The Clarion Investment Committee met on 26 February 2025. The following notes summarise the main points of consideration in the Investment Committee Discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic Commentary & Market Outlook.

The following is a summary of the major news events since the last Clarion Investment Diary.

Economics

- US president Donald Trump said he may impose a tariff of 25% or “substantially higher” on imports of cars, pharmaceuticals, and semiconductors.

- UK earnings growth accelerated – average regular weekly earnings in the final quarter of last year were 5.9% higher than the same period in 2023, driven by strong growth in the private sector.

- UK inflation rose to 3% in the 12 months to January, its highest level in 10 months as services and core inflation both rose.

- UK consumer confidence saw a modest rise in February following the Bank’s quarter-point rate cut but savings intentions remained unusually high.

- UK retail sales volumes rose by 1.7% between December and January, ahead of expectations.

- Japanese inflation rose to 4% in the 12 months to January, strengthening the case for rate hikes by the Bank of Japan

- The gold price hit a new record of $2,942.70 per ounce last week boosted by trade and wider geopolitical uncertainties.

- The UK said it would not immediately retaliate against US steel and aluminium tariffs and may seek exemptions due to low export volumes and its steel being used in the US defence industry.

- US consumer price inflation unexpectedly increased to 3% in the year to January, up from 2.9% increasing investor expectations that the Federal Reserve will cut interest rates only once this year.

- UK GDP unexpectedly grew by 0.1% in the final quarter last year, resulting in GDP growth of 0.9% in 2024. However, GDP on a per capita basis fell 0.1% last year.

- The National Audit Office reported that UK businesses face a “significant cost burden” to comply with UK tax legislation, with HM Revenue and Customs’ estimate of £15.4 billion a year likely to be an understatement.

- The UK’s House of Commons Public Accounts Committee said that HMRC’s tax evasion estimates, amounting to £5.5 billion in the 2022-23 tax year, are “likely being vastly underestimated”.

- Annuity sales in the UK rose to a ten-year high of £7 billion in 2024, according to the Association of British Insurers, amid higher rates and global economic uncertainty.

- The number of UK first-time house buyers increased by 20% in 2024 and represented a record 54% share of all property sales requiring a mortgage, according to Halifax. The average age of a first-time buyer was 33, the highest in the past 20 years.

Business

- The Financial Times reports that carmakers have stepped up investment in petrol and hybrid vehicles and slowing the changeover to electric vehicles.

- BMW has put a £600 million investment in producing electric Mini in Oxford on hold.

- Microsoft claimed a major breakthrough in computing that it claimed would allow it to develop a useful quantum computer in “years, not decades.”

- UK-based Lloyds Banking Group raised its provision for car finance mis-selling from £450 million to £1.2 billion ahead of a Supreme Court appeal expected in April. Some estimates suggest that the industry may have to pay out tens of billions in compensation.

- Four banks settled cases with the UK competition watchdog over the sharing of sensitive information on gilt-trading between 2009 and 2013.

- UK chancellor Rachel Reeves said she wanted to “create more of a culture in the UK of retail investing” following reports that she was considering lowering the limit on tax-free cash savings under the ISA scheme to encourage greater investment in stocks and shares.

- Shares of European defence firms rose last week ahead of an expected increase in European defence spending.

- Mining giant Glencore said it was considering moving its share listing from London, in a potential blow to the market that has seen a number of companies delisting in recent years.

- Private equity activity in the UK rose to £63 billion last year, close to the record high of £68 billion in 2021, according to figures from Dealogic.

- The UK High Court approved a £3 billion interim refinancing package for troubled utility Thames Water, avoiding a collapse into administration. Thames Water and five other water companies are challenging their funding settlements from the regulator.

- Heathrow Airport confirmed multi-billion plans to expand two of its terminals, following recent announcements to build a third runway within the next ten years.

- French president Emmanuel Macron announced AI investments worth £109 billion, while urging more European investment in the AI industry currently dominated by the US and China

- Following a fall in underlying profit to its lowest level since 2020, energy company BP said it would “fundamentally reset” its strategy to boost returns.

- NHS chief executive Amanda Pritchard said that the UK’s health service should consider “private capital investment” to restore buildings and technology needed to deliver long-term improvement.

- Sales by electric car manufacturer Tesla, owned by Elon Musk, fell across Europe in January compared with the same month last year, with Chinese rival BYD selling more electric vehicles in the UK for the first time.

- Music streaming company Spotify reported its first annual profit since its launch in 2008, amid price increases and growth in subscriber volumes.

- Energy company Shell has restarted production in the North Sea’s Penguins oilfield following the installation of new infrastructure, while Equinor announced plans to increase oil production.

- Planned reforms by the European Commission would make more than 80% of EU companies exempt from paying additional tax as part of the incoming carbon border adjustment mechanism

Global & Political Developments

- US and Russian officials convened for high-level talks in Saudi Arabia and agreed to form negotiating teams to seek to end the war in Ukraine.

- The talks, which came as a “surprise” to Ukraine, and other comments by US president Donald Trump have led some to claim that we are witnessing the breakdown of the transatlantic alliance.

- The EU announced its 16th package of sanctions on Russia, targeting the oil and aluminium exports.

- UK prime minister Keir Starmer said that he would be willing to deploy British troops to Ukraine in the event of a peace deal but that a “US backstop” would be needed.

- Swedish police announced that they are investigating suspected sabotage of an undersea telecommunications cable in the Baltic Sea

- Poland’s government and opposition both accused each other of attempting to interfere with upcoming presidential elections in May. Judges appointed by the nationalist Law and Justice Party announced a probe into the pro-EU government for allegedly planning a coup while the government warned that the same judges may annul the result if their preferred candidate does not win.

- Russia’s military spending in 2024 was $462 billion, surpassing the $457 billion combined total of European defence budgets, according to the International Institute for Strategic Studies think-tank.

- Mr Macron described Mr Trump’s return to the US presidency as an “electroshock” that could spark EU investment to bolster its security and economy.

- Mr Trump signed an executive order to pause the Foreign Corrupt Practices Act, which forbids US organisations from bribing foreign officials to win business, to “further American economic and national security.”

- US Navy Admiral Samuel Paparo said that China’s military exercises around Taiwan could soon become a “fig leaf” to hide an attack on the island.

- The UK and US refrained from signing an international agreement at the AI Action summit in Paris, with the UK government citing concerns over the declaration’s clarity on global governance and national security.

- UK business secretary Jonathan Reynolds said the Competition and Markets Authority should be less risk averse and more agile, amid the government providing the regulator with an updated mandate that focuses more on growth

We are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Asia and Emerging Markets where valuations are generally more attractive which will help to offset some of the economic headwinds and geopolitical uncertainty.

Please click here to access the February Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary

- Most sensible market watchers warned of increased volatility as we started 2025, in the main due to the re-election of Donald Trump who was inaugurated on 20 January. This has indeed proved to be true, but perhaps not for the reasons expected.

- This initial utopia following President Trump’s inauguration was rudely interrupted by a relatively unknown Chinese AI company, DeepSeek, that released a piece of AI software known as a Large Language Model (LLM) which performed as well as OpenAI and ChatGPT. This was not in itself big news, however what spooked Nvidia and AI investors was it needed much less computational power and, because of this, much less energy to do it.

- Many investments in the US are not just predicated on AI chips, but also the infrastructure which needs to be built to support them. This includes data centres and energy grids. So, the perception that we can deliver AI with a lot less computational and energy needs, impacted several industrial and utility stocks in similar manner to Nvidia.

- Is this the end of the AI led bull market? Was AI just a bubble which will now burst? As we have previously noted, one difference between a bubble and a bear market is if you are invested in it or not! To those who have missed out on the investment returns from AI related stocks, this will feel like vindication for their scepticism. For those who have benefited and are still invested, this will seem like a bump in the road. Who is correct?

- The best investment tool is a pair of eyes, and what the market was telling us via share price movements was very instructive. Apple shares were up on the day as what DeepSeek has achieved should allow AI to work on smartphones, not just in big servers. This increases the likelihood of an upgrade cycle for their core product, the iPhone. Meta (Facebook as it was once known) was also up. They will use many LLMs in their business in future years, and if they are becoming cheaper to use and run that will allow Meta to be more profitable.

- Companies such as Alphabet (Google) and Microsoft were down only marginally suggesting there are as many positives as negatives for them. The semiconductor companies, such as ASML, Broadcom and Nvidia were down significantly as it was perceived there will be less demand for their products in the future.

- The first message from this is the market was not saying this is the end of the ‘Magnificent Seven’ technology companies as some headlines suggested. Some will benefit from DeepSeek. The second message is there is an interesting buying opportunity for those who believe in the Jevons paradox, that efficiency gains generate a net increase in demand. Increasing efficiency should increase demand, which in theory should increase the need for many things the market saw as less valuable (semiconductors, data centres etc). For anyone who has missed out on AI as an investment area, serious consideration needs to be given as to if this is an opportunity to gain exposure.

- Ultimately, investing is about probabilities not certainties. It is impossible to say one day after an event of this scale exactly what the future holds. That said, there was a lot of knee jerk reactions, accentuated by technical factors in how markets work. What has not changed is the transformational nature of AI and how early it is in its development. This week has increased the scale of its potential impact, and accelerated the time in which it will do this. Logically investors should be enthused by this, not put off!

Strategy

The current strategy remains broadly unchanged.

- The Investment Committee are maintaining their tactical position of being underweight US stocks, particularly mega cap tech stocks, and overweight UK, Asia & Emerging Markets and broadly neutral on Europe and Japan.

- Short duration bonds are preferred to longer duration bonds.

- Inflation is expected to persist, and the long-term average is expected to be around the 3% level which will curtail future interest rate cuts.

- A new interest rate cutting cycle has begun and is expected to create optimism throughout 2025, but a higher interest rate and higher inflation environment will become the new norm.

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future. Liquidity has been the most significant driver of returns to date but there remains a downside risk to high valuation stocks.

- The Chinese economy is stagnant but further fiscal and monetary stimulus may provide relief.

- It will take a full economic cycle for the inflationary effects of printing money after the global financial crisis and Covid to dissipate.

- After extensive changes to the underlying funds in recent weeks the Investment Committee are very comfortable with the present position and no further fund changes were proposed.

Clarion Funds & Discretionary Portfolios:

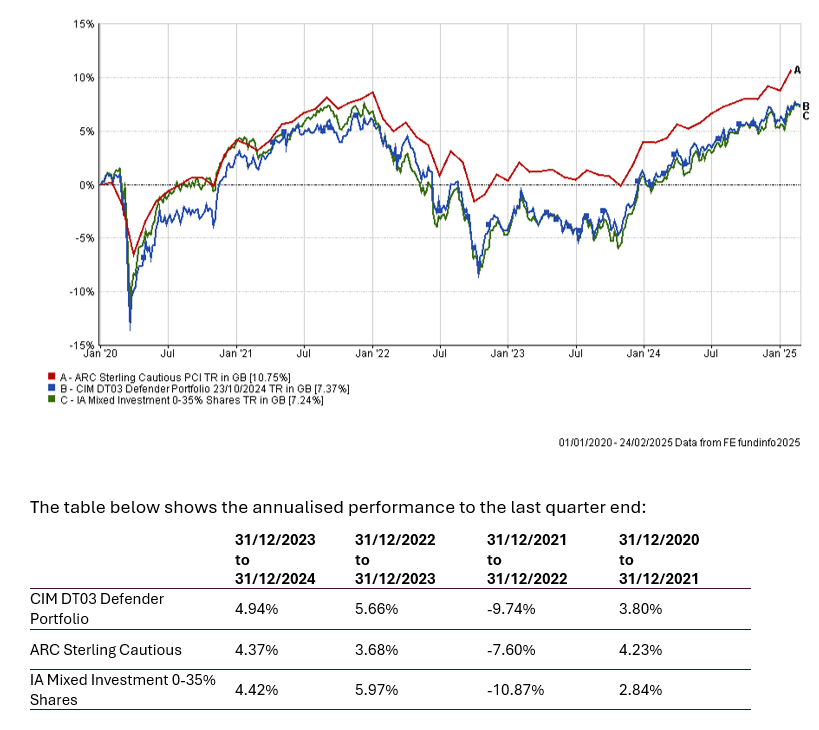

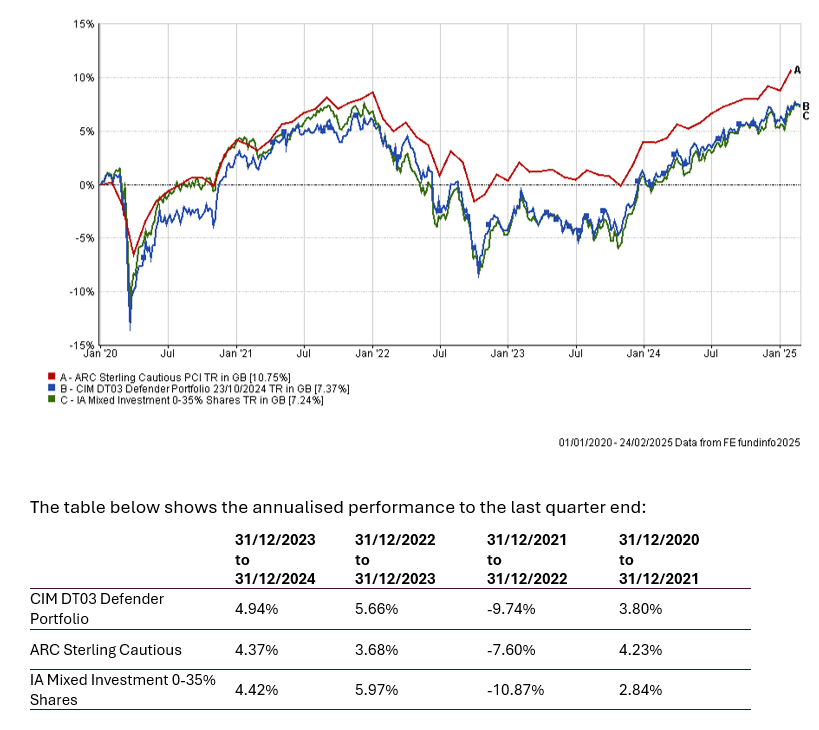

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

Changes to the Defender Portfolio

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund & Portfolio

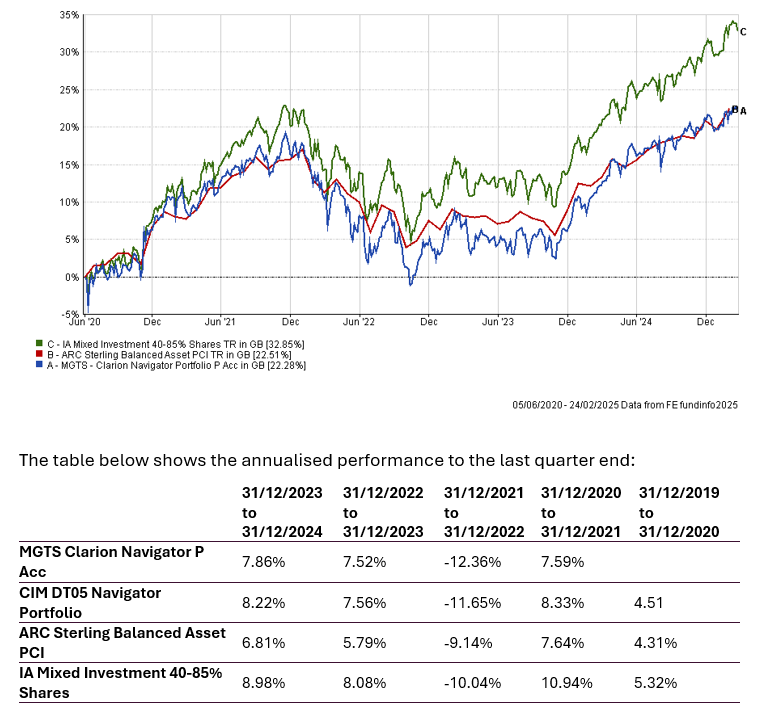

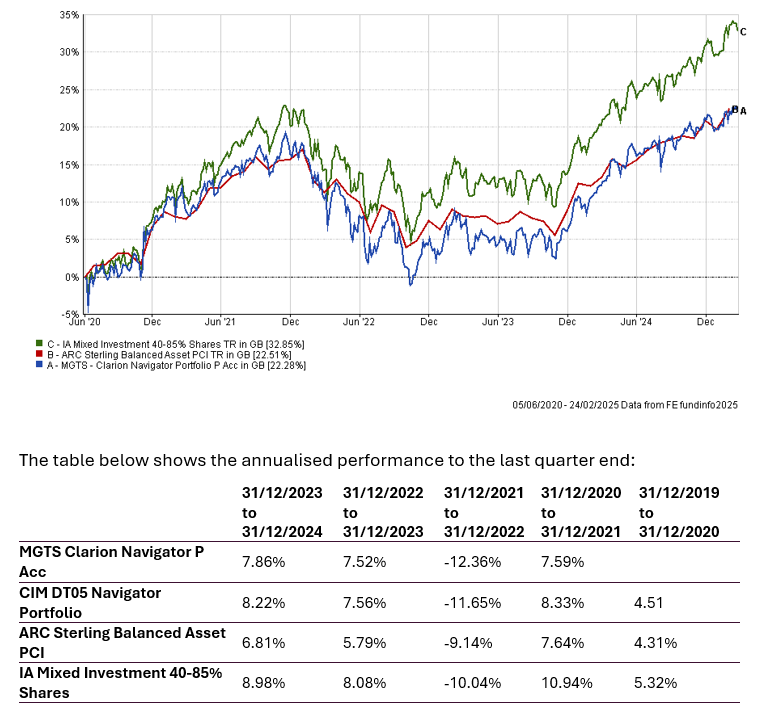

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

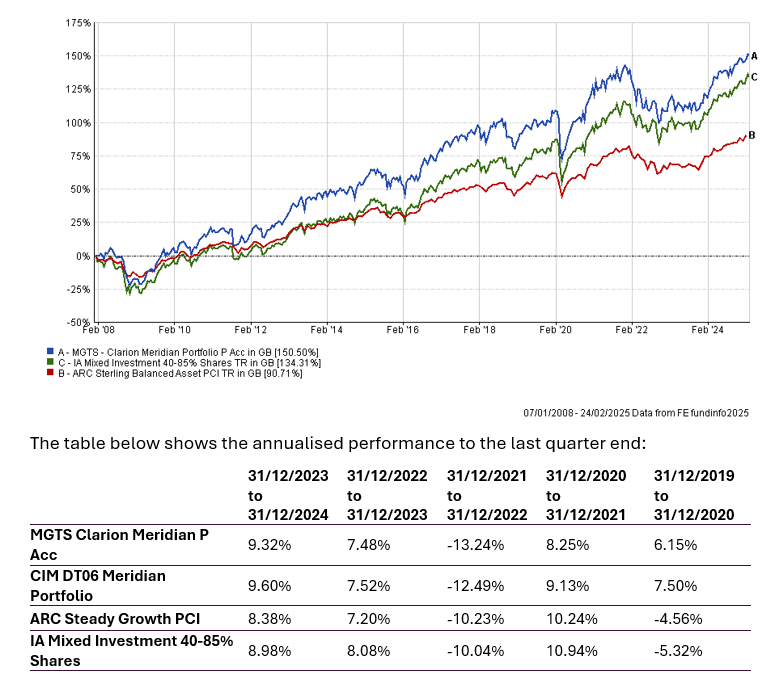

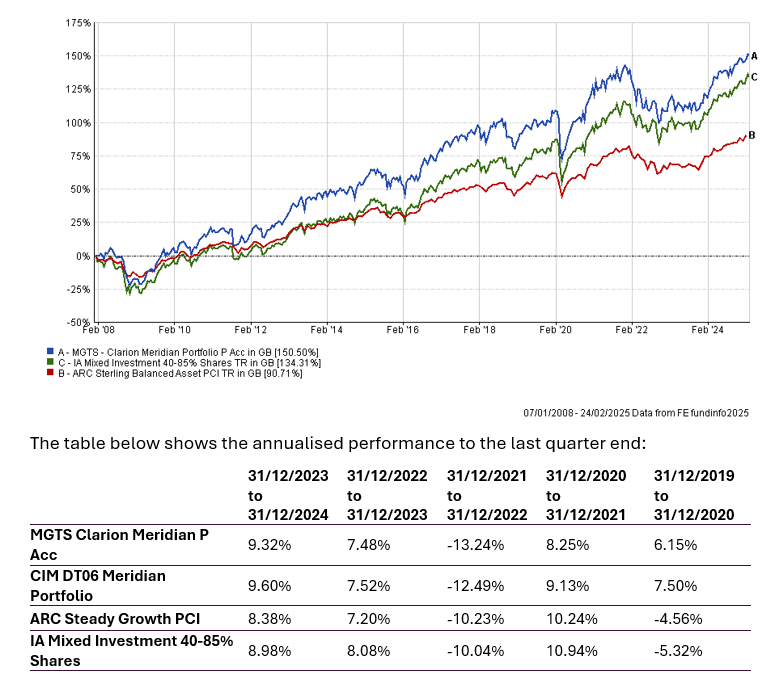

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

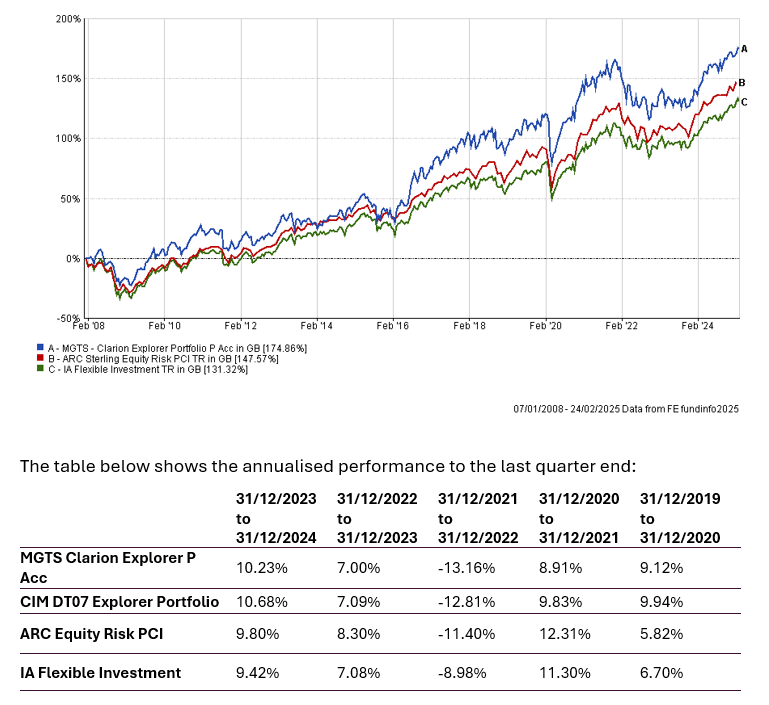

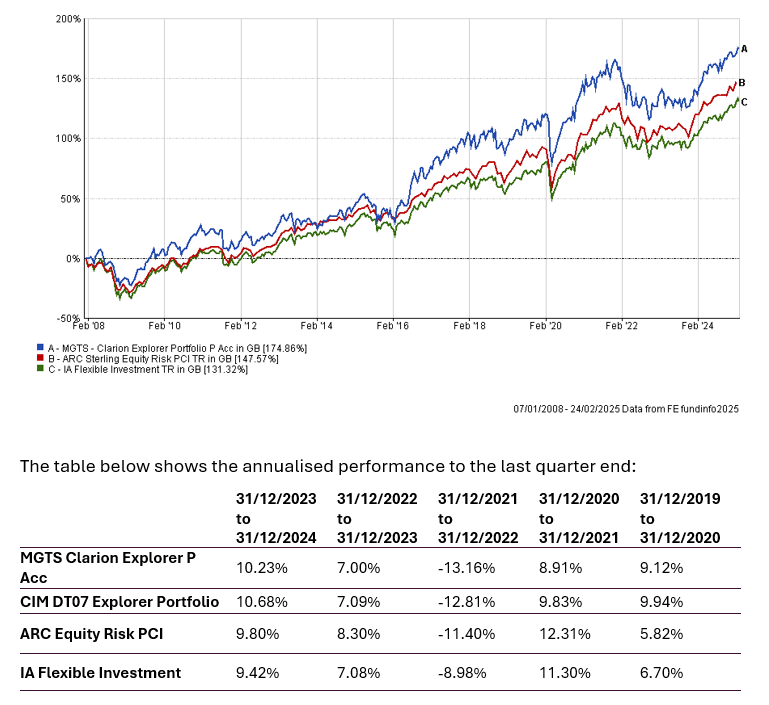

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

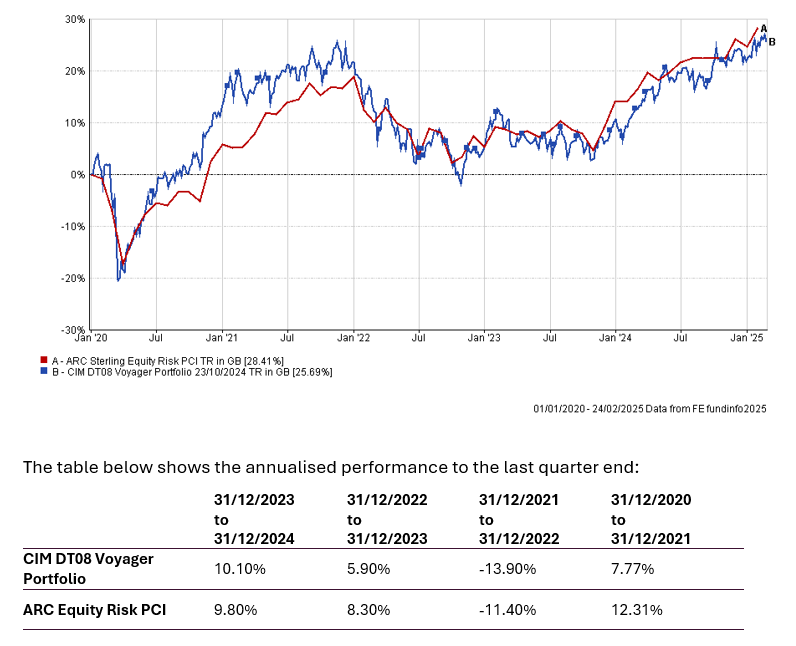

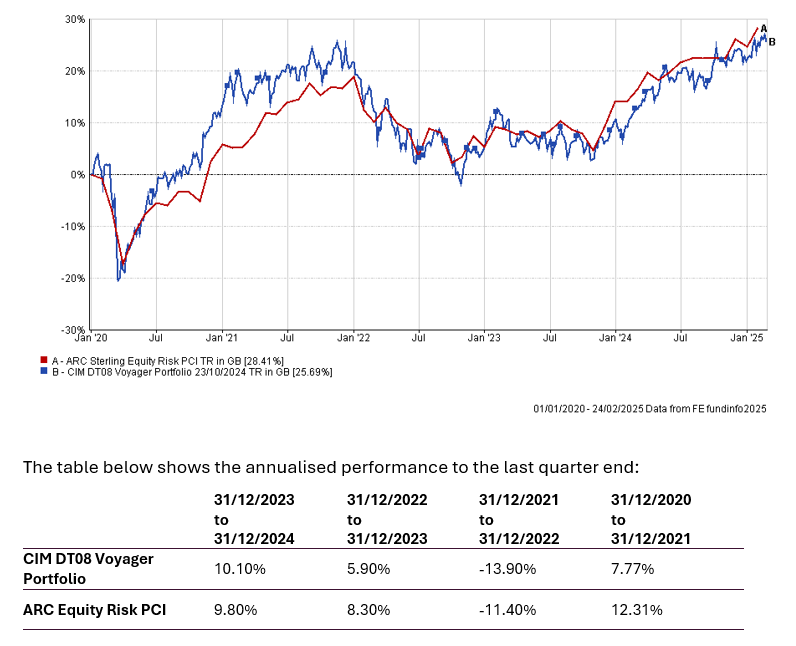

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

Changes to the Voyager Portfolio

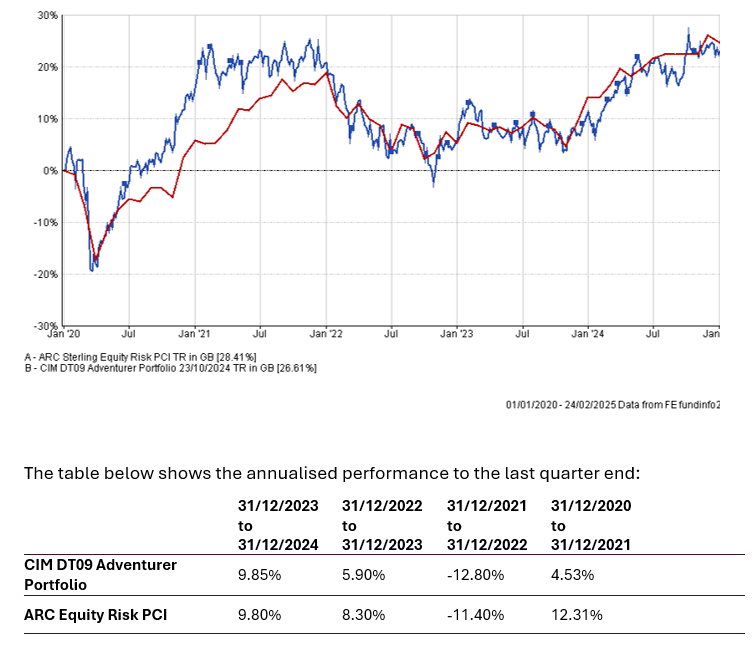

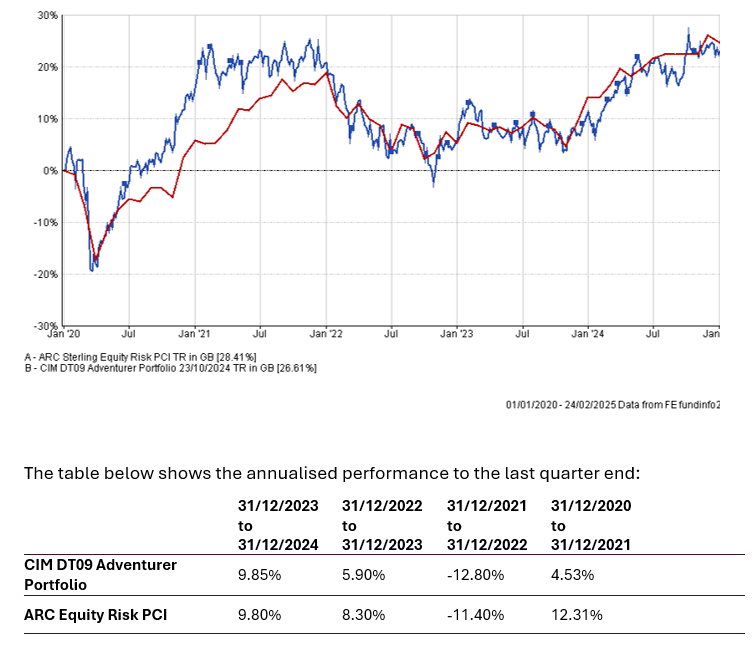

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Adventurer Portfolio

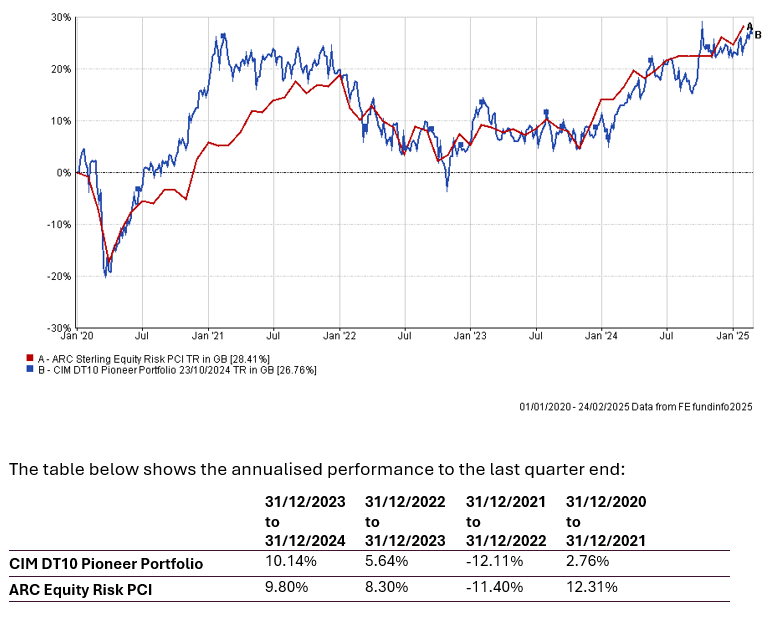

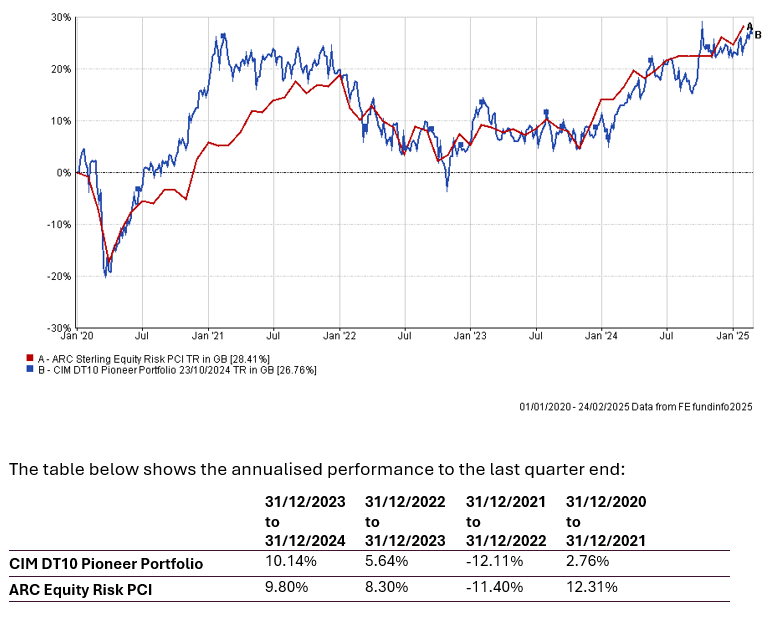

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Pioneer Portfolio

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

February 2025

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.