Minutes of the Clarion Investment Committee held at 10am on 20th August 2020 by video link.

Committee Members in attendance: –

| Sam Petts (SP) |

IC Chairman and Financial Planner |

| Keith Thompson (KWT) |

Clarion Chairman |

| Dmitry Konev (DK) |

Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) |

Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) |

Technical Assistant Clarion |

|

|

Apologies from Ron Walker, Founding Director, Clarion.

Review of previous minutes and action points

Minutes from the previous meeting held on 16th July 2020 were agreed by the Committee as a true and accurate record.

Economic commentary and market outlook

Please click here to access the August Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee

- Markets continue to rise albeit with bouts of volatility. Smaller companies and technology shares have led global shares higher. Market optimism seems to be based on the presumption that further fiscal stimulus will be forthcoming in the US.

- The market continues to ‘look through’ the dire economic numbers from lockdown – the UK has now officially entered a recession and seen its largest drop in employment in over a decade – and is focusing instead on the rebound in activity that has occurred since restrictions were loosened in June.

- Commodity markets have been heating up recently too, with both cyclical commodities (oil) and defensive commodities (gold) rallying. Whilst gold has been in spotlight, briefly breaching 2,000 $/oz, silver has been the truly astonishing performer, having gained 50% since June.

- On aggregate, there have now been over 24 million recorded cases of COVID-19 worldwide, but regional variations are massive. Latin America, the US and India have accounted for the majority of COVID-19 related deaths in recent weeks, although Brazil’s excess death rate is on a sharp decline.

- Meanwhile, South Korea continues to be the posterchild when it comes to dealing with COVID-19. The OECD now predicts Korean GDP will contract just 0.8% in 2020, the best performer of 37 OECD nations.

- On the medical front, Russia has registered a COVID-19 vaccine in record time and intends to roll it out to the key workers and the vulnerable imminently. Other nations have expressed scepticism about the rigour of the Russian testing and approval system but are now under pressure to follow suit.

- Sadly, there has been an increase in civil unrest in specific countries lately, with clashes in Minsk occurring after a disputed Belarusian election result, as well as the entire Lebanese government resigning amidst the furore following the Beirut port explosion.

- Whilst not likely to trigger a global market reaction, there are two market implications: locally, following default earlier in 2020, Lebanese government bonds are trading at 16-22 cents to the dollar (par value 100). Resolving an economic crisis and regaining access to capital markets will be a high priority for the next Lebanese government.

- China and the US engaged in the tit-for-tat imposition of tariffs on individuals. The US targeted those officials close to the recently passed Hong Kong security law, whilst China retaliated by pinpointing the most outspoken US lawmakers, including Marco Rubio and Ted Cruz. With China a rising superpower and the US an ageing one, this head-to-head is not going away and what remains to be seen is the extent of the escalation.

- With the announcement that Kamala Harris will be Joe Biden’s running mate in the US presidential election it is worth noting that the likelihood of a Trump re-election has been relatively stable over the last few weeks, hovering around 40-45% according to prediction markets.

The economy

- We continue to see signs that in locations enjoying lockdown easing and where the virus appears to be under control, economic activity is beginning to recover. Consumer spending (a significant driver of economic growth in most developed nations) is recovering well, in some cases even returning to pre-pandemic levels. Positive survey data on manufacturing, services and construction has also pointed to healthy expansion, while better export data in China and durable goods orders in the US indicate recovering demand globally. More mixed news is in evidence in the tourism sector, where recovery is volatile as ‘second wave’ fears take their toll.

- Finally, the Bank of England left interest rates unchanged at 0.1% and held total asset purchases steady at £745bn. The Bank also issued some relatively optimistic commentary around the initial economic impact of lockdown, but still anticipates that full economic recovery will take until the end of 2021.

Strategy

The significant intervention in government bond markets via monetary stimulus, with the expectation that more will be required, continues to flatten yields. It is our view that the risk of inflationary pressure is not being adequately reflected in the price and with sovereign debt already likely to produce a sub‐inflationary return if held to redemption, the attraction of owning such assets is low. We retain an overweight position to short‐dated corporate bonds with an emphasis on investment grade debt. The yields on offer are above inflation while protecting our investors from the credit spread and duration risks.

With interest rates looking increasingly likely to stay low for longer and the prospects of nominal yields on government bonds moving into negative territory, we see no alternative to equities. In our equity allocation, we continue to hold overweight positions in Asia Pacific, as the response of China, Taiwan, South Korea etc. to the Covid‐19 virus has been exemplary and these economies are likely to recover faster from the crisis.

Our Emerging Markets holdings contain very little exposure to LATAM countries where reported cases of the virus continue to increase. We retain an underweight exposure to the US, which has handled the virus poorly and aside from the mega‐cap tech companies, is showing signs of economic slowdown. Our overweight UK positioning will benefit from positive Brexit developments and we remain quietly optimistic that progress towards a trade deal of some capacity is being made.

Many factors are uncertain, such as how long the Covid‐19 pandemic will last and how well countries will deal with a second wave, as well as the outcome of Brexit negotiations but we are cautiously optimistic that equity valuations will continue to recover albeit with a degree of volatility.

Review risk management, eligibility and investment and borrowing powers

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

Management of the Clarion funds; Prudence, Navigator, Meridian and Explorer

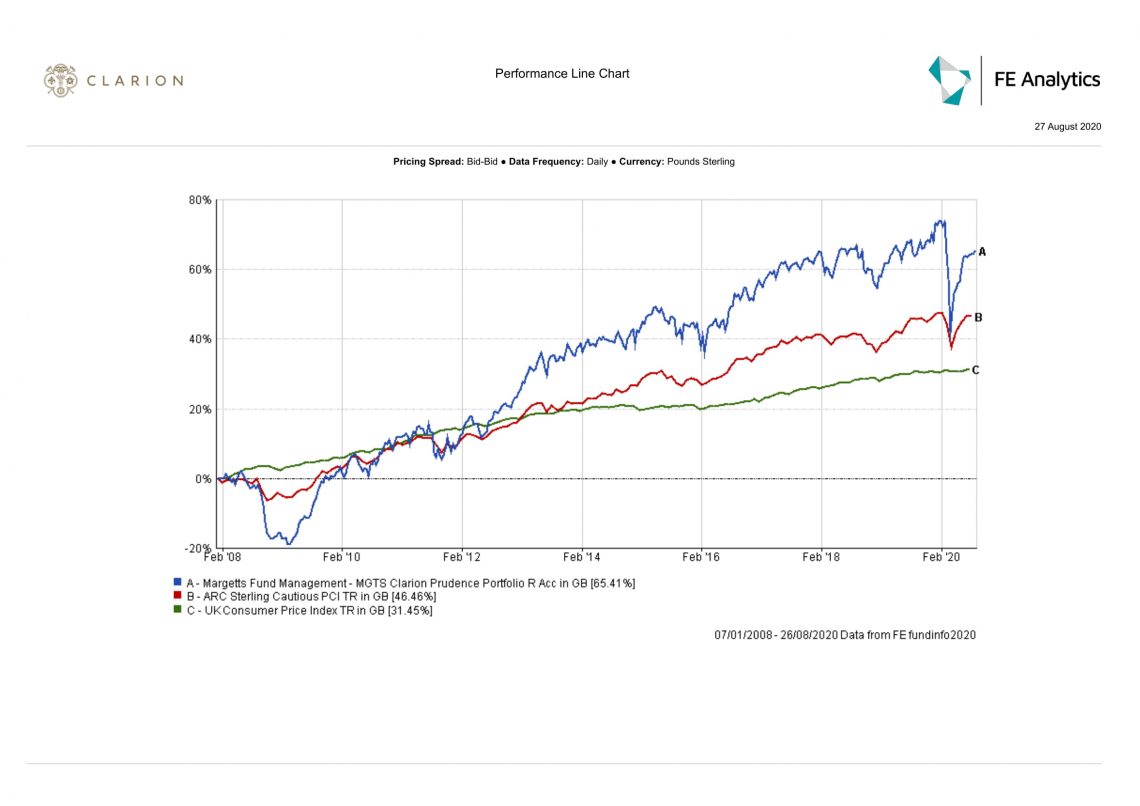

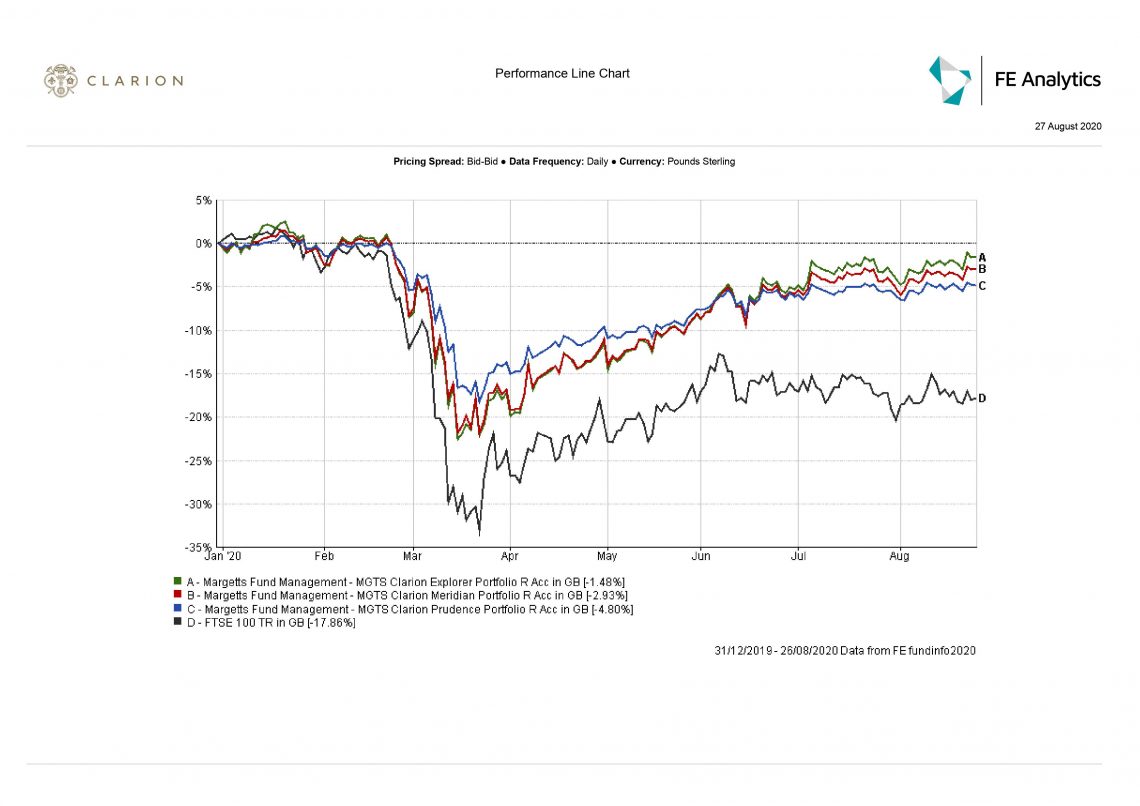

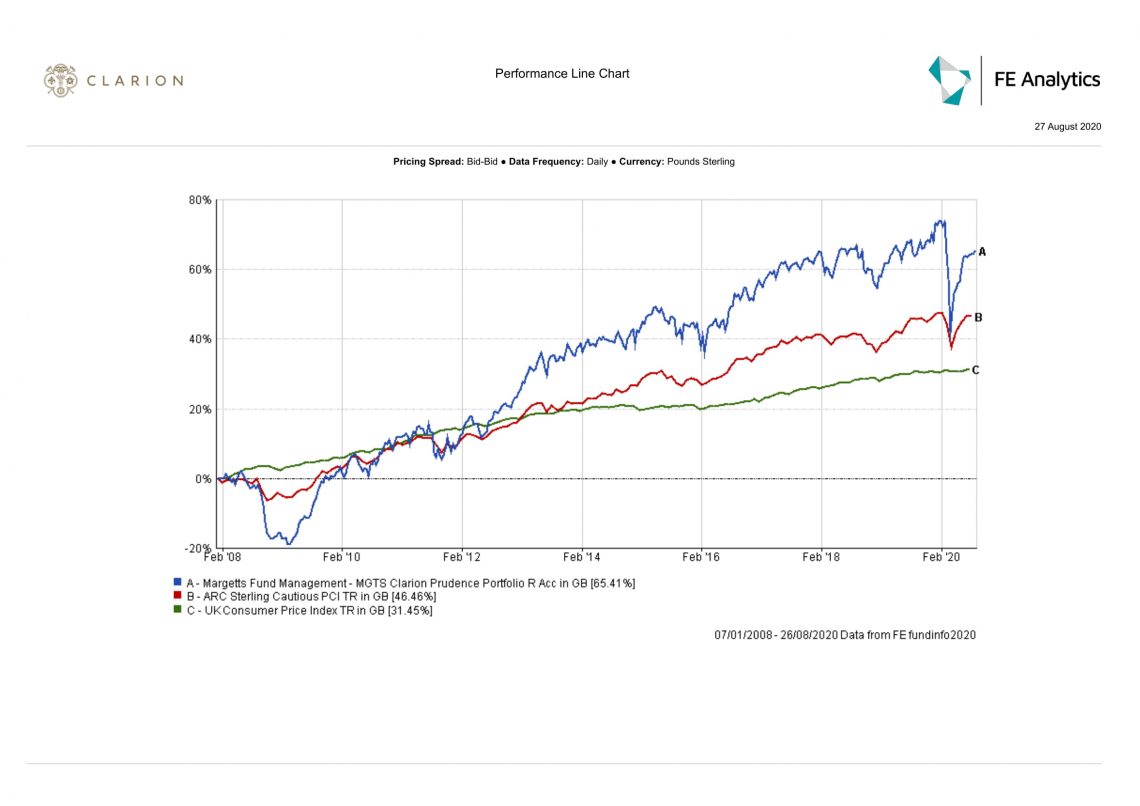

MGTS Clarion Prudence

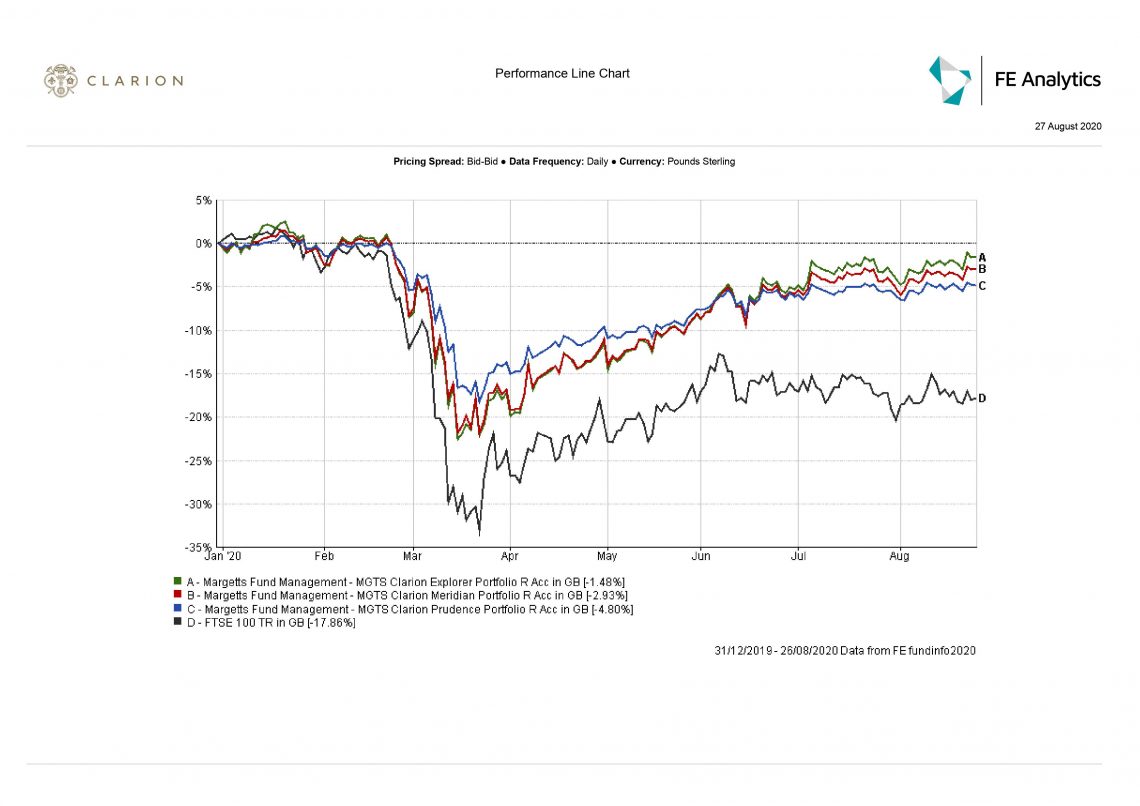

- Performed in line with sector over the last quarter whilst outperforming DT strategic benchmark over the same time period.

- We have seen recent strong performance within the short duration bond element of the portfolio, particularly in the ‘Baillie Gifford High Yield Bond Fund’ which has returned 1.75% over the last 4 weeks and 4.28% over the last 12.

- In contrast, the performance in long dated bonds has been relatively flat over the same period.

- Bonds continue to outperform equities over a 4-week period due to the growing concerns of a second wave of Covid-19.

- Fidelity European has suffered the greatest loss across the portfolio over the last 4 weeks with a loss of 2.06%. This fund still plays a key role within the portfolio given the funds weighting to more defensive stocks and therefore has potential to hold up better during periods of market downturn. This has been evident given the funds strong performance over 1 year.

- The M&G Global Dividend fund has benefited from a short-term rotation from growth to value stocks, resulting in a period of strong performance over the last 2 weeks. This fund has returned 1.79%.

- Hermes Global Emerging Markets continues to look strong, particularly over 1 year where the fund has returned 8.40%. Looking more short term, this fund continues to hold its own with strong performance over a 4- and 12-week period.

- The Gold element of the portfolio has performed well of late given the historic inflation hedge this commodity has shown over the years. Investors remain fearful of a period of high inflation driven by governments due to public spending and in order to drive the real value of debt down which has racked up considerably as a result of government activity concerning Covid-19. The high price of gold at present is a good indicator that investors predict a period of inflationary pressures moving forwards.

- As a result of the inevitable dividends cuts of UK companies, the performance of the funds held within UK Equity Income have been relatively flat over the last 12 and 4 weeks.

- M&G Global Dividend and Fundsmith Equity continue to work well alongside one another.

- ‘Man GLG UK Income’ was brought to attention given the poor performance of late. This fund fell harder than the market at the start of the year and has struggled to recover from this. It was agreed that we would keep an eye on this fund over the next month or to and consider a replacement if necessary. The high expense ratio of this fund was also highlighted.

- The portfolio remains in good shape and therefore no changes are required at this stage.

- Fund size is currently £34.8m.

- Performance over 1 year is marginally down at -0.26% compared to a fall in the UK Footsie 100 index of circa -14%

There were no proposed changes to fund selection.

The Committee approved the strategy and confirmed it is in line with the mandate.

MGTS Clarion Navigator

- ‘SLI Global Emerging Markets’ has performed well over the last couple weeks, returning 0.47%. This fund has a portfolio bias to ‘value’ stocks which has been reflected in the portfolio returns given the recent shift in performance from growth, to value.

- Man GLG to be kept under review as per Prudence, Meridian and Explorer.

- The portfolio remains in good shape and therefore no changes are required at this stage.

- The fund is yet to be fully invested in line with the agreed assets/ allocation. Margetts make additional purchases of assets on receipt of new cash inflows.

- Fund size is currently £1.89m

The fund’s size increased to c.£1.4m and its portfolio now includes 9 underlying holdings.

The Committee proposed no changes to fund selection.

The Committee approved the strategy and confirmed it is in line with the mandate.

Due to the fact that the Navigator Fund is not fully invested and has only been operating for a short period of time, we are unable to provide a useful performance graph of the fund versus its relevant benchmark. However for information, the unit price as at the 26th August 2020 was 101.58p; a 1.58% increase having been launched at 100p on the 11th May 2020.

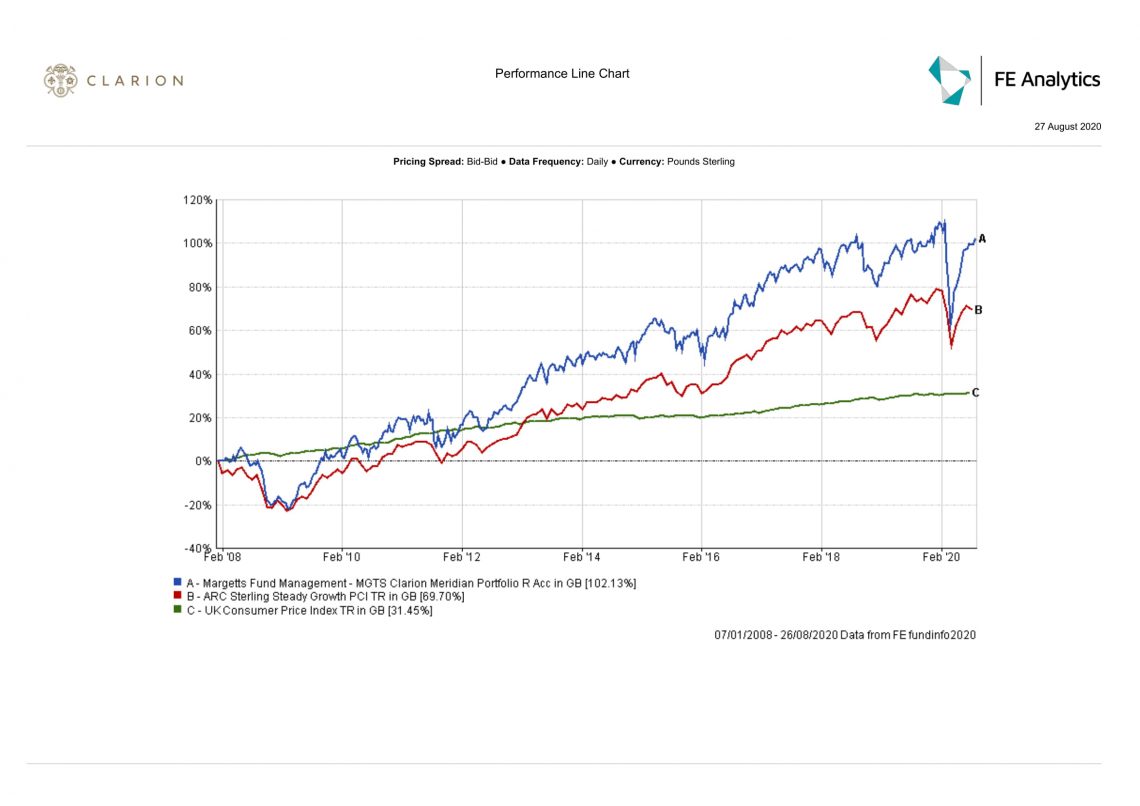

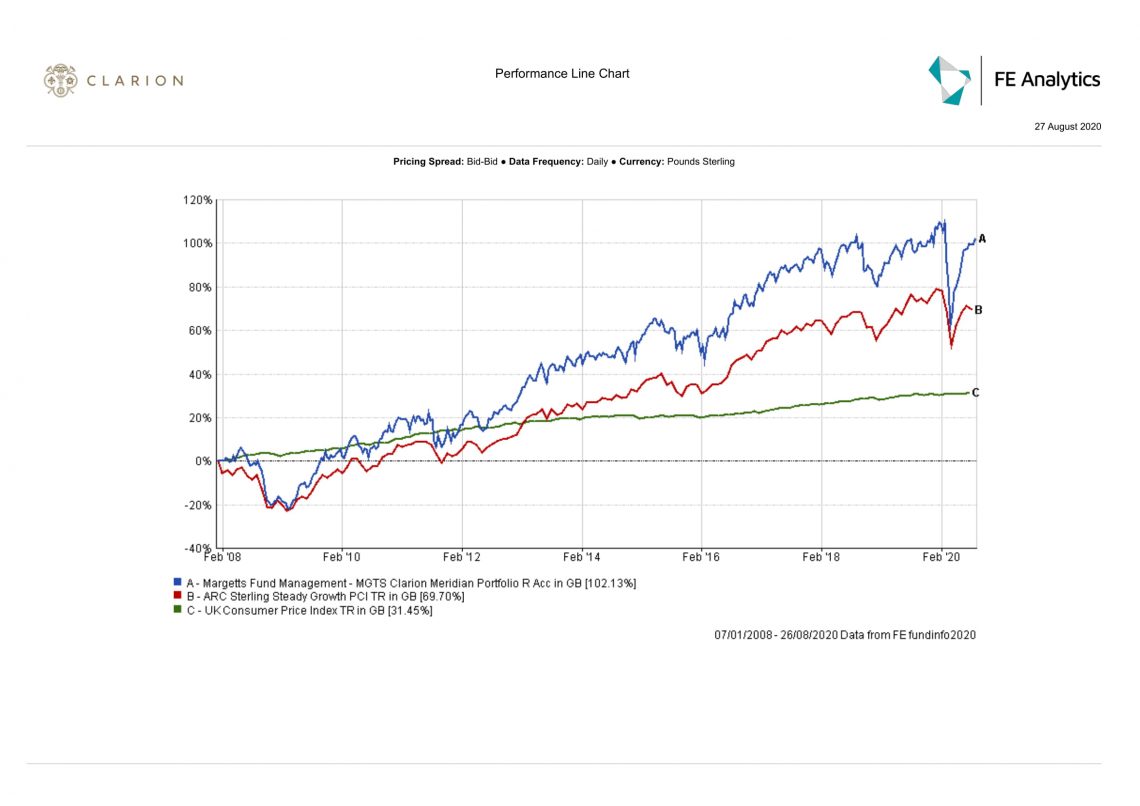

MGTS Clarion Meridian

- Meridian is currently circa 1.60% above its sector over the last quarter and circa 3.40% above DT strategic benchmark. IC very pleased with how this fund has performed.

- ‘Fundsmith Equity’ and ‘Artemis Global Select’ have underperformed over 12 weeks.

- Artemis believe that a lot of US companies took high revenues throughout Covid-19 and believe that things will start to slow down moving forwards. As a result, they have recently reduced their allocation to the US and redistributed the allocation to Europe and Asia. In doing so, they have focused on companies who are socially responsible, in particular companies of Green Energy, as they believe fiscal stimulus will be heading in their direction.

- Man GLG to be kept under review as per Prudence, Navigator and Explorer.

- The portfolio remains in good shape and therefore no changes are required at this stage.

- Fund size is currently £50.01m which is an increase from previous levels due to the rotation of Clarion clients from DFM to fund of funds.

- Performance over 1 year currently stands at +0.31% compared to a fall in the UK Footsie 100 index of circa -14%

There were no proposed changes to fund selection.

The Committee approved the strategy and confirmed it is in line with the mandate.

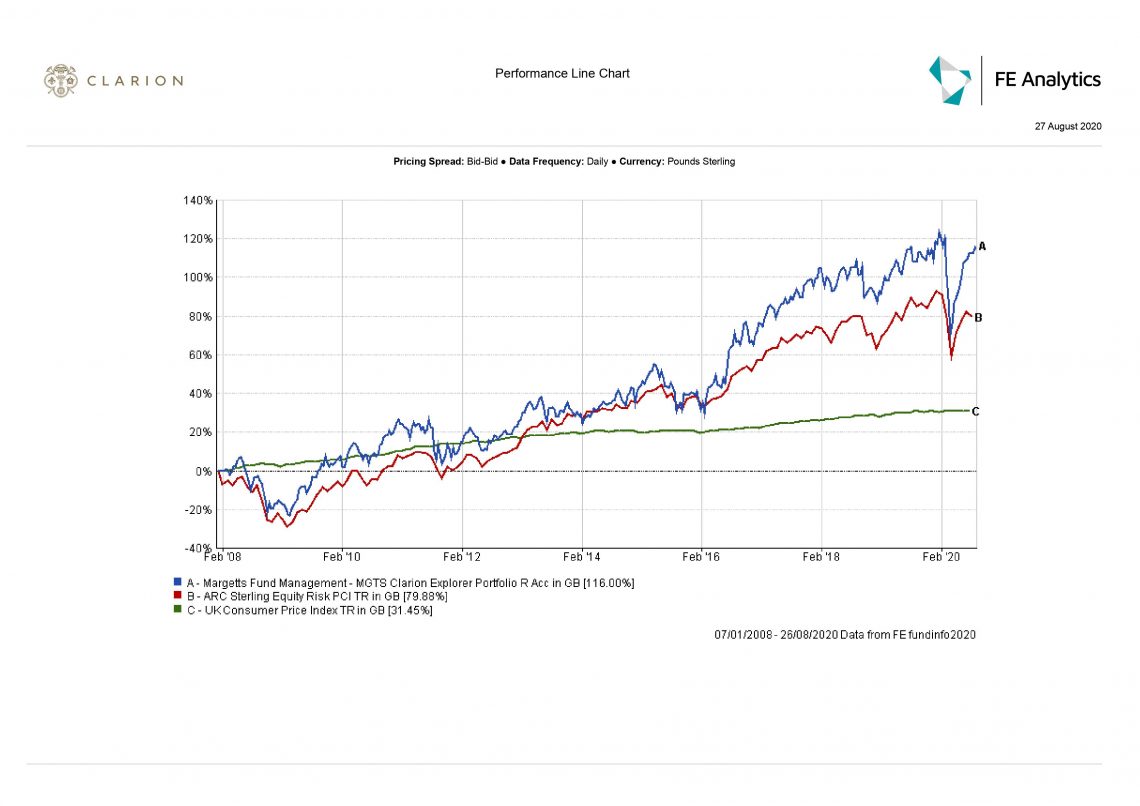

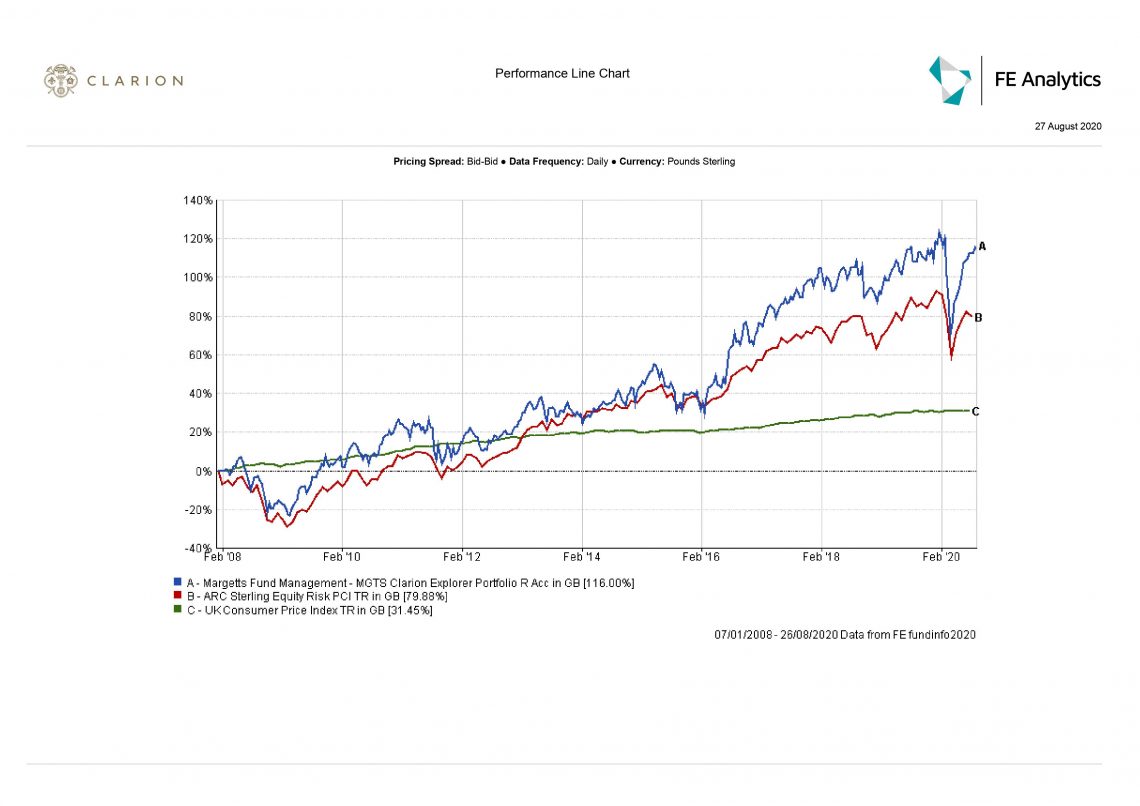

MGTS Clarion Explorer

- Explorer is currently circa 1.00% above both its sector YTD and its DT strategic benchmark.

- IC very pleased with the performance of ‘Hermes Europe Ex-UK Equity’ fund which has performed well consistently over 12 months. Over 12 months, this fund has returned 13.40% whilst over 12 and 4 weeks, the fund has returned 3.34% and 1.66% respectively.

- ‘Lindsell Train Japanese’ previously underwent a period of underperformance. The fund is very concentrated with one of the key holdings focusing on consumer discretionary. This holding was hit heavily as a result of weak demand domestically along with Chinese tourists which represents a large proportion of turnover. Demand of late has started to increase, leading to a recovery within the fund which is evident by the fund return of 2.17%; the highest within the Explorer portfolio over a 4-week period. The fact we hold the hedged share class of this fund assisted in this growth given the appreciated of Sterling versus the Yen.

- Man GLG to be kept under review as per Prudence, Navigator and Meridian.

- The portfolio remains in good shape and therefore no changes are required at this stage.

- Fund size is currently £22.15m.

- Performance over 1 year is marginally down at -0.09%. compared to a fall in the UK Footsie 100 index of circa -14%

The Committee proposed no changes to fund selection.

The Committee approved the strategy and confirmed it is in line with the mandate.

Model Portfolios

No changes were made to the model portfolios.

Next Investment Committee Meeting is 17th September although in the interim period the Committee intend to conduct slightly shorter conference calls on a weekly basis.