Tags: Adventurer Portfolio, Defender Portfolio, Discretionary Investment Management, Explorer Portfolio, funds, investment, Meridian Portfolio, MGTS Clarion Explorer, MGTS Clarion Meridian, MGTS Clarion Prudence, MTGS Clarion Navigator, Navigator Portfolio, Pioneer Portfolio, Prudence Portfolio, Voyager Portfolio

Category:

Investment management

The Clarion Investment Committee met on the 13th of April 2023. The following notes summarise the main points of consideration in the Investment Committee discussions but have also been updated to include commentary on recent events and the wider implications for financial markets.

Early estimates of activity in April from surveys of purchasing managers suggest a pronounced acceleration in service sector activity in the UK, Euro area and US, and a further decline in manufacturing activity in the UK and Euro area. US manufacturing returned to growth.

The Deloitte CFO Survey showed a strong rebound in business confidence and a sharp decline in perceptions of external financial and economic uncertainty.

UK consumer confidence rose to its highest level since the invasion of Ukraine but remains well below average levels.

UK consumer prices rose by a greater-than-expected 10.1% in the year to March, down from 10.4% the previous month. Food price inflation hit 19.1%. UK inflation has remained stubbornly high even as US and euro area inflation rates ease.

UK job vacancies fell and the number of people looking for work rose signalling a cooling labour market.

UK average weekly earnings grew by 5.9%, well below the rate of inflation.

UK retail sales volumes fell by 0.9% in March perhaps in part due to the weather – the month saw the sixth-highest rainfall of any March since 1836.

In a sign of concern about the effects of a potential economic rift between the US and China, US Treasury Secretary Janet Yellen said that: “We do not seek to decouple our economy from China’s. A full separation of our economies would be disastrous for both countries”.

Relatively strong UK inflation and labour market data strengthen the case for a further rate rise when the Bank of England meets next month.

China posted better-than-expected growth of 4.5% in the first quarter of 2023 compared with the same quarter last year confirming the post-lockdown acceleration in the Chinese economy. Commodities prices rallied on the news.

Investors are shifting aggressively into short-term US Treasury bills to protect themselves against the risk of a sell-off in US government bonds in the event of a failure to raise the debt ceiling. The spread between one-month and three-month US treasuries – a gauge of relative demand for one-month treasuries – has risen to record levels.

US banks are seeing significant outflows of deposits as savers search for higher returns.

US median house prices have fallen by 9.2% from last June’s high.

Earnings reports so far from US regional banks show a sharp drop in their margins in the wake of the failure of Silicon Valley Bank. Funding costs are rising as banks increasingly compete for deposits.

Following a mild winter EU gas storage was at 56% of capacity in early April, around 20 percentage points higher than typically seen at this time of year.

US broadcaster Fox News paid $788m to settle a defamation case brought by Dominion, a manufacturer of voting machines. Fox had broadcast accusations that Dominion had rigged the machines in favour of Joe Biden.

The holders of $4.5bn in Credit Suisse bonds that were wiped out when Credit Suisse was merged with UBS are suing the Swiss financial regulator.

SpaceX’s Starship, the most powerful rocket ever built, exploded around four minutes after launch. Such an outcome is not unusual for a first test.

Businesses are concerned that their insurance policies will not pay out following a state-backed cyberattack, the FT reports. Insurance typically does not cover damages from war.

The UK government warned businesses of the risk of cyber-attacks from groups linked to Russia.

UK pension funds have criticised proposals that may see them being encouraged to invest in riskier assets to boost economic growth, saying their primary responsibility is to safeguard their members’ assets.

Royal Mail and union leaders agreed on a deal that included a 10% pay rise over three years, a lump-sum payment and commitments on jobs and conditions. Union members will now vote on the deal.

Chilean president Gabriel Boric said that he would nationalise the country’s lithium industry. Demand for lithium has soared alongside rising battery production.

The EU agreed a €43bn plan that aims to boost EU production of semiconductor chips from 10% to 20% of the global total.

Chinese foreign minister Qin Gang said that: “Those who play with fire on Taiwan will eventually get themselves burned”.

UK deputy prime minister Dominic Raab resigned after an independent report upheld allegations of bullying.

US president Joe Biden has announced he will run for re-election.

French president Emmanuel Macron reiterated France’s commitment to Taiwan after he has been criticised for suggesting that Europe should distance itself from US-China tensions over the island.

Israeli prime minister Benjamin Netanyahu reinstated defence minister Yoav Gallant following protests and a general strike following his dismissal.

The FBI arrested Jack Teixeira, a member of the Massachusetts Air National Guard, following an investigation into the leak of highly classified US intelligence documents.

The German government granted Poland permission to transfer five MiG-29 fighter jets to Ukraine.

G7 member states criticised Japan’s climate strategy to use ammonia as low-carbon energy as its production heavily relies on fossil fuels.

Finland formally joined NATO. Sweden’s membership bid is being held up by Turkey and Hungary.

China conducted military manoeuvres around Taiwan as tensions rise following the visit of Taiwanese president Tsai Ing-Wen to the US.

A trade deal between the EU and Brazil, Argentina Uruguay and Paraguay has been held up by disagreement over binding commitments to prevent rainforest deforestation, the FT reports.

Saudi Arabia and Iran held official talks for the first time in seven years.

March saw headwinds across the financial sector affecting the IA North American Smaller Companies and large IA UK sectors in particular. The largest IA sector falls were IA North American Smaller Companies (-5.89%), IA UK Smaller Companies (-5.74%), and IA UK Equity Income (-4.08%). Conversely, with the pace of rate hikes being broadly expected to slow down, the best-performing IA sectors during March were the IA UK Index Linked Gilts (7.48%), IA Gilts (3.05%) and IA Global Inflation Linked Bonds (2.5%).

The SVB collapse on March 10th marked the largest bank failure since the Global Financial Crisis, resulting predominantly from poor management and overexposure to duration risk. SVB’s ill-advised strategy left the bank vulnerable to rising interest rates as the bank’s asset book, dominated by long-duration bonds, was coupled with a client base of venture-backed tech startups with correlated revenue streams. A botched attempt to raise capital led to a bank run and ultimately, the bank’s closure. A softening regulatory environment for smaller banks in the US was a contributory factor for this failure, and the bank’s poor management played a significant role in SVB’s collapse. “Quis custodiet ipsos custodes”? (Who will guard the guards?). This failure underscores the need for tighter regulations on small to mid-sized banks in the US to protect against such mismanagement.

Meanwhile, Credit Suisse faced its final crisis in the aftermath of the SVB collapse, admitting weaknesses in financial controls and experiencing a sharp drop in its share price following an announcement by the Saudi National Bank confirming it had no plans to provide additional capital. A string of scandals, money laundering, and exposure to insolvent entities had eroded confidence in the bank, leading to massive withdrawals and a takeover by rival UBS. In Credit Suisse’s case “alea iacta est” (the die is cast), as years of scandal ultimately sealed the bank’s fate.

These two cases, while significant, are unlikely to indicate a systemic issue within the banking sector. Both banks’ failures resulted from poor management and unique circumstances, suggesting that fears in other regions may be overstated. Nonetheless, tighter regulations and oversight may be necessary to prevent similar collapses in the future.

According to the Office for National Statistics (ONS), the consumer price index (CPI) rose 10.1% in the year to March, down from February’s 10.4%, but still higher than economists’ expectations for a 9.8% print. It marked the seventh successive month that headline CPI remained in double figures.

The monthly CPI rise was 0.8%, compared to a 1.1% increase in February, with motor fuels and heating oil prices making the largest downward contributions. However, food prices were a significant weight on the index, hitting a fresh 45-year high of 19.2% in March, up from February’s 18.2%.

The core CPI including owner-occupier housing costs (CPIH) rose 5.7% in the 12 months to March, unchanged from February. Core CPI itself was 6.2%, also higher than the expected 6.0%.

Separate ONS data meanwhile showed that UK house price growth slowed for the third consecutive month in February. Average UK house prices increased 5.5% in the 12 months to February, down from January’s upwardly revised growth of 6.5%.

The current inflationary environment may resemble the 1970s, when wage-price spirals fuelled inflation; however, stagflation seems unlikely based on current forecasts. Last month’s rise in inflation appears to be more a result of sector-specific volatility and short-term factors rather than a long-term problem. While the ongoing rate rises may curb demand-pull inflation in the short term, knock-on effects like delayed output cost rises and wage increases could cause inflation to tick back up after an initial fall. In this environment, companies that are not interest rate-sensitive and have low debt burdens and resilient cash flows are likely to perform best, while those with opposite characteristics may see share price erosion.

The outlook for the real estate market in 2023 presents several challenges, with rising financing costs and constrained debt availability emerging through the course of 2022. Interest rates have increased on both sides of the Atlantic, making debt for real estate harder to come by, resulting in decreased appetite for leverage and putting existing real estate capital under pressure.

Amidst these headwinds, opportunities are emerging for organisations with the flexibility to pivot and respond to shifting market dynamics. Real estate companies will also need to focus on embracing digital transformation and implementing ESG best practices to future-proof their operations. In these tumultuous times, it’s the adaptable and resilient players in the real estate market who will continue to find opportunities to invest in high-quality assets and thrive, offering potential investment prospects for fund managers.

Chinese President Xi Jinping and Russian President Vladimir Putin held a three-day summit in Moscow to discuss strengthening their bilateral relationship amid growing rifts with Western countries. China, alongside India and other nations, has become Russia’s main economic support in the face of crippling sanctions imposed by the West. During the meeting, Putin and Xi signed two joint documents, one detailing plans for economic cooperation and another outlining the deepening Russia-China partnership. Although Xi made little mention of the Ukraine conflict, the summit signified Putin’s ability to maintain the support of a powerful ally despite Western attempts at isolating Russia.

Xi Jinping has been cautious about adopting a hawkish stance in the context of China’s recent posturing towards Taiwan, as Beijing seeks to avoid triggering alarm bells in the international community. While emphasizing China’s ties with Russia as “no-alliance, no-confrontation and not targeting any third party,” Xi focused on economic cooperation, with little discussion about military cooperation. While Putin may have hoped for more substantial Chinese support, such as weapons or financial aid, the public diplomacy and joint agreements on economic cooperation and deepening their partnership sends a strong message. One key outcome was the agreement on a new gas pipeline to China, with Russia essentially serving as a fuel provider for its eastern neighbour. As tensions rise over a potential conflict with Taiwan, China is keen to secure as many natural resources as possible.

The outcome of the summit demonstrates the delicate balance both leaders are trying to maintain. Putin aims to secure tangible support from China in the face of Western sanctions, while Xi is careful not to provoke additional hostilities or alienate key trading partners. While the meeting may not have resulted in all of Putin’s desired outcomes, the strengthening of the Russia-China alliance is a significant development in the evolving geopolitical landscape.

For a fuller version of Clarion’s Economic and Stock Market Commentary, written by Clarion Group Chairman Keith Thompson, please click here

Long-dated bonds are yet to reach a yield that justifies their position. In the Investment Committee’s view, the additional risk that is taken by adding duration is not yet met with an appropriate term premium. The Committee expect interest rates to continue to rise and/or remain elevated and inflation to stay higher for longer. As such, the Committee maintain an underweight to bonds across funds, this goes hand in hand with maintaining a slight bias towards short-dated bonds. The Committee are, however, slowly extending the underlying duration of the bond allocation within the relevant Clarion funds.

The Committee identify potential value in the UK market, which has experienced a period of increased political risk due to Brexit-related uncertainties. They anticipate that as Brexit issues continue to be addressed and resolved, there may be relative gains to be made in the UK. In comparison to other developed economies, the UK is more attractively priced, which contrasts with richly valued US stocks. Moreover, UK market constituents are better equipped to withstand rising interest rates, as they generally carry lower debt burdens compared to their US counterparts. As a result, Committee have decided to retain an overweight position in the UK and an underweight position in the US.

The Committee observe that China’s macroeconomic environment differs significantly from that of developed economies. Inflation remains subdued, and accumulated savings from Covid lockdowns are just beginning to re-enter the economy. Although the Chinese economy faces substantial political risks, both from domestic regulations and global tensions with political adversaries, the consensus is that the market’s valuations are highly attractive. In the Committee’s assessment, the potential rewards offered by these valuations and favourable macroeconomic factors outweigh the associated political risks. Consequently, the portfolios with a higher risk tolerance maintain an overweight allocation to Asian equities, reflecting the Committee’s confidence in the opportunities presented by the Asia Pacific region, particularly in China.

The key themes are as follows:

In the Committee’s view, central banks are likely to shift from the previous inflation target of 2% to a higher figure or a floating range, which will most likely be around 3-4%. The amount of economic destruction required to bring inflation back to a 2% target would be too great to be justifiable. Coupled with multiple developed economies (US and Europe) trying to ease the reliance on supply chains from China, inflation is likely to be stickier, although much lower than current levels, than initially thought.

Continuing to hold a globally diversified portfolio of high-quality assets is important to protect and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

April 2023

Creating better lives now and in the future for our clients, their families and those who are important to them.

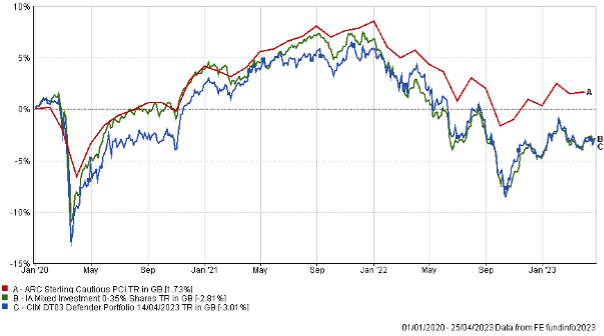

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/2022

to 31/03/2023 |

31/03/21 31/03/20

to to 31/03/22 30/03/21 |

|

| CIM DT03 Defender Portfolio | -7.11% | 1.34% 13.36% |

| ARC Sterling Cautious PCI | -3.83% | 1.62% 11.34% |

| IA Mixed Investment 0-35% Shares | -5.94% | -0.20% 12.09% |

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22 to 31/03/23 | 31/03/21 to 31/03/22 | 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | |

| MGTS Clarion Prudence P Acc | -7.44% | 2.30% | 18.26% | -7.89% | 3.87% |

| CIM DT04 Prudence Portfolio | -7.58% | 2.88% | 18.24% | -7.42% | 4.15% |

| ARC Sterling Cautious PCI | -3.83% | 1.62% | 11.34% | -2.29% | 1.71% |

| IA Mixed Investment 20-60% Shares | -4.80% | 2.73% | 19.83% | -7.19% | 2.86% |

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | |

| MGTS Clarion Navigator P Acc | -6.97% | 2.81% | |||

| CIM DT05 Navigator Portfolio | -6.97% | 2.81% | 22.28% | -9.14% | 4.12% |

| ARC Sterling Balanced Asset PCI | -4.32% | 3.46% | 17.86% | -5.44% | 2.98% |

| IA Mixed Investment 40-85% Shares | -4.54% | 5.23% | 26.44% | -7.99% | 4.30% |

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 30/12/21

to 30/12/22 |

30/12/20

to 30/12/21 |

30/12/19

to 30/12/20 |

30/12/18

to 30/12/19 |

30/12/17 to 30/12/18 | |

| MGTS Clarion Meridian P Acc | -7.50% | 1.50% | 30.12% | -10.01% | 4.27% |

| CIM DT06 Meridian Portfolio | -6.65% | 1.76% | 30.90% | -9.43% | 4.28% |

| ARC Steady Growth PCI | -4.60% | 4.64% | 23.53% | -7.71% | 4.85% |

| IA Mixed Investment 40-85% Shares | -4.54% | 5.23% | 26.44% | -7.99% | 4.30% |

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

31/03/19

to 31/03/20 |

31/03/18

to 31/03/19 |

|

| MGTS Clarion Explorer P Acc | -7.41% | 1.90% | 34.77% | -9.05% | 4.23% |

| CIM DT07 Explorer Portfolio | -6.44% | 1.61% | 35.28% | -10.10% | 5.22% |

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% | -9.65% | 6.04% |

| IA Flexible Investment | -4.03% | 4.95% | 29.10% | -8.14% | 3.31% |

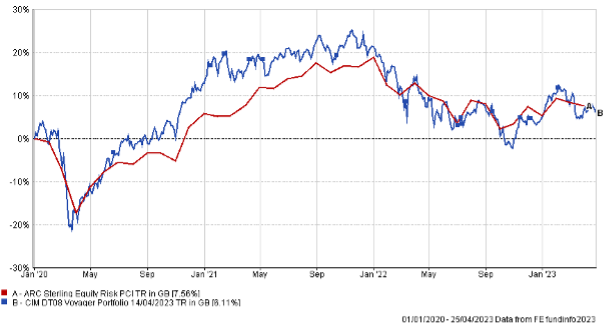

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

|

| CIM DT08 Voyager Portfolio | -6.00% | -1.91% | 39.32% |

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% |

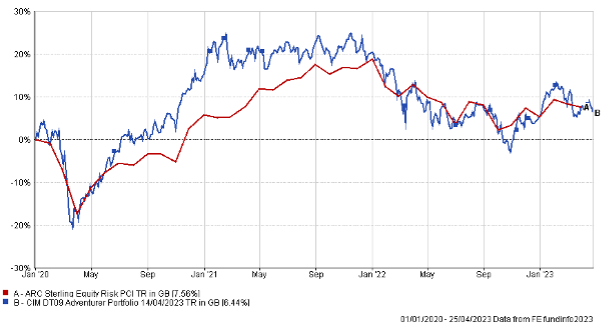

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

|||

| CIM DT09 Adventurer Portfolio | -4.13% | -5.07% | 42.38% | ||

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% |

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 30/12/22

to 30/12/23 |

30/12/21

to 30/12/22 |

31/03/20

to 31/03/21 |

|||

| CIM DT10 Pioneer Portfolio | -4.11% | -6.12% | 45.66% | ||

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% |

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.