The Clarion Investment Committee met on 20 May 2025. The following notes summarise the main points of consideration in the Investment Committee discussions and provide information about our current investment strategy and fund performance.

Please click here to access our May Stock Market & Economic Commentary written by Clarion Group Chairman, Keith Thompson.

Economic Commentary & Market Outlook.

Economics

- Donald Trump agreed to delay his threatened 50% tariff rate on the EU and extend trade negotiations until 9 July following a call with EU Commission president Ursula von der Leyen

- Mr Trump also threatened Apple with tariffs of at least 25% on iPhones made overseas

- Estimates of business activity in May from surveys of purchasing managers indicated rising growth in the US, while activity declined across the UK and EU

- The UK and EU reached an agreement that includes provisions to ease barriers for UK food exports to the EU in return for EU access to UK fishing waters. The deal is expected to add £9 billion to the UK economy by 2040

- UK inflation increased to a greater-than-expected 3.5% in the year to April, a 15-month high, driven by higher taxes and energy bills

- The UK domestic energy price cap will fall by 7% from July, according to the energy regulator Ofgem, the first cut since July 2024

- The Bank of England’s (BoE) chief economist, Huw Pill, warned that the Bank was cutting rates too quickly and risked inflation rising further above target

- UK net migration nearly halved in 2024 compared with the previous year, from 860,000 to 431,000, following the imposition of stricter migration rules effective from the end of 2023

- UK retail sales volumes rose more than expected in April, by 1.2% compared with the previous month, driven by the warm weather boosting food sales

- Consumer confidence in the UK and euro area improved in May, partly reversing the decline in sentiment seen last month

- German business sentiment continued to improve in May, according to the Institute for Economic Research (ifo) Business Climate survey as expectations improved. The ifo commented that Germany “is slowly regaining its footing”

- Polish equities have risen over 28% this year, one of the fastest rates globally, due to Poland’s relatively insulated position against US tariffs and expectations that higher European defence spending will boost growth

- Applications for New Zealand’s “golden visas” have surged, primarily due to higher applications from the US, following a relaxation of rules aimed at attracting more foreign direct investment

Business

- Semiconductor manufacturer Nvidia announced plans for additional investment in Taiwan, including constructing an AI supercomputer, despite Taiwan’s geopolitical tensions and global trade uncertainties

- Chinese electric car manufacturer BYD sold more vehicles across Europe than US rival Tesla for the first time last month, according to Jato Dynamics research group, highlighting the rising competition from Chinese auto manufacturers

- Investment management company Redbird Capital Partners agreed to buy the Telegraph Media Group for £500 million, following the UK government’s previous concerns over foreign ownership of the UK newspaper

- UK real estate company British Land reported a rise in demand for older office space across London, driven by rising rental costs and limited supply of new offices across the capital

- Unilever announced an £80 million investment in the UK to develop its fragrance capabilities

Global & Political Developments

- Israeli prime minister Benjamin Netanyahu said Israel’s aim in its latest military campaign is “to take over all of the territory of Gaza”

- Mr Trump announced plans for a US “golden dome” missile defence system, inspired by Israel’s Iron Dome, with initial costs of around $175 billion

- UK prime minister Keir Starmer signalled a partial reversal of cuts to pensioners’ winter fuel payments following significant cross-party opposition

Strategy

- The bond allocations within the portfolios target short and mid sections of the yield curve where capital appreciation is expected.

- High yield bond strategies are avoided as credit spreads do not currently offer a worthwhile risk premium.

- The US equity market is underweighted on a valuation basis and strategies within the portfolio are particularly underweight mega-cap stocks.

- The UK equity market is conversely overweighted on a valuation basis.

- Asia, Emerging Markets and China are also overweighted as they trade below their long-term historical averages after experiencing a period of poor performance. The IC believe these regions have potential to grow their valuations in the long-term from a low base.

- UK and US small and mid-cap equity allocations are also included based on an attractive entry point which current valuations provide.

- US big tech and large cap stocks are likely to underperform because of the current unsustainable high valuations. Faith in AI has tempered somewhat as costs are higher and revenue is pushed into the future.

- No changes were considered necessary to the underlying funds. However, research into the BNY Mellon Global Infrastructure fund is ongoing to see if this fund might be an appropriate fund to include in the Clarion Portfolio Funds. The recent underperformance of the Baillie Gifford Pacific fund was also noted. Further analysis has been requested, and this fund will be subject to further review at the next IC meeting.

- We are cautiously optimistic about stock markets in 2025 and see valuation opportunities in the US beyond the big tech stocks and in markets outside the US, particularly the UK, Europe, Asia, and Emerging Markets where valuations are generally more attractive which will help to offset some of the economic headwinds and geopolitical uncertainty.

Clarion Funds

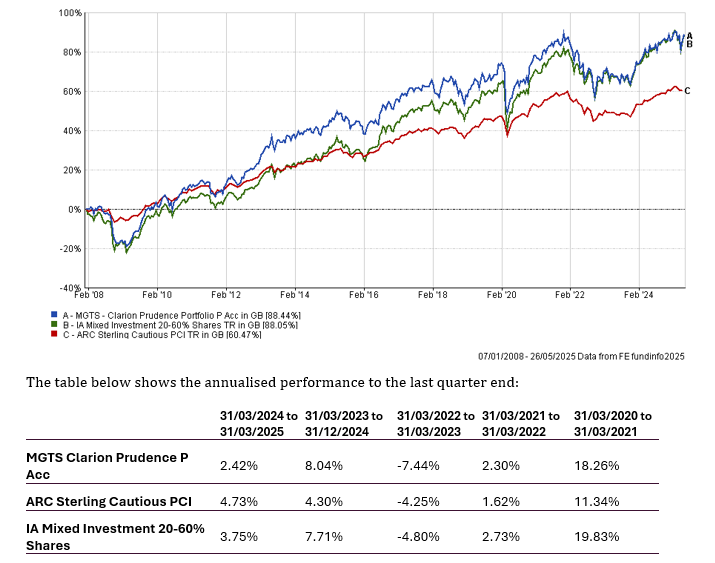

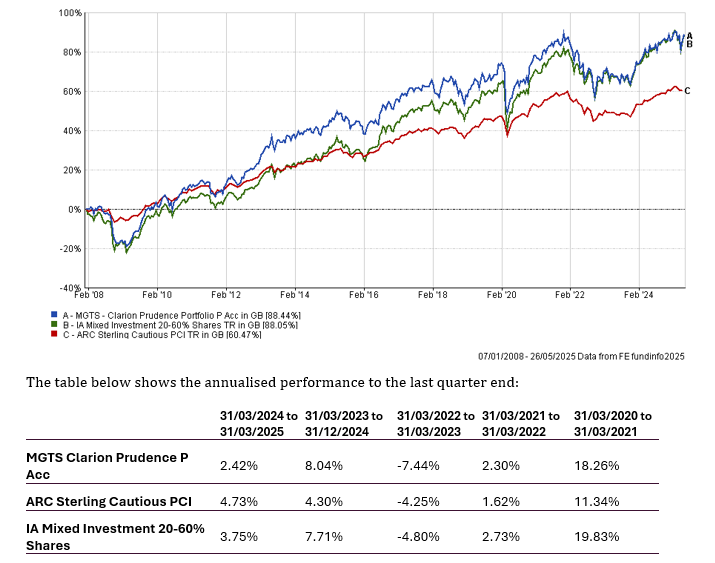

Prudence Fund

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

Changes to the Prudence Fund

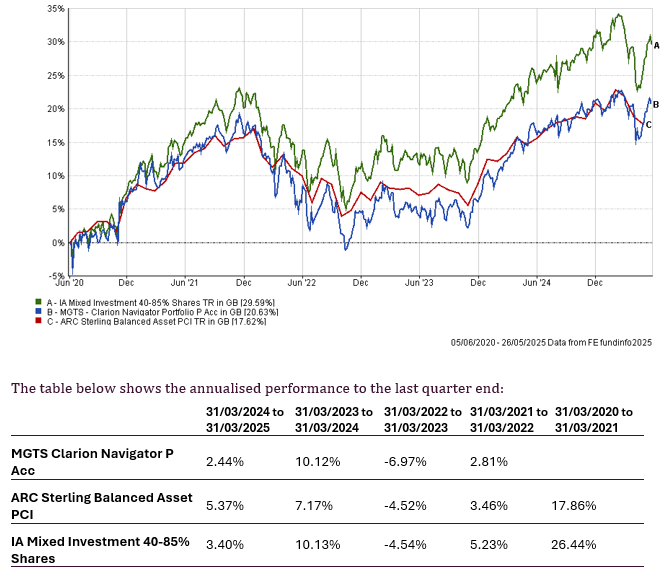

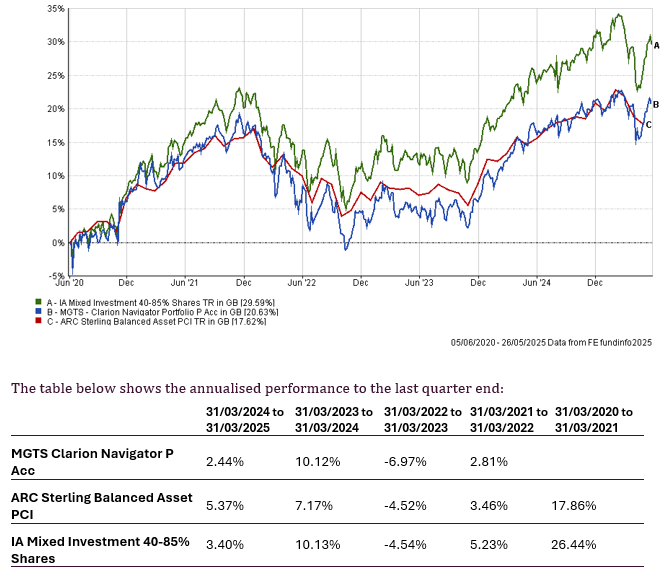

Navigator Fund

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

Changes to the Navigator Fund

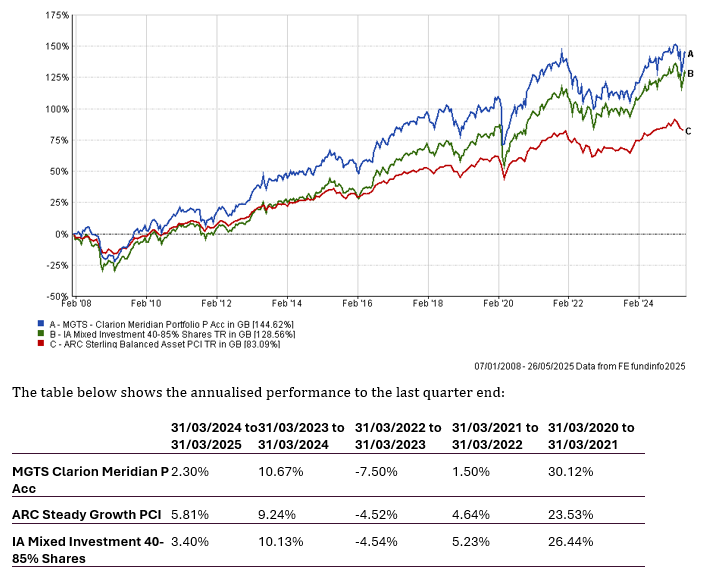

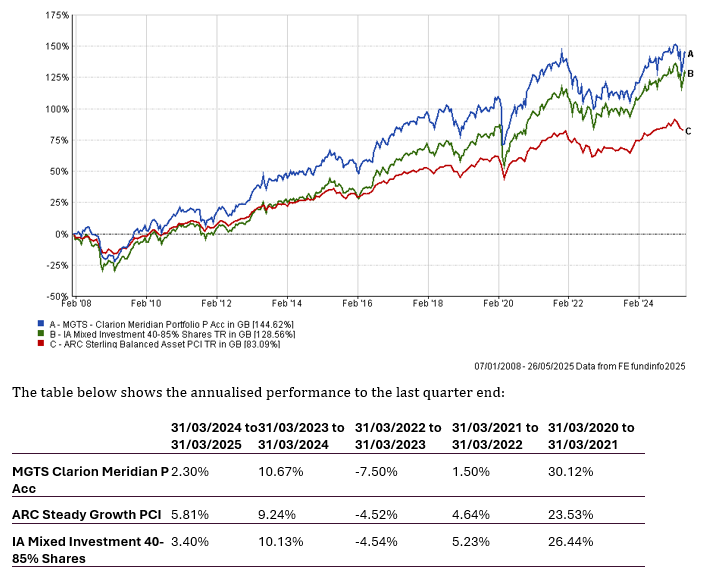

Meridian Fund

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

Changes to the Meridian Fund

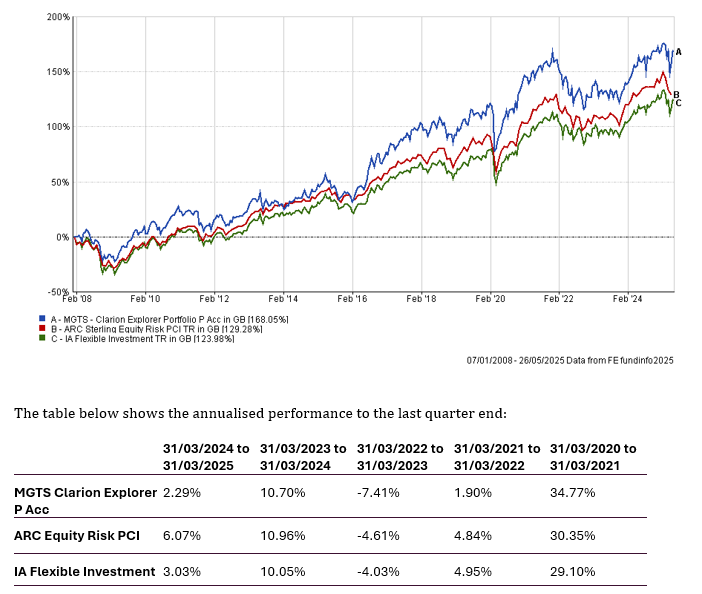

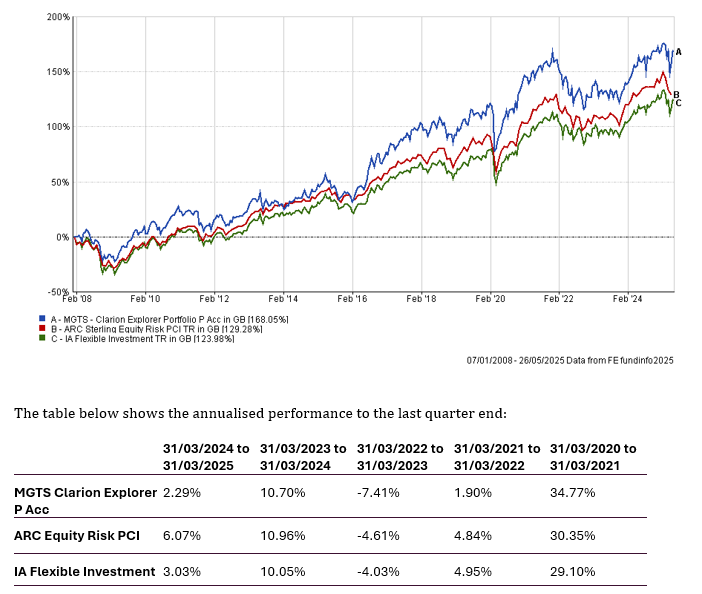

Explorer Fund

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

Changes to the Explorer Fund

Holding a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long-term.

Keith W Thompson

Clarion Group Chairman

May 2025

Risk Warnings

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice, and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.