Tags: Adventurer Portfolio, Defender Portfolio, Discretionary Investment Management, Explorer Portfolio, funds, investment, Meridian Portfolio, MGTS Clarion Explorer, MGTS Clarion Meridian, MGTS Clarion Prudence, MTGS Clarion Navigator, Navigator Portfolio, Pioneer Portfolio, Prudence Portfolio, Voyager Portfolio

Category:

Investment management

This article provides a brief overview of the topics discussed in the recent investment committee meeting (10th March 2022) and the decisions made following those discussions.

The following notes summarise the main points discussed by the Investment Committee.

Since the full-scale military attack on Ukraine, launched by Russia on Thursday 24th February, greater clarity has emerged regarding potential outcomes, future geopolitical considerations, and the likely impact on global stock markets.

The word ‘credit’ is widely believed to derive from the Latin word ‘credo’ meaning ‘I believe’ representing trusting the stated intentions of a third party. The invasion of Ukraine surprised the world, as it represented a betrayal of international agreements and, more importantly, the implicit principles of humanity established following the atrocities of the second world war.

The security of Ukraine was guaranteed in 1994 under the Budapest Memorandum by UK, USA and Russia in return for Ukraine surrendering its nuclear capabilities. As we witnessed a peaceful, democratic sovereign nation being invaded by a global superpower, our expectations for the future have changed significantly.

The betrayal was captured in the response of a Ukrainian politician who, when asked if they would be prepared to agree a peace deal with Russia responded, “No thank you, we already have one of those”. The Russian narrative that Ukraine’s pursuit of NATO membership as cause is not creditable and echoes the stereotypical abuser gaslighting the victim by saying “look what you made me do”. It is now apparent that Russia’s intentions go back some time and recent diplomatic overtures were insincere. It is difficult to see how trust can be re-established without fundamental change within the Russian approach and/or leadership.

During the early days of the invasion, the Russian military has encountered far more resistance than was expected and suffered heavy losses. The rush to arms from civilians means that, despite the involvement of nearly 200,000 Russian troops, they are effectively outnumbered in close combat and the home advantage is with the Ukrainians. Russian troops are also de-motivated by a war they do not understand or widely support.

The Russian military has re-appraised tactics and switched to shelling from a distance. This will slowly reduce the Ukrainian resistance and lead to huge civilian losses and damage to civilian infrastructure. Russia is now ruthlessly pursuing the objective of controlling Ukraine and humiliating itself on the global stage as the world watches. Although these brutal tactics will probably prevail militarily, it is already a strategic defeat.

The West misjudged the risk to Ukraine and events have lurched to the edge of World War III very quickly. The sense of ‘waking-up’ in Europe is palpable, with Germany immediately reversing years of policy to boost defence spending and allowing weapons to be provided into Ukraine. Switzerland has broken with years of neutrality to impose sanctions, and post-Brexit ‘red-lines’ suddenly seem irrelevant.

Priorities have changed; in the first instance, the West must tread carefully to prevent escalation of the current conflict. Sadly, for the Ukrainians, this means there is little help coming their way beyond basic military equipment and humanitarian donations. NATO cannot risk direct military combat with Russia. Instead, the West will rapidly re-group for a much longer-term economic war with Russia, which we will describe as Cold War II, and has already begun with a series of punishing sanctions.

The Iron Curtain will be re-drawn, with Russia isolated from, and not trusted by, the West, with few willing to extend “credit”. The West, re-unified by a common threat, will double down on military spending to defend against Russia and renewable energy to reduce reliance on key exports of oil and gas. The prospects for the Russian economy are bleak; the currency has already devalued by over 40% and the stock market has not traded since the invasion.

The economic repercussions are significant, and lessons can be drawn from the first Cold War, which began in 1945 and ended in 1990. This was a period of rising inflation and interest rates, as central banks were torn between economic support and inflation reduction, leaning towards the economy and allowing inflation to run “hot”.

Inflationary pressures have already been pushing higher as the global economy exited Covid-19 restrictions. Many of the factors were considered temporary but this has now changed as the effects of sanctions imposed on Russia will increase energy and commodity prices over the long term. The medium-term view compounds this further as Cold War II is expected to cause de-globalisation, with manufacturing supply chains becoming more Western but more expensive.

While global trade decreases, NATO members and close allies will bring their trade ever closer together. Recent trade agreement issues should resolve quickly as a new mood of co-operation takes hold.

The future direction of China will be important as they have close links with Russia whilst also benefitting from trade with the West. As Russia has become marginalised by global sanctions in a matter of days, there is increased emphasis on their relationship with China. There have been signs that China is concerned about Russian aggression, but they have not condemned Russia’s actions.

China will need to find a delicate balance between Russia and the West to maintain a good relationship with both sides. This could prove tricky, with recent events likely to increase suspicion of communist superpowers.

The de-coupling of Russia from the global economy will be painful and only partly off-set by the gains of closer trade and co-operation in the West. Fortunately, Russian influence has been reducing in recent years due to the sanctions in place following the annexation of Crimea in 2014, limiting the impact. Nevertheless, the short-term outlook is stagnating economic growth and inflation, referred to as stagflation.

Within an inflationary environment, cash may be attractive during short term market volatility but, overall, the inflationary effects are counterproductive, rendering cash a generally poor asset class. Quality equities are preferred due to their long-term inflation protection and, although economic growth may be near zero in real terms, equities are more sensitive to nominal economic growth, which is expected to remain positive. Although it may feel counterintuitive, carefully chosen equities and risk assets are likely to retain growth and purchasing power, especially when considering normal investment time horizons, although the year-on-year high positive returns of the past decade are not expected to be repeated.

Recent developments represent a turning point where future expectations have materially changed. Much as the banking crisis followed a period of complacency, where banks were considered “safe”, current events reveal a similar complacency towards global security. In the wake of the banking crisis, the role and regulation of banks was carefully rebuilt, taking a decade to fully implement. Similarly, NATO and European security will be carefully considered and restructured so that Europe can feel secure once more.

At this stage, it is not possible to determine whether this will be a short or long-term conflict. Having denied any intension to invade Ukraine consistently during the build-up, the Russian military objectives are still not clear, but are likely to focus on regime change to bring Ukraine back within the control and influence of Russia, as existed during the Soviet Union era. The time scale for this outcome will depend on Ukrainian resistance, which is reported to be stronger than expected. As Ukraine is being provided with defensive weapons by Western allies, they could “dig in” or a bitter and lengthy battle, especially as the Ukraine people appear motivated to fight for their freedoms.

Recent events have unified NATO members to create a spirit of co-operation which had been absent for some time. Germany, long criticised by Donald Trump for failing to spend the agreed 2% of GDP on defence, announced recently that defence spending would jump immediately to this level. China, a key supporter of Russia, showed some signs of standing back from their relationship during the United Nations security committee meeting. The meeting was aimed at condemning the invasion of Ukraine and, whilst Russia vetoed the vote as a permanent member, China abstained rather than support the invasion. The Chinese Foreign Minister Wang Yi went further stating, “China firmly advocates respecting and safeguarding the sovereignty and territorial integrity of all countries”.

From a strategic perspective, we are not looking to raise cash with the expectation of repurchasing at lower prices. Cash is providing little return, and with heightened inflation risk, cash is an unattractive asset unless other asset prices are falling. A resolution to current events is skewed to a shorter time scale due to the unexpectedly strong global response and isolation of Russia, which will become extremely uncomfortable. Any resolve would lead to a rapid recovery of any market falls, leaving cash holdings out of the market and subject to the effects of inflation or having to pay a premium to re-enter global stock markets.

The Clarion portfolios have good exposure to the “value’ stocks”, such as those in the energy, financials and industrials sectors, which have consistent earnings but lower growth prospects than stocks such as those in the technology sector. This strategy has provided some protection against recent market falls as value stocks tend to be more predictable during periods of market uncertainty. For the time being, we intend to remain invested in accordance with the current strategy and accept the short-term heightened levels of market volatility. Any significant move to safer assets could be ill timed and safe assets, such as bonds, continue to be elevated in the wake of the recent pandemic and not offering sufficient protection against rising interest rates.

Bonds remain deeply unattractive due to low yield on offer, the likelihood of real terms loss if held to maturity and the impending step back from the market by central banks, which will remove buying pressure from some of the largest holders. Short-dated and tactical bond funds are preferred by the investment committee as they are more likely to outperform in a rising yield environment.

UK equities continue to trade at a wide discount relative to peer developed equities on a long-term historical basis. The yield on FTSE 100 is close to 4%, which is attractive in an inflationary environment, and remains far ahead of UK government bond yields. Many companies in the FTSE are likely to benefit from an inflationary environment due to predictable cashflows and their ability to pass on costs to consumers. The managers favour an overweight position across the Clarion Portfolio Funds and model portfolios as a result.

US equities are at most risk from investors reconsidering long-duration assets. With the changing financial conditions and the expectation that central banks will raise interest rates to combat inflation (despite the scenario in Ukraine to be factored in), equities priced on cashflows generated years into the future will suffer as investors factor in the risk of missing earnings targets. The investment committee retain an underweight position to US equities on this basis.

For a fuller version of Clarion’s Economic and Stock Market Commentary, written by Clarion Group Chairman Keith Thompson, please click here.

The charts below show the tactical asset allocation of the Defender Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | |

| CIM DT03 Defender Portfolio | 3.26% |

| ARC Sterling Cautious PCI | 4.09% |

| IA Mixed Investment 0-35% Shares | 2.52% |

Changes to the Defender model

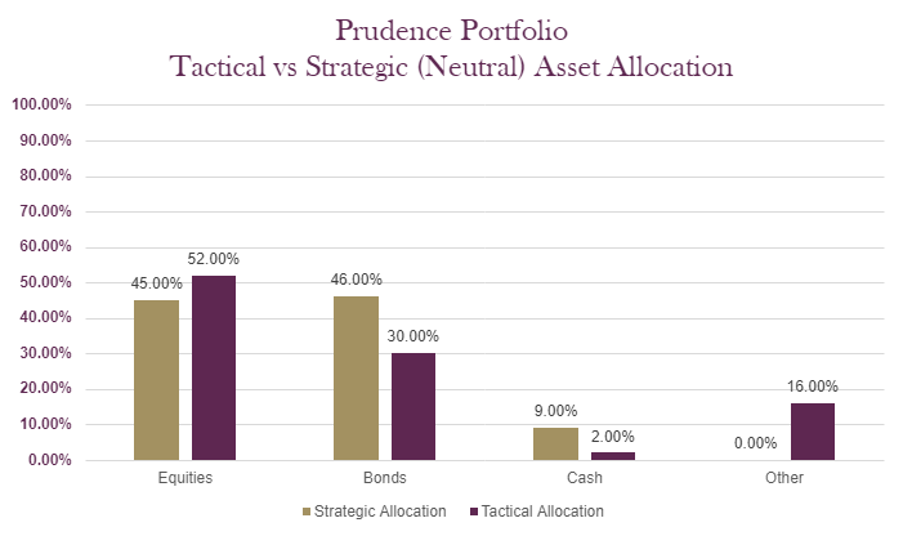

The charts below show the tactical asset allocation of the Prudence Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark(s) since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | 31/12/19 to 31/12/20 | 31/12/18 to 31/12/19 | 31/12/17 to 31/12/18 | 31/12/16 to 31/12/17 | |

| MGTS Clarion Prudence X Acc | 5.52% | 2.08% | 12.50% | -5.90% | 5.59% |

| CIM DT04 Prudence Portfolio | 6.08% | 2.90% | 11.52% | -5.74% | |

| ARC Sterling Cautious PCI | 4.09% | 4.20% | 8.05% | -3.63% | 4.48% |

| IA Mixed Investment 20-60% Shares | 6.58% | 2.85% | 11.25% | -5.68% | 6.48% |

Changes to the Prudence fund & model

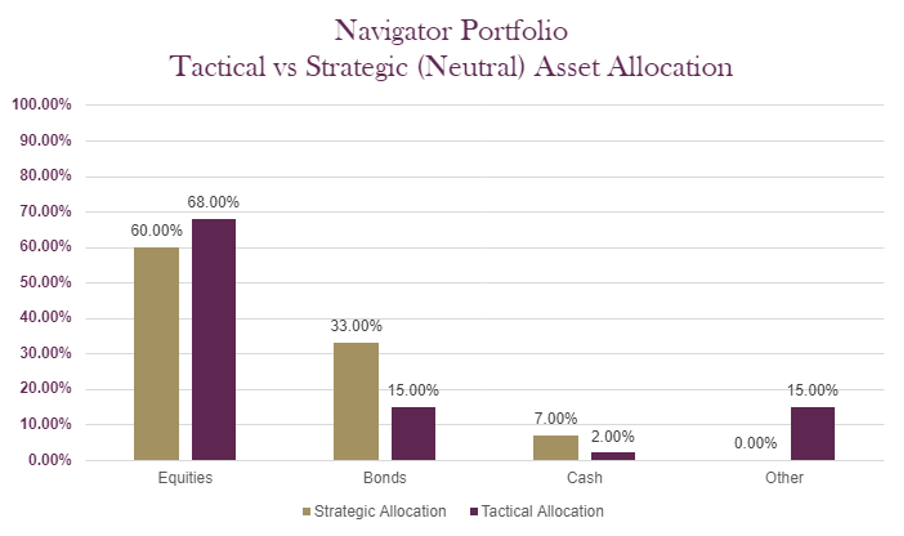

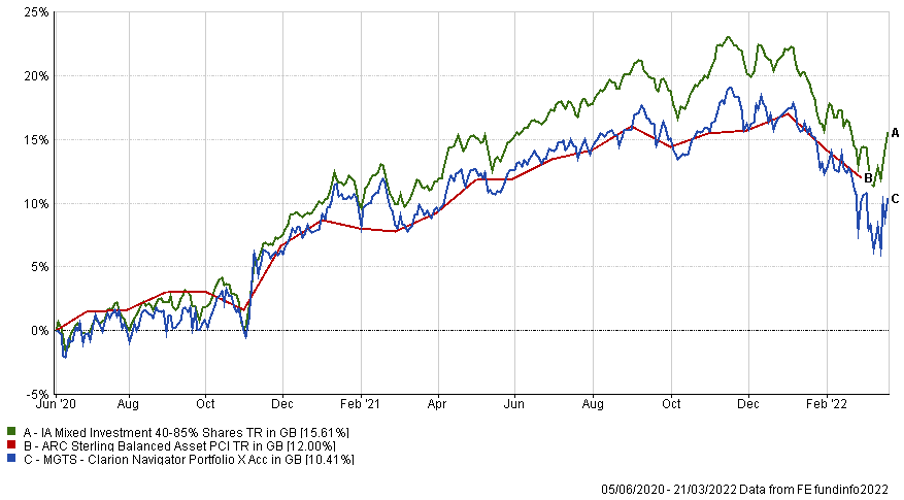

The charts below show the tactical asset allocation of the Navigator Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark(s) since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | |

| MGTS Clarion Navigator X Acc | 7.49% |

| CIM DT05 Navigator Portfolio | 7.97% |

| IA Mixed Investment 40-85% Shares | 10.67% |

ARC Sterling Balanced Asset PCI 7.90%

Changes to the Navigator fund & model

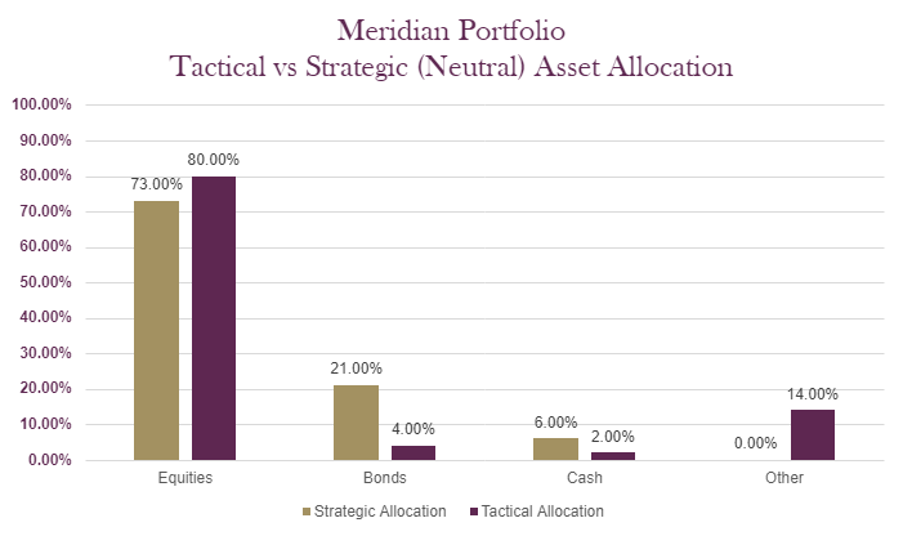

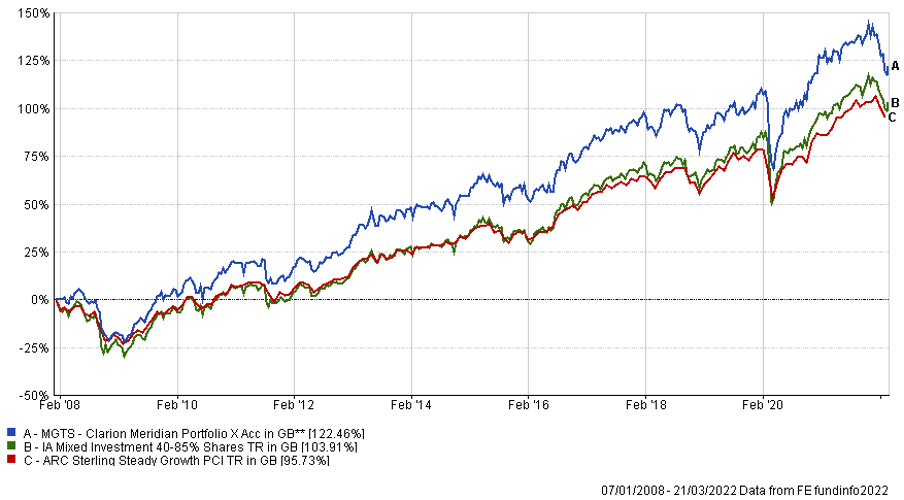

The charts below show the tactical asset allocation of the Meridian Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark(s) since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | 31/12/19 to 31/12/20 | 31/12/18 to 31/12/19 | 31/12/17 to 31/12/18 | 31/12/16 to 31/12/17 | |

| MGTS Clarion Meridian X Acc | 8.14% | 6.09% | 15.51% | -7.84% | 9.82% |

| CIM DT06 Meridian Portfolio | 8.88% | 7.34% | 15.51% | -7.05% | |

| ARC Steady Growth PCI | 10.76% | 4.56% | 15.00% | -5.64% | 9.40% |

| IA Mixed Investment 40-85% Shares | 10.67% | 5.00% | 15.29% | -6.46% | 9.58% |

Changes to the Meridian fund & model

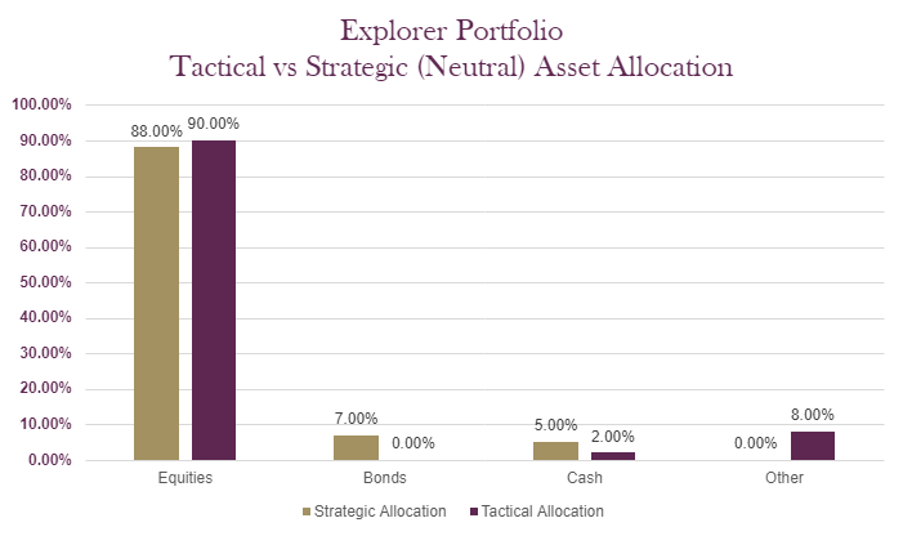

The charts below show the tactical asset allocation of the Explorer Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark(s) since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | 31/12/19 to 31/12/20 | 31/12/18 to 31/12/19 | 31/12/17 to 31/12/18 | 31/12/16 to 31/12/17 | |

| MGTS Clarion Explorer X Acc | 8.80% | 9.05% | 16.94% | -6.41% | 16.48% |

| CIM DT07 Explorer Portfolio | 9.69% | 9.74% | 16.16% | -5.66% | |

| ARC Equity Risk PCI | 13.32% | 5.82% | 18.04% | -6.50% | 11.39% |

| IA Flexible Investment | 11.06% | 6.45% | 15.26% | -6.91% | 11.02% |

Changes to the Explorer fund & model

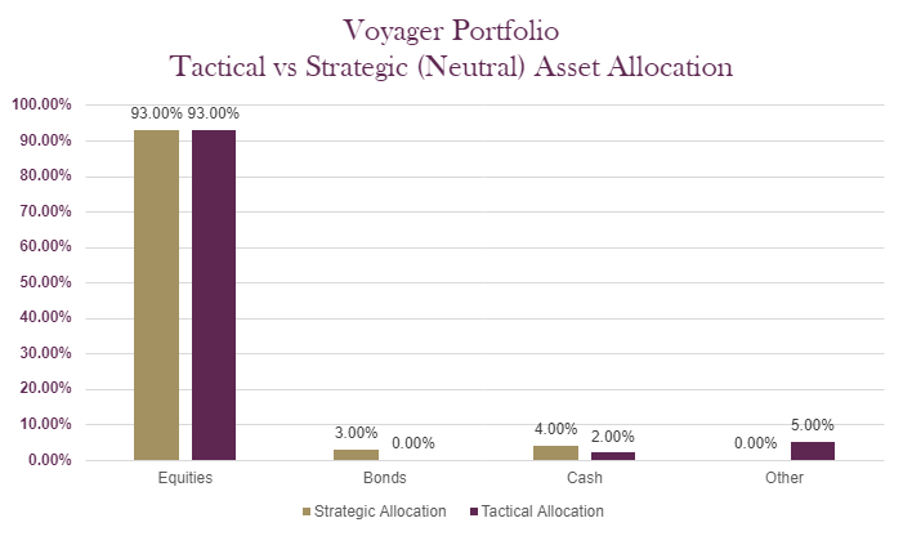

The charts below show the tactical asset allocation of the Voyager Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark(s) since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | |||||

| CIM DT08 Voyager Portfolio | 7.64% | ||||

| ARC Equity Risk PCI | 13.32% |

Changes to the Voyager fund & model

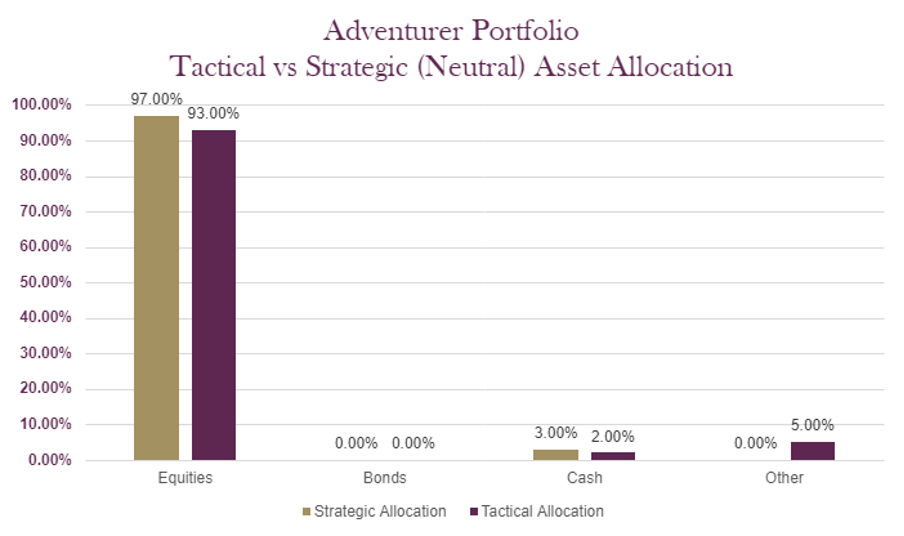

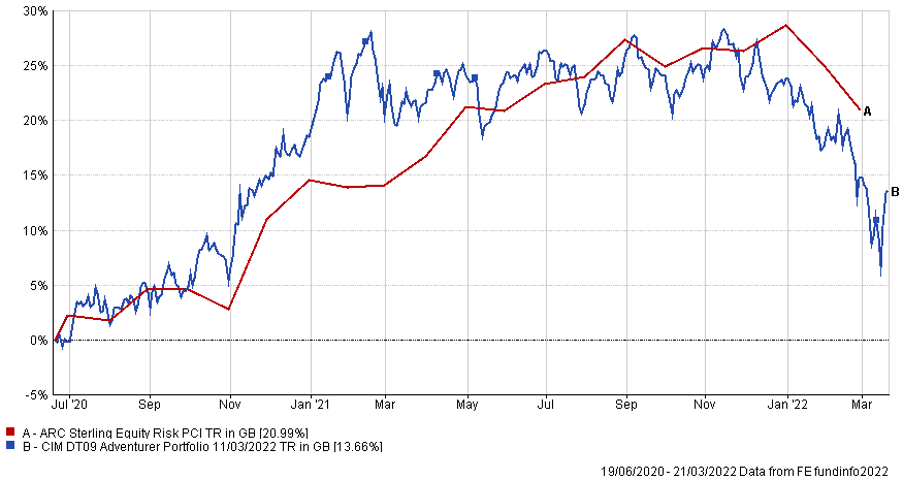

The charts below show the tactical asset allocation of the Adventurer Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark(s) since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | |||||

| CIM DT09 Adventurer Portfolio | 4.41% | ||||

| ARC Equity Risk PCI | 13.32% |

Changes to the Adventurer model

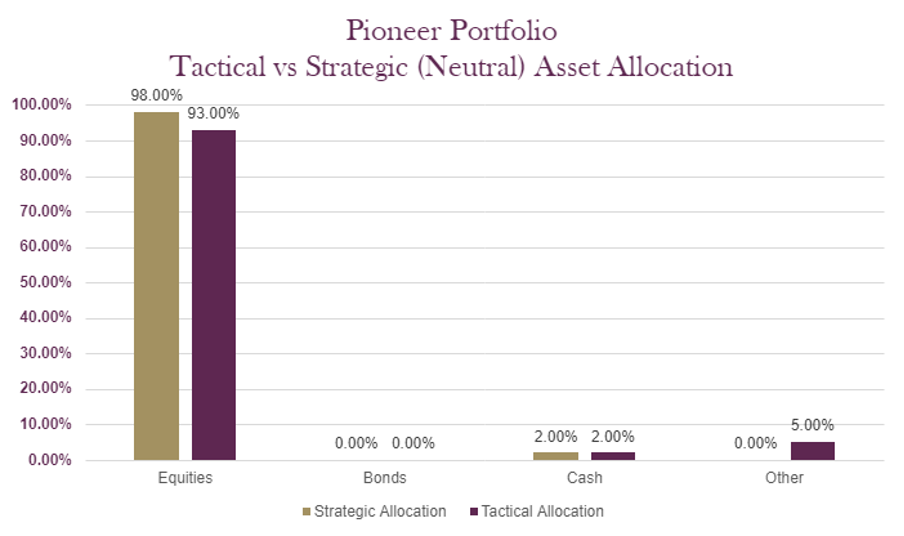

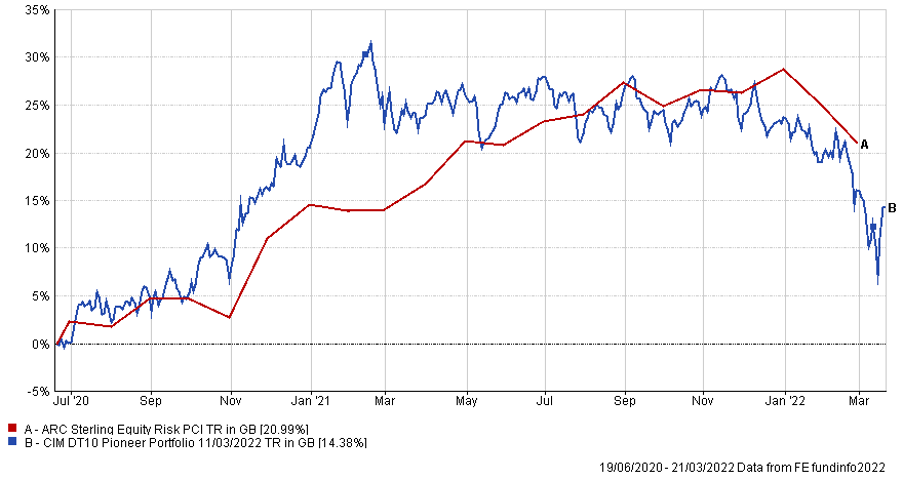

The charts below show the tactical asset allocation of the Pioneer Portfolio against the neutral/strategic asset allocation as well as the historical performance of the portfolio against a relevant benchmark(s) since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/12/20 to 31/12/21 | |||||

| CIM DT10 Pioneer Portfolio | 2.66% | ||||

| ARC Equity Risk PCI | 13.32% |

Changes to the Pioneer model

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.