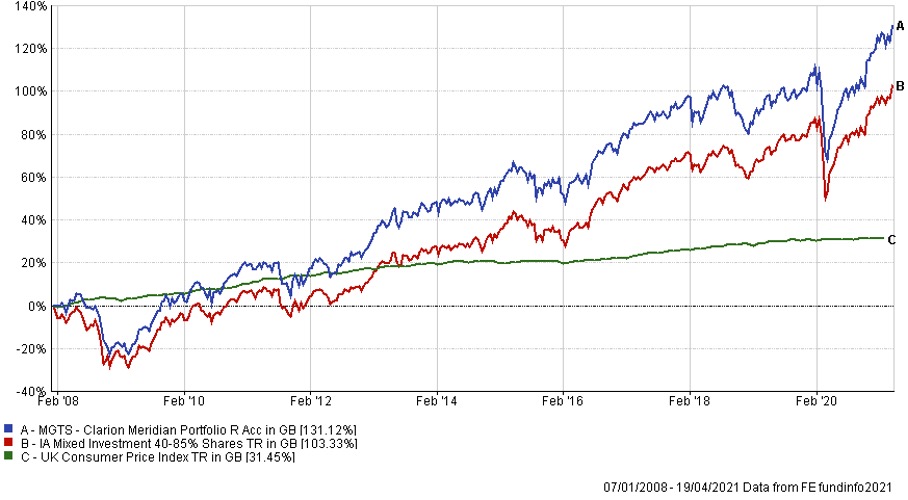

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end.

| 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | 31/03/17 to 31/03/18 | 31/03/16 to 31/03/17 | |

| MGTS Clarion Meridian R Acc | 29.63% | -10.01% | 4.27% | -0.40% | 16.80% |

| IA Mixed Investment 40-85% Shares | 26.44 | -7.99% | 4.30% | 1.54% | 17.11% |

To summarise, the committee agreed the following changes to the Explorer fund:

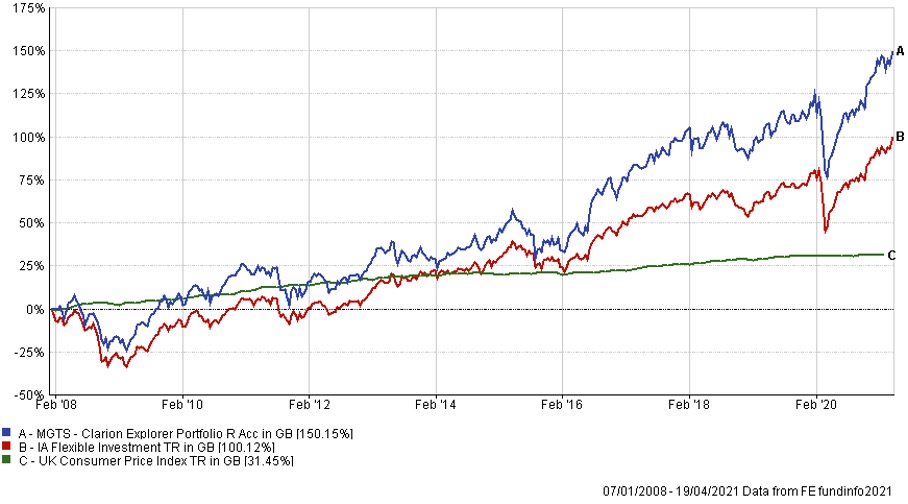

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end.

| 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | 31/03/17 to 31/03/18 | 31/03/16 to 31/03/17 | |

| MGTS Clarion Explorer R Acc | 34.25% | -9.05% | 4.23% | 3.50% | 27.04% |

| IA Flexible Investment | 29.10% | -8.14% | 3.31% | 2.36% | 19.06% |

It was agreed to make appropriate changes to the model portfolios to reflect the changes to the Portfolio Funds detailed above.

The next Investment Committee Meeting is on 6th May 2021 although in the interim period the Committee intend to conduct slightly shorter conference calls as considered appropriate.

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.