The Clarion Investment Committee met on 13 December 2023. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Economics

- US consumer inflation fell to 1.9% in November much lower than market expectations as food and energy prices continued to moderate. Core inflation remained at 4%.

- The US Federal Reserve left interest rates unchanged at 5.25%-5.5%. However, officials are now forecasting a 75 basis points cut to rates by the end of 2024 – this represented the first dovish shift in the Fed’s stance since they started raising rates in late 2022.

- US two-year treasuries rallied on the back of the Fed’s meeting as yields dropped by 35 basis points, reaching 4.25% for the first time since May.

- President of the Federal Reserve Bank of New York, John Williams, said that it is “premature” to talk about imminent interest rate cuts.

- The S&P 500 hit a 23-month high as investors’ risk appetite grew due to lower interest rate expectations.

- CEOs felt more confident in the US economic outlook and expected to increase hiring despite a cooling economy, according to a survey by Business Roundtable.

- UK inflation also fell in November to less than 4%. GDP declined by 0.3% in October, with production and construction the worst hit, increasing the likelihood of a contraction in the fourth quarter.

- UK business activity rose more than expected to 51.7 in December, according to the flash Purchasing Managers’ Index, as the expansion in services activity offset the continuing decline in manufacturing.

- The Bank of England kept interest rates at 5.25% but stressed that monetary policy will need to be restrictive for an “extended period of time” as inflation risks remain “skewed to the upside.”

- Interest rate expectations in the UK fell following the disappointing GDP figures and the Bank of England meeting. Investors now expect interest rates to reach 4% by the end of 2024.

- UK wage growth moderated somewhat to 7.3% in the three months to October and vacancies continued to decline indicating a further gradual softening of the labour market.

- UK productivity growth from 2011 until 2019 has been more dependent on a few extremely efficient businesses than before the financial crisis as productivity is weighed down by a long tail of poorly performing companies, according to the ONS.

- House prices in the UK are expected to decline by 2% to 4% in 2024 as high borrowing costs hit affordability, according to retail bank Halifax.

- Mortgage arrears in the UK increased to the highest levels in six years in the third quarter of 2023 as higher interest rates hit homeowners.

- Global oil demand growth slowed “drastically” in the fourth quarter due to high interest rates darkening the economic outlook, according to the International Energy Agency.

- Euro area industrial production fell by 0.7% in October, increasing the chances of a contraction of the bloc’s economy in the fourth quarter. However, economists estimated that the contraction is closer to 0.1% as volatile Irish production figures distorted the headline number.

- Euro area economic activity fell faster than expected in December as the flash Purchasing Manager’s Index dropped to 47, as businesses reported falling order and depleting inventories.

- The German government managed to secure a last-minute budget deal and averted a government shutdown in January after it agreed cuts on energy and industry subsidies as well as slashing its transport budget.

- The International Monetary Fund approved the release of loans to Sri Lanka and Bangladesh as the countries suffered from high inflation, falling foreign reserves and high government deficits.

- Recently elected Argentine president Javier Milei announced a devaluation of the peso, cuts in spending and smaller energy and transport subsidies to rein in fiscal deficits and hyperinflation.

- The Israeli central bank warned that war spending may add to inflation as it forecasts a government deficit of 3.7% for 2023 and 5% in 2024.

Business

- US pharmaceutical company Pfizer warned that its 2024 revenues may be weaker than expected as its sales struggle without the demand for its COVID-19 products.

- The UK Payment Systems Regulator cautioned that cross-border debit and credit card charges should be capped “to protect UK businesses from overpaying” when trading internationally.

- The UK Financial Conduct Authority promised to intervene if investment and pension platforms continue to withhold interest payments from customers.

- The Anglo-Swedish drugmaker AstraZeneca agreed to acquire Icosavax for $1bn to snap up a potential breakthrough vaccine for two common respiratory diseases.

- Chinese property developer Country Garden slashed the salaries of its chair and other executives as the company struggles with the Chinese property crisis.

- US toymaker Hasbro announced that it will cut 1,100 jobs, around 10% of its global workforce, as weak demand during the holiday period is likely to extend to next year.

- Online marketplace Etsy announced 225 job cuts, around 11% of its workforce, as sales have flatlined due to consumer preferences for services and experiences.

Global and Political Developments

- Countries attending the COP28 summit agreed to “call on parties to contribute” and transition away from fossil fuels. However, the agreed text stopped short of calling for the full phase-out of coal, oil, and gas.

- US president Joe Biden urged Israel’s prime minister Benjamin Netanyahu to change the right wing of his government to stem the loss of global support as the countries disagree on the post-war future of Gaza.

- The UN General Assembly voted in favour of a resolution demanding a humanitarian ceasefire in Gaza, as well as the “immediate and unconditional” release of all hostages.

- The US House of Representatives approved an impeachment inquiry into President Joe Biden based on allegedly benefitting from his son’s business dealings.

- EU leaders vowed to find a way to send an additional €50bn of financial support to Ukraine despite Hungary’s veto.

- The first minister of Wales, Mark Drakeford, announced he would be stepping down as Welsh Labour leader, triggering a leadership contest.

- Newly elected Polish prime mister Donald Tusk was sworn into office as he promised to unlock EU funds frozen by Brussels over fears of the country’s limited judicial independence.

Please click here to access the December Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary

The US labour market added a substantial 199,000 jobs in November, a positive signal for avoiding a hard-landing recession amid the ongoing challenges posed by elevated interest rates in the world’s largest economy. As a potential consequence of the latest wave of added jobs, the Bureau of Labour Statistics revealed that the headline unemployment rate declined to 3.7%, down from the previous month’s 3.9%

While this job growth is encouraging from a US consumer standpoint, it raises questions about the potential long-term implications for inflation. The decrease in the unemployment rate could bring an uptick in wage-inflation, a concern that policymakers need to carefully monitor. On the other hand, the likely improvement in GDP would suggest a resilient economy, and a higher probability of avoiding a recession.

The relationship between employment and inflation will be a focal point in Federal Reserve (Fed) and other central bank policy decisions. The argument that the Fed should sustain higher interest rates for an extended period could be boosted by the employment data and weigh on investor sentiment for interest rate sensitive assets. The argument to keep rates higher for longer is also backed up by the concept that knock-on effects of inflation might have not yet fully materialised in the broader economy. Further to this, there is the suggestion that the decline in inflation is more attributable to a high base effect rather than the actions of raising interest rates. Historically, such monetary policy adjustments typically take 12-18 months to manifest fully within the economy.

At the December meeting Federal Open Market Committee (FOMC) members decided to hold interest rates at their 22-year high but signalled that rate cuts in 2024 were likely. It seems that the Fed believe that, if disinflation coincides with indications of future GDP growth, a monetary policy pivot could be the most prudent strategy to mitigate the potential risk of future recessions.

As with the time lag associated with rate hikes impacting the economy, there is a corresponding belief that the effects of rate decreases will also take time (albeit shorter) to fully materialise. During this transitional period, the Fed will want to exercise caution to prevent the economy from sliding into a recession. Ultimately, the Fed is navigating a delicate balance, aiming to avoid policy errors in both the tightening and easing of interest rates. They will want to encourage economic stability, while not incurring additional policy-led inflation.

Strategy

There have been no further changes to the bond allocation and the investment committee believe the current strategy is still best placed to deal with short-term interest rate decisions from central banks. We believe that developed market central banks are unlikely to pivot meaningfully in the short term with interest rates likely to be left higher for longer. In the long-term, the investment committee could look towards longer dated assets as a viable strategy as knock on effects and the risk of policy error become a diminishing risk.

The investment committee also continue to overweight the UK and underweight the US against relevant sectors in the portfolios on a valuation basis. In the US, the committee are specifically underweight the ‘Magnificent Seven’ stocks which are trading on astronomical valuations. Although the committee see benefits in the long run for AI technology, it is felt that the euphoria has been overstated and either revaluation or future underperformance will result from these extreme valuations. In both the UK and US, the committee also look towards small and mid-cap equities which have undergone a period of subdued performance but have future recession risk priced into the assets.

Asia and Emerging Markets are also overweighted against the relevant sectors on a valuation basis. The committee see a positive, long-term picture in China which is still being held back by a fallible property sector, but valuations in the region outweigh these risks and offer a persuasive argument for outperformance once these factors have been rectified.

The key themes can be summarised below as:

- In the fixed income space, we hold a well-diversified mix of government bond, corporate bond and index linked funds with a medium-term duration to mitigate risk in case interest rates do not fall as expected.

- With inflation looking to be stickier in the UK due in part to higher wage growth, Index Linked Gilts look attractive at current prices.

- Given the increase in interest rates, yields on Investment Grade Corporate bonds have become more attractive and consequently we favour an allocation to Global Fixed Income.

- A general softening in the macro environment in developed economies has prompted a small reduction in equity exposure for the lower risk portfolios.

- The IC favour an underweight exposure to US large cap and technology stocks due to high valuations and favour mid to small cap stocks as part of the overall US weighting.

- Due to their greater economic resilience, Asia Pacific as well as Emerging Market Equities are favoured for the higher risk benchmarks.

- In the Committee’s view central banks are likely to shift from the previous inflation target of 2% to a higher figure or a floating rate, which will most likely be around 3%. The amount of economic destruction required to bring inflation back to a 2% target would be too great to be justifiable. Coupled with multiple developed economies (US and Europe) trying to ease the reliance on supply chains from China, inflation is likely to be stickier, although much lower than current levels, than initially thought.

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

December 2023

Creating better lives now and in the future for our clients, their families and those who are important to them.

Clarion Funds & Discretionary Portfolios:

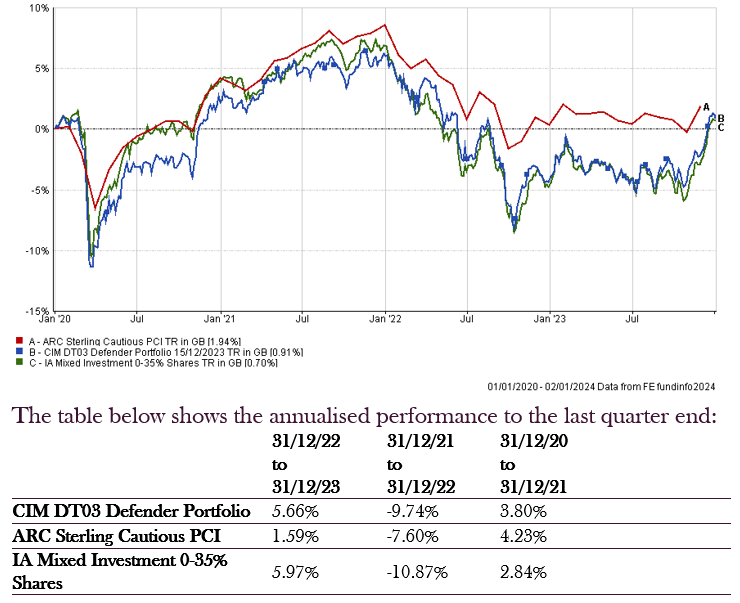

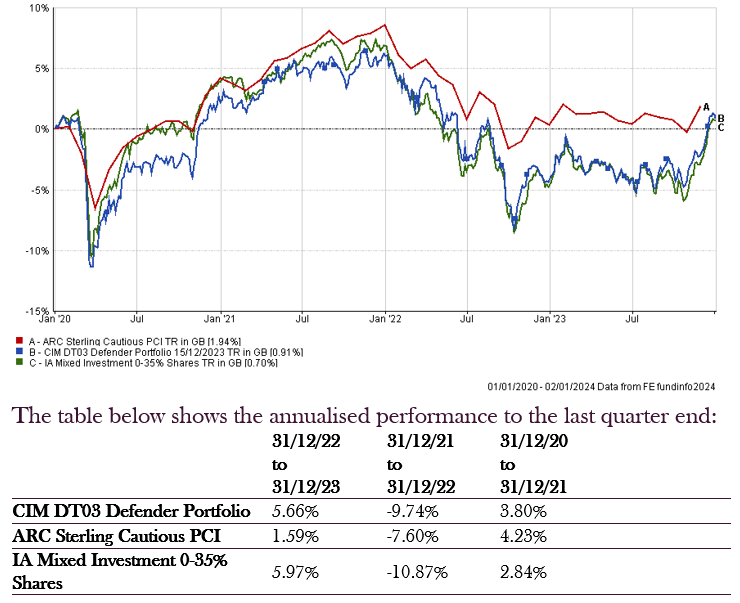

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

Changes to the Defender Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (5.00% to 2.50%)

- The Dimensional U.S. Core Equity GBP fund was added to the portfolio (0.00% to 2.50%)

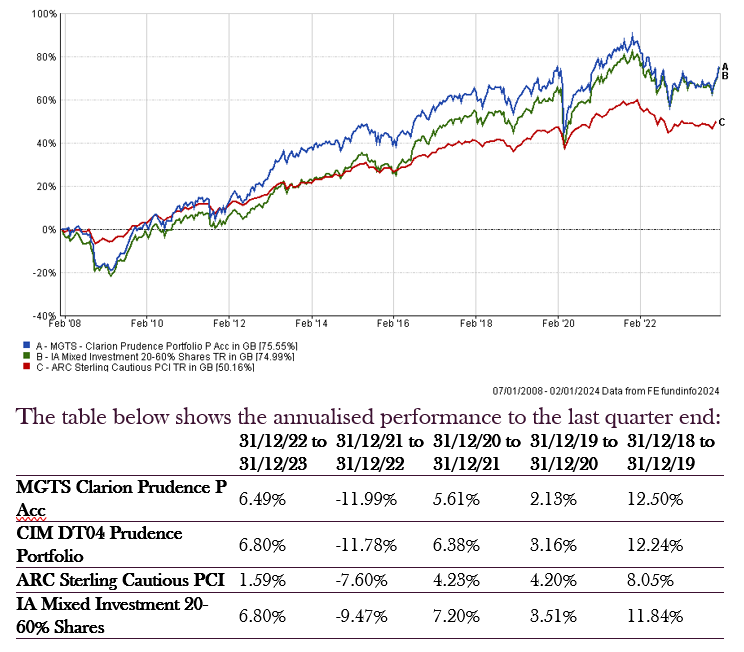

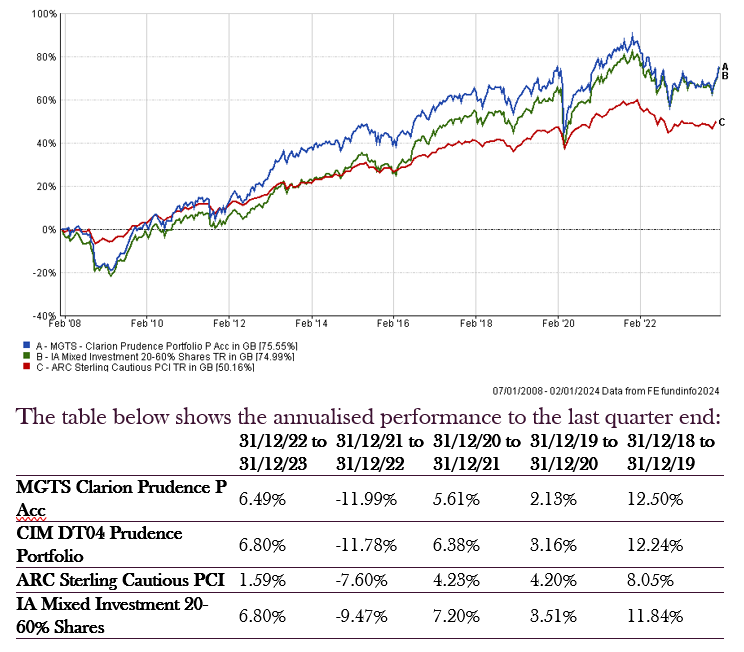

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund & Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (7.50% to 3.75%)

- The Dimensional U.S. Core Equity GBP Acc fund was added to the portfolio (0.00% to 3.75%)

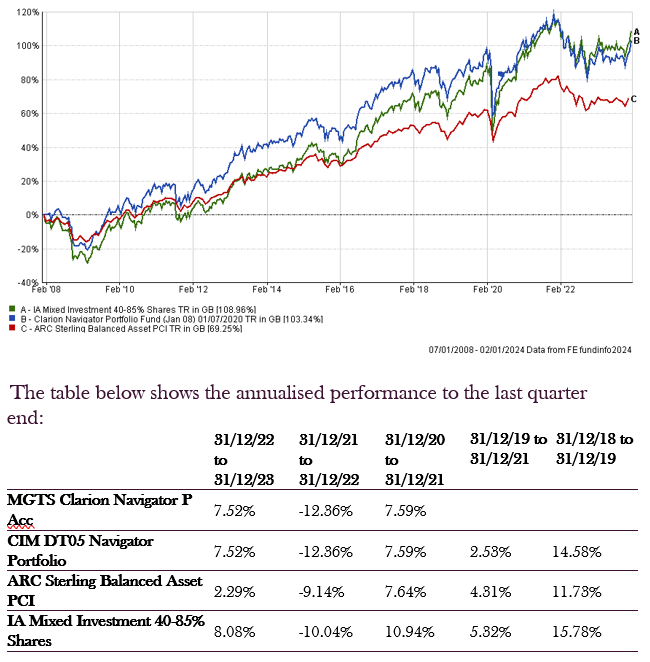

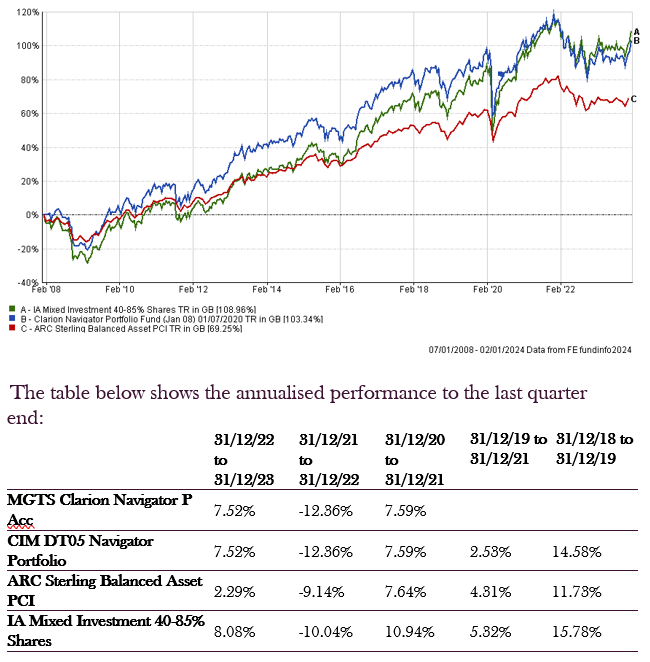

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (11.00% to 5.50%)

- The Dimensional U.S. Core Equity GBP Acc fund was added to the portfolio (0.00% to 5.50%)

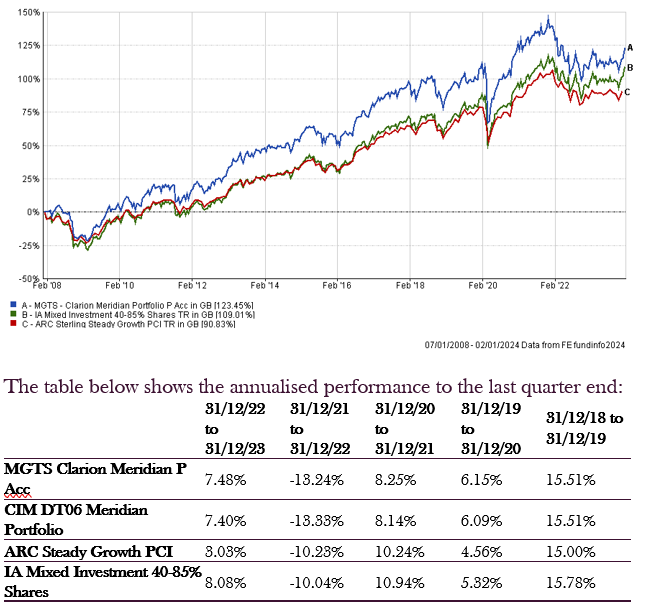

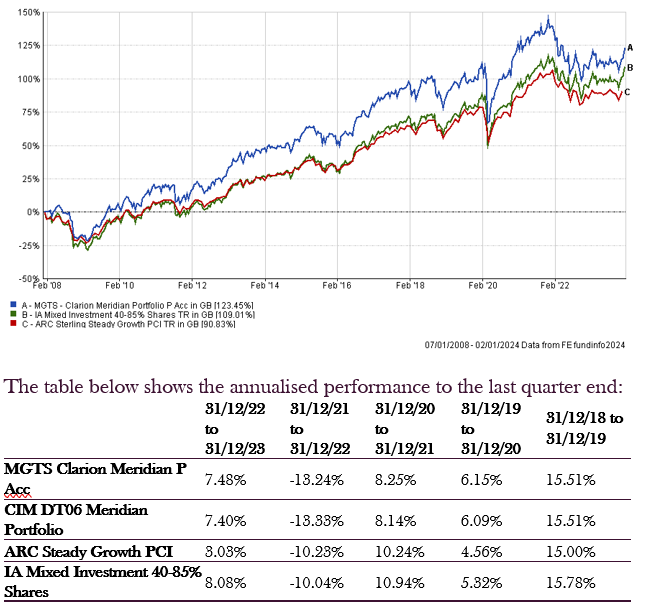

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (11.00% to 5.50%)

- The Dimensional U.S. Core Equity GBP Acc fund was added to the portfolio (0.00% to 5.50%)

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (12.50% to 6.25%)

- The Dimensional U.S. Core Equity GBP Acc fund was added to the portfolio (0.00% to 6.25%)

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

Changes to the Voyager Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (6.00% to 3.00%)

- The Dimensional U.S. Core Equity GBP Acc fund was added to the portfolio (0.00% to 3.00%)

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Adventurer Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (4.00% to 2.00%)

- The Dimensional U.S. Core Equity GBP Acc fund was added to the portfolio (0.00% to 2.00%)

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Pioneer Portfolio

- The Fidelity Index US fund had its allocation reduced in the portfolio (8.00% to 4.00%)

- The Dimensional U.S. Core Equity GBP Acc fund was added to the portfolio (0.00% to 4.00%)

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.