Category: Financial Planning, Investment management

The Clarion Investment Committee met on 22 February 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Please click here to access the February Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Global growth slowed last year as the effects of high inflation and rising interest rates weighed on activity in the rich world, but things could have been worse.

Activity has weakened but among the major economies only Germany and the UK have fallen into recession, and a mild one at that. Activity in the US and Japan has accelerated. Emerging market economies as a whole have shown good growth partly as a result of China’s recovery from the pandemic.

A number of big, much analysed risks, failed to materialise. This time last year the talk was all about to the risks to growth, everything from energy blackouts and surging energy prices to mass layoffs, collapsing house prices and deep financial crisis. None occurred.

The shocks that did occur, including the regional banking crisis in the US, the conflict in the Middle East and the emergence of deflationary risk in the Chinese economy, have not so far had pronounced negative effect on growth.

According to the Internal Monetary Fund global growth slowed from 3.5% in 2022 to 3.0% in 2023, a rather higher growth rate than the IMF had forecast at the start of the year, largely because of the strength of the US economy.

The IMF expects global growth to remain at about 3.0% this year, with emerging markets generally holding up well but a more uncertain picture in developed economies.

It is too early to say that the global economy is out of the woods. The last two years have witnessed a bout of inflation, an energy price shock, and a tightening of monetary policy the likes of which have not been seen for 40 years. The impact on growth has been moderate by the standards of past economic cycles but has not been fully felt.

The effect of rising interest rates on mortgage costs, and of rising rents, have yet to fully feed through to consumers. Unemployment lags the economic cycle and is likely to nudge higher this year. Business insolvencies are likely to rise.

As a result, activity in the UK, the euro area and the US is likely to be lacklustre in the first half of 2024 but, with further falls in inflation, activity is likely to stir in the second half on the back of rising real incomes and lower interest rates.

UK GDP is likely to stagnate in the current quarter but by the end of the year growth is likely to be running close to a trend. A similar outcome, of a weak start being followed by firmer second half seems plausible in the US and the euro area.

For now, the risks to global growth lie firmly on the downside. The resilience that helped support growth and shrug off the effect of shocks last year cannot be taken for granted. Economic activity is more volatile than the stylised forecasts of economists suggest. Few expect to see a strong or swift recovery.

There are three particular sources of risk.

Number one is that inflation proves more embedded in the system, with wages and underlying prices, excluding energy and food, holding up. That could force central banks to raise rates increasing the risks of a hard landing.

Geopolitics is an obvious second source of risk. Conflicts in Ukraine and the Middle East, disruption to trade in the Red Sea, and elections in the US and more than 50 other countries are the current focus, but new shocks could emerge quickly and unexpectedly.

Sometimes they have little discernible effect on overall growth, as with the 9/11 attacks on the US. On other occasions, as happened in the wake of the invasion of Ukraine, with a surge in gas prices, the economic effects are significant.

The risks are greatest when geopolitics disrupt financial markets, energy supply or trade. (The last two factors motivate current concerns about the economic impact of attacks on freight shipping in the Red Sea).

Elections, particularly the US election on 5 November, are another event risk. The US elections currently seems likely to be a contest between radical visions of America, with Mr Trump promising major new import tariffs, an activist, pro-fossil fuel industrial policy, and tax cuts.

The third category of risk relates to financial markets. High interest rates and weakening growth often exposes hidden weaknesses or contradictions in financial systems. This has been a feature of major rate hiking cycles.

The dotcom crash of 2000, the global financial crisis of 2008 and last year’s blow up in regional US banks were all preceded by significant rate rises. Most measures of stress in financial markets are currently running at reassuringly low levels and central banks and regulators have responded swiftly and effectively to the shocks which have emerged, such as the turmoil in the UK government bond market in late 2022.

Still, history suggests that this is the stage in the economic cycle when things have a habit of going wrong in financial markets. Vigilance is warranted.

The good news is that inflation, the principal cause of the West’s problems, is heading down. UK inflation has dropped from an October 2022 peak of 11.1% to less than 4% and is running at even lower rates in the US and the euro area.

Progress from here will be erratic and dependent on a fading of commodity price pressures, softer wage growth and an absence of supply shocks. But it is quite possible that inflation could drop to around the 2.0% mark in the UK, US and euro by the middle of the year paving the way for central banks to reduce rates.

Financial markets have become more optimistic on this front and are now pricing interest rates cuts of more than 100bp in the UK, US, and eurozone by the end of this year.

Falling rate expectations have, in turn, bolstered stock markets, with US and euro area equities showing solid returns since late October. Since the end of December rising oil prices and the disruption to trade in the Red Sea have unsettled markets. But investors still seem to be positioned for a relatively benign outcome for the global economy this year.

That the global economy has weathered the effects of high inflation, high interest rates and an energy shock as well as it is quite an achievement, but a soft landing is not in the bag.

Engineering a return to low inflation without landing the economy in recession is notoriously difficult, especially against a background of elevated geopolitical risk. The most likely outcome is that growth will come back in the rich world this year but quite a lot needs to go right for that to happen.

The investment committee continue to monitor the bond duration within the portfolios. The likelihood of interest rate cuts in the first half of 2024 is viewed with scepticism as a result of continued inflationary pressures.

The average bond duration of the underlying bond holdings remains targeted at approximately six years, in line with the average duration of the corporate bond market.

The Clarion portfolios remain underweight to the US and overweight to the UK against their respective benchmarks. This is due to the view that mega-cap stocks within the US equity market are overvalued, and markets should re-price over the longer term.

Conversely, it is the committee’s view that small-cap stocks are currently trading at attractive earnings multiples presenting a more favourable outlook for potential outperformance over the short to medium term.

Furthermore, the more adventurous portfolios remain overweight to Asia Pacific equities. This is driven by the view that valuations within the Chinese equity market specifically are currently compressed due to ongoing geopolitical tensions and economic challenges. Despite these concerns, it is the committee’s view that this risk has been priced in and that there is scope for potential strong outperformance over the long-term.

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

February 2024

Creating better lives now and in the future for our clients, their families and those who are important to them.

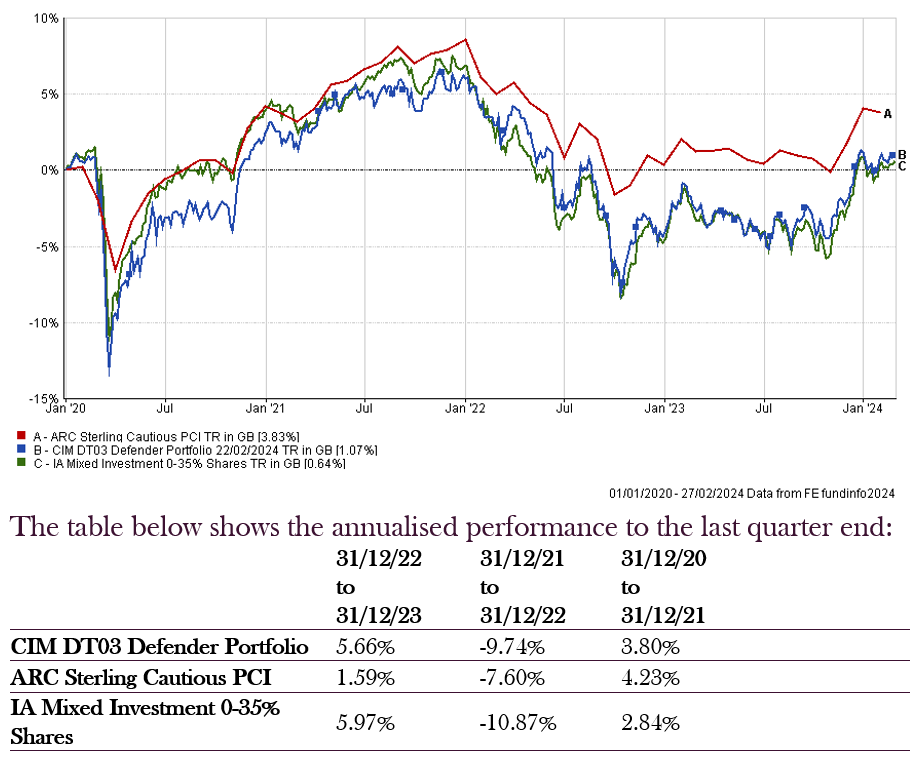

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

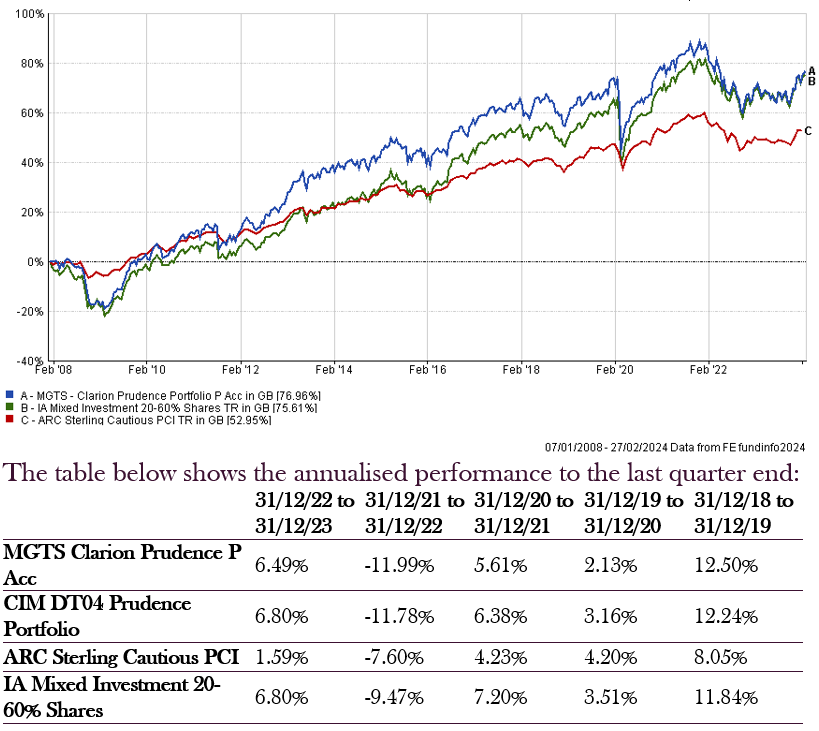

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

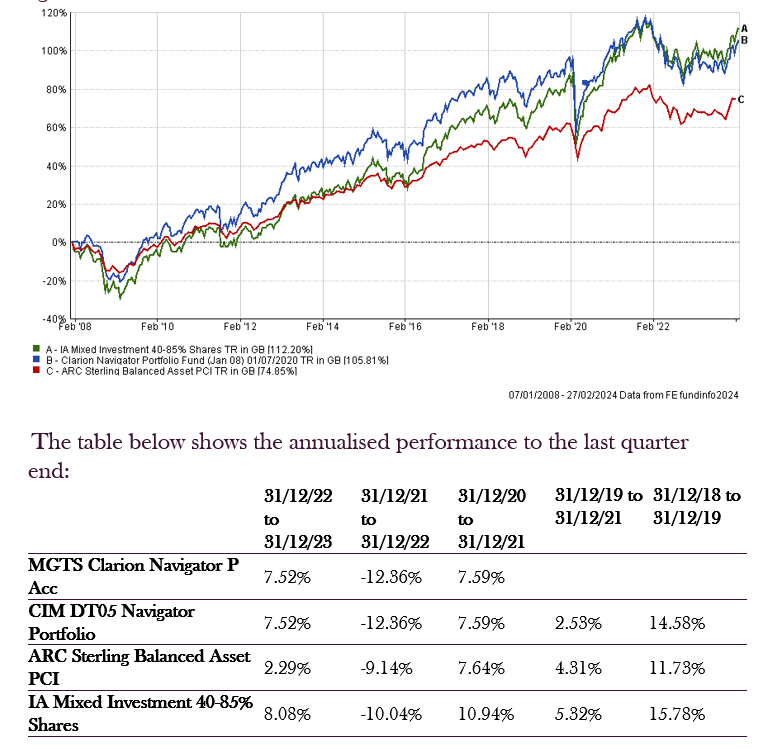

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

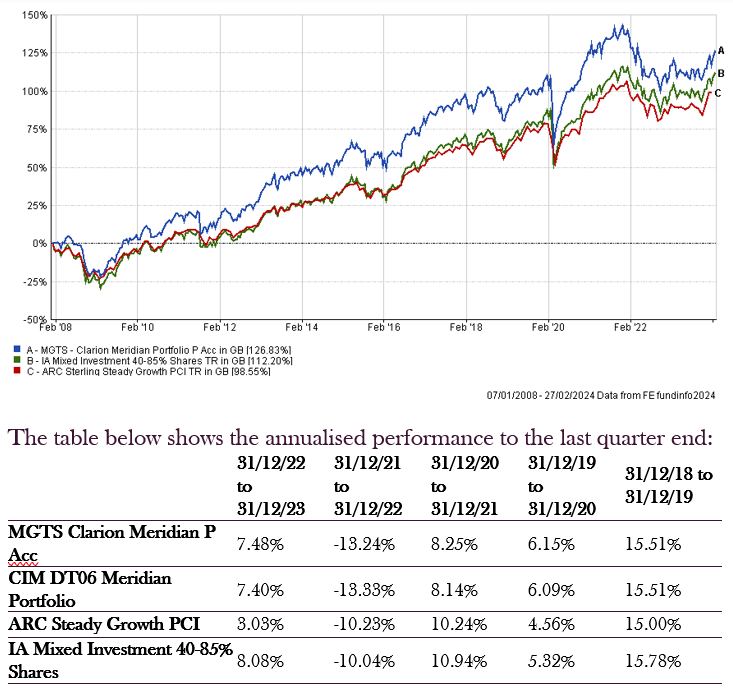

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

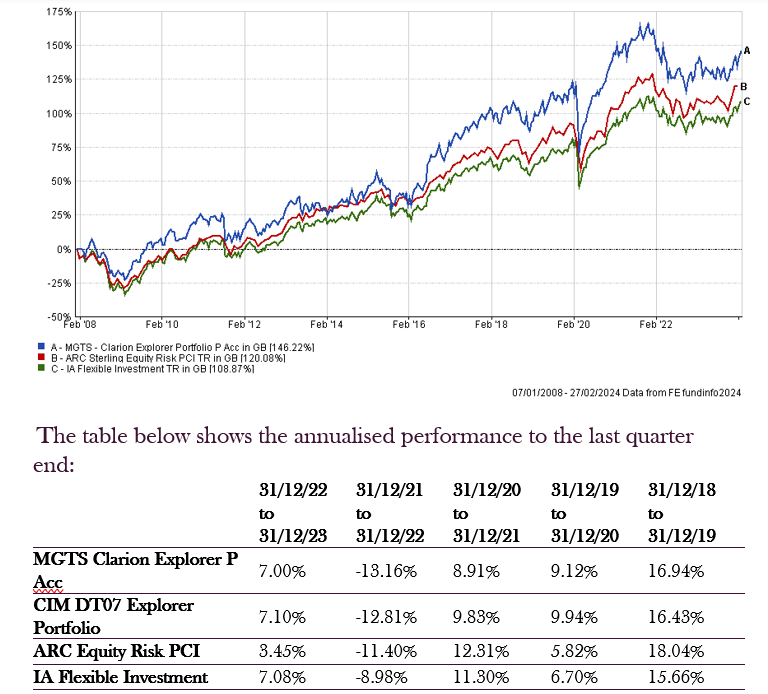

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

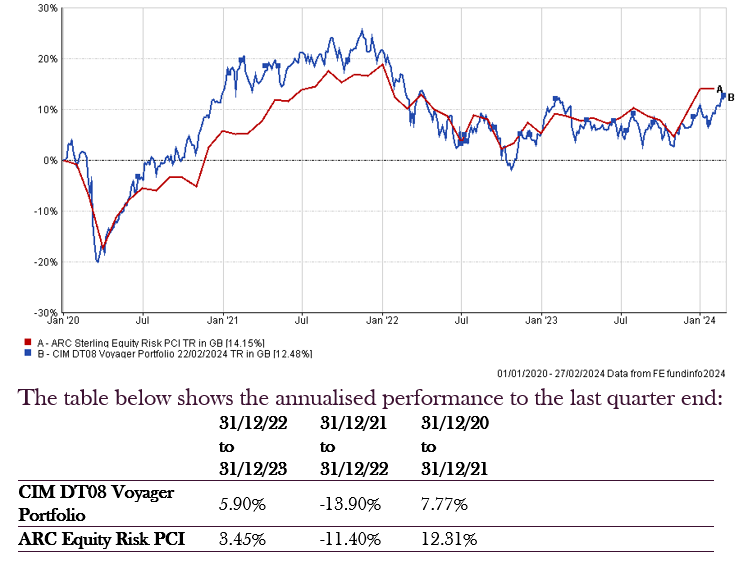

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

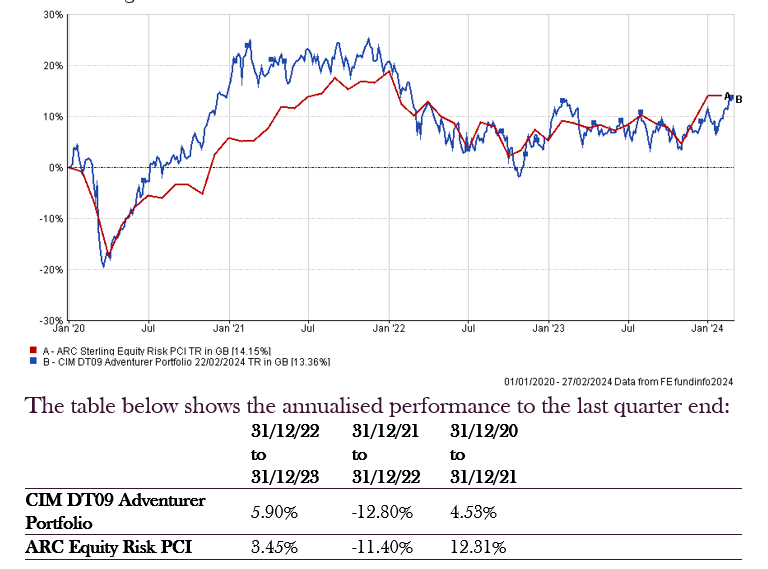

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

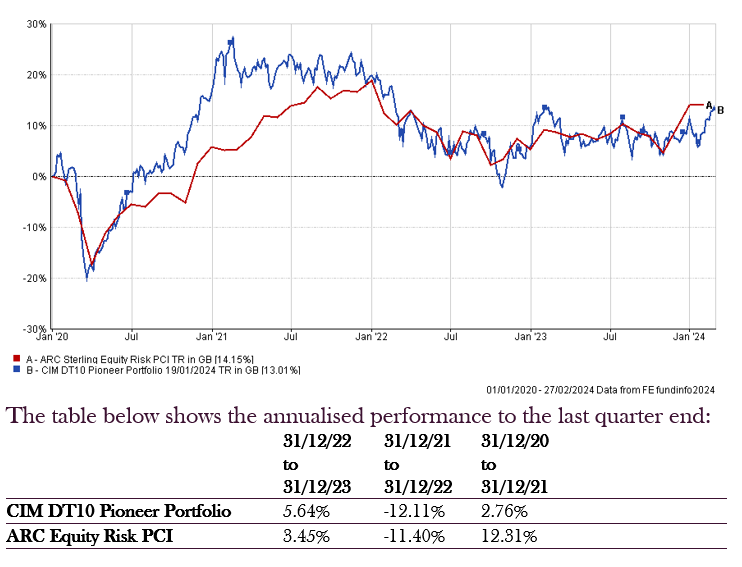

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email enquiries@clarionwealth.co.uk.

Click here to sign-up to The Clarion for regular updates.