Minutes of the Clarion Investment Committee held at 1pm on 6th May 2021 by video link.

Committee Members in attendance: –

| Sam Petts (SP) | IC Chairman/Investment Manager |

| Keith Thompson (KWT) | Chairman (Clarion Investment Management) |

| Adam Wareing (AW) | Operations Director & Compliance Director (Clarion Investment Management) |

| Jacob Hartley (JH) | Associate Financial Planner (Clarion Wealth Planning) |

| Dmitry Konev (DK) | Senior Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) | CEO (Margetts Fund Management) / Investment Manager |

| Elizabeth Chapman (EC) | Analyst (Margetts Fund Management) |

Apologies from:

Ron Walker (RW) Managing Director—Clarion Investment Management

Minutes from the previous meeting held on 8th April 2021 were agreed by the Committee as a true and accurate record.

Please click here to access the May Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

Global stock markets achieve a V-shaped recovery post Covid-19 lows. The post-Covid V-shaped recovery shows how dangerous panic selling can be, with investors who sold down their portfolios around the bottom of the market in March/April 2020 missing out on the recovery that followed shortly after.

China economy achieves V-shaped recovery whilst Europe and USA follow an upward “W”. US/China relations deteriorate.

Covid-19 stimulus now exceeds $15 trillion with a further $2 trillion US package. Money supply during the Covid pandemic has grown exponentially and there is a high likelihood of it being inflationary at least in the short term. The rise in the US money supply was the biggest ever seen and is expected to create inflationary pressures once the velocity of money increases as economies open up.

While central banks still indicate that interest rates are more likely to stay low, factory prices are rising, which is projected to feed through to consumers in the following months.

Inflation risk moves firmly into focus as bond yields move higher. Higher inflation is expected to translate into higher bond yields, leading to weaker bond prices and having a negative effect on the valuations of growth stocks, which tend to correlate with long-dated bond issues.

Rises in bond yields prompted underperformance of index tracking funds, which did not have the opportunity to re-position their portfolios and reduce exposure to long-dated bonds. Over 6 months, the yield on 10-year Gilts increased by c.40bps, which led to a significant change in valuations of long-dated bonds, with the longer duration bonds falling by c.20%.

Big Tech dominates and bloats the US stock market and begins to underperform despite earnings surprising to the upside. There are signs that the market sees tech stocks peaking, with Apple, Tesla and other major tech giants reporting huge increases in earnings, but their share prices fail to outperform the market.

Vaccine strategy provides light at the end of the tunnel, but risks of variants remain. There is evidence that vaccination programmes work, with Israel, UK and Chile providing good case studies, showing a sharp reduction in deaths and critically ill patients among the vaccinated part of the population.

Europe lags in vaccination programme while the US, Israel and the UK move forward.

Growth to value rotation continues in a “jumpy” fashion.

Our overweight position in UK equities is based on the attractive valuations and the potential relative outperformance as the largely service based economy re-opens. The major UK indices have an inherent bias towards value companies badly affected by the pandemic, and the impressive vaccination rollout could see the UK emerge from social restrictions faster than many peer economies.

Our underweight US position is also based on valuations, as most US outperformance has been from the dominant tech stocks which make up the top quartile of the indices. The market forces underpinning the successful run of these stocks through the pandemic were disturbed in Q1 of this year as the yield on US treasuries rose from c.0.9% to c.1.75% with a fall in capital values of long dated bonds of circa 20%. This increase in yields saw high growth companies and some tech stocks fall in conjunction as the possibility of justifying the eye-watering p/e ratios lessened in the face of easy capital drying up.

Our bond positioning is biased towards short-dated corporate debt. As investors have sought outperformance by either increasing duration exposure or settling for lesser credit quality, spreads have tightened, with central bank interference a constant element. Small increases in inflation would see longer-dated bonds suffer adversely, as the inflation panic in Q1, where 10-year treasuries lost c.9%, demonstrated. The inverse performance correlation of these long bonds against equities is also not as apparent as in in the past. Our selection ought to outperform as yields rise; and offers above inflation income for an appropriate level of risk in challenging fixed-income markets.

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

To summarise, the committee agreed the following changes to the Prudence fund:

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end.

| 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | 31/03/17 to 31/03/18 | 31/03/16 to 31/03/17 | |

| MGTS Clarion Prudence R Acc | 17.96% | -7.89% | 3.87% | -1.24% | 9.59% |

| IA Mixed Investment 20-60% Shares | 19.83% | -7.19% | 2.86% | 0.83% | 12.90% |

To summarise, the committee agreed the following changes to the Navigator fund:

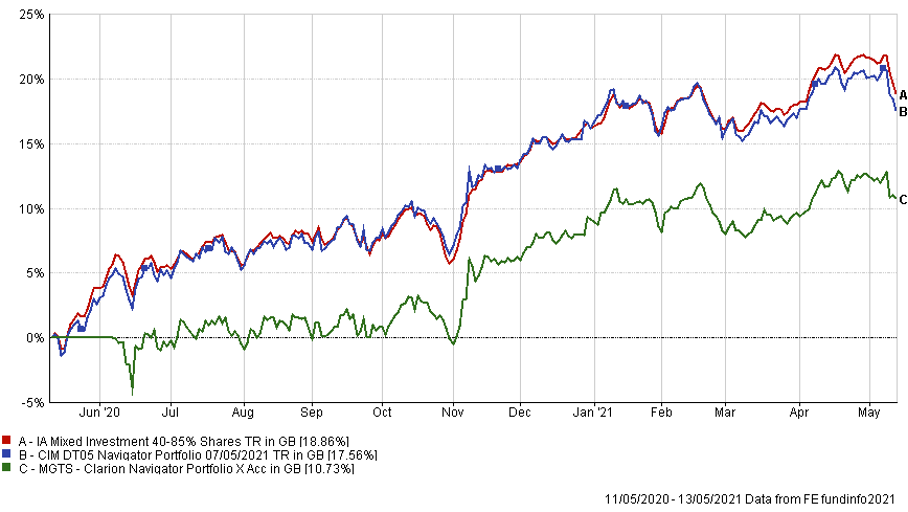

Whilst the Navigator fund launched on 11th May 2020, the fund didn’t receive any cash inflows until 5th June 2020 meaning that no investments were made before this date. You can identify this period as the Navigator fund growth appears flat whilst the sector grew over this period. This gives the impression that the fund lagged behind the sector when, in fact, the Navigator fund was unable to participate in any market growth during this period.

However, we also manage a Navigator discretionary portfolio containing almost identical investments to the Navigator fund and this was invested during this period. The chart below compares the performance of this portfolio against both the Navigator fund and the sector since 11th May 2020. The table shows the performance between 11th May 2020 and the end of the previous quarter.

| 11/05/20 to 31/03/21 | |

| MGTS Clarion Navigator X Acc | 9.67% |

| CIM DT05 Navigator Portfolio | 17.02% |

| IA Mixed Investment 40-85% Shares | 17.98% |

To summarise, the committee agreed the following changes to the Meridian fund:

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end.

| 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | 31/03/17 to 31/03/18 | 31/03/16 to 31/03/17 | |

| MGTS Clarion Meridian R Acc | 29.63% | -10.01% | 4.27% | -0.40% | 16.80% |

| IA Mixed Investment 40-85% Shares | 6.44 | -7.99% | 4.30% | 1.54% | 17.11% |

To summarise, the committee agreed the following changes to the Navigator fund:

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end.

The chart below shows the performance of the above fund since inception. The table below that shows the discrete annual performance to the last quarter end.

| 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | 31/03/17 to 31/03/18 | 31/03/16 to 31/03/17 | |

| MGTS Clarion Explorer R Acc | 34.25% | -9.05% | 4.23% | 3.50% | 27.04% |

| IA Flexible Investment | 29.10% | -8.14% | 3.31% | 2.36% | 19.06% |

It was agreed to make appropriate changes to the model portfolios to reflect the changes to the Portfolio Funds detailed above.

The next Investment Committee Meeting is on 11th June 2021 although in the interim period the Committee intend to conduct slightly shorter conference calls as considered appropriate.

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.