The Clarion Investment Committee met on 18 January 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Economics

- The US economy grew by 3.1% in 2023, well in advance of expectations at the start of the year with activity remaining strong in the fourth quarter.

- US manufacturing and services activity improved unexpectedly in January thanks to easing price pressures and strong demand, according to the S&P Global PMI flash index.

- US core inflation fell to 2.9% in December, dipping below 3% for the first time since 2021, increasing the chances of a soft landing and potentially opening the way for interest rate cuts this year.

- US secretary of the Treasury Janet Yellen stated that the strong economic growth in the US at the end of 2023 will not lead to another bout of inflation.

- US president Joe Biden indefinitely paused approvals for new liquefied natural gas export terminals in a victory for climate change campaigners.

- The UK economy showed signs of recovery as the S&P Global Flash UK PMI Composite Output index rose faster than expected in January and private sector activity gained momentum.

- UK consumer confidence reached a two-year high in January.

- The Office for Budget Responsibility warned the UK government that it has a “tiny” margin for error in its debt-reduction rules, despite lower-than-expected public sector borrowing in December.

- The International Energy Agency warned that geopolitical conflict in the Middle East could lead to volatile gas prices this year as it could disrupt the shipping of liquefied natural gas.

- The European Central Bank kept interest rates unchanged at 4%. Markets expect the first interest rate cut to come in April despite ECB president Christine Lagarde insisting that it is “premature to discuss rate cuts.”

- The euro area economy continued to slow in January, albeit at a marginally slower rate – a decline in services activity offset an improvement in manufacturing activity, according to the S&P Global PMI flash index.

- Euro area consumer confidence fell unexpectedly in January and remains well below its long-term average.

- German business confidence unexpectedly fell to the lowest levels since the start of the pandemic as the economy seems “stuck in a recession” according to the Ifo Institute.

- China’s central bank signalled a loosening of monetary policy as it eased reserve requirements by 0.5 percentage points in a bid to boost its economy.

- China’s commerce minister Wang Wentao warned that rising protectionism, geopolitical trade disruptions and soft demand would threaten global trade this year.

Business

- NextEra Energy, the biggest US renewable energy producer, beat expectations and posted record revenues of $7.3 billion in 2023 despite supply chain disruptions and higher interest rates.

- The UK government announced that a stake in the telecom firm Vodafone held by Emirates Telecommunications, also known as e&, poses a national security risk and ordered the companies to take steps to mitigate it.

- UK estate agents Foxtons announced that 2023 profits will beat expectations and predicted strong performance in 2024 as lower mortgage rates spur demand.

- Airline Wizz Air disclosed that the conflict in the Middle East widened losses in Q4 2023 as it had to suspend flights to Israel.

- South Korean chipmaker SK Hynix beat expectations by returning to profitability after a tough year following a surge in demand for high-end AI memory chips.

- Electric carmaker Tesla announced sales would be “notably lower” in 2024 as demand for electric vehicles appears softer than forecasted.

- Video streaming service Netflix outperformed estimates by announcing an additional 13m new subscribers and $1.5 billion operating income in Q4 2023.

- Bank of America sent a “letter of education” to employees not returning to the office and warned them of disciplinary action.

Global and political developments

- Former US president Donald Trump won the New Hampshire Republican primary, beating Nikki Haley who vowed to carry on the contest and after Ron DeSantis dropped out of the race and endorsed the former president.

- Hungarian prime minister Viktor Orbán committed to ratifying Sweden’s bid to join NATO after the Nordic country also secured Turkey’s approval.

- The US military struck three facilities used by Iranian-backed militias in Iraq in response to escalating attacks against US and coalition bases in Iraq and Syria.

- The UK and Canada halted negotiations on a post-Brexit trade deal after a dispute over tariffs on agricultural exports.

Please click here to access the January Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary

The UK

Both real and economic storm clouds are battering the UK. Yet while there are reasons for concern, we can also allow ourselves some cheerfulness about economic and market prospects.

Firstly, just as the pandemic crisis faded out of sight in 2022/23, the inflation crisis which followed is now gradually moving into the rear-view mirror.

Secondly, the UK economy avoided the predicted severe recession last year although admittedly it ended the year close to a very mild one.

Thirdly, household cost pressures are easing with the fall in inflation. Through real wage growth households are gaining purchasing power which should lead to upwards momentum in retail spending. Many households have also now rebuilt the savings buffer they lost in 2022. Although rail and NHS strikes persist, there’s likely to be no more talk of “a return to the disruption of 1970s”.

Cheaper mortgage rates will spur the housing market and will also benefit the estimated 1.5 million households who need to remortgage this year as their old lower fixed rate deals come to an end.

The Centre for Economics and Business Research (CEBR) calculates that the UK will maintain its position as the world’s sixth largest economy over the next few years and will grow more quickly than France & Germany. Notably the CEBR also says India will become the world’s 3rd largest economy by 2035.

This stabilising macro backdrop will encourage business confidence, and willingness to invest in the future. Some business surveys are showing positive signs.

There are also several tail winds for the UK equity market. Inflation continues to fall yet the economy has remained largely resilient to higher interest rates. Share buy backs, and as a result, cash flow and dividend per share growth, continue in earnest. Valuations remain low and international investors are starting to wake up to the compelling value in UK shares.

There may be tax giveaways in forthcoming Budget on the 6th of March and the stock market will be buoyed as much by US interest rate cuts as by UK ones. The Bank of England base rate is expected to fall to 3.25% by the end of the year, even in the face of the BoE’s concern over tightness in labour markets continuing to drive strong wage growth.

The US

The macro environment in 2023 was not conducive to small & medium cap stocks in the US which tend to underperform their larger peers when there is greater uncertainty about the direction of the US Economy.

As we moved into December, however, it became clear that elements of inflation were subsiding, supporting a view that the Federal Reserve would pause their rate hiking cycle and cut rates in 2024.

The Federal Reserve confirmed this expectation citing that interest rates were having their intended effect on demand and labour (and therefore inflation). The Fed also pulled forward the prospect of interest rate cuts in the belief that housing costs including rents (a major component of CPI) would tumble over the next year due to significantly increased supply.

This prompted a sharp rally in equity markets, and in particular the share prices of those companies most sensitive to an improved macro environment.

This resulted in an extremely strong period for small and medium cap stocks, an area of the US market which has been favoured by the investment committee in recent months.

Emerging Markets

After outperforming UK equities and keeping pace with the S&P 500 in the 12 months after the pandemic, Emerging Markets (EM) equities have lagged their Developed Markets counterparts.

The exceptional strength of the US dollar is one headwind that can explain this. Another has been weakness in the Chinese market driven by capital flight from the country due to increasing geopolitical tensions with the West.

As the largest constituent in the index, this has weighed on broader performance. However, some areas such as India and Latin America are performing strongly.

EMs are also feeling the pressure from the same issues that are affecting equity markets all around the world. However, the significant valuation discounts to, in particular, US equities, coupled with the greater growth opportunities over time mean investors should look through the current uncertainty and maintain a meaningful allocation to EM.

Strategy

There have been no further changes to the bond allocation and the investment committee believe the current strategy is best placed to deal with short-term interest rate decisions from central banks.

The investment committee could consider exposure to longer-dated assets as a viable strategy when there are clearer signs that interest rates will start to fall, and the risk of central bank policy error diminishes.

The investment committee also favour an overweight to the UK and underweight the US against the relevant benchmarks on a valuation basis. In the US, the committee are specifically underweight the ‘Magnificent Seven’ stocks which are trading on astronomical valuations.

Although the committee see benefits in the long term for AI technology, it is felt that the euphoria has been overstated and either revaluation or future underperformance will result from these extreme valuations. In both the UK and US, the committee also look towards small and mid-cap equities which have undergone a period of subdued performance but have future recession risk priced into the assets.

Asia and Emerging Markets are also overweighted against the relevant sectors on a valuation basis. The committee see a positive, long-term picture in China which is still being held back by a fallible property sector, but valuations in the region outweigh these risks and offer a persuasive argument for outperformance once these factors have been rectified.

The key themes can be summarised below as:

- In the fixed income space, we hold a well-diversified mix of government bond, corporate bond and index-linked funds with a medium-term duration to mitigate risk in case interest rates do not fall as expected.

- In the UK due in part to higher wage growth, Index-Linked Gilts look attractive at current prices.

- Yields on Investment Grade Corporate bonds have become more attractive and consequently we favour an allocation to Global Fixed Income.

- A general softening in the macro environment in developed economies favours a small reduction in equity exposure for the lower risk portfolios.

- We are underweight US large cap and technology stocks due to high valuations and favour mid to small cap stocks as part of the overall US weighting.

- Due to their greater economic resilience, Asia Pacific as well as Emerging Market Equities are favoured for the higher risk benchmarks.

- In recent months, the investment committee have been carefully analysing the performance and risk/reward statistics of the Dimensional funds dimensional.com. These funds can best be described as index-tracking funds with an active management overlay. Investment performance has been impressive, and costs are low, and it was decided to introduce the following funds into the portfolios.

- Dimensional US Core to replace Fidelity US Index. This will avoid overexposure to the “Magnificent 7” tech stocks.

- Dimensional UK Value to replace Allianz UK Equity Income (Allianz had a good period around Covid but has underperformed and is quite volatile)

- Dimensional Emerging Markets Core to replace BNY Mellon Global EM and UBS Global Emerging Markets and for this to be our core holding in the lower risk profiles, in place of the Invesco fund.

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

January 2024

Creating better lives now and in the future for our clients, their families and those who are important to them.

Clarion Funds & Discretionary Portfolios:

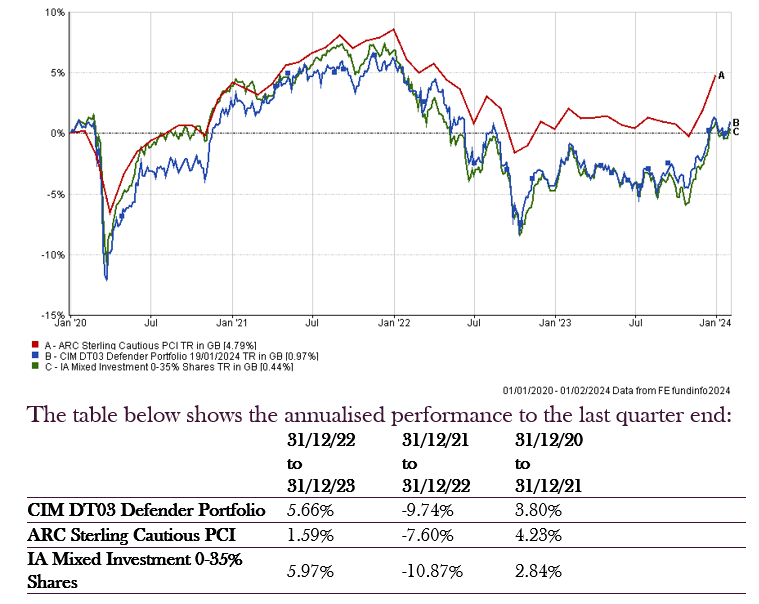

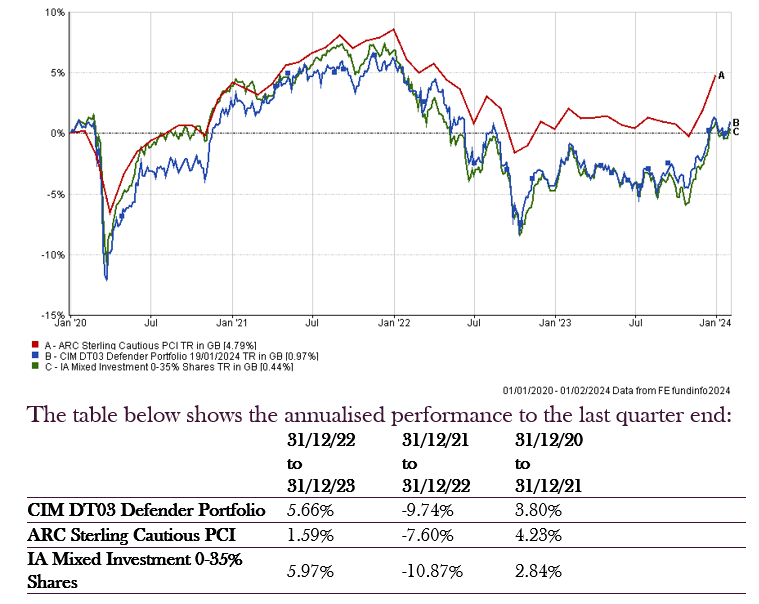

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

Changes to the Defender Portfolio

- The Allianz UK Listed Equity Income C Acc fund was removed from the portfolio (2.25% to 0.00%)

- The Dimensional UK Value Acc fund was added to the portfolio (0.00% to 2.25%)

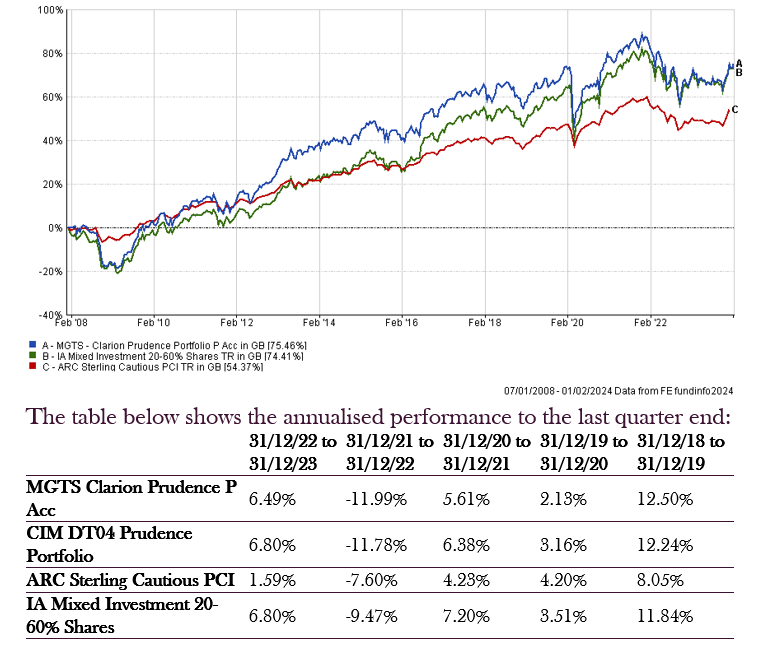

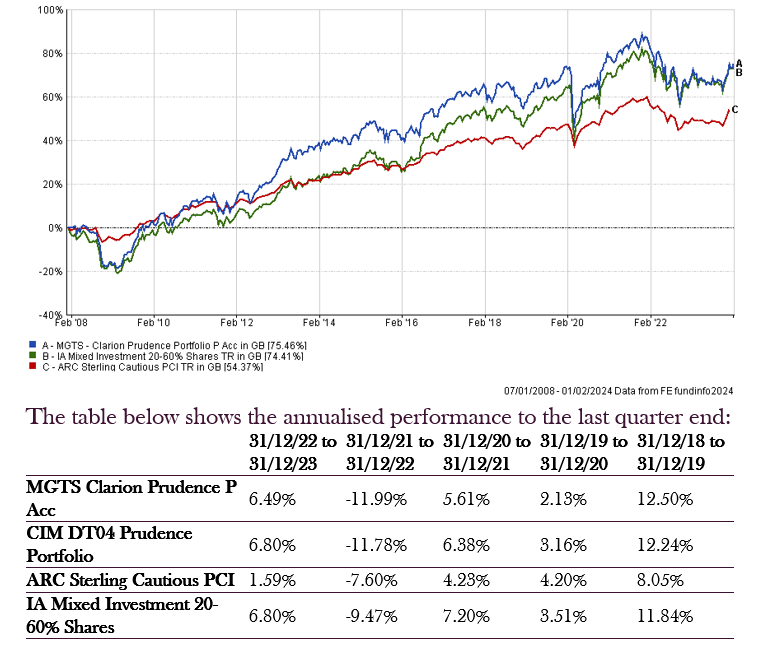

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund & Portfolio

- The Allianz UK Listed Equity Income C Acc fund was removed from the portfolio (3.00% to 0.00%)

- The Dimensional UK Value Acc fund was added to the portfolio (0.00% to 3.00%)

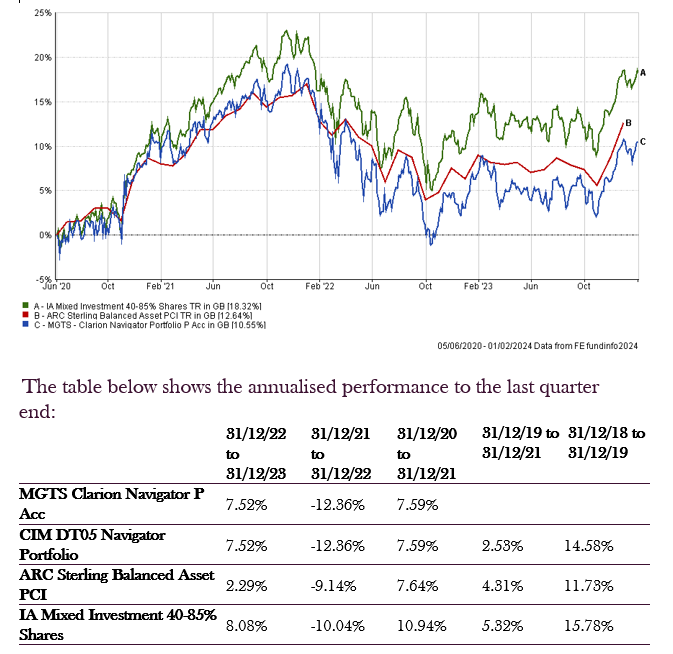

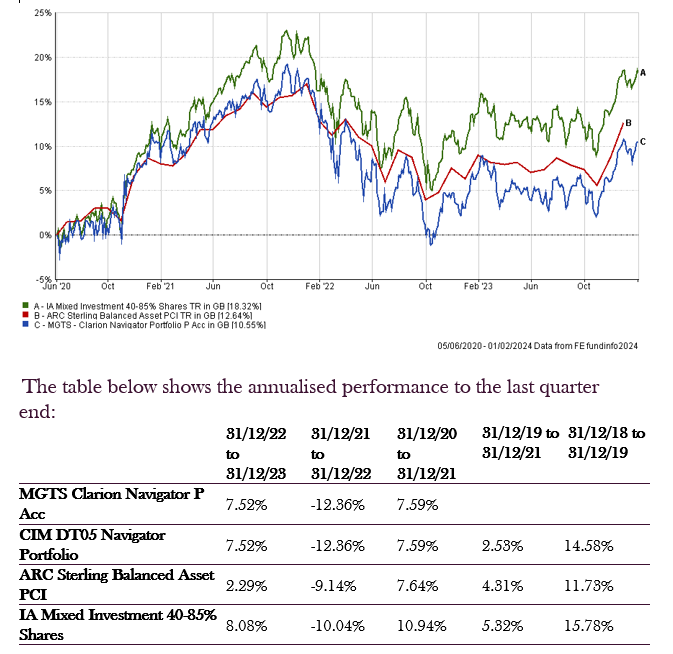

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

- The Allianz UK Listed Equity Income C Acc fund was removed from the portfolio (5.25% to 0.00%)

- The Invesco Global Emerging Markets (UK) Z Acc fund was removed from the portfolio (4.00% to 0.00%)

- The Dimensional UK Value Acc fund was added to the portfolio (0.00% to 5.25%)

- The Dimensional Emerging Markets Core Equity Acc fund was added to the portfolio (0.00% to 4.00%)

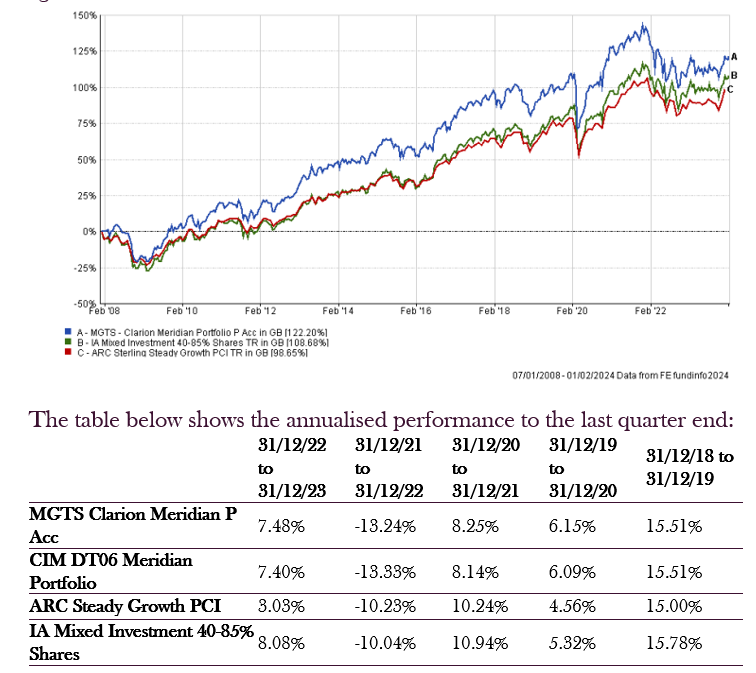

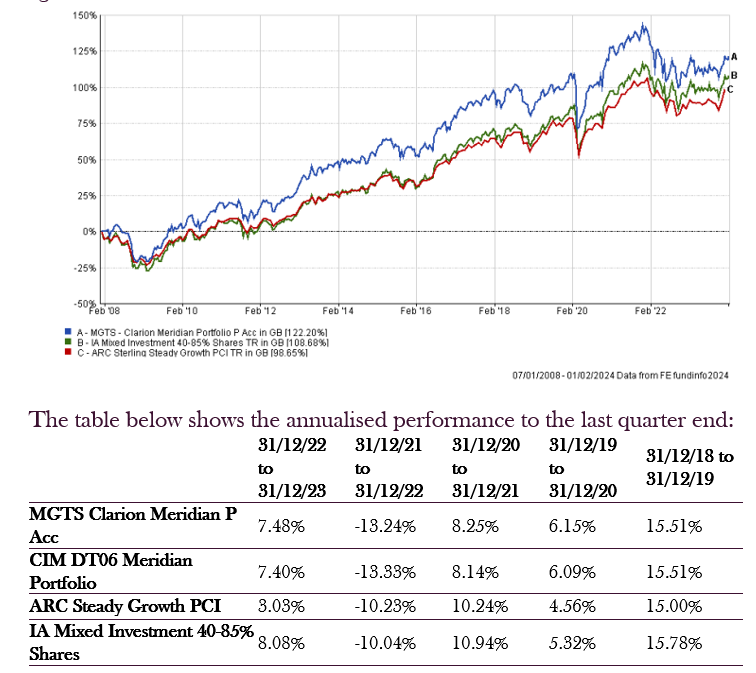

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

- The Allianz UK Listed Equity Income C Acc fund was removed from the portfolio (5.50% to 0.00%)

- The Invesco Global Emerging Markets (UK) Z Acc fund was removed from the portfolio (3.00% to 0.00%)

- The UBS Global Emerging Markets Equity C Acc fund was removed from the portfolio (3.00% to 0.00%)

- The Dimensional UK Value Acc fund was added to the portfolio (0.00% to 5.50%)

- The Dimensional Emerging Markets Core Equity Acc fund was added to the portfolio (0.00% to 6.00%)

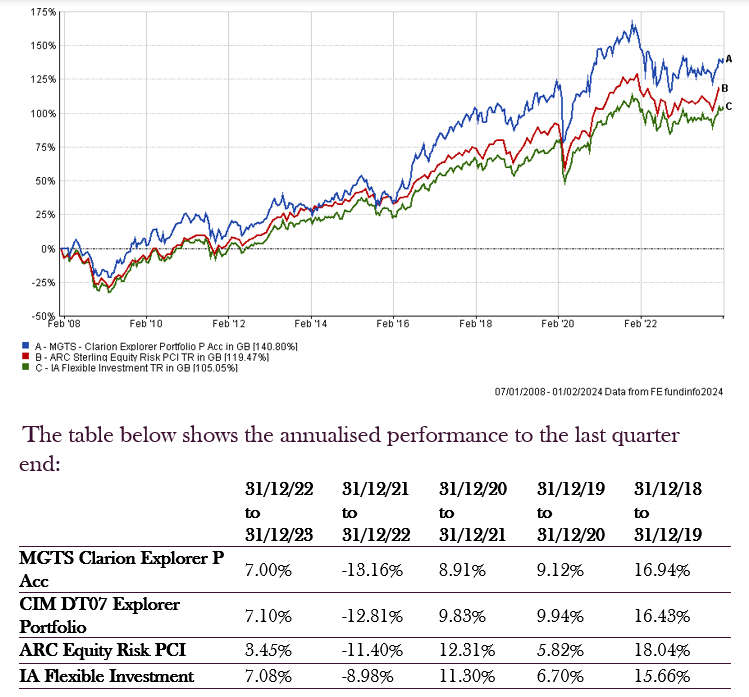

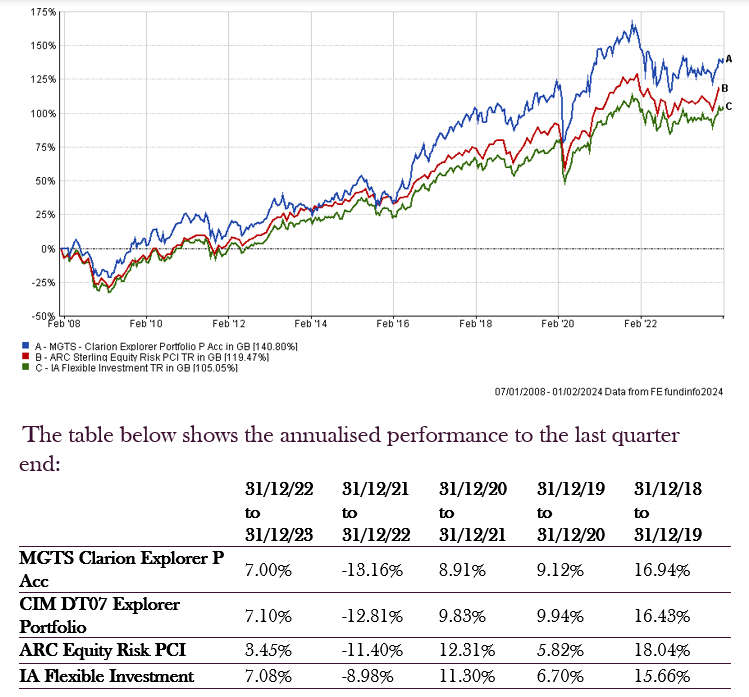

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

- The Allianz UK Listed Equity Income C Acc fund was removed from the portfolio (7.75% to 0.00%)

- The Invesco Global Emerging Markets (UK) Z Acc fund was removed from the portfolio (2.20% to 0.00%)

- The UBS Global Emerging Markets Equity C Acc fund was removed from the portfolio (2.20% to 0.00%)

- The BNY Mellon Global Emerging Markets Opportunities Inst W Acc was removed from the portfolio (2.20% to 0.00%)

- The Dimensional UK Value Acc fund was added to the portfolio (0.00% to 7.75%)

- The Dimensional Emerging Markets Core Equity Acc fund was added to the portfolio (0.00% to 6.60%)

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

Changes to the Voyager Portfolio

- The Allianz UK Listed Equity Income C Acc fund was removed from the portfolio (3.50% to 0.00%)

- The UBS Global Emerging Markets Equity C Acc fund was removed from the portfolio (5.60% to 0.00%)

- The BNY Mellon Global Emerging Markets Opportunities Inst W Acc was removed from the portfolio (5.60% to 0.00%)

- The Invesco Global Emerging Markets (UK) Z Acc fund had its allocation increased in the portfolio (5.60% to 6.80%)

- The Dimensional UK Value Acc fund was added to the portfolio (0.00% to 3.50%)

- The Dimensional Emerging Markets Core Equity Acc fund was added to the portfolio (0.00% to 10.00%)

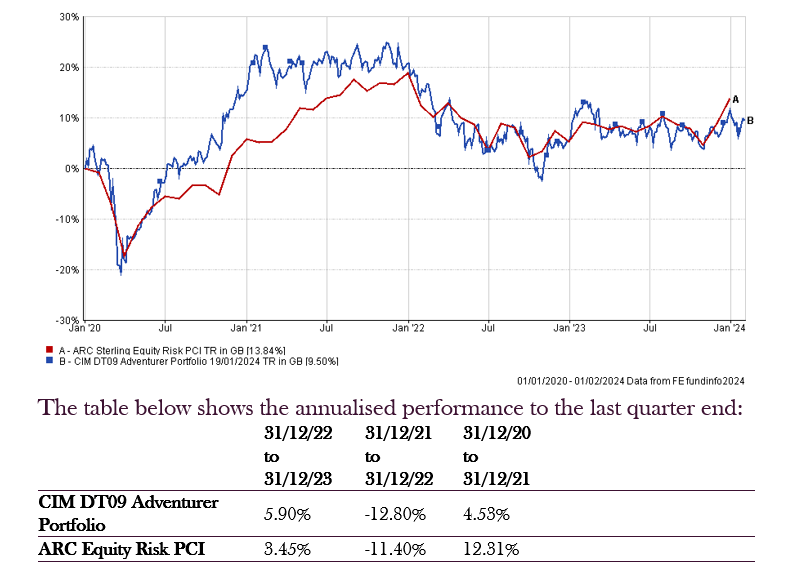

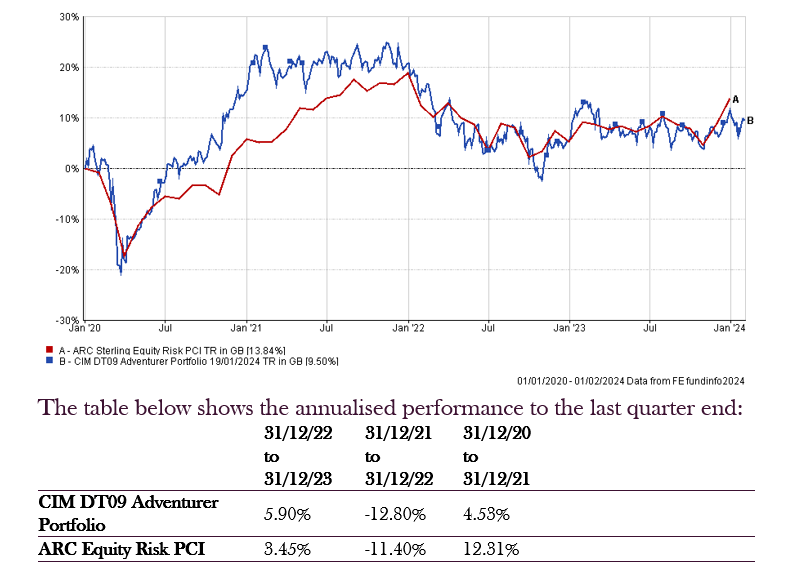

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Adventurer Portfolio

- The Allianz UK Listed Equity Income C Acc fund was removed from the portfolio (2.50% to 0.00%)

- The BNY Mellon Global Emerging Markets Opportunities Inst W Acc was removed from the portfolio (8.40% to 0.00%)

- The Dimensional UK Value Acc fund was added to the portfolio (0.00% to 2.50%)

- The Dimensional Emerging Markets Core Equity Acc fund was added to the portfolio (0.00% to 8.40%)

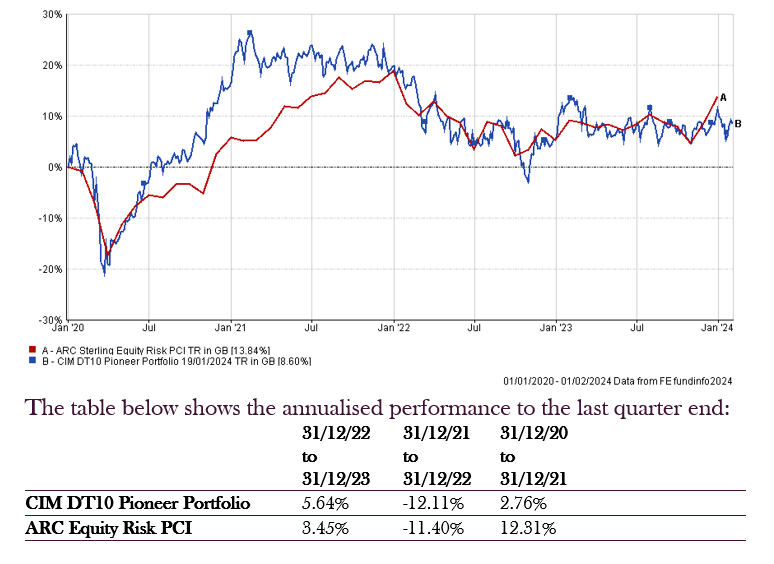

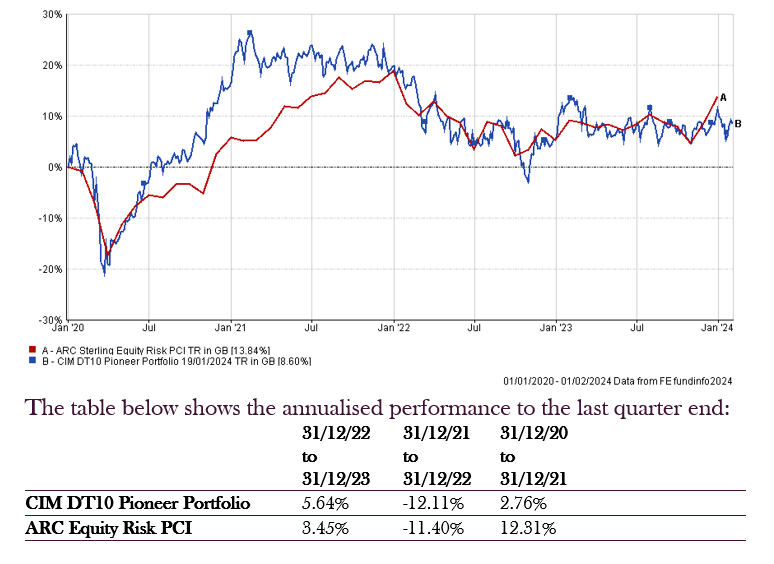

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Pioneer Portfolio

- The BNY Mellon Global Emerging Markets Opportunities Inst W Acc was removed from the portfolio (10.00% to 0.00%)

- The Dimensional Emerging Markets Core Equity Acc fund was added to the portfolio (0.00% to 10.00%)

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.