The Clarion Investment Committee met on Thursday 17th July. The following notes summarise the main points of consideration in the Investment Committee discussions and have been updated to include commentary on recent events and the wider implications for financial markets.

Please click here to access our July Stock Market & Economic Commentary written by Clarion Group Chairman, Keith Thompson.

Economic Commentary & Market Outlook.

The following is a summary of the major news and events since the last Clarion Investment Diary.

Economics

- The US and Japan agreed a trade deal that will see tariffs of 15% on Japanese goods including cars imported into the US, higher than the 10% interim tariff

- At the time of writing, the US and EU are reportedly close to a similar deal, however the EU has readied a package of retaliatory tariffs of up to 30% should an agreement not be reached

- Early estimates of business activity in July from surveys of purchasing managers suggest an acceleration in growth in the UK, US and euro area despite declining manufacturing activity

- US president Donald Trump called Fed chair Jay Powell a “numbskull” for not cutting interest rates and very publicly criticised the cost of refurbishing the Fed’s headquarters in Washington before saying that firing Mr Powell would not be “necessary”

- The European Central Bank kept its benchmark interest rate on hold at 2% with President Christine Lagarde saying the bank was in a “wait-and-watch situation”

- The UK and India signed their previously announced trade deal following last-minute talks on some of the details, including automotive tariffs

- UK retail sales volumes rose by a less-than-expected 0.9% in June following a 2.8% contraction in May

- Further evidence of UK consumer caution comes from a survey by GfK that found that consumers are more likely to say that now is a “good time to save” than at any point since November 2007

- The UK government launched a review of the state pension age that is set to start rising to 67 from next year and 68 from 2044

- The UK government borrowed a greater-than-expected £20.7bn in June, adding to speculation that taxes may have to rise in the Autumn Budget

- Tens of thousands of preschools are closing down in China where the annual number of births has nearly halved since 2016

- US president Donald Trump said he was “very unhappy” with Russia and threatened to impose 100% tariffs and other sanctions on third parties who trade with Russia if there is no peace deal between Ukraine and Russia “in 50 days”

- The US raised a record $64bn in customs duties over the second quarter this year, an increase of $47bn from the previous year, following Mr Trump’s imposition of import tariffs

- Fund managers have increased investments into technology equities at the fastest rate since 2009, according to a monthly survey by the Bank of America, as US equities continue to rebound

- US inflation increased by a more than expected 2.7% in the year to June

- US consumer sentiment improved more than expected in July to reach a five-month high, according to the University of Michigan, however the index remains well below historical averages

- UK inflation increased to an 18-month high of 3.6% in the year to June, up from 3.4% in May, driven by rising transport costs

- The UK labour market continued to soften, with unemployment rising to 4.7% in the three months to May and the number of vacancies continuing to fall in the second quarter this year. Annual average wage growth slowed to 5% in the three months to May

- German investor sentiment continued to improve in July for the third consecutive month, according to research institute ZEW, driven by government spending announcements and hopes of the US and EU reaching a trade deal

- Chinese GDP increased to 5.2% in the second quarter this year, a stronger than expected increase despite global trade disruptions and weak domestic demand

- The Bank of England said that most UK companies would still be able to service their debts in the face of global shocks, such as sharply higher tariffs, as household and corporate resilience “remains strong in aggregate”

- The UK Office for Budget Responsibility said the UK fiscal outlook “remains daunting” as low economic growth and higher interest rates have made addressing high public debt levels “considerably more challenging”

- Investor sentiment in the euro area increased in July to its highest level since February 2022, with significant increases in Germany following its fiscal expansion plans

- The number of applications for companies wanting to list in Hong Kong reached a record high in the first half of 2025, amid rapid growth of its equity market and interest from Chinese firms looking to expand abroad

Business

- The UK prime minister Keir Starmer and health secretary Wes Streeting criticised a five-day strike by resident (formerly junior) doctors over pay with the latter saying it “enormously undermines the entire trade union movement”. The British Medical Association union is seeking a 29% pay rise following a 22% settlement over two years agreed last year

- The UK government announced it would scrap and replace water regulator Ofwat following a review by former Bank of England governor Sir Jon Cunliffe

- US carmaker General Motors and German carmaker Volkswagen both announced a fall in operating profit in the second quarter as US tariffs on car imports caused difficulties on both sides of the Atlantic

- The number of recorded shoplifting incidents in the UK rose 20% in the year to the end of March, the highest since comparable data began in 2003

- The $8bn merger between Paramount Global and Skydance Media was approved by US regulators

- Private equity groups are making record use of ‘continuation funds’, where assets are effectively sold to themselves, amid a continued drought in IPOs and deal activity, the FT reports

- Tom Hayes, a banker jailed over the Libor rigging scandal, had his conviction overturned

- The UK and Turkey signed a preliminary agreement to sell Eurofighter Typhoon jets to Turkey

- The UK gave the final approval for the Sizewell C nuclear project despite a near-doubling in estimated cost to £38bn

- Uber announced plans to invest $300m in US electric vehicle manufacturer Lucid as part of plans to launch a fleet of robotaxis

- Saudi Arabian utilities company ACWA Power announced an $8.3bn investment into wind and solar farms as part of a consortium, as the country continues to develop its renewable energy capacity

- Applications from US students to UK universities increased to their highest level since records began in 2006, amid threats that US universities will have their funding cut by the US government

- The UK government published its financial services strategy, aimed to reduce red tape and improve UK growth. Proposals include reforming ringfencing rules for banks and overhauling the Financial Ombudsman Service

- Troubled utilities company Thames Water said it faces “material uncertainty” amid the possibility of temporary nationalisation. Thames Water chief executive Chris Weston said it would take “at least a decade” to turn the company around

- The UK government announced a £650m scheme to subsidise purchases of electric vehicles in a bid to accelerate sales to meet net-zero targets

- President of the British Academy, Dame Julia Black warned of the long-term decline in the UK’s higher education system without significant reform to regulation and government oversight

- UK digital bank Starling is considering listing in the US as part of its expansion plans, the latest in a trend of UK companies choosing to list in New York instead of London

- UK bank Barclays was fined £42m by the Financial Conduct Authority for insufficient checks on its clients

- Insurance costs for ships passing through the Red Sea surged after Houthi rebels resumed attacks on commercial shipping traffic

- Tesla shares fell by nearly 7% after Mr Trump called Elon Musk a “train wreck” in response to Mr Musk’s announcement that he was forming a new political party

- Semiconductor manufacturer Nvidia became the first company with a market valuation of over $4tn

- Italian food group Ferrero agreed to buy breakfast cereal company Kellogg’s in a deal worth $3.1bn

- The UK’s Financial Conduct Authority fined consumer bank Monzo £21m for failing to undertake sufficient checks on high-risk customers

- Asset management company Brookfield is expected to take a 20% stake in the Sizewell C nuclear power plant, making it the largest private investor, while energy company EDF will reduce its shareholding, the FT reports

- UK television broadcaster ITV agreed with Disney to show each other’s programmes across both their streaming platforms as part of a growing relationship between broadcasters and US online streaming services

- UK media regulator Ofcom approved Royal Mail to end its Saturday deliveries of second-class letters in a bid to save costs

Global & Political Developments

- French president Emmanuel Macron said that France would recognise a Palestinian state at the UN in September, increasing pressure on the UK to do the same

- UK prime minister Keir Starmer is expected to meet US president Donald Trump during his five-day golf trip to Scotland with steel tariffs expected to be a key topic of discussion

- Former Labour leader and now independent MP Jeremy Corbyn announced he was setting up a new party together with former Labour MP Zarah Sultana

- Acting Thai prime minister Phumtham Wechayachai warned that border clashes between Thailand and Cambodia that include heavy weapons and have killed at least 16 people have the potential to “move towards war”

- Ukrainian president Volodymyr Zelenskyy scrapped planned reforms to the independence of the country’s anti-corruption institutions following protests

- UK Conservative Party leader Kemi Badenoch reshuffled her shadow cabinet and appointed former leadership rival Sir James Cleverly as shadow housing secretary

- Talks resumed between Iran and the UK, France and Germany ahead of a deadline to reimpose sanctions on Iran if a deal is not reached over its nuclear programme

- Israel launched airstrikes on military targets in Syria. The Israeli government said the attacks were to protect members of the Druze religious group

- Two ultraorthodox parties quit the Israeli government over disagreements on conscription of religious students, leaving the ruling coalition led by prime minister Benjamin Netanyahu with a one-seat parliamentary majority

- It was recently revealed that a UK database containing the details of thousands of Afghan nationals was accidentally leaked by the Ministry of Defence in 2022, raising concerns of reprisals by the Taliban. Thousands of people on the list have since been relocated to the UK under a secret scheme following the leak

- The UK and Germany agreed to work more closely in selling jointly made weapons, including Typhoon jets, as many European nations commit to increasing defence spending

- The UK government suspended four MPs from the Labour Party following recent rebellions in parliament

- The UK government announced that the voting age in England and Northern Ireland will be lowered from 18 to 16

- Sea levels in the UK are rising faster than the global average and more extreme weather “becomes the norm”, according to a report published in the International Journal of Climatology

- Mr Trump announced that the US reached a new deal to send air defence systems to Ukraine via purchases through NATO countries

- Russian drone missile attacks continued against Ukraine, mainly targeting the capital city Kyiv

- Israeli prime minister Benjamin Netanyahu met Mr Trump in the US to discuss a ceasefire proposal with Hamas. A deal has not yet been reached

- The EU said it has reached a deal with Israel to substantially increase aid deliveries to Gaza

- Israel struck ports in Yemen held by Houthi rebels following recent attacks on commercial shipping vessels in the Red Sea

- France and the UK finalised a deal to tackle migrant Channel crossings and pledged to coordinate the use of nuclear weapons to protect against “extreme threats”

- Finland and Denmark opposed plans for the EU to issue joint debt for functions other than boosting defence spending, dampening the EU’s ambitions for greater joint capabilities to respond to future crises

- The UK government dropped a zonal electricity pricing proposal and is instead considering other market reforms to achieve its targets of lowering energy prices and decarbonising the electricity grid

- Resident doctors, formally junior doctors, voted to strike for five days in July over pay following escalating tensions between the British Medical Association and the government

Strategy

- The bond allocations within the portfolios target short and mid sections of the yield curve where capital appreciation is expected.

- High yield bond strategies are avoided as credit spreads do not currently offer a worthwhile risk premium.

- The US equity market is underweighted on a valuation basis and strategies within the portfolio are particularly underweight mega-cap stocks.

- The UK equity market is conversely overweighted on a valuation basis.

- Asia, Emerging Markets and China are also overweighted as they trade below their long-term historical averages after experiencing a period of poor performance. The IC believe these regions have potential to grow their valuations in the long-term from a low base.

- UK and US small and mid-cap equity allocations are also included based on an attractive entry point which current valuations provide.

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future.

- No changes to the underlying funds were considered necessary as all funds were performing in line with expectations and within their risk reward parameters.

- Despite rising geopolitical tensions we are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Europe, Asia and Emerging Markets where valuations are generally more attractive which will help to offset some of the economic headwinds and geopolitical uncertainty.

Clarion Funds

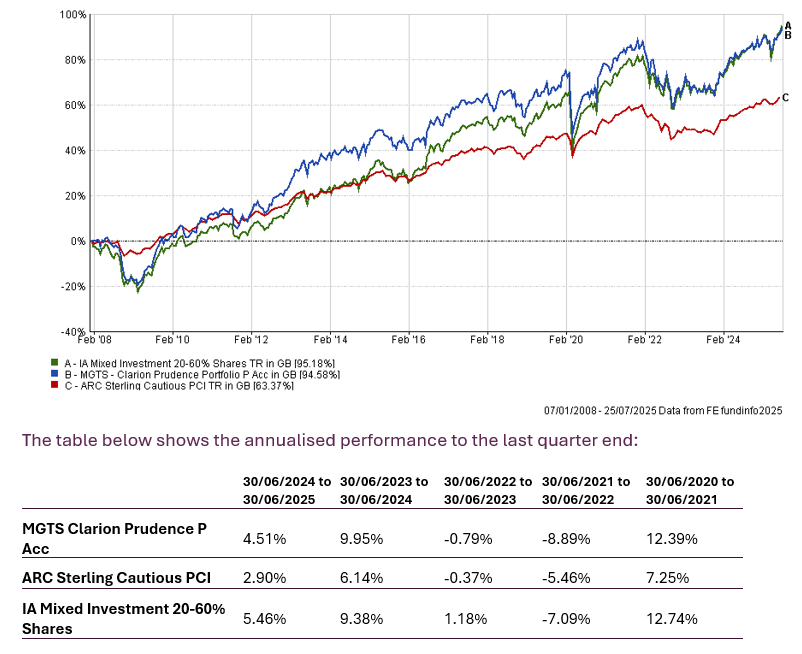

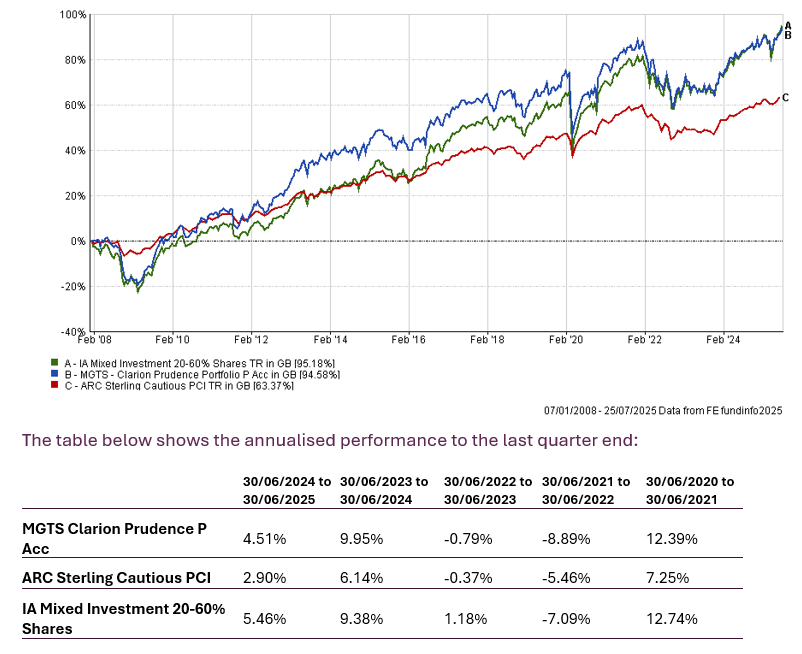

Prudence Fund

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund

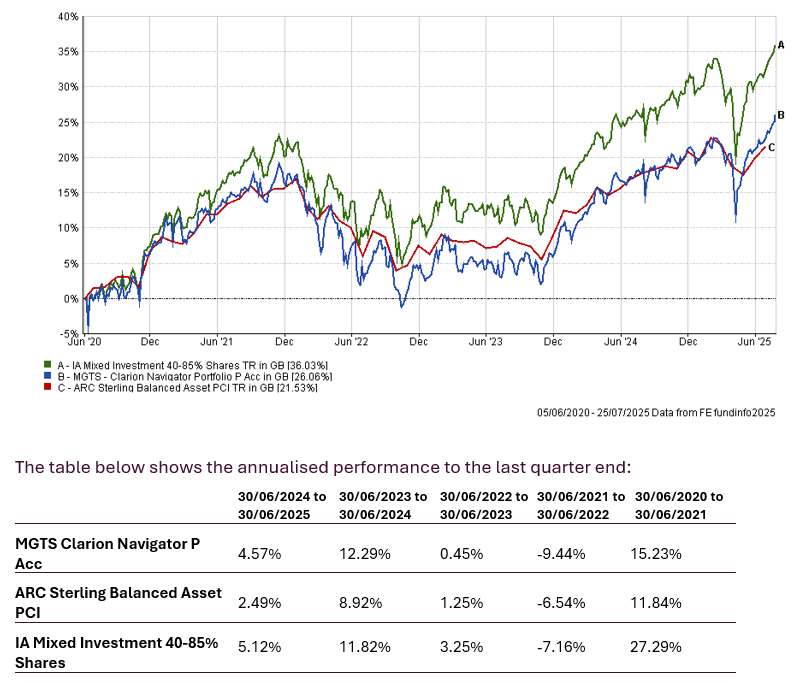

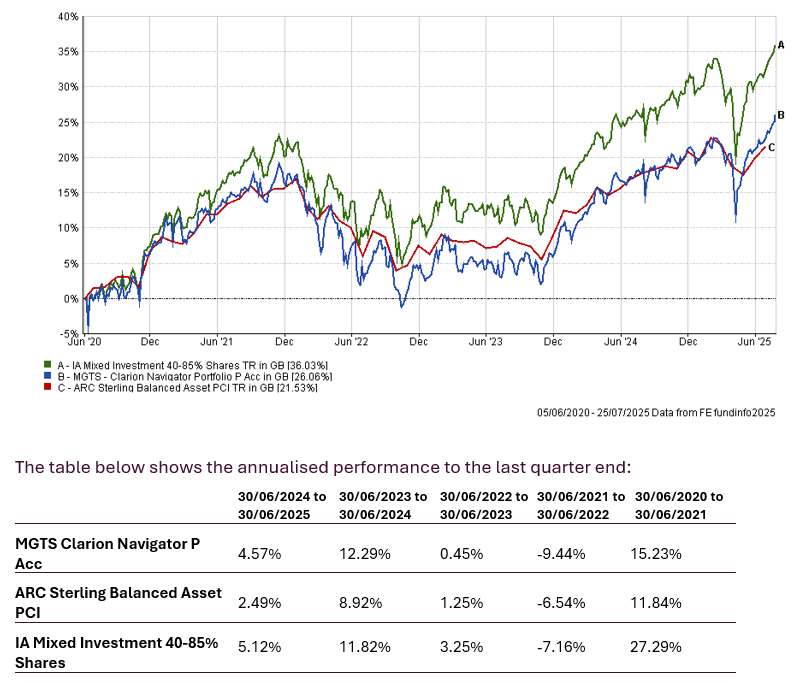

Navigator Fund

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund

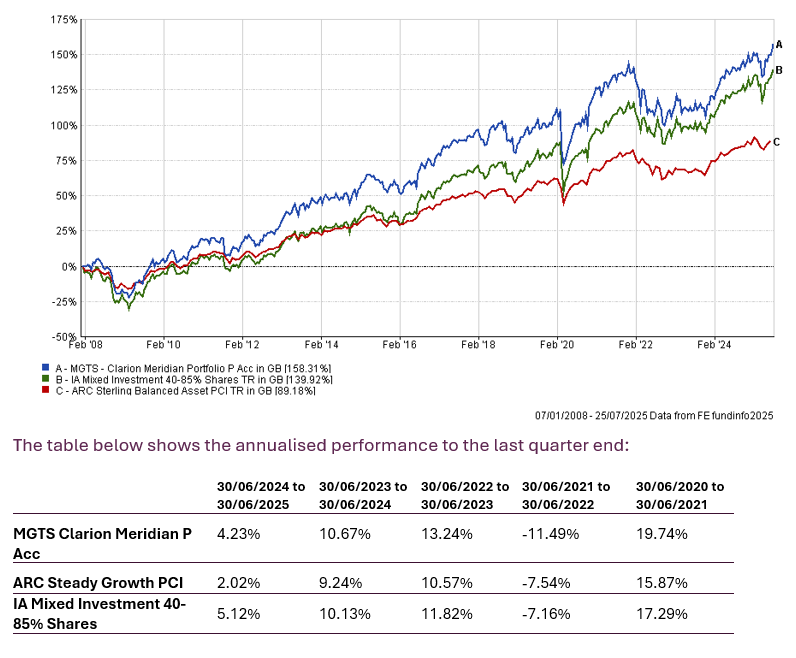

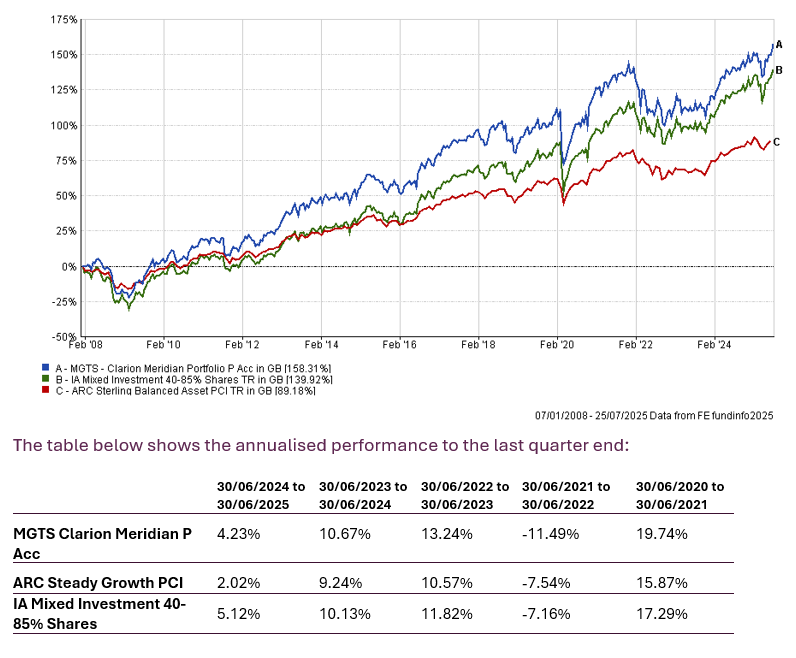

Meridian Fund

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund

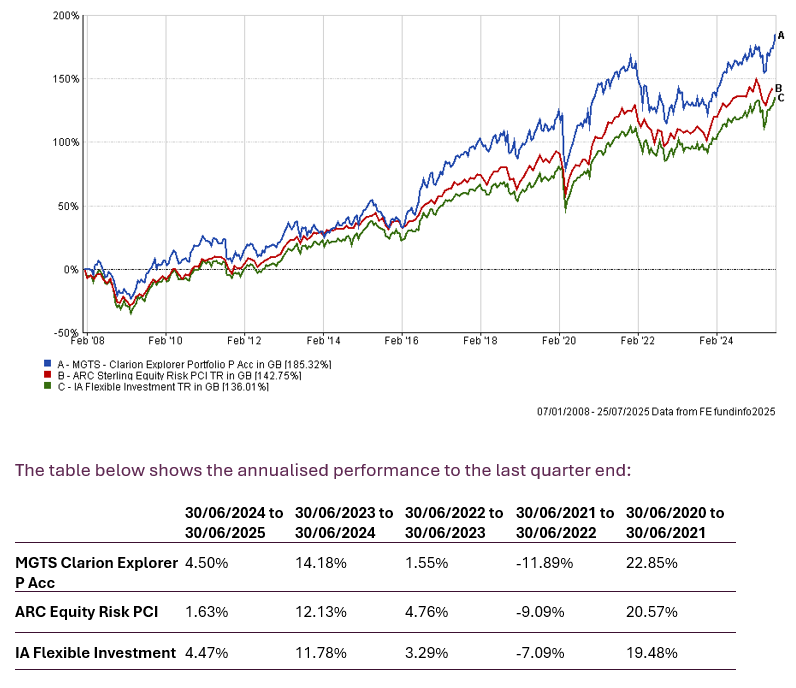

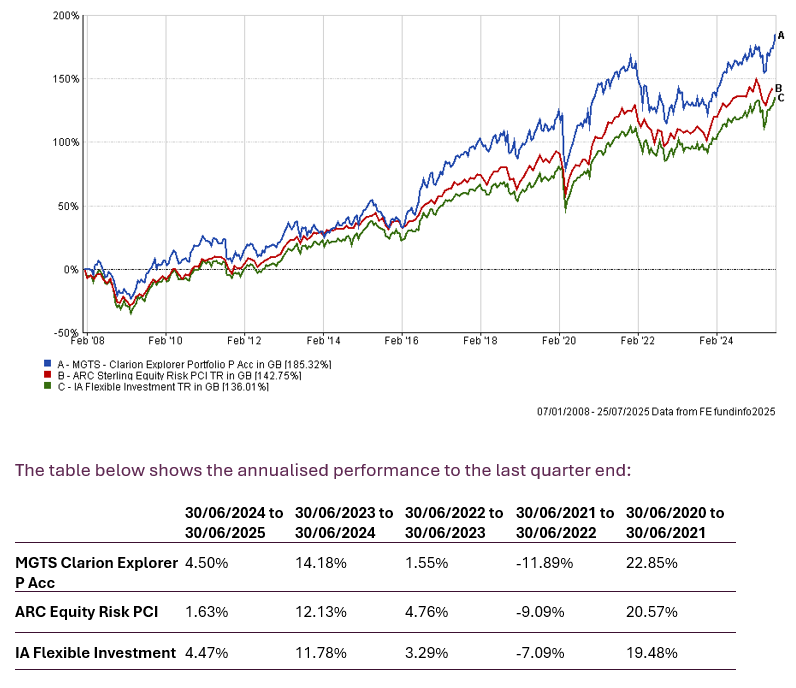

Explorer Fund

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

July 2025

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.