The Clarion Investment Committee met on 18 July 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Economics

- An IT outage hit organisations around the world, disrupting flights, live broadcasts, healthcare retail and many other sectors. US software group CrowdStrike said that its software update had impacted Windows hosts.

- Shipping data business Xeneta reported that the cost of moving a container between Asia and northern Europe has more than doubled since April due to increased Houthi attacks on ships.

- The UK’s Climate Change Committee warned that the UK was not on track to meet its 2030 climate target and called for a reduction in electricity levies and an acceleration of wind, solar and heat pump installations.

- UK average earnings growth slowed to 5.7% in the three months to May while the unemployment rate remained unchanged at 4.4%.

- UK consumer prices rose by 2.0% in the 12 months to June, unchanged from the previous month and in line with the Bank of England’s target. While goods prices fell by 1.4% the prices of services rose by 5.7%, which together with still-high earnings growth could be seen by the Bank as evidence of continued inflationary pressure.

- UK public sector borrowing of £14.5bn in June was higher than expected but also the lowest seen in that month since 2019 as tax revenues have risen and the energy support scheme has ended.

- UK retail sales fell by a greater-than-expected 1.2% from May to June amid unseasonably poor weather.

- UK consumer confidence edged up to reach its highest level since September 2021.

- China posted lower-than-expected GDP growth of 4.7% year on year in the second quarter amid continued weakness in the property sector.

- The Chinese Communist Party’s deputy director for economic affairs said that “proactive fiscal policy must be used to better effect” as “China’s economic recovery is not strong enough”.

- US stocks have seen a rotation away from mega-cap tech stocks and towards small-cap stocks following strong earnings data and falling inflation.

- US chip stocks also saw a difficult week after Donald Trump said that Taiwan should pay for its own defence and reports that President Biden was considering further restrictions on sales of semiconductors to China.

- The price of gold reached a record high of $2,483.60 per ounce as investors increasingly expect the Fed to begin cutting rates in September.

Business

- Consumer goods giant Unilever announced that it would cut one-third of all office roles in Europe by the end of next year as it looks to boost growth.

- JPMorgan Chase posted record profits in the second quarter as a rebound in dealmaking boosted its investment banking operation.

- Bidding has begun for the UK newspaper The Daily Telegraph and Spectator magazine after the UK government blocked the sale to an Abu Dhabi-backed group.

- UK telecoms regulator Ofcom will restrict inflation-linked price rises mid-contract for mobile and broadband services from January next year.

- A record 418,000 flights are scheduled between the US and Europe this summer, 7% above last year’s record as the strong dollar boosts demand from US holidaymakers.

- Netflix announced that it added more than 8m subscribers in the second quarter, in part due to a crackdown on password sharing.

Global and political developments

- President Biden dropped out of the race for the White House and endorsed Vice President Kamala Harris for the Democratic nomination.

- US Republican presidential candidate Donald Trump formally accepted his party’s nomination, vowing to reduce taxes, raise tariffs and cut immigration.

- Mr Trump announced Ohio senator JD Vance as his running mate. Mr Vance has been highly critical of American aid to Ukraine.

- Mr Trump was injured but survived an assassination attempt at a campaign rally.

- Houthi rebels in Yemen claimed responsibility for a drone attack on Tel Aviv that killed one person and injured several others.

- French president Emmanuel Macron’s preferred candidate was re-elected as president of the National Assembly, suggesting possible support for a broad alliance from the centre of politics to form a new government.

- A Russian court jailed US journalist Evan Gershkovich for 16 years following a conviction for espionage. Washington described the trial as a “sham”.

- The King set out the legislative agenda for his new Labour government that included the nationalisation of the railways, new protections for workers, planning reform and new powers for the Office for Budget Responsibility.

- UK prime minister Keir Starmer called for deeper defence and security cooperation across Europe at a meeting of the European Political Community.

- Mr Starmer also announced that 44 European countries had agreed to crack down on the so-called ‘shadow fleet’ of tankers that were being used to flout sanctions on exports of Russian oil.

- The UK Covid-19 Inquiry published its first report that criticised the government for preparing for the “wrong pandemic”.

- Welsh first minister Vaughan Gething announced that he would stand down after four of his ministers resigned.

- The US Supreme Court ruled that presidents cannot be prosecuted for official acts taken while in office meaning that it is unlikely that former president Donald Trump will face another criminal trial prior to elections in November.

- The Bank for International Settlements (BIS) warned that rising government debt levels exposed financial markets to the risk of a crisis similar to that which hit the UK in 2022. The BIS urged governments to start reducing debt levels

- Some 32 countries at NATO’s 75th-anniversary summit in Washington signed the Ukraine Compact, vowing to support Ukraine.

- Beijing criticised NATO for saying that China had become a “decisive enabler” of Russia’s war in Ukraine.

Please click here to access the July Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary & Strategy

- North America is still leading in terms of returns YTD but over the last 3 months, we have seen a reversal and the UK, Asia and Emerging Markets have been the best markets. These markets still look cheap on a historical basis.

- In recent weeks there has been a rotation out of US big tech into US smaller companies which has benefitted our holding in Dimensional US smaller companies.

- The Investment Committee are of the view that Donald Trump will defeat the Democratic Candidate, whoever that may be, in the US Presidential election in November and will become the 47th President of the United States. This will likely mean a renewal of his “America First” rhetoric raising the prospect of protectionist policies with high tariffs on imported goods from other countries notably China, India & Europe. Unfortunately, trade wars usually result in higher inflation.

- Trump is also an advocate of lower interest rates, a weaker dollar and low taxes for both companies and individuals. He is also likely to introduce a tax levy on big tech companies.

- Dollar weakness will have a negative impact on US-based investments.

- All the above supports the committee’s stance of being underweight US large-cap stocks, particularly US tech. The committee favour an overweight position to Emerging Markets, UK, and Europe.

- The Investment Committee believe that inflation will persist and whilst it is likely to dip below 2% in the next few months, the long-term average is expected to be around the 3% level due to wage inflation.

- A higher interest rate and higher inflation environment will become the new normal.

- Value stocks and undervalued markets are likely to be the key beneficiaries with a rotation to Asia, UK and Europe particularly.

- US big tech and large-cap stocks are likely to underperform from here because of the current unsustainable high valuations. For example, Nvidia’s current valuation is 50 x Gross Revenue.

- US consumer spending will come under pressure due to overindulgence and run down of Covid savings.

- Upward stock market momentum in 2024 may fade in 2025 as debt servicing headwinds emerge.

- Liquidity is the most significant driver of returns at present but there remains a downside risk to high PE stocks.

- It will take a full economic cycle for the inflationary effects of printing money after the global financial crisis and Covid to dissipate.

- The investment committee have become concerned about the duration risk in the iShares £ index-linked gilts fund. The iShares fund has a duration of 16 years which makes it more sensitive to interest rate changes. The Committee favour a short-duration fund to reduce interest rate risk and decided to switch to the iShares Dollar Tips hedged ETF which has a much shorter duration and will benefit from falls in US inflation. This ETF also has a very low OCF.

- The committee are also slightly concerned about the relatively poor performance in recent months of the Schroder Institutional Pacific Fund and has therefore requested the fund analyst for a full review and to also look at alternative funds.

Since December 2023, there has been a tilt towards evidence-based factor investing, which involves a disciplined approach backed up by significant amounts of Nobel Prize-winning economic research. Factor investing involves trusting the market but tilting the investment choice towards smaller companies, value companies (those trading at a discount) and profitable companies. The evidence shows that over the long-term, these types of investments outperform the typical index tracking and actively managed funds.

Clarion is primarily accessing these factor-based investments through Dimensional Fund Advisors (www.dimensional.com). At the present time Dimensional are the only investment manager in the UK which offer this type of investment. Since inclusion, investment performance has been impressive, costs have decreased, and it is likely that we will look to introduce more factor-based funds into the portfolios as and when appropriate.

The Clarion funds are well positioned to take advantage of the latest economic conditions and over the last 12 months (to 23/07/2024):

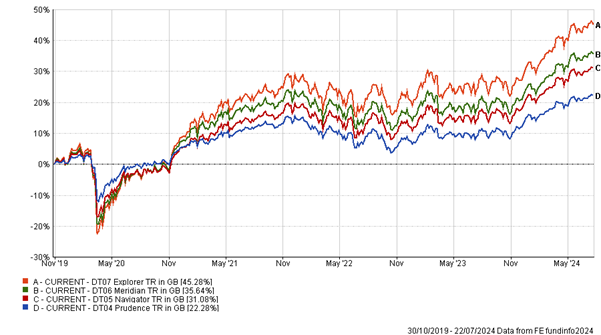

- Explorer has returned 11.79% against the RTMA Risk 5 Growth sector average of 70% and the IA Flexible sector average of 10.11%

- Meridian has returned 11.27% against the RTMA Risk 5 Growth sector average of 70% and the IA Mixed Investment 40-85% Shares sector average of 10.26%

- Navigator has returned 10.56% against the RTMA Risk 4 Balanced sector average of 10.10% and the IA Mixed Investment 40-85% Shares sector average of 10.26%

- Prudence has returned 8.64% against the RTMA Risk 3 Moderate sector average of 8.69% and the IA Mixed Investment 20-60% Shares sector average of 8.46%.

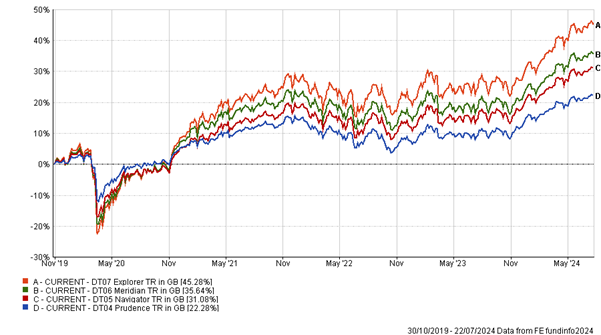

The performance of the CURRENT portfolios back tested over 5 years is shown in the chart below. This is assuming that we made the recent changes 5 years ago and then adopted the buy-and-hold approach favoured when using evidence-based factor investing.

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

July 2024

Clarion Funds & Discretionary Portfolios:

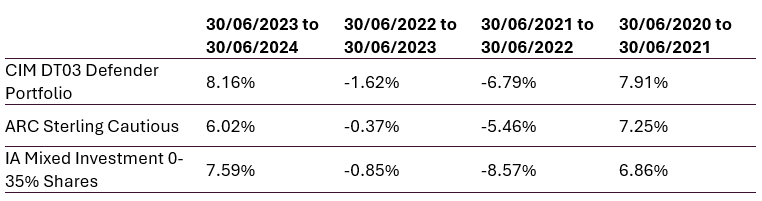

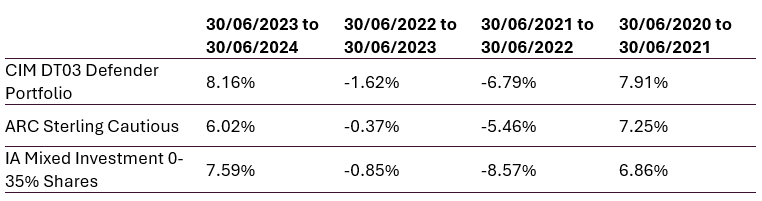

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Defender Portfolio

- iShares £ Index Linked Gilts ETF GBP (8.00%) was replaced by iShares $ TIPS ETF Hedged GBP (8.00%).

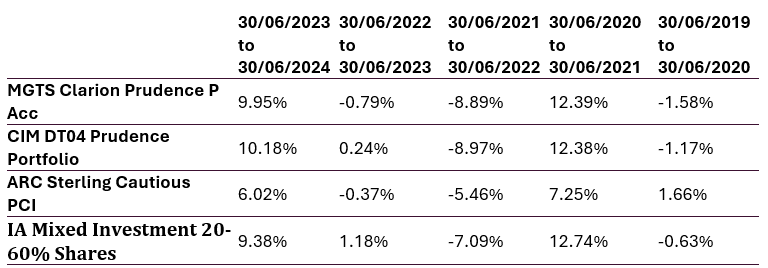

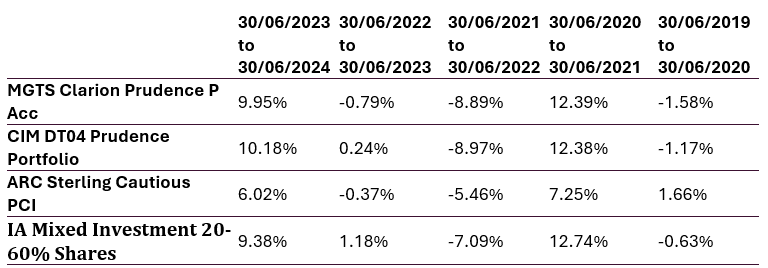

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Prudence Fund & Portfolio

- iShares £ Index Linked Gilts ETF GBP (7.00%) was replaced by iShares $ TIPS ETF Hedged GBP (7.00%).

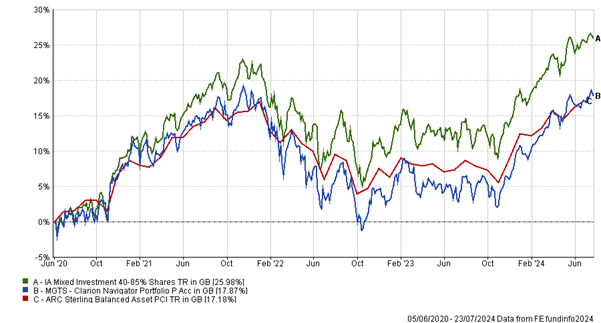

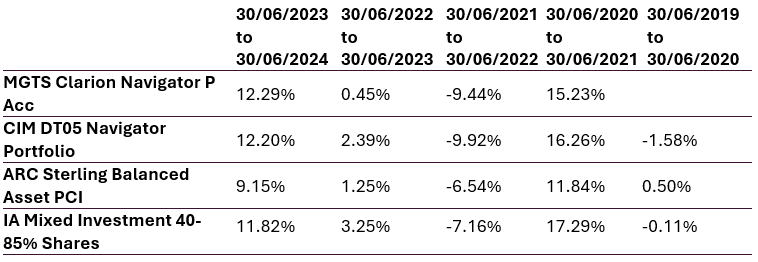

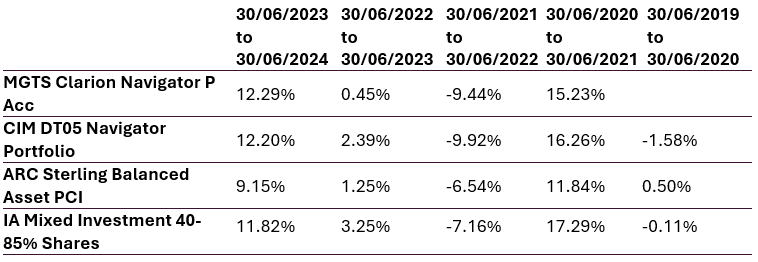

Navigator Fund & Managed Portfolio

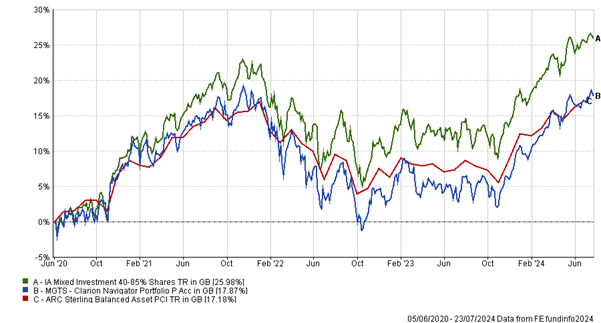

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Navigator Fund & Portfolio

- iShares £ Index Linked Gilts ETF GBP (8.00%) was replaced by iShares $ TIPS ETF Hedged GBP (8.00%).

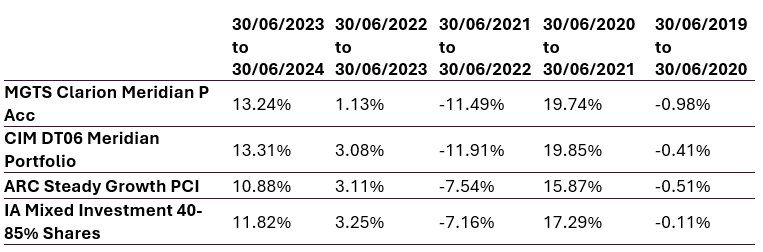

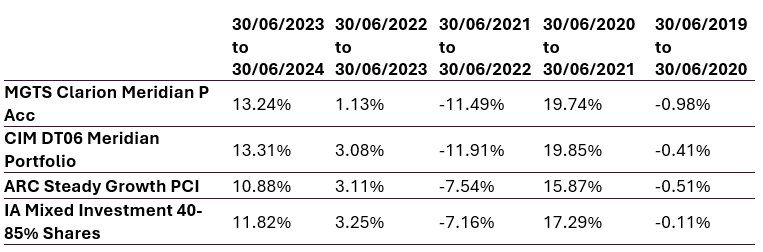

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Meridian Fund & Portfolio

- There were no changes to the Meridian fund or portfolio in July 2024.

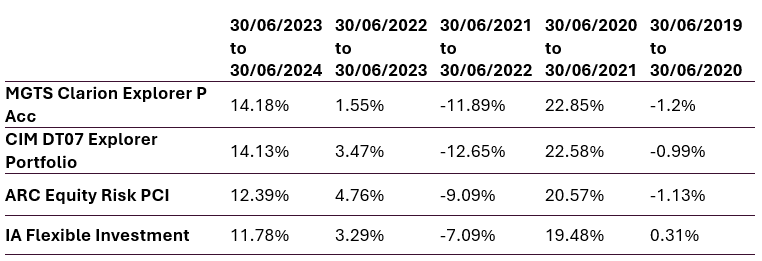

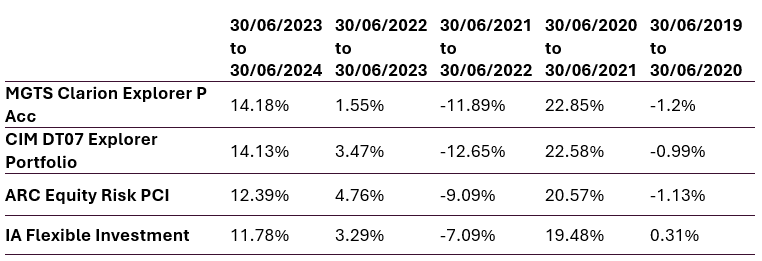

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Explorer Fund & Portfolio

- There were no changes to the Explorer fund or portfolio in July 2024.

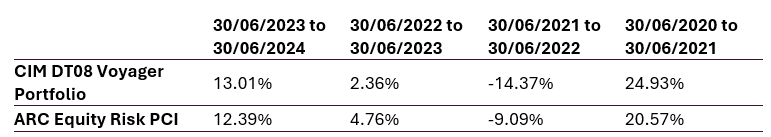

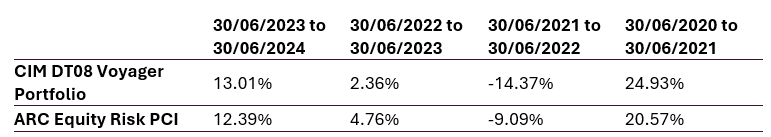

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Voyager Portfolio

- There were no changes to the Voyager portfolio in July 2024.

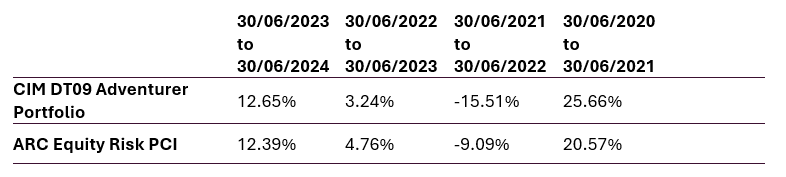

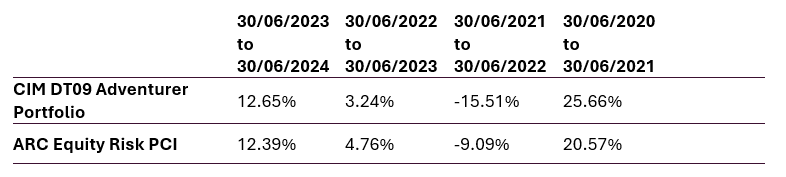

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Adventurer Portfolio

- There were no changes to the Adventurer portfolio in July 2024.

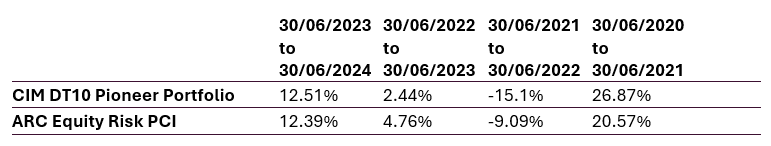

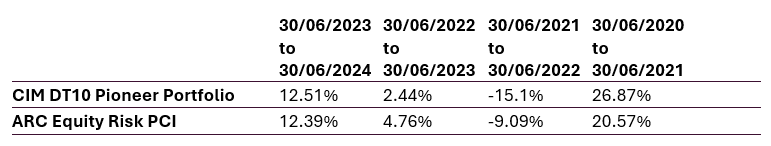

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Pioneer Portfolio

There were no changes to the Pioneer portfolio in July 2024.

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.