Category: Financial Planning

The Clarion Investment Committee met on 11 December 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

For the second year in a row, global equities are on course for double-digit gains, far out-pacing returns from bond markets. So far this year, of the major asset classes, only gold has outshone equities, with a gain of nearly 30%.

Within equities, the US has become all-dominant, driven by its mega-cap tech stocks. The top 10 stocks in the MSCI World Index are all American and represent 25% of its total market capitalisation. The biggest non-US stock is Novo Nordisk, the Danish pharmaceutical company, placed 23rd.

Diversification across asset classes, regions, and stocks has not paid off. A key question for investors as we move towards the year end, is whether US exceptionalism and its corporate dominance can persist, with 2025 shaping up to be a pivotal year politically, not only in the US but also in Europe. Uncertainty is a given in the investing world, but the change of leadership in the free world in the new year brings considerably more uncertainty than is usual, both economically and geopolitically. That uncertainty is amplified by Donald Trump’s selections for senior roles in his administration, which point to an intent not merely to change, but to transform, the policy agenda. The appointment of anti-establishment loyalists and China hawks suggests that Trump wants full control to implement his disruptive agenda. With this caveat in mind and the inevitable volatility that is to be expected, we set out a brief overview for financial markets in the year ahead.

Despite Trump’s unpredictability, key elements of his domestic policy seem clear: Tax cuts, at the very least extending his 2017 cuts beyond their scheduled expiry at end 2025, worth, according to many forecasts, over 1% of GDP, and probably followed by additional cuts. Looser regulation, including the relaxation of environmental rules to allow more oil and gas drilling (Trump has promised to take the US out of the Paris Agreement – as he briefly did during his last presidency). Higher tariffs and protectionism, with a particular focus on China, but also encompassing Mexico, Canada, and Europe. Reduced fiscal spending compared with the Democrats – the nomination of Scott Bessent for Treasury Secretary, who advocates spending cuts to reduce the fiscal deficit to 3% of GDP, introduces a moderating voice and has helped to calm the worst fears about the burgeoning Federal deficit ($1.8 trillion, 6.4% of GDP, in the latest year to 30 September 2024).

Tighter immigration policy, including the threatened mass deportation of millions of illegal immigrants. Foreign policy implications are less clear; a more isolationist policy is likely, but the constraints of realpolitik would suggest continuing support for Israel and Ukraine, albeit with a greater focus on negotiated settlements, and, critically, support for NATO, but with intensified pressure on EU nations to share more fully in defence commitments. The net result is likely to lead to stronger growth in the US, boosted by tax cuts and deregulation, offset in part by higher tariffs/protectionism and lower immigration, continuing high fiscal deficits but with a focus on cost cutting and productivity improvements across the public sector, with Elon Musk to head up Trump’s Department of Government Efficiency (DOGE). On the balance of probabilities, it improves prospects for corporate earnings, supports equities, requires continuing high Treasury bond issuance, but risks stoking upward pressure on inflation, leading to a slower pace of rate cuts from the Fed and a stronger dollar.

Whereas the US economy is a clear beneficiary of Trump’s policies, China, Europe, and Mexico are the obvious losers. While the tariffs threatened by Trump are most likely negotiating tactics, there are only downside risks to growth in these countries, and in Europe’s case a deal on tariffs might well be accompanied by commitments to materially higher defence spending. This combination can only exacerbate the problems of high fiscal deficits in many member states and the EU’s structurally weak economy, not helped by the political leadership vacuum across Europe, especially in its two largest economies, Germany and France.

The UK is less vulnerable to US tariffs, but has chosen to follow the same high tax, big state, tight regulatory model as the EU, with almost certainly the same outcome of moribund growth. While Europe and the UK largely stagnate, and China struggles with its well-known headwinds, US exceptionalism is alive and well. The extent to which this outlook drives markets through 2025 is complicated by the depth of uncertainty and the moves that markets have already made both ahead of and since the US Presidential election. The ‘Trump trade’ has driven the US equity market higher while most markets in Europe and Asia have drifted lower in recent weeks, and the dollar has been strong. Inflation expectations have risen, bond yields have moved higher, and market expectations for lower rates in the US have shifted substantially, with only three or four Federal Reserve rate cuts of 25bps by the end of 2025 expected, meaning that expectations for rates at the end of 2025 have moved up by a full one percentage point since mid-September. The Trump trade might well have largely played out, and investors are in wait-and-see mode as 2024 draws to a close.

It is important in this uncertain environment to avoid complacency. Risks abound – policy errors, the possibility of the US economy weakening while growth outside the US is under pressure, high government debt levels constraining fiscal flexibility, and a deterioration in geopolitical tension points. Furthermore, pockets of exuberance and excess, in crypto currencies, and in valuations of some of the mega cap equity leaders, are perhaps warning signs. However, the policy easing cycle has further to run and provides a strong foundation for valuations of equities, while the sell-off in bond markets in the past few weeks brings better value into fixed income markets. There might well be a period of consolidation after the initial positive reaction to the Trump win, but we are cautiously constructive about markets in 2025 and see valuation opportunities in the US beyond the big tech stocks which have driven returns over the past two years, and in markets outside the US, where valuations are generally more attractive and offset some of the economic headwinds faced. A repeat of the exceptional returns in equity markets, especially the US, through 2023 and 2024 is unlikely, but we expect equities to make further progress in this cycle, albeit amidst greater volatility.

We are cautiously constructive about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Asia, and Emerging Markets where valuations are generally more attractive, helping to offset some of the economic headwinds and geopolitical uncertainty.

Please click here to access the December Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The current strategy remains broadly unchanged.

Since December 2023, there has been a tilt towards evidence-based factor investing, which involves a disciplined approach backed up by significant amounts of Nobel Prize winning economic research. Factor investing involves trusting the market but tilting the investment choice towards smaller companies, value companies (those trading at a discount), and profitable companies. The evidence shows that over the long-term, these types of investments outperform the typical index tracking and actively managed funds.

Clarion is accessing these factor-based investments through Dimensional Fund Advisors. At the present time Dimensional are the only investment manager in the UK which offer this type of investment. Since inclusion, investment performance has been impressive, costs have decreased, and it is likely that we will look to introduce more factor-based funds into the portfolios as and when appropriate.

The performance of the current portfolios back tested since the start of the available data in September 2020 is shown in the chart below. This is assuming that we made the recent changes at that time and then adopted the buy and hold approach favoured when using evidence-based factor investing.

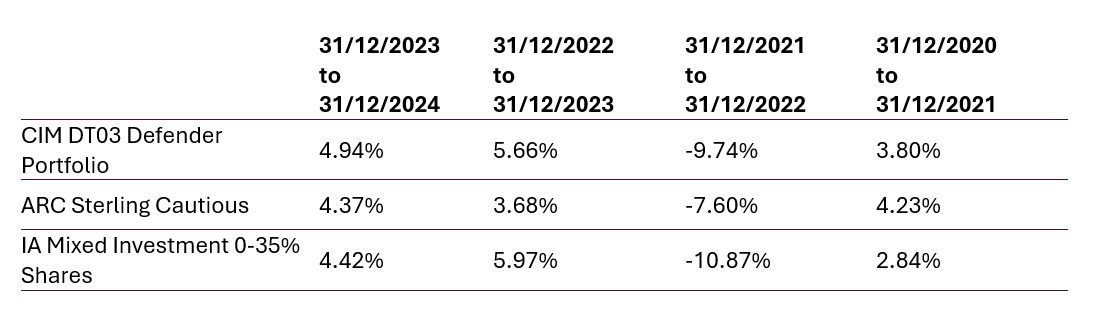

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

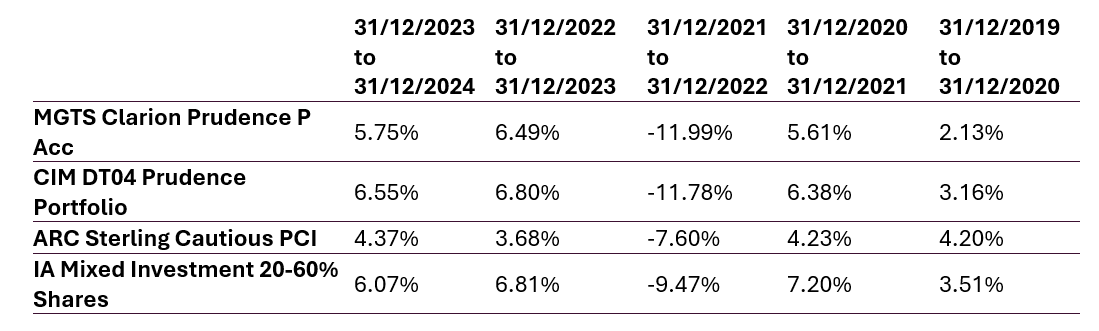

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

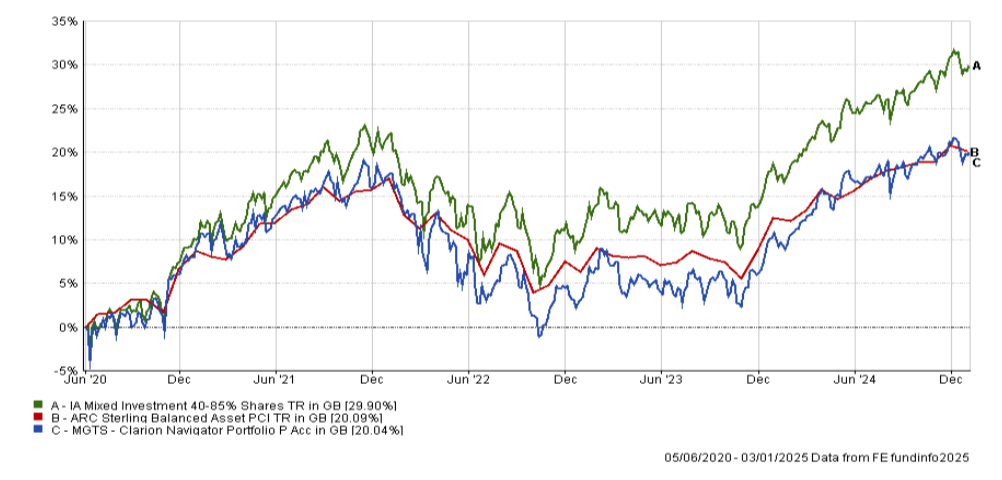

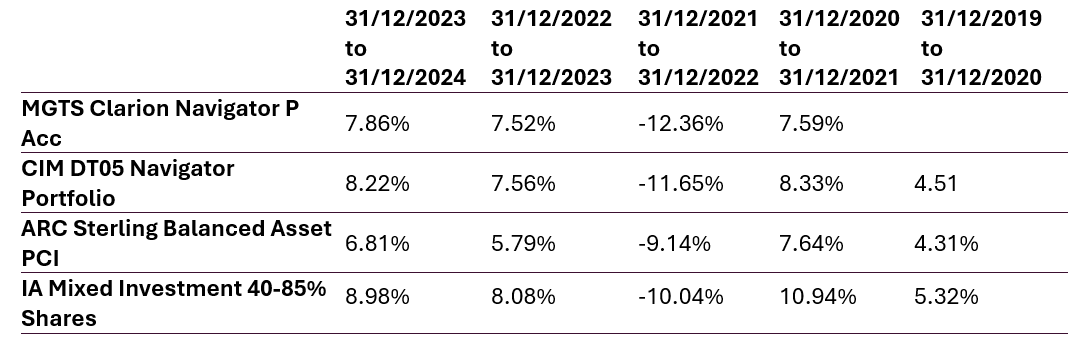

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

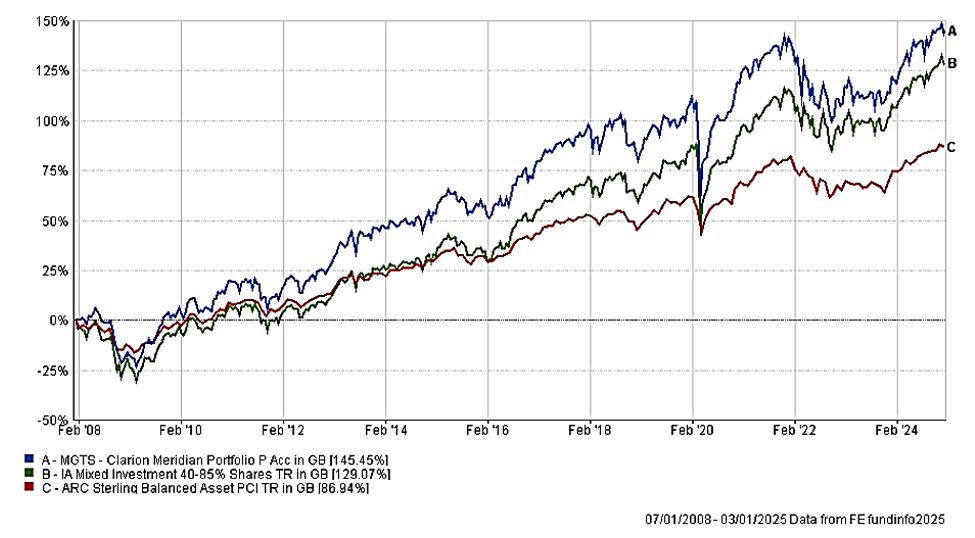

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

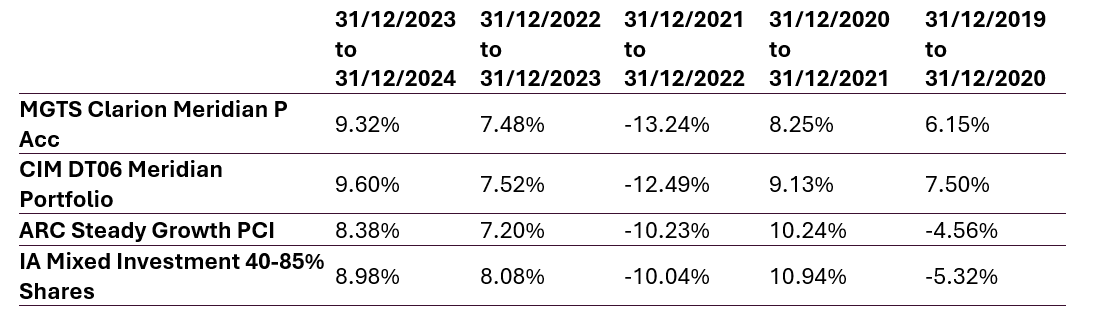

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

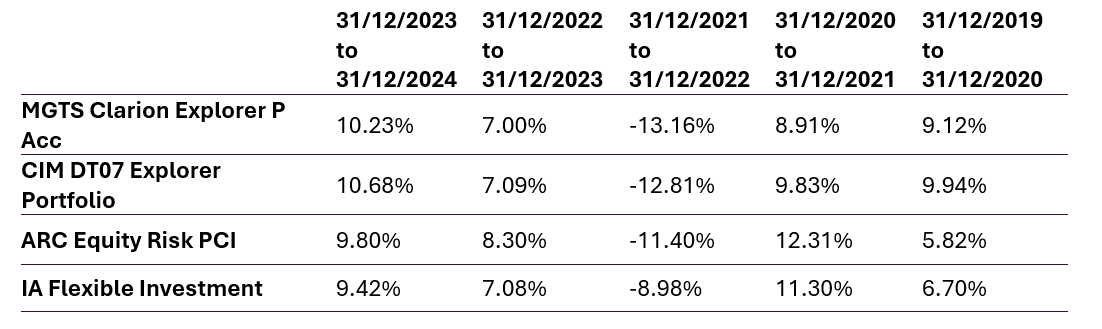

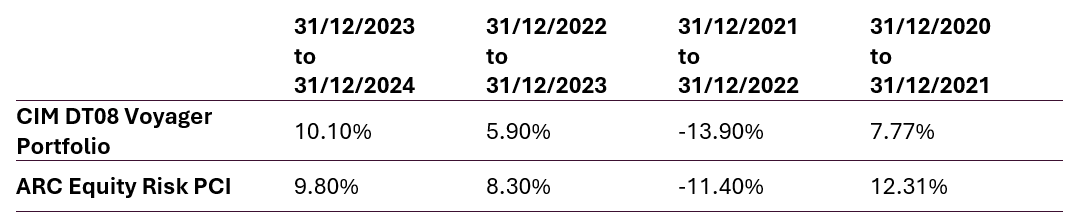

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

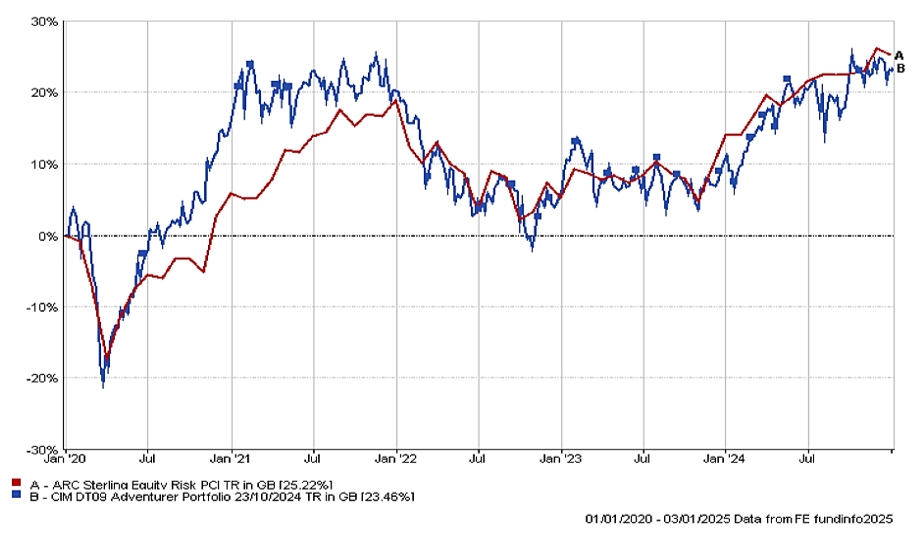

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

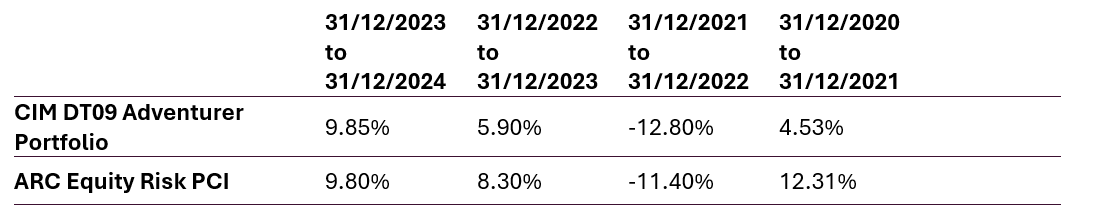

The table below shows the annualised performance to the last quarter end:

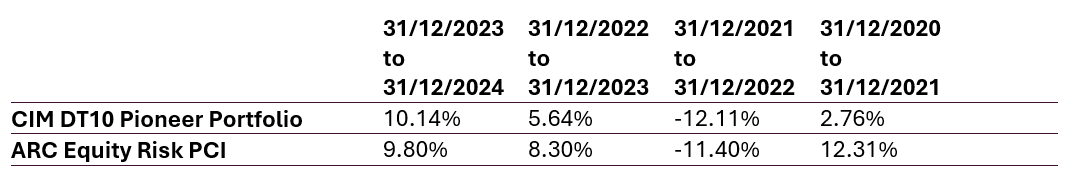

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

December 2024

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.