Category: Financial Planning

The Clarion Investment Committee met on 9 November 2023. The following notes summarise the main points of consideration in the Investment Committee discussions but have been updated to include commentary on recent events and the wider implications for financial markets.

Economic, Political and Business Snapshot

Please click here to access the November Economic and Stock Market Commentary written by Clarion Group Chairman, Keith Thompson.

At the recent meeting, the Clarion Investment Committee reflected on the fact that inflation rates globally are approaching or past their terminal levels, hinting at a reduced likelihood of further interest rate hikes.

Whilst hoping that the peak in the current tightening had been reached, the Bond markets continued to grapple with the prospect of persistently high inflation and a longer period of elevated interest rates. Corporate credit and high yield bonds have outperformed government bonds, as hopes of a soft economic landing and the peak in interest rates held sway.

The United States may delay rate cuts in comparison to Europe and the UK due to the prevalence of long-term fixed-rate mortgages. 30-year mortgages are commonplace in the US meaning that rate hikes are unlikely to have an intrinsic impact on consumers in the short run.

Furthermore, there is a growing consensus regarding the inflationary effects of on/near-shoring, which seems to have gained bi-partisan support. While localising the production of goods creates more reliable supply chains, there is also a likelihood of increased costs.

The Israel-Palestine conflict appears to be maintaining a relatively regional stance, and markets have normalised after an initial severe reaction. However, there could still be some fallbacks in international relations, especially with the middle east and oil producing nations, as the conflict continues.

The UK’s public finances surprised recently – with the borrowing level being less than expected. This allowed the Chancellor of the Exchequer to announce a limited range of tax cuts in the Autumn Statement.

The continued flatlining of the UK economy was also a subject of discussion. Inflationary pressures (particularly from semi- and low-skilled wage growth) remains stubbornly high with interest rates, after 14 hikes so far, likely to remain higher for longer.

Quantitative tightening by Central Banks, to reduce their balance sheets, and higher interest rates, mean that major concerns persist for government debt. Bond yields, having risen steeply at the shorter end, have seen the yield curve flatten, but it remains inverted, which traditionally is a recessionary signal.

Whilst interest rate normalization continues, negative real bond returns are to be expected for the foreseeable future, as high inflation persists, and the US / global yield curves steepen. With the prospect of further periods of volatility associated with the ongoing geo-political crises, and the inevitable run in to next year’s elections in the US and UK, the IC focused on the diversification benefits of the benchmark allocations.

One significant concern revolves around debt. High-yield investments are currently unappealing, primarily due to the financial limitations of poor-performing businesses justifying their position in the high-yield sector. These enterprises may be unable to sustain the double-digit interest rates they would be required to pay.

The Investment Committee have kept the bond holdings unchanged in recent weeks and maintain a balanced mix of short and long-duration bond strategies to align with the average duration of the corporate bond market. The Committee are comfortable with their current market exposure but will keep an eye on changes in bond yields. If bond yields increase further, they may consider adding more long-term bonds to their portfolio.

The Committee hold an underweight exposure to US stocks compared to their peers in the relevant IA sectors on a valuation basis. Many of the large US companies have valuations that may not accurately reflect the long-term value of these businesses. Instead, the Committee see valuation opportunities in smaller-cap US companies that are already pricing in recessionary factors not yet evident in the US.

Conversely, the Committee hold a marginally overweight allocation to UK equities due to attractive valuations. UK equities are currently trading well below their long-term average due to issues such as Brexit and persistent inflation. However, the Committee believe the UK has the potential to return to historical averages. Inflation in the UK is decreasing, and the labour market is easing, making UK equities seem promising for long-term outperformance compared to some other regions.

In Asian and Emerging Markets, the focus is on regions that can benefit from macroeconomic differences when compared to developed markets. China and Latin America are seen as promising in this regard. Latin American countries have dealt with inflation by raising interest rates aggressively and well ahead of the western countries, putting them ahead of the curve compared to developed markets. This may open the possibility of earlier economic stimulus, which could benefit equities in these countries.

China, on the other hand, has not faced the same inflationary issues as Western countries, which also creates an opportunity for economic stimulus. Additionally, the region is trading below long-term averages after a period of underperformance when compared to developed markets.

The key themes can be summarised below as:

Continuing to hold a globally diversified portfolio of high-quality assets is important to provide resilience and grow the value of savings over the long term and remains the appropriate method for allocation of investor capital. Cash is unattractive as inflationary pressures, although moderating, look to be structurally long term.

Keith W Thompson

Clarion Group Chairman

November 2023

Creating better lives now and in the future for our clients, their families and those who are important to them.

Clarion Funds & Discretionary Portfolios:

Defender Managed Portfolio

The chart below shows the historical performance of the Defender Portfolio against a relevant benchmark since the start of the available data.

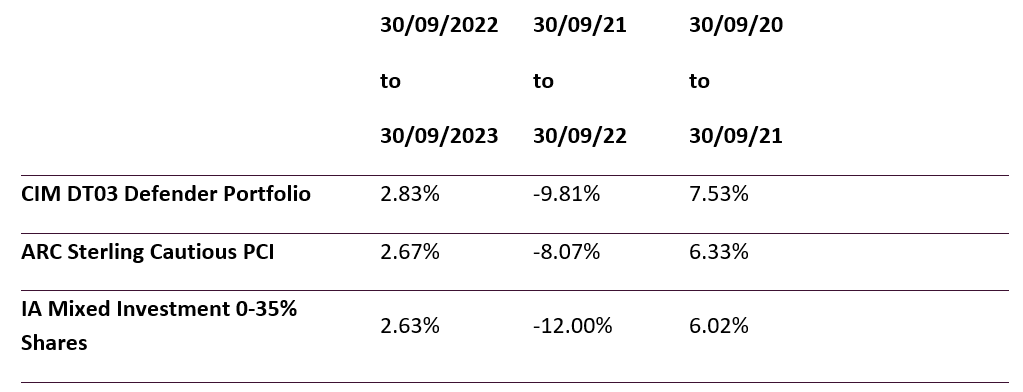

The table below shows the annualised performance to the last quarter end:

Changes to the Defender Portfolio

Prudence Fund & Managed Portfolio

The chart below shows the historical performance of the Prudence Portfolio against a relevant benchmark since the start of the available data.

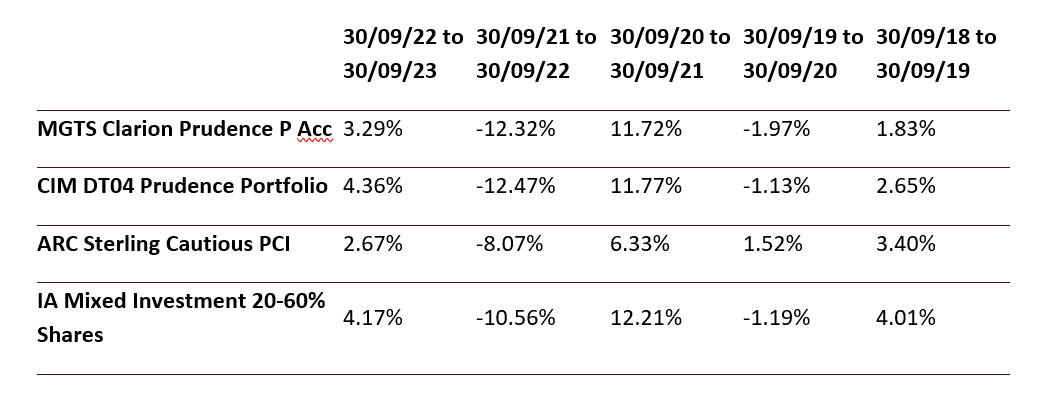

The table below shows the annualised performance to the last quarter end:

Changes to the Prudence Fund & Portfolio

Navigator Fund & Managed Portfolio

The chart below shows the historical performance of the Navigator Portfolio against a relevant benchmark since the start of the available data.

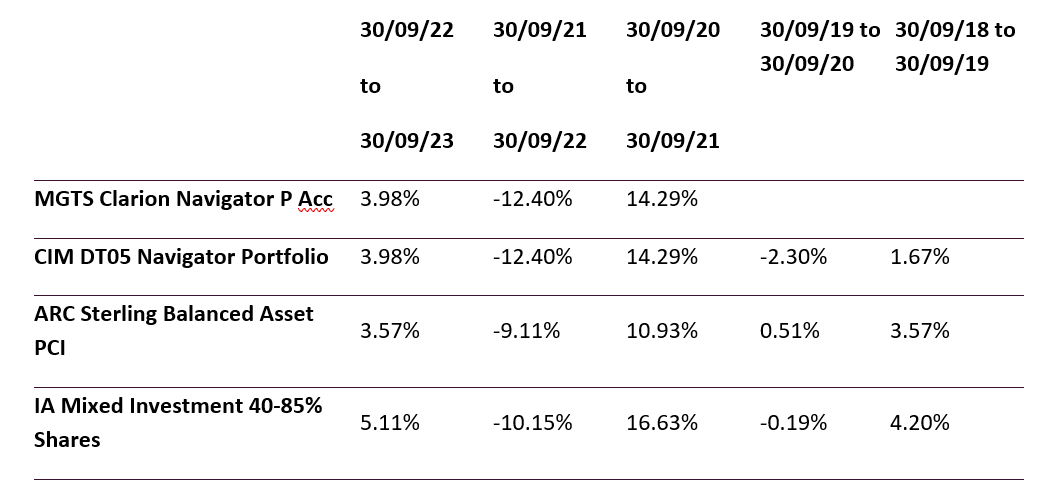

The table below shows the annualised performance to the last quarter end:

Changes to the Navigator Fund & Portfolio

Meridian Fund & Managed Portfolio

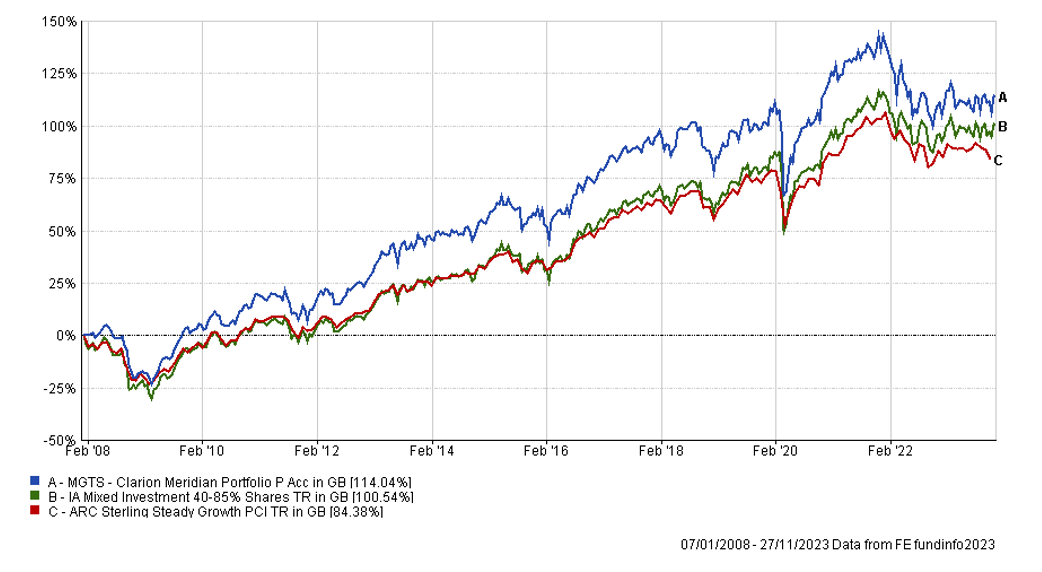

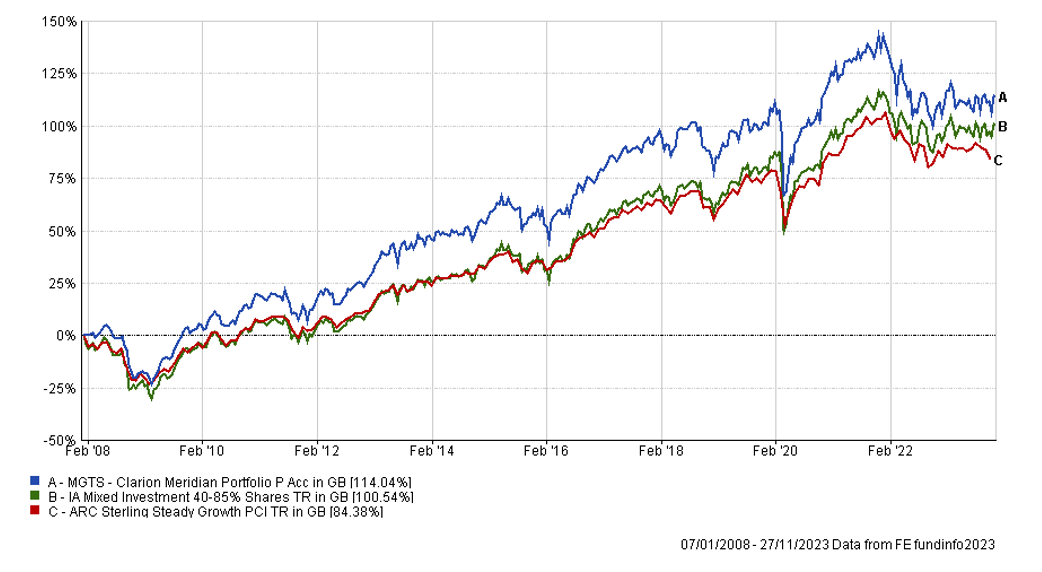

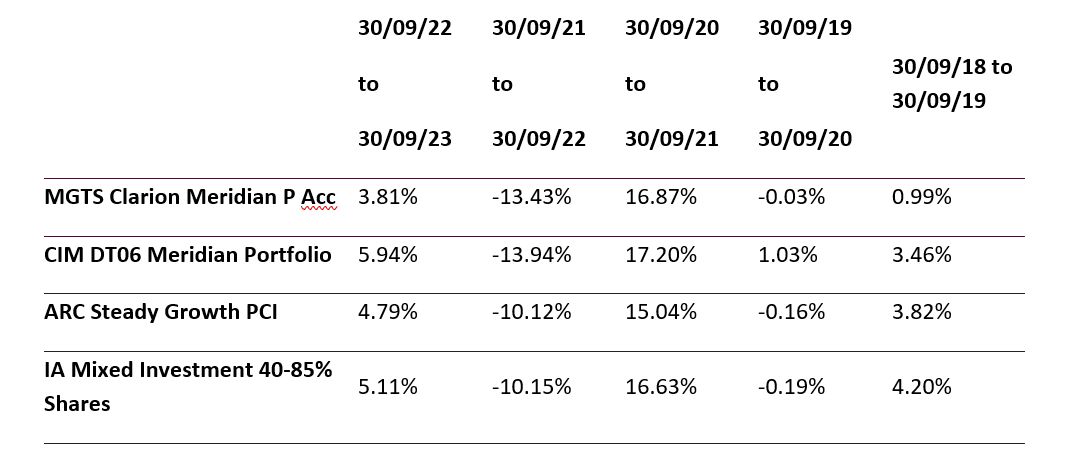

The chart below shows the historical performance of the Meridian Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Meridian Fund & Portfolio

Explorer Fund & Managed Portfolio

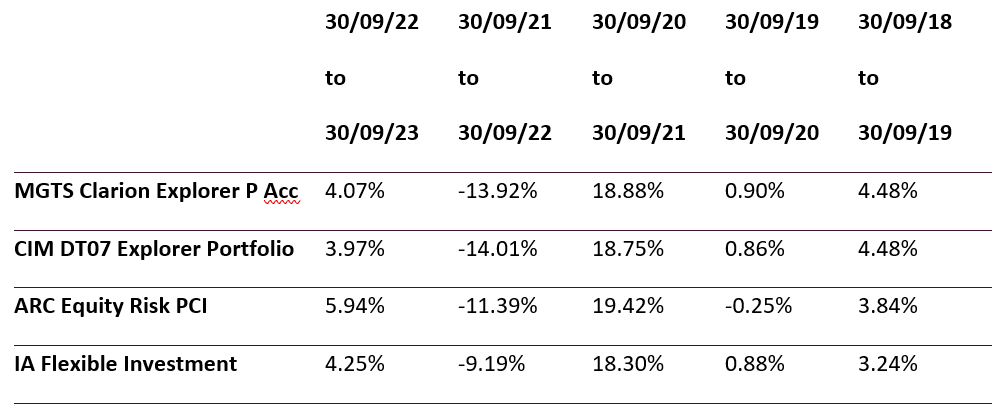

The chart below shows the historical performance of the Explorer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Explorer Fund & Portfolio

Voyager Managed Portfolio

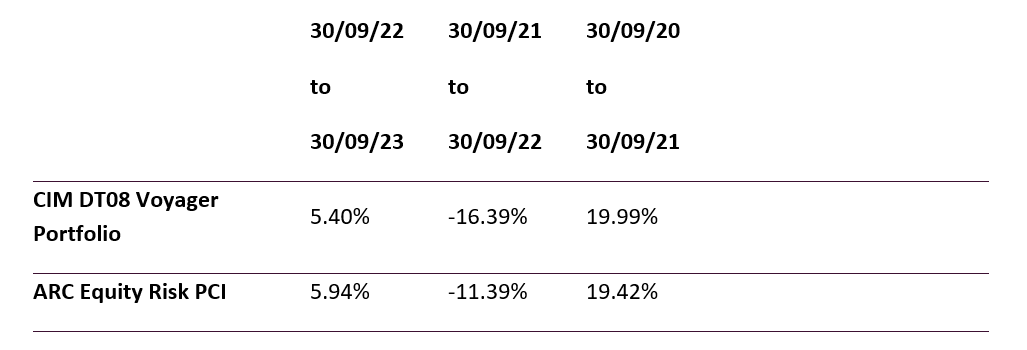

The chart below shows the historical performance of the Voyager Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Voyager Portfolio

Adventurer Managed Portfolio

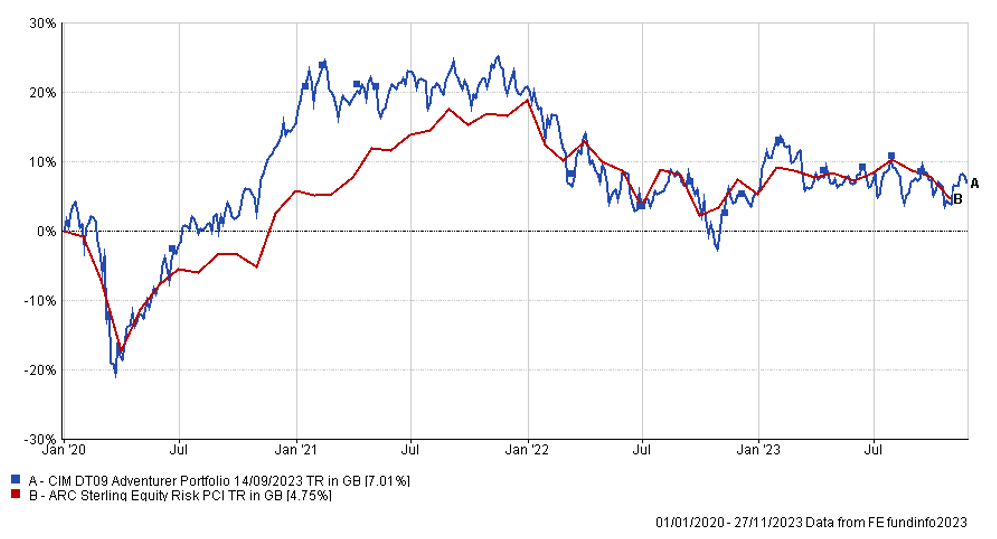

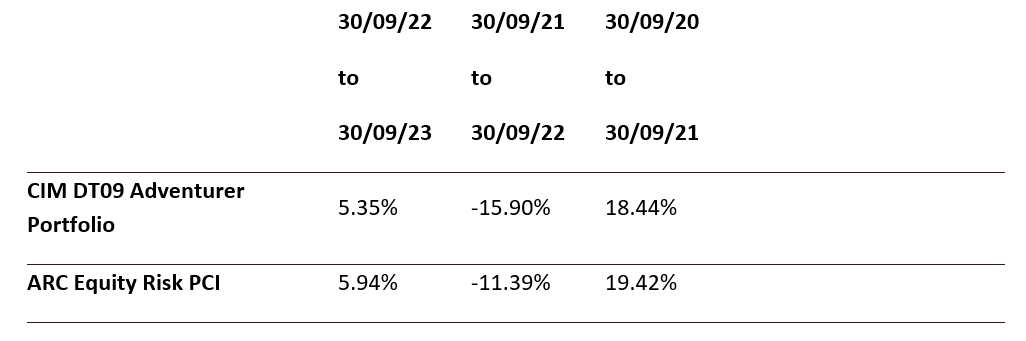

The chart below shows the historical performance of the Adventurer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Adventurer Portfolio

Pioneer Managed Portfolio

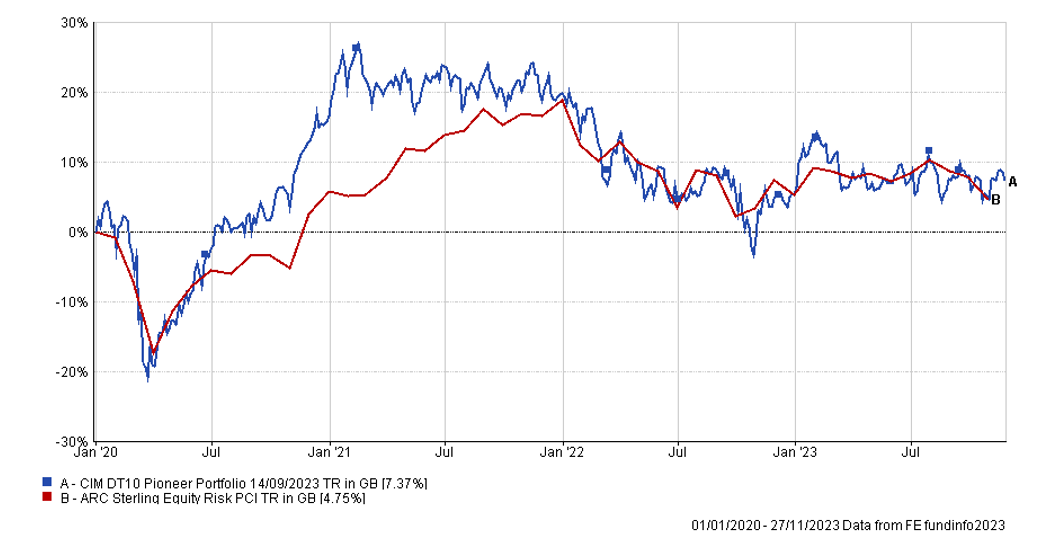

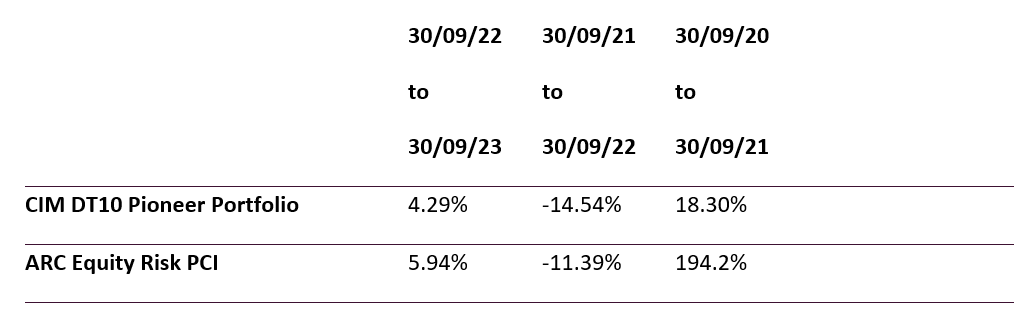

The chart below shows the historical performance of the Pioneer Portfolio against a relevant benchmark since the start of the available data.

The table below shows the annualised performance to the last quarter end:

Changes to the Pioneer Portfolio

Any investment performance figures referred to relate to past performance which is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments, and the income arising from them, can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Unless indicated otherwise, performance figures are stated in British Pounds. Where performance figures are stated in other currencies, changes in exchange rates may also cause an investment to fluctuate in value.

The content of this article does not constitute financial advice and you may wish to seek professional advice based on your individual circumstances before making any financial decisions.

If you’d like more information about this article, or any other aspect of our true lifelong financial planning, we’d be happy to hear from you. Please call +44 (0)1625 466 360 or email [email protected].

Click here to sign-up to The Clarion for regular updates.