The Clarion Investment Committee met on 15 April 2025. The following notes summarise the main points of consideration in the Investment Committee discussions and provide information about our current investment strategy and fund performance.

Please click here to access our April Stock Market & Economic Commentary written by Clarion Group Chairman, Keith Thompson.

Economic & Market Snapshot.

Economics

- US president Donald Trump said he has “no intention” of firing Federal Reserve chair Jay Powell following his recent criticism of the Fed. Equities rallied on the news

- China has granted some exemptions to import tariffs on US goods, according to the lobby group American Chamber of Commerce in China

- Estimates of business activity in April from surveys of purchasing managers indicated a slowdown in growth across the US and the euro area. UK activity declined at its fastest pace since November 2022

- US equities have underperformed the rest of the world this year by the widest margin in 32 years

- In a sign of rising risk aversion, Japanese investors sold more than $20 billion of international bonds at the start of April, one of the largest outflows on record since 2005

- Gold prices rose above $3,500 per troy ounce for the first time as ongoing global uncertainty boosted demand for the safe-haven asset

- UK chancellor Rachel Reeves said that she is “confident” of securing a trade deal with the US amid ongoing trade talks

- The UK government announced a review of the low value import scheme, whereby imports under £135 are exempt from customs duties, following fears of Chinese firms “dumping” products in the UK as they reroute goods from the US to avoid tariffs

- The UK government borrowed £15 billion more than expected in the 12 months to March, according to the Office for National Statistics (ONS), raising concerns that the government may have to adjust spending and taxation plans to meet its fiscal targets

- UK retail sales unexpectedly rose in March by 0.4% compared with the previous month, with recent good weather providing a boost to sales

- UK consumer confidence fell in April to its lowest level since November 2023 due to rising bills and deteriorating future economic expectations

- Declining cash transactions, despite a record £86 billion worth of banknotes in circulation, suggest UK consumers are hoarding cash as a store of value, according to analysis by the FT

- Insolvencies of UK recruitment firms over the last six months rose by the fastest rate since the global financial crisis, according to analysis by City AM

- German business sentiment improved slightly in April, according to the ifo Business Climate survey, however, future expectations fell. The ifo Institute commented that “the German economy is preparing for turbulence”

- The European Central Bank (ECB) cut the benchmark interest rate to its lowest level since 2022, to 2.25%. The ECB noted that “the outlook for growth has deteriorated owing to rising trade tensions”

- Chinese GDP increased to 5.4% in the first quarter of 2025 compared with the same period last year, exceeding expectations as producers brought forward exports ahead of rising US tariffs on Chinese goods

- The UK economy grew by 0.5% in February compared with the previous month, above expectations of 0.1% and the fastest monthly growth rate since March 2024

- UK house prices unexpectedly fell by 0.5% in March compared with the previous month, according to Halifax, as buyer demand normalised following a surge in activity prior to the March Stamp Duty deadline

- UK government long-term borrowing costs rose to their highest level since 1998 following a global bond market sell-off amid recent trade uncertainty. Borrowing costs across most major economies also rose.

Business

- The EU has fined Apple €500 million and Meta, owner of Facebook, €200 million for breaching competition regulations

- Apple said it plans to shift production of its US-sold iPhone from China to India, the FT reports, amid rising US-China trade tensions

- The FT reports that US Republicans are planning to close the US audit regulator founded in the wake of the Enron scandal as part of the administration’s deregulation agenda

- German logistics company DHL said it was suspending some deliveries to the US due to recent higher administration costs

- Chinese battery manufacturer CATL revealed a car battery that provides 520 kilometres from just 5 minutes of charging, surpassing the 470 kilometres recently announced by Chinese rival BYD

- Steel manufacturer British Steel reversed plans to cut 2,700 jobs following the UK government’s takeover of its Lincolnshire production site

- The cost of obtaining planning permission for the Lower Thames Crossing tunnel project surpassed £450 million, more than one-third of total spending to date, the FT reports, highlighting the complex UK planning and regulatory environment

- The UK will expand its domestic production of explosives following investments made by defence company BAE Systems, in a bid to reduce the UK’s reliance on international partners

- Harvard University is suing the Trump administration over the government’s decision to freeze more than $2.2 billion of federal funding and increase oversight of the university

- Luxury fashion brand Hermès announced future price rises in the US to counter higher US import tariffs

- US semiconductor manufacturer Nvidia said that it expected to take a $5.5 billion hit to earnings in the three months to April because of new export restrictions on its ability to sell chips to Chinese organisations

- Demand for London office space increased 39% in the first quarter of this year compared with the previous quarter, according to estate agent Knight Frank, in part due to the increasing return-to-office trend

- US private equity firm Atlas announced a £236 million takeover of UK banknote printer De La Rue

- Car manufacturer Jaguar Land Rover paused car shipments to the US for one month following the imposition of 25% import tariffs by the US

- US entertainment organisation Universal announced plans to build a theme park in Bedfordshire, to be opened in 2031. James Bond and Paddington Bear are among the attractions, the BBC reports

- Luxury fashion brand Prada announced the purchase of rival brand Versace for $1.4 billion.

Global & Political Developments

- President Trump and president Zelensky held talks on the fringes of the Pope’s funeral, after which Mr Trump suggested that Vladimir Putin could be stringing him along over ending the war in Ukraine

- Mr Zelensky said that their 15-minute conversation had the “potential to become historic”, and the White House described it as “a very productive discussion”

- The Wall Street Journal reports that Mr Trump’s approval rating has declined by about seven points since the start of the administration in the polling average maintained by analyst Nate Silver. The loss of confidence in Mr Trump’s ability to manage the economy is especially striking. A Fox News poll released last week shows that 38% approved of Mr Trump’s handling of economic matters and 56% disapproved

- Pakistan said it would suspend its peace treaty with India as tensions rise following the killing of 26 tourists in the Kashmir region

- China has seized a disputed reef close to the Philippines’ most important military outpost in the South China Sea, increasing the chances of a stand-off between the two countries

- US vice president JD Vance said that there is a “good chance” of a US-UK trade deal. Trade talks are currently ongoing

- The FT reported that in recent weeks, Chinese state-backed investment funds have been pulling back from investing in the funds of US-headquartered private capital firms

- A migrant returns pilot scheme between the UK and France to return migrants is currently under discussion

- The US House of Representatives China committee is questioning how the Chinese company DeepSeek obtained and used US export-controlled chips, produced by US technology company Nvidia, to power its artificial intelligence app

- The US has imposed sanctions on a Chinese oil refinery in response to their purchasing of more than $1 billion worth of Iranian crude oil, the latest action of increased US pressure against Iran

- Donald Trump said the US will hold high-level talks with Iran to discuss its nuclear arms programme

- Swiss president and finance minister Karin Keller-Sutter said that Switzerland wanted to “deepen relations with the EU”, while UK chancellor Rachel Reeves said an improved UK-EU relationship was “imperative” amid rising global tensions. Both finance ministers met with EU counterparts last week

- The UK Cabinet Office said that nearly one-third of staff, totalling 2,100, would be cut or moved to another department amid wider government plans to boost public sector efficiency

- The UK’s Reform Party said it would not form coalitions with the Conservative Party in the upcoming local elections in May.

Strategy

- The bond allocations within the portfolios target short and mid sections of the yield curve where capital appreciation is expected.

- High-yield bond strategies are avoided as credit spreads do not currently offer a worthwhile risk premium.

- The US equity market is underweighted on a valuation basis, and strategies within the portfolio are particularly underweight mega-cap stocks.

- The UK equity market is conversely overweighted on a valuation basis.

- Asia, Emerging Markets, and China are also overweighted as they trade below their long-term historical averages after experiencing a period of poor performance. The IC believe these regions have the potential to grow their valuations in the long term from a low base.

- UK and US small and mid-cap equity allocations are also included based on an attractive entry point, which current valuations provide.

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future. Geopolitical risks remain elevated.

- No changes were considered necessary to the underlying funds.

- We are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Europe, Asia, and Emerging Markets where valuations are generally more attractive which will help to offset some of the economic headwinds and geopolitical uncertainty.

Clarion Funds:

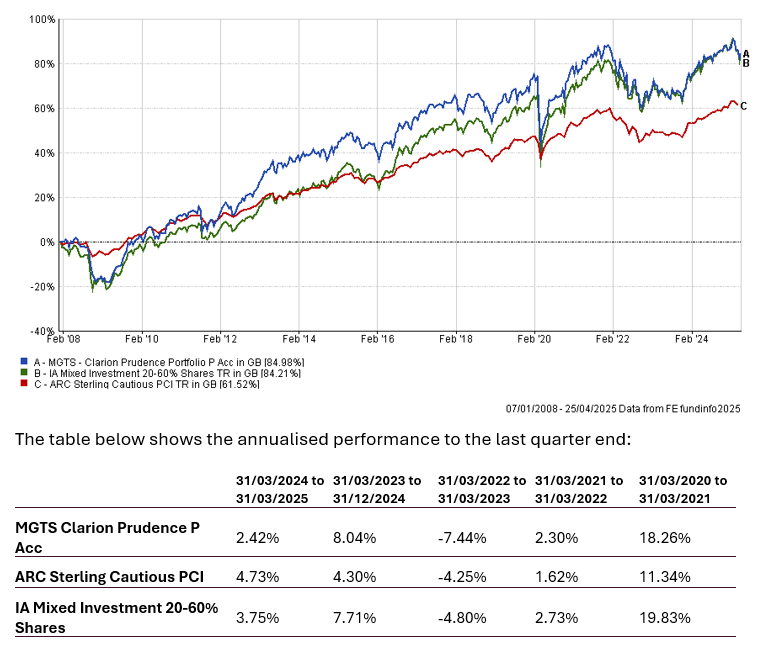

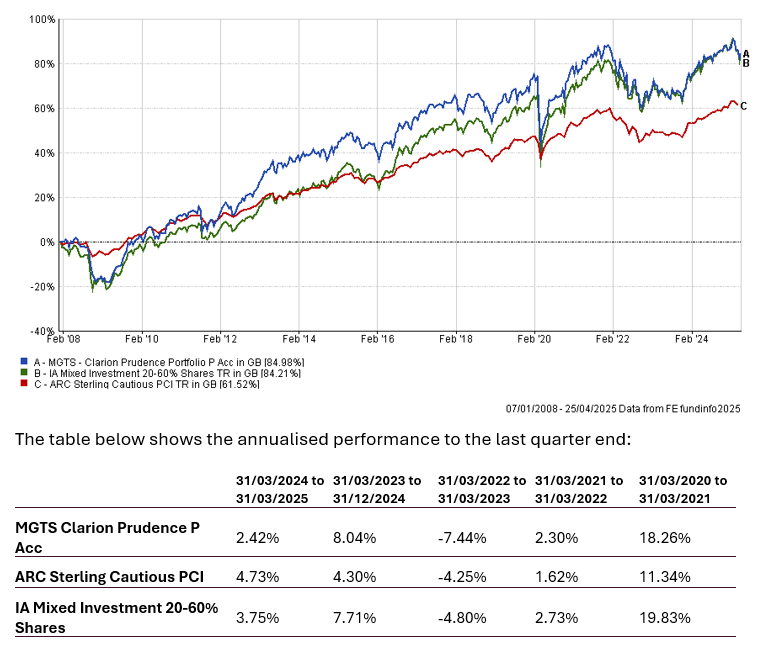

Prudence Fund

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund

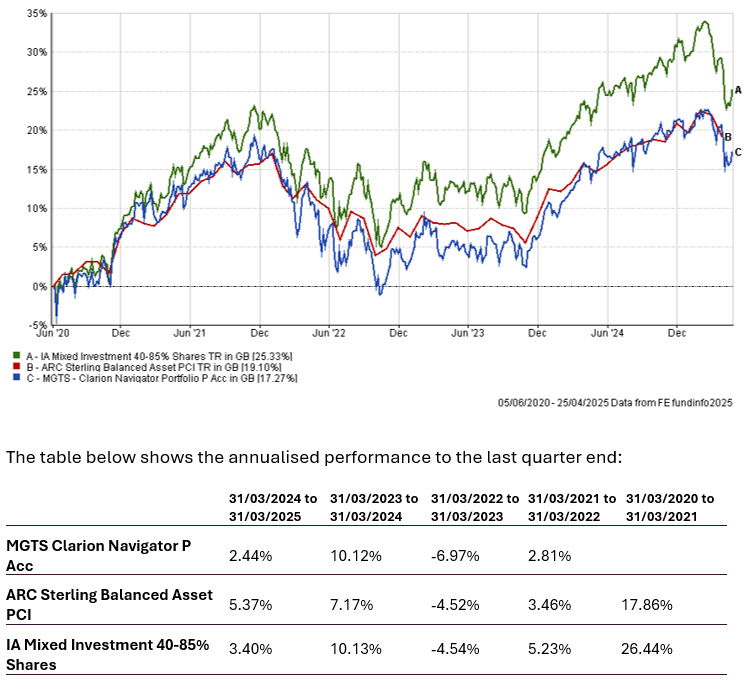

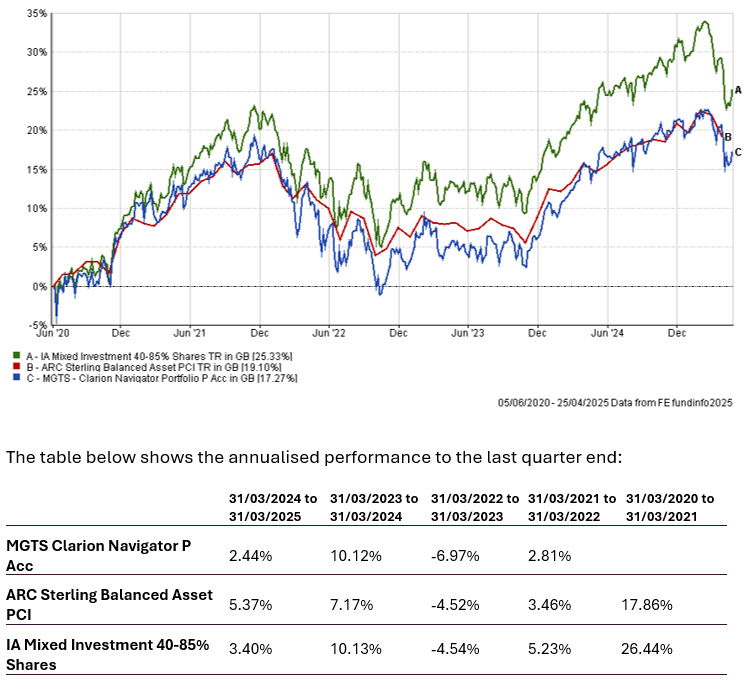

Navigator Fund

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund

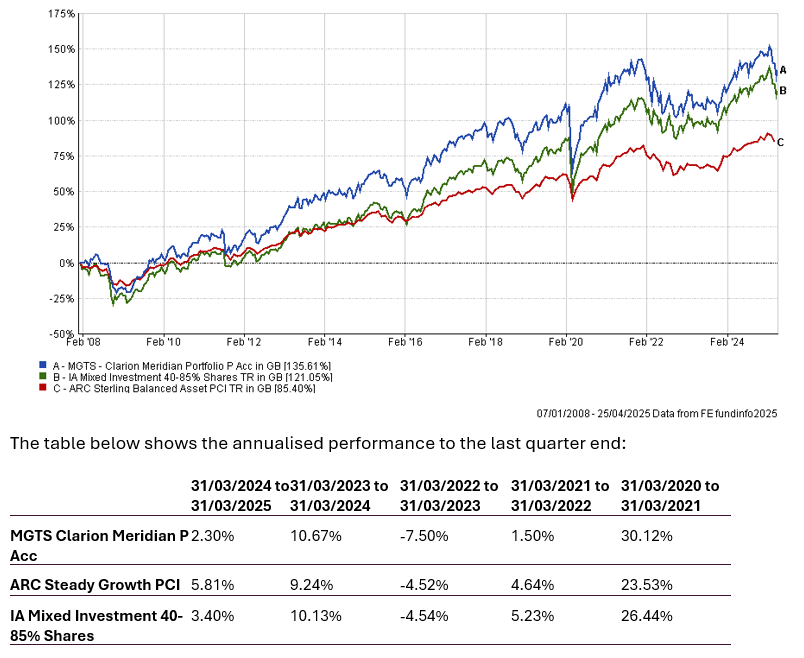

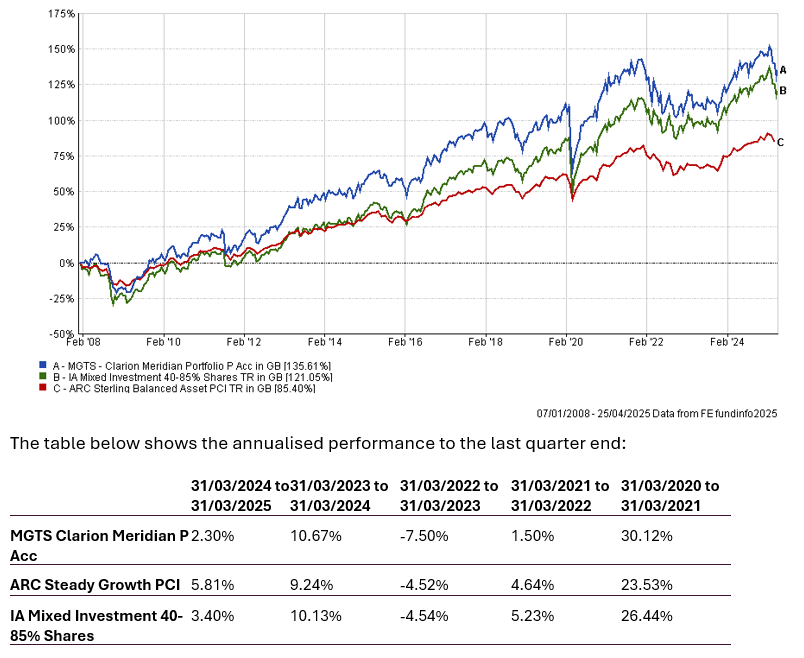

Meridian Fund

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund

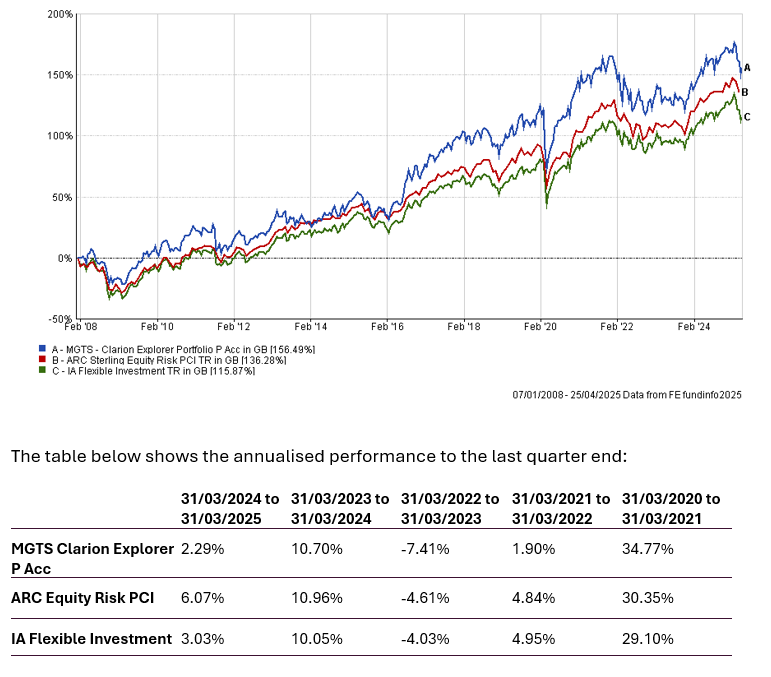

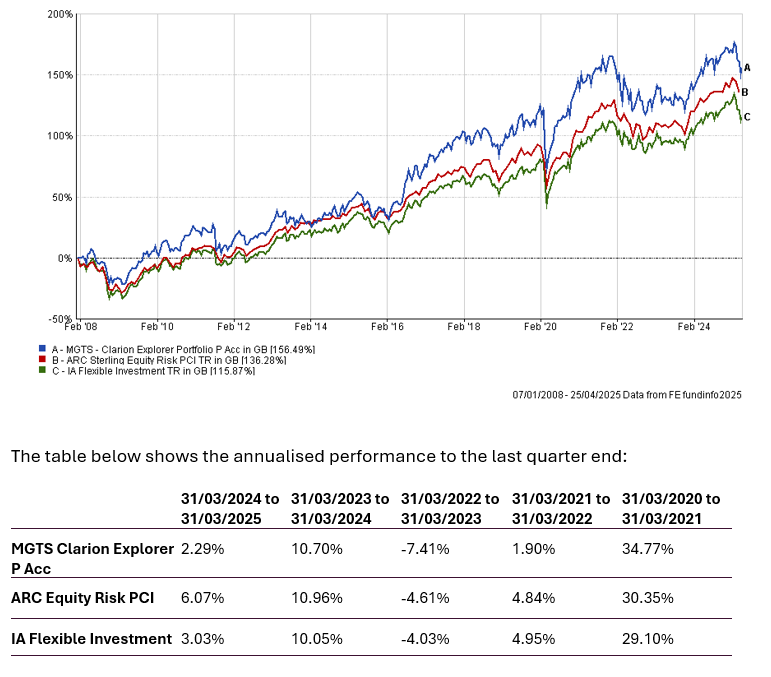

Explorer Fund

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

April 2025

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.