Minutes of the Clarion Investment Committee held at 1pm on 11th March 2021 by video link.

Committee Members in attendance:

| Sam Petts (SP) |

IC Chairman and Financial Planner |

| Keith Thompson (KWT) |

Clarion Chairman |

| Dmitry Konev (DK) |

Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) |

Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) |

Technical Assistant Clarion |

| Ron Walker (RW) |

Founding Director, Clarion |

| Adam Wareing (AW) |

Operations Director, Clarion |

Review of previous minutes and action points

Minutes from the previous meeting held on 11th February 2021 were agreed by the Committee as a true and accurate record.

Economic commentary and market outlook

Please click here to access the March Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

- Israel is leading the world in rolling out the Covid-19 vaccine; as they are approximately 4 weeks ahead of the UK, the Committee are watching for the infection rate and hospitalisation figures in Israel to come down, as this will provide a good idea of what the UK can expect in a month’s time.

- Global stock markets have achieved a V shaped recovery post Covid-19 lows.

- Covid-19 stimulus exceeds $15 trillion with a further $1.9US package to follow.

- Inflation risk moves firmly into focus and bond yields move higher. Inflation is a theme for the next decade.

- Brexit agreement marks the beginning of new negotiations and trade difficulties are emerging.

- Big Tech which has dominated the US stock market, begins to underperform.

- Vaccine strategy in the UK provides light at the end of the tunnel but risks of variants remain.

- Rotation to value continues in a “jumpy” fashion.

- UK Budget – largely neutral from an economic perspective.

- If the vaccines are successful in suppressing the virus, we can expect lockdowns to ease and spending to resume, creating an inflationary effect that could benefit value stocks and be detrimental to some growth stocks.

- Active managers are gradually increasing their exposures to small and mid-cap stocks, which could lead to their outperformance of the index tracking passive strategies.

- The S&P 500 is heavily concentrated and passive investors could be taking too much stock and sector specific risk.

- On average, both the corporate and private sectors were net savers during the pandemic; despite falling sales for some businesses, their cost base has decreased significantly while, the gross debt to profits ratios remained approximately the same.

- The growth in money supply following the Covid crisis has been faster than it was after the financial crisis, at c.25% in the US, c.13% in the UK and c.11% in Europe. The growth of money supply and GDP are both related to change in prices; one of the reasons inflation has been poor over the last few years is that, although there was a lot of money supply, velocity was coming down as it was going into financial assets and not being spent in the economy.

- Asset price inflation is a form of inflation and we have seen this in Tesla and Bitcoin.

- China is looking to leverage its position and increase prices gradually.

- UK gilts have not performed well for the last 6 months or so; this trend is starting to appear in asset price movements.

- Tech stocks do well when interest rates fall as they get cheap access to capital. When tech stocks fell in the 2000s, value stocks surged. While we are not expecting the same kind of crash in tech this time around, we do expect some slowdown in the growth of tech stocks.

- The vaccine strategy deployed by the UK suggests we are better off out of Europe, nevertheless it may be some time before we know whether leaving the EU has been better or worse for the UK.

Strategy

The slump in long-dated bonds saw short-dated bonds outperform over the month, as they produce better relative returns in rising yield environments. These instruments form the core of our fixed interest holdings, and provide above inflation yield for reduced risk. Recent weeks have revealed the folly of investors pushing at the envelope of their risk tolerance and increasing duration in fixed interest, as the mere spectre of inflation cost investors dearly. With rising global shipping costs and heavy central bank intervention continuing, a spike in inflation is possible, over the short and medium term if not long-term, as the demand side of the equation recovers and puts pressure on the decimated supply side.

Our overweight UK positioning is primarily based upon attractive valuations, particularly on a relative basis, to other equity markets. Years of outflows from overseas investors due to Brexit uncertainty and the poor drawdown in March 2020, due to the service industry (to which the UK indices are heavily biased) being the worst affected sector in the Covid-19 pandemic, have left quality UK assets trading at a discount. Before the impressive start to the vaccine rollout there was a good case for the investment in UK equities, and the possibility that the UK could emerge from the pandemic ahead of other western countries is another element adding to our bullish attitude towards UK stocks.

In the US, our decision to allocate to US Smaller Companies is based on the expected fiscal stimulus and reducing our large-cap exposure has already benefitted our portfolios due to tech stocks selling off as bond yields rose. Our Asia Pacific overweight positioning is due to reasonable valuations and a strong recovery from the Covid-19 pandemic, which has seen all economic indicators barring tourism return to pre-pandemic levels. This should see Asia Pacific equities outperform on this basis.

Review risk management, eligibility and investment and borrowing powers

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

Management of the Clarion Funds

MGTS Clarion Prudence

- The last quarter has seen Prudence underperform its sector by -0.60% whilst performing in line with its DT strategic benchmark over the same time period. Over 12 months, Prudence remains ahead of both sector and benchmark.

- The fund continues to benefit from its allocation effect versus its sector, mainly due to the overweight allocations within the IA Global sector and IA UK All Companies sectors as a result of being underweight in the US.

- The bonds holdings within the Prudence portfolio have all performed well over 4 and 12 weeks with all underlying bond holdings outperforming compared to the weighted sector average.

- BlackRock Continental European has underperformed against its benchmark over 1, 2, 4 and 12 weeks as the rotation in growth to value continues to gather momentum.

- M&G Global Dividend on the other hand continues to benefit from the value rotation,and is the strongest performing fund in the portfolio over 2 and 4 weeks; outperforming its sector by 3.50% and 3.67% respectively.

- Fundsmith continues to underperform given its bias to growth assets. Over 1 year, Fundsmith and M&G Global Dividend are broadly level with the negative correlation trend continuing.

- It was agreed last meeting that we would look to potentially replace the Royal London UK Equity Fund following a period of underperformance along with an imminent change to the fund manager. Further to these discussions, it was agreed that now would be the time to execute the change, and that the Artemis Income fund would be the most suitable replacement following research conducted pre-meeting. The committee agreed to complete a straight swap post meeting.

- The gold holding within the portfolio has been the biggest detractor in investment performance over the last 4 weeks; returning -7.93%. However, the committee believe that the holding remains a good insurance policy for the low risk mandate of Prudence, and will serve the portfolio well during periods of downturn in other assets within the portfolio.

- The rest of the portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £18.61m.

- Performance over 1 year is up at +2.50% compared to a fall in the UK FTSE 100 index of circa -8.97%

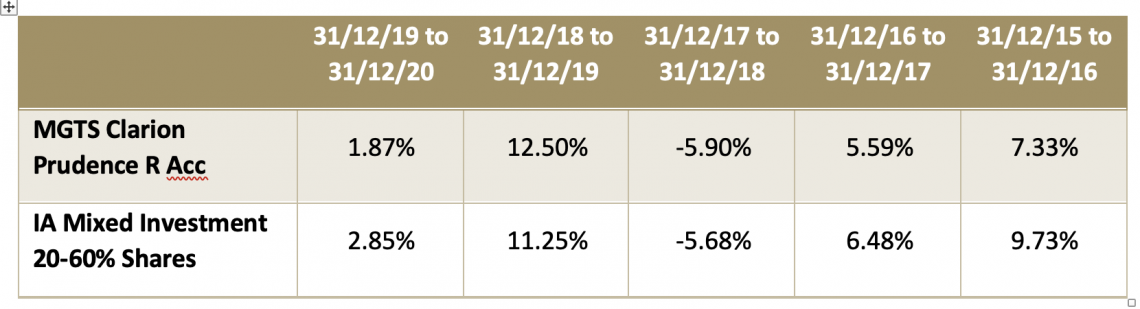

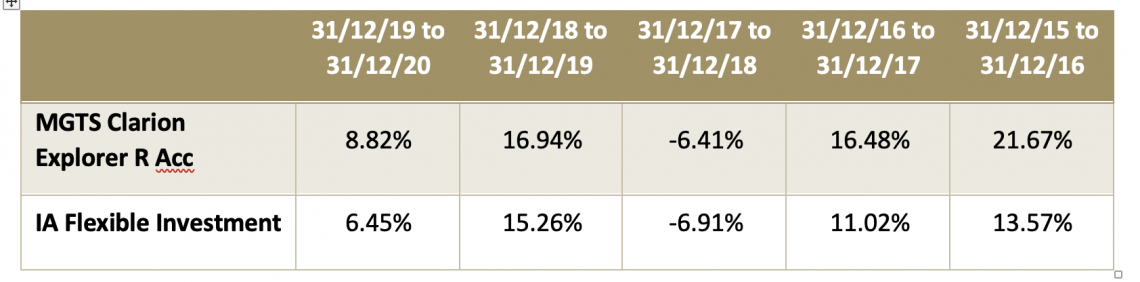

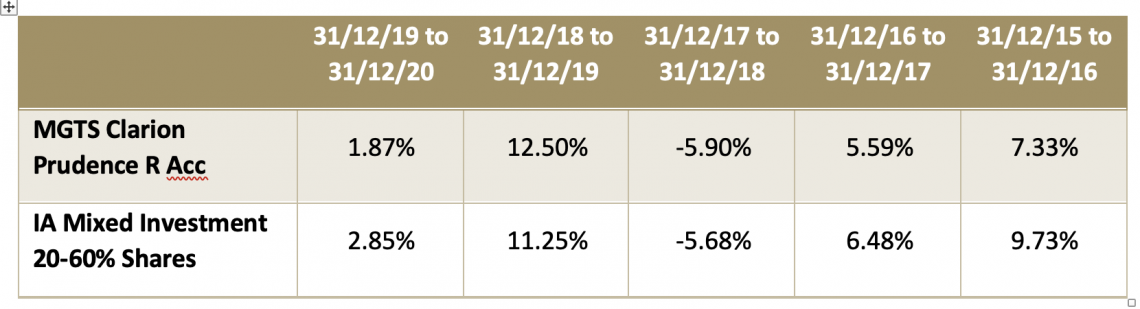

MGTS Clarion Prudence – Historical Performance

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end

MGTS Clarion Navigator

- Navigator has underperformed its sector by 0.80% over the last quarter whilst performance falls in line with the strategic benchmark over the same time period. Over 6 months, the portfolio performance falls in line with the sector whilst outperforming the strategic benchmark by circa 3%.

- JPM Japan has returned -8.41% over 4 weeks, underperforming the sector average by -4.86%. Given the growth bias within this fund, this underperformance falls in line with the Investment Committees expectations during a period where value assets have prospered.

- A beneficiary of the growth to value rotation is Man GLG UK Income. This fund has now outperformed its sector over 1, 2, 12 and 24 weeks and remains the strongest performing UK Equity Income fund in the portfolio over these timeframes.

- The portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £48m.

- The unit price as of the 22nd March 2021 was 109.03; showing a 9.03% increase having been launched at 100p on the 11th May 2020.

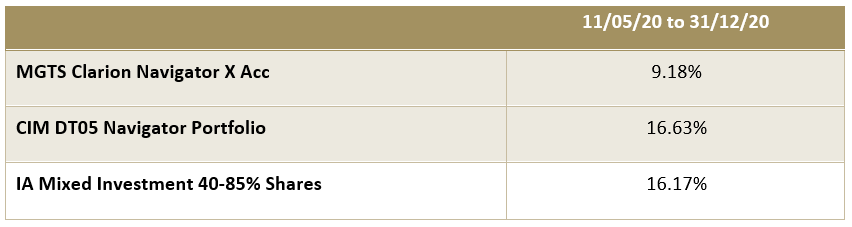

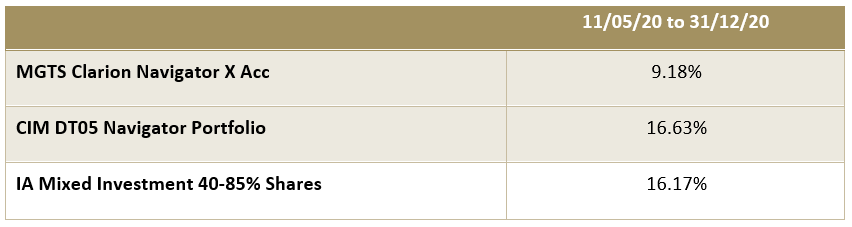

MGTS Clarion Navigator – Historical Performance

Whilst the Navigator fund launched on 12th May 2020, the fund didn’t receive any cash inflows until 5th June 2020 meaning that no investments were made before this date. You can identify this period as the Navigator fund growth appears flat whilst the sector grew over this period. This gives the impression that the fund lagged behind the sector when, in fact, the Navigator fund was unable to participate in any market growth during this period.

However, we also manage a Navigator discretionary portfolio containing almost identical investments to the Navigator fund and this was invested during this period. The chart below compares the performance of this portfolio against both the Navigator fund and the sector since 12th May 2020. The table shows the performance between 11th May 2020 and the end of the previous quarter.

MGTS Clarion Meridian

- Over the last quarter, Meridian has outperformed its benchmark and sector by 0.10% and 0.20% respectively. The fund has also outperformed both over 6 and 12 months.

- Over 12 months, Meridian has outperformed its sector by 7% and its benchmark by 2%. The committee are very pleased with the outperformance figures over this timeframe.

- In similar vein to Prudence, the Meridian fund has outperformed its sector over the last 12 months as a result of the funds allocation attribution in the IA Global and IA UK All Companies sectors. The selection attribution and overall interaction in the portfolio has counteracted the positive allocation attribution which has had the effect of how neutralising the cumulative attribution compared to its sector.

- The Emerging Markets holdings with Meridian fund continue to be very strong side by side with the SLI fund having a growth bias and the Hermes fund having a value bias. The conflicting investment styles provide negatively correlated returns when compared to the sector, adding to the overall diversification within the portfolio.

- Baillie Gifford Japanese has outperformed its sector over 4 and 12 weeks. This fund has a balance of value and growth assets, providing a degree of downside protection in the rotation of investment styles.

- The Artemis US Smaller Companies fund has proved to be a good addition to the portfolio so far, outperforming its sector over 1,2 and 4 weeks. Over 4 weeks, the portfolio has performed in line with the large cap holdings in North America.

- BlackRock UK Equity and Slater Growth have both lagged in performance over the last 4 weeks as a result of their growth investment styles and the underperformance versus value. However, the performance of the value orientated Man GLG UK Income fund has counteracted some of the losses made given the strong fund performance we have seen in this fund consistently over 1, 2 4, 12 and 24 weeks.

- The portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £60m.

- Performance over 1 year is up at +56 compared to a fall in the UK FTSE 100 index of circa -8.97%

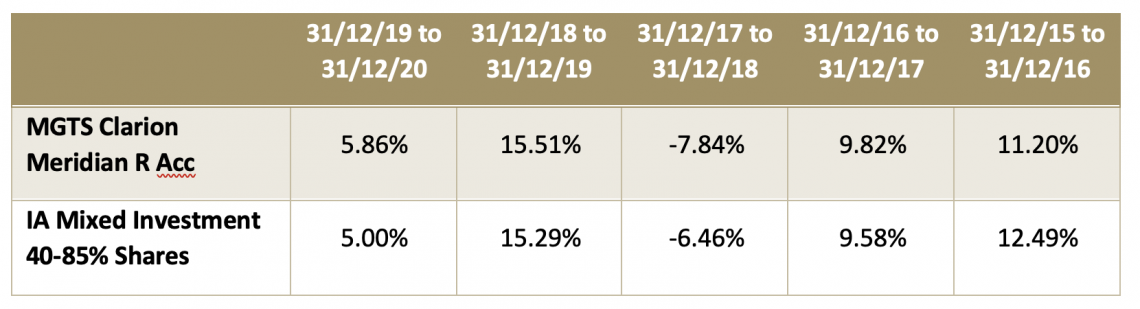

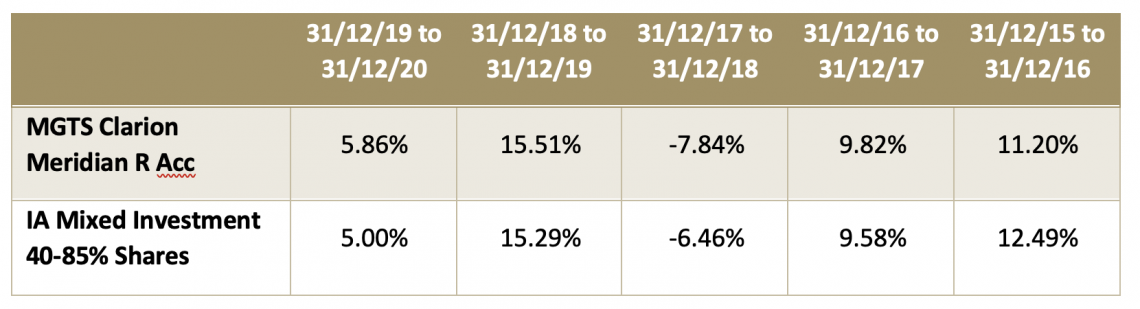

MGTS Clarion Meridian – Historical Performance

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the previous quarter end.

MGTS Clarion Explorer

- Over the last quarter, Explorer has returned 1.30%, falling in line with its strategic benchmark over this time period whilst underperforming its sector by 0.40%. Looking at 6 and 12 months, the fund remains ahead of its sector with outperformance of 1.90% and 8.30% respectively.

- The performance of the Explorer fund has been relatively flat when compared to its benchmark and sector which is reflective of the funds neutral allocation and selection attribution.

- Similar patterns have emerged within the Explorer portfolio with the two value biased Schroder funds in Asia outperforming the growth orientated Fidelity and Stewart Investors Asia funds.

- Likewise, the same is true within the Emerging Markets element of the portfolio with SLI and JPM outperforming their sector over 4 and 12 weeks whilst Hermes and UBS which have a bias to growth strategies have underperformed.

- The portfolio remains in good shape and the committee agree that no changes are required at this stage.

- Fund size is currently £18.02m.

- Performance over 1 year is up at +28% compared to a fall in the UK FTSE 100 index of circa -8.97%

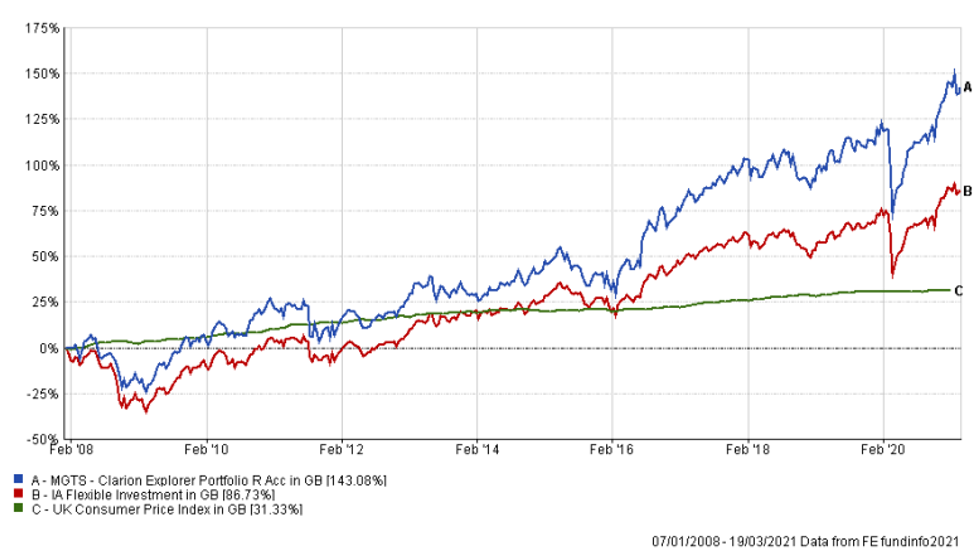

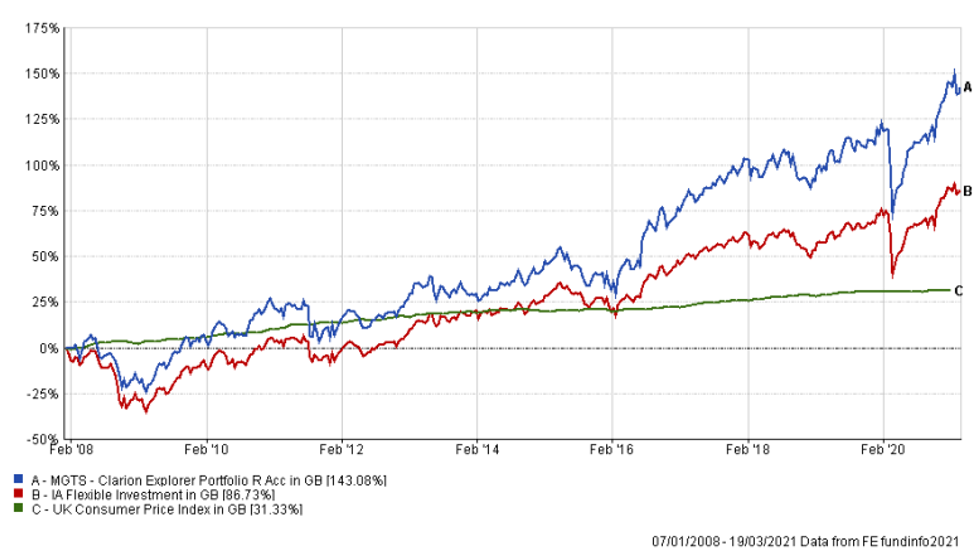

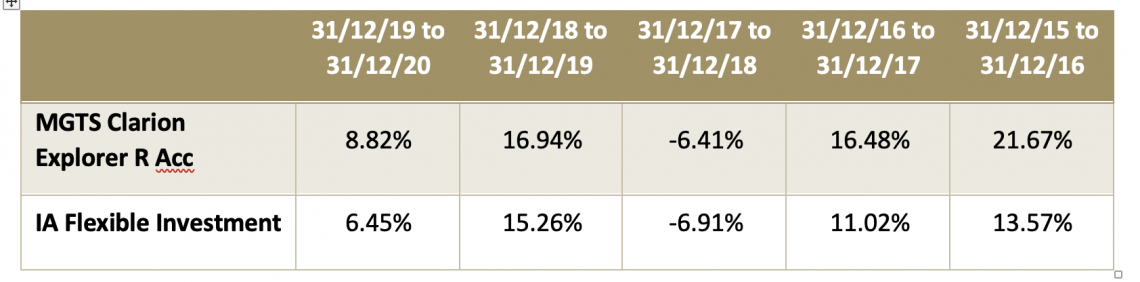

MGTS Clarion Explorer – Historical Performance

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the previous quarter end.

Model Portfolios

It was agreed to make appropriate changes to the model portfolios to reflect the changes to the Portfolio Funds detailed above.

Next Investment Committee Meeting is on 8th April 2021 although in the interim period the Committee intend to conduct slightly shorter conference calls as considered appropriate.

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.