Minutes of the Clarion Investment Committee held at 1pm on 19th November 2020 by video link.

Committee Members in attendance: –

| Sam Petts (SP) |

IC Chairman and Financial Planner |

| Keith Thompson (KWT) |

Clarion Chairman |

| Dmitry Konev (DK) |

Analyst (Margetts Fund Management) |

| Toby Ricketts (TR) |

Fund Manager (Margetts Fund Management) |

| Jacob Hartley (JH) |

Technical Assistant Clarion |

|

|

*Apologies from Ron Walker, Founding Director, Clarion

Review of previous minutes and action points

Minutes from the previous meeting held on 15th October 2020 were agreed by the Committee as a true and accurate record.

Economic Commentary & Market Outlook

Please click here to access the November Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

The following notes summarise the main points discussed by the Investment Committee.

- The news of a potentially viable COVID-19 vaccine, developed by pharmaceutical giant Pfizer was quickly followed by what appears to be a more effective vaccine being developed by Moderna and then further news of a vaccine being developed by Oxford University in conjunction with Astra Zeneca. Reflecting the hopes of the world population, global stock markets rose by way of response. Investment sentiment is now caught between two extremes – the economic hardship of lockdowns rolling out across the northern hemisphere (albeit not so restrictive as last time) and the hope of a medical solution to the virus.

- On home shores in the UK confirmed COVID-19 cases continue to increase. However, the level of overall UK deaths – from all causes, not just the pandemic – now appears to be following a typical seasonal pattern. This indicates that while cases are rising, fatalities are not. This is quite a different picture versus the early UK stages of COVID-19 and suggests either we are getting better at treating the disease or at protecting those most vulnerable to its effects or both.

- Meanwhile, the seemingly endless Brexit negotiations continue despite now having passed various purported final deadlines. We still feel that some form of deal will materialise, though the situation is extremely fraught. At 10 Downing Street a shakeup of the prime minister’s advisory team has led many to believe that a deal is afoot, though this may be a case of wishful thinking.

- In the US presidential election, challenger Joe Biden and running mate Kamala Harris were elected by US voters in a closer-than-expected contest, the results of which remain disputed by the incumbent president. Trump has until 8 December to resolve any legal challenges.

- Financial markets appear comfortable with the results. Suggestions of a ‘blue wave’ (Democrats taking the White House plus both houses of government) remain unfulfilled, meaning that it will be harder for Biden to push through stringent tax rises or increased regulation in key sectors. Consequently, technology shares led the way for US stock markets in the wake of the results.

- However, any further US government stimulus bill is now likely to be watered down in size and scope too, due to a still divided governing house. Last week, US Federal Reserve Chair Powell was at pains to remind the government that the central bank can only do so much of the heavy lifting in supporting the US economy. The latest US employment data showed continued improvement, but remains a long way off pre-pandemic levels.

- Meanwhile, global economic survey data showed that the manufacturing sector continues to recover better than the services sector. Restricted populations are still spending their money on goods rather than services.

Strategy

Equity markets are set for a confluence of events which could lead to a remarkable re-rating, akin to last December’s Tory election victory and Withdrawal Agreement powering sterling and the FTSE indices. With excellent vaccine developments, a forthcoming peaceful transfer of power in the US, and the apparent closeness of a Brexit trade deal, 2021 is looking positive for bullish investors. The UK stands to benefit more than many equity markets, having suffered depressed relative valuations since 2016 as foreign investors held back, and having a natural value bias with few tech companies. The kudos of the “Oxford” vaccine, likely to form the backbone of the global response to Covid-19 due to its low cost, may also boost the UK’s global standing.

The Asia Pacific economies have recovered well from Covid-19 and positive vaccine developments will enable countries to solve the last aspect of the recovery puzzle: tourism. Their head start in Covid-19 recovery over western economies is an attractive element of their equity markets and remains the key argument for the investment committee to hold an overweight position in our portfolios.

Bond markets remain unappealing due to their heavy central bank intervention, with little to no chance of a positive return upon redemption, even in the current low interest rate environment. Our bond positioning seeks to counter this by investing in corporate debt at the short end of the yield curve, which offers above inflation yield and reduced duration risk.

Review Risk Management, Eligibility and Investment and Borrowing Powers

The Committee reviewed risk reports and confirmed that all Clarion funds have been run in line with expectations. The Committee confirmed that there have been no breaches recorded for any of the funds included in the Clarion range.

Management of the Clarion Funds; Prudence, Navigator, Meridian and Explorer

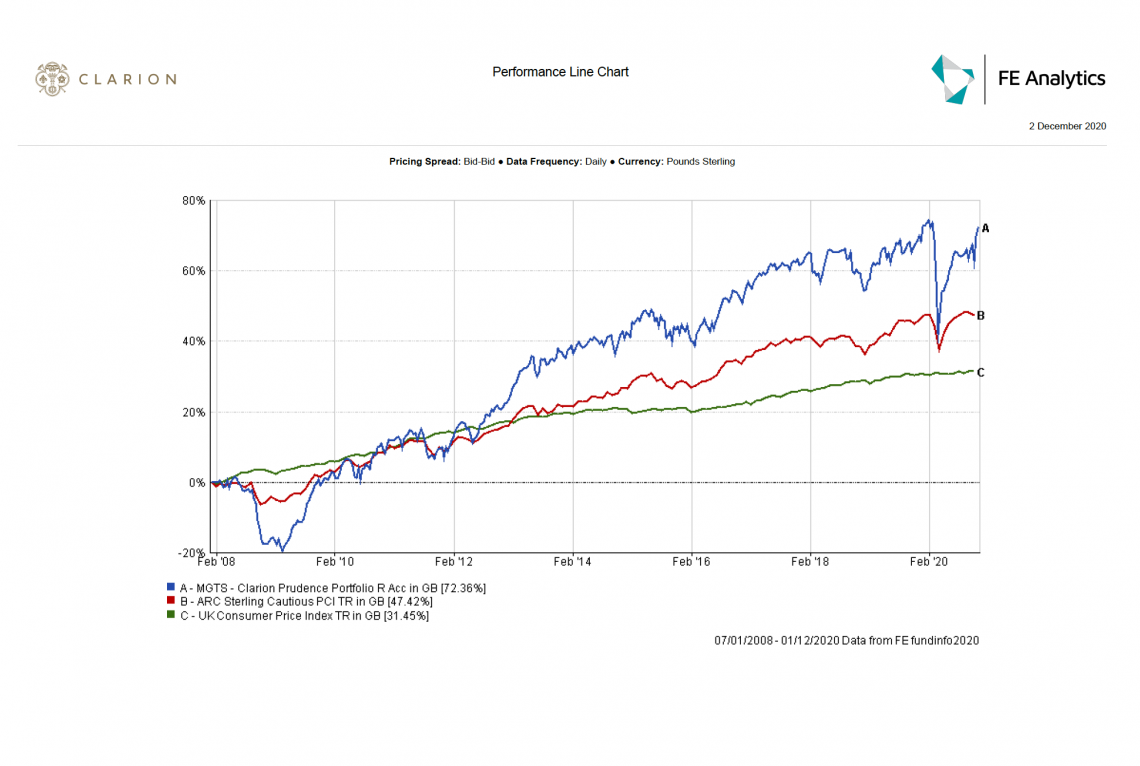

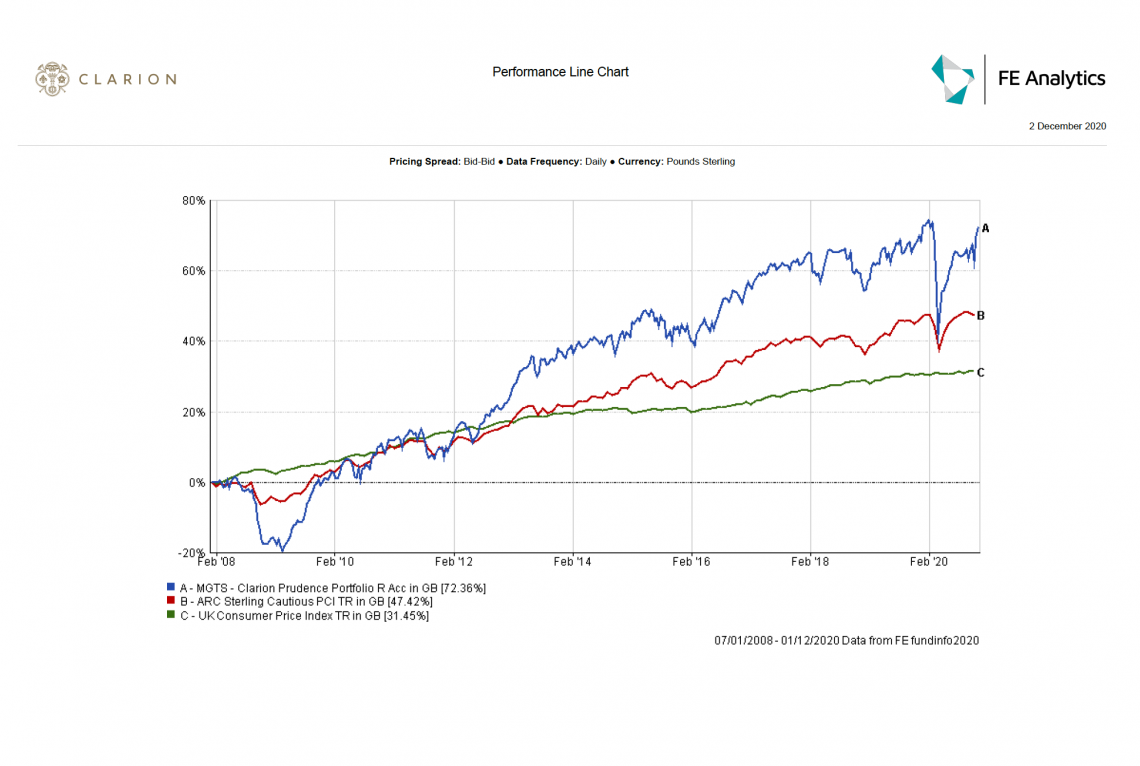

MGTS Clarion Prudence

- The last quarter has seen Prudence outperform both its sector and its DT strategic benchmark by 0.60% and 1.20% respectively.

- The outperformance has mainly derived from our allocation attribution within the IA Global and IA UK Equity sectors. Over the same period, our fund selection attribution has been relatively flat.

- Our selection in Asia (ex Japan) continues to be strong with First State Asia Focus returning +2.2% over the last 4 weeks which is a reflection of the funds ‘value’ investment approach.

- The recent increase we have seen in credit spreads has fed through to the ‘Baillie Gifford High Yield Bond Fund’ which over the last month has returned 1.10%; making it the strongest performing holding with our fixed interest allocation over a 1, 2, 4 and 12-week period.

- The short dated bond selection within the portfolio has remained relatively flat since the last meeting and continues to play an important role in dampening the overall portfolio volatility.

- Merian Gold & Silver has returned -6.49% over the last quarter, proving to be the biggest loss within the portfolio. Whilst this is disappointing to see, the committee remain firm believers this fund will prove to be beneficial in periods of higher inflation, which we are likely to see moving forwards.

- M&G Global Dividend has continued to perform strongly following our last meeting, providing returns of 2.04% and 1.21% over 1 and 2 week periods. This fund has benefited as a result of the recent swing from growth to value, hence the continued short term outperformance versus Fundsmith Equity. The contrast in these two funds demonstrate just how quickly things can change given the trade-off between their value and growth strategies and reemphasises the importance of holding these two side by side.

- A further winner we have seen as a result of the rotation from growth to value is Man GLG UK Income. This fund had previously raised concerns within the committee as the fund appeared to lack resilience following the market falls experienced earlier this year. However, it was agreed to retain this fund given its investment approach and value philosophy, which has proved to be the right decision with the fund returning 3.29% over the last 2 weeks.

- Whilst the rotation has benefitted some holdings, funds weighted more towards growth stocks have subsequently suffered. A good example of this is JPM Japan providing a loss of -3.04% over the last month. This fund is however not a concern for the committee at this juncture, given the 1 year growth figure of +25.18% and overall track record.

- Threadneedle UK Equity has performed better than the committee had anticipated, returning 2.93% and 1.54% over the last 2 and 4 weeks. This performance has mainly been driven by the funds stock selection with industrials and has also benefitted from less strict lockdown restrictions than what we saw earlier this year.

- In light of the strong performance we have seen of late from Threadneedle along with Man GLG, the committee agreed that now would be a good opportunity to deploy 1% of the cash holding into the portfolio, allocating 0.50% to each of these funds.

- The rest of the portfolio remains in good shape and the committee agree that no further changes are required at this stage.

- Fund size is currently £28.48m.

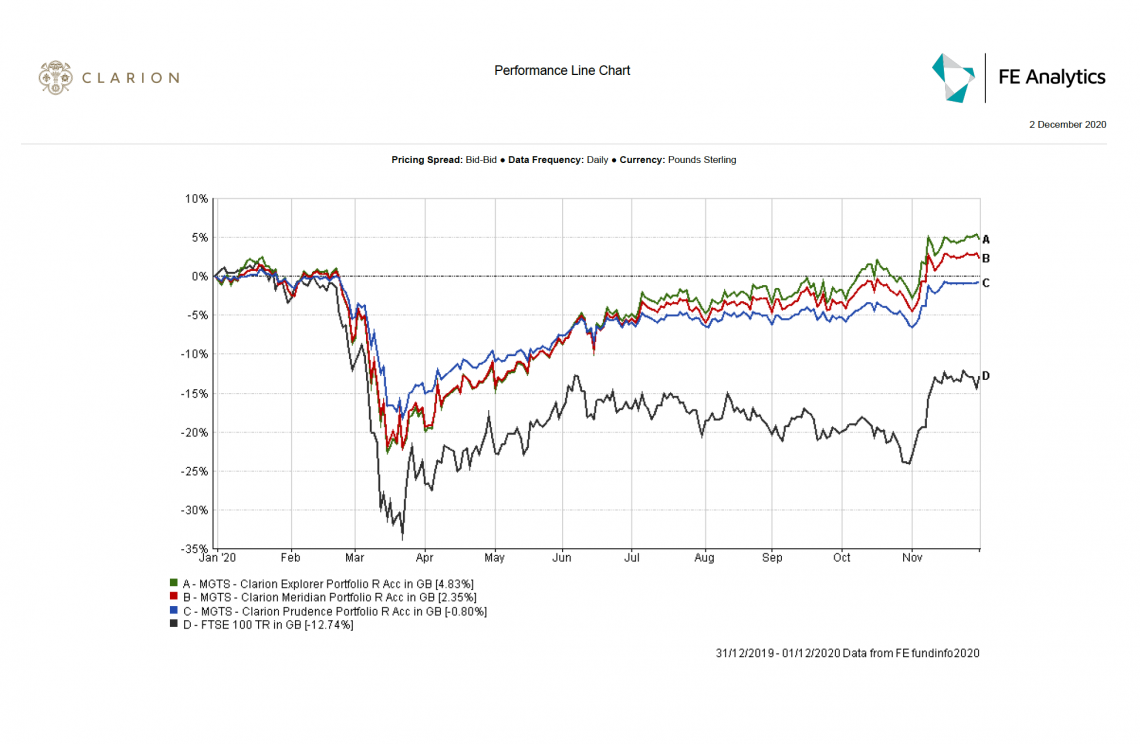

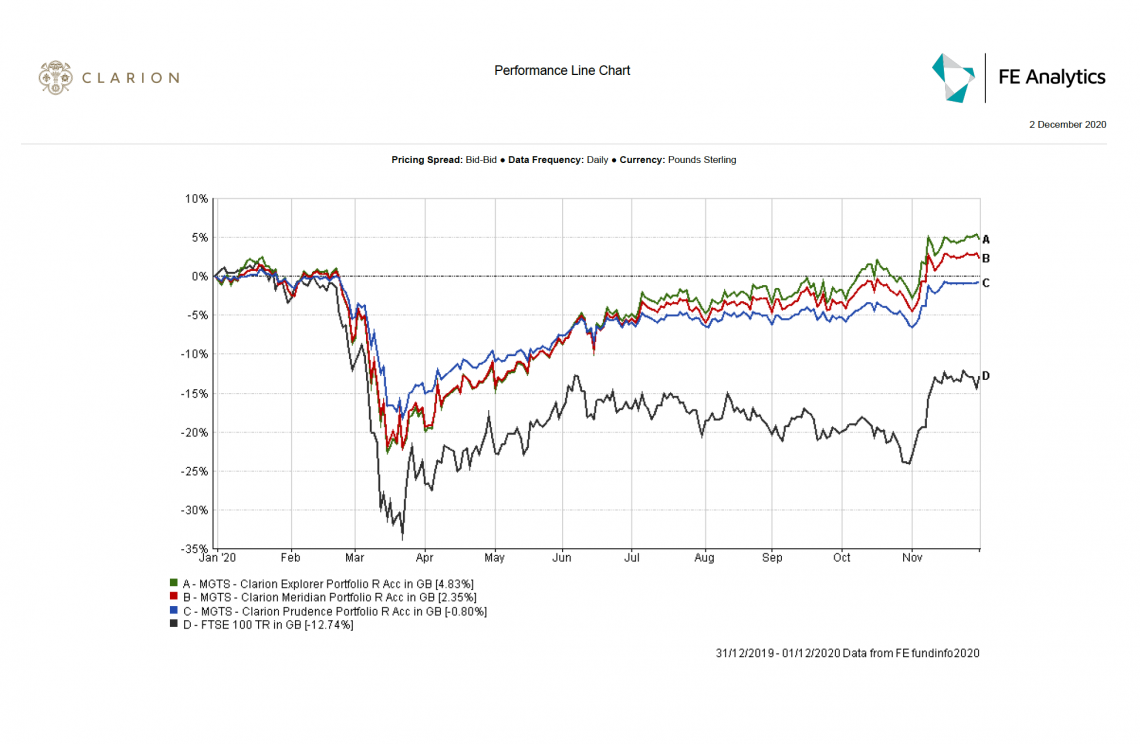

- Performance over 1 year is up at +2.15% compared to a fall in the UK Footsie 100 index of circa -14%

MGTS Clarion Navigator

- The fund has performed in line with sector since launch in May this year.

- Buffettology has suffered as result of its growth approach having fallen in value by -5.36% over the last month. This isn’t of great concern at this moment, however, it was agreed that we would keep a close eye on this over the coming weeks, and compare how the fund is doing versus its peers. It was agreed however that we would take the opportunity to realise some of the profit made within the fund by reducing our allocation by 1%, and redistributing these funds to BlackRock UK Equity.

- At the same time, it was agreed that we would deploy 1% of the cash in the portfolio by allocating a further 0.50% to both Franklin UK Equity and Man GLG UK Income.

- No further changes are required to the portfolio at this juncture.

- Fund size is currently £10.78m; an increase of circa £6m from the last committee meeting carried out in October following a number of large inflows.

- The unit price as at the 1st December 2020 was 106.02p; showing a 6.02% increase having been launched at 100p on the 11th May 2020.

Due to the fact that the Navigator Fund has only been operating for a short period of time, we are unable to provide a useful performance graph of the fund versus its relevant benchmark.

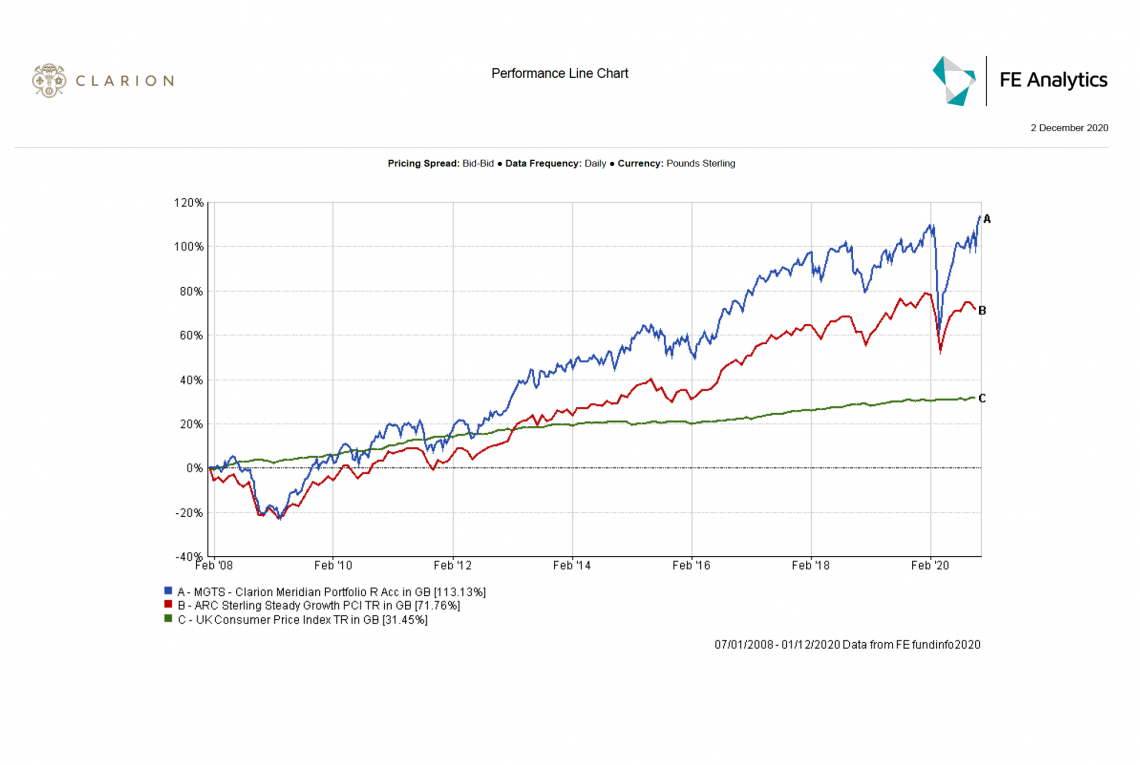

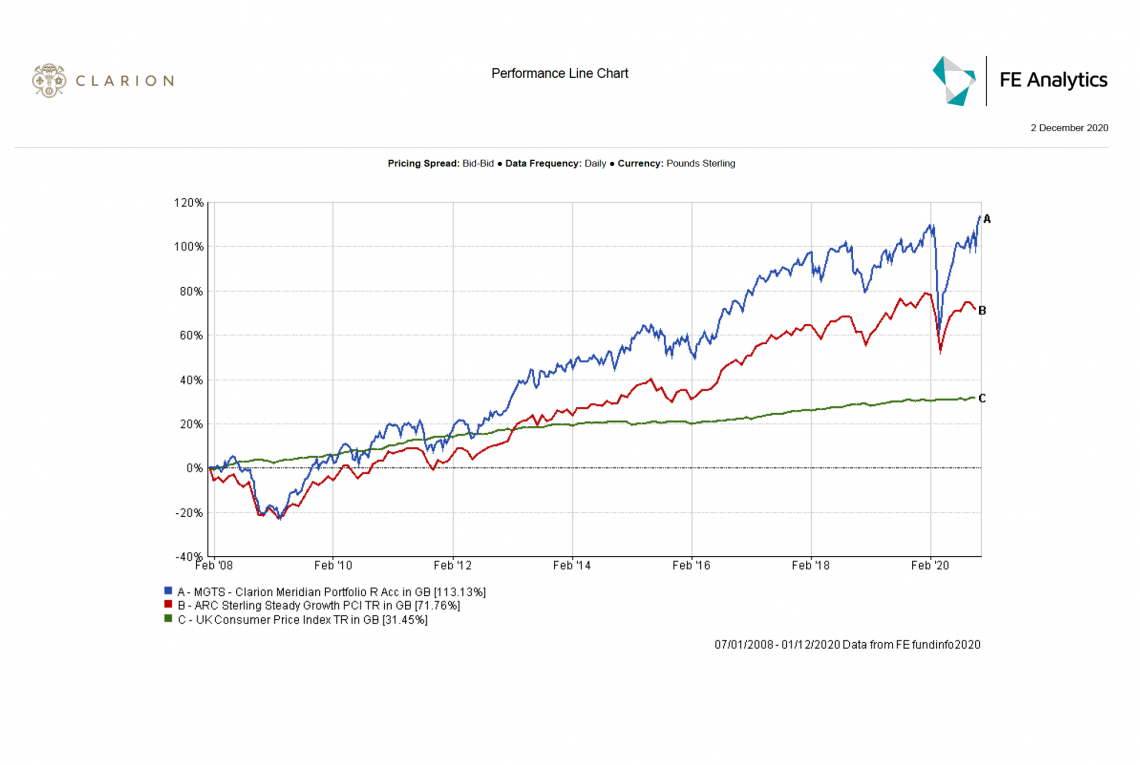

MGTS Clarion Meridian

- Meridian has returned 5.20% over the last quarter, outperforming both its sector and DT strategic benchmark by +1.00% and +0.30% respectively.

- The outperformance was driven by our allocation attribution, mainly within the UK Equity Income and Global Sectors whilst North America was our biggest detractor. Our selection attribution over this period was relatively flat.

- Over the last 12 months which has been very volatile, we have seen the Meridian portfolio fall in line with its sector during periods of downturn whilst outperforming during periods of upturn. The committee are very pleased with this.

- In line with Prudence, First State Asia Focus has done very well, returning +2.2% over the last 4 weeks as a result of its ‘value’ investment approach. The Fidelity Asia fund, which is growth orientated, has underperformed over the same period, returning -1.28%. This demonstrates a good level of diversity held within the Asia (ex Japan) element of our portfolio.

- All three bond holdings have done well within Meridian following the recent increase in credit spread along with the fact they have little exposure to long dated bonds.

- Despite having a good mix of value and growth stocks, Fidelity European has marginally underperformed, returning -1.45% over 4 weeks. This suggests the fund is down as a result of stocks selection as we would of expected performance to be more neutral all things being equal.

- We have seen Fundsmith Equity, Artemis Global Select and Baillie Gifford Japan suffer as a result their bias to growth stocks which have recently taken a downward turn.

- In line with Navigator, the committee have agreed to realise 1% from Buffettology and redistribute this to BlackRock UK Equity.

- The rest of the portfolio remains in good shape and the committee agree that no further changes are required at this stage.

- Fund size is currently £56.75m.

- Performance over 1 year is up at +6.09% compared to a fall in the UK Footsie 100 index of circa -14%

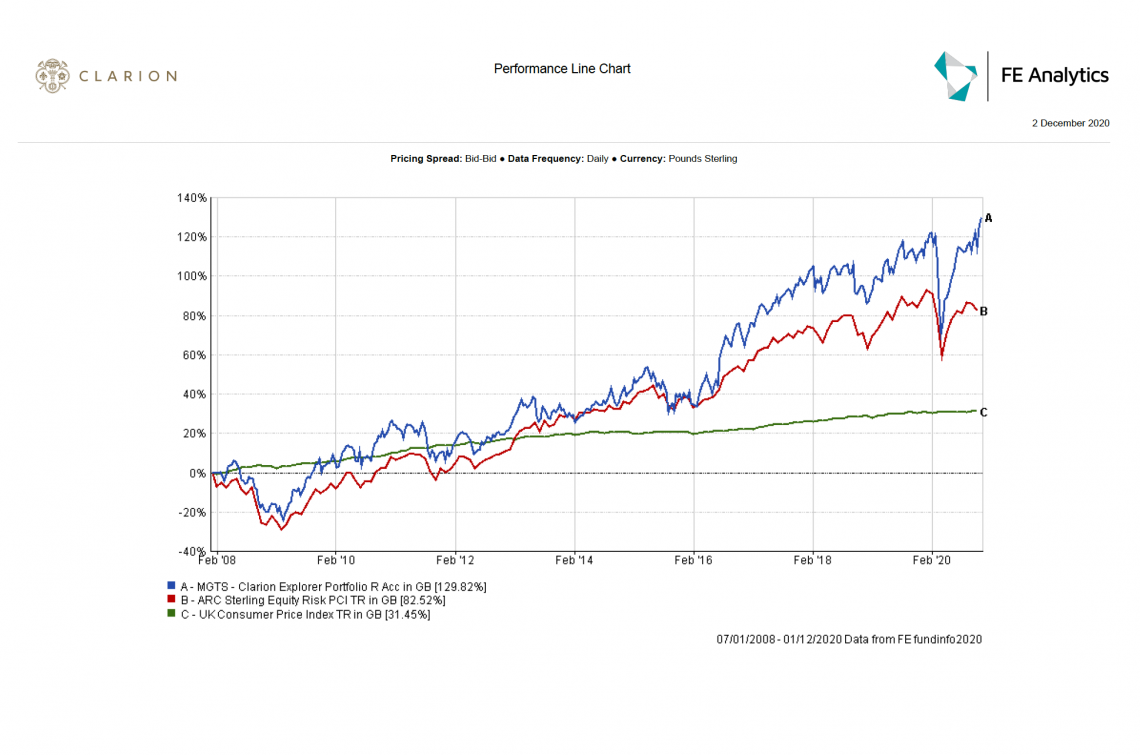

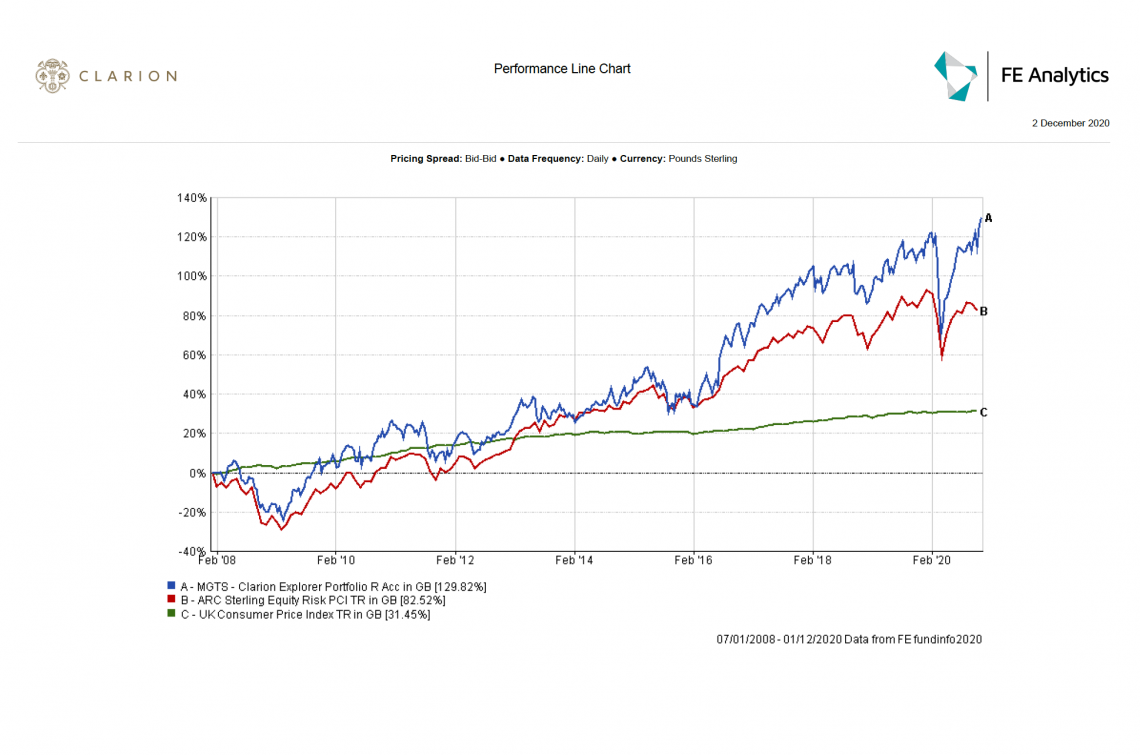

MGTS Clarion Explorer

- Explorer has returned 6.60% over the last quarter, outperforming both its sector and DT strategic benchmark by +1.40% and +0.30% respectively.

- When compared to its sector, our allocation selection has been relatively flat with our underweight positioning in North America cancelling out gains made elsewhere in the portfolio.

- We have seen a rotation in performance within our Asia (ex Japan) allocation with both Schroder Asian Income and Schroder Pacific benefitting from the recent shift in growth to value, with the funds returning +3.10% and +4.21% respectively over a 2-week period. The shift has pulled back on performance in the other two funds held within this sector, however, these have not fallen as hard as the Schroder funds have gained.

- In line with the above, the same is true with our Emerging Market holdings with JPM Emerging Markets and SLI Global Emerging Markets benefiting from the rotation whilst Hermes and UBS have subsequently suffered.

- L&G UK Mid Cap has been the strongest performing fund within the Explorer portfolio over the last quarter with a return of +4.35%.

- Lindsell Train Japanese has continued to underperform since the last meeting with the fund currently down by -11.64% over the quarter. Whilst this fund is growth orientated, the poor performance has mainly derived from poor stock selection which is possible within such a high concentrated fund. The fund currently holds just 25 stocks with the 10 largest stocks representing 65% of the overall portfolio. It was agreed that we would keep this fund under review until the next meeting with a view of potentially replacing it should performance not improve.

- The portfolio remains in good shape and no further changes are required at this stage.

- Fund size is currently £20.22m.

- Performance over 1 year is up at +7.94% compared to a fall in the UK Footsie 100 index of circa -14%

Model Portfolios

Model Portfolios

It was agreed to make appropriate changes to the model portfolios to reflect the changes to the Portfolio Funds detailed above.

Next Investment Committee Meeting is on 10th December although in the interim period the Committee intend to conduct slightly shorter conference calls as considered appropriate.

Model Portfolios

Model Portfolios