Category: Financial Planning, Investment management, Our team news

The Clarion Investment Committee met on 18 April 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

UK inflation fell to 3.2% in the 12 months to March, a lower-than-expected fall from 3.4% the previous month. Core inflation and services inflation also saw modest declines but remained above the headline reading, at 4.2% and 6%, respectively.

UK wage growth was stable at 5.6% in the three months to February compared with the same period last year. Analysts had expected a slight decline.

UK unemployment rose by 0.3 percentage points to 4.2% in the three months to February compared with the preceding three months. Bank of England policymakers will have to weigh continued wage pressures against signs of falling worker bargaining power in deciding monetary policy.

The UK government has advised its port authorities that it will not enforce border checks on food and plant imports from the EU as planned later this month, instead opting for a phased approach, the FT reports.

The IMF published forecasts predicting strong growth in output in the US and emerging markets this year and slower growth in other advanced economies.

US retail sales grew by 0.7% from February to March, the latest in a string of red-hot data from the world’s largest economy.

US president Joe Biden called for a tripling in tariffs on imports of Chinese steel and aluminium.

The price of cocoa hit a record high following disease and poor weather linked to climate change in West Africa.

The Japanese yen fell to its lowest level against the dollar since 1990. Following this the US, Korean and Japanese governments issued a joint statement that they would “consult closely on foreign exchange market developments”, highlighting concern over currency weakness

The Chinese economy posted growth of 5.3% in the first quarter compared with the same period last year. A fall in property investment of 9.5% was offset by a 9.9% increase in manufacturing investment. This evidence of manufacturing-led growth will do little to assuage concerns about Chinese industrial overcapacity.

The VIX volatility index, sometimes called Wall Street’s fear gauge, hit its highest level since the aftermath of the Hamas attack on Israel last October. Fears over escalating conflict in the Middle East and fading expectations for rate cuts this year are the likely drivers.

UK prime minister Rishi Sunak spoke of the need to “change the sick note culture” in the UK in a speech on welfare reform, claiming that spending on Personal Independence Payment is forecast to increase by 50% over the next four years.

Data from the S&P Global Composite PMI index suggests that the UK economy returned to growth in the first quarter of 2024 following the technical recession in the second half of 2023.

UK mortgage approvals rose to the highest level in 17 months in March, according to the Bank of England.

Data showed that last month was the warmest March on record with average temperatures 1.68°C warmer than pre-industrial levels. The record temperature experienced for the tenth consecutive month can partly be explained by the El Niño weather system but has sparked some concerns that the world is warming at a faster-than-expected rate.

The rising price of oil, which has broken through $85/barrel in recent weeks, contributed to a 6.4% increase in US petrol costs from February to March, driving the overall inflation reading upward and creating political problems for president Joe Biden.

Financial markets scaled back their expectations for US rate cuts following the inflation news, and now expect one to two cuts this year while the dollar strengthened, rising to its highest level against the sterling and the euro since last November.

The ECB kept its benchmark interest rate on hold at 4% and hinted it could begin rate cuts in June.

A review of the Bank of England’s forecasting approach by former Fed chair Ben Bernanke was critical of the Bank’s economic modelling and recommended a number of changes.

US Treasury secretary Janet Yellen warned China that the US would not accept a repeat of the “China shock” of the early 2000s when rising Chinese imports displaced American manufacturing jobs as she urged Beijing to reduce excess industrial capacity.

The population of Japan fell by 595,000 in the year to October 2023, in large part due to low birth rates. A fall of 837,000 Japanese nationals was partly offset by rising immigration.

Troubled UK utility Thames Water could be nationalised with lenders to the operating company facing losses of up to 40% under government contingency plans, the Guardian reports.

Blackstone President Jonathan Gray said that it would take time for private equity firms to return cash to investors. This follows two years of turgid M&A activity that has led to a record backlog of unsold assets.

UK car insurance prices fell for the first time in two years in the first quarter but are still up 43% on the year, according to data from Confused.com.

Streaming giant Netflix reported a 54% rise in operating income in the first quarter as its efforts to crack down on password sharing last year bore fruit.

Apple removed Meta’s WhatsApp and Threads apps from its App Store at the direction of the Chinese government due to national security concerns.

UK MPs voted to ban anyone born in or after 2009 from ever purchasing cigarettes, leading to an effective ban over time.

Blackrock, the world’s largest money manager, announced growth in assets under management to a record $10.5 trillion, in part due to the success of a new Bitcoin exchange-traded fund.

US banks JPMorgan, Citigroup and Wells Fargo reported better-than-expected results in the first quarter.

The UK National Farmers’ Union warned of substantially reduced food production this year following extreme weather and flooding linked to climate change. Vice president Rachel Hallos warned that “these extremes could soon become the norm”.

The NHS England waiting list fell for a fifth month, down to 7.54 million in February from a peak of 7.75 million.

UK supermarket Tesco reported 4.4% sales growth and a 159% increase in profit before tax and noted an easing of inflationary pressures.

US carmakers and insurance companies are set to face lower sales and higher costs following the Baltimore bridge collapse. The city is the US’s largest vehicle import destination.

International cruise operator Carnival Cruise Line raised its profit expectations for this year as higher prices and strong demand boosted earnings, however, they warned that the Baltimore bridge collapse may cause a $10 million hit to profits due to higher costs.

Iran attacked Israel with over 300 drones and missiles with almost all being brought down before striking their intended targets. Israel’s war cabinet said the country would respond “in the manner and at the time of our choosing”. The US urged restraint as it sought to prevent a slide into a wider Middle Eastern war.

Israel subsequently launched missiles against targets in Iran, including the City of Isfahan, which is home to military and atomic sites.

Prior to this, the Iranian government had said that it may “reconsider” its nuclear doctrine, which it claims is peaceful, should Israel threaten its nuclear installations.

The International Atomic Energy Agency confirmed that there had been no damage to nuclear sites on Friday.

Iranian oil exports are at a six-year high, selling 1.56 million barrels a day mostly to China in the first three months of the year despite Western sanctions, according to data from Vortexa.

Peter Murrell, former chief executive of the Scottish National Party and husband of former first minister Nicola Sturgeon, was charged in connection with the embezzlement of party funds.

Police in Germany apprehended two men it suspects are Russian agents who were planning to bomb military and industrial sites to disrupt aid deliveries to Ukraine. Police in Poland also detained a man suspected of passing information to Russian agents.

Indians began voting last week in a six-week election that is expected to deliver another five-year term for prime minister Narendra Modi.

The European Commission said that it will seek its members’ approval to offer a youth mobility scheme to the UK, allowing young people in the UK and EU the ability to work and study on both sides of the Channel. The Labour Party downplayed the offer, saying it would cross red lines on freedom of movement.

The US House of Representatives approved a new $61 billion package of military assistance for Ukraine after six months of delays. Ukraine will face a major challenge deploying new US weapons at speed to stem Russia’s advance

Greater Manchester Police announced that they were investigating Labour deputy leader Angela Rayner over allegations that she broke electoral law by failing to properly declare her main residence.

Ukraine’s military intelligence chief said that Ukraine should expect a large Russian offensive in late spring or early summer.

US president Joe Biden called for an “immediate ceasefire” in Gaza.

Please click here to access the April Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

In March, the Bank of England’s Monetary Policy Committee voted to hold rates at 5.25% for the fifth consecutive time, marking the first occasion since September 2021 that no members of the Committee advocated a rate hike.

In the latest inflation data, there was a notable decrease in March’s CPI figure, which fell to 3.2%, a move in the right direction to cut rates. This was driven by a drop in food and non-alcoholic drink costs, as well as prices in restaurants and cafés. Housing and fuel prices, on the other hand, continued to rise rapidly, with the cost of renting jumping by 9% in the year to February.

Furthermore, persisting issues in the Red Sea could pose a risk to inflation figures, with speculation that the impact of the crisis may not have materialised. Markets are still, however, pricing in three cuts for 2024.

Meanwhile, indications of expansion in the UK’s GDP figure have led the MPC to project a growth acceleration in the latter half of 2024. March’s data suggests a modest uptick, with monthly real GDP estimated to have increased by 0.2% in January 2024.

Businesses are poised to ramp up investment levels, while higher disposable incomes are anticipated to fuel demand for goods and services. Measures such as the government’s freeze on fuel duty and declines in energy and food prices are still, however, forecasted to counteract this demand and push inflation below 2% in the second half of the year.

Nonetheless, the ONS’s data on government debt unveils a less optimistic aspect, with government borrowing in February exceeding expectations, coming out at £8.4 billion compared to the £6 billion anticipated by many economists.

The variance can be attributed to factors such as cost-of-living payments and inflation-linked increases in benefits. Consequently, as of February, the national debt stood at 97.1% of GDP. This underlines the complex dynamics shaping the UK’s economic outlook.

Rising inflation and high interest rates acted as a headwind for M&A activity in the first half of 2023 but with these stabilising, the UK could see a rebound in activity. According to research by the BDO and Make UK, 26.8% of UK manufacturers are looking to make acquisitions in the next two years as they seek to scale up operations and access new products and markets. Low valuations in the UK market may attract potential buyers and encourage acquisitions. This may be good news for the UK small-cap market where valuations are particularly compressed as companies subject to M&A activity could experience upticks in share prices.

Shifting focus to the US, the small-cap rally experienced in the final months of 2023 has waned with small-cap stocks performing approximately in line with large companies in March.

The performance of small-cap stocks in the US over the last decade represents a divergence from the historical tendency for fast-growing small caps to outperform over the long term. Greg Tuorto, a small-cap portfolio manager at Goldman Sachs, highlighted the potential need for an uptick in M&A or a thriving IPO market to drive small-cap performance.

Moreover, higher for longer interest rates may also be a headwind for small caps; approximately 40% of debt on Russell 2000 balance sheets is short-term or floating rate, which compares to 9% for S&P 500 companies.

It is worth noting, however, that companies on floating rates have already been subject to high interest rates, and the rally in small caps at the tail end of last year may evidence their ability to weather that storm. Once S&P 500 companies eventually refinance at higher rates, the question that arises is how well they will fare compared to small caps in that environment.

During their most recent meeting in March, the Fed decided to hold rates. Chair of the Fed, Jerome Powell indicated a potential cut of up to 75 basis points in 2024, leading to a temporary boost in the Russell 2000; the index was up by a percentage point more than the S&P 500 on the day.

The discount on small caps may hold potential for growth, since multiples this cheap have, historically, been proceeded by significant returns.

The dwindling of small caps relative to their mega-cap peers underscores the concentration of investment into the Magnificent Seven. However, the rally of some of these stocks is starting to dwindle; Apple and Tesla fell 11% and 30% respectively in Q1 2024. Meanwhile, Alphabet shares experienced lacklustre performance at the beginning of the year before recovering in March.

This has led many strategists to christen a new “Fab Four,” with Nvidia, Meta, Microsoft and Amazon continuing their spectacular run.

Since all of the S&P 500 sectors, with the exception of real estate, recorded gains in the first quarter, one can conclude the US equity market remains bullish. This is good news for the comparatively weaker small-cap sector as it indicates that the market is beginning to broaden beyond mega-cap technology stocks.

The investment Committee maintain a tactical positioning consistent with a sector-neutral fixed income duration approach, reflecting a preference for stability and risk management in fixed income assets.

The persistent low levels of speculative-grade fixed income spreads compared to historic averages suggest that the market may not be adequately pricing in the default risk associated with these assets, particularly considering the looming debt maturity wall. Consequently, the Committee maintain a cautious outlook on high-yield corporate debt.

An underweight position in US equities is maintained across all portfolios, driven by the belief that the market is concentrated in a small number of overvalued technology stocks.

This view is supported by comments made above that the “Magnificent Seven” may be devolving into the “Fabulous Four.” Meanwhile, we remain overweight to UK equities due to the potential for significant gains on the back of attractive valuations.

As for Asia Pacific, we remain overweight to the region motivated by the belief that Chinese equities are undervalued due to disproportionately high-risk premiums. Significant regional outperformance is anticipated should valuations return to historical averages.

The key themes can be summarised below as:

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

April 2024

Creating better lives now and in the future for our clients, their families and those who are important to them.

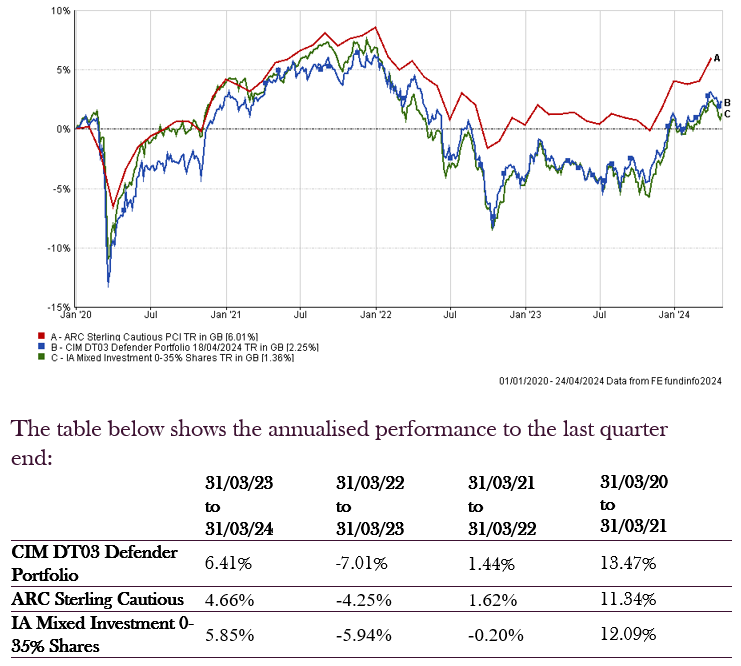

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

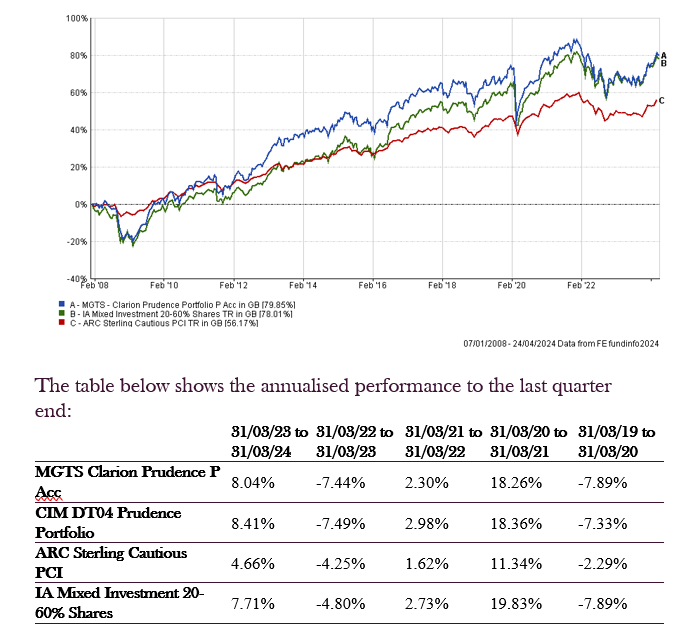

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

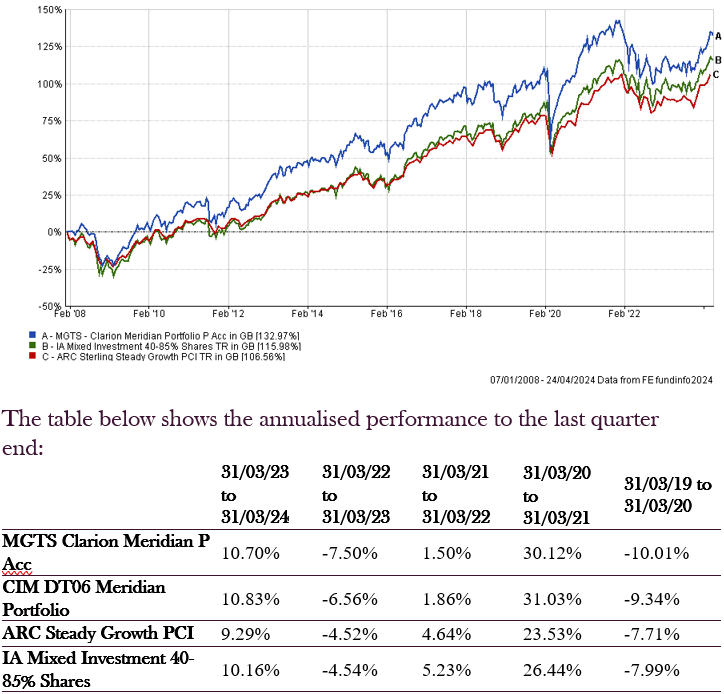

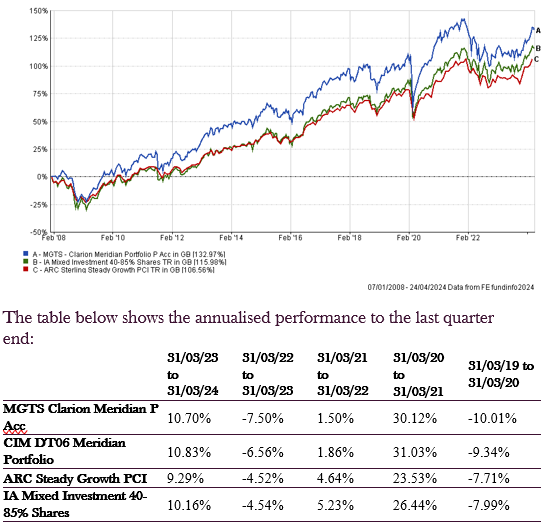

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

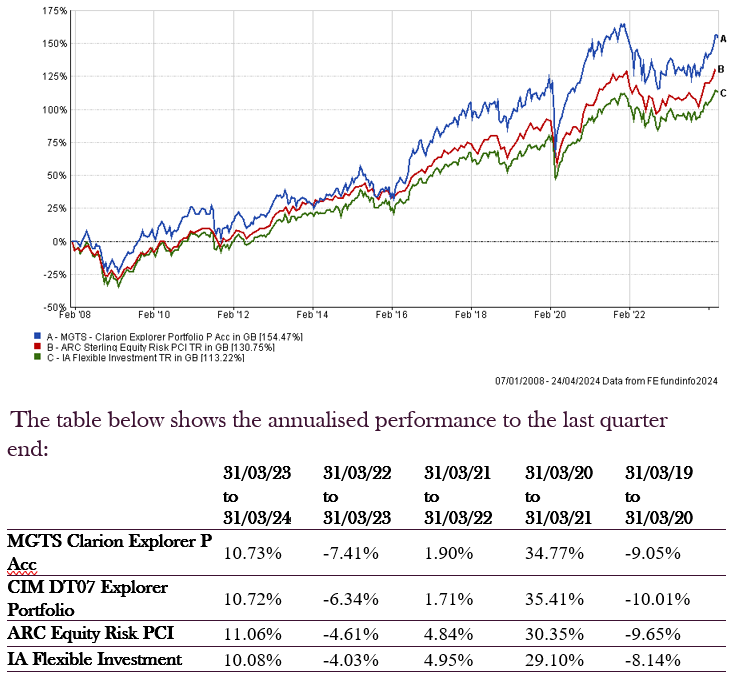

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

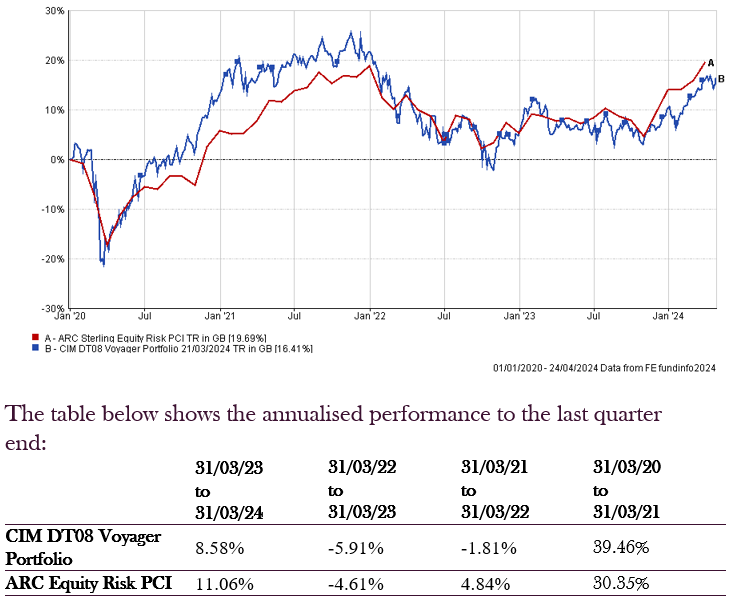

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

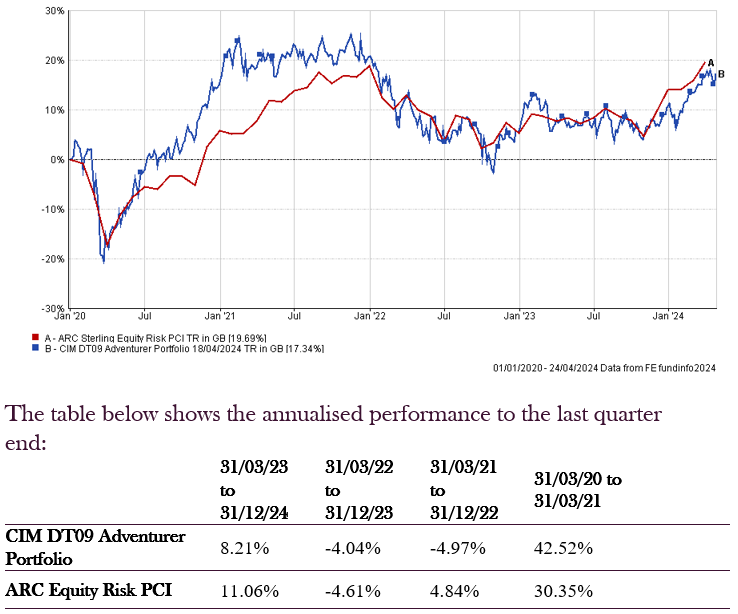

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.