The Clarion Investment Committee met on 22 January 2025. The following notes summarise the main points of consideration in the Investment Committee Discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic Commentary & Market Outlook.

The following is a summary of the major since the last Clarion Investment Diary.

Economics

- UK government long-term borrowing costs reached their highest level since 1998 as investors weighed the government’s borrowing needs, the threat of weak growth and persistent inflation

- Revised figures show the UK economy did not grow in the third quarter last year, while monthly GDP data indicated a 0.1% contraction in October

- The UK is likely to grow more than France and Germany in 2025, according to the Financial Times’ poll of economists. However, the UK government is expected to increase taxes further before the end of parliament

- The Bank of England (BoE) held interest rates at 4.75% in December, with Governor Andrew Bailey saying a “gradual approach to future interest rate cuts remains right”

- The UK’s inflation rate increased to 2.6% in the year to November, up from 2.3% in the previous month, while wage growth increased to 5.2% in the three months to October compared with the same period last year

- UK retail sales volumes fell for a third consecutive month in December. Retailers expect sales to drop again in January, according to the Confederation of British Industry

- The average price of a house in the UK grew 3.3% in the year to December, to £297,166, according to the Halifax

- UK construction activity increased for the tenth consecutive month in December but at a slower pace of growth, according to surveys of purchasing managers

- Estimates of business activity in December from surveys of purchasing managers indicated continued growth in the US, a marginal increase in the UK and a decline in activity in the euro area. German business activity fell for the sixth consecutive month

- The US Federal Reserve’s (Fed’s) preferred inflation measure increased to 2.4% in the year to November, up from 2.3% in October

- The Fed cut interest rates by 0.25 percentage points to 4.25%–4.5% in December, but signalled a slower easing of rates throughout 2025 amid concerns of persistent inflation

- The US economy added 256,000 jobs in December, exceeding expectations of 160,000, while the unemployment rate fell to 4.1%

- Following the jobs report, US Treasury yields increased as investors bet on a slower pace of rate cuts this year

- The UK economy grew 0.1% in November, below expectations of 0.2% but higher than the previous two months of negative growth

- The BoE monetary policy committee member Alan Taylor said a “more accelerated pace of rate cuts” may be needed given the softening in UK growth

- UK inflation fell to 2.5% in the year to December, from 2.6% in the previous month, due to lower hotel and restaurant prices

- UK house prices and sales are expected to rise throughout 2025, according to the Royal Institute of Chartered Surveyors

- UK retail sales fell unexpectedly by 0.3% in December compared with the previous month, as food sales fell to their lowest level since 2013

- Germany’s economy contracted by 0.2% in 2024, the second consecutive year of declining output, highlighting the country’s continued economic weakness. The Bundesbank predict growth of just 0.1% growth in 2025

- China’s economy grew by 5% in 2024, the lowest annual growth outside the pandemic since 1990

- China’s trade surplus reached a record high of $992 billion in 2024, with strong annual export growth suggesting a possible frontloading of trade ahead of potential US tariffs

- Donald Trump said that the EU should increase its imports of US oil and gas or face tariffs on their exports to the US

- US credit card defaults in the first nine months of 2024 rose to their highest level since 2010, with recent high inflation and interest rates adding pressure to lower-income households, the FT reports

- US corporate bankruptcies in 2024 reached their highest level since 2010 amid higher interest rates and weaker consumer spending

- Inflation in the euro area rose for the third consecutive month to 2.4% in the year to December, according to flash estimates

- The German Ifo index signalled the weakest business environment in December since May 2020. The Ifo Institute said, “The weakness of the German economy has become chronic”

- The People’s Bank of China said that it was likely to cut interest rates in 2025 and move away from its current monetary policy tools, the FT reports

- China’s renminbi fell against the US dollar to a 16-month low, amid upbeat US economic data and potential import tariffs from the incoming Trump administration

Business

- India overtook China as Asia’s top market for initial public offerings in 2024 following strong growth in Indian equities and tighter Chinese regulations

- Before leaving office, US president Joe Biden blocked Japanese company Nippon Steel from buying its smaller American rival US Steel, citing national security threats

- Apple agreed to pay $95 million to settle a lawsuit alleging that its devices were listening to customers without permission

- Japanese car manufacturers Nissan and Honda announced plans to begin talks on a merger agreement to be completed by 2026

- Annual vehicle deliveries by electric carmaker Tesla fell in 2024 compared with the previous year, the first fall since 2011. Chinese electric carmaker BYD reported record sales in 2024

- The US Department of Defence awarded aerospace company Boeing a $616 million contract to produce its electronic warfare system for the US Air Force’s F-15 fighter jets

- New York became the first US city to implement congestion charging, aimed to reduce traffic and raise $15 billion for public transit projects

- Wind power overtook gas as the single largest source of electricity in the UK in 2024, accounting for 30% of total electricity generation, according to the National Energy System Operator

- Supermarket chains Aldi, Lidl and Sainsbury’s recorded their best-ever Christmas sales in the UK, while Asda suffered its worst Christmas performance since 2015

- The six largest US banks generated $142 billion in profit in 2024 amid higher trading and dealmaking activity, the Financial Times reports

- The US announced an export licencing regime on chips used in artificial intelligence applications in an attempt to limit exports to China

- Aerospace company Boeing’s commercial jet deliveries in 2024 were the lowest since the pandemic due to strikes and production issues

- TikTok resumed services in the US to 170 million subscribers after Donald Trump said that he would issue an executive order to give the app a reprieve when he takes office

- Meta, owner of Facebook, announced it will end its fact-checking programme in the US and instead use a community-based system similar to X

- New York rush-hour traffic speeds have improved dramatically in the first weeks of Manhattan’s congestion charging scheme, the Financial Times reports

- Oil company Saudi Aramco announced plans to increase its investments in lithium production, aiming to commercially produce the metal by 2027 in a bid to diversify away from oil

- The UK government launched its AI Opportunities Action Plan, consisting of 50 recommendations in a bid to become an “AI superpower”

- Energy company BP announced 4,700 job cuts equivalent to over 5% of its workforce

- UK games and figurines manufacturer Games Workshop, creator of the Warhammer game series, posted a record performance in the second half of 2024, supported by strong growth in video games sales

- Royal Mail is expected to return to profit following a “successful Christmas period” of parcel deliveries

- Lloyds Bank announced approximately 500 job cuts and the closure of two offices as part of its four-year investment plan

- Spain has proposed a 100% tax on non-EU resident property buyers in an attempt to improve housing affordability for residents.

Global & Political Developments

- Average global temperatures in 2024 were 1.6 degrees above pre-industrial trends, according to Europe’s Copernicus Climate Change Service, albeit not a definitive breach of the Paris accord limit of 1.5 degrees, which refers to temperatures over a sustained period

- Republican Mike Johnson, endorsed by Donald Trump, was re-elected as speaker of the US House of Representatives

- Donald Trump said he would not exclude military or economic force to obtain control of Greenland and the Panama Canal

- Russian gas stopped flowing through Ukraine pipelines to supply Europe following the expiration of the existing transit agreement

- Finland seized an oil tanker suspected of being part of Russia’s “shadow fleet” as part of an investigation into severed underwater electricity and communication cables in the Gulf of Finland

- Former cabinet minister and EU commissioner Lord Peter Mandelson was appointed as Britain’s ambassador to the US

- The new French economy minister Eric Lombard said the government is willing to impose €10 billion fewer spending cuts and tax rises, following the former prime minister Michel Barnier’ failed attempts to pass through more significant fiscal tightening proposals

- European leaders, including the UK, Germany and France, responded to Elon Musk’s recent tweets criticising European leaders and governments

- The US announced nearly $6 billion of additional aid to Ukraine and issued wide-ranging sanctions on Russia’s energy sector

- Wildfires continue to spread in Los Angeles, with the death toll rising to ten

- Canadian prime minister Justin Trudeau resigned amid “internal battles” within the Liberal Party

- Ahmed al-Sharaa, Syria’s de factor leader, said elections may not be held for up to four years following the fall of the Assad regime, the Financial Times reports

- South Korean acting president Han Duck-Soo was impeached following a motion passed by the opposition-controlled parliament and replaced by finance minister Choi Sang-Mok

- US officials said Russian anti-aircraft fire was responsible for the crash of an Azerbaijan Airlines flight that killed 38 people on Christmas day

- Israel and Hamas agreed to a ceasefire and the release of remaining hostages, halting the 15-month conflict in Gaza

- South Korea’s impeached president Yoon Suk Yeol was arrested by police and investigators following his attempt to impose martial law in December

- Canada warned of implementing “tit-for-tat” tariffs on US products if the incoming Trump administration imposes planned tariffs on Canadian imports

- Former governor of the BoE Mark Carney announced his candidacy to replace Justin Trudeau as head of the Liberal Party and as Canada’s prime minister

- UK prime minister Keir Starmer signed a 100-year pact with Ukraine during his first visit to the country as prime minister. Starmer said the UK will play its “full part in guaranteeing Ukraine’s security”

- Polish president Donald Tusk warned that “Russia was planning acts of terrorism in the air not only against Poland”

We are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Asia and Emerging Markets where valuations are generally more attractive which will help to offset some of the economic headwinds and geopolitical uncertainty.

Please click here to access the January Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Strategy

The current strategy remains broadly unchanged.

- The Investment Committee are maintaining their tactical position of being underweight US stocks, particularly mega cap tech stocks, and overweight UK, Asia & Emerging Markets and broadly neutral on Europe and Japan.

- Short duration bonds are preferred to longer duration bonds.

- Inflation is expected to persist, and the long-term average is expected to be around the 3% level which will curtail future interest rate cuts.

- A new interest rate cutting cycle has begun and is expected to create optimism into 2025, but a higher interest rate and higher inflation environment will become the new norm.

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future. Liquidity has been the most significant driver of returns to date but there remains a downside risk to high PE stocks.

- The Chinese economy is stagnant but recent announcements of fiscal and monetary stimulus may provide relief.

- It will take a full economic cycle for the inflationary effects of printing money after the global financial crisis and Covid to dissipate.

- After extensive changes to the underlying funds in recent weeks the Investment Committee are very comfortable with the present position and no further fund changes were proposed.

- The Legal & General Global Infrastructure Index fund which was bought approx. 3 months ago to replace the Time Social Impact Property fund and the MSCI Target Real Estate fund has been a standout performer and has justified the Committee’s decision to sell the property funds which have suffered due to a rise in bond yields.

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Clarion Funds & Discretionary Portfolios:

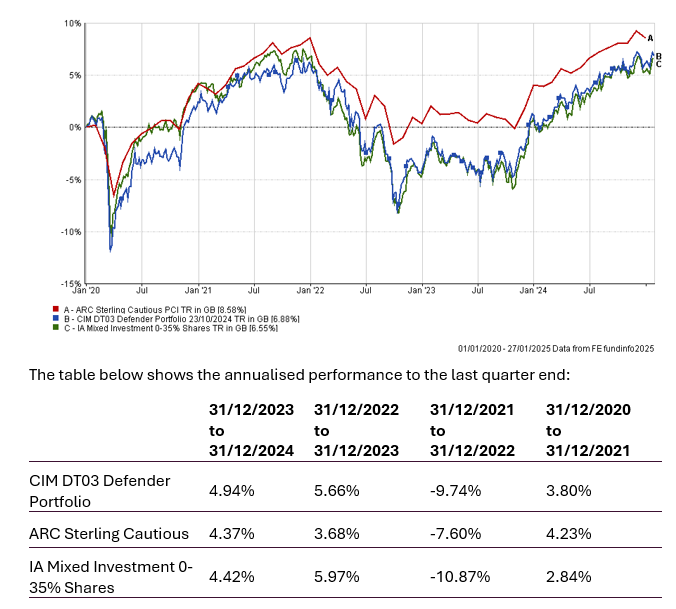

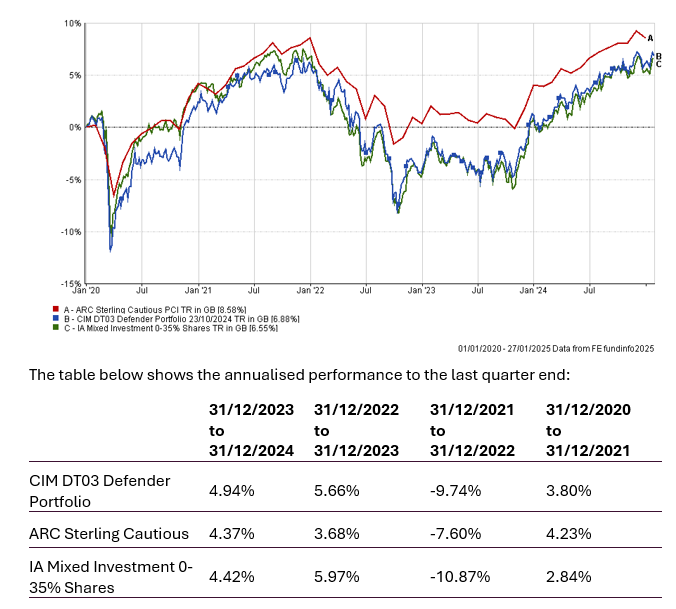

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

Changes to the Defender Portfolio

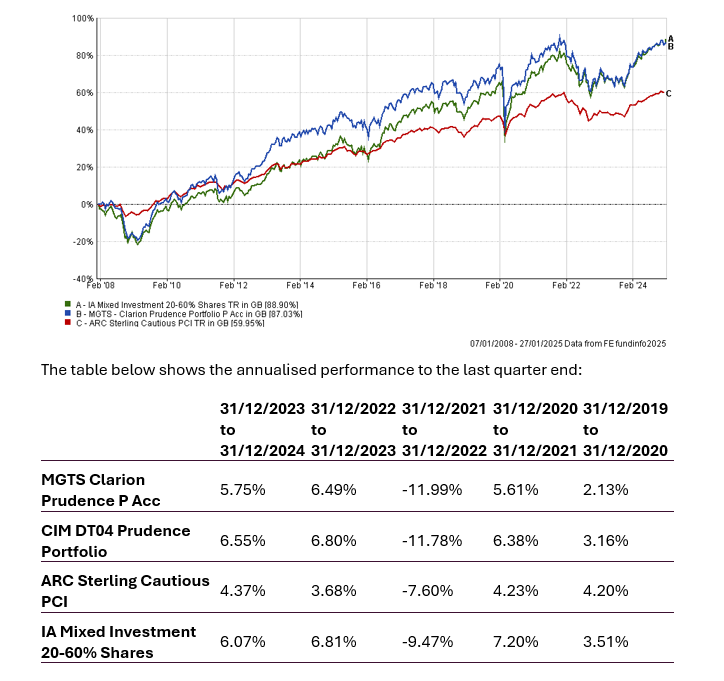

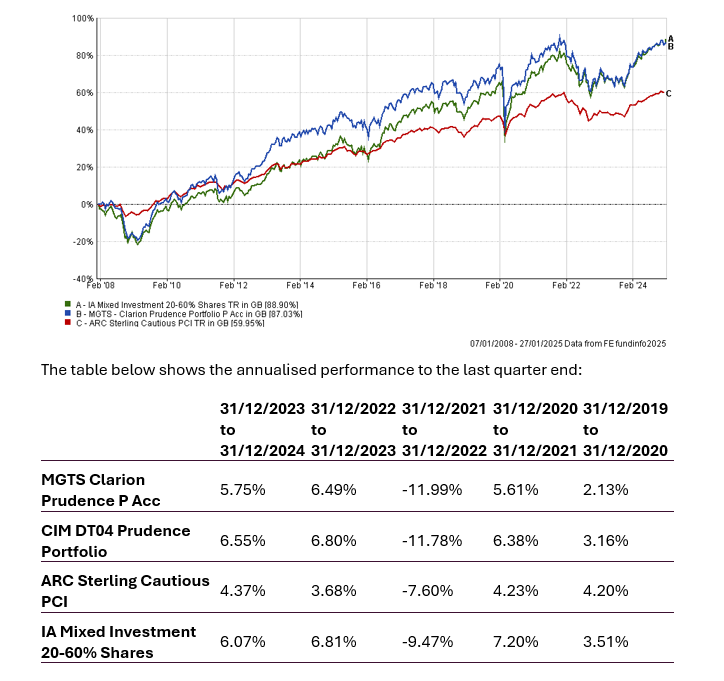

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund & Portfolio

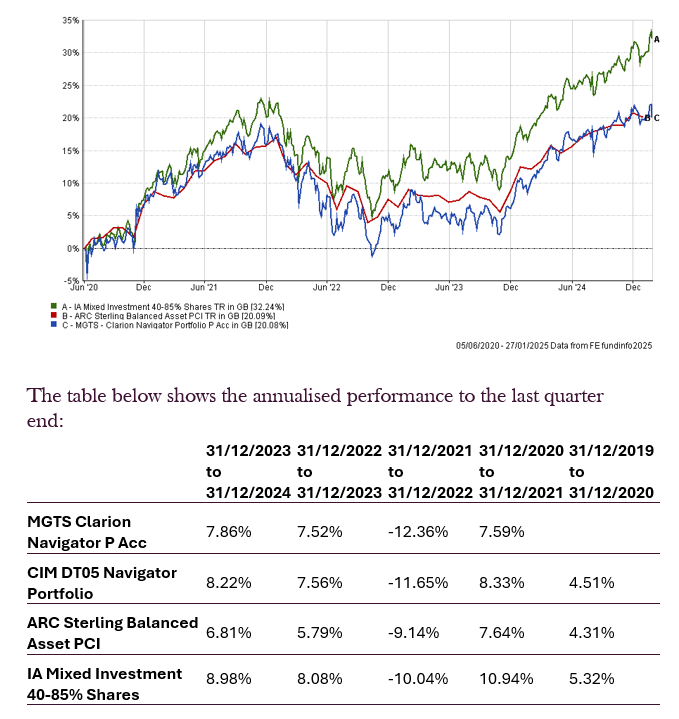

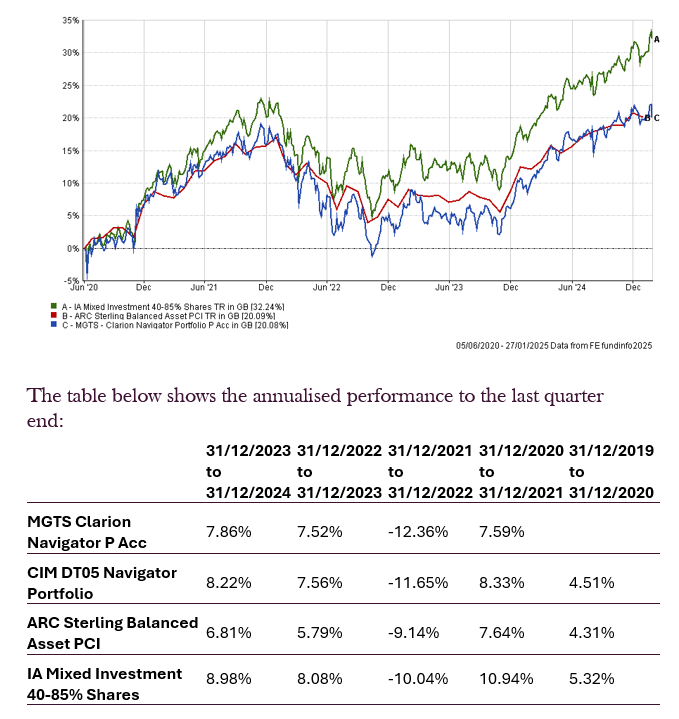

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

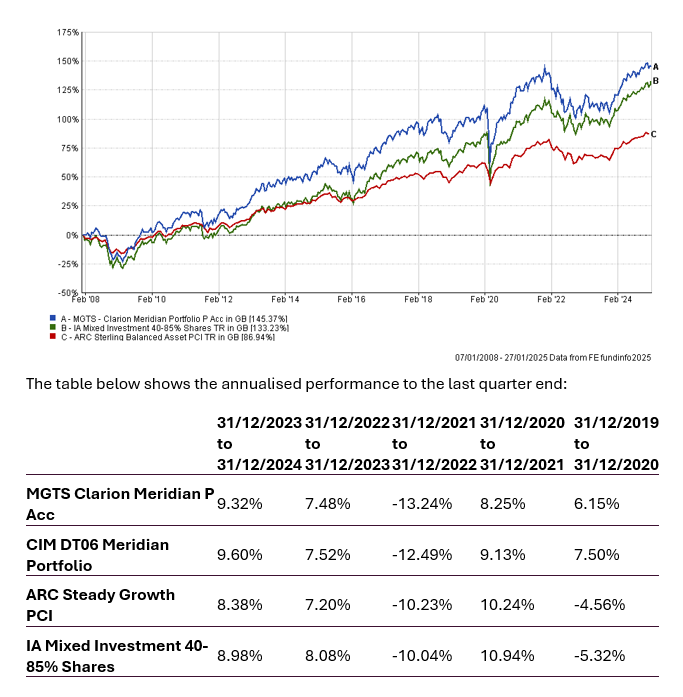

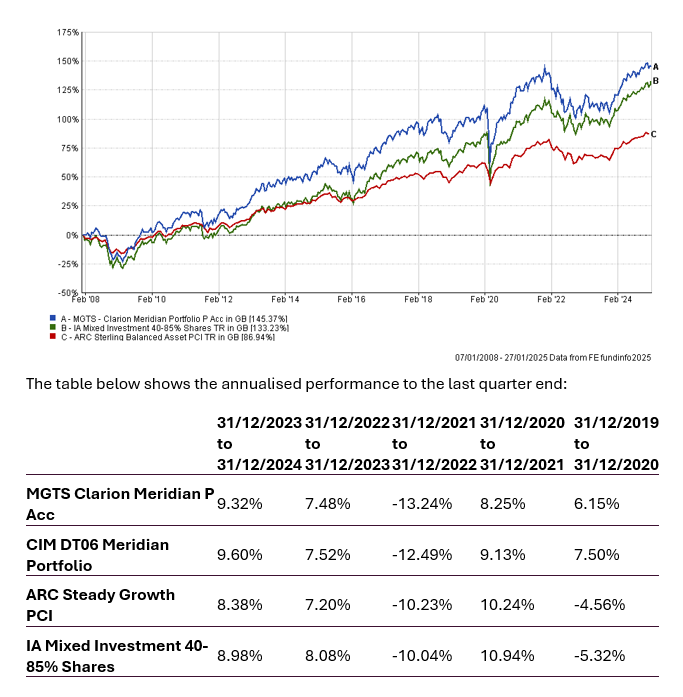

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

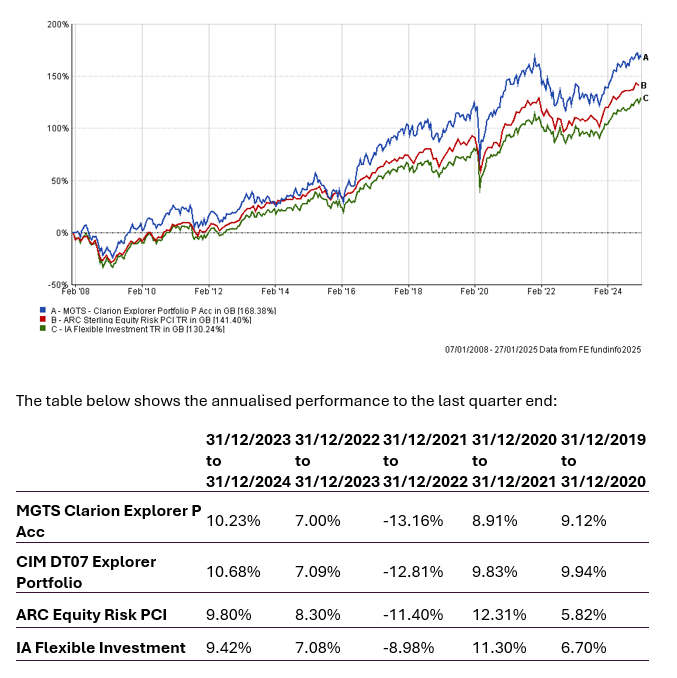

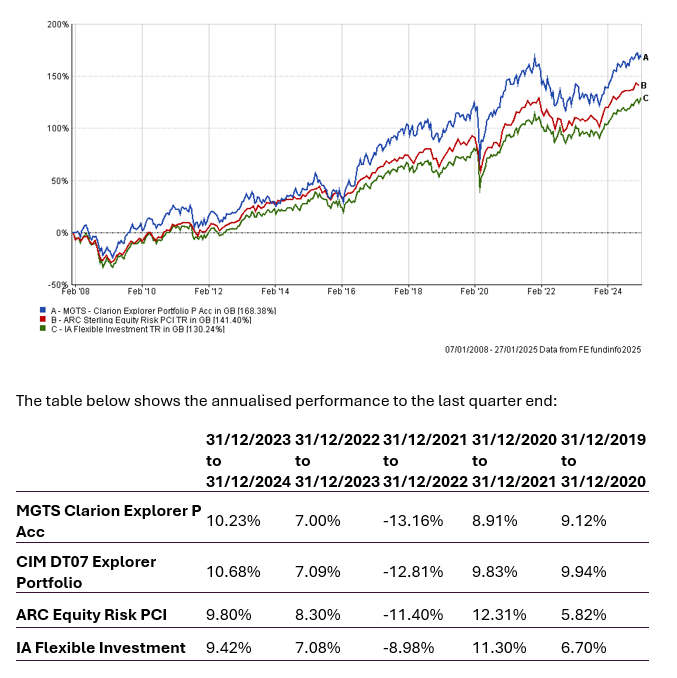

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

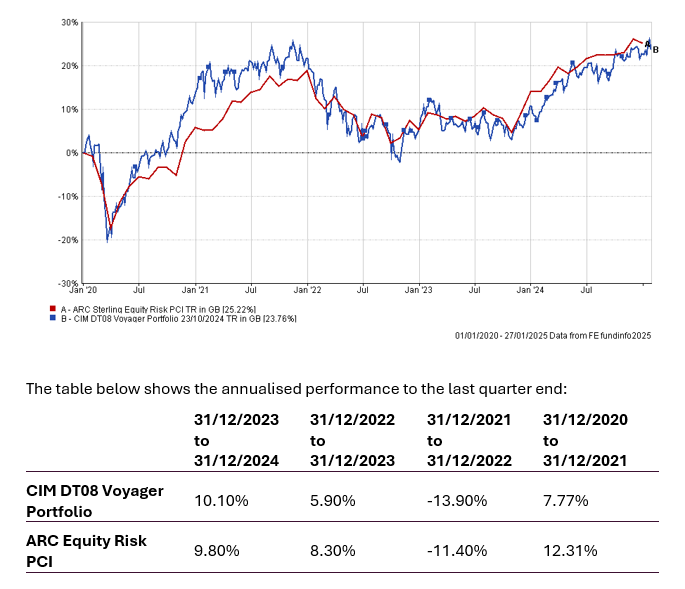

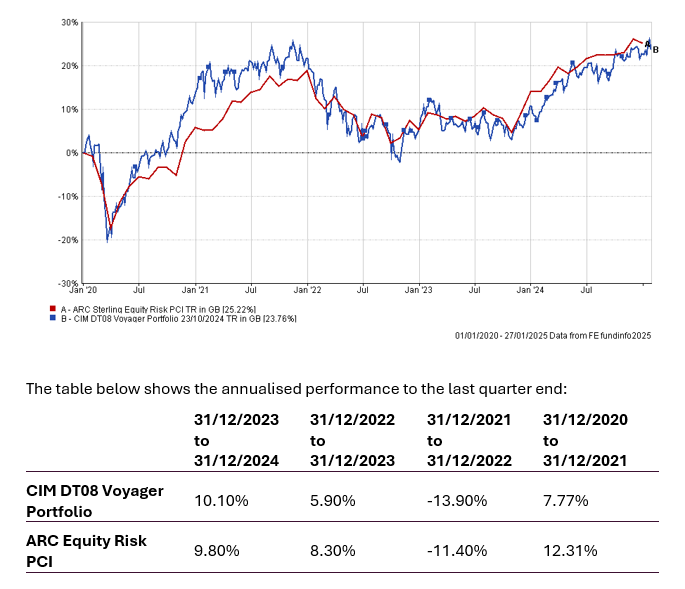

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

Changes to the Voyager Portfolio

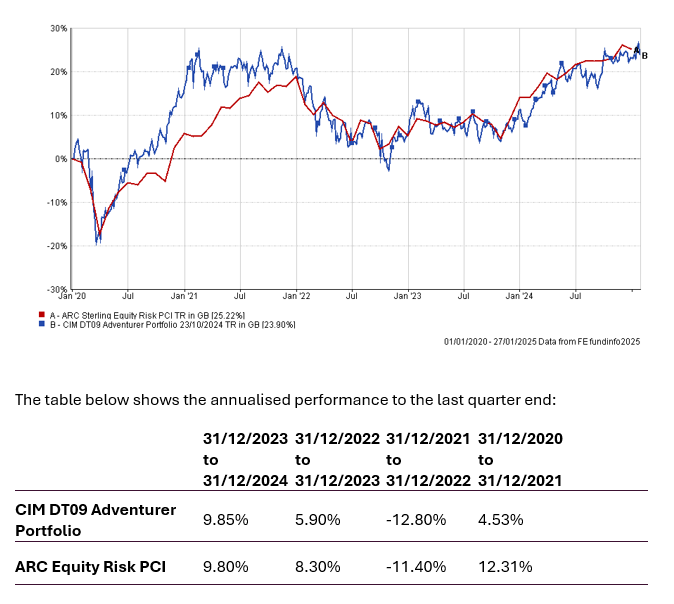

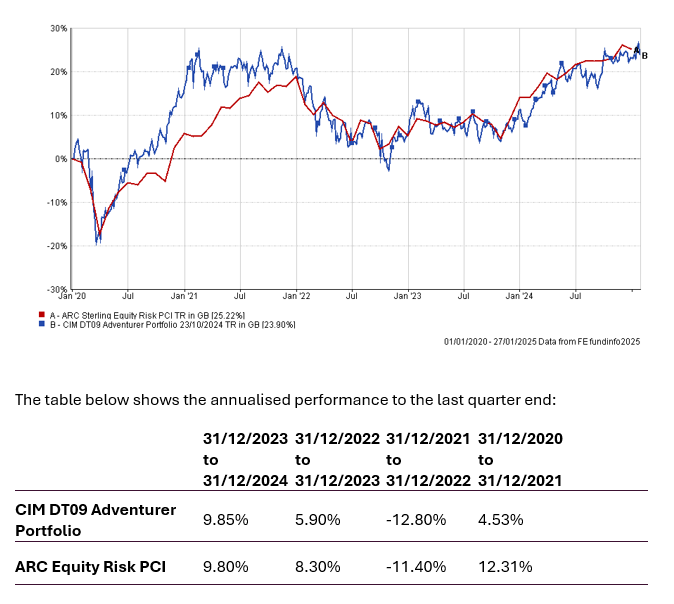

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Adventurer Portfolio

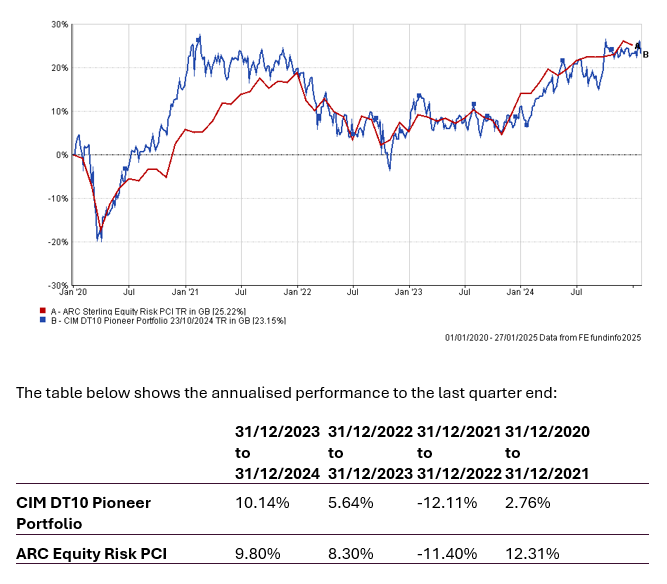

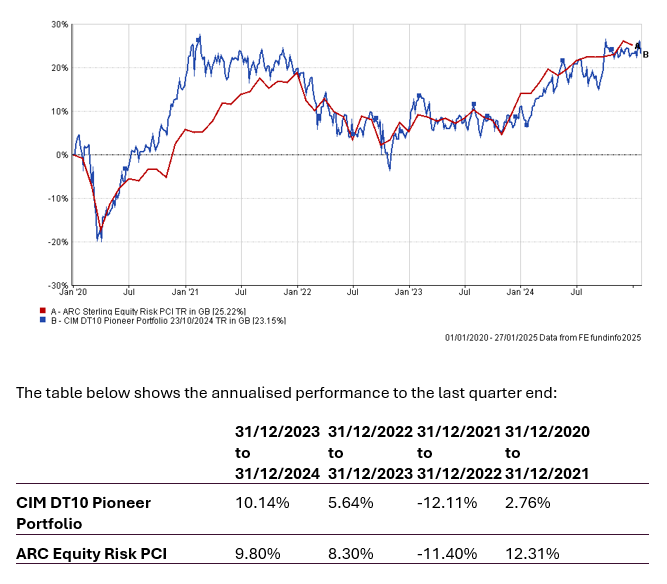

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Pioneer Portfolio

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

December 2024

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.