The Clarion Investment Committee met on 13 June 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Economics

- US consumer confidence rose in May following three months of falls.

- German consumer confidence continues to rise, increasing for the fourth month in a row.

- The European Central Bank cut its benchmark deposit rate for the first time since 2019, from 4% to 3.75%, but cautioned that further cuts would “depend on the data”.

- The Bank of Canada cut its interest rate from 5% to 4.75% as the economy softens.

- The US economy added 272,000 jobs in May, significantly ahead of expectations and up from a revised 165,000 in April, lowering expectations of rate cuts later in the year.

- The UK’s Local Government Association warned that English local authorities face a budget shortfall of £6.2bn over the next two years.

- UK house prices unexpectedly fell by 0.1% in May compared with the previous month, according to estimates from Halifax.

- UK rental inflation for new tenancies fell to a 30-month low of 6.6% in the year to May as affordability constraints bite many renters.

- Chinese exports grew by 7.6% in May compared with the same period a year earlier while imports only grew by 1.8%, adding to concerns over weak domestic consumption.

- The Japanese central bank spent a record $62bn of its reserves in an attempt to boost the yen between late April and late May. Despite the intervention, the yen has continued to weaken.

- The Chicago Federal Reserve Bank Financial Conditions Index reached its most favourable level since January 2022 as bond yields and risk spreads have fallen in recent weeks. The development should support corporate borrowing and deal activity.

- UK inflation fell to 2.3% in the year to May down from 3.2% the previous month but slightly ahead of expectations. Falling gas and electricity prices drove much of the decline. More modest falls were seen in the core inflation measure and the services inflation measure possible evidence of continued underlying inflationary pressure.

- Investors’ expectations of an early UK rate cut declined on the news. Investors now see the first cut coming in September or November.

- UK energy regulator Ofgem announced that a reduction in its price cap would mean a typical domestic fuel bill would fall by 7% to £1,568 from July. Prices are expected to rise again in October.

- UK retail sales fell by a greater-than-expected 2.3% from March to April. Rainfall of 155% of normal levels was likely to be partially responsible.

- UK consumer confidence saw a small rise in May to reach its highest level since December 2021. Euro area consumer confidence also rose to its highest level since February 2022.

Business

- The volume of follow-on transactions on the London Stock Exchange, in which investors sell a significant stake in listed companies, has reached $11.5bn so far this year, the fastest start to the year since 2021 as the FTSE 100 reached record highs.

- Czech businessman Daniel Křetínský agreed a £5.3bn deal to take London-listed International Distribution Services, owner of Royal Mail and GLS, into private ownership.

- UK water regulator Ofwat is planning to reduce fines on regulated water companies in a bid to reduce financial distress in the sector, the Financial Times

- Chipmaker Nvidia overtook Apple as the world’s second-most valuable public company as extraordinary demand for its AI chips continues.

- Former chief executive of Autonomy, Mike Lynch, was acquitted of fraud by a court in San Francisco.

- A number of private equity bosses have cautioned that their sector faces the possibility of years of lower returns amid a backlog of unsold companies and higher interest costs, the Financial Times

- Lord John Browne, former chief executive of BP, endorsed the UK Labour Party’s policy to end new licences for drilling in the North Sea saying that remaining resources would not make a significant contribution to energy security or lower fuel prices.

- Saudi Arabia is to raise over $11bn by selling shares in state oil company Aramco.

- United Nations secretary general Antonio Guterres called for a ban on advertising by fossil fuel companies, calling them “godfathers of climate chaos”.

- Operations were suspended at several NHS hospitals in London following a ransomware attack. A Russian group is thought to be behind the attack.

- A group of investors is planning to open a new stock exchange in Texas aiming to provide a less regulated alternative to the New York Stock Exchange and Nasdaq.

- Activist investor Palliser Capital called for mining company Rio Tinto, the fifth-largest company on the London Stock Exchange, to drop its London listing in favour of Sydney, claiming it was trading at a $27bn discount .

- Nvidia announced $26bn in revenues in the first quarter, up 262% on the same quarter last year, as sales of artificial intelligence chips soared.

- UK stockbroker Hargreaves Lansdown turned down a £4.7bn takeover offer from a consortium of private equity buyers saying it undervalued the firm.

- UK retailer Marks and Spencer announced profits of £673m for last year, a 41% increase.

- A UK public inquiry into infected blood products provided by the NHS between the 1970s and 1990s found significant wrongdoing and evidence of a cover-up. The government undertook to provide compensation which some estimates put at over £10bn, a material figure for the public finances.

Global and political developments

- Far-right parties made significant advances in the EU elections with exit polls suggesting major gains for the right in France, Austria and Germany. The Financial Times commented that the gains are likely to tilt the European Parliament to “a more anti-immigration, anti-green stance”.

- President Emmanuel Macron dissolved the French Parliament and called snap elections in the wake of the European election results. The French parliamentary elections will be held on 30 June and 7 July.

- The European commission is pushing for Ukraine to start EU membership talks ahead of Hungary taking over the rotating EU presidency, the Financial Times

- Russian president Vladimir Putin warned he may provide weapons to enemies of the West to strike western targets in response to NATO allowing Ukraine to use western arms to strike targets inside Russia.

- The Financial Times reported that Labour has dropped plans to bring back the pension Lifetime Allowance on the grounds of complexity and uncertainty for savers.

- Veteran Brexit campaigner Nigel Farage announced that he would stand for election in Clacton, UK and assume leadership of the right-leaning Reform UK party.

- An average of eight polls published after Mr Farage’s announcement put Reform UK on 15%, up from an average of 11% in eight polls that preceded the announcement.

- Israeli war cabinet minister Benny Gantz quit the emergency government in a sign of deepening divisions over prime minister Benjamin Netanyahu’s post-conflict plans for Gaza.

- Indian prime minister Narendra Modi formed a coalition government after his Bharatiya Janata Party unexpectedly failed to win a majority.

- The US and Germany authorised Ukraine to use weapons that they had supplied to strike targets inside Russia.

- Former US president Donald Trump was found guilty of 34 counts of falsifying business records in a New York court. The criminal conviction will not stop Mr Trump from running for the presidency, even if he were to be imprisoned at sentencing next month.

- A poll of British voters by the Financial Times/Ipsos found that an absolute majority expect to pay more tax if either the Conservatives or Labour win the general election.

- The British Chambers of Commerce called for the next government to negotiate a better trading relationship with the EU, saying that exporters were finding it increasingly difficult to sell in Europe.

- The US and UK conducted airstrikes in Yemen last week. Houthi rebels claimed they had launched an attack on a US aircraft carrier in response. Shipping volumes through the Red Sea remain depressed.

- Several pieces of planned UK legislation including the Renters (Reform) bill and the phased ban on sales of cigarettes were shelved due to insufficient parliamentary time.

- Hungarian president Viktor Orban said he wanted to “redefine” the country’s membership of NATO. Mr Orban has opposed military aid to Ukraine and delayed sanctions against Russia.

- Chief prosecutor at the International Criminal Court in the Hague, Karim Khan, applied for arrest warrants for three Hamas commanders, Israeli prime minister Benjamin Netanyahu and Israeli minister of defence Yoav Gallant on suspicion of war crimes and crimes against humanity. Israeli and US lawmakers reacted with fury to the news with US secretary of state Anthony Blinken hinting he may support sanctions against the court.

- China conducted military drills around Taiwan including mock missile strikes following the inauguration of Taiwanese president Lai Ching-te.

Please click here to access the June Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary & Strategy

- North America is still leading in terms of returns year to date, but over the last 3 months, we have seen a reversal and the UK and Asia have been the best markets. These markets still look cheap on a historical basis.

- The Investment Committee believe that inflation will persist and whilst it is likely to dip below 2% in the next few months, the long-term average is expected to be around the 3% level due to wage inflation.

- A higher interest rate and higher inflation environment will become the new normal.

- Value stocks and undervalued markets are likely to be the key beneficiaries with a rotation to Asia, UK and Europe particularly.

- US large cap to underperform as Fed interest rate pivot disappoints.

- US consumer spending will come under pressure due to overindulgence and run down of Covid savings.

- Long-dated yields to rise leading to reduced capital values.

- Upward stock market momentum in 2024 may fade in 2025 as debt servicing headwinds emerge.

- Liquidity is the most significant driver of returns at present but there remains a downside risk to high PE stocks.

- It will take a full economic cycle for the inflationary effects of printing money after the global financial crisis and Covid to dissipate.

- There were no fund changes at this meeting.

Since December 2023, there has been a tilt towards evidence-based factor investing, which involves a disciplined approach backed up by significant amounts of Nobel Prize-winning economic research. Factor investing involves trusting the market but tilting the investment choice towards smaller companies, value companies (those trading at a discount) and profitable companies. The evidence shows that over the long-term, these types of investments outperform your typical index tracking and actively managed funds.

Clarion is primarily accessing these factor-based investments through Dimensional Fund Advisors (www.dimensional.com). Since inclusion, investment performance has been impressive, costs have decreased, and it is likely that we will look to introduce more factor-based funds into the portfolios as and when appropriate.

The Clarion funds are well positioned to take advantage of the latest economic conditions and over the last 12 months (to 25/06/2024):

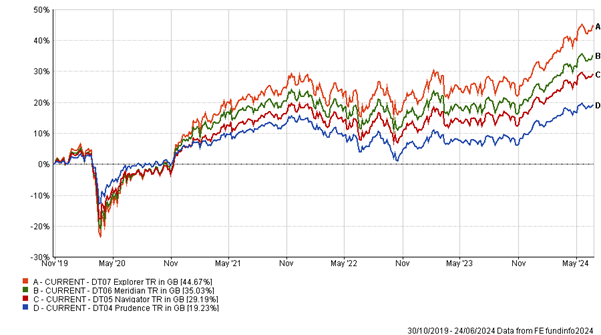

- Explorer has returned 14.77% against the RTMA Risk 5 Growth sector average of 14.71% and the IA Flexible sector average of 12.48%.

- Meridian has returned 13.91% against the RTMA Risk 5 Growth sector average of 14.71% and the IA Mixed Investment 40-85% Shares sector average of 12.64%.

- Navigator has returned 12.87% against the RTMA Risk 4 Balanced sector average of 12.29% and the IA Mixed Investment 40-85% Shares sector average of 12.64%.

- Prudence has returned 10.42% against the RTMA Risk 3 Moderate sector average of 10.24% and the IA Mixed Investment 20-60% Shares sector average of 9.90%.

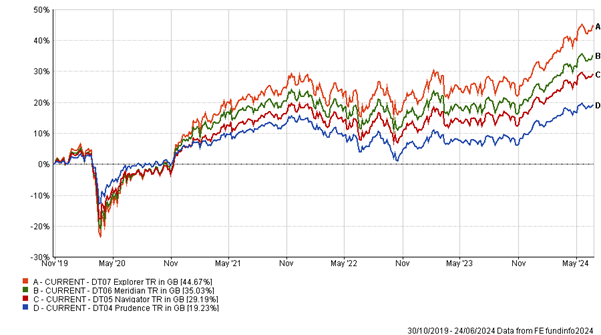

The performance of the CURRENT portfolios back tested over 5 years is shown in the chart below. This is assuming that we made the recent changes 5 years ago and then adopted the buy and hold approach favoured when using evidence-based factor investing.

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

June 2024

Creating better lives now and in the future for our clients, their families and those who are important to them.

Clarion Funds & Discretionary Portfolios:

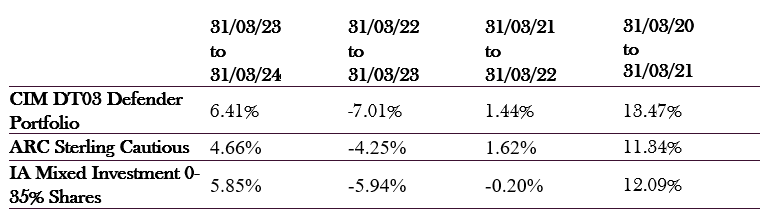

Defender Managed Portfolio

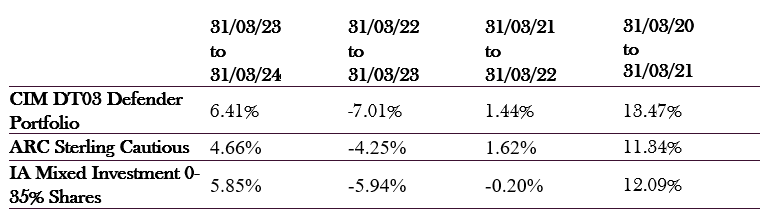

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Defender Portfolio

- There were no changes to the Defender Portfolio in June 2024.

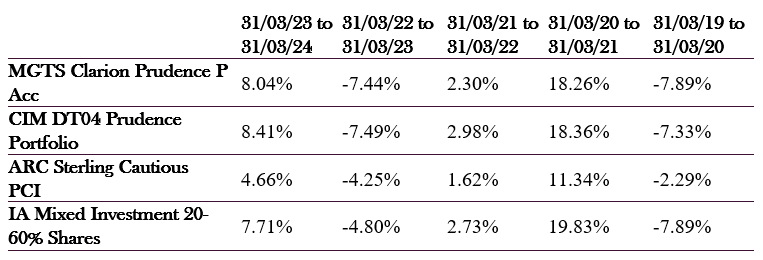

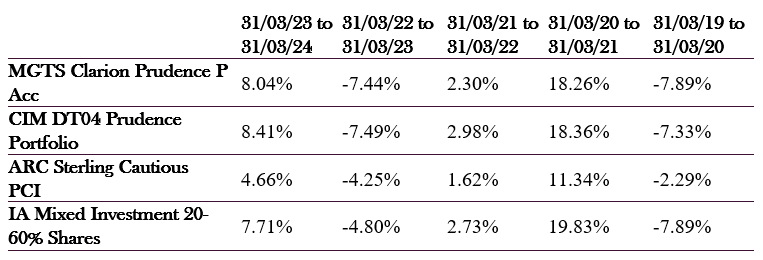

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Prudence Fund & Portfolio

- There were no changes to the Prudence fund or Portfolio in June 2024.

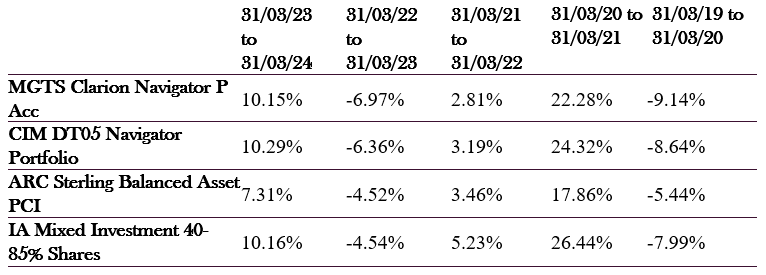

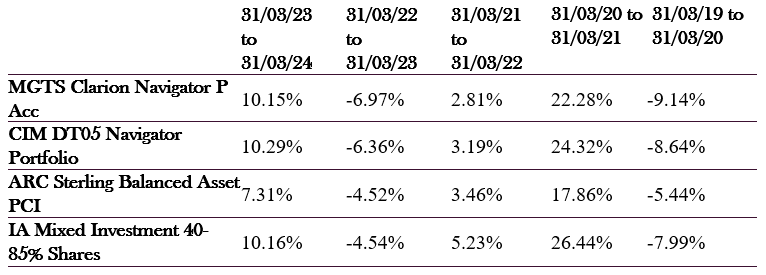

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Navigator Fund & Portfolio

- There were no changes to the Navigator fund or portfolio during June 2024.

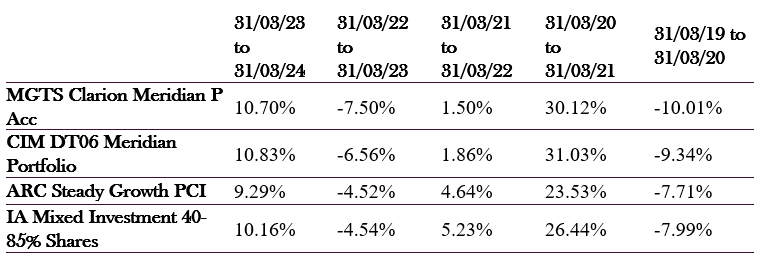

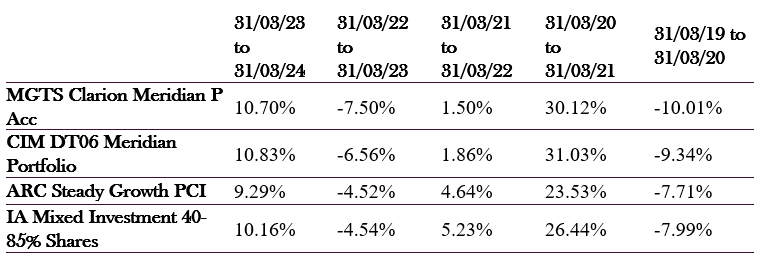

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Meridian Fund & Portfolio

- There were no changes to the Meridian fund or portfolio in June 2024.

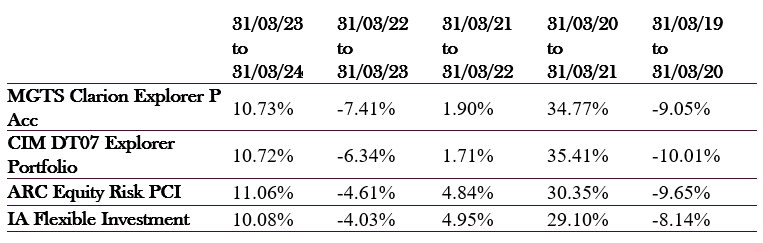

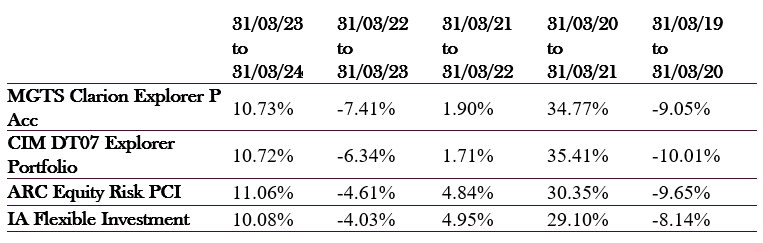

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Explorer Fund & Portfolio

- There were no changes to the Explorer fund or portfolio in June 2024.

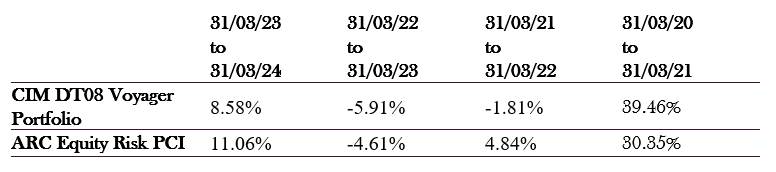

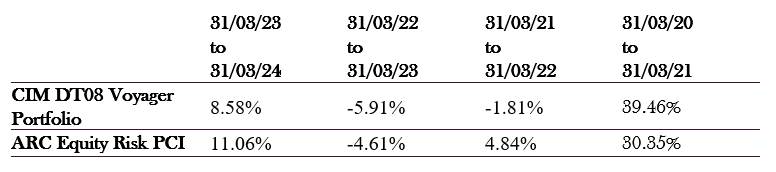

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Voyager Portfolio

- There were no changes to the Voyager portfolio in June 2024.

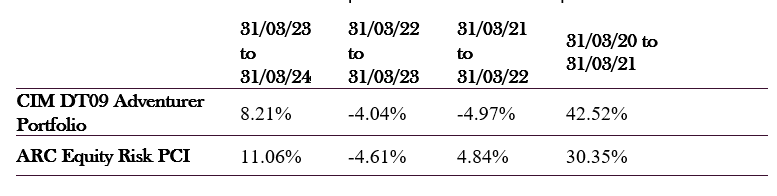

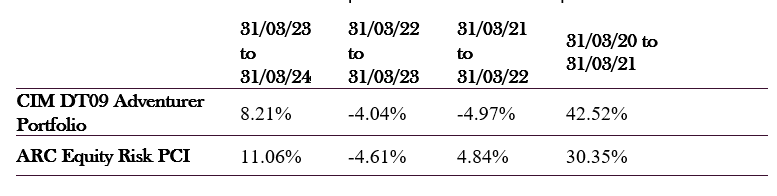

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Adventurer Portfolio

- There were no changes to the Adventurer portfolio in June 2024.

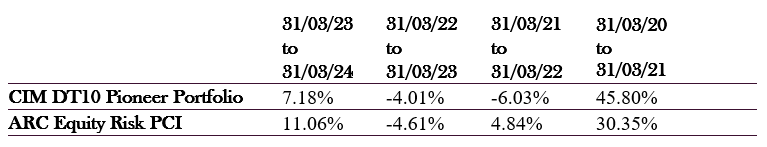

Pioneer Managed Portfolio

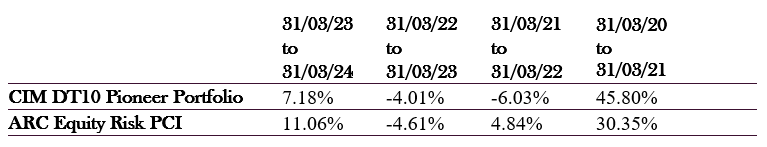

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Pioneer Portfolio

- There were no changes to the Adventurer portfolio in June 2024.

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.