The Clarion Investment Committee met on 21 March 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Economics

- UK business activity expanded in March as the manufacturing outlook improved and the services sector showed good growth, pointing to an end to the recession.

- UK retail sales beat expectations in February as the quantity of goods bought was unchanged from the previous month.

- UK inflation fell more than expected to 3.4% in February, increasing the chances of interest rate cuts in the summer.

- Bank of England governor, Andrew Bailey said that interest rate cuts are “in play” and that he is increasingly confident that inflation is heading towards target.

- The UK government borrowed more than forecasted in February, highlighting the fragility of the public finances ahead of the general election.

- The US Fed kept interest rates unchanged at 5.5% but indicated that it expects to cut rates by 75 basis points by the end of the year.

- Investors have flooded the US corporate bond market this year as they seek to lock in higher yields ahead of expected interest rates cuts expected this year.

- The price of gold climbed to a record $2,222 per troy ounce.

- US home builder sentiment unexpectedly rose in March to the highest level in eight months.

- The Ifo index of German business confidence rose at a faster than expected rate in March.

- Investors are more positive on the German economy as a result of falling inflation and potential interest rate cuts, according to the ZEW Institute.

- Euro area economic activity picked up in March but remained in contractionary territory, according to S&P Global’s flash composite purchasing managers’ index.

- The Euro area’s monthly trade surplus rose to a record high of €28bn in January as the price of energy imports fell, and exports increased.

- The Bank of Japan raised interest rates for the first time since 2007, from -0.1% to 0%, ending almost a decade of negative nominal interest rates as deflationary worries faded.

- The Swiss National Bank unexpectedly cut interest rates by 25 basis points to 1.5%, as inflation fell to 1.2% in February.

- Saudi Aramco’s CEO Amin Nasser said the world should “abandon the fantasy of phasing out oil and gas” and new energy sources should be phased in when they become “economically competitive.”

- Foreign investment into China fell 20% in the first two months of 2024 on a year earlier.

Business

- Nationwide Building Society agreed to purchase Virgin Money for £2.9bn as it is set to become the second-largest provider of mortgages and savings accounts in the UK.

- French luxury group Kering issued a profit warning as sales for Gucci are expected to fall by 20% chiefly due to weak demand in the Asia-Pacific markets.

- Chipmaker Nvidia revealed a “superchip,” aimed to meet the growing demand for more powerful hardware driven by the recent boom in AI technology.

- The US government relaxed rules for carmakers, demanding cuts to emissions to start three years later in 2030.

- Shares in social media company Reddit leapt by almost half on its market debut, in an encouraging sign for companies looking to go public.

- The UK Competition and Markets Authority is planning a probe into the £16.5bn merger between Vodafone and Three due to weaker competition concerns.

- Unilever announced plans to split off its ice cream business and extend its productivity programme, which hopes to deliver €800m of savings.

- UK pub group JD Wetherspoon posted an eightfold increase in profits to £36m, as customers returned to its pubs after the pandemic despite cost-of-living pressures.

- Borse Dubai sold 30% of its stake in the US exchange operator Nasdaq, leaving the Middle Eastern exchange with a 10.8% stake, making it Nasdaq’s second-largest investor.

Global and political developments

- Republican US presidential candidate Donald Trump softened his stance on NATO and said that the US would “100%” defend allies if member nations pay “their fair share”.

- Israel prime minister Benjamin Netanyahureaffirmed the country’s plans for a Rafah ground invasion, despite opposition from the US.

- Russia and China vetoed a US resolution calling for “an immediate and sustained ceasefire” as part of a deal to release hostages held by Hamas.

- Germany and France have reached a ‘breakthrough’ on plans for a joint tank in a clear sign of convergence over European defence policy and arms for Ukraine.

- Germany’s attorney general charged a German military officer with spying for Russian intelligence services.

- Germany announced a new €500m military aid package to Ukraine including 10,000 rounds of ammunition aimed at relieving Kyiv’s dire shortage.

- Vladimir Putin won the Russian presidential election after most opposition candidates were blocked from running.

- Russia is producing three times as many artillery shells as the US and Europe combined, CNN reports. The Institute for the Study of War warned that the ammunition shortage was making Ukraine’s front line increasingly fragile.

Please click here to access the March Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary

The UK’s economic landscape is marked by several significant developments in the last few weeks.

Interest rates, set by the Bank of England, have been a focal point of economic discussions, with recent trends indicating a cut being priced in the second half of 2024. Speculation around interest rate cuts stems from current economic conditions, with an eye towards stimulating growth within the UK amidst global uncertainties.

The Bank of England’s decisions in this area are critical as they impact borrowing costs, consumer spending, and overall economic momentum.

One of the major concerns has been the rising level of personal debt among UK citizens. A record number of individuals are reported to be in debt, highlighting the growing financial stress on households. This increase in debt levels can have far-reaching implications for economic stability, influencing consumer confidence and spending patterns.

The economic growth figures offer a glimmer of hope, with the UK GDP showing signs of expansion. This growth is a positive indicator amidst the challenges of managing public finances and addressing the debt levels. It suggests resilience in the economy, driven by various sectors’ performance, and provides a basis for cautious optimism about the future economic trajectory.

Another dimension of the economic discussion is the valuation of equities in the financial markets, particularly in North America.

There is a shift in investment strategies among fund managers, moving from larger companies, perceived as overvalued, to smaller companies with potential for growth. This reflects broader market sentiments and strategies to navigate current valuations and seek investment opportunities.

In conclusion, the UK’s economic outlook is shaped by a complex interplay of interest rates, debt levels, economic growth, and investment strategies.

The Bank of England’s policies on interest rates are particularly pivotal in this context, as they influence various economic activities and confidence levels. The challenge lies in balancing the need for economic stimulation with the management of public and personal debt, ensuring sustainable growth in the face of global economic uncertainties.

Strategy

The tactical position remains unchanged from recent weeks, aiming for market-neutral fixed income duration. Given the evolving sentiment, fixed income asset duration continues to be under review.

There is a continued tactical underweight stance towards North American equities, influenced by the belief that larger S&P 500 companies are overvalued. This viewpoint is bolstered by the shift in market favour from the “Magnificent Seven” to the “Fabulous Four” – with Apple, Google, and Tesla becoming somewhat less favoured compared to Nvidia, Microsoft, Amazon, and Meta.

To leverage this perceived disparity in valuation, the investment committee have tweaked the US equity exposure in favour of smaller companies concentrating on quality and profitability.

The tactical overweight to the UK and Asia Pacific, including China, is maintained due to valuation multiples in these regions being below their long-term average price to earnings ratios (P/Es). This strategy mirrors the rationale behind the underweight to North American equities.

The key themes can be summarised below as:

- In the fixed income space, we hold a well-diversified mix of government bond, corporate bond and index linked funds with a medium-term duration to mitigate risk in case interest rates do not fall as expected.

- Yields on Investment Grade Corporate bonds have become more attractive and consequently we favour an allocation to Global Fixed Income.

- We are underweight US large cap and technology stocks due to high valuations and favour mid to small cap stocks as part of the overall US weighting.

- Due to their greater economic resilience, Asia Pacific as well as emerging market equities are favoured for the higher risk benchmarks.

- In recent months, the investment committee have been carefully analysing the performance and risk reward statistics of the Dimensional funds. These funds can best be described as index-tracking funds with an active management overlay with three predominant themes favouring smaller companies, profitable quality companies and value stocks. Investment performance has been impressive, and costs are low, and it is likely that we will continue to introduce more Dimensional Funds into the portfolios as and when appropriate.

- At this month’s meeting we replaced Artemis US Smaller Companies with Dimensional US Smaller Companies. The Artemis fund has performed well with a 30% rise in recent months, but the Dimensional Fund is less volatile and has a better longer term track record and a much lower fund management fee. We felt it was appropriate to bank the recent uptick and consolidate into the Dimensional Fund.

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

March 2024

Creating better lives now and in the future for our clients, their families and those who are important to them.

Clarion Funds & Discretionary Portfolios:

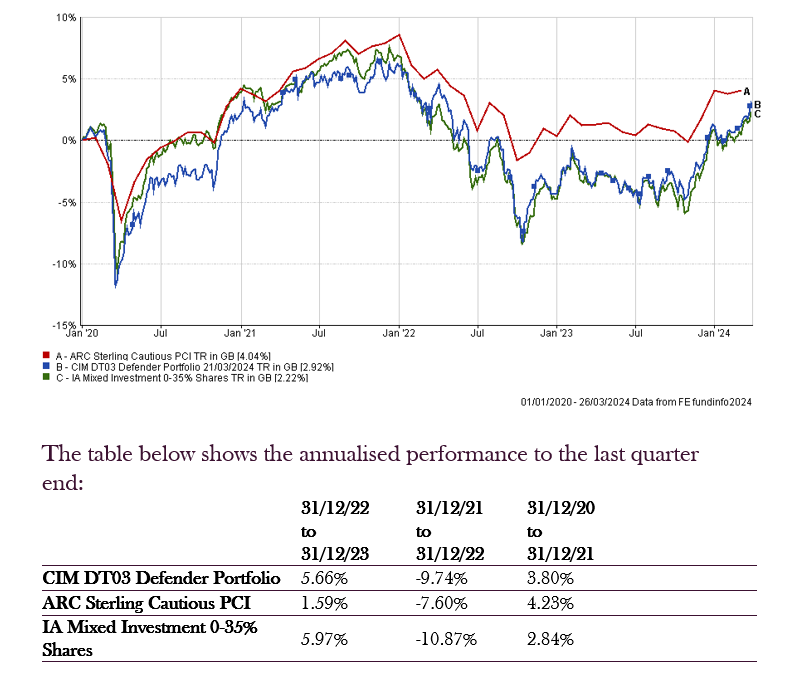

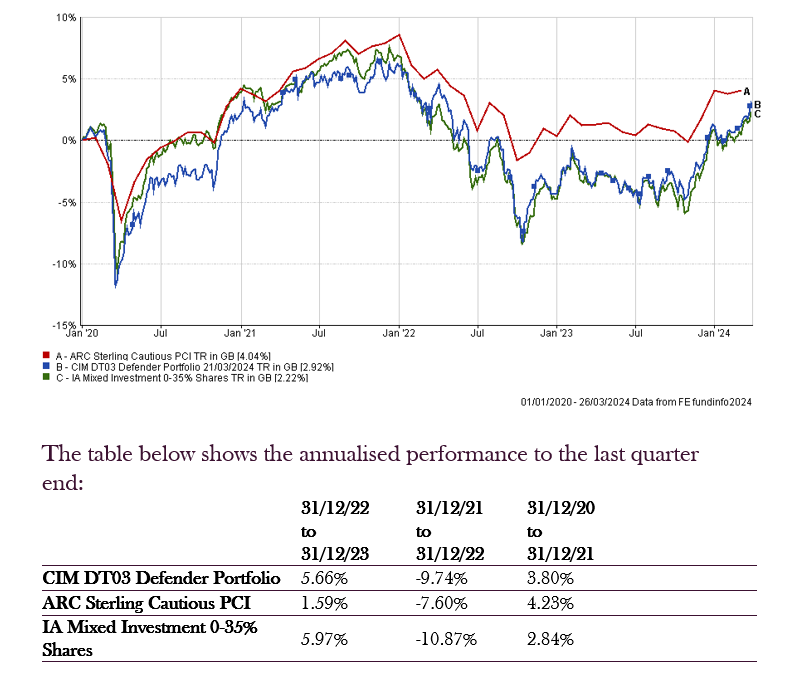

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

Changes to the Defender Portfolio

- The Artemis US Smaller Companies I Acc fund was removed from the portfolio (2.50% to 0.00%)

- The Dimensional U.S. Small Companies Acc fund was added to the portfolio (0.00% to 2.50%)

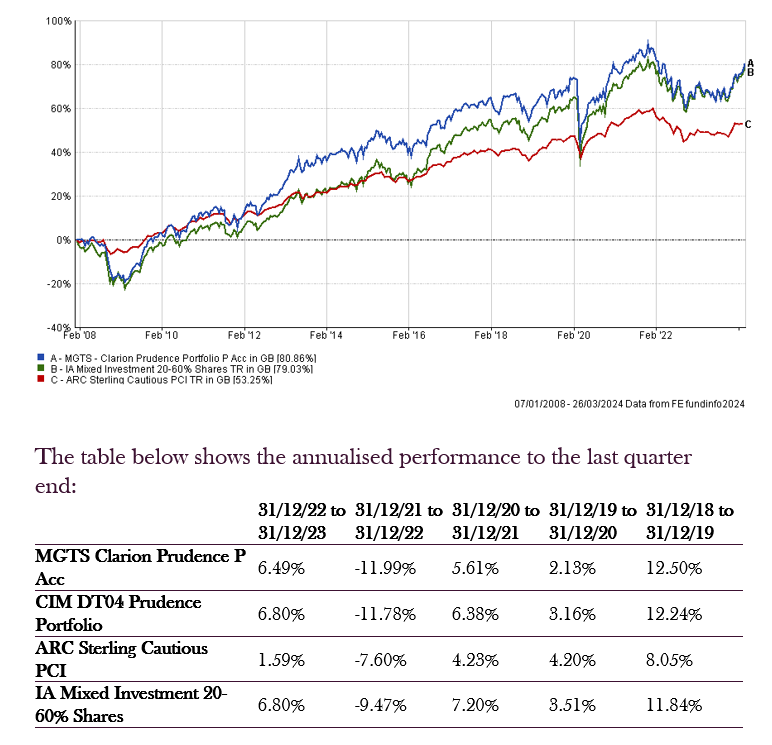

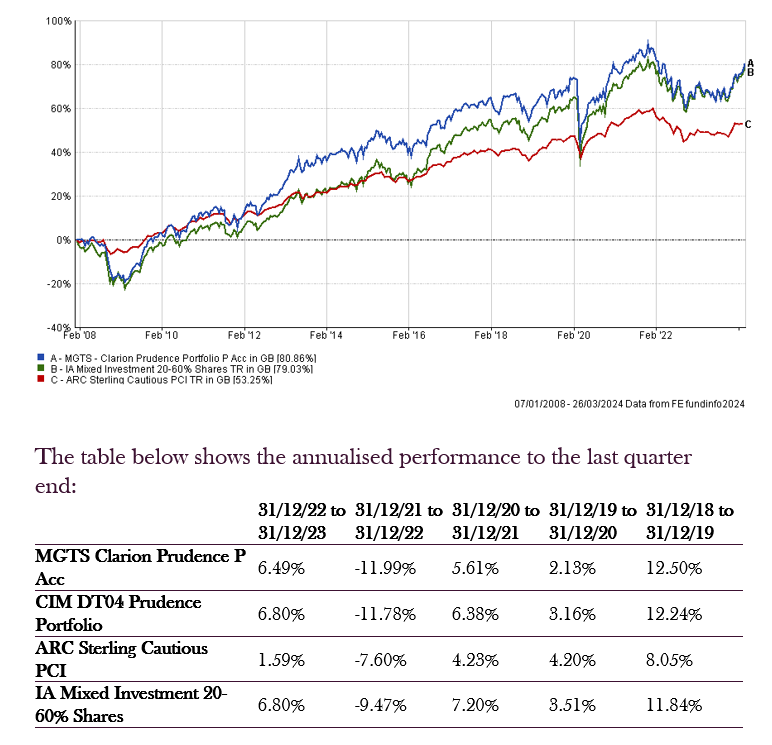

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund & Portfolio

- The Artemis US Smaller Companies I Acc fund was removed from the portfolio (3.75% to 0.00%)

- The Dimensional U.S. Small Companies Acc fund was added to the portfolio (0.00% to 3.75%)

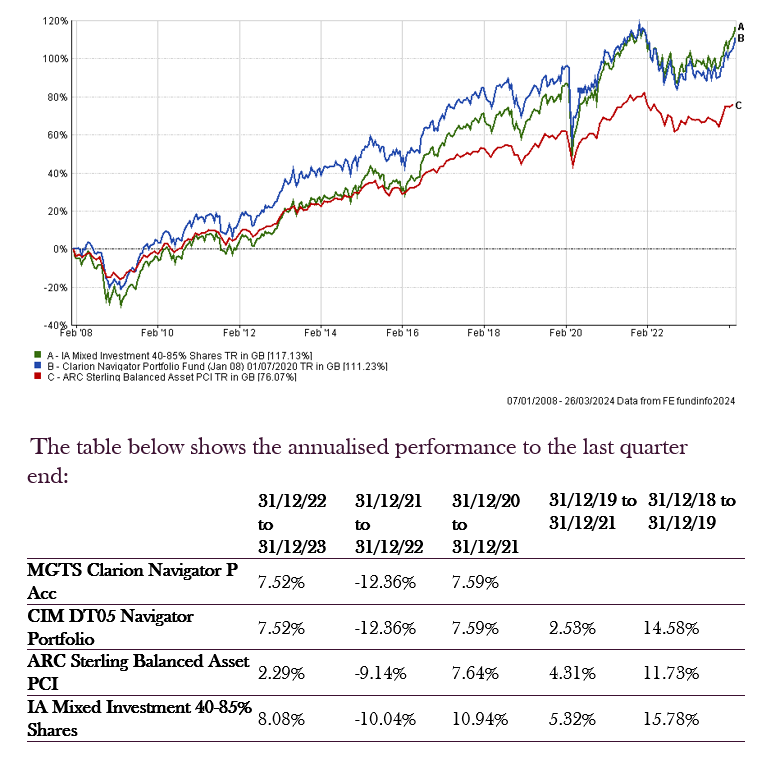

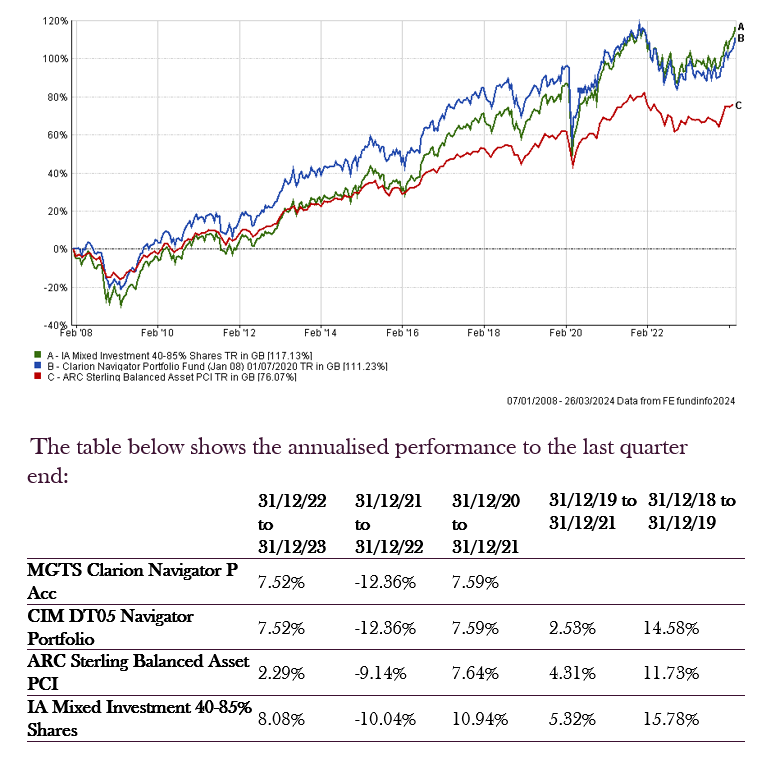

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

- The Artemis US Smaller Companies I Acc fund was removed from the portfolio (5.50% to 0.00%)

- The Dimensional U.S. Small Companies Acc fund was added to the portfolio (0.00% to 5.50%)

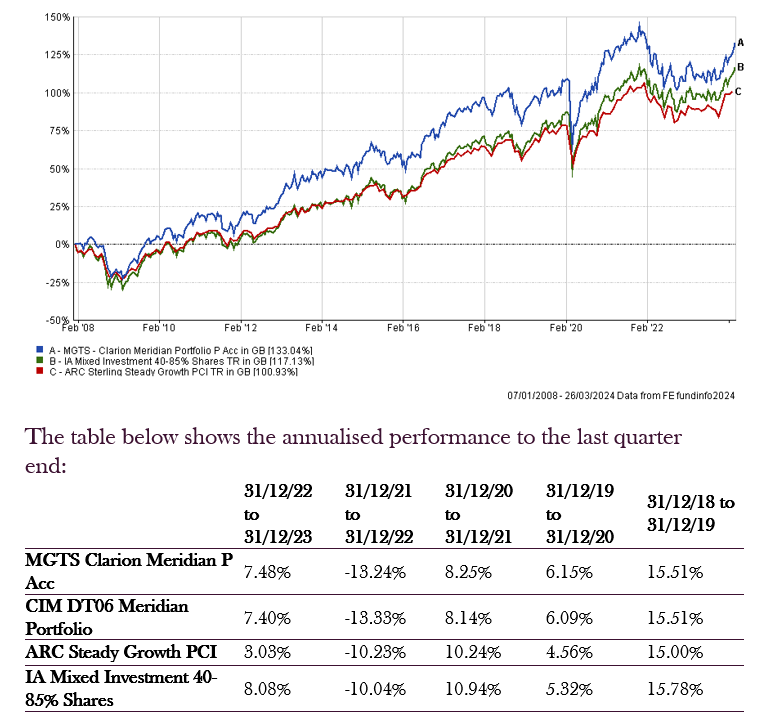

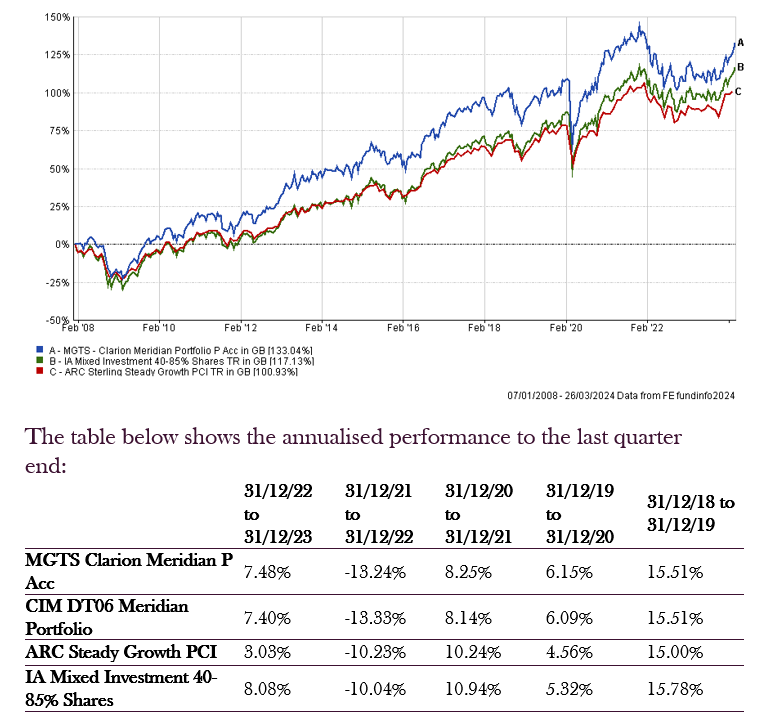

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

- The Artemis US Smaller Companies I Acc fund was removed from the portfolio (5.50% to 0.00%)

- The Dimensional U.S. Small Companies Acc fund was added to the portfolio (0.00% to 5.50%)

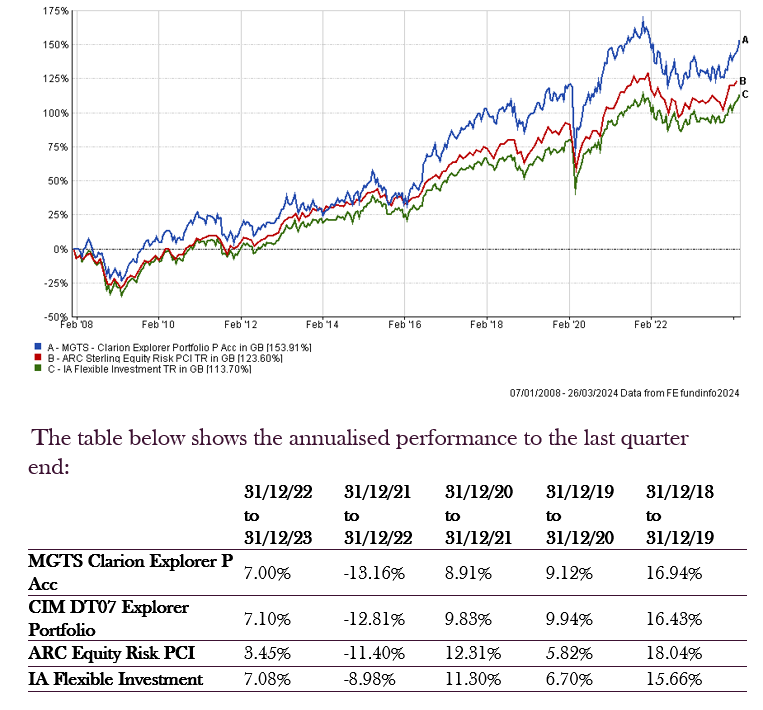

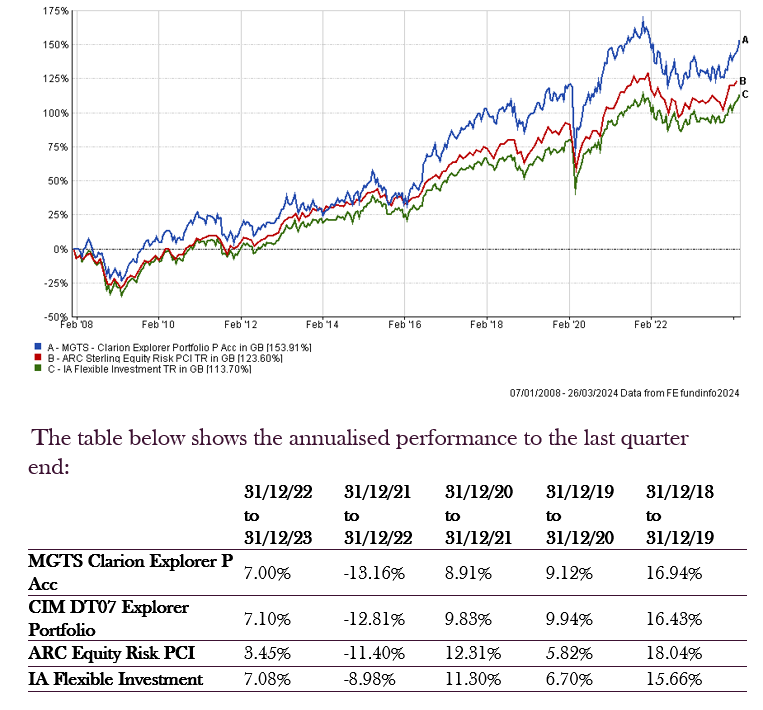

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

- The Artemis US Smaller Companies I Acc fund was removed from the portfolio (6.25% to 0.00%)

- The Dimensional U.S. Small Companies Acc fund was added to the portfolio (0.00% to 6.25%)

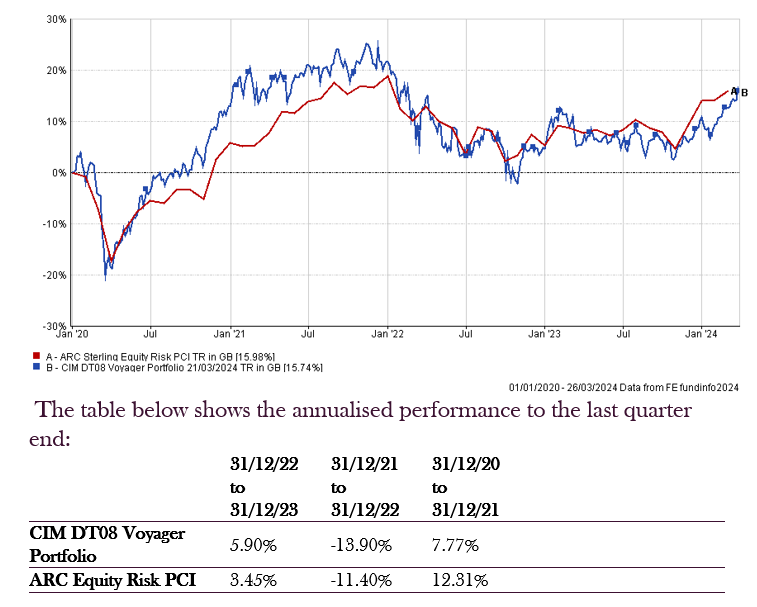

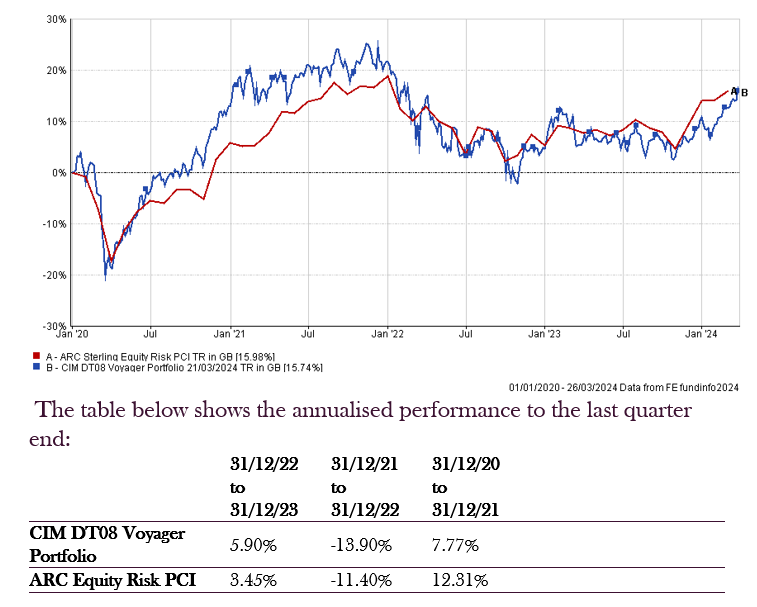

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

Changes to the Voyager Portfolio

- The Artemis US Smaller Companies I Acc fund was removed from the portfolio (3.00% to 0.00%)

- The Dimensional U.S. Small Companies Acc fund was added to the portfolio (0.00% to 3.00%)

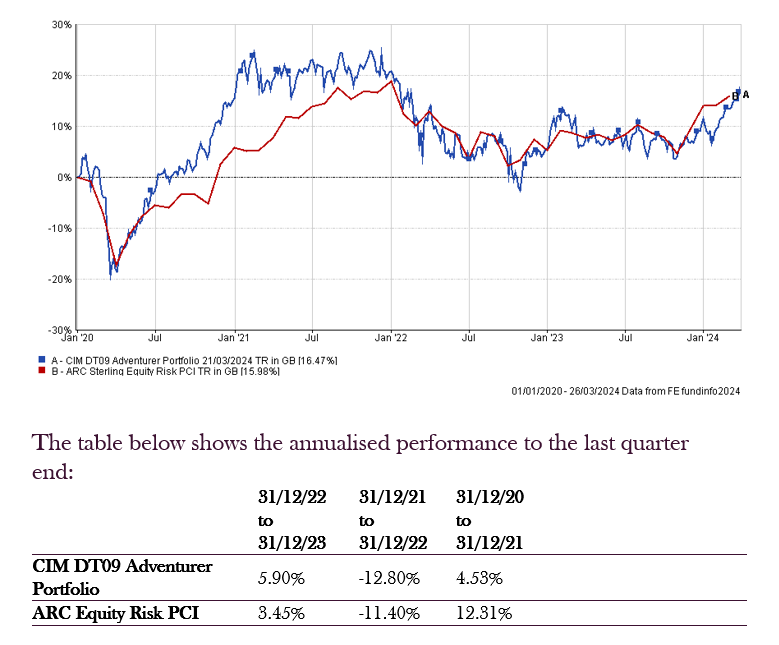

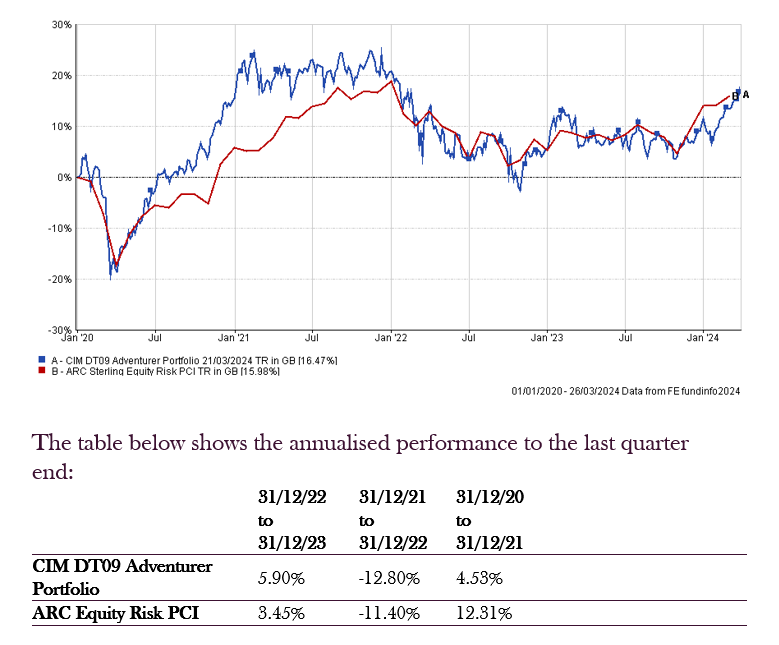

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Adventurer Portfolio

- The Artemis US Smaller Companies I Acc fund was removed from the portfolio (2.00% to 0.00%)

- The Dimensional U.S. Small Companies Acc fund was added to the portfolio (0.00% to 2.00%)

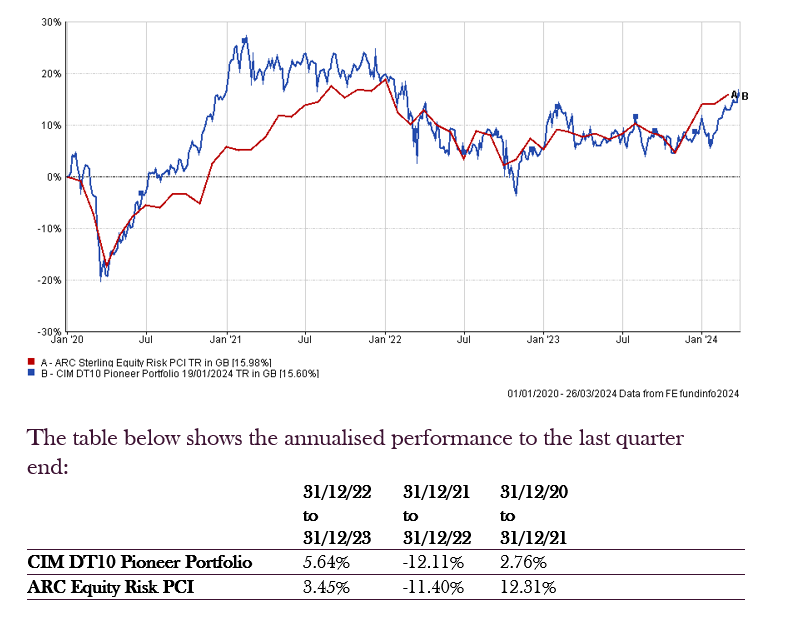

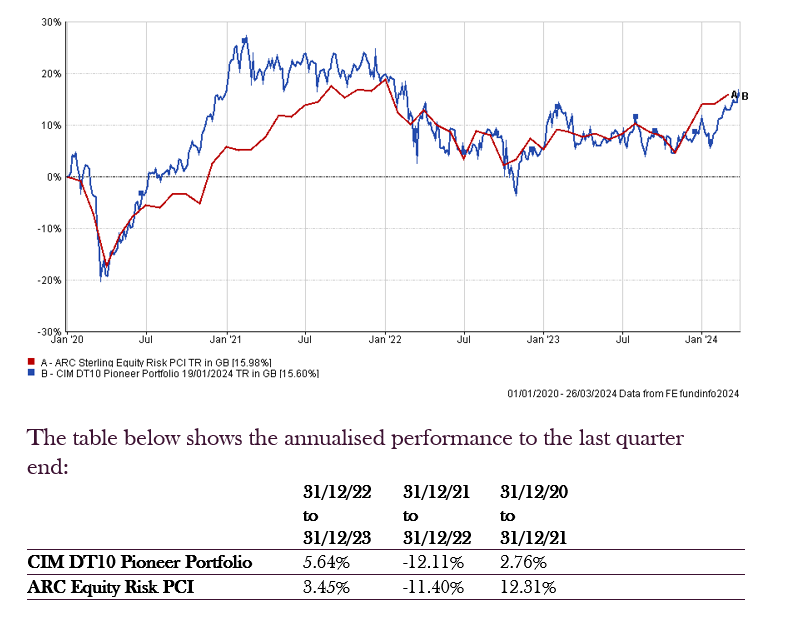

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Pioneer Portfolio

- There were no changes made to the Pioneer portfolio in March 2024

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.