Minutes of the Clarion Investment Committee held at 1pm on 11th February 2021 by Video Link.

Committee Members in attendance:

| Sam Petts (SP) |

IC Chairman and Financial Planner |

| Keith Thompson (KWT) |

Clarion Chairman |

| Dmitry Konev (DK) |

Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) |

Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) |

Technical Assistant Clarion |

|

|

*Apologies from Ron Walker, Founding Director, Clarion

Review of previous minutes and action points

Minutes from the previous meeting held on 14th January 2021 were agreed by the Committee as a true and accurate record.

Economic commentary and market outlook

Please click here to access the February Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

The main theme for the year ahead is a positive continuation of economic recovery in developed and emerging markets as vaccine programmes are rolled out.

We are optimistic that Covid-19 risks will diminish throughout 2021 as the vaccine response accelerates and is further boosted by warmer weather heading into spring and summer. With vaccination programs being rolled out, c.50% of the UK population is expected to have been vaccinated by April 2021, at which time economies are likely to start to open again. As economic activity recovers, inflation is likely to follow, as people start spending pent-up savings and goods start moving around, which will be positive for risk assets and negative for fixed income assets.

The evidence from economies that have successfully suppressed Covid-19 indicates a rapid economic rebound is likely as restrictions are reduced.

This is expected to be positive for stock markets generally, with real economy stocks having more scope for recovery. Economies able to release restrictions sooner are expected to maintain an advantage into the next cycle, particularly the UK, which is leading vaccine roll outs and recovering from longstanding Brexit issues.

Over the next 10-15 years, UK large caps, Emerging Markets and Asia are likely to be the strongest performers on an annualised basis, with US equities lagging.

The US did well in the credit crisis because it had the ability to print money; QE benefitted the tech sector, which set the US on a 10-year path of outperformance. In the same way, Asia and EM are expected to come out of Covid-19 faster than western economies because of a more favourable demographic and/or more effective measures to control new infections.

Strategy

We believe our current strategy remains appropriate with reduced weighting to US equities and global fixed interest. Increased weightings are held in the UK, Asia, Emerging Markets and Japan where appropriate to the target level of risk. In the most recent investment committee meeting a decision was taken to reduce exposure to US large cap equities where valuations are stretched in favour of US smaller companies.

Elevated market volatility is expected in the short-term, requiring patience as speculation is creating unpredictable micro-trends.

In our view, the UK remains one of the most attractive investment opportunities on a valuation basis. With Brexit resolved, overseas investors now have a realistic expectation of what happens with their capital and can allocate accordingly. The UK suffered from years of relative underperformance due to Brexit undercutting Sterling and confidence. Additionally, UK equity indices have a bias towards services and commodities and underperformed many other markets during the falls induced by the Covid-19 pandemic. With the UK demonstrating remarkable resolve in its vaccination programme, it could emerge from lockdown earlier than other western countries and provide a significant boost for many companies that have struggled in the pandemic, which ought to result in relative outperformance.

Our overweight Asia Pacific positioning is based on the success of Asian economies in suppressing the Covid-19 pandemic. Most economic indicators have returned to pre-pandemic levels, with the exception of tourism. Vaccination rollouts will allow this final sector to improve, further boosting the relative success and growth of these economies. The head start these countries have had in terms of pandemic recovery and a reasonable valuation on a historical basis mean we are not overpaying for an attractive investment opportunity.

Bond markets remain unappealing from a long-term investment perspective. Yields on government bonds remain close to all-time lows and central bank intervention continues to be the main factor in the marketplace. With governments struggling for tax receipts and Covid-19 costs continuing to mount, these yields will remain flattened to assist with cheap borrowing for as long as possible. This is a good outcome for government finances but terrible for pension funds and asset managers searching for yield. With limited options for yield without undertaking excess risk, our positioning is conservative within the short-dated end of the yield curve, where corporate bonds offer above-inflation yield with reduced duration and credit risk. Should inflation rise and put pressure on yields, these bonds should outperform on a relative basis.

Review risk management, eligibility and investment and borrowing powers

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

Management of the Clarion Funds: Prudence, Navigator, Meridian and Explorer

MGTS Clarion Prudence

- The last quarter has seen Prudence perform in line with its DT strategic benchmark whilst marginally underperforming its sector by -0.10% over the same time.

- The positive ‘allocation’ attribution in the fund is counteracted by the negative ‘selection’ attribution, neutralising the overall portfolio effect versus its sector.

- The ‘First State Asia Focus’ fund continues to underperform considering the funds defensive strategy which tends to perform well during market downturns and lags on the recovery. The underperformance in recent weeks does not raise too much concern for the committee, and the fund remains appropriate for Prudence given its low volatility mandate.

- We have seen positive developments in the bond allocation of the portfolio which has mainly been driven by the rise in bond yields in the UK, resulting in an upward movement in the short duration holdings in particular.

- In terms of the high yield bond funds in the portfolio, these continue to perform relatively well as a result of spread compression. Compared to historical averages, the spread compression of high yield bonds remains tight.

- Overall, the biggest underperformers in the bond element of the portfolio over 1 month are Royal London Sterling Credit and Royal London Global Index Linked which are the two strategies with the longest bond duration.

- Despite the marginal rotation, we have seen JPM Japan which adopts a growth strategy underperform whilst Man GLG UK Income which adopts a value-based strategy has outperformed over the same time period.

- It was discussed that Royal London UK Equity should be considered for replacement following a period of average investment performance. This, alongside the fact the long-standing fund manager of this fund is soon to retire, feels like the right time to exit the fund. This is to be reviewed further at the next IC meeting and in the meantime, a suitable replacement is to be researched.

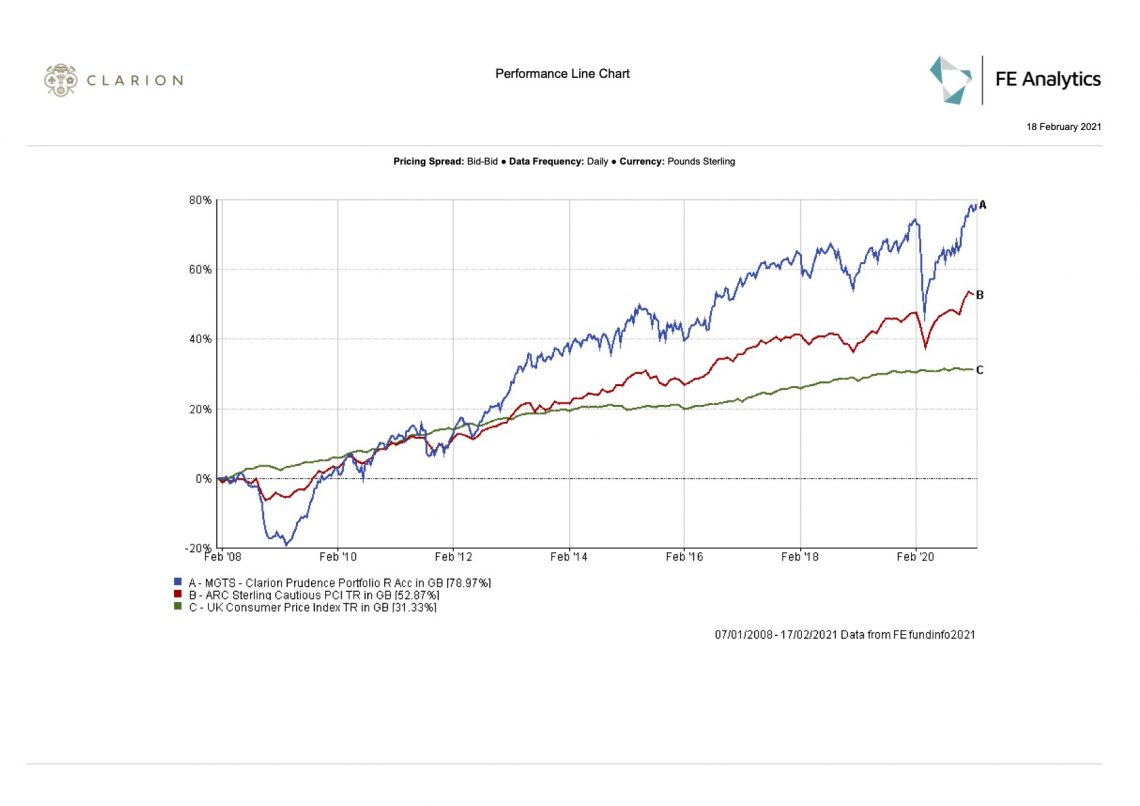

- The portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £20.39m.

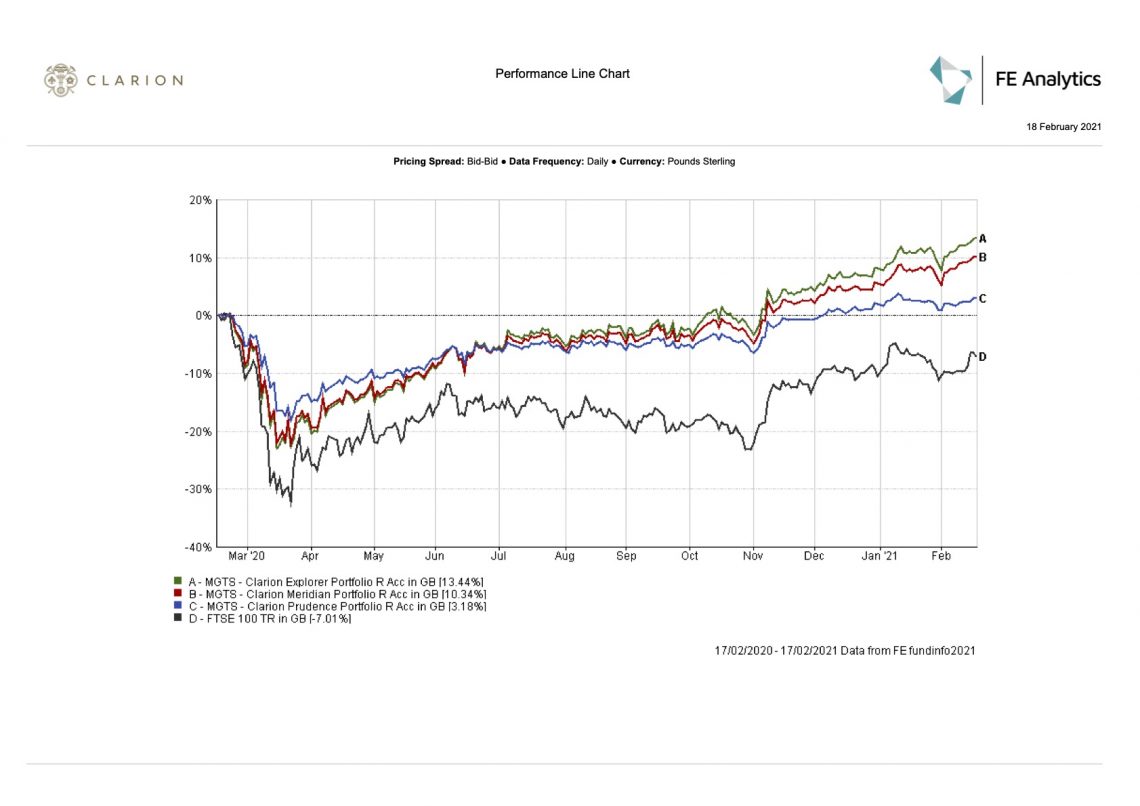

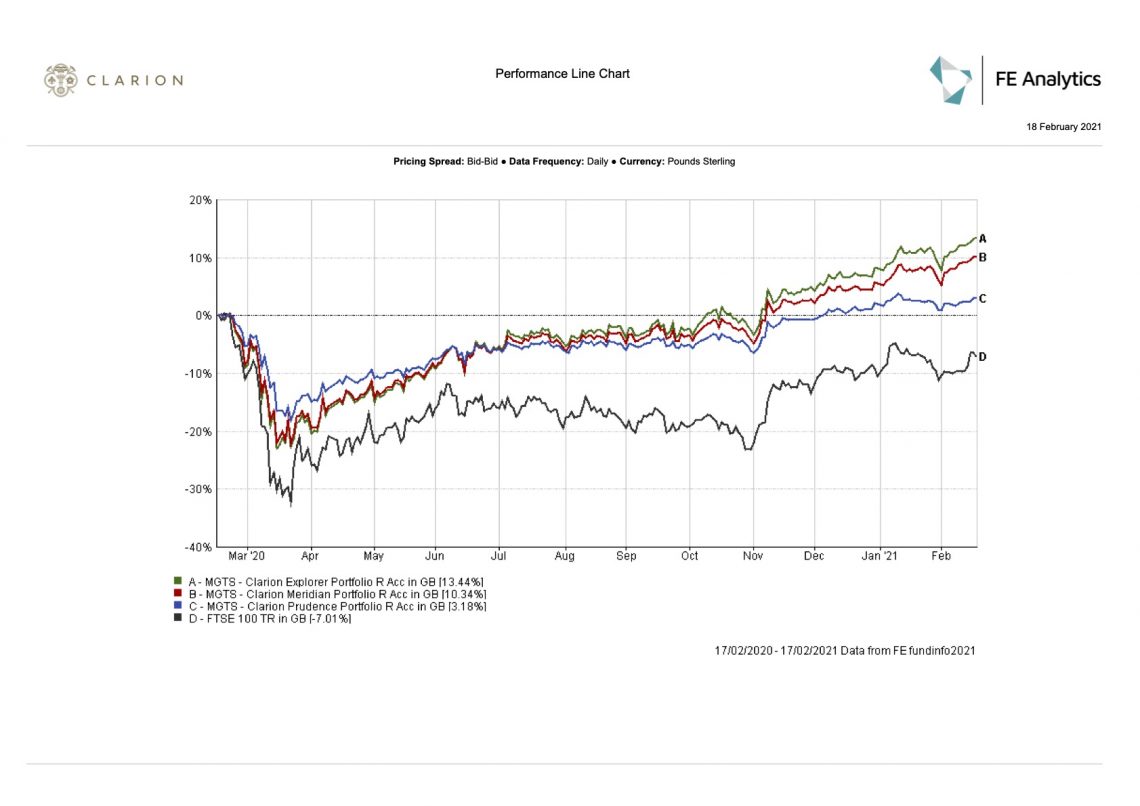

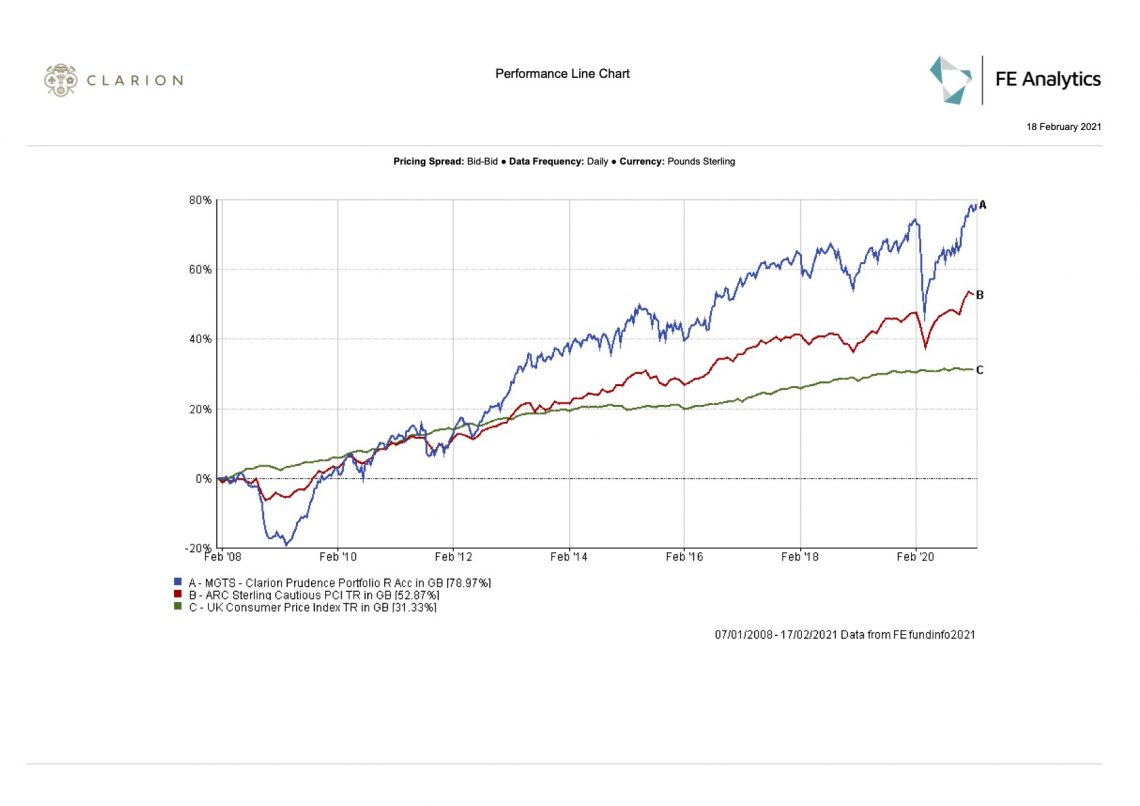

- Performance over 1 year is up at +3.18% compared to a fall in the UK FTSE 100 index of circa -7.01%

MGTS Clarion Navigator

- Over 6 months, the fund is slightly ahead of its strategic benchmark whilst slightly behind its sector. The fund sits within the same sector as Meridian yet takes less risk, and therefore performance slightly behind its sector is expected.

- The newly introduced BlackRock Continental European fund has slightly underperformed since adding to the portfolio and has underperformed its sector by 0.35% over 1 month. This underperformance is marginal and therefore of little concern to the committee at this juncture.

- We have seen a marginal rotation back from value, to growth in the last couple of weeks which has seen Fundsmith Equity come out on top versus M&G Global Dividend. Over 2 weeks, the funds have returned 1.57% and -1.30% respectively which demonstrates how these two funds continue to work well alongside each other.

- The remainder of the portfolio remains in good shape and the committee agree that no further changes are required at this stage.

- Fund size is currently £63m.

- The unit price as of the 17th February 2021 was 111.88p; showing a 11.88% increase having been launched at 100p on the 11th May 2020.

MGTS Clarion Meridian

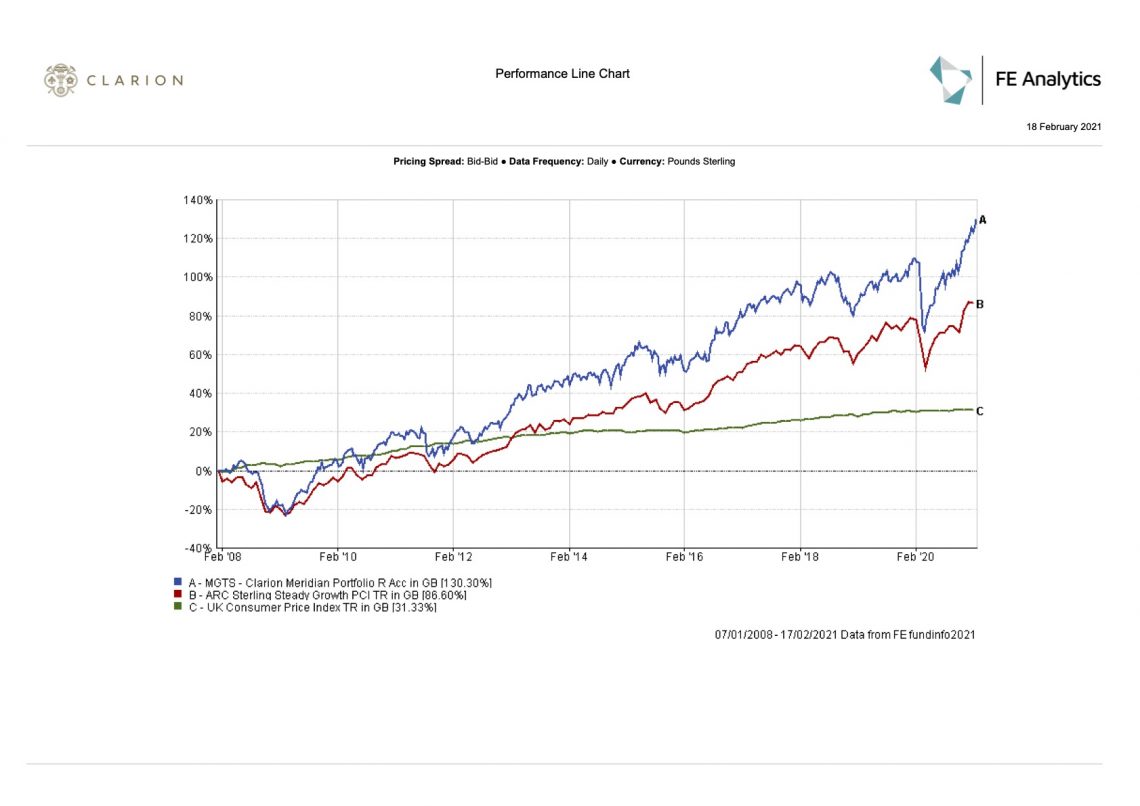

- Meridian has outperformed against both its benchmark and sector over the last quarter by +0.80% and +1.60% respectively.

- The outperformance versus is sector derived from the portfolio allocation attribution within the IA Global sector along with Asia (excluding Japan). The biggest detractor on performance was our fund selection in the UK Equity Income and UK All Companies element of the portfolio. Overall, the cumulative interaction between selection and allocation was positive.

- The First State Asia and Fidelity Asia funds have negatively correlated in terms of investment performance over 1, 2, 4 and 12 weeks as result of their individual bias to growth/ value. Over four weeks, Fidelity Asia has outperformed its benchmark by 3.98% which is the strongest outperformance in the Meridian portfolio over that timeframe.

- In similar vein to the Asia funds, the same correlation is prevalent in the Emerging Markets element of the portfolio with the Hermes fund being more growth focused whereas SLI is more value focused. This is evidenced by the performance over 2 weeks with Hermes returning +0.71% and SLI returning -0.60% following the slight rotation we have seen over the last few weeks.

- At recent IC meetings, we have seen Artemis Global Select perform strongly and outperform Fundsmith. However, over the last month, we have seen this trend in performance reverse with Fundsmith returning 0.82% over the last month whilst Artemis has returned -1.34%. Despite this, Artemis remains ahead of Fundsmith over 12 weeks, 24 weeks and 1 year.

- The committee are very pleased with the performance of Baillie Gifford Japanese following outperformance of 1.42% versus its sector over 1 month. This fund has performed stronger compared to the JPM Japan fund held within Prudence and Explorer.

- We have seen strong performance in UK small cap’s in recent weeks which has benefitted the strategy of Slater Growth which has outperformed its benchmark by 3.69% over 4 weeks. This fund is the strongest performing UK equity fund over 1, 2, 4 and 12 weeks.

- It was agreed that a US smaller companies fund should be introduced into the portfolio to gain exposure to the potential upside in the global recovery whilst also reducing allocation to US trackers which have large exposure to large caps companies who already have gained as a result of the pandemic (tech focused businesses). Research conducted pre-meeting has led to the committee agreeing a 4% weighting in ‘Artemis US Smaller Companies’ which will be funded by trimming back both US trackers in the portfolio by 2% each.

- The remainder of the portfolio remains in good shape and the committee agree that no further changes are required at this stage.

- Fund size is currently £35.

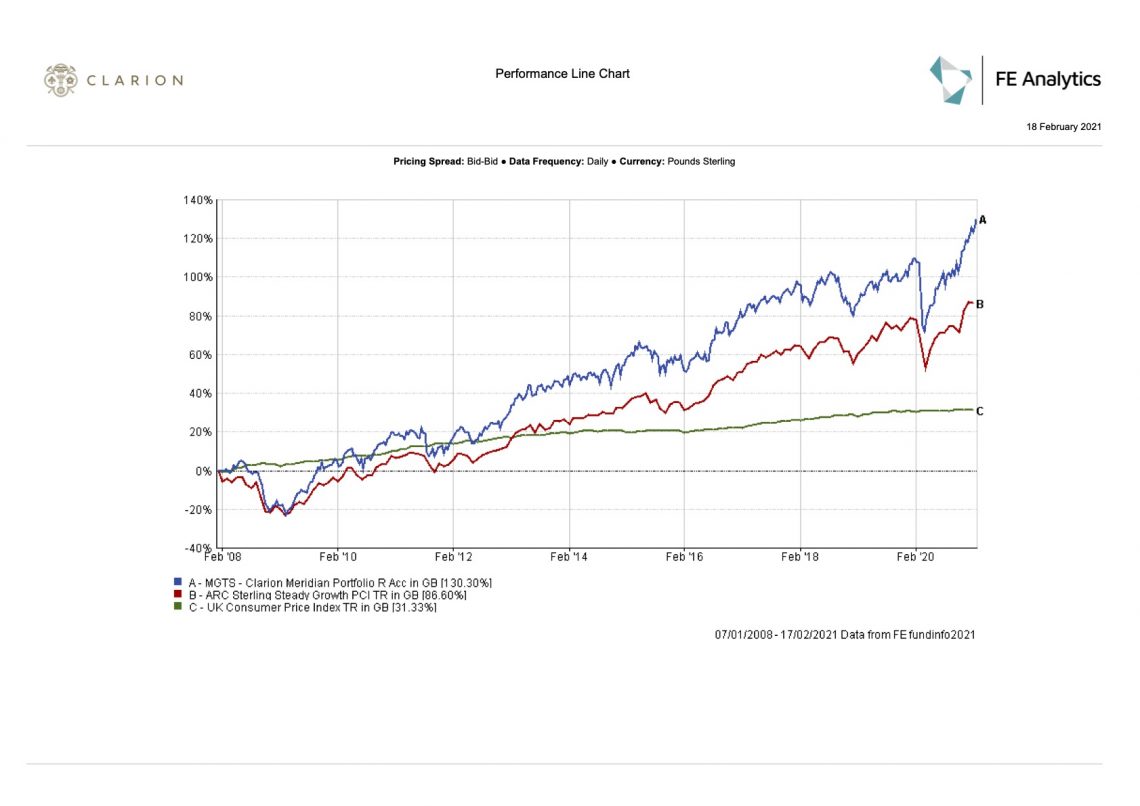

- Performance over 1 year is up at +10.34% compared to a fall in the UK FTSE 100 index of circa -7.01%

MGTS Clarion Explorer

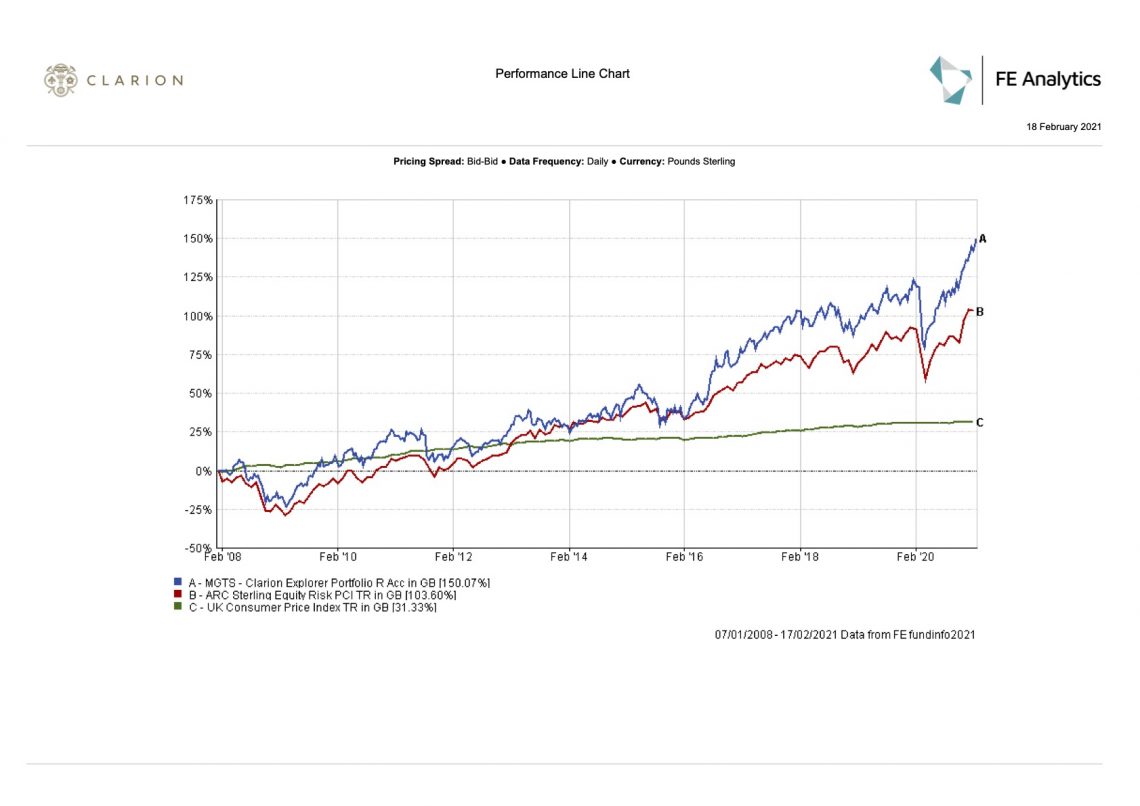

- Over the last quarter, Explorer has returned 7.20%, underperforming both its benchmark and sector by 1.20% and 0.50% respectively over the same timeframe. Explorer however still remains ahead of its benchmark and sector over 6 and 12 months.

- The underperformance over the last quarter has derived from a combination of negative allocation and selection attribution with the main pull back on performance being our allocation in North America.

- Stewart Asia, Schroder Pacific and Schroder Asian Income have all underperformed over 4 weeks as a consequence of the fund’s defensive strategies. The growth strategy of Fidelity Asia however has led to a period of strong performance over the same time period, neutralising the performance within the Asia Pacific (ex-Japan) sector.

- In the emerging markets sector, both Hermes and UBS have outperformed SLI and JPM over 1 month in light of their bias towards growth type holdings. UBS stands out over a month, returning 5.71% which is by far the highest performing fund in Explorer over 1 month.

- Hermes Europe Ex-UK Equity and BlackRock Continental European are both marginally behind their sector over 1 month. However, over the longer term, both funds remain strong with them outperforming their sectors by 13.10% and 16.01% respectively, over 1 year.

- Looking at the UK, mid-caps outperformed with L&G Mid Cap being the strongest UK holding over both the last month and quarter.

- We have seen BlackRock UK Equity claw back some gains in recent weeks following the slight pull back in growth stocks.

- In line with Meridian, it was agreed to introduce the ‘Artemis US Smaller Companies’ fund at 4% whilst also trimming back on both US equity trackers by 2% each.

- The rest of the portfolio remains in good shape and no other changes are required at this stage.

- Fund size is currently £19.11m.

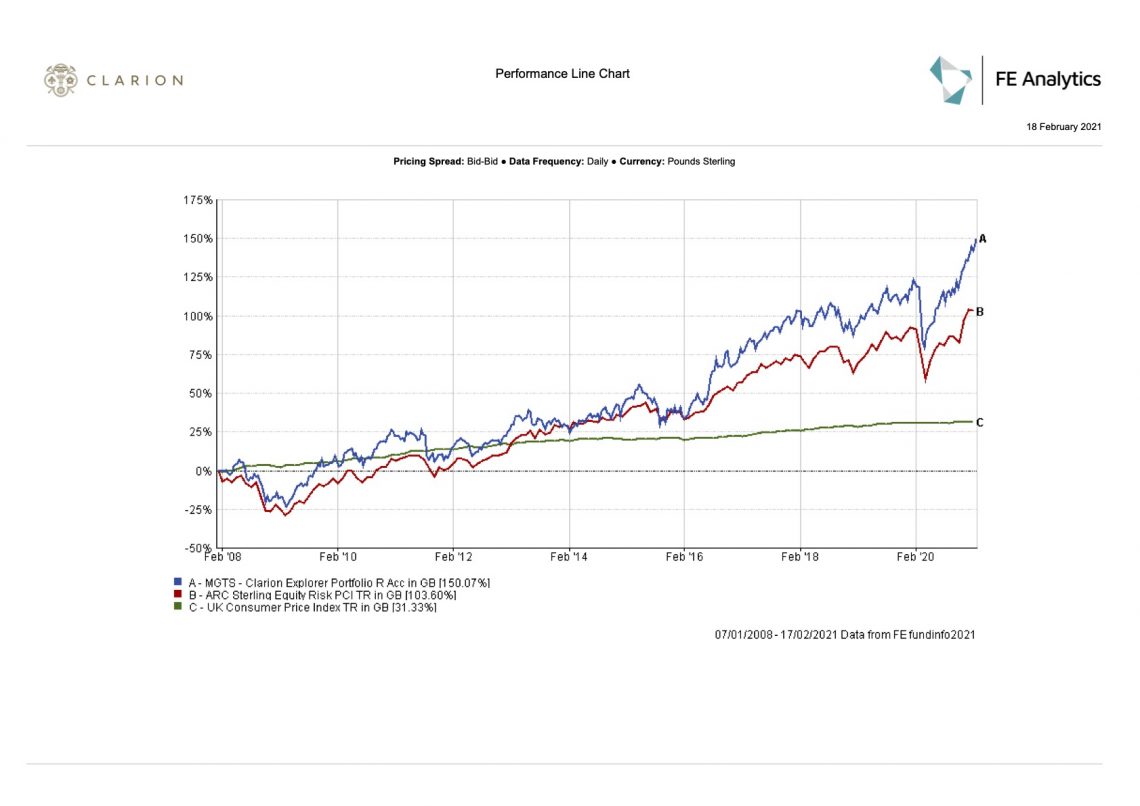

- Performance over 1 year is up at +13.44% compared to a fall in the UK FTSE 100 index of circa -7.01%

Model portfolios

It was agreed to make appropriate changes to the model portfolios to reflect the changes to the Portfolio Funds detailed above.

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

Next Investment Committee meeting is on 11th March 2021 although in the interim period the Committee intend to conduct slightly shorter conference calls as considered appropriate.