The Clarion Investment Committee met on the 16 May 2024. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Economics

- The UK economy grew by a greater-than-expected 0.6% in the first quarter of the year, meaning the UK is no longer in recession. The pick-up in UK growth was broad-based with increases in both manufacturing and services offsetting a fall in construction output.

- UK per capita output grew by 0.4% in the first quarter, the first growth in this measure in two years.

- The Bank of England kept its benchmark interest rate on hold at 5.25% but said that: “It’s likely that we will need to cut bank rates over the coming quarters”. Two of the nine-member rate-setting committee voted for a cut.

- UK house prices rose by 0.1% in April following a contraction of 0.9% in March according to estimates from Halifax.

- The OECD revised up its forecasts for global growth this year to 3.1% with particularly strong growth expected in India, Indonesia, China and the US and called on governments to tackle “worrying” levels of public debt.

- US president Joe Biden announced steep rises in tariffs on imports of Chinese EVs, batteries and solar panels amid concerns that a flood of imports driven by overcapacity and subsidies would damage US producers.

- Beijing criticised the move saying it would “take all necessary measures to safeguard its legitimate rights and interests”. The EU is also expected to introduce new tariffs.

- US inflation fell to 3.4% in the 12 months to April, down from 3.5% the previous month. The fall, in line with expectations, has reinforced beliefs that the Fed will start to cut US interest rates later in the year.

- UK unemployment ticked up to 4.3% in the three months to March, but average total pay was up 5.7% in the three months to March compared with the same period last year, ahead of expectations, painting a mixed picture of the labour market.

- UK Steel has written to the UK government to urge them to speed up plans to bring in a carbon-border adjustment tax amid fears that when the EU brings in such a tax in 2026, it will flood the UK market with high-emission steel, the Financial Times

- UK chancellor Jeremy Hunt hinted that he would like to cut National Insurance again in the Autumn if possible, describing it as a “double tax on work”

- Matthew Beesley, CEO of UK asset manager Jupiter Asset Management, said investors were turning to UK equities because they were “the cheapest they have been in 50 years” and trading at a large discount to US stocks.

- Land Securities, a major office landlord in London, said that attendance at its offices had risen by 18% over the year to March as workers return to the office.

- The Japanese economy shrank by a greater-than-expected 0.5% in the first quarter as the weak yen continues to put consumers under pressure.

- US retail sales were flat in April compared with the previous month.

- Nickel prices rose to a nine-month high as pro-independence protests in New Caledonia, a French overseas territory with significant deposits of the mineral, turned violent.

- The European Central Bank (ECB) warned that high public debt levels in the euro area left members vulnerable to adverse geopolitical shocks and at risk of persistently high interest rates. It noted that many support measures introduced following the invasion of Ukraine and the pandemic had yet to be reversed.

- Chinese retail sales grew by 2.3% in April compared with the same month last year, the lowest growth since December 2022, while industrial production grew by 6.7% over the same period. These readings will do little to assuage concerns over Chinese industrial overcapacity.

- Chinese property investment was down 9.8% in the first four months of the year compared with a year earlier while new home sales were down 24% as difficulties in the real estate sector persist. The Chinese central bank loosened mortgage regulations in an attempt to stimulate the sector.

- ECB policymakers said it was “plausible” that interest rate cuts may begin in June, according to recently published minutes of their meeting in April.

- Euro area retail sales rose by 0.8% from February to March, the strongest monthly growth since September 2022, in part due to strong growth in Germany and France.

- The Swedish Riksbank became the second central bank in Europe to cut interest rates following the Swiss National Bank in March. Although Swedish inflation remains above target – due in part to strong growth in the price of housing – concerns about growth have been increasing with unemployment at 9.2%.

- Germany did more trade with the US than China in the first quarter of the year, possibly signalling an end to an eight-year era in which China has been Germany’s highest-value trading partner. Lacklustre Sino-German growth, Chinese manufacturers shifting into higher-value goods, and robust US demand are all possible factors.

- Renewable sources generated a record 30% of global electricity in 2023, driven by growth in solar and wind production.

Business

- Ontario’s municipal pension fund wrote off its investment in troubled UK utility Thames Water. It was the largest shareholder.

- A Russian court seized €463m of assets owned by Italian bank UniCredit in a dispute over bank guarantees. The ECB has reportedly asked euro area lenders to detail their exit plans from their Russian exposures.

- Chinese EV producers are reportedly rushing to ship vehicles to Brazil and Mexico amid speculation that they are planning to introduce high tariffs.

- Tesla chair Robyn Denholm said that the company needed to climb “Mount Everest” to persuade shareholders to back a relocation to Texas and a $56bn pay deal for Elon Musk.

- The US Department of Justice said it is considering launching a criminal prosecution against troubled plane manufacturer Boeing after an alleged breach of a 2021 agreement that protected the company from criminal charges over deadly 737 Max crashes in 2018 and 2019.

- Airlines IAG, Lufthansa and Air France-KLM predicted strong growth demand for travel this summer driven by strong leisure demand and a continued recovery of business travel.

- Jaguar Land Rover announced its highest profit in 9 years on the back of strong sales of its premium vehicles.

- US law firm Quinn Emanuel announced it was raising pay for its newly qualified lawyers in London to £180,000, a sign that the market for legal talent in London is heating up again.

- Swiss bank UBS reported profits of $1.8bn last quarter, well ahead of expectations. Its takeover of Credit Suisse is expected to be completed by the end of the month.

Global and political developments

- The Financial Times reports that new cases of COVID are rising driven by a new variant prompting concerns about a surge in cases over summer.

- Russian forces have advanced 10km over the Russo-Ukrainian border towards Kharkiv, Ukraine’s second-largest city, but their advance has now been halted, according to Kyiv.

Russia and China reaffirmed their close relationship during a two-day visit of Russian president Vladimir Putin to Beijing.

- UK Labour leader Keir Starmer announced six election pledges ahead of an expected general election later this year.

- Slovakian president Robert Fico remains in a serious but stable condition following an attempted assassination that saw him shot five times.

- US president Joe Biden and former president Donald Trump will face off in debates in June and September.

- Georgia’s pro-Russian government signed into law controversial measures seen by some as restricting media and civic freedoms despite widespread protests.

- And finally… Barclays recently published research estimating that Taylor Swift’s Eras Tour will provide a £1bn boost to the UK economy, with fans attending one of the 15 UK concerts spending an average of £848 once costs of accommodation, food, drink and merchandise are accounted for.

Please click here to access the May Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

Commentary & Strategy.

North America is still leading in terms of returns YTD but over the last 3 months, we have seen a reversal and the UK and Asia have been the best markets. These markets still look cheap on a historical basis.

The Investment Committee believe that inflation is going to be sticky and while it will dip below 2% later this year, the long-term average will be around the 3% level due to wage inflation.

- It will take a full economic cycle (at least) for the inflationary effects of printing money after the global financial crisis and Covid to dissipate.

- The fund changes at this meeting were as follows:

- Abrdn Emerging Markets Income swapped for Dimensional Emerging Markets Targeted Value (Meridian upwards in relation to the associated level of risk)

- 40% of HSBC European Index swapped into Dimensional European Value, taking profit from the HSBC fund (which has returned 28% since we included it) and reflecting our fears of stock concentration in the European markets (as well as US).

- For the last 6 months, there has been a tilt towards evidence-based factor investing, which involves a disciplined approach backed up by significant amounts of Nobel Prize-winning economic research. Factor investing involves trusting the market but then tilting the investment choice towards smaller companies, value companies (those trading at a discount) and profitable companies. The evidence shows that over the long term, these types of investments outperform your typical index tracking and actively managed funds.

- Clarion is primarily accessing these factor-based investments through Dimensional Fund Advisors (dimensional.com). Since inclusion, investment performance has been impressive, costs have decreased, and it is likely that we will look to introduce more factor-based funds into the portfolios as and when appropriate.

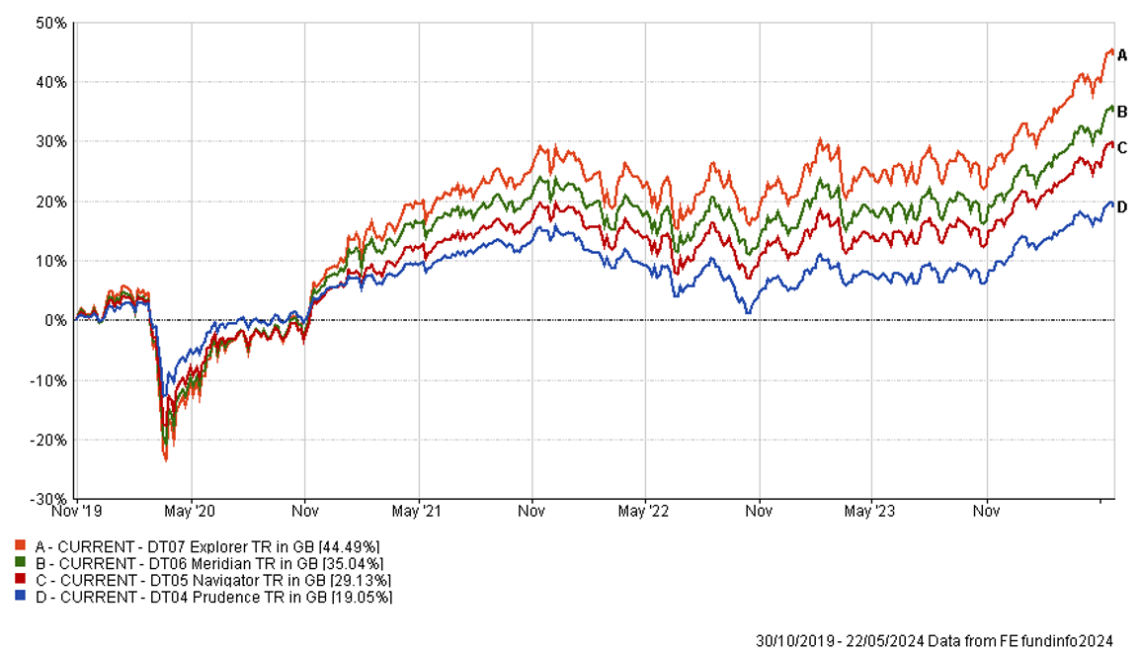

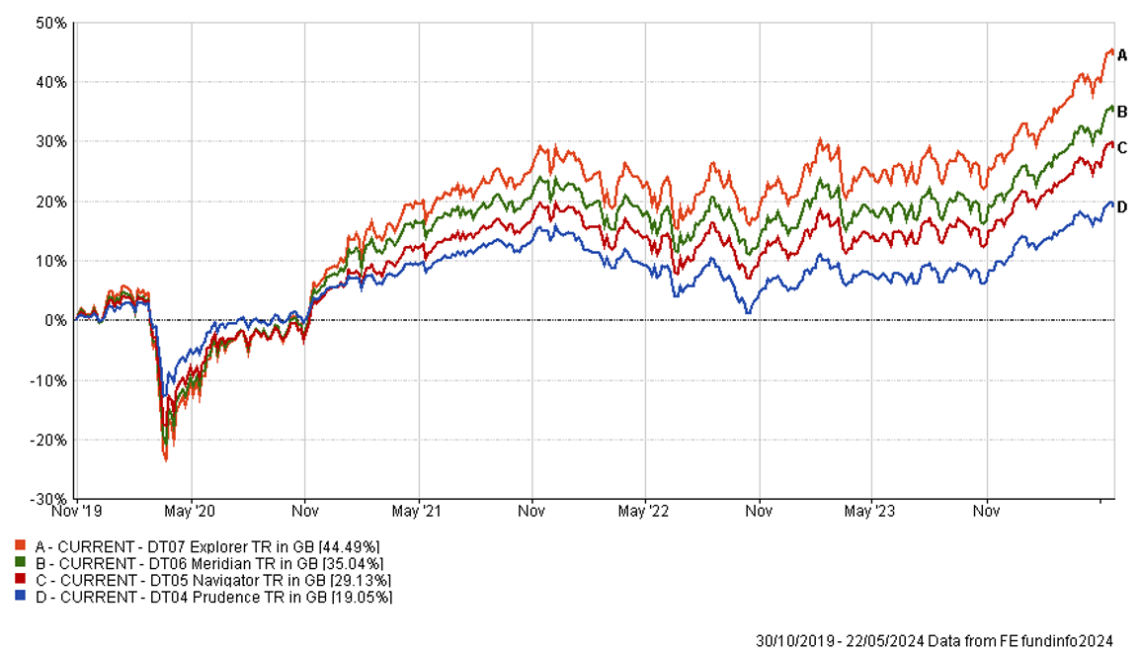

- The Clarion funds are well positioned to take advantage of the latest economic conditions and over the last 3 months (to 23/05/2024):

- Explorer is 3rd out of 62 in the RTMA Risk 5 Growth sector (1st Quartile)

- Meridian is 19th out of 62 in the RTMA Risk 5 Growth sector (2nd Quartile)

- Navigator is 22nd out of 93 in the RTMA Risk 4 Balanced sector (1st Quartile)

- Prudence is 40th out of 95 in the RTMA Risk 3 Moderate sector (2nd Quartile)

- The funds are all performing well over 6 months and 1 year, mainly driven by the asset allocation.

- Tracking error has decreased significantly across all the portfolios, meaning that our investment returns are now more closely matching the return of the strategic benchmarks.

The performance of the CURRENT portfolios back tested over 5 years is shown in the chart below. This is assuming that we made the recent changes back then and then adopted the buy and hold approach favoured when using evidence-based factor investing.

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

May 2024

Creating better lives now and in the future for our clients, their families and those who are important to them.

Clarion Funds & Discretionary Portfolios:

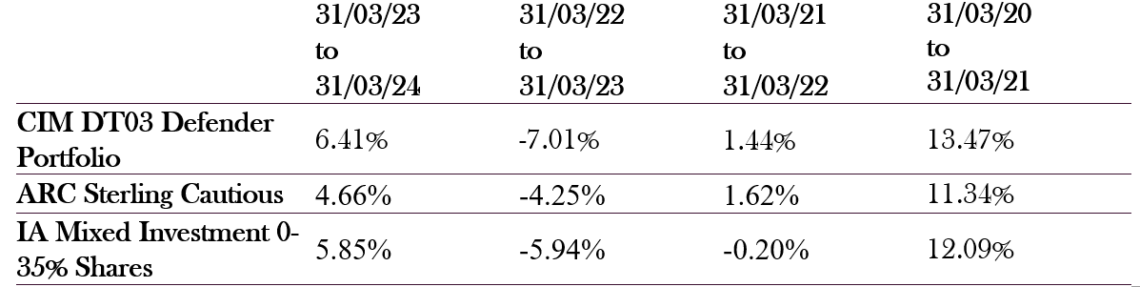

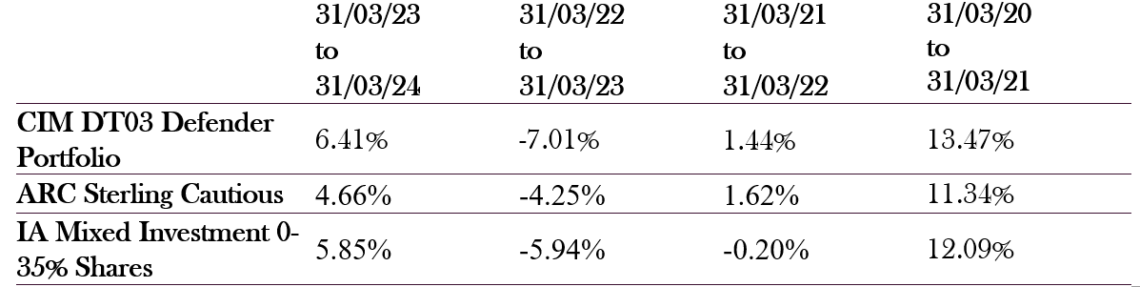

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Defender Portfolio

- There were no changes to the Defender Portfolio in May 2024

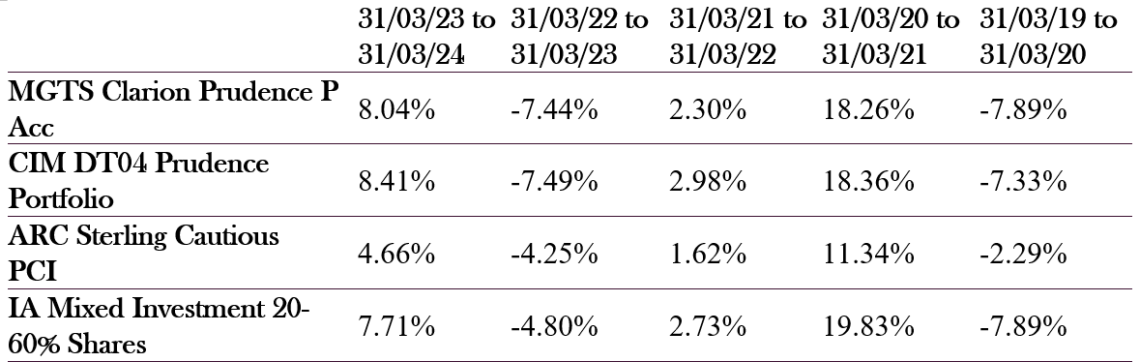

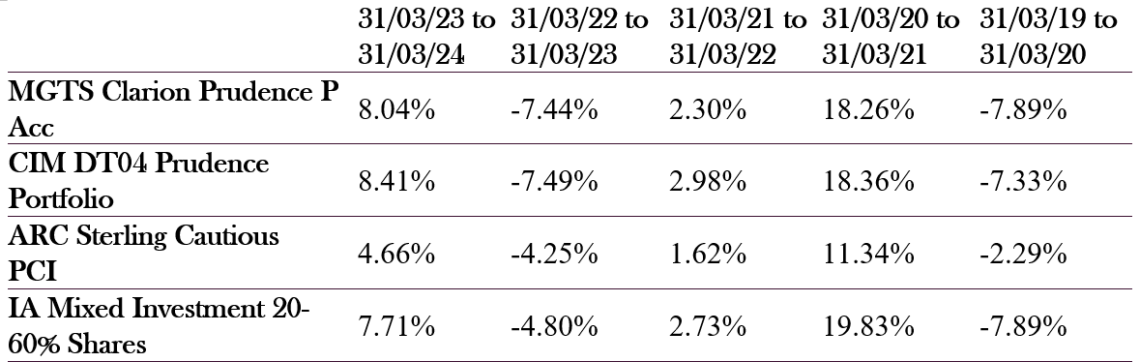

Prudence Fund & Managed

Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

The table below shows the annualised performance to the last quarter end:

Changes to the Prudence Fund & Portfolio

- HSBC European Index C Acc was reduced from 6.00% to 3.60%

- Dimensional European Value was added to the portfolio (0.00% to 2.40%%).

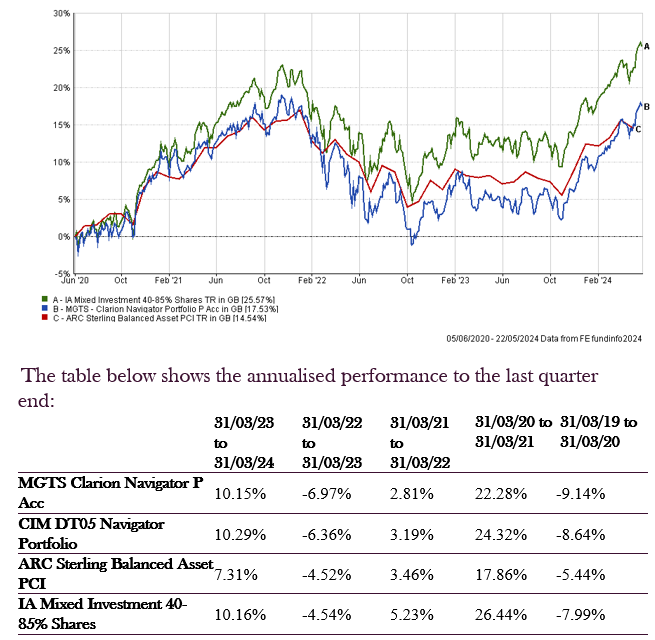

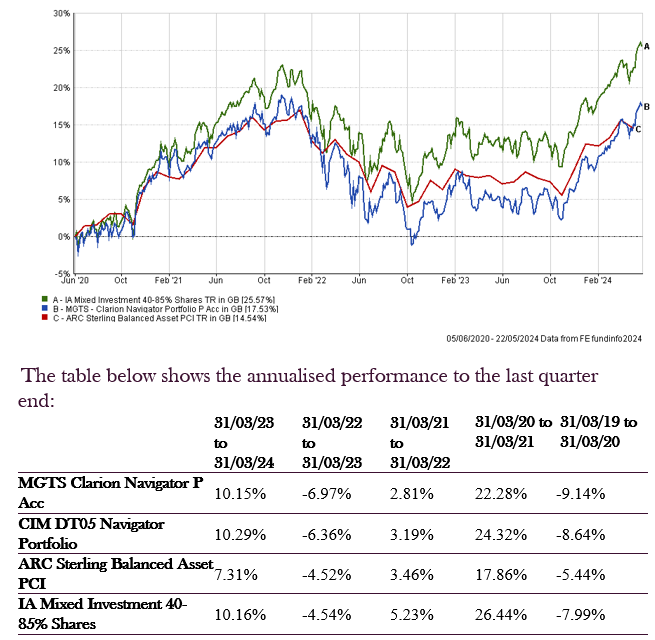

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund & Portfolio

- HSBC European Index C Acc was reduced from 6.00% to 3.60%.

- Dimensional European Value was added to the portfolio (0.00% to 2.40%).

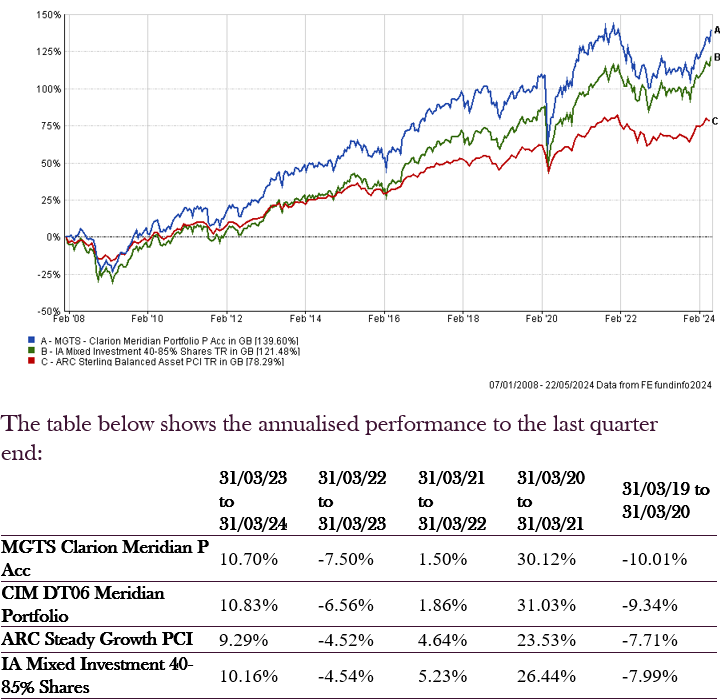

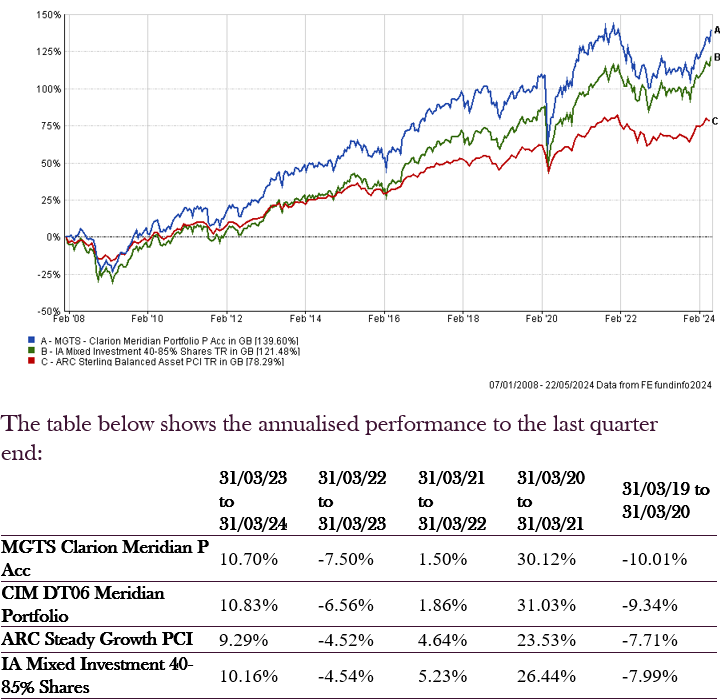

Meridian Fund & Managed Portfolio

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund & Portfolio

- HSBC European Index C Acc was reduced from 6.00% to 3.60%.

- Dimensional European Value was added to the portfolio (0.00% to 2.40%)

- Abrdn Emerging Markets Income Equity Ret Platform 1 Acc was removed from the portfolio (2.00% to 0.00%)

- Dimensional Emerging Markets Targeted Value Acc was added to the portfolio (0.00% to 2.00%).

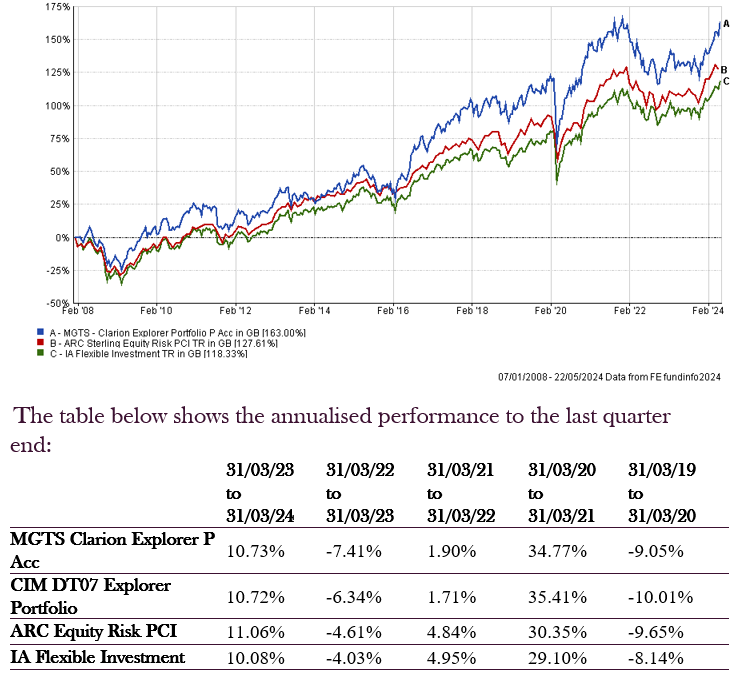

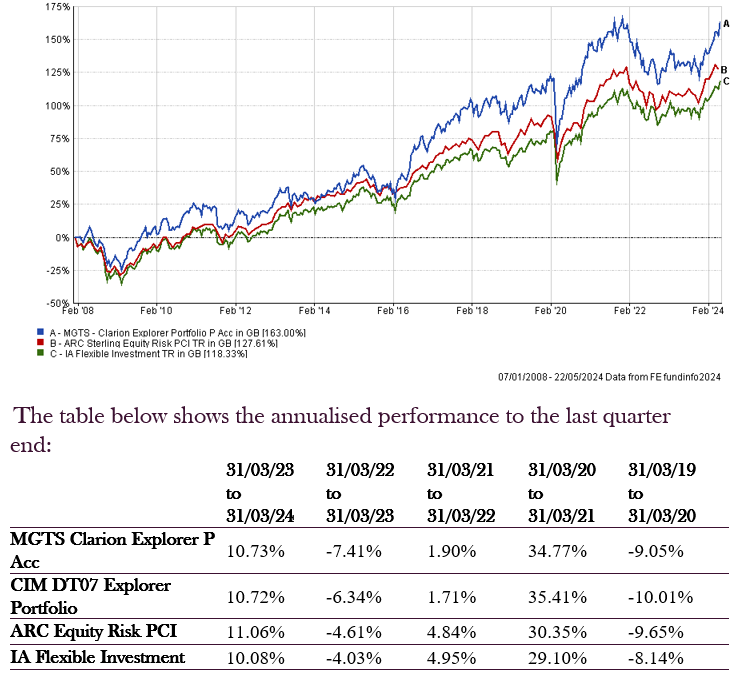

Explorer Fund & Managed Portfolio

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund & Portfolio

- HSBC European Index C Acc was reduced from 6.00% to 3.60%

- Dimensional European Value was added to the portfolio (0.00% to 2.40%)

- Abrdn Emerging Markets Income Equity Ret Platform 1 Acc was removed from the portfolio (2.20% to 0.00%)

- Dimensional Emerging Markets Targeted Value Acc was added to the portfolio (0.00% to 2.20%).

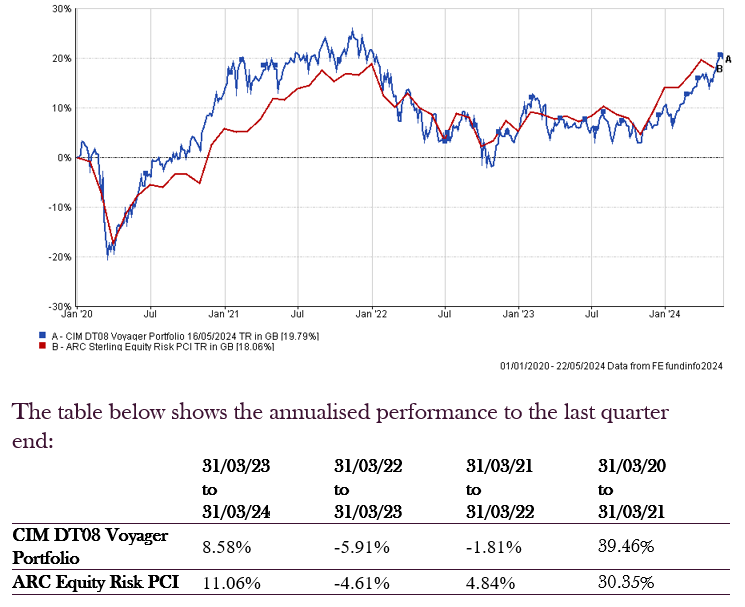

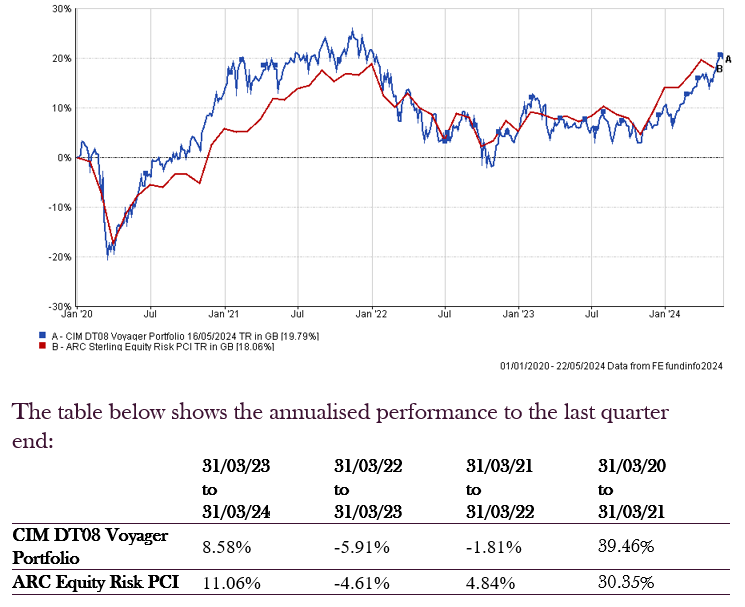

Voyager Managed Portfolio

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

Changes to the Voyager Portfolio

- HSBC European Index C Acc was reduced from 6.00% to 3.60%

- Dimensional European Value was added to the portfolio (0.00% to 2.40%)

- Abrdn Emerging Markets Income Equity Ret Platform 1 Acc was removed from the portfolio (5.60% to 0.00%)

- Dimensional Emerging Markets Targeted Value Acc was added to the portfolio (0.00% to 5.60%).

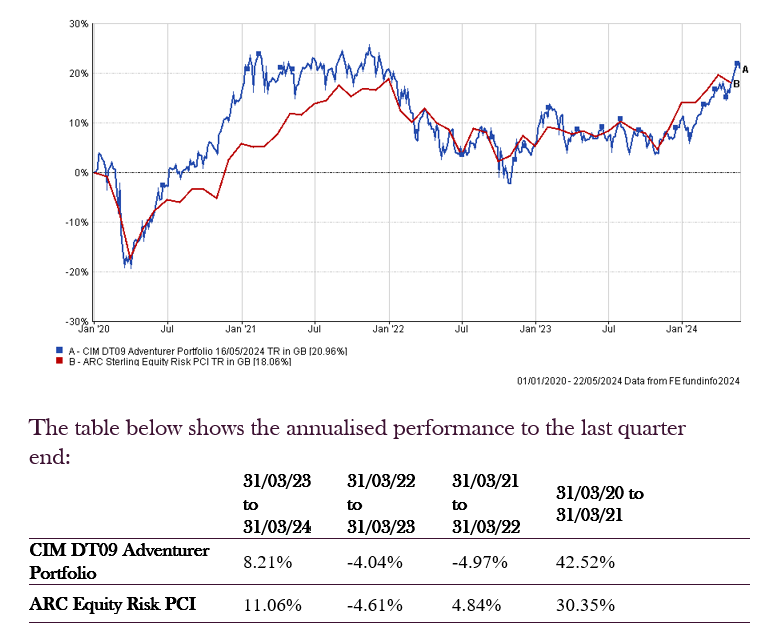

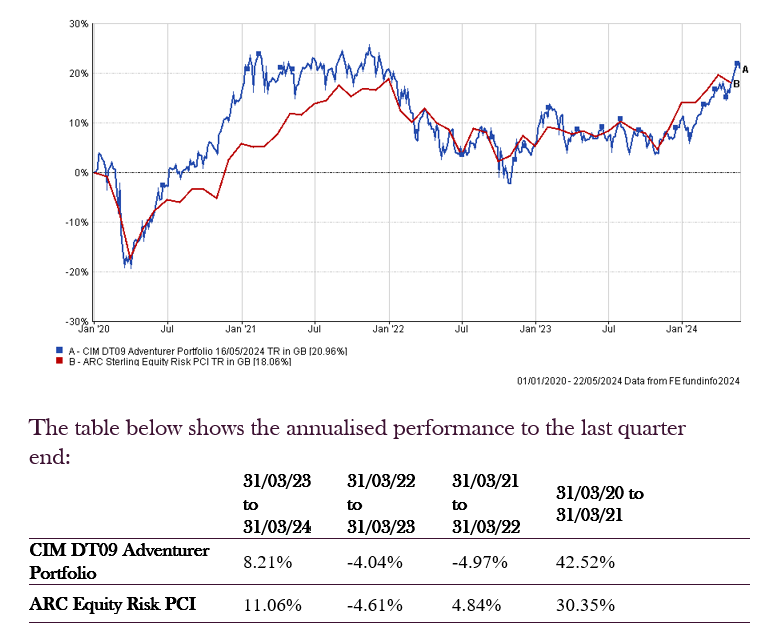

Adventurer Managed Portfolio

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Adventurer Portfolio

- HSBC European Index C Acc was reduced from 6.00% to 3.60%

- Dimensional European Value was added to the portfolio (0.00% to 2.40%)

- Abrdn Emerging Markets Income Equity Ret Platform 1 Acc was removed from the portfolio (8.40% to 0.00%)

- Dimensional Emerging Markets Targeted Value Acc was added to the portfolio (0.00% to 8.40%).

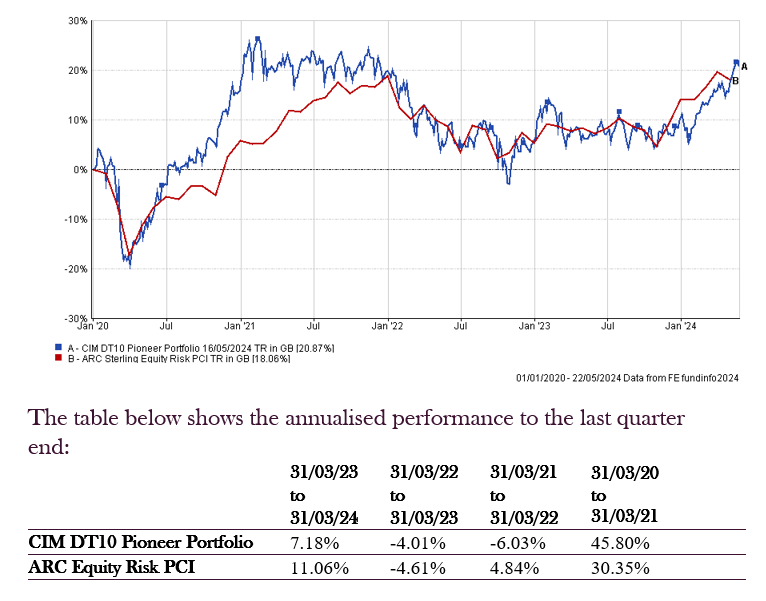

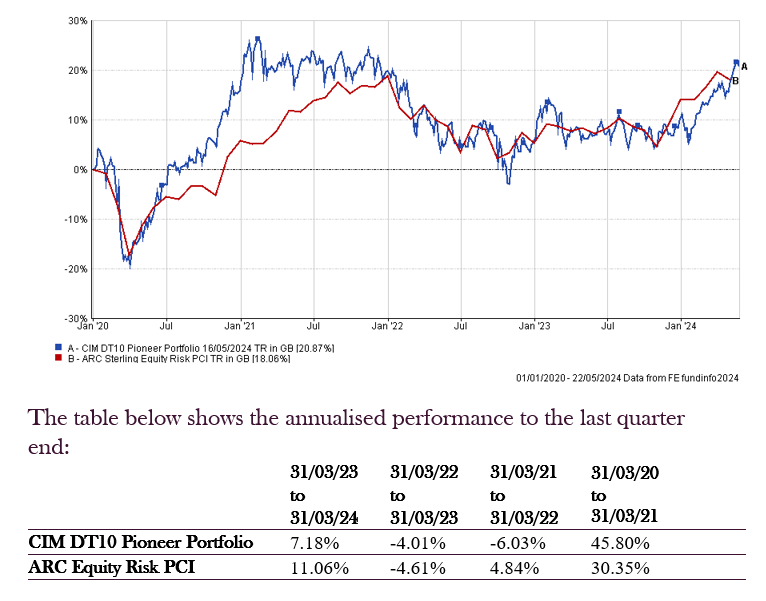

Pioneer Managed Portfolio

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Pioneer Portfolio

- Abrdn Emerging Markets Income Equity Ret Platform 1 Acc was removed from the portfolio (10.00% to 0.00%)

- Dimensional Emerging Markets Targeted Value Acc was added to the portfolio (0.00% to 10.00%).

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

The table below shows the annualised performance to the last quarter end:

The table below shows the annualised performance to the last quarter end: