Minutes of the Clarion Investment Committee held at 1pm on 10th December 2020 by Video Link.

Committee Members in attendance: –

| Sam Petts (SP) |

IC Chairman and Financial Planner |

| Keith Thompson (KWT) |

Clarion Chairman |

| Dmitry Konev (DK) |

Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) |

Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) |

Technical Assistant Clarion |

|

|

*Apologies from Ron Walker, Founding Director, Clarion

Review of previous minutes and action points

Minutes from the previous meeting held on 19th November 2020 were agreed by the Committee as a true and accurate record.

Economic Commentary & Market Outlook

Please click here to access the December Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

- The past week has seen Brexit concerns re‐emerge, as what looked like good progress between the negotiators turned out to have not been fruitful. Sterling had tentatively crept out of its recent trading range on the apparently positive news, passing 1.35 against the dollar for the first time since May 2018. The UK’s currency then slumped back over 1% on the weekend’s less positive news. This currency volatility pales in comparison to some of the Brexit sentiment shifts over the past 4 years, perhaps indicating that the markets are not seeing a wide divergence in outcomes as to whether the year ends with any form of trade deal or not. The catastrophic predictions of a no-deal outcome have largely been negated by Covid-19, such that the worst‐case scenario is predicted as a 2% drop in the UK’s GDP.

- With an apparent stalemate at the negotiating table, Boris Johnson and Ursula von der Leyen arranged to meet in person in Brussels. One of the more problematic elements in the negotiations was the UK’s two upcoming pieces of legislation; the Internal Market Bill and the Taxation Bill. These were, in the form proposed by the government, due to overriding aspects of the Withdrawal Agreement (in particular the movement of goods in Northern Ireland). Michael Gove met with Maros Sefkovic and both agreed on the implementation of the Irish border in line with the Withdrawal Agreement. As a result, the UK government agreed to remove these controversial parts of the Internal Market and Taxation bills. This will focus the negotiations squarely on the sticking points; fishing rights and the level playing field for state aid (including how this is to be enforced subsequently).

- The rollout of Covid‐19 vaccinations has begun in the UK, with the Pfizer/BioNTech vaccine now being given to elderly at-risk patients, along with NHS and care staff. In time, this should bring down the UK death rate considerably, which has been, in the vast majority, amongst the over 70s. Vaccinated NHS and care staff will also help with capacity in general, as escalated staff absence during the first wave was a significant problem, with the overall absence rate of NHS staff in April

- 2020 hitting c.6% according to recently released data. The problem was particularly acute amongst support staff, hitting c.8% absence in April.

- In the United States, with Biden now preparing to take office, attention has turned to resurrecting some form of stimulus package. The current proposal in the pipeline is a stimulus bill worth c.$900m, which has been put forward by a bipartisan group of ten senators. The bill would not pay out money directly to citizens, but proposes to offer small business aid, additional unemployment benefits, and aid for specific sectors still struggling in the pandemic, such as airlines. Consensus is growing over the necessity for action after weaker jobs statistics in November, and millions of Americans still remain out of work. Whether this consensus can get the bill past Mitch McConnell in the Senate remains to be seen.

Strategy

The emergence of plausible vaccines bodes well for the eventual global recovery, although it may yet take many months for countries to achieve herd immunity. The logistical problems of manufacture and transport need to be overcome once regulators approve the vaccines. This ought to be a positive environment for equities, especially those which have suffered badly in the pandemic, notably in the tourism, leisure, and service industries. There is also opportunity for takeovers and mergers, as the firms which have best managed the pandemic may find targets for consolidation. The UK market is biased towards service companies in its major indices and, as such, is likely to be one of the major beneficiaries of emergence from the pandemic. The early rollout of the vaccines ahead of other nations also ought to provide a boost.

The investment committee remains positive on Asia’s economic recovery following their handling of the pandemic, which has normalised across all economic indicators except for tourism. With vaccines, these countries can finally solve the final aspect of their recovery. Their ‘first mover’ advantage out of the virus recovery, along with lower stimulus measures and reduced economic scarring, bode well for the decade ahead.

Bond markets continue to be heavily impacted by central bank intervention, with more QE soon to be passed in the Eurozone. With the possibility of recovery will inevitably come an increase in money velocity, as forced savers from the pandemic will finally have an opportunity to spend. This, in turn, ought to stoke the demand side of the inflation equation, which has hereto been suppressed, and could lead to inflation finally pushing through in a way not seen since the Credit Crisis, if not in the short‐term then plausibly in the medium term. At this point, long‐dated bondholders will be left holding the short straw as their capital return erodes. The upside from such bonds, based on the yield curve, is limited and too great a risk for our investors. Accordingly, we seek income at the shorter end of the yield curve in the corporate sphere, which offers attractive income possibilities with reduced duration risk.

Review Risk Management, Eligibility, and Investment and Borrowing Powers

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

Management of the Clarion Funds; Prudence, Navigator, Meridian and Explorer

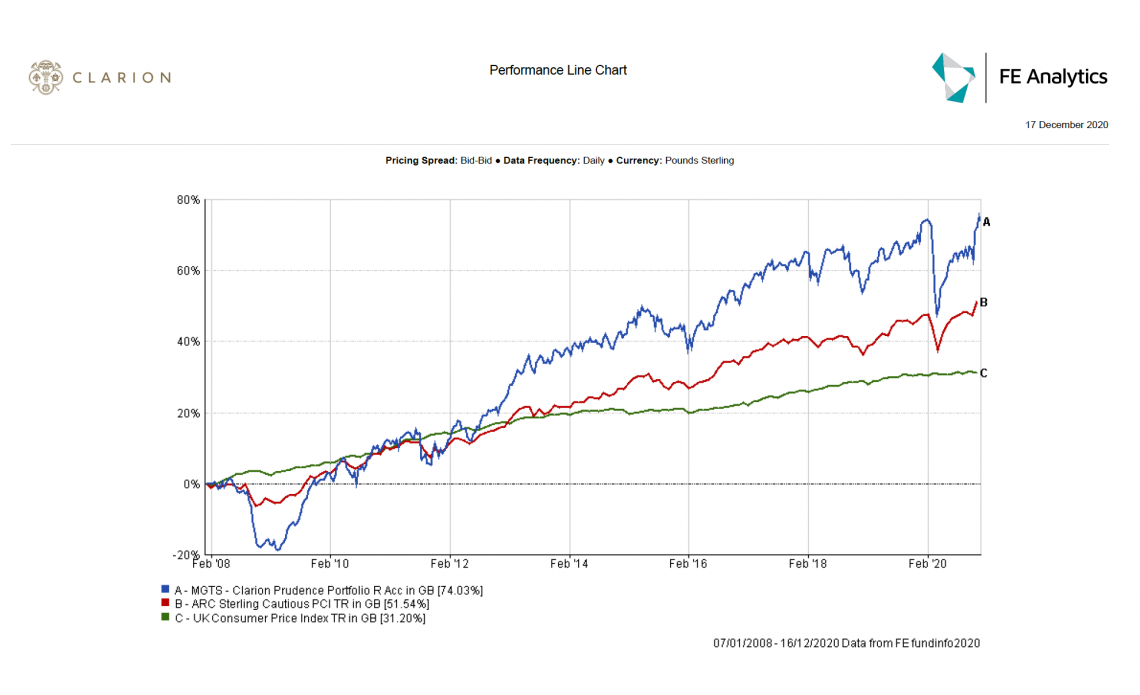

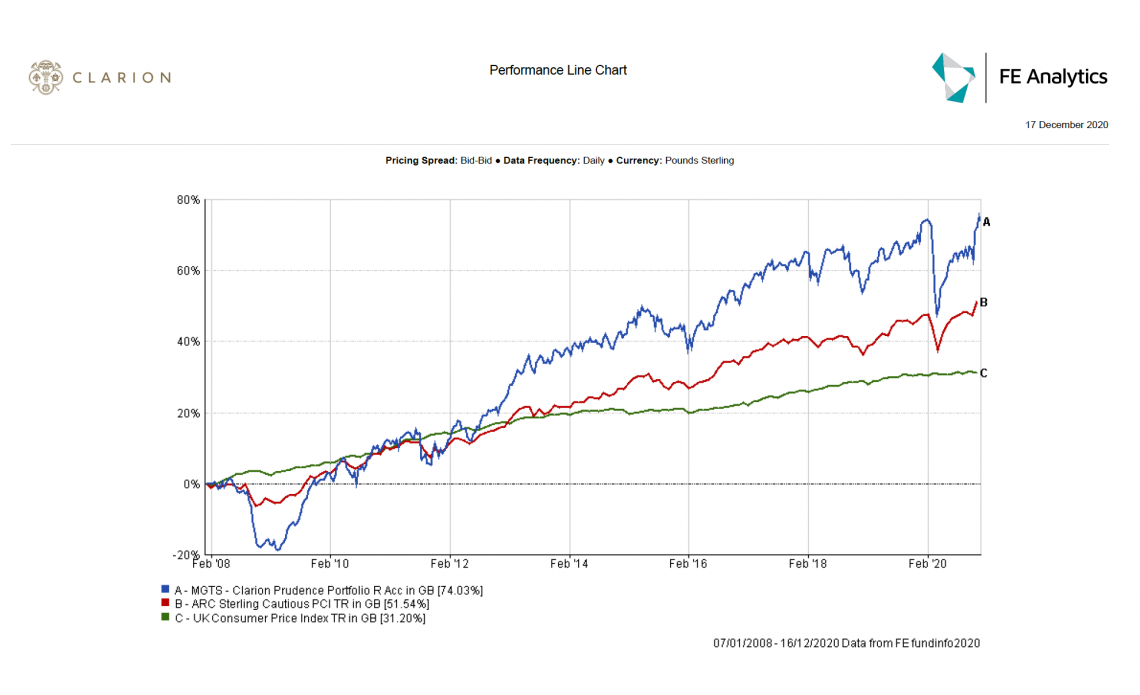

MGTS Clarion Prudence

- The last quarter has seen Prudence outperform its sector by 0.80% whilst marginally underperforming against its DT strategic over the same time period.

- The outperformance compared to its sector mainly derived from our allocation attribution within the IA Global sector. A detractor from this is that our selection attribution was down as a result of our fixed interest holdings, but overall, the last quarter has been positive for the Prudence fund.

- The ‘First State Asia Focus’ holding is slightly behind its sector over 1, 2 and 4 weeks. The fund is deemed to be at the lower end of the risk scale compared to the other funds held within its sector and historically has performed well on market falls whilst lagging on market rises.

- The performance of the fixed interest holdings within the portfolio has been relatively flat over the last month with the outperformance of the long duration bond holdings being cancelled out by the underperformance of the short duration holdings.

- The ‘Baillie Gifford High Yield Bond Fund’ continues to perform well by returning 1.01% over the last 4 weeks. This is as a result of the increase in credit spread we have seen as a result of growing concerns corporate’s will be unable to service the debt for investors given the financial difficulties experience on the back of Covid-19.

- The momentum in the recent switch from ‘growth’ to ‘value’ has continued to prove beneficial for M&G Global Dividend with this fund returning 4.42% over the last 4 weeks. In contract, Fundsmith Equity has suffered as a result, with performance of -3.15% over the last quarter. Combined, the two funds have returned in line with their sector and the committee continues to be pleased with how these two funds act as a good hedge against one another in the Global element of the portfolio.

- A further beneficiary of the rotation is Man GLG UK Income with this fund returning 4.65% over the last 4 weeks, the strongest performing fund within the portfolio over this time period.

- Hermes Global Emerging Markets has continued to prove itself as a strong holding within the portfolio, being the only fund to of delivered a positive return consecutively over 1, 2, 4, 12, 24 and 52 weeks.

- It was agreed that the committee would arrange an interim meeting to conduct a wholesale review of the fixed interest holdings within all four of the Clarion funds. It is felt that fixed interest as a whole is not offering much to the portfolios whilst yields remain so low, and it is expected that this will remain for some time. The interim meeting will explore the options available to get more out of this asset class whilst also exploring alternatives.

- The portfolio remains in good shape and the committee agrees that no changes are required at this stage.

- Fund size is currently £27.20m.

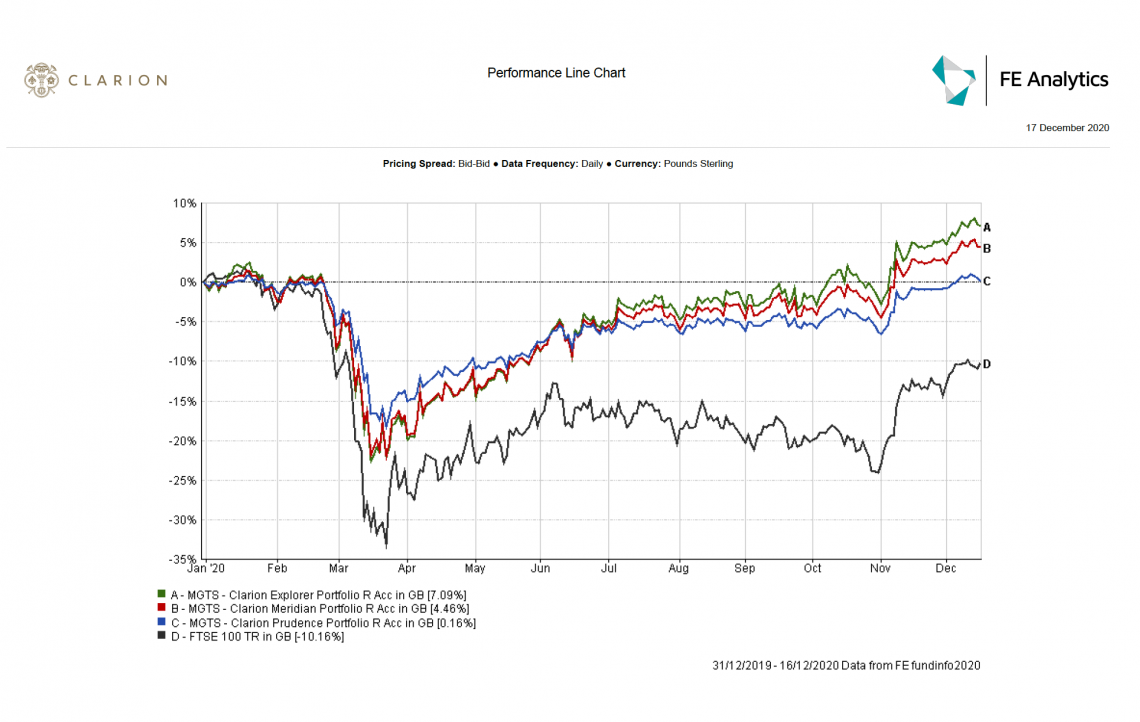

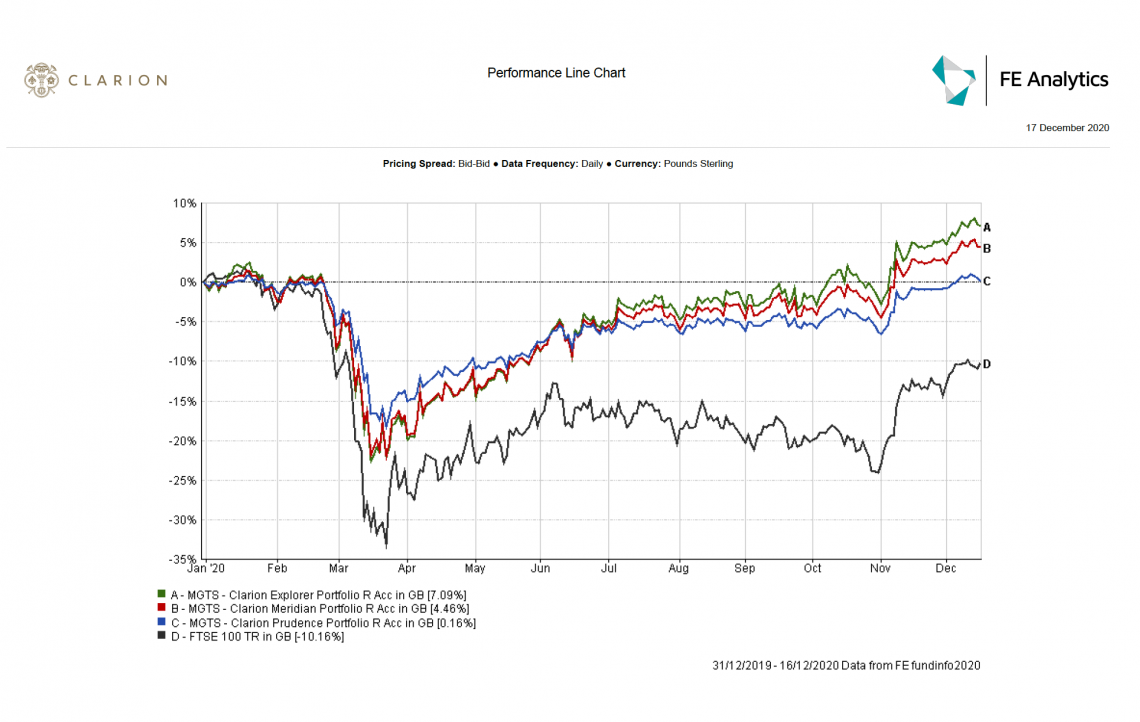

- Performance over 1 year is up at +3.76% compared to a fall in the UK Footsie 100 index of circa -5.55%

MGTS Clarion Navigator

- The fund continues to perform in line with its sector since the fund launch in May of this year.

- JPM Japan has had a period of strong performance and the fund is now up over 22% in the last 12 months. Looking at the shorter term, the portfolio has returned 3.82% over the last quarter and is the strongest performing holding over this time period.

- The committee raised their concerns with regards to the ‘Fidelity European’ fund which has consistently underperformed against its sector over the last couple of quarters. Following the market volatility experienced earlier this year, this holding held up relatively well but simply has not picked up on the recovery. It was agreed this fund would be kept under review until the next meeting, with a view of replacing the fund should the same trend continue.

- At last month’s meeting, it was agreed that we would keep an eye on the performance of Buffettology given that the fund had suffered as a result of the rotation from growth to value. Since the last meeting, the fund has returned -7.51% and has shown a lack of resilience to claw back some of the losses made as a result of the rotation. Ultimately, the fund performed well on the recovery from this year’s low, however, since the rotation has occurred, it has lost its momentum. In light of this and the fact that we are currently sitting on a good profit from the holding, it was felt that now would be an opportune moment to find a replacement for this fund. Having analysed funds available within the UK Equity sector both before and during the meeting, it was agreed that ‘Baillie Gifford UK Equity Focus’ would be the most suitable replacement for a straight swap.

- No further changes are required to the portfolio at this juncture.

- Fund size is currently £10.78m; an increase of circa £6m from the last committee meeting carried out in October following several large inflows.

- The unit price as of the 16th December 2020 was 107.27p; showing a 7.27% increase having been launched at 100p on the 11th May 2020.

Due to the fact that the Navigator Fund has only been operating for a short period of time, we are unable to provide a useful performance graph of the fund versus its relevant benchmark

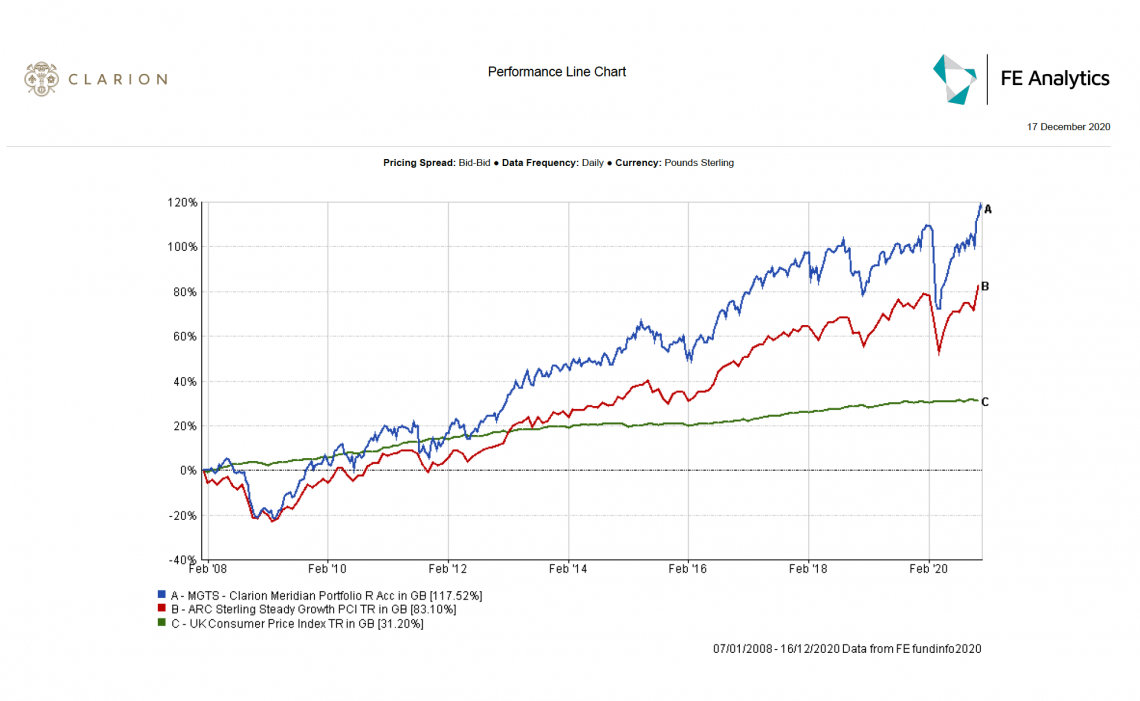

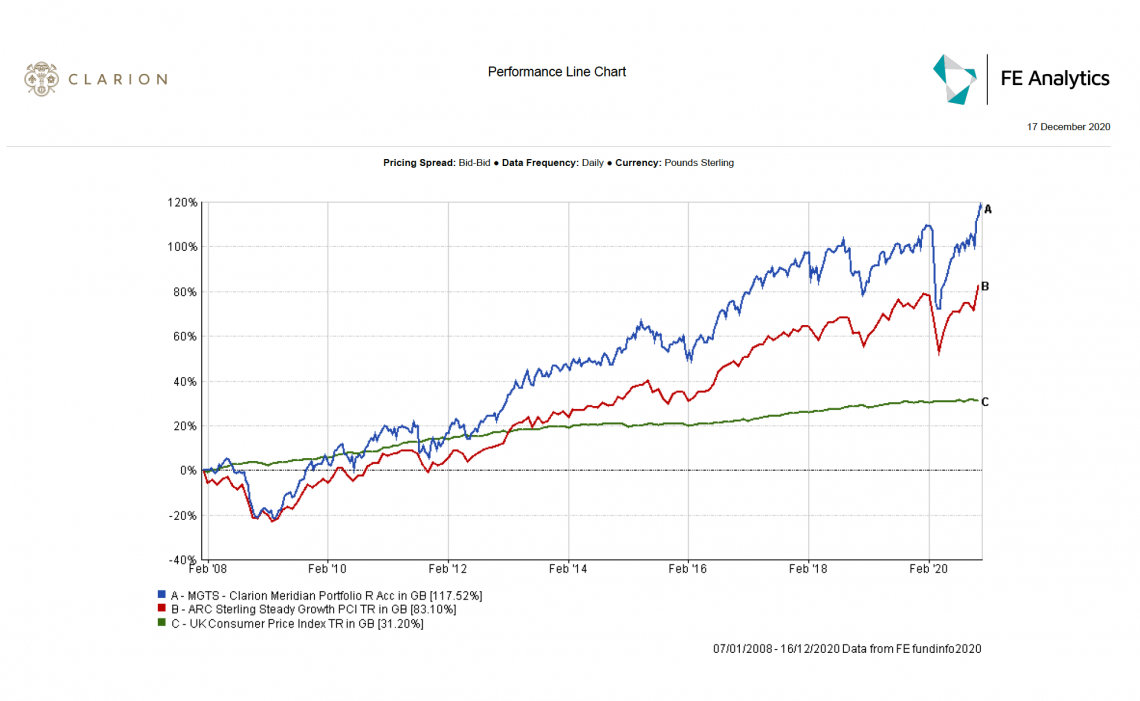

MGTS Clarion Meridian

- Meridian has performed in line with its benchmark over the last quarter whilst outperforming its sector by 1.80%.

- In similar vein to Prudence, Meridian has outperformed its sector due to its allocation attribution within the IA Global sector. Further contributors to this attribution was the allocation within the Japan and UK Equity Income sectors.

- Fidelty Asia has underperformed of late due to the rotation in growth to value. That being said, the committee remain happy with the differing investment approaches in the First Asia Focus and Fidelity Asia funds as these continue to add a good level of diversity to the portfolio.

- Fundsmith Equity has struggled with the rotation in growth to value given the nature of its holdings and has returned -4.64% over the last quarter. Likewise, Artemis Global Select has also underperformed by returning -2.01% over the same time period. This fund has not fallen as hard as Fundsmith given that is has more of a balance to its investment strategy but with a tilt to growth type holdings.

- Both the SLI and Hermes Global Emerging Market funds have done really well over the last quarter, returning 3.79% and 2.73% respectively. These two funds are the highest performers within the Meridian portfolio over this time period.

- In line with Navigator, the committee have agreed to replace Buffettology with Baillie Gifford UK Equity Focus.

- The remainder of the portfolio remains in good shape and the committee agree that no further changes are required at this stage.

- Fund size is currently £60.47m.

- Performance over 1 year is up at +8.62% compared to a fall in the UK Footsie 100 index of circa -5.55%

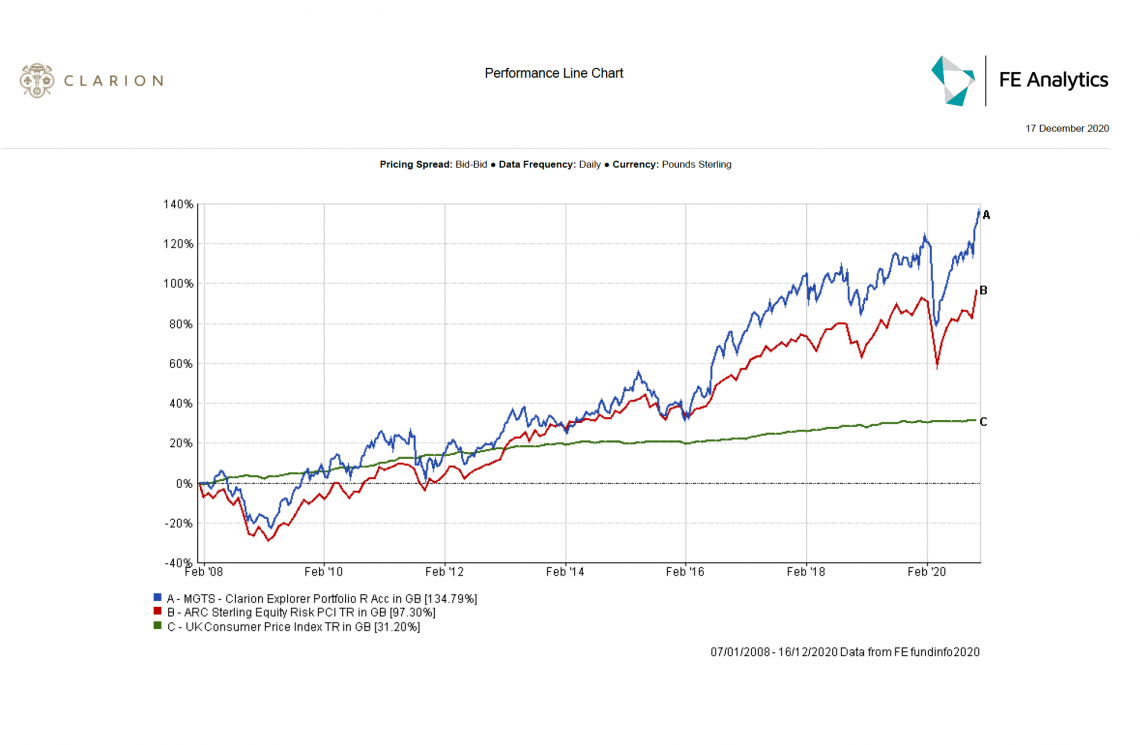

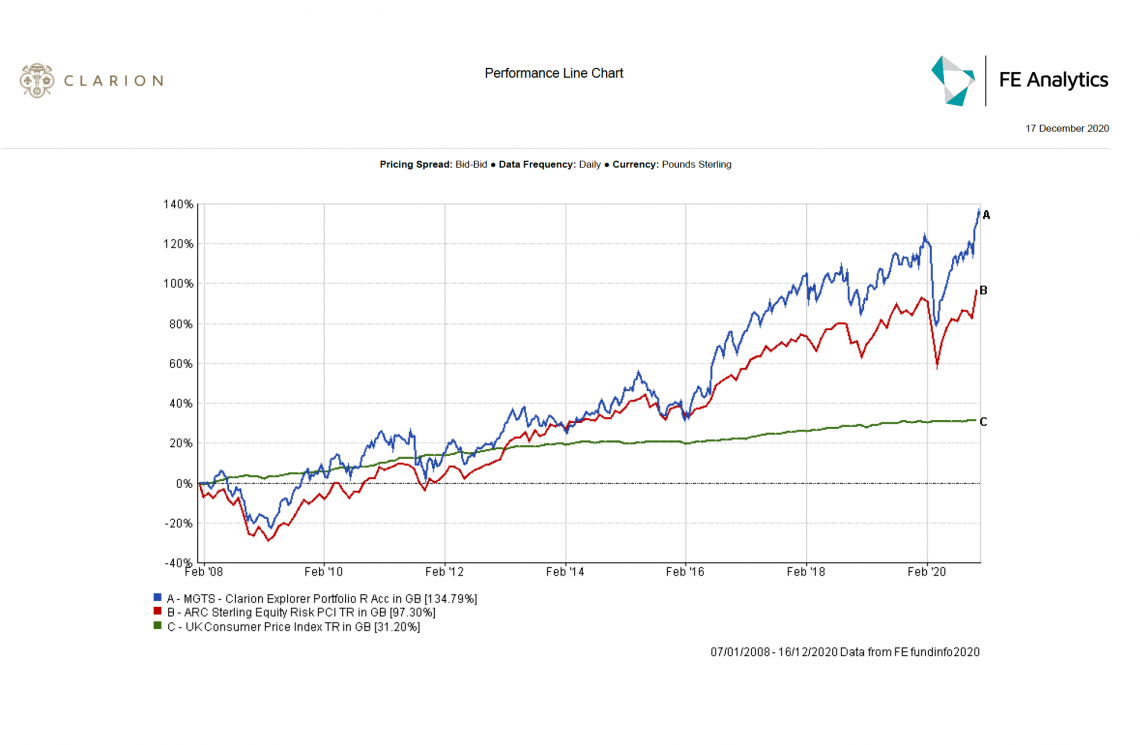

MGTS Clarion Explorer

- Explorer has returned 10% over the last quarter whilst its benchmark and sector returned 8.40% and 7.70% respectively. The committee is very pleased with this outperformance.

- Compared to its sector, the funds selection attribution has been relatively flat whilst the allocation attribution is marginally down, mainly due to the funds over-allocation to UK Equity Income.

- Whilst Lindsell Train Japanese has sprung to life in the last couple of weeks, looking back over the quarter, this holding has been disappointing returning -8.24%. The biggest detractor in the performance is the funds allocation to Luxury brands which benefit largely from tourism. The committee is to keep this holding under review until the next meeting and will look for replacements in the interim.

- The portfolio remains in good shape and no changes are required at this stage.

- Fund size is currently £20.08m

- Performance over 1 year is up at +11.50% compared to a fall in the UK Footsie 100 index of circa -5.55%

Model Portfolios

It was agreed to make appropriate changes to the model portfolios to reflect the changes to the Portfolio Funds detailed above.

The next Investment Committee Meeting is on 14th January 2020 although in the interim period the Committee intends to conduct slightly shorter conference calls as considered appropriate.