Tags: Adventurer Portfolio, Defender Portfolio, Discretionary Investment Management, Explorer Portfolio, funds, investment, Meridian Portfolio, MGTS Clarion Explorer, MGTS Clarion Meridian, MGTS Clarion Prudence, MTGS Clarion Navigator, Navigator Portfolio, Pioneer Portfolio, Prudence Portfolio, Voyager Portfolio

Category:

Investment management

The Clarion Investment Committee met on the 10th of May 2023. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

US treasury secretary Janet Yellen said Republicans and Democrats had found some areas of agreement in their negotiations on the US debt ceiling. Ms Yellen had previously warned that the US might be unable to pay its bills as early as 1 June.

The Bank of England raised its benchmark interest rate by 25 basis points to 4.5% and now expects inflation to stay higher for longer.

The Bank of England reported a marked improvement in its economic forecast and now expects the UK economy to grow by 0.4% in 2023.

UK GDP grew by 0.1% in Q1 2023 with services output weighing on growth in February and March.

US inflation fell for the tenth consecutive month to 4.9% in April, increasing the chances of a pause in the Federal Reserve’s interest rate hiking cycle.

US consumer sentiment fell to its lowest level this year as households worry about the state of the US economy.

The Fed’s Financial Stability Report highlighted the risk of recent stress in US regional banks fuelling a credit crunch and resulting in an economic slowdown.

UK house prices fell by 0.3% over April after recovering in the previous three months, according to the Halifax.

The Resolution Foundation think tank warned that two-thirds of the £12bn total increase in UK mortgage costs from higher interest rates have yet to be passed on to borrowers.

Euro area consumer inflation expectations over the next 12 months jumped from 4.6% to 5% in May.

Global luxury house prices fell in Q1 2023 for the first time since 2009 as rising interest rates hit demand.

US crude oil inventories rose by 3.6m barrels in a possible sign of weakening demand, according to the American Petroleum Institute.

EU population declined by more than half a million from 2020 to 2022, with Italy suffering the largest decline.

Shares in several US regional banks fell sharply and then recovered some of their losses; the pressure on US regional banks follows the failure of First Republic Bank on 1 May, the second-largest bank failure in US history.

The US economy added a greater-than-expected 253,000 jobs in April while the unemployment rate fell to 3.4%, suggesting continued tightness in the American labour market.

The World Health Organisation declared an end to the COVID-19 global emergency, over three years after it was first declared.

Domestic tourism in China exceeded its pre-pandemic peak during the May Day holiday.

Gold hit an all-time high of $2,071/troy ounce following concern over the US banking sector and resurgent demand for gold from China.

UK households drew down on their stock of savings in April, with the combined value of their bank deposits and NS&I savings falling by £1.3billion.

The European Central Bank raised interest rates from 3.0% to 3.25% and its president Christine Lagarde said that “we are not pausing” monetary tightening.

The US Fed raised interest rates by a quarter point to target a range between 5% to 5.25%; Chair Jay Powell said that “there is a sense that, you know, we’re much closer to the end of this than to the beginning”.

Euro area inflation rose to 7.0% in the 12 months to April, up from 6.9% the previous month.

The UK competition regulator announced it was opening a review into AI models.

Warren Buffett said that the UK was wrong to block Microsoft’s planned $69bn takeover of Activision.

11,500 film and television writers in the US went on strike over an unacceptable compensation package and they also demanded that AI only be used to assist writers rather than replace them.

Online study guide publisher Chegg warned that the growing popularity of AI chatbots was hitting its revenues.

HSBC shareholders rejected a proposal that would have seen it split its operations in Asia from the rest of the business.

The CEO of UK utility Octopus Energy said that artificial intelligence is doing the work of 250 people in answering customer emails and achieving higher customer satisfaction scores.

The UK’s Skipton Building Society will be the first since 2008 to offer 100% mortgages.

Several airlines including IAG, Air-France KLM and Lufthansa have said they expect to see robust demand over the summer despite the ongoing squeeze on household incomes.

UK City regulator the FCA published proposals to simplify the rules for listed companies in a bid to increase the competitiveness of the UK listing regime; the number of listings in London is down by 40% since 2008.

UK railway workers represented by the RMT union voted for further strikes in a long-running dispute over a pay deal with train companies.

Amazon reported better-than-expected revenues and profits driven by growth in its cloud services.

Construction equipment maker Caterpillar beat profit expectations thanks to strong demand and higher prices.

French luxury group LVMH reported strong watch and jewellery sales driven by a rebound in demand in Asia as China’s economy reopened.

Rising interest rates helped Barclays, NatWest and Deutsche Bank beat earning expectations.

The US published intelligence estimating that 20,000 Russian troops have been killed in Ukraine since December with 80,000 wounded.

The UK delivered longer-range Storm Shadow missiles to Ukraine.

The US authorised the first transfer of assets from a sanctioned Russian oligarch to help Ukraine’s reconstruction efforts.

The ruling UK Conservative Party suffered steep losses in local elections while the Labour, Liberal Democrat and Green parties made gains.

The FT reported that the Labour Party intends to increase the stamp duty paid by foreign buyers of UK property and restrict the sale of new-build properties to overseas investors.

UK Labour leader Keir Starmer abandoned a promise to scrap university tuition fees in England if he wins office.

The EU signed off on Bulgaria, Hungary, Poland, Romania and Slovakia imposing a ban on imports of Ukrainian grain to protect their farmers’ commercial interests.

Ukraine’s defence minister Oleskiy Reznikov confirmed that the country is nearly ready for the counter-offensive after receiving weapons from its Western partners.

US Secretary of State Antony Blinken warned that Russia’s Wagner Group risks intensifying the conflict in Sudan by providing the paramilitary force with advanced weapons.

Inflationary pressures within the UK showed signs of easing throughout April, which may bear some responsibility for the outperformance of the UK stock market.

The Federal Reserve has released a report on the recent collapse of Silicon Valley Bank, which underscores the far-reaching impact of the bank’s failure on the technology sector and the broader US economy. The report reveals that the collapse was primarily due to mismanagement, weak oversight, and a culture of excessive risk-taking that went unchecked. This failure has exposed numerous vulnerabilities in the banking sector, prompting regulators to re-evaluate current practices and call for stricter regulations.

Tech companies that relied on Silicon Valley Bank for financing have faced severe disruptions; some have been forced to seek alternative sources of funding or scale back their operations. The ripple effects of the bank’s collapse have also extended to other sectors of the economy, causing a slowdown in growth and raising concerns about financial stability. The Fed’s report serves as a stark reminder of the potential consequences of inadequate regulation and oversight in the banking sector and underscores the need for systemic reforms to prevent such collapses in the future.

In response to the ongoing crisis, JPMorgan CEO, Jamie Dimon, emphasised the need for a comprehensive review of the regulatory environment to address the underlying issues that led to the crisis. He also stressed the importance of learning from the current situation to prevent future financial disasters and ensure the stability of the banking system.

As the crisis unfolds, financial institutions are re-evaluating their risk management strategies and operations, while regulatory authorities are expected to implement stricter measures to safeguard the sector. The ongoing repercussions of the banking crisis could lead to a more cautious lending environment, potentially impacting economic growth and business development in the longer term.

China’s economic roadmap for 2023, discussed during the National People’s Congress (NPC), includes a lower GDP growth target of “around 5%”, with the previous target being “around 5.5%”, reflecting a cautious approach to projecting economic growth this year. The government plans to provide less fiscal support, with the augmented fiscal deficit remaining broadly unchanged relative to GDP.

The labour market will see the government aiming to create 12 million new urban jobs, with a goal of keeping the surveyed unemployment rate “around 5.5%.” The focus on fiscal and monetary policy will prioritize addressing structural issues and financial risks.

In the property sector, the NPC signals greater support for China’s housing market, with measures to support first-time buyers and upgraders. However, developers will face continued pressure to improve debt-to-asset ratios, and the government will push for an increased supply of government-subsidised rental housing.

The private sector may see some support as part of the wider campaign to “boost market confidence,” with the government promising to “support the private sector” and protect “the rights and interests of entrepreneurs.” However, the durability of this shift remains uncertain, with the “common prosperity” push still appearing to guide policy.

The US fell behind Europe on a two-year performance basis, and the strong relative outperformance of the US since the Global Financial Crisis (GFC) has started to erode. Year-to-date Europe is the strongest performing sector, with the UK closely behind. There is a new interest rate environment, with some investors pricing in inflation to fade away and subsequently interest rates to go back to their prior lows. While inflation should decline in the short-term, many long-term knock-on effects have yet to feed through and these investors may experience detrimental returns if central banks do not pivot following a reduction in inflation.

The likelihood of a second GFC is relatively low, despite the collapse of Silicon Valley Bank (SVB) and Credit Suisse. The GFC brought more regulation into banking capital requirements and the interconnectivity of banks has reduced since then. Those that have failed have been a result of poor management and strategy rather than systemic issues in the banking sector and should have little material impact on the market as a whole.

There are attractive value investment opportunities in the UK, Europe, Asia, and US smaller companies. Yield curve opportunities are also present, but an inflation rollercoaster could lead central banks to over-tighten monetary policy and over the longer-term interest rates may overshoot current expectations. Inflation numbers are likely to fluctuate, with February and March being strong but April to July may pull down the headline figure. Wheat and natural gas prices are now back at pre-war levels.

In terms of geopolitical tensions, there has been a de-escalation in Ukraine, and Russia no longer looks able to achieve its objectives. A lower level of conflict suits both sides, and China which will be worried about Russia replacing Putin with a pro-Western figure. A China-brokered deal could be beneficial for both sides.

The Committee observe that China’s macroeconomic environment differs significantly from that of developed economies. Inflation remains subdued, and accumulated savings from Covid lockdowns are just beginning to re-enter the economy. Although the Chinese economy faces substantial political risks, both from domestic regulations and global tensions with political adversaries, the consensus is that the market’s valuations are highly attractive. In the Committee’s assessment, the potential rewards offered by these valuations and favourable macroeconomic factors outweigh the associated political risks. Consequently, the portfolios with a higher risk tolerance maintain an overweight allocation to Asian equities, reflecting the Committee’s confidence in the opportunities presented by the Asia Pacific region, particularly in China.

The key themes are as follows:

In the Committee’s view, central banks are likely to shift from the previous inflation target of 2% to a higher figure or a floating range, which will most likely be around 3-4%. The amount of economic destruction required to bring inflation back to a 2% target would be too great to be justifiable. Coupled with multiple developed economies (US and Europe) trying to ease the reliance on supply chains from China, inflation is likely to be stickier, although much lower than current levels, than initially thought.

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long-term.

Keith W Thompson

Clarion Group Chairman

May 2023

Creating better lives now and in the future for our clients, their families and those who are important to them.

For a fuller version of Clarion’s Economic and Stock Market Commentary, written by Clarion Group Chairman Keith Thompson, please click here

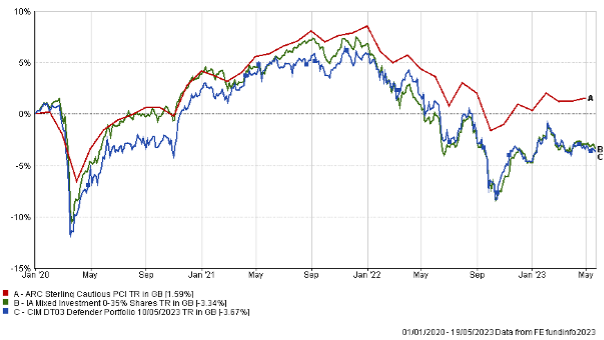

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/2022

to 31/03/2023 |

31/03/21 31/03/20

to to 31/03/22 30/03/21 |

|

| CIM DT03 Defender Portfolio | -7.11% | 1.34% 13.36% |

| ARC Sterling Cautious PCI | -3.83% | 1.62% 11.34% |

| IA Mixed Investment 0-35% Shares | -5.94% | -0.20% 12.09% |

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22 to 31/03/23 | 31/03/21 to 31/03/22 | 31/03/20 to 31/03/21 | 31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | |

| MGTS Clarion Prudence P Acc | -7.44% | 2.30% | 18.26% | -7.89% | 3.87% |

| CIM DT04 Prudence Portfolio | -7.58% | 2.88% | 18.24% | -7.42% | 4.15% |

| ARC Sterling Cautious PCI | -3.83% | 1.62% | 11.34% | -2.29% | 1.71% |

| IA Mixed Investment 20-60% Shares | -4.80% | 2.73% | 19.83% | -7.19% | 2.86% |

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

31/03/19 to 31/03/20 | 31/03/18 to 31/03/19 | |

| MGTS Clarion Navigator P Acc | -6.97% | 2.81% | |||

| CIM DT05 Navigator Portfolio | -6.97% | 2.81% | 22.28% | -9.14% | 4.12% |

| ARC Sterling Balanced Asset PCI | -4.32% | 3.46% | 17.86% | -5.44% | 2.98% |

| IA Mixed Investment 40-85% Shares | -4.54% | 5.23% | 26.44% | -7.99% | 4.30% |

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

31/03/19

to 31/03/20 |

31/03/18 to 31/03/19 | |

| MGTS Clarion Meridian P Acc | -7.50% | 1.50% | 30.12% | -10.01% | 4.27% |

| CIM DT06 Meridian Portfolio | -6.65% | 1.76% | 30.90% | -9.43% | 4.28% |

| ARC Steady Growth PCI | -4.60% | 4.64% | 23.53% | -7.71% | 4.85% |

| IA Mixed Investment 40-85% Shares | -4.54% | 5.23% | 26.44% | -7.99% | 4.30% |

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

31/03/19

to 31/03/20 |

31/03/18

to 31/03/19 |

|

| MGTS Clarion Explorer P Acc | -7.41% | 1.90% | 34.77% | -9.05% | 4.23% |

| CIM DT07 Explorer Portfolio | -6.44% | 1.61% | 35.28% | -10.10% | 5.22% |

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% | -9.65% | 6.04% |

| IA Flexible Investment | -4.03% | 4.95% | 29.10% | -8.14% | 3.31% |

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

|

| CIM DT08 Voyager Portfolio | -6.00% | -1.91% | 39.32% |

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% |

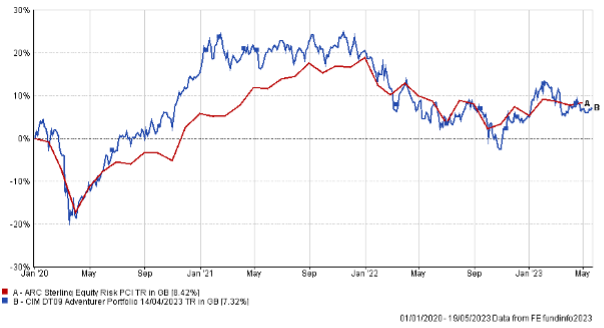

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 31/03/22

to 31/03/23 |

31/03/21

to 31/03/22 |

31/03/20

to 31/03/21 |

|||

| CIM DT09 Adventurer Portfolio | -4.13% | -5.07% | 42.38% | ||

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% |

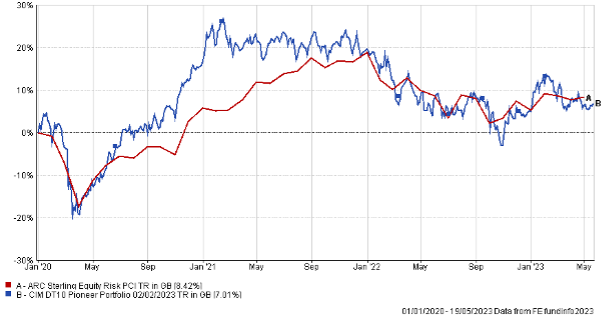

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

| 30/12/22

to 30/12/23 |

30/12/21

to 30/12/22 |

31/03/20

to 31/03/21 |

|||

| CIM DT10 Pioneer Portfolio | -4.11% | -6.12% | 45.66% | ||

| ARC Equity Risk PCI | -4.80% | 4.84% | 30.35% |

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.